11

Lindsey Skidmore

Introduction

Keywords

- SARS-CoV-2/COVID-19/Coronavirus

- Volatility

- Lethality

- Black Monday II

- Dow Jones Industrial Average (DJIA)

- Gross Domestic Product (GDP)

- Stimulus Checks

- CARES ACT

- Money Transactions

- Trading Floor

- Imports

- Exports

- Supply Side Economic

- Demand Side Economics

Learning Objectives

- Describe the effects of the COVID-19 pandemic on different sectors of the economy.

- Differentiate between the supply side and demand side economic effects of the Coronavirus pandemic.

- Understand the effect of social restrictions on the stock market.

- Explain how government responses to the spread of COVID-19 affected the economy.

- Describe how the crude oil sector of the economy was affected by factors other than the Coronavirus.

- Differentiate between the economic effects of COVID-19 and the economic effects of other pandemics like the Swine Flu and influenza pandemics.

The Coronavirus is a respiratory virus that is extremely contagious. In China, following the first outbreak, many preventative measures were taken to stop the spread of the virus. Because China is a country run by a communist party, the restrictions put in place, while effective, were very extreme. Despite heavy restrictions, COVID-19 spread rapidly to other countries. Developed countries began to worry when Italy developed the virus at a regional level. Italy was one of the first democratic, first-world countries to implement heavy social restrictions such as social distancing, travel bans, and stay at home orders. Italy showed high death tolls due to their ageing population and lack of quick response. The rest of Europe shortly followed. While the United States of America discovered its first case in January, 2020, they did not put social restrictions in place until March, 2020. The virus was classified as a global pandemic in March, 2020 by the World Health Organization.

Some of the social restrictions that were put in place to slow the spread of COVID-19 included wearing masks, social distancing, cancellation of large gatherings, business closures, capacity limitations and stay at home orders. These restrictions impacted the economy, often negatively. Stay at home orders and social distancing overall decreased consumption by people being confined to their homes. Canceling large events deprived the economy from the revenue that would come from those events. Business closures limited supply and capacity regulations indirectly decrease consumption by encouraging consumers to stay home. The question many countries had to answer was to save the economy before the people or save the people before the economy. Most countries chose the latter.

Saving the people before the economy was morally correct but had lasting negative impacts on the economy. The reduction of general economic activity caused by social restrictions had a negative impact on the stock market by increasing its volatility or uncertainty. The stock market had a vital role in global and national economic activity. Economic reduction due to COVID-19 also had negative impacts on individuals within the US and their personal economic situations. Social restrictions were likely to stay in effect for a long period of time. The longer these restrictions were in place, the greater their effect on the economy became. A global recession was experienced in 2020 due to the economic effects of Coronavirus. The global economic future was unpredictable because many aspects of Coronavirus remain unknown. These uncertainties included the possibility of a second wave, the development of a vaccine, and the effect of asymptomatic patients on the rate of the spread of COVID-19. These impacts were not comparable to other economic events because there has never been a disease that has had this type of effect on economic activity. The COVID-19 pandemic had a large impact on the stock market, unemployment, and economic sectors in a short period of time.

Figure 1. “Social Distancing Corona” is in the Public Domain, CC0

The Stock Market

Key Takeaways

The economy of The United States of America was negatively impacted due to the COVID-19. The negative impact can be associated with the government response to the virus and the social restrictions used to decrease the rate of infection of Coronavirus.

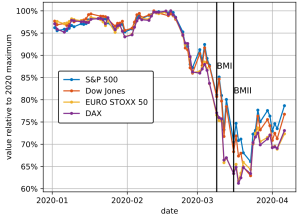

The stock market is a vital part of economics that can be used to assess the current state of the economy. The economy has been negatively affected by an outside factor when the stock market crashes. During 2020 many stock market drops were seen throughout the year. The largest of these drops occurred on March 26, 2020 and was nicknamed Black Monday II. As one of the largest single day drops in history, the stock market plummeted 12-13% in one day during Black Monday II (Mazur, 2020). Some sectors of the economy were impacted more than others. The best performing industries include healthcare, food, software and technology, and natural gas which all experienced around 20% gain. The worst performing industries included crude petroleum and oil services, real estate, and hospitality and entertainment all of which experienced over 70% drops (Mazur, 2020). In 2020, the stock market experienced increased volatility which is a sign of negative economic growth.

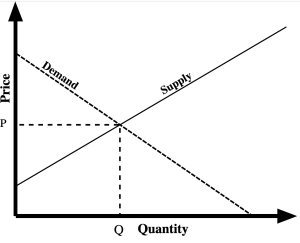

The negative effect on the stock market was caused by the appearance of Coronavirus and its classification as a global pandemic. Social restrictions, like stay at home orders and capacity regulations, decreased economic activity by decreasing consumption. Forced closures and bankruptcy of businesses caused decreases in supply side economic activity. This decrease will be long lasting as many small businesses have gone out of business permanently. It will be easier to correct the economy from the demand side because consumption increases as social restrictions are gradually lifted in different states and countries. The drop in the stock market was caused by the decrease in supply side and demand side economics due to social restrictions. From February 24 to April 20, 2020, two dozen changes in the stock market greater than 2.5 percent were discovered to be related to the Coronavirus (Baker, 2020). This is a large number of stock market moves seen in a relatively short time period all caused by one source.

The effect on the stock market was caused by the social restrictions associated with the virus but can not be connected to the lethality of COVID-19 or the rate of infection of the virus. COVID-19 is roughly one twenty-fifth as lethal as the Spanish Flu pandemic of 1918-1920 (Baker, 2020). There was no recession during 1918-1920, meaning that the Spanish Flu did not cause a recession or have many negative economic consequences. However, the Spanish Flu was more lethal than the Coronavirus. If lethality of a virus contributed to recession and economic activity, then a recession would have begun mid-1918. The difference between the Spanish Flu Pandemic and Coronavirus was in the government response during the different time periods. In 1918, there was no technology capable of keeping people connected while in isolation. In 2020, people could work from home, educate from home, and have food and groceries delivered, allowing them to stay in isolation for as long as necessary. The CDC in 2020 responded with stay at home orders and limited capacity guidelines. These restrictions were the difference between the economic patterns during the Spanish Flu and the Coronavirus and were considered the reason for the stock market crash of 2020. Similar results can be drawn when comparing Coronavirus to the influenza pandemics of 1957-58 and 1968 (Baker, 2020).

One common way to measure the stock market is using the Dow Jones Industrial Average (DJIA), a widely accepted benchmark index for United States stock. If we look at this index throughout 2020, we can see a period of time in which the market fell 26% in four days (Mazur, 2020). This was a large decrease seen over a very short period of time that was caused by government response to the pandemic. This drop shows that the US economy was the most affected by the pandemic. The economic decrease in the United States was felt worldwide because the US economy often supports the economies of developing countries through imports. Another common measure of the United States economy is by looking at the US GDP which was seen to drop by 4.8 points during the first quarter of 2020, when Coronavirus was spreading toward its peak. (Mazur, 2020). US GDP is the United States Gross Domestic Product or the value of all finished goods and services in the country. The United States economy began to suffer due to the social restrictions put in place to slow the spread of COVID-19.

Figure 2. “Stock-indices-2020crash” by Geek3 is licensed under CC BY-SA 4.0

Unemployment

Key Takeaways

The unemployment rate was at an all time high during the Coronavirus pandemic as business closed and had to fire many employees. The American governments did what they could to help the economic situation for their citizens.

Social restrictions in the US included business closures. Businesses had to close dine-in services for restaurants and bars but many restaurants remained open for takeout and curb side pick up. They offered delivery services to maintain sales and make some sort of profit. Small restaurants suffered the most. When restaurants were allowed to open again, they did not have many customers due to social restrictions. Bars were the last to open but the experience had changed, hurting their revenue. Small restaurants could not afford to stay open while losing most if not all of their revenue. Many local restaurants were forced to close indefinitely. In addition to restaurants, small businesses like shopping boutiques, advertising companies, and amusement parks were negatively impacted by coronavirus and forced to close. Amusement parks were unable to operate normally, meaning they could not gain any revenue. Still having to spend some money on maintenance fees, they rapidly lost money and some were forced to close permanently. Due to cancelation of large events and closures of many businesses, advertising was not needed. Advertising businesses lost clients and some were not able to make profit and had to shut down. All sectors of the economy experienced a decrease in consumption, including small boutiques. The boutiques that stayed open had extra expenses for safety precautions and cleaning supplies. People feared for their health when going out and would only go out for necessary items, which did not include items found in boutiques. With increased expenses and decreased consumption, many small shops were forced into closure.

All types of closures lead to an increase in unemployment. When restaurants closed their dine in options, waitresses and bartenders were out of work. It started as a temporary lay off, but as the months continued and permanent closures began, many workers were forced to file for unemployment. Owners of small businesses had to file for unemployment. School closures nationwide caused some unemployment of teachers and administrators whose jobs did not convert to virtual learning platforms. The unemployment rate spiked to over 20% in the first quarter of 2020 (Mazur, 2020). Hotels were a large source of job loss. With travel restrictions and business conference meetings being held online, hotels lost business quickly. The estimated job loss from the hotel and travel industry alone is 3.5 million, which is roughly 33% of all job loss experienced directly due to COVID-19 (Carpenter, 2020). An additional 120,000 jobs were lost in the entertainment sector and an estimated 50,000 entertainment industry freelancers lost their jobs due to cancelations of shows and large in person events (Peterson 2020). The effect of COVID-19 on unemployment was common across all countries, not just in the United States of America. Millions of people worldwide lost income or employment due to the Coronavirus.

There were varying government responses to the increase in unemployment within their countries. In America, stimulus checks were given out in order to help citizens recover from the economic impacts from COVID-19. The US government passed the Coronavirus Aid, Relief, and Economic Security Act, also known as the CARES Act. With the CARES Act, the US government gave a total of 2.2 billion dollars to its citizens to help them recover from the virus economically. It provided American citizens with up to $1,200 of recovery money (Schulze 2020). These payments were targeted toward people who had suffered job loss as a direct result of the pandemic. By looking at the distribution of spending of stimulus checks by Americans, we can see how bad the situation was. Unsurprisingly, 16% of all stimulus checks were spent on food (Schulze 2020). The second largest spending category is what is surprising. Americans spent roughly 14% of their checks on money transactions (Schulze 2020). Money transactions occurred between friends and family members, either lending or borrowing money. When people had a sudden influx of cash, they used a large portion of it to pay back borrowed money. This shows that the economic state for individuals was so bad that they had to spend 14% of government sanctioned money to pay back friends and family. Mass unemployment had caused stress on the American government and the American people.

Figure 3. “Businesses closed in Portland because of Coronavirus” by Sarahmirk is licensed under CC BY-SA 4.0

Sectors of the Economy

Key Takeaways

The spread of COVID-19 had negative impacts on many sectors of the economy including the crude oil, travel and hospitality, education, and agriculture sectors. Each sector of the economy was impacted in a different way.

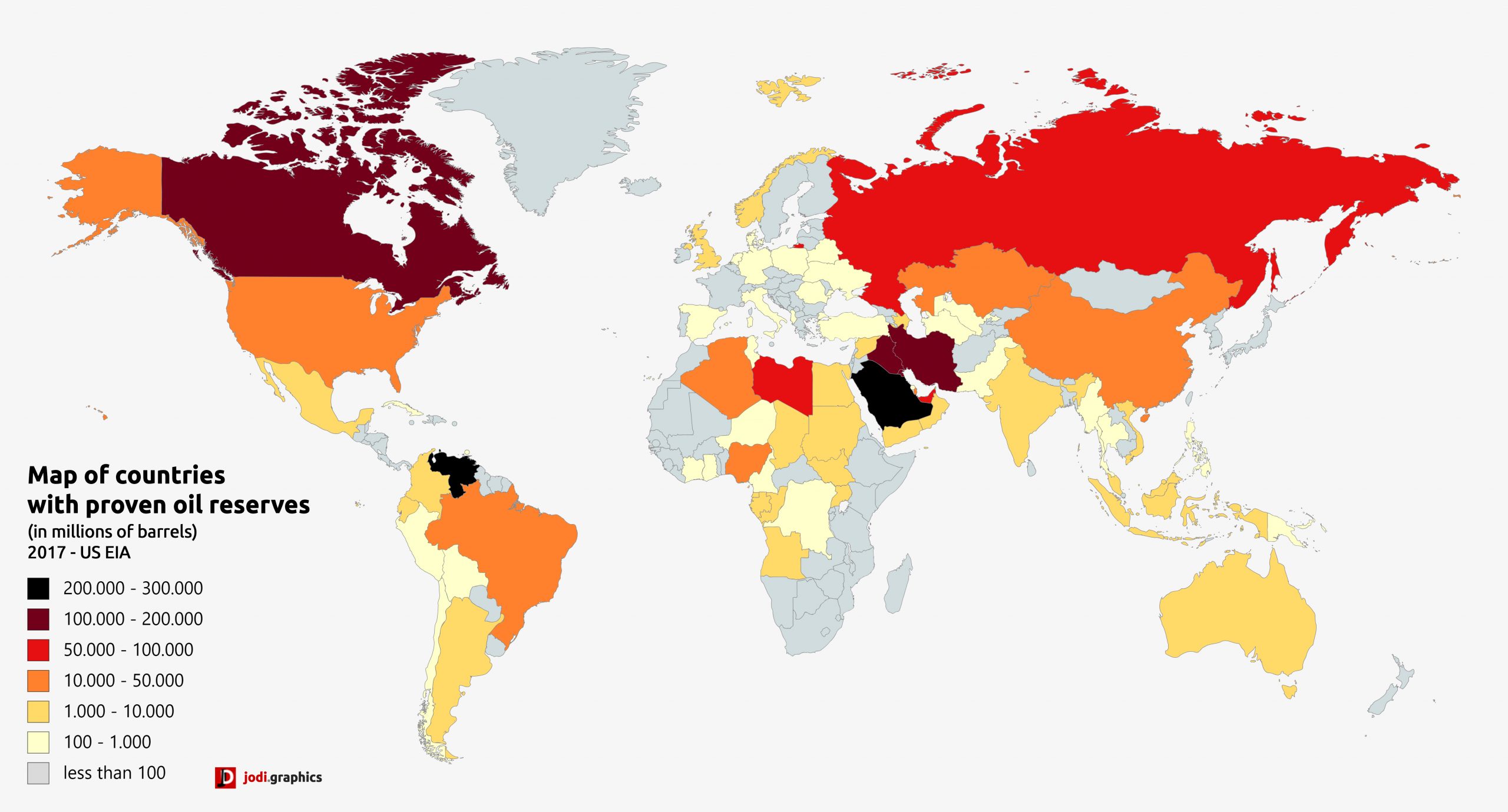

Figure 4. “Simple supply and demand” by Dallas.Epperson is licensed under CC BY-SA 3.0

Crude Oil Sector

The oil sector of the economy was affected during the Coronavirus pandemic from both the supply side and the demand side. From the supply side, there was a surplus of oil. Saudi Arabia started an oil war with Russia mid-march, just 49 days after the initial outbreak of COVID-19 in China. Oil flooded the market as the two nations fought to drive prices down and increase their revenue. The supply side changes were not due to the onset of Coronavirus, but the demand side was directly affected by the pandemic. The demand for oil decreased steadily. Travel bans and stay at home orders meant people were driving less as they were working from home. Airplanes were flying less so less jet fuel was being used. Consumption dropped in most places around the world, forcing oil prices even further down. In developed countries like America that import oil, the price reduction helped their economies. However, oil dependent countries like Venezuela, Angola, and Nigeria suffered greatly. Their economies are dependent on the revenue from exporting oil. Between the decrease in demand and the forced price reduction for their product from the oil war, oil dependent countries were receiving little revenue. Their economies continued to worsen as social distancing and travel restrictions remained in many countries and oil demand did not increase as quickly as they had hoped. The economies of oil-dependent countries are still recovering as demand increases slowly.

Figure 5 “:Map-of-countries-by-proven-oil-reserves-(in-millions-of-barrels)” by Jo Di Graphics is licensed under CC BY-SA 4.0

Travel and Hospitality Sectors

The travel and hotel industries were negatively affected by the COVID-19 pandemic. International travel bans were placed by many countries. Airplanes were forced to follow social distancing restrictions by seating the passengers six feet apart. Maintaining social distancing guidelines was not an issue for airlines because most planes flew almost empty. All airlines experienced a decrease in revenue and some were forced to shut down because they could not afford to maintain operation throughout the COVID-19 pandemic. The International Air Transportation Association (IATA) stated that the air travel industry would lose $113 billion if the COVID-19 outbreak was not quickly contained (Carpenter, 2020). The outbreak was not contained quickly and the airline industry continued to suffer.

The hotel industry experienced an extreme decrease in demand. With people no longer traveling for pleasure due to the government restrictions, few people needed a hotel. Business travelers were a large source of revenue for hotels when conferences occu[]red for multiple days and employees were required to stay in hotels. Because large corporations were operating through online platforms, their meetings were not held in hotels and the hotels lost this source of revenue. On average, hotel capacity dropped by over 40% (Carpenter, 2020). The hotel industry revenue per available room in the US dropped by 11.6% the week after the stock market crash (Nicola, 2020). This rapid loss of revenue due to COVID-19 caused many hotels to be unable to afford to pay employees. Many jobs were lost in hotels globally because of the global pandemic. Roughly 50 million jobs in the tourism sector of the economy were at risk as a direct consequence of COVID-19 (Nicola, 2020). The hotel and aviation industries experienced massive loss of income due to Coronavirus and its social restrictions.

Education Sector

The education sector of the economy was affected when schools closed to decrease the rate of transmission of the virus between students. Students were told to continue their studies from home through various online platforms. Because public schools are funded by the government, the cost of closures came out of the government budget. In America, the average cost of closing schools was approximately $142 per student per week (Nicola, 2020). Considering most schools were closed nationwide, the sum total loss for closing schools in the United States was large. Nationwide closure for 12 weeks would cost roughly $1.1 billion (Nicola, 2020). Students in K-12 were projected to experience a 3% lower income over their lifetimes and an average of 1.5% lower annual GDP for the remainder of the century due to learning loss equivalent to one-third of a school year (Camera, 2020). This economic burden fell disproportionately on impoverished areas within the country. Low income areas were at a disadvantage because they did not always have access to the technology or the high speed internet that was required for many online learning platforms. In addition to the burdens on the national economy and the children in school, parents were negatively impacted by school closures. Economic burden on families increased due to the loss of access to the free and reduced lunch programs. Many families also experienced a lack of income because some parents could not work. Some parents had to take time off work in order to teach their children, which resulted in a loss of income for the family. The negative impact on the economy due to school closures continued to grow unless there was improvements made to the online education system.

Figure 6. “School Classroom seating arrangements during the time of covid 19” by Akbarali is licensed under CC BY-SA 4.0

Agriculture Sector

Historically, the agriculture sector of the economy is the most resilient. Through many recessions and economic hardships, this sector has typically remained unharmed. Through the 2020 recession brought on by the COVID-19 pandemic, agricultural economies began to suffer. From the supply side, not much had changed. Nothing was affecting the ability of farmers to grow and harvest crops. Manual work continued and crops were harvested normally. However, the first issue occurred when there was a lack of delivery drivers and food inspectors due to stay at home orders and travel bans. Then, many countries were not accepting imports for a period of time, halting international trade. On the domestic level, limitations were put on the trading floor which decreased the ability for farmers to trade their goods. Then, businesses closed or experienced decreased consumption, limiting the need for them to order new inventory. Finally, decreased consumption for fresh produce was seen in grocery stores because people needed to have food that would last them fourteen days if they were to quarantine. These decreases in business hurt the agricultural sector of the economy.

Chapter Summary

- The stock market experienced a crash in March, 2020 due to the social restrictions put in place by the government. The stock market crash contributed to a global recession in 2020.

- Unemployment rates reached all time high during the Coronavirus pandemic because many businesses were forced to close their doors after major loss of revenue.

- The crude oil sector of the economy was negatively affected by the decrease in demand for oil due to social restrictions and an increase in supply due to an oil war during the same time period as the pandemic. These two factors drove oil prices down, hurting the economies of oil dependent countries.

- The travel and hospitality sectors of the economy lost revenue during the COVID-19 pandemic due to the decrease in consumers because of travel bans. The hotel and aviation industries were especially affected by these factors.

- The education sector of the economy lost money due to prolonged school closures nationwide. The closures disproportionately affected people from low income families.

- The agricultural sector of the economy experienced a decrease in demand due to business closures and consumers being in quarantine.

Review Questions

The Stock Market crash in 2020 was caused by

a) Lethality of Coronavirus

b) The recession period of the business cycle

c) Social restrictions put in place to slow the spread of COVID-19

d) A second Great Depression

What was the rate of unemployment during the COVID-19 pandemic

a) Over 20%

b) 15%

c) 11.2%

d) Under 10%

Which sector of the economy is known for being resilient but was negatively impacted by COVID-19?

a) Education sector

b) Agricultural sector

c) Crude oil sector

d) Travel and hospitality sector

What was one reason for high unemployment rates during the Coronavirus pandemic?What group was disproportionately affected by the educational impacts of COVID-19?

Answers

1-c, 2-a, 3-b

References

Albulescu, C. (2020, March 18). Coronavirus and Oil Price Crash. Retrieved November 17, 2020, from https://ssrn.com/abstract=3553452

Baker, S. R. (2020). Unprecedented Stock Market Impact of COVID-19. Retrieved November 8, 2020, from https://www-nber-org.libproxy.clemson.edu/papers/w26945.pdf

Camera, L. (2020, September 14). Report: COVID-19 School Closures Could Cost U.S. Economy $14 Trillion. Retrieved November 17, 2020, from https://www.usnews.com/news/education-news/articles/2020-09-14/report-coronavirus-school-closures-could-cost-us-economy-14-trillion

Carlsson-Szlezak, P. (2020, August 18). Understanding the Economic Shock of Coronavirus. Retrieved November 17, 2020, from https://hbr.org/2020/03/understanding-the-economic-shock-of-coronavirus

Carpenter, N. (2020, November 13). COVID-19 Travel Industry Research. Retrieved November 17, 2020, from https://www.ustravel.org/toolkit/covid-19-travel-industry-research

Eschulze. (2020, April 15). Americans are spending their coronavirus stimulus checks on food, gas and paying back friends. Retrieved November 17, 2020, from https://www.cnbc.com/2020/04/15/coronavirus-stimulus-checks-how-americans-are-spending-money.html

Mazur, M., Dang, M., & Vega, M. (2020, July 09). COVID-19 and the march 2020 stock market crash. Evidence from S&P1500. Retrieved November 17, 2020, from https://www.sciencedirect.com/science/article/pii/S1544612320306668

Nicola, M., Alsafi, Z.,… (2020). The Socio-Economic Implications of the Coronavirus Pandemic (COVID-19): A Review. Elsevier Public Health Emergency Collection. doi:10.34293/commerce.v8i4.3293

Ozili, P., & Arun, T. (2020, March 30). Spillover of COVID-19: Impact on the Global Economy. Retrieved November 17, 2020, from https://ssrn.com/abstract=3562570