KAYA LIMITED entered into the following transactions in respect of the ordinary shares and rights to ordinary shares of Elna Limited in order to generate profits from short-term fluctuations in prices. Rights are not acquired for hedging purposes.

2021

| January | 2 | Purchased 500 ordinary shares for cash at the fair value of CU7,00 each. |

| 17 | Purchased 500 ordinary shares for cash at the fair value of CU7,20 each. | |

| 29 | Sold 600 ordinary shares for cash at the fair value of CU7,20 each. | |

| 30 | Each ordinary share was sub-divided in two ordinary shares. |

| March | 15 | Sold 400 ordinary shares for cash at the fair value of CU1,82 each. |

| 29 | Purchased 1,200 ordinary shares for cash at the fair value of CU1,84 each. | |

| 30 | On this date, the fair value per ordinary share was CU1,90. | |

| 31 | Received one right for every 5 ordinary shares held to take up one ordinary share per right at CU1,60 per share. | |

| April | 15 | Sold 240 rights for cash at the fair value of CU0,30 each. |

| 30 | Exercised 60 rights to ordinary shares. | |

| June | 15 | Sold 1,500 ordinary shares for cash at the fair value of CU1,88 each. |

Additional information:

- As a result of a strike by employees of Elna Limited, the market value of the company’s ordinary shares dropped to CU1,50 per share on 30 June 2021

- The rights to acquire ordinary shares in Elna Limited expired on 30 June 2021.

- Ignore brokerage and other transaction costs.

REQUIRED

Prepare the investment accounts for ordinary shares and rights to ordinary shares in Elna Limited in the general ledger of Kaya Limited for the year ended 30 June 2021.

🇿🇦 Kaya means “restful place” and is a popular Zulu name. Pronounce it KAH-yah.

🇿🇦 Elna is an Afrikaans name meaning “beloved” and is derivative from the Swedish Elin and the Danish and Dutch Helena. Pronounce it ÊLL-nah.

SOLUTION

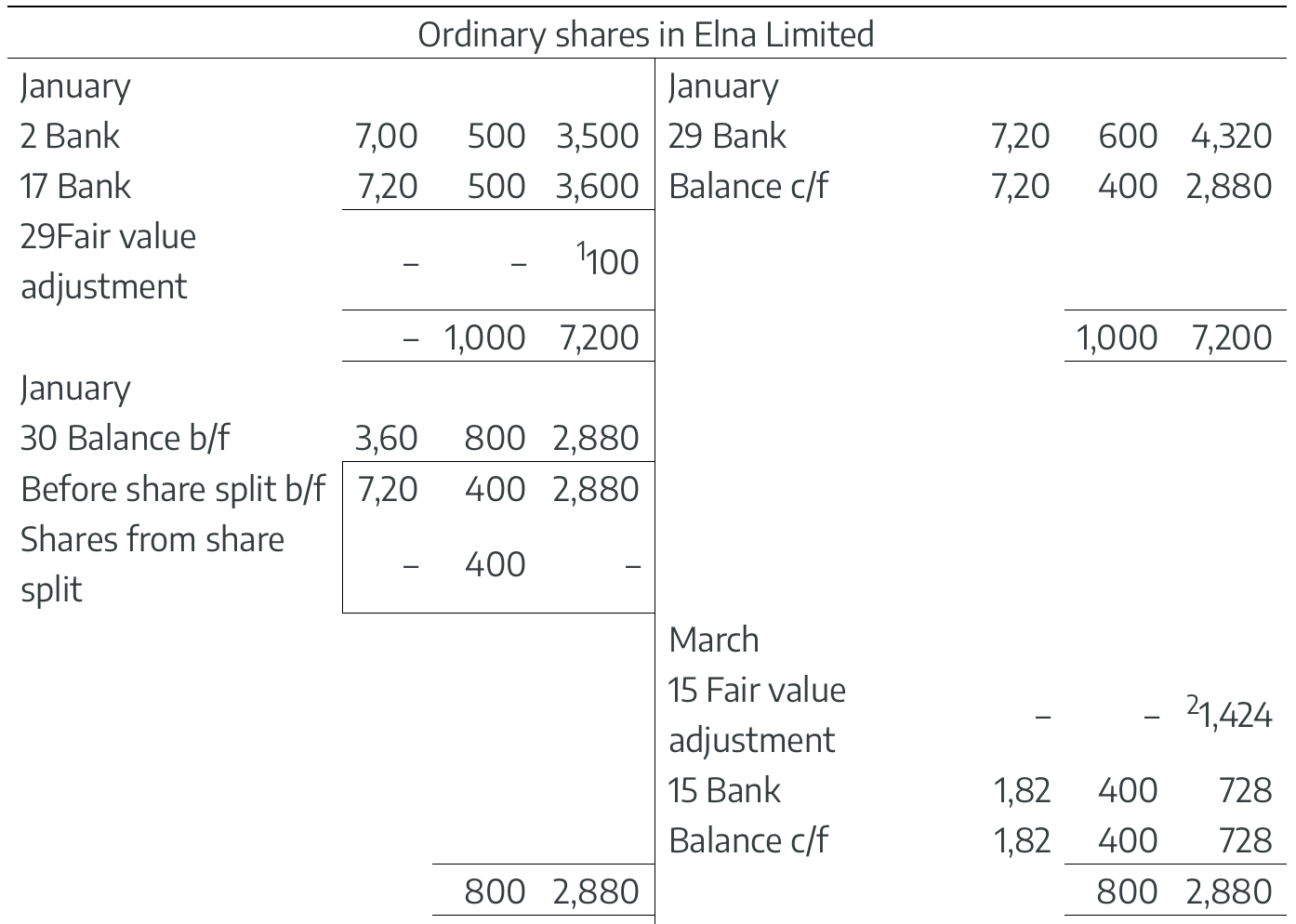

General ledger of Kaya Limited

Calculations

|

|

|

CU |

|

1. |

Fair value of all shares on date of sale (500 + 500 shares xCU7,20) |

7,200 |

|

|

Carrying amount of all shares on date of sale (CU3,500 + CU3,600) |

(7,100) |

|

|

Fair value adjustment |

100 |

|

|

|

CU |

|

2. |

Fair value of all shares on date of sale (800 shares x CU1,82) |

1,456 |

|

|

Carrying amount of all shares on date of sale |

(2,880) |

|

|

Fair value adjustment |

(1,424) |

|

|

NB: Impairment losses on financial instruments are not considered in this material. This implies that all changes in the fair value of shares (even decreases) are treated as fair value adjustments and recognised in “Profit or loss”. Also, a share split will cause a decrease in the value per share, as there are more shares available. |

|

|

|

|

CU |

|

3. |

Fair value of shares (1,600 shares x CU1,90) |

3,040 |

|

|

Carrying amount of shares (CU728 + CU,208) |

(2,936) |

|

|

Fair value adjustment |

104 |

|

|

|

Shares x CU/s |

CU |

|

|

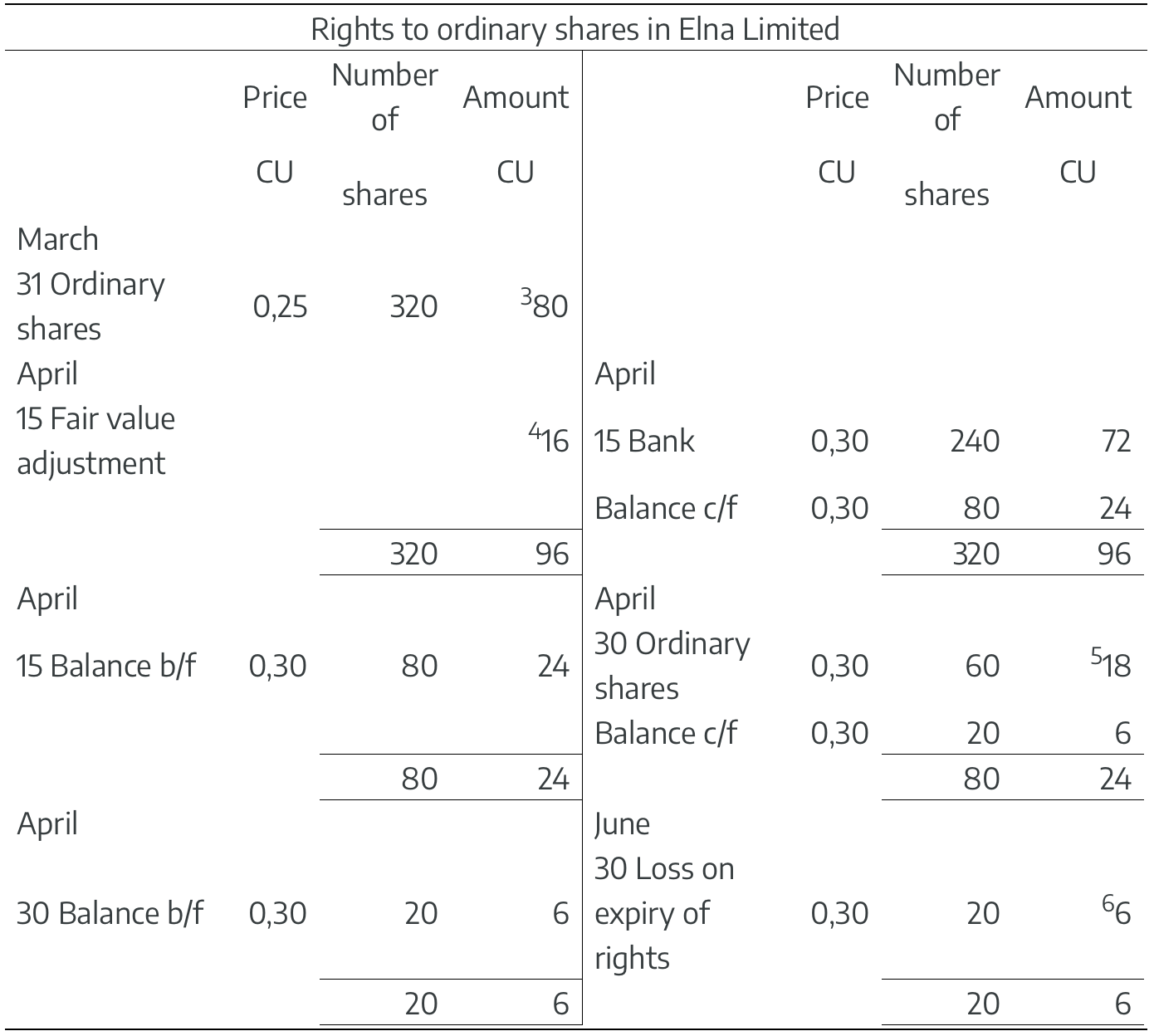

Before rights issue |

1,600 x CU1,90 |

3,040 |

|

|

Rights issue (1,600 / 5 = 320 rights x 1 share per right = 320 shares) |

320 x CU1,60 |

512 |

|

|

|

1,920 x CU1,85 |

3,552 |

|

|

|

CU |

|

|

Ex rights value per share (CU3,552/1,920 shares) |

1,85 |

|

|

Price per rights issue (to convert 1 right to 1 new share) |

(1,60) |

|

|

Value per new share |

0,25 |

|

|

OR |

|

|

|

Cum rights value per share (CU3,040/1 600 shares) |

1,90 |

|

|

Ex rights value per share (CU3,552/1 920 shares) |

1,85 |

|

|

Value change per existing share |

0,05 |

|

|

OR |

|

|

|

Each 5 shares are 1 right = 0,05 per existing share x 5 = |

0,25 |

|

|

Value per right |

|

|

|

|

CU |

|

|

Value of rights to be transferred to Rights account (320 rights x CU0,25 per right) or (1,600 existing shares x CU0,05 per existing share) or (320 new shares x CU0,25 per new share) |

80 |

|

|

|

|

|

|

Ex rights value of shares to remain in Ordinary shares investment account (1,600 shares x CU1,85) |

2,960 |

|

|

|

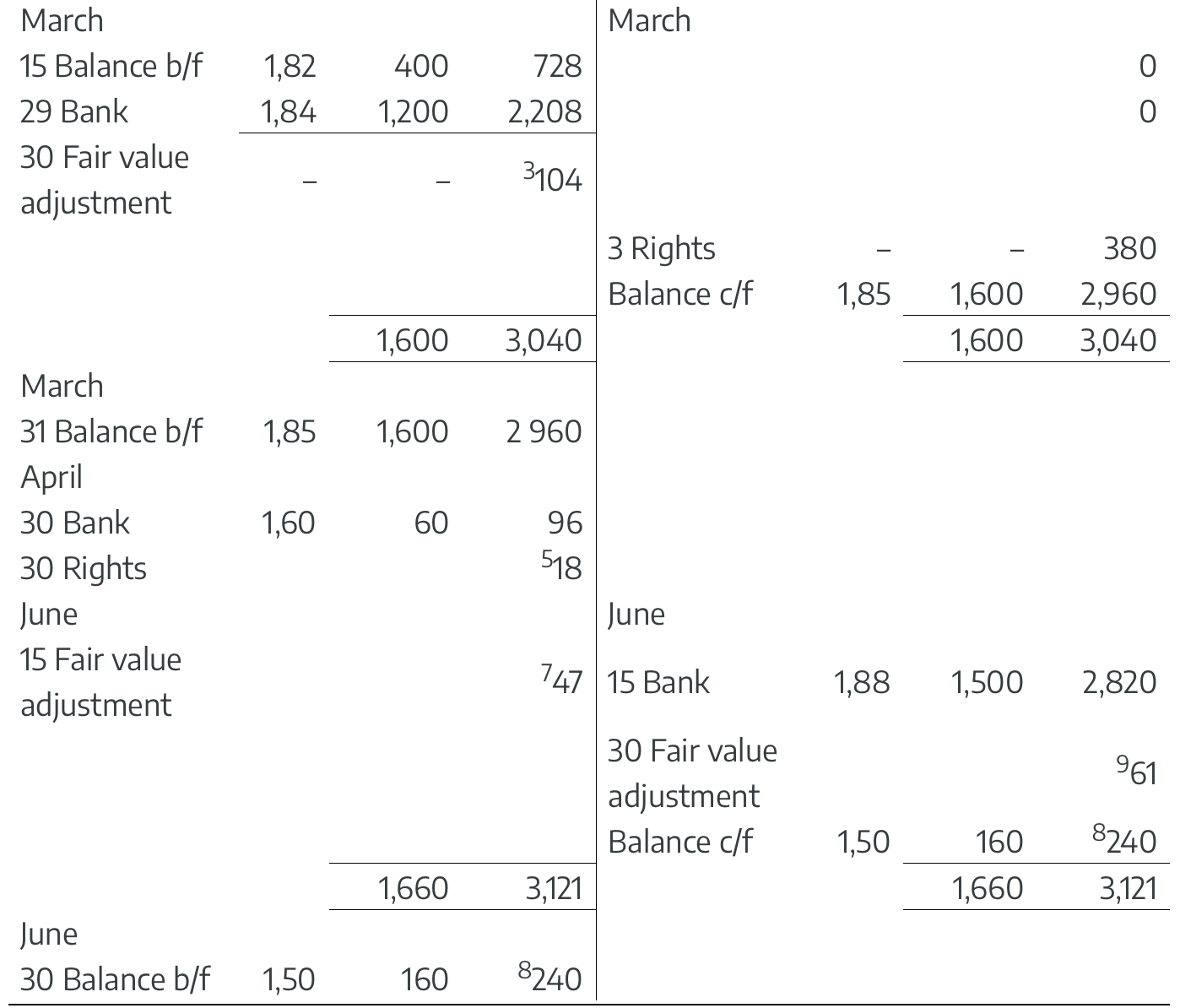

CU |

|

4. |

Fair value of all rights on date of sale (320 rights x CU0,30) |

96 |

|

|

Carrying amount of all rights on date of sale |

(80) |

|

|

Fair value adjustment |

16 |

|

|

|

CU |

|

5. |

Rights converted to shares (exercise the rights), CU1,60 per share 60 new shares x CU1,60 |

96 |

|

|

|

|

|

|

Value to be transferred from the Rights account to the Ordinary shares investment account (60 rights x CU0,30) |

18 |

|

|

|

CU |

|

6. |

On 30 June 2021, rights expired and therefore any remaining rights not yet converted into shares (exercised) must be written off (20 rights x CU0,30) to profit or loss. |

6 |

|

|

|

CU |

|

7. |

Fair value of all shares on date of sale (1,600 + 60 shares x CU1,88) |

3,121 |

|

|

Carrying amount of all shares on date of sale (CU2,960 + CU96 + CU18) |

(3,074) |

|

|

Fair value adjustment |

47 |

|

|

|

CU |

|

8. |

Financial assets held for trading (@ FV through P or L) are valued at fair value (market value) at year end (which is the subsequent measurement rule application) (160 shares x CU1,50) |

240 |

|

|

|

CU |

|

9. |

Fair value of shares (160 shares x CU1,50) |

240 |

|

|

Carrying amount of shares (160 shares x CU1,88) |

(301) |

|

|

Fair value adjustment |

(61) |

NB: Impairment losses on financial instruments are not considered in this material. This implies that all changes in the fair value of shares (even decreases) are treated as fair value adjustments and recognised in “Profit or loss”.