Purchased at par (nominal value) and matures once-off at discount

IMKA LIMITED purchases a 10% CU1,000 debenture at par on 1 January 2011, issued by Kholwa Limited, a company listed on the JSE Limited. The debenture matures once-off on 31 December 2013 at CU900. Interest on the debenture is payable six-monthly on 30 June and 31 December. Transaction costs of CU75 were paid on this purchase by Imka Limited. The market-related interest rate for debentures with similar terms is 5,05% per annum.

Imka Limited’s reporting date is 31 December. The objective of Imka Limited’s business model is to hold the debenture in order to collect contractual cash flows. The contractual terms of the debenture give rise on specified dates to cash flows that are solely payments of principal and interest on the principal amount outstanding. The asset was at no stage credit impaired. Ignore expected credit losses. Kholwa Limited did not designate the debenture as measured at fair value through profit or loss.

REQUIRED

- Prepare the general journal entries (cash transactions included) in the books of Imka Limited for the years 1 January 2011 to 31 December 2013 (inclusive) to account for all matters related to the above transaction.

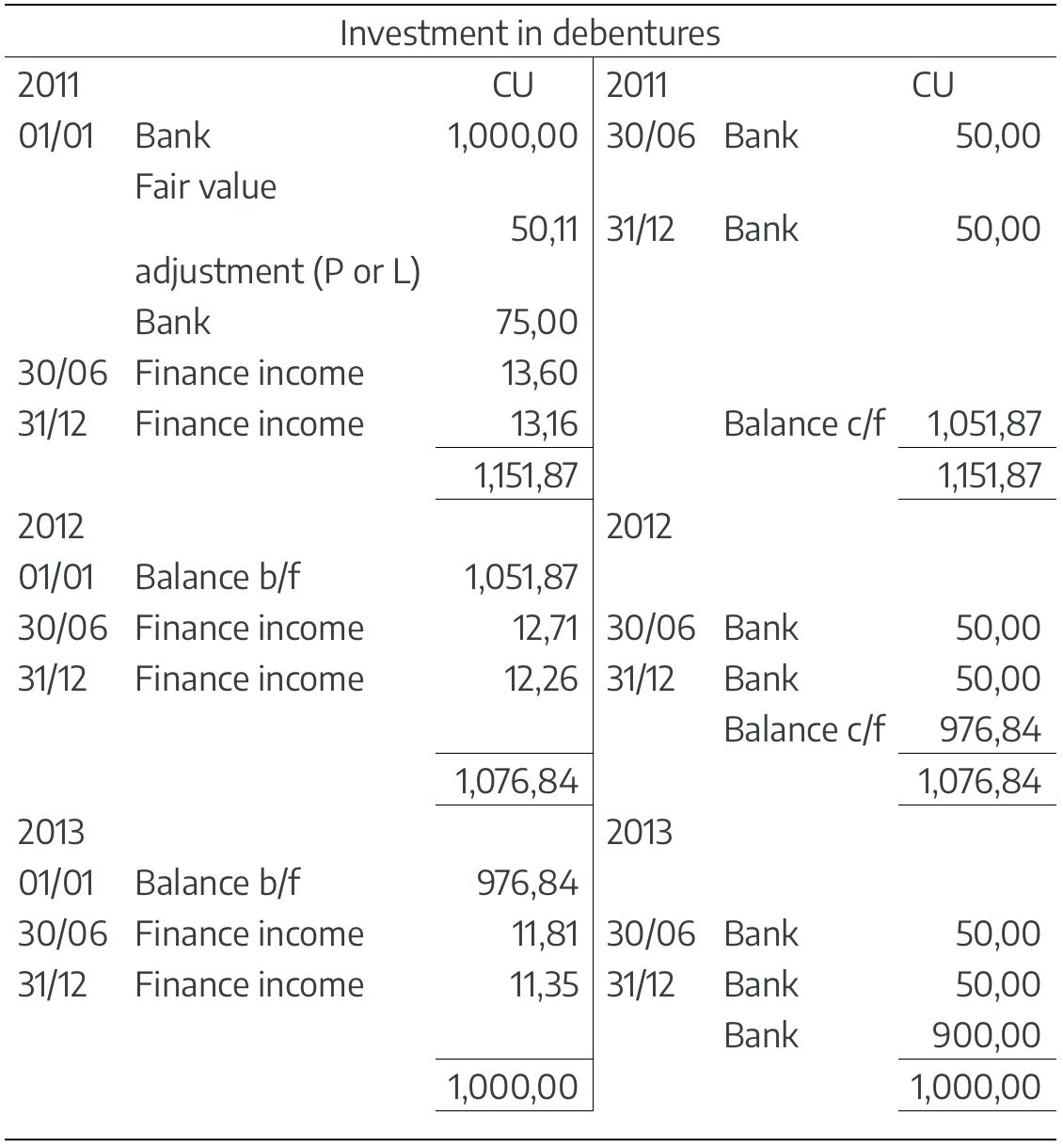

- Prepare the Investment in debentures general ledger account of Imka Limited for the years 1 January 2011 to 31 December 2013 (inclusive), properly closed off:

🇿🇦 Imka, meaning “water”, is an Afrikaans name of Frisian derivative. Pronounce it IEM-ka.

🇿🇦 Kholwa is a name used in both the Zulu and Ndebele cultures and means “believe”. The name is pronounced Col-u-WHA.

SOLUTION

Calculations

|

Date of cash flow |

Cash flow CU |

| 01/01/2011 (CU1,000 + R75) | (1,075) |

| 30/06/2011 (CU1,000 x 10% x 6/12) | 50 |

| 31/12/2012 (CU1,000 x 10% x 6/12) | 50 |

| 30/06/2012 (CU1,000 x 10% x 6/12) | 50 |

| 31/12/2012 (CU1,000 x 10% x 6/12) | 50 |

| 30/06/2013 (CU1,000 x 10% x 6/12) | 50 |

| 31/12/2013 (CU1,000 x 10% x 6/12) | 50 |

| 31/12/2013 | 900 |

Calculation of the fair value of the investment on initial recognition

| FV | 900 | |

| PMT | 50 | (1,000 x 10%) ÷ 2 |

| N | 6 | (3 x 2) |

| I/YR | 2,525 | (5,05 ÷ 2) |

| Thus PV | = -R1,050,11 |

Calculation of “i” (the effective interest rate) as the present value changed due to the R75 transaction costs that must now be capitalised to the amount initially recognised for the investment

| PV | -1,125,11 | (1,050,11 + 75,00 transaction costs) |

| FV | 900 | |

| PMT | 50 | (1,000 x 10%) ÷ 2 |

| N | 6 | (3 x 2) |

| Thus I/YR | = 1,2087273 (per 6 months)= 2,417454661 per annum |

(1) General Journal of Imka Limited

|

2011 |

|

DR CU |

CR CU |

|

01/01 |

Investment in debentures (SFP) |

1,050,11 |

|

|

|

Bank (SFP) |

|

1,000,00 |

|

|

Fair value adjustment (other income) (P or L)

|

|

50,11 |

|

|

Debenture accounted for at fair value on initial recognition |

|

|

|

|

Investment in debentures (SFP) |

75,00 |

|

|

|

Bank (SFP) |

|

75,00 |

|

|

Transaction costs paid |

|

|

|

30/06 |

Investment in debentures (SFP) |

13,60 |

|

|

|

Finance income (P or L) |

|

13,60 |

|

|

(CU1,050,11 + CU75) x 2,417454661% x 6/12 |

|

|

|

|

Finance income recognised at the effective interest rate |

|

|

|

30/06 |

Bank (SFP) |

50,00 |

|

|

|

Investment in debentures (SFP) |

|

50,00 |

|

|

Recognise finance income received |

|

|

|

|

Balance on Investment in debentures account: CU1,050,11 + CU75,00 + CU13,60 – CU50,00 = CU1 088,71 |

|

|

|

31/12 |

Investment in debentures (SFP) |

13,16 |

|

|

|

Finance income (P or L) |

|

13,16 |

|

|

CU1,088,71 x 2,417454661% x 6/12 |

|

|

|

|

Finance income recognised at the effective interest rate |

|

|

|

31/12 |

Bank (SFP) |

50,00 |

|

|

|

Investment in debentures (SFP) |

|

50,00 |

|

|

Recognise finance income received |

|

|

|

|

Balance on Investment in debentures account: CU1,088,71 + CU13,16 – CU50,00 = CU1 051,87 |

|

|

|

2012 |

|

|

|

|

30/06 |

Investment in debentures (SFP) |

12,71 |

|

|

|

Finance income (P or L) |

|

12,71 |

|

|

CU1,051,87 x 2,417454661% x 6/12 |

|

|

|

|

Finance income recognised at the effective interest rate |

|

|

|

30/06 |

Bank (SFP) |

50,00 |

|

|

|

Investment in debenture (SFP) |

|

50,00 |

|

|

Recognise finance income received |

|

|

|

|

Balance on Investment in debentures account: CU1,051,87 + CU12,71 – CU50,00 = CU1,014,58 |

|

|

|

31/12 |

Investment in debentures (SFP) |

12,26 |

|

|

|

Finance income (P or L) |

|

12,26 |

|

|

CU1,014,58 x 2,417454661% x 6/12 |

|

|

|

|

Finance income recognised at the effective interest rate |

|

|

|

31/12 |

Bank (SFP) |

50,00 |

|

|

|

Investment in debenture (SFP) |

|

50,00 |

|

|

Recognise finance income received |

|

|

|

|

Balance on Investment in debentures account: CU1,014,58 + CU12,26 – CU50,00 = CU976,84 |

|

|

|

2013 |

|

|

|

|

30/06 |

Investment in debentures (SFP) |

11,81 |

|

|

|

Finance income (P or L) |

|

11,81 |

|

|

CU976,84 x 2,417454661% x 6/12 |

|

|

|

|

Finance income recognised at the effective interest rate |

|

|

|

30/06 |

Bank (SFP) |

50,00 |

|

|

|

Investment in debentures (SFP) |

|

50,00 |

|

|

Recognise finance income received |

|

|

|

|

Balance on Investment in debentures account: CU976,84 + CU11,81 – CU50,00 = CU938,65 |

|

|

|

31/12 |

Investment in debentures (SFP) |

11,35 |

|

|

|

Finance income (P or L) |

|

11,35 |

|

|

CU938,65 x 2,417454661% x 6/12 |

|

|

|

|

Finance income recognised at the effective interest rate |

|

|

|

31/12 |

Bank (SFP) |

50,00 |

|

|

|

Investment in debentures (SFP) |

|

50,00 |

|

|

Recognise finance income received |

|

|

|

|

Balance on Investment in debentures account: CU938,65 + CU11,35 – CU50,00 = CU900 |

|

|

|

|

Bank (SFP) |

900,00 |

|

|

|

Investment in debentures (SFP) |

|

900,00 |

|

|

Maturity of investment |

|

|

|

|

Balance on Investment in debentures account:R900,00 – R900,00 = R0 |

|

|

(2) General ledger of Imka Limited

Comment

The coupon rate of the debenture of 10% p.a. (nominal rate) > 2,417454661 p.a. offered on similar instruments in the market. Therefore the debenture with a nominal value of CU1,000 will be redeemed at a discount, for CU900. Investors earned more interest in cash during the term of the debenture investment than the market was offering and would therefore have been prepared to receive less capital back than was originally invested, when the investment matured.