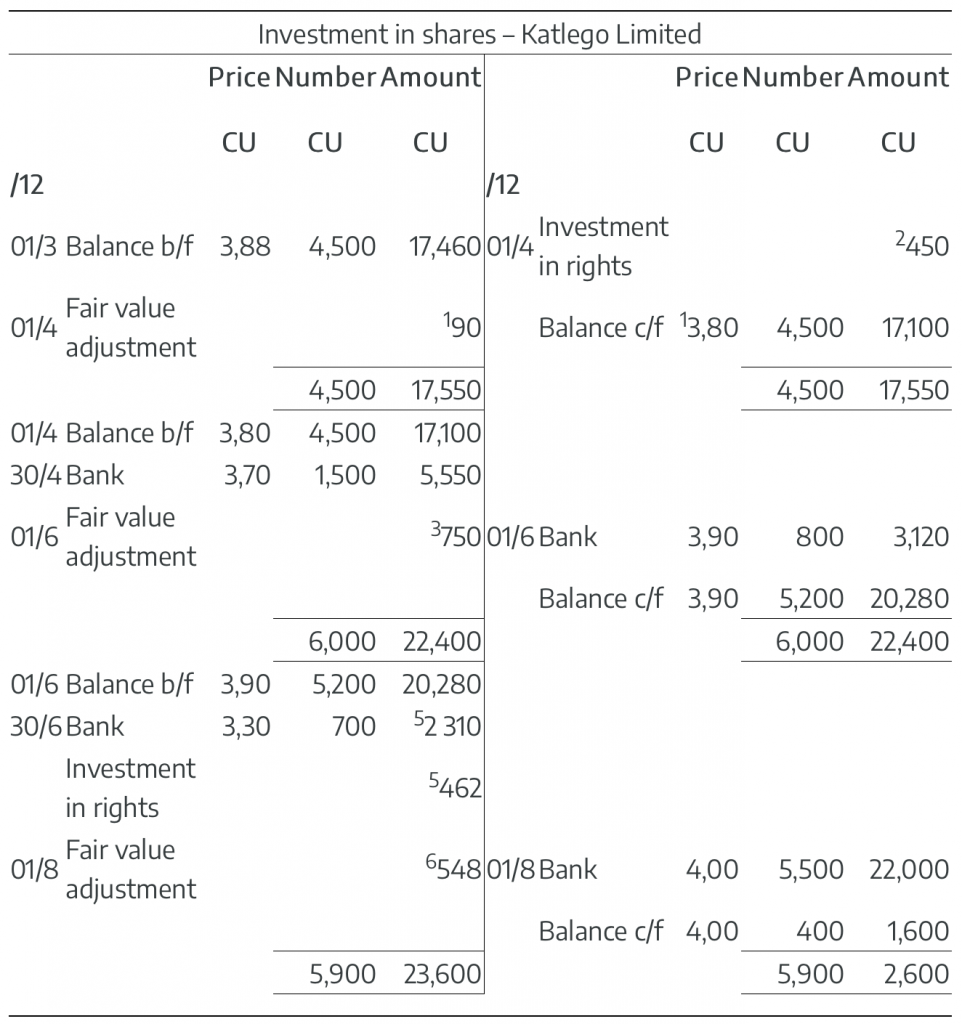

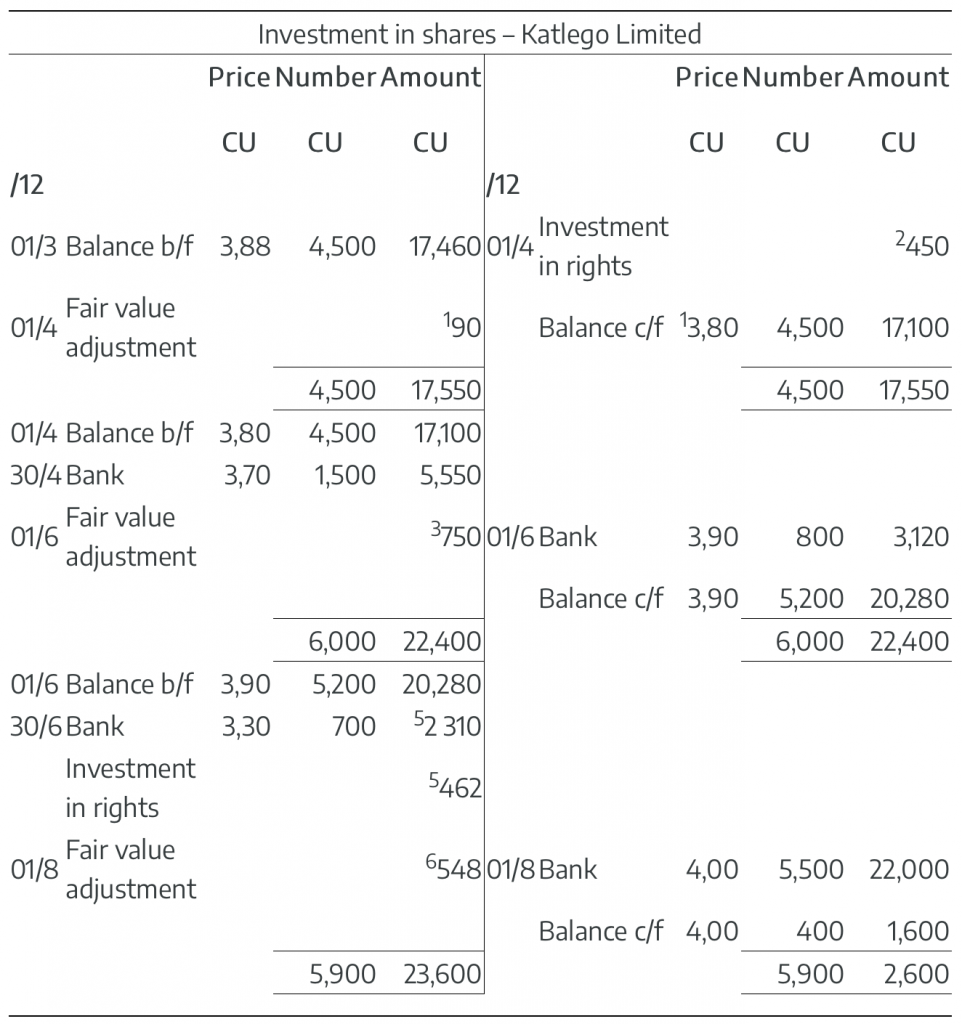

General ledger of Mbali Limited

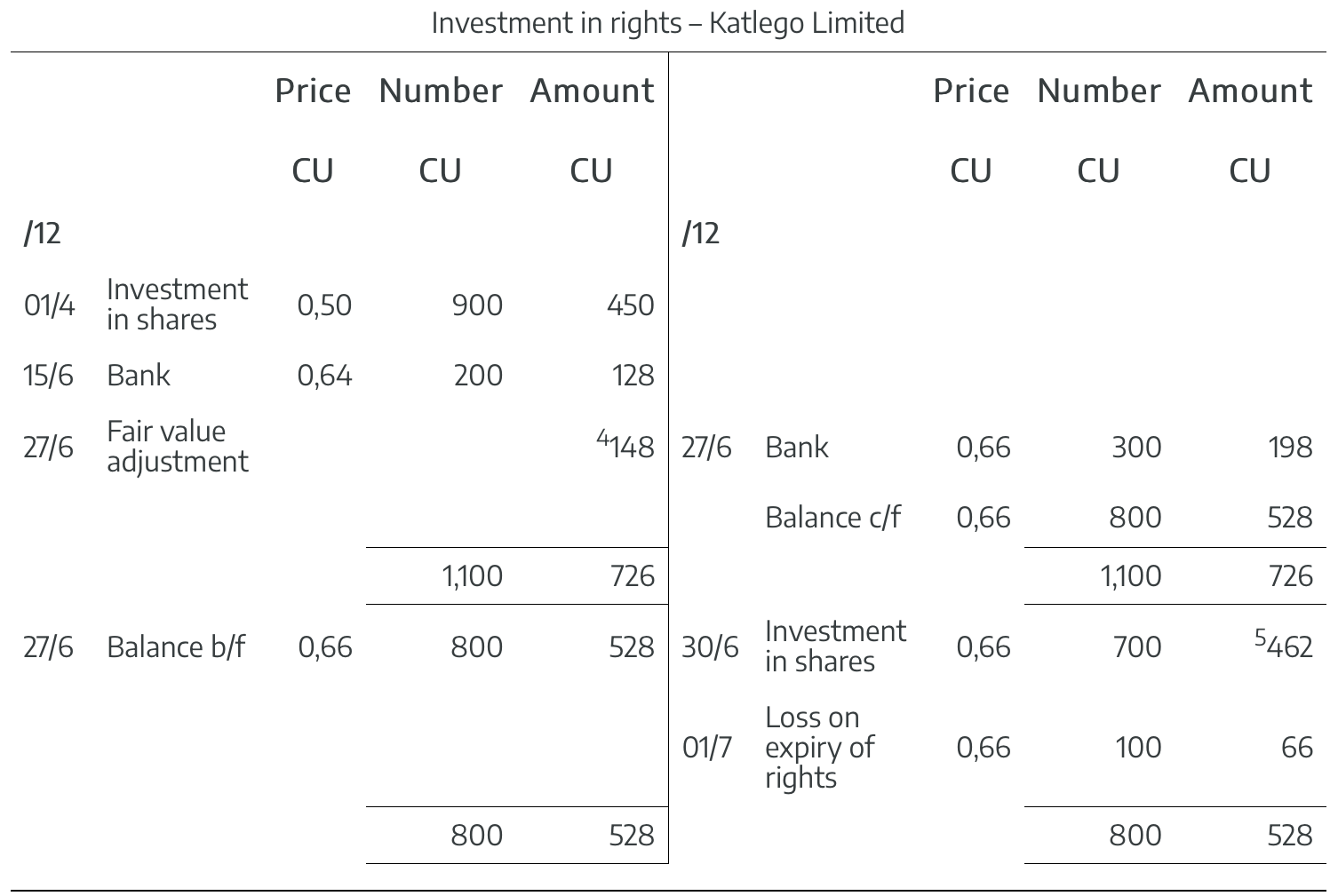

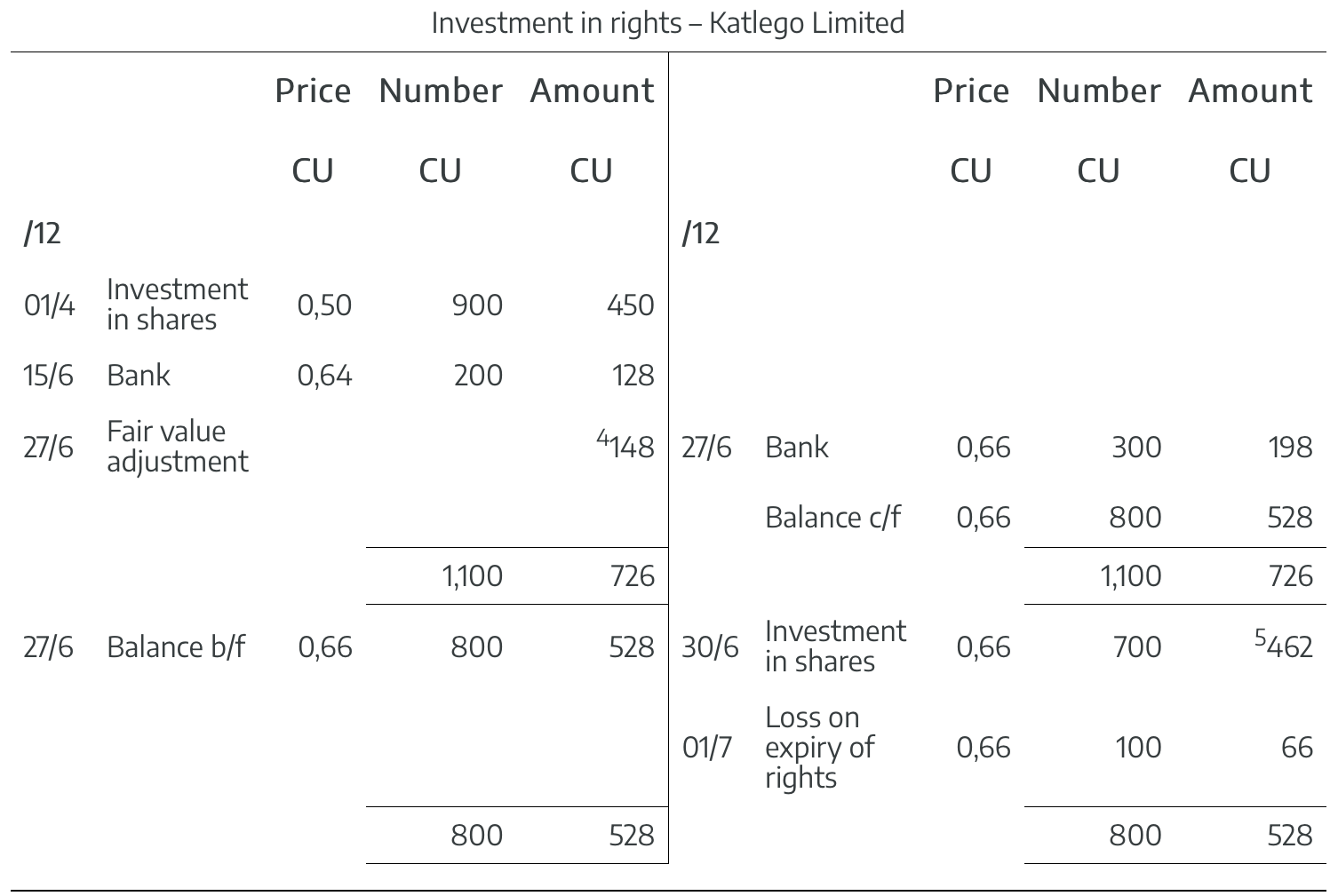

* The rights expired on 1 July 2012, which is before the reporting date.

Calculations

| 1. |

CU |

| Fair value of shares (4,500 x CU3,90) |

17,550 |

| Carrying amount of shares (4,500 x CU3,88) |

(17,460) |

| Fair value adjustment |

90 |

| 2. |

Number of shares and R/s |

Amount

CU

|

| Before rights issue |

4,500 x CU3,90 |

17,550 |

| Rights issue (4,500 / 5 = 900 rights x 1 share per right = 900 shares) |

900 x CU3,30 |

2,970 |

|

5,400 x CU3,80 |

20,520 |

|

CU |

| Ex-rights value per share (CU20,520/5,400 shares) |

3,80 |

| Rights issue price |

3,30 |

| Value per new share |

0,50 |

OR:

|

CU |

| Cum rights value per share |

3,90 |

| Ex rights value per share |

3,80 |

| Value change per existing share |

0,10 |

OR:

|

CU |

| 5 existing shares = 1 right = 0,10 per existing share x 5 = |

0,50 |

| Value per right |

|

|

|

| Value of rights to be transferred to the investment in rights account(900 rights x R0,50 per right) or (4,500 existing shares x R0,10 per existing share) or (900 new shares x R0,50 per new share) |

450 |

| 3. |

CU |

| Fair value of all shares on date of sale (4,500 + 1,500 shares x CU3,90) |

23,400 |

| Carrying amount of all shares on date of sale (CU17,400 + CU5,550) |

(22,650) |

| Fair value adjustment |

750 |

| 4. |

CU |

| Fair value of all rights on date of sale (900 + 200 rights x R0,66) |

726 |

| Carrying amount of all rights on date of sale (CU450 + CU128) |

(578) |

| Fair value adjustment |

148 |

| 5. Exercise rights (convert rights into shares): |

CU |

| – Pay in cash (CU3,30 x 700 new shares) |

2,310 |

| – Transfer rights value to shares (R0,66 x 700 rights) |

462 |

| Total value recognised in investment in shares account |

2,772 |

| 6. |

CU |

| Fair value of all shares on date of sale (5,200 + 700 shares x CU4,00) |

23,600 |

| Carrying amount of all shares on date of sale (CU20,280 + CU2,310 + CU462) |

(23,052) |

| Fair value adjustment |

548 |

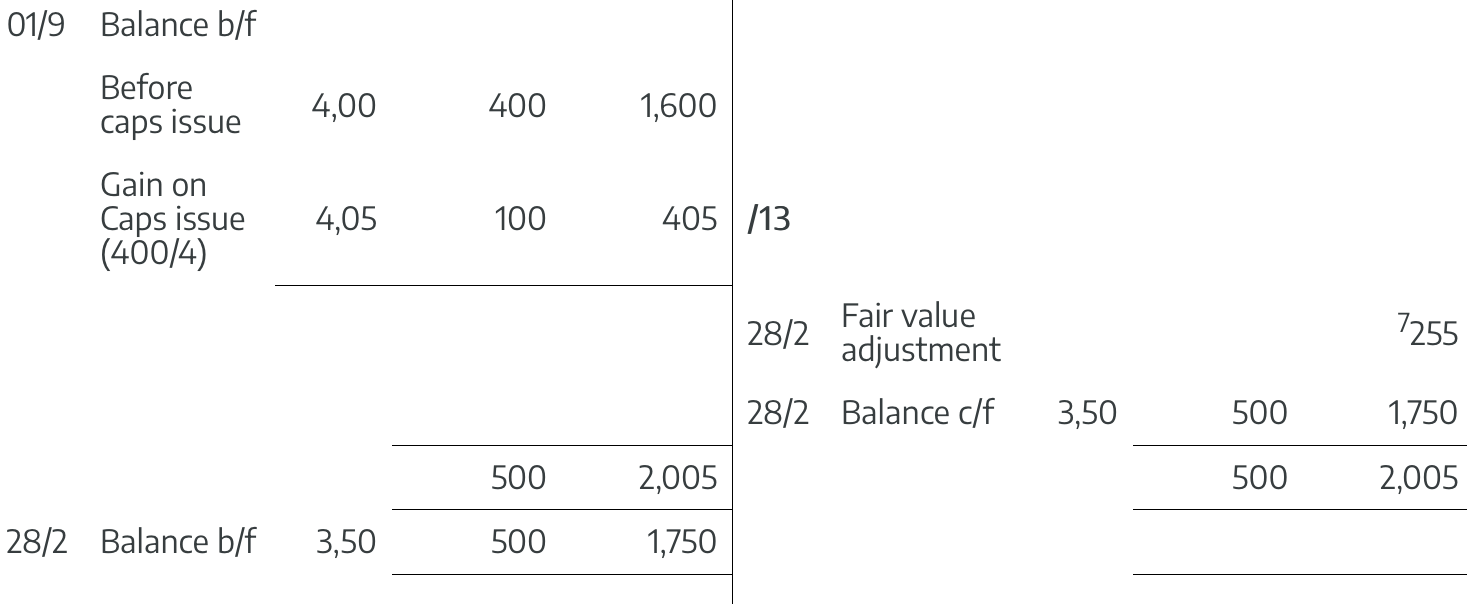

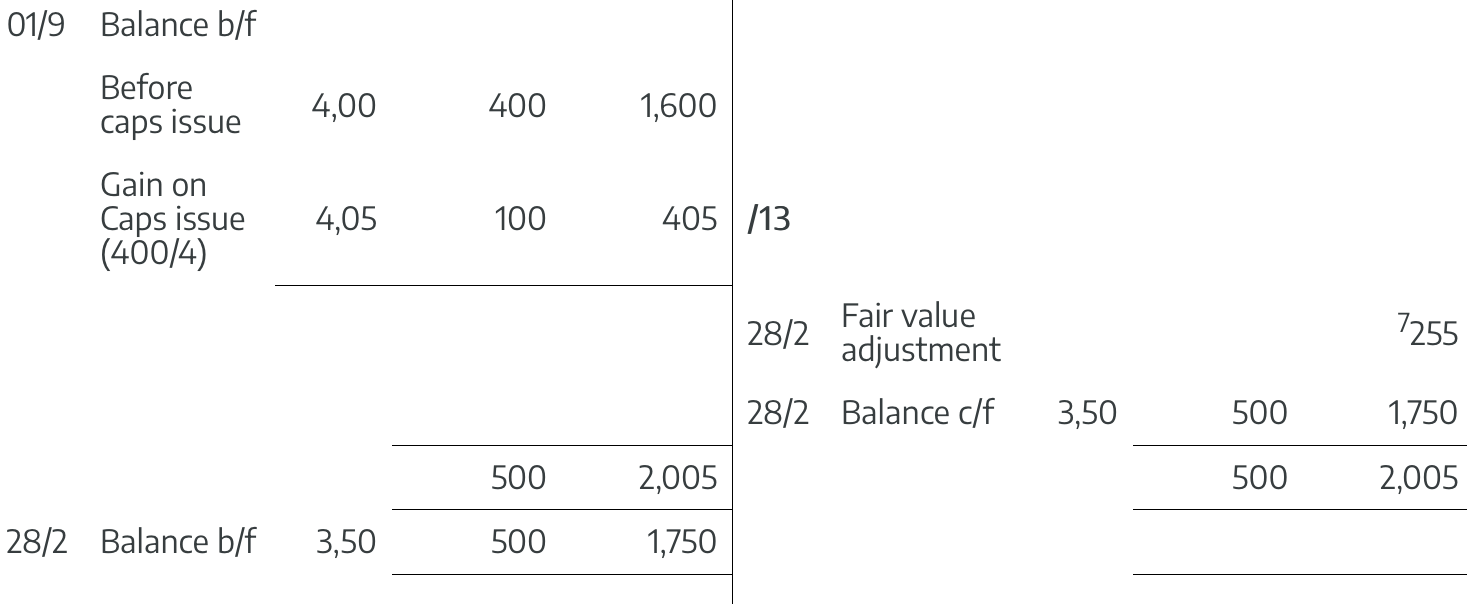

| 7. |

CU |

| Fair value of shares (500 shares x CU3,50) |

1,750 |

| Carrying amount of shares (CU1,600 + CU405) |

(2,005) |

| Fair value adjustment |

(255) |