Issued at par (nominal value) and matures at premium in instalments

Oratile Limited purchases a 10% CU1,000 debenture on 1 January 2011 issued by THABISA LIMITED, a company listed on the JSE Limited. The debenture was purchased at its nominal value and it matures at 110% in two equal annual instalments on 31 December, with the first maturity on 31 December 2011. Interest is payable on 31 December. The market related interest rate for similar debentures with the same terms as this debenture is 16,5015%. Ignore transaction costs.

The objective of Oratile Limited’s business model is to hold the debenture in order to collect contractual cash flows. The contractual terms of the debenture give rise on specified dates to cash flows that are solely payments of principal and interest on the principal amount outstanding. The asset was at no stage credit impaired. Ignore expected credit losses. Liable Limited did not designate the debenture as measured at fair value through profit or loss. Thabisa Limited’s reporting date is 31 December.

REQUIRED

- Prepare the general journal entries (cash transactions included) of Liable Limited for the years 1 January 2011 to 31 December 2012 (inclusive) to account for all matters related to the above transaction.

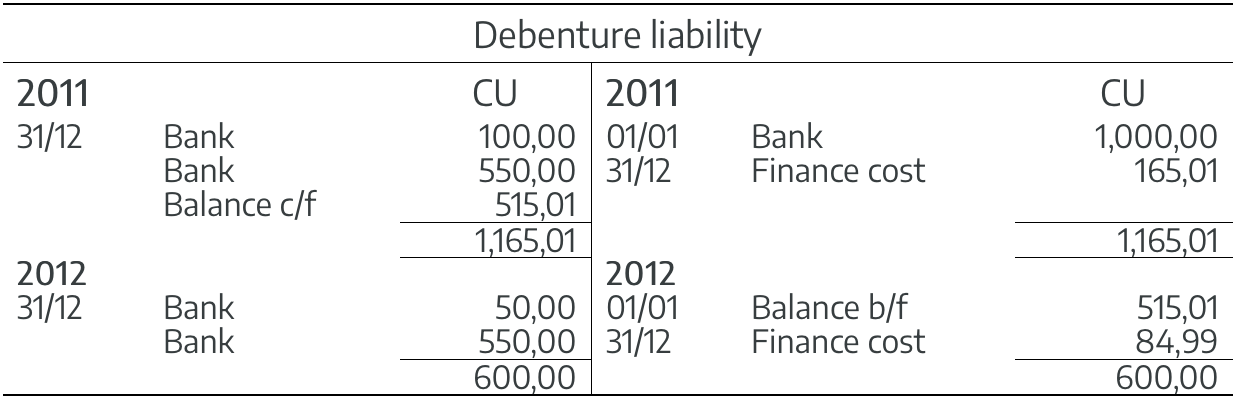

- Prepare the Debenture Liability general ledger account of Liable Limited for the years 1 January 2011 to 31 December 2012 (inclusive), properly closed off.

🇿🇦 Oratile is a unisex name meaning “origin” and is pronounced O-ra-TEE-lê.

🇿🇦 Thabisa is a Zulu name meaning “to bring joy” and is pronounced Tha-BEE-sa.

SOLUTION

Calculations

|

Date of cash flow |

Cash flow CU |

|

| 01/01/2011 | 1,000 | |

| 31/12/2011 | (CU1,000 x 10%) | (100) |

| (CU1,000/2) x 110% | (550) | |

| 31/12/2012 | (CU500 x 10%) | (50) |

| (CU1,000/2) x 110% | (550) | |

Calculation of the fair value of the liability on initial recognition

| Cf0 | 0 |

| Cf1 | 100 +550 = 650 |

| Cf2 | 50 + 550 = 600 |

| I/YR | 16,5015 |

| NPV = ? = | 1,000 (rounded) |

(1) General Journal of Liable Limited

|

|

|

DR CU |

CR CU |

| 2011 | |||

| 01/01 | Bank (SFP) | 1,000,00 | |

| Debenture liability (SFP) | 1,000,00 | ||

| Debenture initially recognised at fair value | |||

| 31/12 | Finance cost (P or L) | 165,01 | |

| Debenture liability (SFP) | 165,01 | ||

| CU1,000,00 x 16,5015% | |||

| Finance cost recognised at the effective interest rate | |||

| 31/12 | Debenture liability (SFP) | 100,00 | |

| Bank (SFP) | 100,00 | ||

| Recognise finance cost paid | |||

| Balance on Debenture liability account: CU1,000,00 + CU165,01 – CU100,00 = CU1,065,01 | |||

| 31/12 | Debenture liability (SFP) | 550,00 | |

| Bank (SFP) | 550,00 | ||

| Redemption at a premium of 10%(CU500 x 110% = CU550) | |||

| Balance on Debenture liability account: CU1,065,01 – CU550 = CU515,01 | |||

| 2012 | |||

| 31/12 | Finance cost (P or L) | 84,99 | |

| Debenture liability (SFP) | 84,99 | ||

| CU515,01 x 16,5015% | |||

| Finance cost recognised at the effective interest rate | |||

| 31/12 | Debenture liability (SFP) | 50,00 | |

| Bank (SFP) | 50,00 | ||

| Recognise finance cost paid | |||

| Balance on Debenture liability account: | |||

| CU515,01 + CU84,99 – CU50,00 = CU550,00 | |||

| 31/12 | Debenture liability (SFP) | 550,00 | |

| Bank (SFP) | 550,00 | ||

| Redemption at a premium of 10%(CU500 x 110% = CU550) | |||

| CU550,00 – CU550,00 = R0 |

(2) General ledger of Liable Limited