SIYABONGA LIMITED

Calculations

| Date of cash flow | CU | |

| 01/01/2014 | (CU500,000 x 105%) | 525,000 |

| 31/12/2014 | (CU500,000 x 18%) | (90,000) |

| 31/12/2015 | (CU500,000 x 18%) | (90,000) |

| [(CU500,000 x 95%)/2] | (237,500) | |

| 31/12/2016 | [(CU500,000 – CU250,000) x 18%] | (45,000) |

| [(CU500,000 x 95%)/2] | (237,500) |

Calculation of the fair value of the liability on initial recognition

| Cf0 | 0 |

| Cf1 | 90,000 |

| Cf2 | 90,000 + 237,500 = 327,500 |

| Cf3 | 45,000 + 237,500 = 282,500 |

| I/YR | 14,5 |

| NPV | = ? = 516,599,52 |

Calculation of “i” (the effective interest rate) as the present value changed due to the CU15,000 transaction costs that must now be recognised against the liability initially recognised at fair value

| Cf0 | – (516,599,52 – 15,000,00) = – 501,599,52 |

| Cf1 | 90,000 |

| Cf2 | 90,000 + 237,500 = 327,500 |

| Cf3 | 45,000 + 237,500 = 282,500 |

| IRR = ? = | 16,037558661% |

1. General journal of Siyabonga Limited

|

DR CU |

CR CU |

||

| 2014 | |||

| 01/01 | Bank (SFP) | 525,000,00 | |

| Debenture liability (SFP) | 516,599,52 | ||

| Fair value adjustment (other income)(P or L) | 8,400,48 | ||

| Debenture liability (SFP) | 15,000,00 | ||

| Bank (SFP) | 15,000,00 | ||

| 31/12 | Finance cost (P or L) | 80,444,32 | |

| Debenture liability (SFP) | 80,444,32 | ||

| CU501,599,52 x 16,037558661% | |||

| 31/12 | Debenture liability (SFP) | 90,000,00 | |

| Bank (SFP) | 90,000,00 | ||

| Balance on Debenture liability account:CU501,599,52 + CU80,444,32 – CU90,000,00 = CU492,043,84 | |||

| 2015 | |||

| 31/12 | Finance cost (P or L) | 78,911,82 | |

| Debenture liability (SFP) | 78,911,82 | ||

| CU492,043,84 x 16,037558661% | |||

| 31/12 | Debenture liability (SFP) | 90,000,00 | |

| Bank (SFP) | 90,000,00 | ||

| Balance on Debenture liability account:CU492,043,84 + CU78,911,82 – CU90,000 = CU480,955,66 | |||

| Debenture liability (SFP) | 237,500,00 | ||

| Bank (SFP) | 237,500,00 | ||

| (CU500,000/2 x 95%) | |||

| Balance on Debenture liability account:CU480,955,66– CU237,500 = CU243,455,66 | |||

| 2016 | |||

| 31/12 | Finance cost (P or L) | 39,044,34 | |

| Debenture liability (SFP) | 39,044,34 | ||

| CU243,455,66 x 16,037558661% | |||

| 31/12 | Debenture liability (SFP) | 45,000,00 | |

| Bank (SFP) | 45,000,00 | ||

| Balance on Debenture liability account:CU243,455,66 + CU39,044,34 – CU45,000,00 = CU237,500,00 | |||

| Debenture liability (SFP) | 237,500,00 | ||

| Bank (SFP) | 237,500,00 | ||

| (CU500,000/2 x 95%) | |||

| Balance on Debenture liability account:CU237,500,00 – CU237,500,00 = R0,00 | |||

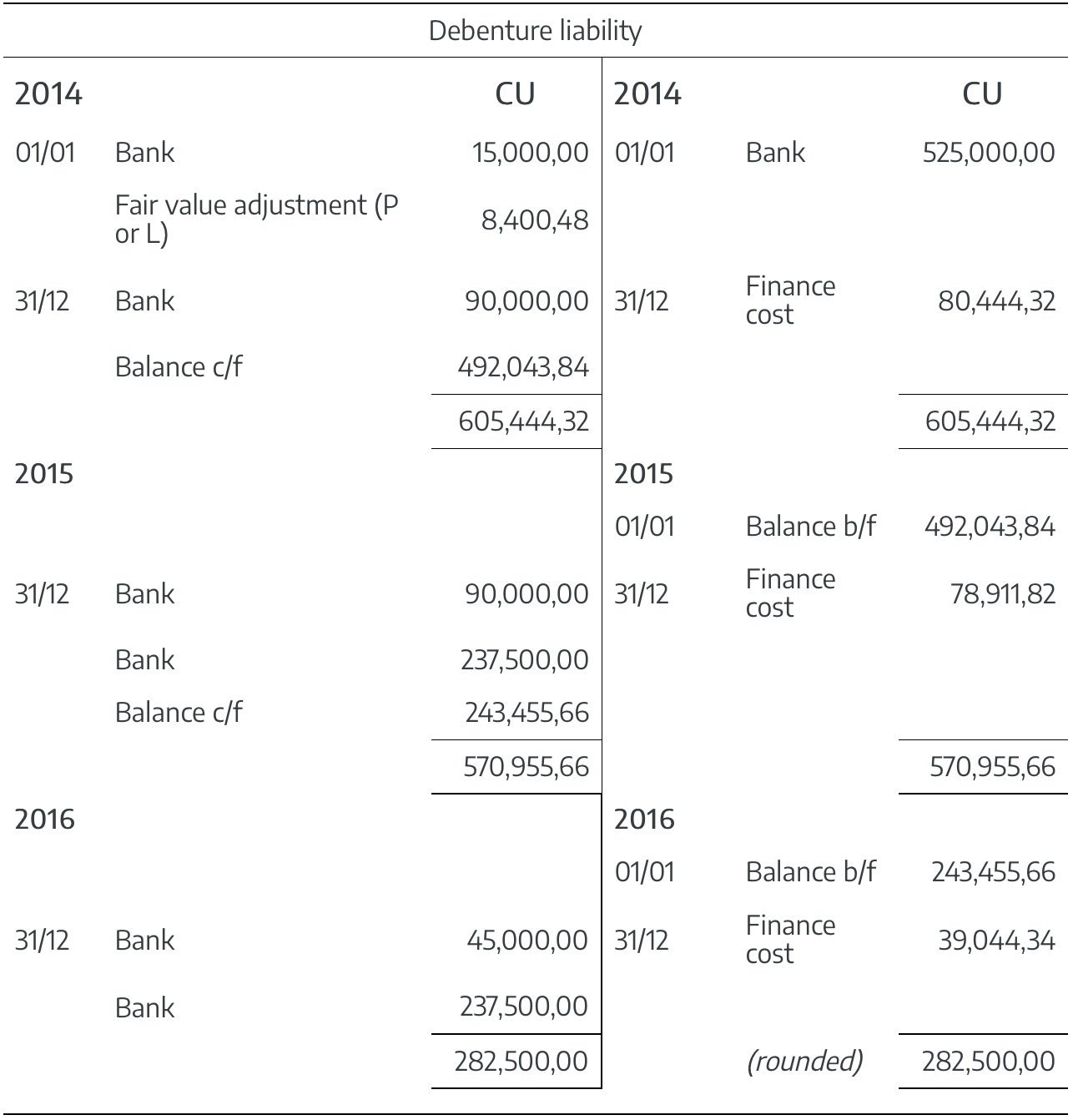

2. General ledger of Siyabonga Limited