ARNO LIMITED entered into the following share transactions in Jabulani Limited during the financial year ended 31 December 2021:

| 1 January | Balance: 4,000 ordinary shares at CU1,95 each. |

| 1 February | Purchased 2,000 ordinary shares for cash at the fair value of CU2,10 each. |

| 1 April | Jabulani Limited has a capitalisation issue of 1 ordinary share for every 4 ordinary shares held on 25 March 2021. Immediately prior to the capitalisation issue, the shares of Jabulani Limited had a fair value of R2,15 each. Arno Limited chose to do a fair value adjustment immediately prior to recognising the shares from the capitalisation issue. |

| 1 May | Sold 1,700 ordinary shares for cash at the fair value of CU1,70 each. |

| 30 June | On this date, the fair value per share was CU1,80. |

| 1 July | Jabulani Limited had a rights issue of 1 right to 1 ordinary share for every 4 ordinary shares held, at CU1,50 per share. The rights expire on 15 January 2022. |

| 1 September | Purchased 800 rights for cash at the fair value of CU0,26 each. |

| 1 October | Sold 1,000 rights for cash at the fair value of CU0,28 each. |

| 1 November | Exercised 500 rights to ordinary shares. |

| 31 December | Sold 4,000 ordinary shares for cash at the fair value of CU1,80 each. |

ARNO LIMITED entered into the following share transactions in Jabulani Limited during the financial year ended 31 December 2021:

| 1 January | Balance: 4,000 ordinary shares at CU1,95 each. |

| 1 February | Purchased 2,000 ordinary shares for cash at the fair value of CU2,10 each. |

| 1 April | Jabulani Limited has a capitalisation issue of 1 ordinary share for every 4 ordinary shares held on 25 March 2021. Immediately prior to the capitalisation issue, the shares of Jabulani Limited had a fair value of R2,15 each. Arno Limited chose to do a fair value adjustment immediately prior to recognising the shares from the capitalisation issue. |

| 1 May | Sold 1,700 ordinary shares for cash at the fair value of CU1,70 each. |

| 30 June | On this date, the fair value per share was CU1,80. |

| 1 July | Jabulani Limited had a rights issue of 1 right to 1 ordinary share for every 4 ordinary shares held, at CU1,50 per share. The rights expire on 15 January 2022. |

| 1 September | Purchased 800 rights for cash at the fair value of CU0,26 each. |

| 1 October | Sold 1,000 rights for cash at the fair value of CU0,28 each. |

| 1 November | Exercised 500 rights to ordinary shares. |

| 31 December | Sold 4,000 ordinary shares for cash at the fair value of CU1,80 each. |

Additional information:

- On 31 December 2021, the JSE Limited closing prices for a right was CU0,30 and that of an ordinary share in Jabulani Limited was CU1,80.

- Arno Limited acquired these ordinary shares in Jabulani Limited with the principal objective to generate profits from short-term fluctuations in prices. The rights were not acquired as hedging instruments.

- Brokerage calculated at 0,5% of the amount paid or received has not been taken into account.

REQUIRED

Prepare the investment accounts for shares and rights in Jabulani Limited in the general ledger of Arno Limited for the year ended 31 December 2021.

🇿🇦 Arno, an Afrikaans name from Germanic origin, means “eagle” and is pronounced AR-nou.

🇿🇦 Jabulani, a Zulu name often shortened to Jabu, means “rejoice” and is pronounced Jah-boo-LAH-nee.

SOLUTION

Note:

1. Since this is a portfolio of shares with a pattern of short-term profit-taking, these shares (financial instruments) would fall within the definition of financial assets held for trading and it is therefore classified as at fair value through profit or loss. The rules relating to measurement would be:

- initial measurement: at fair value excluding transaction costs;

- subsequent measurement (at year end): at fair value with fair value changes recognised through profit or loss.

With derecognition (sale) of the shares, the shares are first restated / adjusted to fair value, then sold at that fair value, accordingly there is no resultant profit or loss on the sales transaction. There can only be a profit or loss on such a transaction if the shares are NOT sold at fair value. This approach follows from IFRS 9 par 3.2.12 that states that the difference between the carrying amount (measured on date of derecognition) and the proceeds received, should be recognised in profit or loss. Therefore, the financial instrument should first be measured at the fair value on date of the sale before that carrying amount is compared to the proceeds from the sale, in order to calculate the resultant profit or loss (if any).

2. Arno Limited must adjust the value of the shares, which it owns in Jabulani Limited before the rights issue, to fair value.

After Arno Limited has made this adjustment to fair value, this cum rights value per share must be allocated between an ex rights value per share and a rights value (value of the rights).

Shares from a capitalisation issue (or a share split) are initially recognised at fair value.

3. Since these are speculative investments and classified as financial assets at fair value through profit or loss, transaction costs on initial recognition are recognised immediately in the “Profit or loss” section of the Statement of profit or loss and other comprehensive income and are not included in the price used to value the shares.

Transaction costs incurred on sale of these shares are recognised immediately in “Profit or loss”.

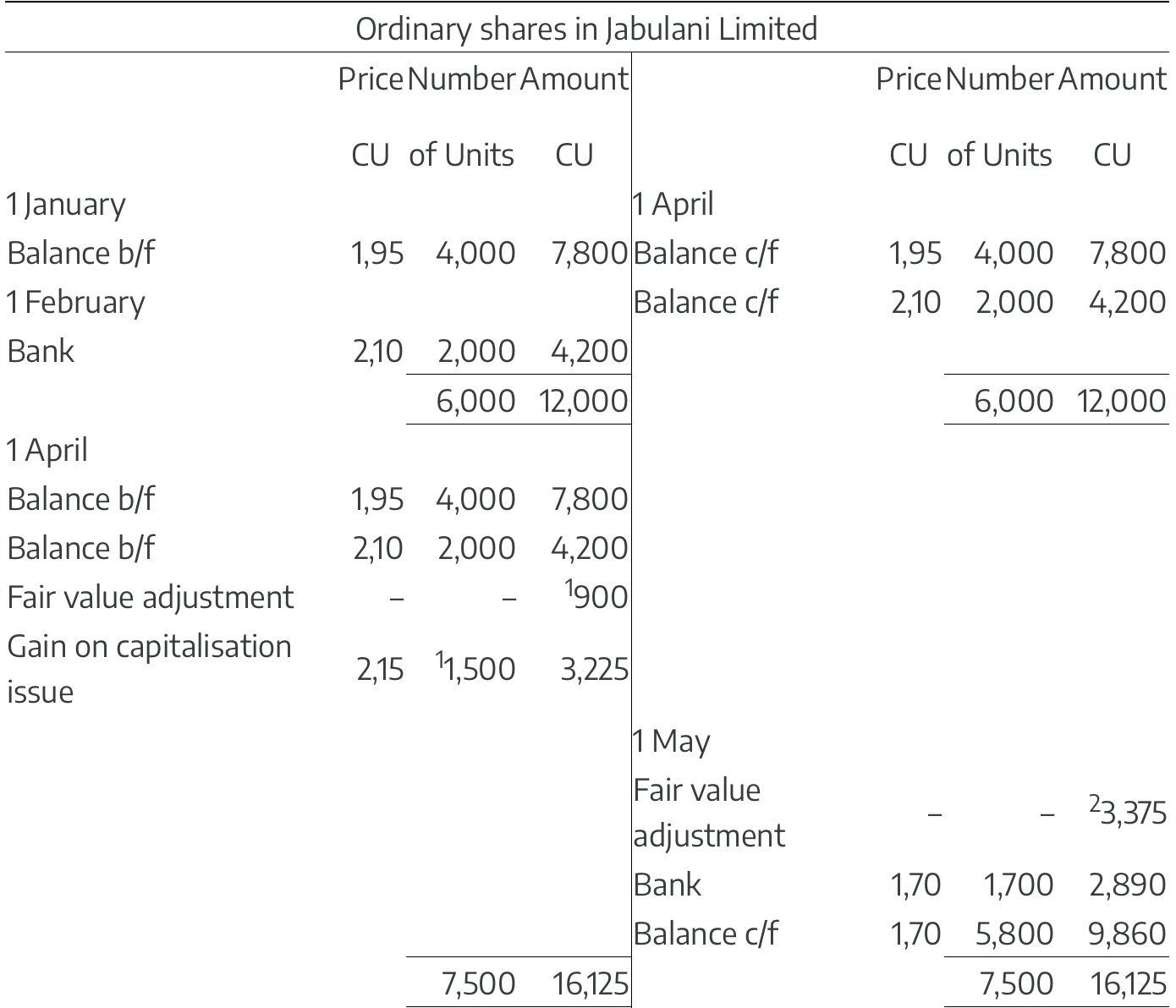

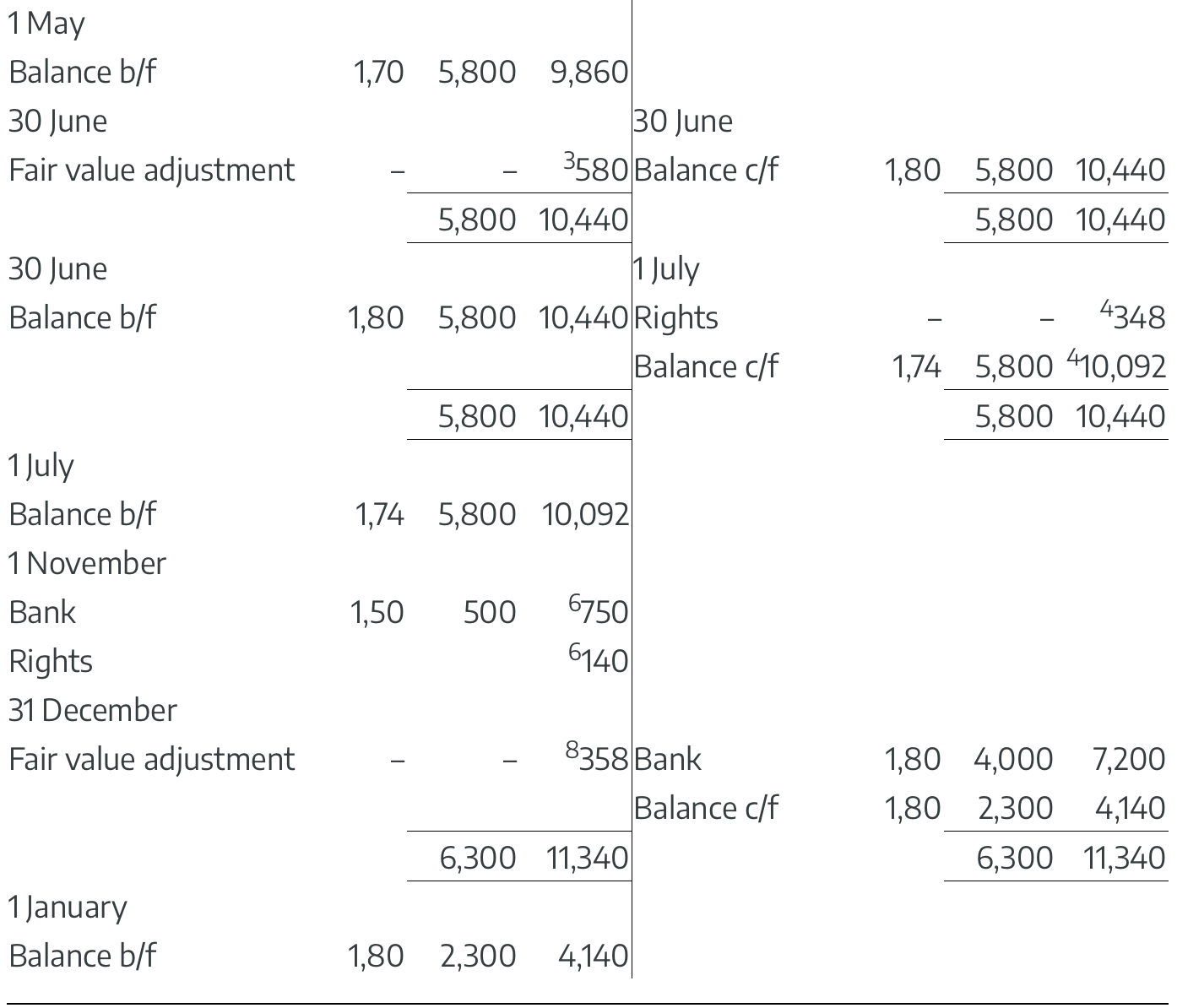

General Ledger of Arno Limited

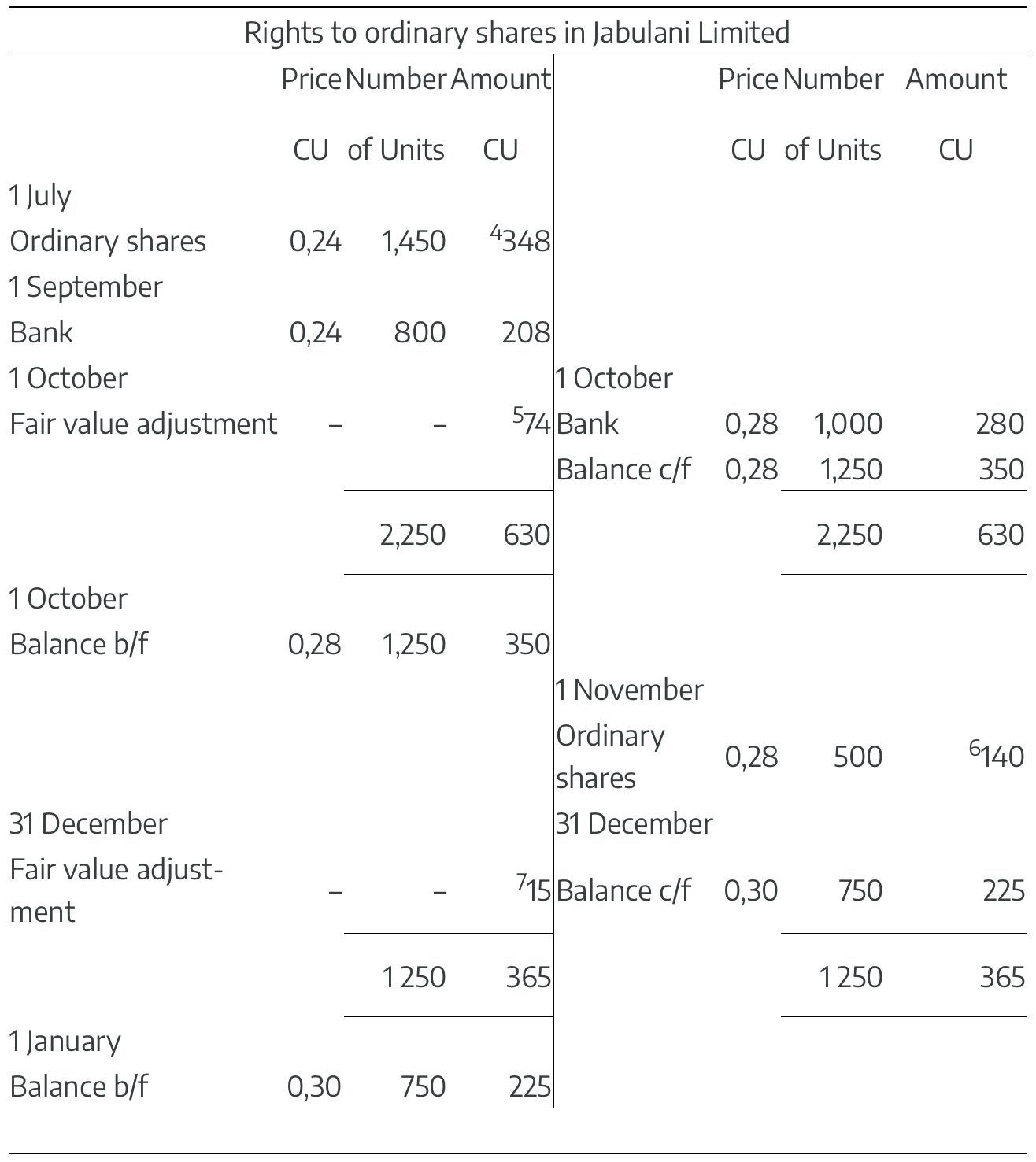

Calculations

|

1. |

|

CU |

|

|

|

Fair value immediately prior to capitalisation issue (4,000 + 2,000 shares x CU2,15 per share) |

12,900 |

|

|

|

Carrying amount of shares immediately prior to capitalisation issue (CU7,800 + CU4,200) |

(12,000) |

|

|

|

Fair value adjustment |

900 |

|

|

|

|

|

|

|

|

Shares received in terms of capitalisation issue (4,000 + 2,000 shares / 4) (valued initially at fair value) |

1,500 |

|

|

2. |

|

CU |

|

|

|

Fair value of all shares on date of sale (CU1,70 x 4,000 + 2,000 + 1,500 shares) |

12,750 |

|

|

|

Carrying amount of all shares on date of sale (CU7 800 + CU4,200 + CU900 + CU3,225) |

(16,125) |

|

|

|

Fair value adjustment |

(3,375) |

|

|

3. |

|

CU |

|

|

|

Fair value of shares (5 800 shares x CU1,80) |

10,440 |

|

|

|

Carrying amount of shares |

(9,860) |

|

|

|

Fair value adjustment |

580 |

|

|

4. |

|

Shares x CU/s |

CU |

|

|

Before rights issue |

5,800 x CU1,80 |

10,440 |

|

|

Rights issue (5,800 / 4 = 1,450 rights x 1 share per right = 1,450 shares) |

1,450 x CU1,50 |

2,175 |

|

|

|

7,250 x CU1,74 |

12,615 |

|

|

|

CU |

|

|

|

Ex rights value per share (CU12 615/7 250 shares) |

1,74 |

|

|

|

Price per rights issue (to convert 1 right to 1 new share) |

1,50 |

|

|

|

Value per new share |

0,24 |

|

|

|

OR |

|

|

|

|

Cum rights value per share (CU10,440/5 800 shares) |

1,80 |

|

|

|

Ex rights value per share (CU12,615/7 250 shares) |

1,74 |

|

|

|

Value change per existing share |

0,06 |

|

|

|

OR |

|

|

|

|

Each 4 shares are 1 right = 0,06 per existing share x 4 = |

0,24 |

|

|

|

Value per right |

|

|

|

|

Value of rights to be transferred to Rights account (1,450 rights x CU0,24 per right) or (5,800 existing shares x CU0,06 per existing share) or (1,450 new shares x CU0,24 per new share) |

348 |

|

|

|

Ex rights value of shares to remain in Ordinary shares investment account (5,800 shares x CU1,74) |

10,092 |

|

|

5. |

|

CU |

|

|

|

Fair value of all rights on date of sale (1,450 + 800 rights x CU0,28) |

630 |

|

|

|

Carrying amount of rights on date of sale (CU348 + CU208) |

(556) |

|

|

|

Fair value adjustment |

74 |

|

|

6. |

|

CU |

|

|

|

Rights converted to shares (exercise the rights), CU1,50 per share (remember 1 right = 1 new share) 500 new shares x CU1,50 |

750 |

|

|

|

Value to be transferred from the Rights account to the Ordinary shares investment account (500 rights x CU0,28) |

140 |

|

|

7. |

|

CU |

|

|

|

Fair value of rights (750 rights x CU0,30) |

225 |

|

|

|

Carrying amount of rights (750 rights x CU0,28) |

210 |

|

|

|

Fair value adjustment needed (subsequent measurement at reporting date) |

15 |

|

|

8. |

|

CU |

|

|

|

Fair value of all shares on date of sale (5 800 + 500 shares x CU1,80) (this is also the reporting date) |

11,340 |

|

|

|

Carrying amount of all shares on date of sale (CU10 092 + CU750 + CU140) |

(10,982) |

|

|

|

Fair value adjustment |

358 |

|