Learning Objective

- Explain the various types of benefits that can be offered to employees.

As you already know, there is more to a compensation package than just pay. There are many other aspects to the creation of a good compensation package, including not only pay but incentive pay and other types of compensation. First, we will discuss benefits that are mandated by the federal government, and then we will discuss types of voluntary benefits, including both incentive pay and other types of compensation.

Mandated: Social Security and Medicare

The Social Security Act of 1935 requires employers to withdraw funds from workers’ paychecks to pay for retirement benefits. This is called a payroll tax. Please note that all organizations are legally compelled to offer this benefit. After several revisions, we now call this OASDHI or the Old Age, Survivors, Disability, and Health Insurance Program. To be insured, employees must work forty quarters, with a minimum of $1,000 earned per quarter. Once this money is put aside, anyone born after 1960 will receive benefits at 67. The OASDHI tax in 2011 is 4.2 percent on earnings for employees, up to $106,800 and 6.2 percent for the employer up to the same limits. This covers both retirement income as well as medical benefits, called Medicare, once the employee reaches retirement age.

Mandated: Unemployment Insurance and Workers’ Compensation

Unemployment insurance is required under the Social Security Act of 1935 and is also called the Federal Unemployment Tax Act (FUTA). This program’s goals include providing some lost income for employees during involuntary unemployment, helping workers find a new job, incentivizing employers to continue employment, and developing worker skills if they are laid off. The majority of this plan is funded by employers’ payroll taxes, which account for .8 percent per employee. The rate is actually 6.2 percent of compensation, but employers are allowed a tax credit for these payments, which results in the net .8 percent. With this benefit, employees receive unemployment benefits and/or job training when they are laid off or let go from a current job. However, employees would be ineligible to receive these benefits if they quit their job, as it must be involuntary. Just like Social Security, this payroll tax on employers is required.

Some employers also offer workers’ compensation benefits. If an employee is hurt on the job, he or she would receive certain benefits, such as a percentage of pay. Jobs are classified into risk levels, and obviously the higher the risk level, the higher the cost of insurance. This is not a federally mandated program, but for some occupations in some states, it may be a requirement.

Mandated: COBRA

While the government does not require companies to provide health-care and medical benefits to employees, the Consolidated Omnibus Budget Reconciliation Act (COBRA) requires companies to allow employees to extend their group coverage for up to thirty-six months. The restrictions for this plan include the requirement of a qualifying event that would mean a loss of benefits, such as termination or reduction in hours. For example, if an employee works forty hours a week with medical insurance, but the schedule is reduced to twenty hours, no longer qualifying him or her for benefits, COBRA would be an option.

Voluntary: Incentive Pay Systems

As we discussed earlier, there are several types of incentive pay systems that can be tied directly to business objectives and the employees’ ability to help the company meet those objectives. They include commissions, bonuses, profit sharing, stock options, team pay, and merit pay.

Commissions are usually calculated on the basis of a percentage and earned based on the achievement of specific targets that have been agreed upon by the employee and employer. For example, many salespeople receive commissions from each item sold. Many commission incentive plans require employees to meet a minimum level of sales, who then are paid a comission on each sale beyond the minimum. A straight commission plan is one in which the employee receives no base pay and entire pay is based on meeting sales goals. Many plans, however, include a base pay and commission for each sale. Base pay is the guaranteed salary the employee earns.

Several types of bonuses can be given to employees as incentive pay. Meeting certain company goals or successfully completing a project or other objectives can be tied to a bonus, which is a one-time payment to an employee. A spot bonus is an unplanned bonus given to an employee for meeting a certain objective. These types of bonuses do not always have to be money; they can be other forms such as a gift certificate or trip. Fifty-eight percent of WorldatWork members (WorldatWork, 2000) said that they provide spot bonuses to employees for special recognition above and beyond work performance.

Some organizations choose to reward employees financially when the organization as a whole performs well, through the use of profit sharing as an incentive. For example, if an organization has a profit-sharing program of 2 percent for employees, the employees would earn 2 percent of the overall profit of the company. As you have guessed, this can be an excellent incentive for employees to both work as a team and also monitor their own personal performance so as not to let down the team. For example, in 2011, US automaker General Motors gave one of its highest profit-sharing payouts ever. Forty-five thousand employees received $189 million in a profit-sharing bonus, which equaled about $4,200 per person (Bunkley, 2011). While profit sharing can be a great incentive, it can also be a large expense that should be carefully considered.

Employee ownership of the organization is similar to profit sharing but with a few key differences. In this type of plan, employees are granted stock options, which allow the employees to buy stock at a fixed price. Then if the stock goes up in value, the employee earns the difference between what he or she paid and the value of the stock. With this type of incentive, employees are encouraged to act in the best interest of the organization. Some plans, called employee stock ownership plans, are different from stock options, in that in these plans the employee is given stock as reward for performance.

Figure 6.5

Profit sharing and stock ownership can be a good way to motivate employees to work toward the goals of the organization.

Chris Potter – 3D Budget Pie Chart – CC BY 2.0.

In a smaller organization, team pay or group incentives can be popular. In this type of plan, if the group meets a specified goal, such as the increase of sales by 10 percent, the entire group receives a reward, which can consist of additional pay or bonus. Please note that this is different from individualized bonuses, discussed earlier, since the incentive is a reward for the group as opposed for the individual.

Merit pay is a pay program that links pay to how well the employee performs within the job, and it is normally tied to performance appraisals. Performance appraisals are discussed further in Chapter 10 “Managing Employee Performance”. Merit base is normally an annual pay increase tied to performance. The problem with merit pay is that it may only be received once per year, limiting incentive flexibility. To make merit pay work, performance guidelines should be predetermined. Some organizations offer cost of living annual increases (COLAs), which is not tied to merit but is given to employees as an annual inflationary increase.

Fortune 500 Focus

While the cost of health insurance premiums may be going up for most Americans, these premiums do not hit the individual employee’s pocketbook at Microsoft. Microsoft, based in Redmond, Washington, finds itself once again on the Fortune 500 Best Companies to Work For list in several areas, including paying for 100 percent of employees’ health-care premiums1. In addition to cutting this cost for employees, Microsoft also offers domestic partner benefits, one of the first Fortune 500 companies to do so. In 2005, Microsoft also began to offer partial coverage for transgender surgery to its existing health-care coverage, which earned Microsoft the highest attainable score by the Human Rights Campaign (HRC) Equality Index (GLEAM, 2011). Microsoft also promotes fitness and wellness as part of its health-care plan, providing an on-site fitness center and subsidized gym memberships.

Voluntary: Medical Insurance

According to the Bureau of Labor Statistics, 62 percent of companies in 2010 offered health-care benefits to employees (US Bureau of Labor Statistics, 2010). The yearly cost for employee medical insurance averages $9,552, according to the 2009 Towers Perrin survey (Watson, 2009). With such a significant cost to companies, it is up to HR managers to contain these costs, while not negatively affecting employee motivation. Medical insurance usually includes hospital expenses, surgical expenses, and routine health-care visits. Most insurance plans also allow for wellness visits and other alternative care (e.g., massage and acupuncture) within the plans. Many employers also offer vision and dental care benefits as part of their benefits packages. Disability insurance is also provided by some employers as well. We will discuss each of these in detail next.

One important law to keep in mind regarding medical insurance is the Health Insurance Portability and Accountability Act (HIPAA) of 1996. It provides federal protections for personal health information held by covered entities, such as employers. In other words, employers cannot divulge or share health care information they may have on an employee.

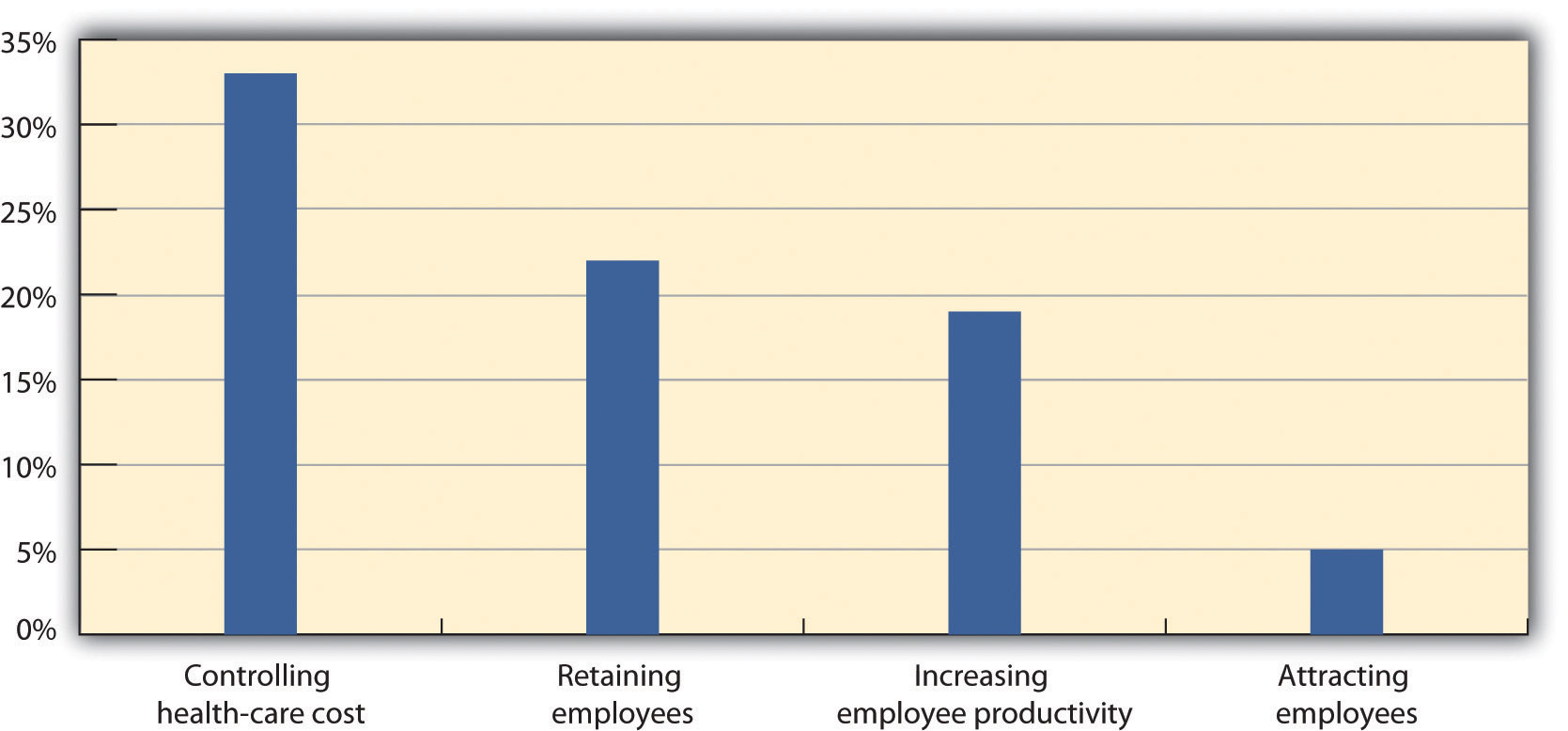

Figure 6.6

As you can see from MetLife’s 9th annual study in 2010, cost containment is an important aspect to health-care plans.

Source: MetLife, “9th Annual Study of Employee Benefits Trends,” 2010, http://www.metlife.com/assets/institutional/services/insights-and-tools/ebts/Employee-Benefits-Trends-Study.pdf (accessed July 23, 2011).

As the HR professional, it will likely be your responsibility to choose the health-care plan that best meets the needs of your employees. Some options include the following:

- Fee-for-service plans. In this type of plan, people pay for medical expenses out of pocket, and then are reimbursed for the benefit level. For example, if your insurance plan covers doctor visits, you could see any doctor, pay the bill, and then submit payment to your insurer for reimbursement. Most companies will have a base plan, which covers more serious issues requiring hospitalization, while the major medical part of the plan would cover routine services, such as doctor’s visits. As you can imagine, the disadvantage of this type of plan can be twofold: first, the initial expense for the employee, and second, the time it may take to receive reimbursement for employees. Remember that medical insurance can help retain and motivate employees and help you recruit new employees, so consideration of the disadvantages is important.

- Health maintenance organizations (HMOs). The HMO will likely have greater coverage than the fee-for-service plan, but it limits the ability of employees to see the doctors they choose. There may be a limited number of physicians and specialists for the employee to see, and going outside the plan and seeing another doctor may result in an out-of-pocket expense for the employee. Most HMOs cover a wide range of medical issues and will usually require a copayment by the employee. Some may have minimum deductibles they must meet before the HMO will cover in full. For example, if you are part of an HMO with a deductible of $500 and copayments of $25, you would need to see the doctor for a value of $500 (paid out of pocket) before you can begin to just make the $25 copayment for visits. Some HMOs will not allow members to see a specialist, such as a dermatologist, without prior approval from the primary care physician.

- Preferred provider organization (PPO). This type of medical plan is similar to HMOs but allows employees to see a physician outside the network. They will likely still have to pay a deductible as mentioned above, but PPOs do allow employees more freedom to see specialists, such as dermatologists.

When choosing the best type of plan for your organization, the following aspects should be considered:

- The cost of the plan

- The type of coverage

- The quality of the care

- Administration of the plan

First, the cost is usually a major consideration for the HR professional. Developing a budget for health-care costs, initiating bids from possible providers, and then negotiating those bids is a key factor in controlling this cost for employers.

Second, asking for employees’ opinions about the type of coverage they would prefer is a way to ensure your plan meets the needs of your employees. Next, consider the quality of care your employees will receive and, finally, how simple will the plan be for your HR department to administer. For example, many HMO plans offer fully automated and online services for employees, making them easy to administer.

Disability insurance provides income to individuals (usually a portion of their salary) should they be injured or need long-term care resulting from an illness. Short-term disability insurance (STD) provides benefits to someone if they are unable to work for six months or less, while long-term disability insurance (LTD) covers the employee for a longer period of time. Normally, disability insurance provides income to the employee that is 60–80 percent of their normal salary.

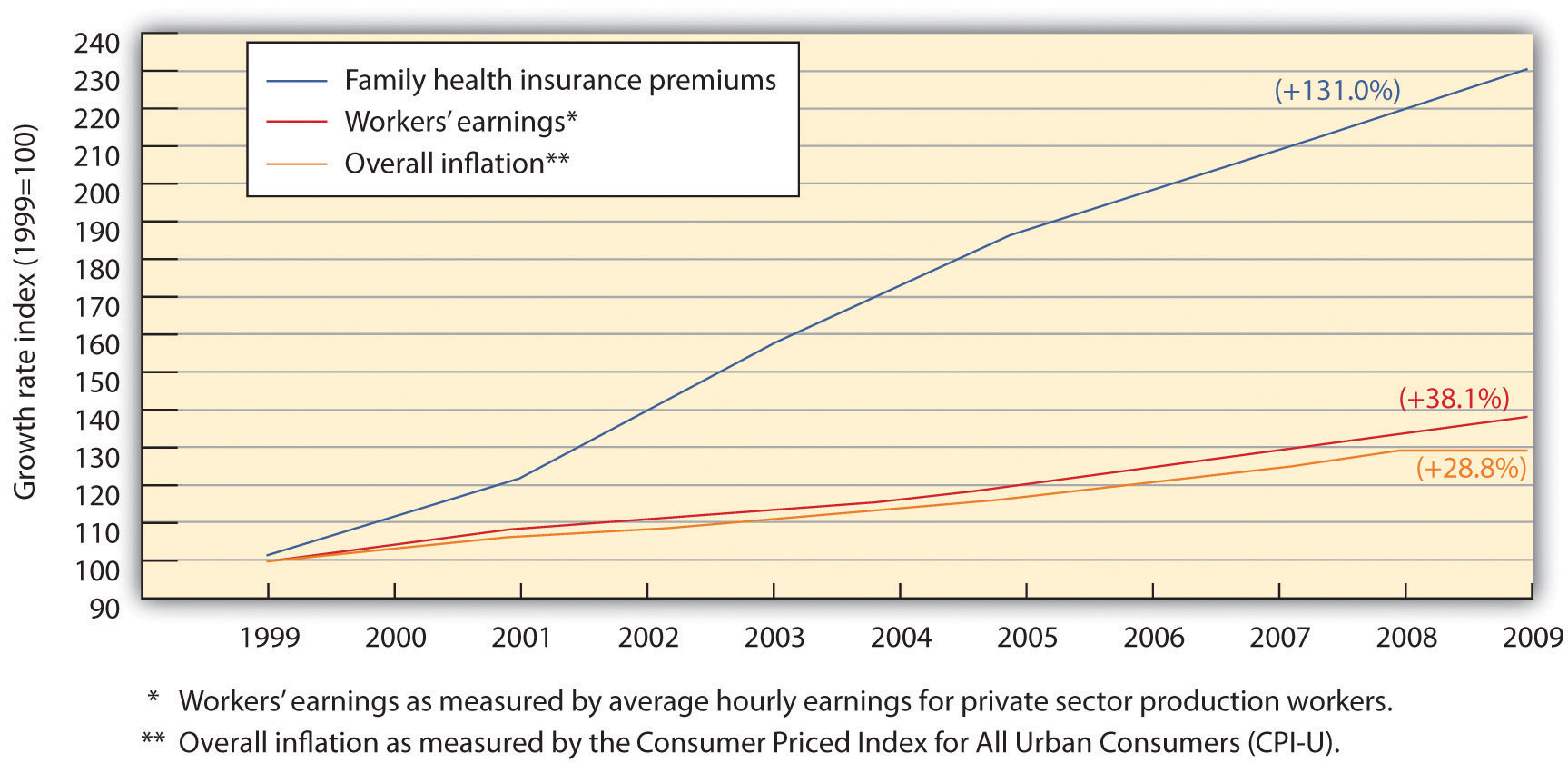

Figure 6.8

One of the biggest challenges in health-care benefits planning is to manage the growing cost of health insurance premiums for employees while still managing cost containment for the organization.

Source: Economic Policy Institute, “The State of Working America: Health Premiums,” http://stateofworkingamerica.org/charts/growth-rate-of-premiums-earnings-and-inflation/ (accessed July 23, 2011).

Voluntary: 401(k) Plans

As the scenery of the workforce has changed, benefits have changed, too. One such recent change is the movement of employee pension plans to 401(k) plans. While some organizations still offer pension plans, such plans are far more rare. A pension plan is a set dollar amount an employee will receive when they retire from their organization. This type of plan was popular when most people worked their entire life at the same company. However, many pension plans have gone bankrupt, and the United States has an agency to protect people from losing pension benefits. The Pension Benefit Guaranty Corporation (PBGC) was created by the Employee Retirement Income Security Act (ERISA) to protect pension benefits in private sector pension plans. If a pension plan ends or isn’t able to pay all benefits, PBGC’s insurance program pays the benefit that should have been provided. Financing for this plan comes from insurance premiums paid by the companies whose plans PBGC protects.

As more mobility in the workplace has occurred, most organizations no longer offer pension plans, but instead, they offer 401(k) plans. While a pension plan can motivate employee loyalty, 401(k) plans are far more popular. According to the US Bureau of Labor Statistics, employer-provided retirement plans, such as 401(k) plans, were available to 74 percent of all full-time workers in the United States (US Bureau of Labor Statistics, 2010), while 39 percent of part-time workers had access to retirement benefits.

A 401(k) plan is a plan set up by the organization in which employees directly deposit money from their paycheck. The funds are tax deferred for the employee until retirement. If an employee leaves the job, their 401(k) plan goes with them. As an extra incentive, many organizations offer to match what the employee puts into the plan, usually based on a percentage. For example, an employee can sign up to contribute 5 percent of salary into a 401(k) plan, and the company will contribute the same amount. Most companies require a vesting period—that is, a certain time period, such as a year, before the employer will match the funds contributed.

Usually, 401(k) plans are easy to administer, after the initial setup has occurred. If the employer is matching employee contributions, the expense of such a plan can be great, but it also increases employee retention. Some considerations when choosing a 401(k) plan are as follows:

- Is the vendor trustworthy?

- Does the vendor allow employees to change their investments and account information online?

- How much are the management fees?

It is first important to make sure the vendor you are considering for administration of your 401(k) plan has a positive reputation and also provides ease of access for your employees. For example, most 401(k) plans allow employees to change their address online and move investments from a stock to a bond. Twenty-four-hour access has become the expectation of most employees, and as a result, this is a major consideration before choosing a plan. Most 401(k) plans charge a fee to manage the investments of your employees. The management fees can vary greatly, so receiving a number of bids and comparing these fees is important to ensure your employees are getting the best deal.

It is important to mention the Employee Retirement Income Security Act (ERISA) here, as this relates directly to administration of your 401(k) plan. First, ERISA does not require employers to offer a pension or 401(k) plan, but for those who do, it requires them to meet certain standards when administering this type of plan. Some of these standards include the following:

- Requires participants receive specific information about the plan, such as plan features and funding

- Sets minimum standards for participation and vesting

- Requires accountability of plan’s fiduciary responsibilities

- Requires payment of certain benefits, should the plan be terminated

Voluntary: Paid Time Off

Time off is a benefit we should address, since this type of benefit varies greatly, especially in other parts of the world. French companies, for example, are mandated by law to provide five weeks of paid vacation time to employees (Leung, 2009). In the United States, the number of days off provided is a major budget item worth considering. Here are the general types of time off:

Paid Holidays

Many companies offer a set number of paid holidays, such as New Year’s Day, Memorial Day, Christmas, Independence Day, and Thanksgiving.

Sick Leave

The number of sick leave days can vary greatly among employers. The average in the United States is 8.4 paid sick days offered to employees per year (HRM Guide, 2011).

Paid Vacation

With full-time employment, many organizations also offer paid vacation to employees, and it is generally expected as part of the compensation package. According to a survey performed by Salary.com, the average number of paid vacation days in the United States is nine days for one year of service, fourteen days for five years of service, and seventeen days for ten years of service to the organization (Yang, 2011).

Organizations vary greatly in how vacation time is accrued. Some organizations give one hour for a certain number of days worked, while others require a waiting period before earning any paid time off (PTO). In addition, some organizations allow their employees to carry over unused vacation time from one year to the next, while other employees must use their vacation every year or risk losing it.

Paid Time Off (PTO)

One option is to provide a set number of days off, which can be used for vacation time, holidays, and/or sick leave.

To promote longevity, some organizations offer paid (or for example, 60 percent of salary paid) sabbaticals. For example, after five years of employment, the employee may take a paid sabbatical for one month.

A Final Note on Compensation and Benefits Strategy

When creating your compensation plan, of course the ability to recruit and retain should be an important factor. But also, consideration of your workforce needs is crucial to any successful compensation plan. The first step in development of a plan is to ask the employees what they care about. Some employees would rather receive more pay with fewer benefits or better benefits with fewer days off. Surveying the employees allows you, as the HR professional, to better understand the needs of your specific workforce. Once you have developed your plan, understand that it may change to best meet the needs of your business as it changes over time.

Once the plan is developed, communicating the plan with your employees is also essential. Inform your employees via an HR blog, e-mails, and traditional methods such as face to face. Your employees might not always be aware of the benefits cost to the company, so making sure they know is your responsibility. For example, if you pay for 80 percent of the medical insurance premiums, let your employees know. This type of communication can go a long way to allowing the employees to see their value to you within the organization.

Compensation Strategies

<a data-iframe-code=”” href=”http://www.youtube.com/v/NCGeEbPYzV0″ class=”replaced-iframe”>(click to see video)

Lynn Cameron, managing partner of TechEdge, discusses compensation strategies.

Key Takeaways

- Before beginning work on a pay system, some general questions need to be answered. Questions such as what is a fair wage from the employee’s perspective and how much can be paid but still retain financial health are important starting points.

- After some pay questions are answered, development of a pay philosophy must be developed. For example, an organization may decide to pay lower salaries but offer more benefits.

- Once these tasks are done, the HR manager can then build a pay system that works for the size and industry of the organization.

- Besides salary, one of the biggest expenses for compensation is medical benefits. These can include health benefits, vision, dental, and disability benefits.

- Social Security and unemployment insurance are both required by federal law. Both are paid as a percentage of income by the employee and employer.

- Depending on the state, workers’ compensation might be a requirement. A percentage is paid on behalf of the employee in case he or she is hurt on the job.

- A mandatory benefit, COBRA was enacted to allow employees to continue their health insurance coverage, even if they leave their job.

- There are three main types of health-care plans. A fee-based plan allows the insured to see any doctor and submit reimbursement after a visit. An HMO plan restricts employees to certain doctors and facilities and may require a copayment and/or deductibles. A PPO plan is similar to the HMO but allows for more flexibility in which providers the employee can see.

- Pension funds were once popular, but as people tend to change jobs more, 401(k) plans are becoming more popular, since they can move with the employee.

- Profit sharing is a benefit in which employees receive a percentage of profit the organization earns. Stock ownership plans are plans in which employees can purchase stock or are granted stock and become an owner in the organization.

- Team rewards are also a popular way to motivate employees. These can be in the form of compensation if a group or the company meets certain target goals.

- Paid time off, or PTO, can come in the form of holidays, vacation time, and sick leave. Usually, employees earn more days as they stay with the company.

- Communication with employees is key to a successful benefits strategy.

Exercises

- Of the benefits we discussed, which ones are required by law? Which are not?

- Research current Federal Insurance Contributions Act (FICA) tax rates and Social Security limits, as these change frequently. Write down each of these rates and be prepared to share in class.

- Describe the considerations when developing medical benefits. Which do you think would be the most important to you as the HR manager?

- Visit websites of three companies you might be interested in working for. Review the incentives they offer and be prepared to discuss your findings in class.

1“100 Best Companies to Work For,” Fortune, accessed July 21, 2011, http://money.cnn.com/magazines/fortune/bestcompanies/2010/snapshots/51.html.

References

Bunkley, N., “GM Workers to Get $189 Million in Profit Sharing,” New York Times, February 14, 2011, accessed February 21, 2011, http://www.nytimes.com/2011/02/15/business/15auto.html?_r=2&ref=business.

Gay, Lesbian, Bisexual, and Transgender Employees at Microsoft (GLEAM), Microsoft website, accessed July 21, 2011, http://www.microsoft.com/about/diversity/en/us/programs/ergen/gleam.aspx.

HRM Guide, “Sick Day Entitlement Survey,” accessed February 21, 2011, http://www.hrmguide.com/health/sick-entitlement.htm.

Leung, R., “France: Less Work, More Time Off,” CBS News, February 11, 2009, accessed July 23, 2011, http://www.cbsnews.com/stories/2005/06/27/60II/main704571.shtml.

US Bureau of Labor Statistics, “Employee Benefits Survey,” 2010, accessed July 23, 2011, http://www.bls.gov/ncs/ebs/benefits/2010/ownership/private/table01a.htm.

Watson, T., “2009 Health Care Cost Survey Reveals High-Performing Companies Gain Health Dividend,”

WorldatWork, “Spot Bonus Survey,” July 2000, accessed July 23, 2011, http://www.worldatwork.org/waw/research/html/spotbonus-home.html.

Yang, J., “Paid Time Off from Work Survey,” Salary.com, accessed September 15, 2011, http://www.salary.com/Articles/ArticleDetail.asp?part=par088.