Rights Issue Explained

While readers of this publication are typically familiar with the economic events and related basic bookkeeping surrounding equity issues, investment in shares, trade debtors and trade creditors, the rights issue of shares may be an economic event that readers of this book may not be familiar with.

Curro launches massive R1.5bn rights issue as it eyes “lucrative opportunities”

South Africa’s largest JSE-listed independent school operator is launching a massive R1.5bn rights issue to take advantage of the opportunities brought on by lockdowns worldwide. Among Curro Holdings’ expansion plans is a new online school the private education company announced in May. At the time of writing the company’s shares were up 0.11% to R9.01 in volatile trade, still a far cry from its 52-week high of R24.57.

South Africa’s largest JSE-listed independent school operator is launching a massive R1.5bn rights issue to take advantage of the opportunities brought on by lockdowns worldwide. Among Curro Holdings’ expansion plans is a new online school the private education company announced in May. At the time of writing the company’s shares were up 0.11% to R9.01 in volatile trade, still a far cry from its 52-week high of R24.57.

Curro Holdings statement:

Curro Holdings today announced a partially non-renounceable Rights Offer to raise up to R1 500 000 000 from its shareholders.

According to Andries Greyling, CEO of Curro Holdings, the rationale for the Rights Offer is to raise additional capital for potential opportunities that have presented themselves in the current market. “Curro is currently assessing several potentially lucrative opportunities,” says Greyling.

In addition, Curro will use the Rights Offer to proactively reduce the gearing levels of the company due to uncertainty created by the Covid-19 pandemic, from a prudency perspective.

“The Covid-19 pandemic presents a number of opportunities to Curro; we are ready to continue to build the company with the primary aim to ensure quality education for more learners in southern Africa, and in so doing, create value for those who walk the path with us,” says Greyling.

In terms of the Rights Offer, 185 873 606 new Curro ordinary shares will be offered to shareholders recorded in Curro’s share register at the close of business on the record date of the Rights Offer at a subscription price of R8.07 per Rights Offer Share and in the ratio of 45.10532 Rights Offer Shares for every 100 Curro ordinary shares held.

The subscription price represents a discount of approximately 10% to the 30-day volume weighted average traded price of Curro’s ordinary shares on the JSE as at close of business on Monday, 8 June 2020.

PSG Financial Services Limited, which currently holds 55.4% of the issued share capital of Curro, has agreed to follow its rights in terms of the Rights Offer and accordingly subscribe for 102 948 406 Rights Offer Shares and partially underwrite a maximum of 39 554 692 Rights Offer shares that are not taken up by other shareholders in terms of the Rights Offer. This equates to approximately R1 150 000 000 in the aggregate.

A circular in respect to the Rights Offer will be distributed to shareholders in due course and salient dates and times will be announced on SENS prior to the distribution of the Rights Offer.

(Source: Biz News, 2020)

After an entity has announced the proposed rights issue, the market, and therefore the share price, reacts. Once the rights issue has been made, the shareholder no longer only owns shares; he also holds right certificates that can be traded separately. The shareholder acquires that right for no consideration and therefore does not have a cost. That, however, does not mean that the right does not have a value. The right is a financial asset that must be accounted for.

Before the rights certificates are issued, the shares trade cum-rights (the rights and the shares are still connected). As soon as the rights certificates are issued, the shares are trading at an ex-rights value, and the rights are trading separately. The cum-rights value is split between the ex-rights value and the value of the right. The value of the shares in the financial records must be allocated to the portion attributable only to shares and the portion attributable to the rights.

The above-mentioned values can be determined by using a shareholder’s interest approach. This method assumes that the equity (shareholder’s interest) of an entity represents the value of the shares. The method used most of the time, however, is to refer to the current market value of the shares. This method assumes that the market price of the shares correctly reflects the value. The market value of the shares is not necessarily equal to the carrying amount of the equity of the entity, since buyers and sellers attach certain goodwill to the shares. If the latter method is used, it is necessary to adjust the shares to the fair value immediately before the rights certificates are issued. This value is then split between the ex-rights value and the value of the right.

After the rights certificates have been issued, the holder of the rights can exercise the rights by paying the issue price and therefore taking up the shares. The rights can also be sold to other investors, who can then acquire shares in the entity, by exercising subject to the conditions of the rights issue. If the rights are not exercised, they will expire on the date determined in the rights issue agreement.

Rights Issue Example

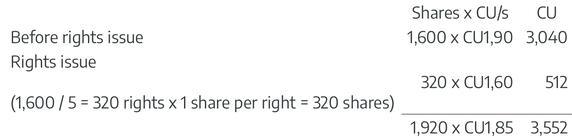

An entity receives one right for every 5 ordinary shares held to take up one ordinary share per right at CU1,60 per share. The entity holds 1,600 shares at a fair value of CU1,90 per share immediately before the rights issue. The current market value (CU1,90) of the shares in the period leading up to the rights issue will price in the value of the rights. The share price at this point effectively reflects the value of the shares and the associated rights.

In the General Ledger at this point you have an investment in shares measured at (1,600 shares x CU1,90) CU3,040. However as soon as the rights are issued the entity will have two investments:

- an investment in the existing shares (now trading without the rights included – ex rights), and

- another investment in the rights to acquire additional shares at a discount.

Estimating the value of the new investment in rights.

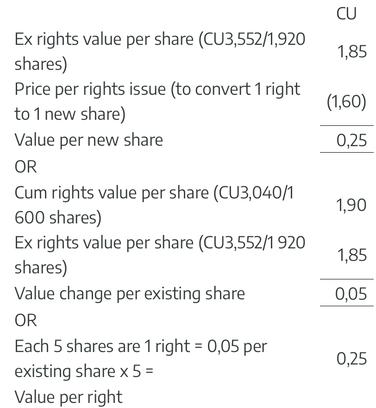

Next you use either the value per share including the rights (cum rights) or the value per share excluding the rights (ex rights value) to calculate the value per right.

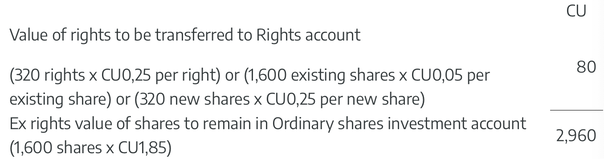

Finally, you determine the total CU value of the rights received, to transfer from the current investment in shares account to the new investment in rights account:

In the General Ledger you now have two investment accounts totaling CU3,040;

- Investment in shares: CU2,960

- Investment in rights: CU80