Share Split Explained

Another economic event underlying financial instrument accounting that readers of this book may be unfamiliar with is a share split.

In June 2014, Apple Inc. split its shares 7-for-1 to make it more accessible to a larger number of investors. Right before the split, each share’s opening price was approximately $649.88. After the split, the price per share at market open was $92.70, which is 648.90 ÷ 7.2 Existing shareholders were also given six additional shares for each share owned, so an investor who owned 1,000 shares of Apple pre-split would have 7,000 shares post-split. Apple’s issued shares increased from 861 million to 6 billion shares, however, the market cap remained largely unchanged at $556 billion. The day after the stock split, the price had increased to a high of $95.05 to reflect the increased demand from the lower share price. In 2020 Apple Inc. announced a further share split.

Apple just announced its 5th stock split – making shares more affordable at around R1,700 each

Apple announced its fifth stock split in its history on Thursday, as the iPhone maker’s stock price marched to the $400 level. Apple said a stock split would allow it to “appeal to a broader base of investors.” The move will appeal to investors who have a difficult time buying a stock that sports a triple digit price. On August 24, Apple investors will receive three additional shares for every one share they own, while the stock price will be divided by four, bringing shares back down to the $100 level – around R1,700. Apple’s last stock split occurred in 2014, when it enacted a 7-for-1 split as its share price reached the $700 level. One share owned prior to Apple’s first split in 1987 will turn into 224 shares once next month’s split goes through.

Visit Business Insider SA for more information.

Share Split Example

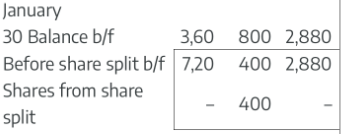

On 30 November each ordinary share of an entity was sub-divided in two ordinary shares. Immediately prior to the share split an investor held 400 shares at a fair value of CU7,20.

The investor gains an additional 400 shares while the market capitalisation has remained unchanged (CU2,880). Consequently, the per share amount decrease from CU7,20 to CU3,60.