GERRIT LIMITED

Calculations

| Date of cash flow | CU |

| 01/07/2013(500,000 x 105%) | (525,000) |

| 01/01/2014(500,000 x 18% x 6/12) | 45,000 |

| 01/07/2014 | 45,000 |

| 01/01/2015 | 45,000 |

| 01/07/2015 | 45,000 |

| 01/07/2015(500,000 x 95%) | 475,000 |

Calculation of the fair value on initial recognition of the investment

| FV | 475,000 | CU500,000 x 95% |

| PMT | 45,000 | CU500,000 x 18% x 6/12 |

| N | 4 | 2,x 2 |

| I/YR | 6,407485 | 12,81497 ÷ 2 |

| PV thus | CU525,000 | (rounded) |

1. General journal of Gerrie Limited

| DR

CU |

CR

CU |

||

| 2013 | |||

| 01/07 | Investment in debentures (SFP) | 525,000,00 | |

| Bank (SFP) | 525,000,00 | ||

| 2014 | |||

| 01/01 | Investment in debentures (SFP) | 32,639,30 | |

| Finance income (P or L) | 32,639,30 | ||

| CU525,000,00 x 12,81497% x 6/12 | |||

| 01/01 | Bank (SFP) | 45,000,00 | |

| Investment in debentures (SFP) | 45,000,00 | ||

| Balance on Investment in debentures account: CU525,000,00 + CU32,639,30 – CU45,000,00 = CU512,639,30 | |||

| 30/06 | Investment in debentures (SFP) | 32,911,36 | |

| Finance income (P or L) | 32,911,36 | ||

| CU512,639,30 x 12,81497% x 6/12 | |||

| 30/06 | Receivable (SFP) | 45,000,00 | |

| Investment in debentures (SFP) | 45,000,00 | ||

| Balance on Investment in debentures account: CU512,639,30 + CU32,911,36,– CU45,000,00 = CU501,550,66 | |||

| 01/07 | Bank (SFP) | 45,000,00 | |

| Receivable (SFP) | 45,000,00 | ||

| 2015 | |||

| 01/01 | Investment in debentures (SFP) | 32,136,78 | |

| Finance income (P or L) | 32,136,78 | ||

| CU501,550,66 x 12,81497% x 6/12 | |||

| 01/01 | Bank (SFP) | 45,000,00 | |

| Investment in debentures (SFP) | 45,000,00 | ||

| Balance on Investment in debentures account: CU501,550,66 + CU32,136,78 – CU45,000,00 = CU488,687,44 | |||

| 30/06 | Investment in debentures (SFP) | 31,312,57 | |

| Finance income (P or L) | 31,312,57 | ||

| CU488,687,44 x 12,81497% x 6/12 | |||

| 30/06 | Receivable (SFP) | 45,000,00 | |

| Investment in debentures (SFP) | 45,000,00 | ||

| Balance on Investment in debentures account: CU488,687,44 + CU31,312,57 – CU45,000,00 = CU475,000,00 (rounded) | |||

| 01/07 | Bank (SFP) | 520,000,00 | |

| Receivable (SFP) | 45,000,00 | ||

| Investment in debentures (SFP) | 475,000,00 | ||

| Balance on Investment in debentures account: CU475,000,00 (rounded) – CU475,000 = R0 | |||

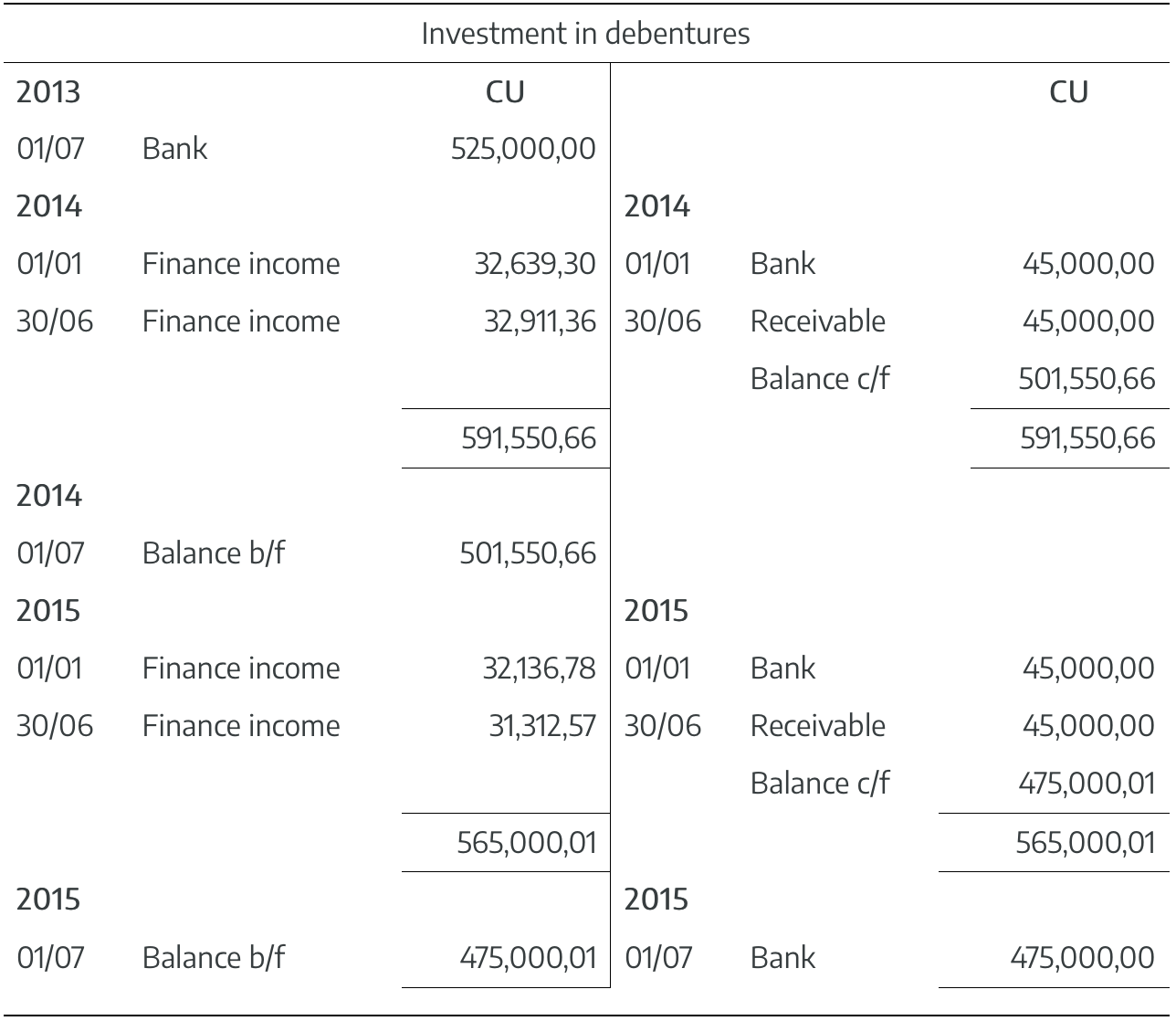

2. General ledger of Gerrie Limited