FRIEDRICH LIMITED, which sells financial calculators to retailers, purchased 100,000 ordinary shares in Kholwa Limited at CU3,50 per share on 15 April 2019.

This acquisition resulted in Friedrich Limited having control over 15% of the voting rights in Kholwa Limited, a major supplier of financial calculators to Friedrich Limited. This secured preferential supplies of calculators to Friedrich Limited.

Transaction costs of CU15,000 were paid by Friedrich Limited on the purchase of these shares on 15 April 2019.

These shares are not held for speculative purposes or designated at initial recognition as at fair value through profit or loss. Friedrich Limited elected irrevocably at initial recognition to classify this investment as at fair value through other comprehensive income.

Both Friedrich Limited and Kholwa Limited are listed on the JSE Limited and both companies’ reporting periods end on 30 June.

The following were the closing prices of one ordinary share in Kholwa Limited:

- on 30 June 2019, CU3,75 per share;

- on 30 June 2020, CU4,00 per share;

- on 30 June 2021, CU3,80 per share.

On 15 September 2021, Friedrich Limited sold the shares in Kholwa Limited when several other suitable suppliers of financial calculators were successfully sourced by the marketing department. The shares were sold at CU3,85 per share. This price represents the market price of the shares on this date. It is the accounting policy of Friedrich Limited to recycle any related cumulative balance in the mark-to-market reserve on equity instruments on sale of the investment or part thereof.

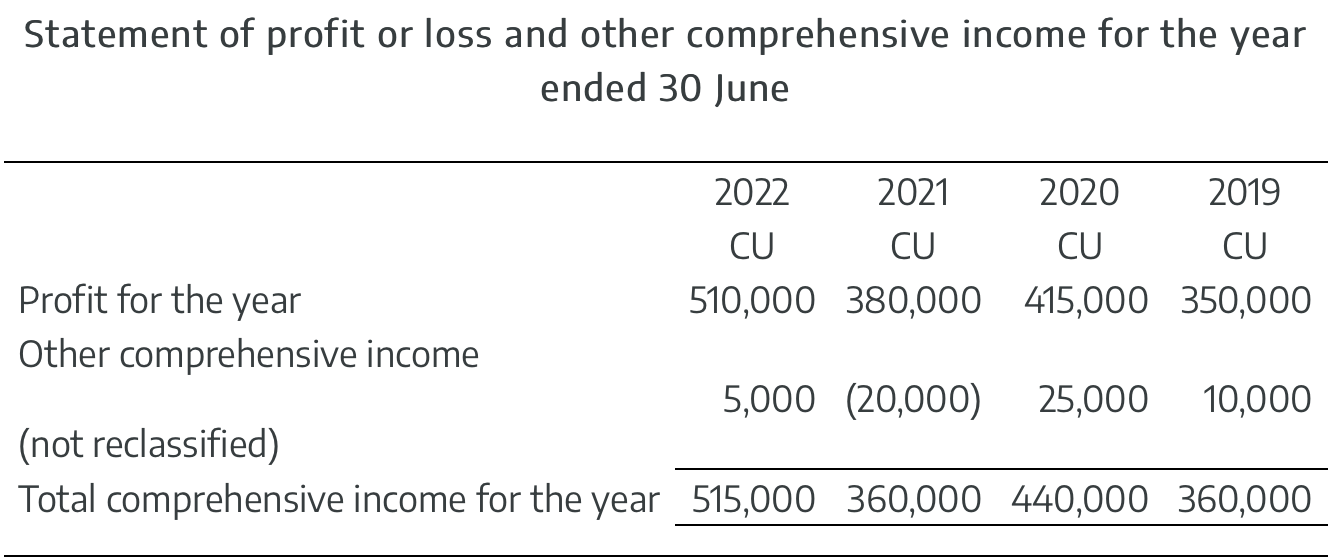

Profit for the year before any adjustments relating to the investment in Kholwa Limited was as follows:

- for year ended 30 June 2019, CU350,000;

- for year ended 30 June 2020, CU415,000;

- for year ended 30 June 2021, CU380,000;

- for year ended 30 June 2022, CU510,000.

Assume Friedrich Limited was incorporated on 1 July 2018.

Since acquisition of the investment until it was disposed of, there were no evidence of impairment as neither Friedrich Limited nor Kholwa Limited experienced financial problems.

REQUIRED

- Prepare the general journal entries (cash transactions included) from 15 April 2019 to 15 September 2021 (inclusive) in the general ledger of Friedrich Limited to account for all matters related to the above investment transaction.

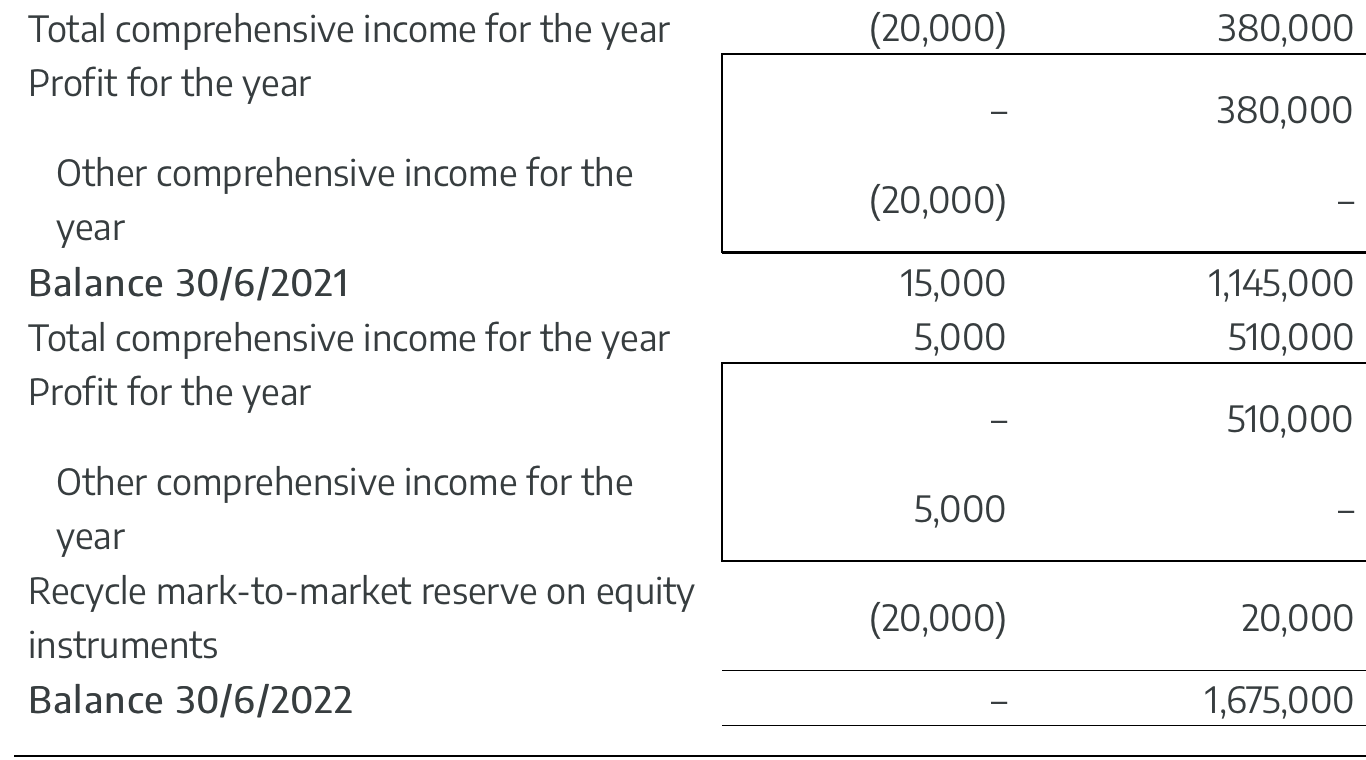

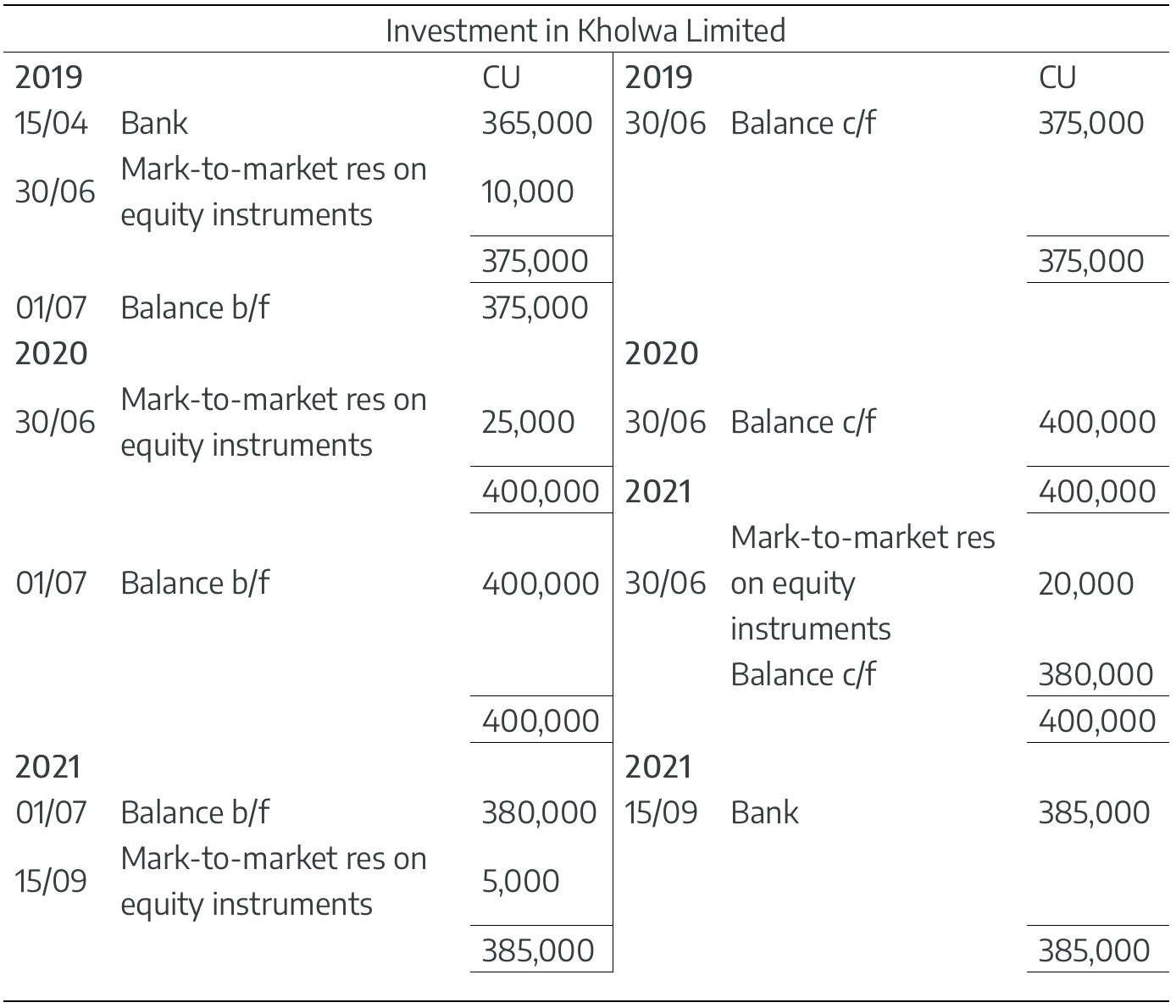

- Prepare the following general ledger accounts, of Friedrich Limited for the period 15 April 2019 to 15 September 2021 (inclusive): investment in Kholwa Limited; mark-to-market reserve on equity instruments.

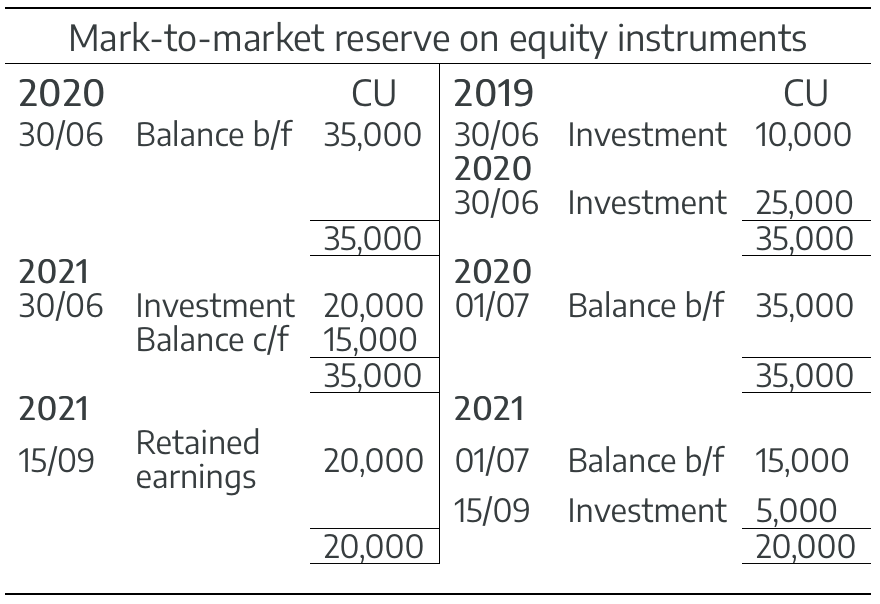

- Present the statement of profit or loss and other comprehensive income of Friedrich Limited for the financial years ended 30 June 2020 to 30 June 2022 (inclusive) in as much detail as is possible from the information presented.

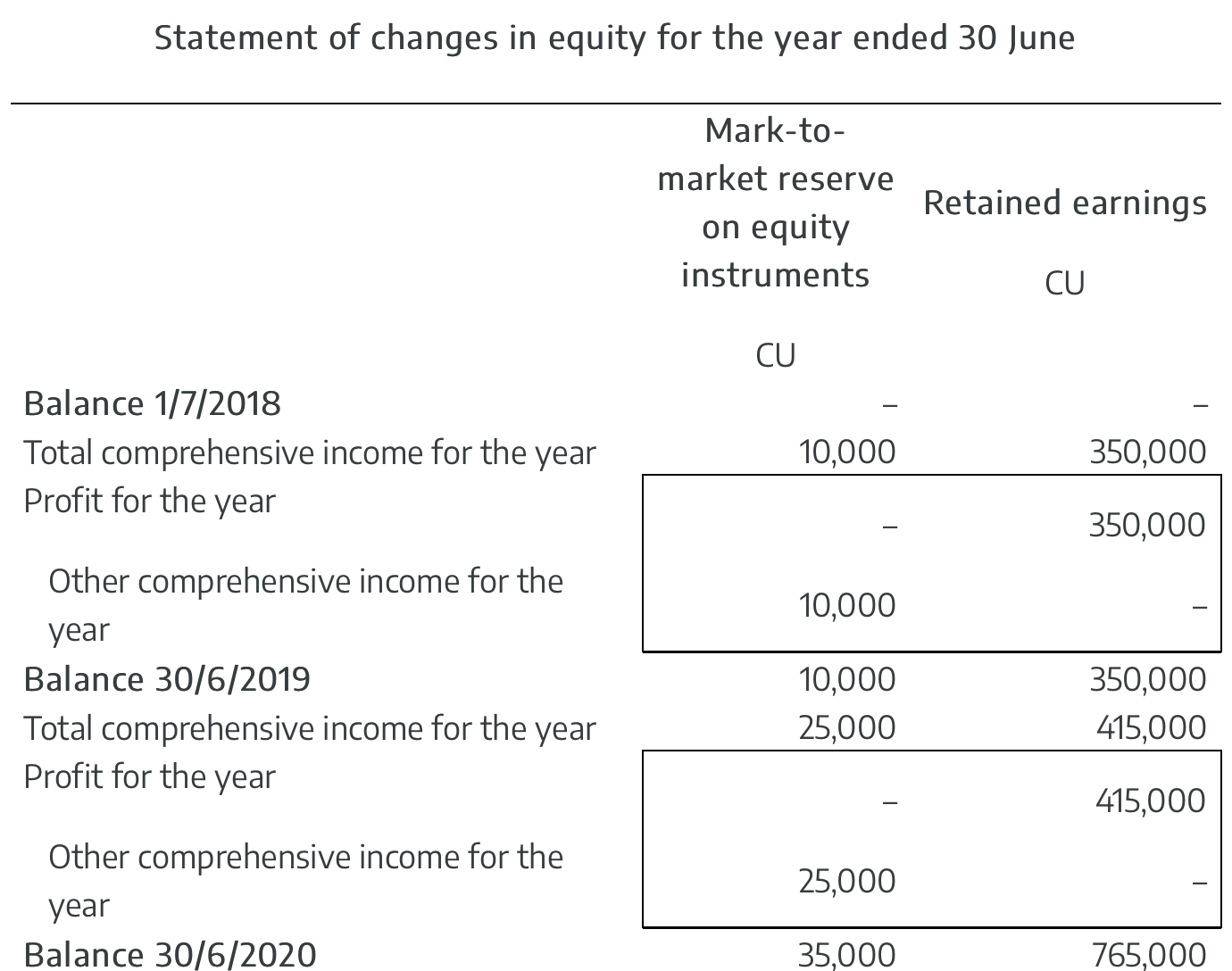

- Present the mark-to-market reserve on equity instruments and retained earnings columns of the statement of changes in equity of Friedrich Limited for the financial years ended 30 June 2019 to 30 June 2022 (inclusive).

🇿🇦 An Afrikaans name from the Old German Frederick, Frederich means “peaceful ruler”. Pronounce it FRED-e-rich.

🇿🇦 Kholwa is a name used in both the Zulu and Ndebele cultures and means “believe”. The name is pronounced Col-u-WHA.

SOLUTION

(1) General Journal of Friedrich Limited

|

|

|

DR CU |

CR CU |

| 2019 | |||

| 15/04 | Investment in Kholwa Limited (SFP) | 350,000 | |

| Bank (SFP) | 350,000 | ||

| Purchase of 100,000 shares at CU3,50 | |||

| 15/04 | Investment in Kholwa Limited (SFP) | 15,000 | |

| Bank (SFP) | 15,000 | ||

| Paid transaction costs of CU15,000 and included it in the fair value of the investment | |||

| 30/06 | Investment in Kholwa Limited (SFP) | 10,000 | |

| Mark-to-market reserve on equity instruments (OCI) | 10,000 | ||

| Subsequent measurement to CU3,75 per share (CU375,000 – (CU350,000 + CU15,000)) | |||

| 2020 | |||

| 30/06 | Investment in Kholwa Limited (SFP) | 25,000 | |

| Mark-to-market reserve on equity instruments (OCI) | 25,000 | ||

| Subsequent measurement to CU4,00 per share (CU400,000 – CU375,000] | |||

| 2021 | |||

| 30/06 | Mark-to-market reserve on equity instruments (OCI) | 20,000 | |

| Investment in Kholwa Limited (SFP) | 20,000 | ||

| Subsequent measurement to CU3,80 per share (CU400,000 – CU380,000) | |||

| 15/09 | Investment in Kholwa Limited (SFP) | 5,000 | |

| Mark-to-market reserve on equity instruments (OCI) | 5,000 | ||

| Re-measure to fair value of CU3,85 on date of sale (CU385,000 – CU380,000) | |||

| Bank (SFP) | 385,000 | ||

| Investment in Kholwa Limited (SFP) | 385,000 | ||

| Investment sold at CU3,85 per share | |||

| Mark-to-market reserve on equity instruments (Equity) | 20,000 | ||

| Retained earnings (Equity) | 20,000 | ||

| Cumulative fair value adjustment recycled to retained earnings on disposal of investment | |||

(2) General ledger of Friedrich Limited

(3) Friedrich Limited

(4) Friedrich Limited