1 Chapter 1 – Introduction to Financial Management

Learning Objectives

- Understand what finance is and how it’s used in business and personal decisions.

- Compare sole proprietorships, partnerships, and corporations, and weigh their pros and cons.

- Explain the benefits and challenges of corporations, like limited liability and double taxation.

- Get to know stocks and bonds—their purpose and key features.

- See how financial managers focus on cash flow and balance its size, timing, and risk.

- Learn why some investors prefer safer options (risk aversion) and how it shapes financial decisions.

- Discover how ethics and social responsibility can boost business success.

- Understand agency relationships and how they affect a company’s goals.

1.1 What is Finance?

Finance is all about managing money to achieve the best results while weighing the risks. It’s a broad field that applies to almost every part of life. Here are a few key areas where finance plays a role:

-

- Corporate Finance: Businesses use finance to decide how to invest, fund projects, and reward shareholders. For example, a company might decide whether to build a new factory or pay off debt.

- Banking: Banks rely on finance to manage loans, set interest rates, and evaluate risks before lending money.

- Personal Finance: Individuals use finance to make budgets, save for big goals like retirement, and make decisions about spending and investing.

No matter the area, the goal is the same: manage money effectively while keeping risks in check.

1.1.1 Commercial Banking/Financial Institutions

Financial institutions like banks, credit unions, and insurance companies play a big role in managing money and connecting borrowers with lenders. They handle:

-

- Managing risks and evaluating returns.

- Helping money grow over time (e.g., through interest).

- Facilitating loans, payments, and financial transactions.

We’ll touch on some of these topics, such as balancing risks and rewards and how money changes value over time. While banking isn’t our main focus, understanding how it fits into the bigger picture of finance is essential.

1.1.2 Understanding the Financial Cycle

Finance is also about how money flows in the economy. The financial cycle connects individuals, businesses, and financial institutions in a continuous loop:

-

- Individuals save money by depositing it in banks.

- Banks lend this money to businesses, fueling growth.

- Businesses repay loans with interest, which helps banks provide more loans.

Case Study: The Financial Cycle: A Local Business Example

Let’s break this down with an example of a small business—a local bakery:

- Raising Capital: The owner secures funding to open the bakery by borrowing from a bank or using personal savings.

- Purchasing Supplies: This funding is spent on ingredients, equipment, and rent.

- Sales and Revenue: The bakery sells bread and pastries to customers, generating income.

- Wages and Economic Flow: Employees are paid wages, which they use to buy goods or save.

- Reinvestment and Growth: Profits are reinvested in the bakery, used to repay loans, or saved for future projects.

1.1.3 Investments

When most people think of finance, they picture investments like the stock market. This field involves managing financial products like stocks, bonds, and mutual funds, with a focus on:

-

- Balancing risks and rewards.

- Diversifying investments to reduce risk.

- Aligning investments with individual goals.

Key Careers in Investments: Roles like stock analyst, portfolio manager, and trader are exciting but competitive, offering high rewards for those who excel.

1.1.4 Personal Finance

Personal finance is about managing your own money to achieve your goals. This includes:

-

- Planning for retirement.

- Creating a budget for big purchases like a car or house.

- Protecting yourself with insurance.

While this course doesn’t focus solely on personal finance, many concepts we’ll cover—like how money changes value over time—apply directly to personal decisions. If you want to dive deeper into personal finance, consider taking another class at foothill, Business 45 personal finance with me! This course focuses on practical strategies and personal experiences to help you manage your money effectively.

1.1.5 Corporate Finance

Corporate finance focuses on how businesses manage money. This includes:

-

- Raising money (through stocks, bonds, or loans).

- Deciding how to spend money (e.g., investing in new products or facilities).

- Managing cash flow to keep the business running smoothly.

Amazon’s rapid growth is a great example of effective corporate finance. From raising capital through bonds to investing in innovations like cloud computing, Amazon’s financial decisions have fueled its expansion into one of the world’s largest companies. By carefully balancing risks and returns, Amazon demonstrates how corporate finance drives success.

Case Study: Amazon’s Expansion and Financial Strategy

Amazon’s growth offers a great example of how corporate finance drives success. Founded in 1994 as an online bookstore, Amazon has since expanded into e-commerce, cloud computing (AWS), and even entertainment. This rapid growth was fueled by strategic financial decisions:

- Raising Capital: Amazon raised billions through bonds and stock offerings to fund logistics, fulfillment centers, and technology innovations. For instance, its bond issues have financed critical infrastructure for its Prime delivery network.

- Investing in Technology: The creation of Amazon Web Services (AWS) showcases how financial strategy drives innovation. AWS now generates significant profits, helping Amazon diversify beyond e-commerce.

- Cash Flow and Efficiency: Amazon’s sophisticated supply chain ensures efficient cash flow. By minimizing inventory costs and leveraging its size, Amazon can reinvest profits into R&D and global expansion.

- Corporate Social Responsibility: Through initiatives like The Climate Pledge, Amazon aligns its growth with sustainability, attracting investors who value ethical practices.

These decisions demonstrate how finance is not just about managing money—it’s about creating long-term value and staying ahead in a competitive market.

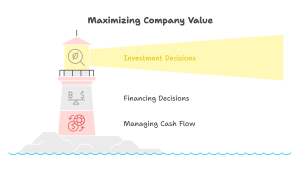

1.1.6 Financial Manager’s Role in a Business

Financial managers are like the navigators of a company, guiding it toward success by making smart money decisions. Their job focuses on three main areas:

-

- Investment Decisions:

This means choosing where the company’s money should go. Should it launch a new product, expand into a new market, or invest in cutting-edge technology? For example, a coffee chain might decide to open stores in a new city based on expected customer demand.

-

- Financing Decisions:

This involves figuring out how to get the money needed for those big plans. Should the company borrow through loans, issue stocks, or reinvest its own profits? Each option has trade-offs in terms of cost and control.

-

- Managing Cash Flow:

Financial managers make sure there’s enough cash to keep the business running smoothly. This includes keeping track of payments coming in from customers and making sure suppliers, employees, and lenders are paid on time.

Case Study: Tesla’s Investment Decisions

Tesla’s Gigafactory, one of the largest battery production facilities in the world, is a perfect example of how financial managers make critical decisions:

- Investment Decisions: Tesla invested billions in the Gigafactory to reduce battery costs and make electric vehicles more affordable. This bold move required careful analysis of the potential benefits and risks.

- Financing Decisions: To fund the project, Tesla raised money through a mix of selling stocks and issuing bonds. This helped them avoid putting too much strain on their existing cash reserves.

- Managing Cash Flow: Building a factory of this size meant significant upfront costs, but Tesla’s financial team ensured the company had enough liquidity to continue operations while completing the project.

The result? The Gigafactory helped Tesla scale its production, lower costs, and dominate the electric vehicle market—all thanks to strategic financial management.

1.2 Forms of Business Organization

When starting a business, choosing the right structure is a big decision. There are three main types of business organizations: sole proprietorships, partnerships, and corporations. Each has its pros and cons, so understanding how they work is crucial.

While this course focuses primarily on corporations, let’s take a quick look at all three to build a solid foundation.

1.2.1 Sole Proprietorship

A sole proprietorship is the simplest and most common type of business ownership. It’s run by one person, and there’s no legal distinction between the owner and the business.

Key Features:

-

- Full Control: The owner makes all the decisions—no partners or boards to consult.

- Personal Liability: The owner is personally responsible for all debts and legal issues. If the business owes money, the owner’s personal assets (like a car or house) are at risk.

- Pass-Through Taxation: Business profits are taxed as part of the owner’s personal income.

Advantages:

-

- Easy to set up and manage.

- The owner keeps all the profits.

- Simple tax structure.

Disadvantages:

-

- Unlimited liability—your personal assets are on the line.

- Harder to raise money, as banks may be hesitant to lend to a sole proprietor.

- The business ends if the owner leaves or passes away.

Example:

Imagine a freelance graphic designer running a sole proprietorship. They manage everything themselves, from client relations to invoices. While this gives them flexibility, it also means they’re responsible for any debts if the business struggles.

1.2.2 Partnership

A partnership involves two or more people sharing ownership. Each partner contributes to the business and shares its profits and losses.

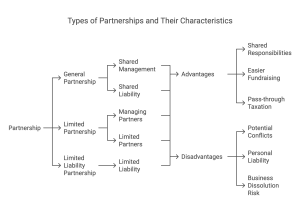

Types of Partnerships:

-

- General Partnership: All partners are equally involved in management and share liability.

- Limited Partnership (LP): Some partners manage the business and take on liability, while others only invest capital and have limited liability.

- Limited Liability Partnership (LLP): All partners enjoy limited liability, protecting them from personal responsibility for business debts.

Advantages:

-

- Shared responsibilities and resources.

- Easier to raise funds compared to sole proprietorships.

- Pass-through taxation—profits are taxed only at the individual level.

Disadvantages:

-

- Conflicts between partners can arise.

- In general partnerships, each partner is personally liable for the business’s debts.

- The business may dissolve if a partner leaves, unless there’s an agreement in place.

Example:

Think of a small law firm run as an LLP. Each partner brings their own expertise and shares the workload. If one partner leaves, the firm can continue without significant disruption, thanks to the LLP structure.

1.2.3 Corporation

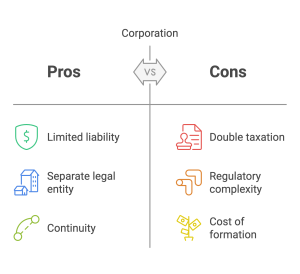

A corporation is a separate legal entity from its owners. It can enter contracts, own property, and even sue or be sued.

Key Features:

-

- Limited Liability: Shareholders are only responsible for the money they invest.

- Separate Legal Entity: The corporation exists independently of its owners, ensuring continuity even if ownership changes.

- Corporate Taxation: Profits may be taxed twice—first as corporate income and again as dividends paid to shareholders.

Advantages:

-

- Easier to raise capital by selling stocks or issuing bonds.

- Limited liability protects shareholders’ personal assets.

- Continuity—the business doesn’t end if an owner leaves.

Disadvantages:

-

- Double taxation on profits and dividends.

- Higher costs and more regulations compared to other structures.

Example:

Snap Inc., the company behind Snapchat, went public in 2017. By selling shares, it raised billions of dollars to fund growth, even though it hadn’t yet turned a profit.

Examples: Apple Inc.

Apple Inc. is one of the most well-known corporations in the world. As a corporation, Apple has raised billions of dollars by selling shares to the public, allowing it to fund innovative projects like the iPhone and its services like Apple Music and iCloud.

The corporate structure provides Apple with the ability to operate on a global scale, employing thousands of people and managing a vast supply chain. At the same time, shareholders enjoy the benefits of limited liability—they can invest in Apple without risking more than the money they’ve put into buying shares.

Apple’s corporate structure also makes it easier to manage ownership changes. When someone buys or sells shares, the company itself isn’t affected. This flexibility, combined with the ability to raise large amounts of capital, is a key reason many businesses choose the corporate form.

1.2.4 Limited Liability Company (LLC)

An LLC blends features of partnerships and corporations, offering flexibility and liability protection.

Key Features:

-

- Limited Liability: Owners’ personal assets are protected from business debts.

- Pass-Through Taxation: Profits are taxed only at the individual level, avoiding double taxation.

- Flexible Management: Owners can run the business themselves or hire managers.

Advantages:

-

- Combines liability protection with tax simplicity.

- Fewer formalities than corporations.

- Owners can choose how to manage the business.

Disadvantages:

-

- Rules and fees vary by state, adding complexity.

- Owners may face self-employment taxes.

Examples: Airbnb host and LLC

Imagine an Airbnb host who owns two vacation rental properties. They decide to set up an LLC to protect their personal assets. Why? Because if something goes wrong—say a guest files a lawsuit after an injury on the property—the LLC structure ensures that the host’s personal savings, home, or car are not at risk. Only the assets within the LLC, such as the rental properties themselves, are exposed.

Beyond liability protection, the LLC structure also offers financial benefits. The host can deduct expenses related to the rentals—like maintenance, utilities, and property management fees—directly through the LLC, simplifying their tax reporting. Additionally, if the host wants to expand their business, the LLC makes it easier to secure loans or attract partners, as the business is already set up as a separate legal entity.

Setting up an LLC requires some upfront work, like filing paperwork and paying fees, but for a host managing multiple properties or considering long-term growth, the flexibility and protection are worth it.

-

- Sole Proprietorship

-

- Liability: Unlimited Personal Liability

- Taxation: Pass-Through (Personal Income Tax)

- Control: Full Control

- Complexity: Low

- Lifespan: Ends with Owner

-

- Partnership

-

- Liability: Shared or Limited Liability

- Taxation: Pass-Through (Personal Income Tax)

- Control: Shared Control

- Complexity: Moderate

- Lifespan: Ends with Partner’s Departure (unless specified)

-

- Corporation

-

- Liability: Limited Liability for Shareholders

- Taxation: Double Taxation (Corporate & Personal)

- Control: Board of Directors

- Complexity: High

- Lifespan: Perpetual

-

- LLC (Limited Liability Company)

-

- Liability: Limited Liability for Members

- Taxation: Pass-Through or Corporate Taxation

- Control: Flexible (Member or Manager Controlled)

- Complexity: Moderate

- Lifespan: Perpetual (if specified in agreement)

1.3 Stocks vs. Bonds

When companies need money, they typically turn to two main sources: stocks and bonds. These financial tools allow businesses to raise capital, but they work very differently. Let’s break them down.

1.3.1 Stocks

Stocks represent ownership in a company. When you buy a stock, you purchase a small part of that company, making you a shareholder. Large corporations can have millions or billions of shares outstanding, so even if you own 100 shares, your ownership is a small fraction. For example, consider the share counts of some prominent companies in early 2023:

Stocks represent ownership in a company. When you buy a stock, you purchase a small part of that company, making you a shareholder. Large corporations can have millions or billions of shares outstanding, so even if you own 100 shares, your ownership is a small fraction. For example, consider the share counts of some prominent companies in early 2023:

-

-

- Apple Inc. had around 15.8 billion shares outstanding

- Ford Motor Company had about 4 billion shares

- Domino’s Pizza had approximately 36 million shares

-

As a shareholder, you benefit in two main ways:

-

- Dividends: If the company earns profits, it may share a portion with you as a dividend. Not all companies pay dividends, as some reinvest profits into growth instead.

- Capital Gains: If the company grows and its stock price rises, you can sell your shares for more than you paid, earning a profit.

Key Characteristics of Stocks:

-

- Variable Returns: Stock returns depend on the company’s performance and market conditions, so they can fluctuate.

- Higher Risk, Higher Reward: Stocks are riskier than bonds because their value can change based on market forces, but they offer the potential for significant gains.

- No Maturity Date: Unlike bonds, stocks don’t expire. You own them indefinitely unless you sell or the company ceases to exist.

Additional Features:

-

- Companies often reinvest profits into new products, research, or reducing debt, which can drive future growth and raise the stock price.

- Some companies may buy back shares, reducing the total number of shares in circulation and increasing the value of each remaining share.

Examples

Let’s say you buy 100 shares of a small tech company. Over time, the company releases innovative new products, driving up revenue. As a result, the stock price increases significantly. You sell your shares for triple the price you paid, earning a substantial capital gain.

However, the opposite can also happen. If the company struggles, the stock price might drop, leaving you with losses if you decide to sell. This variability makes stocks more suitable for investors willing to take on risk for higher rewards.

1.3.2 Bonds

Bonds are a form of debt financing. When you buy a bond, you’re essentially lending money to the company or government that issued it. In return, they agree to pay you back with interest.

Key Characteristics of Bonds:

-

- Fixed Returns: Bonds usually provide predictable payments (called coupons) and return the principal amount when they mature.

- Lower Risk, Lower Reward: Bonds are less risky than stocks but generally offer lower returns.

- Defined Maturity Date: Bonds have a set end date when the borrower repays the principal.

Example: Comparing Historical Returns on Bonds and Stocks

For those interested in historical data, comparing S&P 500 returns with 3-month Treasury bills and 10-year Treasury bonds provides insight into how these investments have performed over the years. According to data from Aswath Damodaran’s site, from 1928 to 2019:

-

- S&P 500 (stocks) returned an average of about 9.71% annually.

- 10-year Treasury bonds yielded an average of 4.88% annually.

Despite stocks having nearly double the average annual return, the power of compounding made a substantial difference. For example:

-

- $100 invested in stocks in 1928 grew to $502,417 by 2019.

- The same $100 invested in 10-year Treasury bonds grew to only $8,013 over the same period.

Stocks and bonds are essential tools for raising money, and they each have their place in a well-rounded financial plan. Understanding the differences helps investors and businesses make smarter decisions about how to grow and manage their money.

Key Differences Between Stocks and Bonds:

-

- Ownership vs. Loan: Stocks represent ownership in a company, while bonds are loans to the issuer.

- Risk and Return: Stocks are riskier but offer higher potential rewards. Bonds are safer but typically provide lower returns.

- Time Horizon: Stocks have no set maturity date, while bonds have fixed terms.

- Payments: Stock returns come from dividends and capital gains, whereas bonds provide fixed interest payments and principal repayment.

1.4 Goal of the Financial Manager

The financial manager’s role is to make decisions that maximize the company’s value for its shareholders. Think of the financial manager as the strategic decision-maker for the company’s money. This involves three primary responsibilities:

-

- Investment Decisions: Where should the company’s money go? Should it invest in new products, expand into new markets, or buy equipment? For example, a financial manager at Tesla might evaluate the costs and benefits of building another Gigafactory.

- Financing Decisions: How does the company get the money it needs? Should it borrow through loans, sell shares, or reinvest its profits? Each option comes with trade-offs, like debt obligations or diluted ownership for shareholders.

- Managing Cash Flow: Can the company pay its bills and meet its obligations on time? Financial managers ensure there’s enough cash on hand to cover expenses, whether that’s payroll, supplier payments, or debt repayments.

The Big Picture: Maximizing Shareholder Wealth

The financial manager’s ultimate goal is to maximize shareholder wealth, which means increasing the company’s value. To achieve this, they focus on three key factors:

-

- Magnitude of Cash Flows: How much money the business generates. Bigger is better.

- Timeliness of Cash Flows: When the money comes in. Cash sooner is worth more than cash later.

- Riskiness of Cash Flows: The uncertainty of cash flows. Lower risk is typically preferred, but sometimes taking on risk is necessary for growth.

Why Focus on Cash Flows?

Financial managers prioritize cash flows because:

-

- Cash is essential: A business that can’t pay its bills won’t survive, no matter how profitable it looks on paper.

- Earnings can be misleading: Accounting practices can manipulate earnings, but cash flow tells a clearer story.

- Time matters: Money today is worth more than money tomorrow, thanks to the time value of money.

Case Study: Tesla’s Financial Management

Tesla’s financial managers are a prime example of how this role translates to real-world success:

-

- Investment Decisions: Building Gigafactories worldwide to scale electric vehicle production.

- Financing Decisions: Raising billions through stock offerings and bonds to fund expansion while maintaining liquidity.

- Managing Cash Flow: Carefully balancing high upfront costs with ongoing operations, ensuring enough cash to support rapid growth.

This strategic financial management has enabled Tesla to become a global leader in electric vehicles while continuously increasing its market value.

In Every Department

The financial manager’s role isn’t isolated. Every department contributes to the goal of maximizing value. For instance:

-

- Marketing campaigns boost revenue.

- Operations improve cost efficiency.

- HR builds a strong workforce.

While the financial manager oversees the numbers, the entire company works together to achieve long-term success.

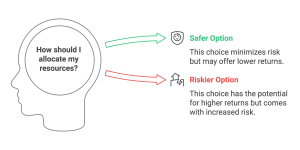

1.5 Risk Aversion

Risk aversion is the tendency to prefer safer options over riskier ones, even when the riskier choice might offer a higher reward. It’s a core concept in finance because it explains how people make decisions about money, from small personal choices to large corporate investments.

Risk aversion is the tendency to prefer safer options over riskier ones, even when the riskier choice might offer a higher reward. It’s a core concept in finance because it explains how people make decisions about money, from small personal choices to large corporate investments.

For example:

-

- An investor might choose a government bond with a guaranteed 3% return over a stock with an uncertain return that could range from -10% to +10%.

- A company might delay launching a risky new product until it has more market data, even if early entry could mean bigger profits.

Risk aversion doesn’t mean avoiding risk entirely—it means people and businesses want to be compensated for taking risks. This compensation often comes in the form of higher potential returns.

Why Does Risk Aversion Matter?

Understanding risk aversion is crucial because it shapes:

-

- Investment Decisions: Safer investments like bonds are designed for risk-averse individuals, while risk-tolerant investors may lean toward stocks or cryptocurrency.

- Corporate Strategies: Companies weigh risks when deciding where to invest, balancing potential rewards with the likelihood of failure.

We’ll explore this balance in much greater detail in a later chapter: Risk and Return, where you’ll learn:

-

- How risk and expected returns are linked.

- Ways to measure risk using tools like standard deviation.

- Strategies like diversification that help manage risk while maximizing returns.

For now, think of risk aversion as a foundational idea that helps explain why people make the financial choices they do—and why risk and reward are always connected.

1.6 Social Responsibility and Ethics

Finance isn’t just about numbers and profits—it’s also about doing the right thing. Businesses operate within communities, and their decisions can have far-reaching effects on people, the environment, and society as a whole. This is where social responsibility and ethics come into play.

1.6.1 Social Responsibility

Social responsibility means that businesses should contribute positively to society. This can involve:

-

- Supporting education through scholarships or donations.

- Protecting the environment by reducing waste or using sustainable materials.

- Investing in community programs or charitable causes.

Being socially responsible helps businesses build trust and loyalty with customers, employees, and investors. For instance, a company known for ethical practices may attract more customers, boosting its profitability in the long run.

1.6.2 Ethics

Ethics in finance is about making decisions that are fair, honest, and aligned with moral principles. Examples include:

-

- Treating employees fairly and ensuring safe working conditions.

- Honoring commitments to customers and suppliers.

- Following not just the letter of the law, but its spirit.

In finance, ethical behavior builds a company’s reputation and ensures long-term success. Cutting corners might deliver short-term gains, but unethical practices often lead to scandals, fines, or even bankruptcy.

1.6.3 Why Does it Matter in Finance?

Social responsibility and ethics align with the financial manager’s goal of maximizing shareholder wealth. While these practices may involve costs, they can lead to significant long-term benefits, such as:

-

- Enhanced brand reputation.

- Increased customer loyalty.

- Better relationships with investors and employees.

Evidence of Positive Impact:

A comprehensive study by Margolis et al. (2009) analyzed 251 studies examining the relationship between social responsibility and firm performance. The findings include:

-

-

- An overall mean correlation of 0.13, showing a positive relationship.

- 28% of the studies revealed a statistically significant, positive relationship.

- 59% indicated no measurable impact.

- Only 2% showed a statistically negative relationship.

-

These results suggest that ethical and socially responsible behavior tends to either benefit firms financially or has no substantial negative impact. In essence, companies that engage in responsible behavior may experience increased shareholder wealth, or at the very least, no noticeable financial detriment.

Companies highly rated for their commitment to social responsibility often excel in building trust and loyalty among consumers and investors. For example, firms featured on the Business Ethics List of 100 Best Corporate Citizens showcase the positive impact of integrating ethical practices into their business models.

How This Relates to Maximizing Value

Social responsibility and ethical behavior contribute to a company’s value by building goodwill and trust. While the primary goal of a business is to generate profits, companies that ignore ethics or social responsibility often face backlash—from customers, employees, or regulators—which can hurt their financial performance.

A Broader Perspective

We’ll explore these ideas further throughout the course, but for now, remember:

•Ethics and responsibility are integral to sustainable financial success.

•Businesses that prioritize these principles often perform better in the long run.

Case Study: Patagonia’s Corporate Social Responsibility (CSR)

Patagonia, the outdoor apparel company, is widely recognized as a leader in Corporate Social Responsibility (CSR). Founded on principles of sustainability and environmental stewardship, Patagonia’s business practices show how CSR can be integrated into a company’s core strategy while maintaining profitability.

Patagonia, the outdoor apparel company, is widely recognized as a leader in Corporate Social Responsibility (CSR). Founded on principles of sustainability and environmental stewardship, Patagonia’s business practices show how CSR can be integrated into a company’s core strategy while maintaining profitability.

Commitment to the Environment

Patagonia’s CSR efforts focus primarily on reducing environmental impact. The company has committed to using sustainable materials, such as organic cotton and recycled polyester, in its products. It also promotes a “worn wear” program, encouraging customers to repair and reuse their clothing rather than buying new items. This initiative not only reduces waste but also deepens customer loyalty.

Philanthropy and Activism

Patagonia donates 1% of its sales to environmental causes, a practice it has maintained for years. Additionally, Patagonia actively supports environmental activism through grants and campaigns aimed at preserving natural habitats and fighting climate change. In 2022, Patagonia’s founder transferred ownership of the company to a trust and non-profit organization, ensuring that its profits will go toward environmental causes indefinitely.

Balancing Profit and Purpose

While Patagonia’s focus on CSR might seem costly, it has proven to be profitable. Consumers are increasingly looking to support brands that align with their values, and Patagonia’s commitment to sustainability has helped differentiate it from competitors, fostering customer loyalty and enhancing its brand image.

Conclusion

Patagonia’s approach to CSR illustrates how companies can balance profit with purpose. By integrating environmental and social responsibility into its business model, Patagonia has built a brand that resonates with socially conscious consumers while continuing to grow financially.

1.7 International Issues

In today’s global economy, businesses can no longer focus solely on their domestic markets. Engaging with international customers, suppliers, and investors has become essential for maximizing firm value. This section highlights the importance of thinking globally in finance.

1.7.1 The Global Marketplace

The world is interconnected, offering businesses opportunities to expand their reach beyond national borders. Consider these facts:

-

- The U.S. population represents only about 4% of the global population, meaning 96% of potential customers live outside the United States.

- Similarly, around 75% of global GDP occurs outside the U.S., offering enormous opportunities for growth.

Companies that ignore international markets limit their potential for expansion and risk being left behind by global competitors.

1.7.2 Expanding Opportunities

Operating internationally can significantly impact a company’s financial performance:

-

- Increased Cash Flows: Selling products or services in foreign markets opens up new revenue streams.

- Diversified Risk: By operating in multiple countries, businesses reduce their dependence on any single market, making them more resilient to local economic downturns.

However, international operations also come with challenges, such as:

-

- Political instability in certain regions.

- Currency exchange rate fluctuations.

- Cultural and regulatory differences.

1.7.3 Real-World Example: S&P 500 Companies

For companies in the S&P 500, around 40-50% of revenue comes from international markets. Take Coca-Cola, for example:

-

- The brand is sold in over 200 countries, and much of its revenue comes from outside the U.S.

- This global presence not only increases revenue but also spreads risk, as poor sales in one region can be offset by strong sales elsewhere.

1.7.4 Balancing Risks and Rewards

While international markets offer growth opportunities, they also introduce additional risks that financial managers must navigate. For example:

-

- Currency Risks: A weakening foreign currency could reduce the value of overseas profits when converted back to U.S. dollars.

- Political Risks: Instability in certain countries could disrupt operations.

Managing these risks requires careful planning, including hedging strategies and thorough market research.

1.7.5 Connecting Back to the Goal of Finance

Expanding internationally aligns with the financial manager’s primary goal of maximizing shareholder wealth by:

-

- Increasing the magnitude of cash flows through larger markets.

- Improving the timeliness of cash flows by accessing regions with favorable economic conditions.

- Reducing the riskiness of cash flows through diversification.

Looking Ahead

As you progress through this course, you’ll see how international finance ties into key topics like exchange rates, global markets, and managing risk. A global perspective is no longer optional—it’s a necessity for success in today’s financial world.

Key Takeaways

- Role of Financial Managers: Financial managers make critical decisions about investments, financing, and managing cash flows, all with the goal of maximizing shareholder wealth.

- Business Forms and Capital: Different business structures—sole proprietorships, partnerships, corporations, and LLCs—have unique implications for raising capital, liability, and taxation.

- The Financial Cycle: Money flows between individuals, businesses, and financial institutions, creating a continuous cycle of savings, loans, and investments that fuels economic activity.

- Corporate Finance Decisions: Companies like Tesla and Amazon demonstrate how financial managers raise capital through stocks and bonds to fund growth, balancing risks and rewards.

- Risk Aversion: Understanding risk aversion helps explain why people and businesses make safer financial choices and how they balance risk with potential returns.

- Ethics and Social Responsibility: Companies that prioritize ethical practices and social responsibility, like Patagonia, often find long-term success and build stronger relationships with stakeholders.

- Global Opportunities: Engaging in international markets expands revenue potential, diversifies risk, and aligns with the financial manager’s goal of maximizing shareholder wealth.

Exercises

Conceptual Questions

- Defining Finance

Explain how finance is used in corporate, personal, and banking contexts. Provide an example for each to illustrate its role.

- Choosing a Business Form

Compare and contrast the benefits and risks of sole proprietorships, partnerships, and corporations. Why might a business owner choose one structure over another?

- The Financial Cycle

What are the key steps in the financial cycle? How do individuals, businesses, and financial institutions contribute to this cycle?

- Risk Aversion

Define risk aversion and explain how it influences financial decision-making for individuals and businesses. Provide an example to illustrate your point.

- Social Responsibility in Finance

Why is corporate social responsibility (CSR) increasingly important in financial decision-making? How can it impact a company’s long-term success?

- The Role of Financial Managers

Identify and describe the three primary responsibilities of financial managers. How do these roles align with the goal of maximizing shareholder wealth?

- Global Finance

Discuss the benefits and challenges of operating in international markets. How do companies manage risks like currency fluctuations or political instability?

Scenario-Based Problems

- Business Structure Decision

Maria is opening a bakery and is deciding between a sole proprietorship and an LLC.

- What factors should Maria consider when choosing a business structure?

- How would liability and taxation differ between these two options?

- The Financial Cycle in Action

Imagine a small café borrows $50,000 from a bank to expand its seating area.

- Outline how this transaction fits into the financial cycle.

- What role does the bank play in supporting the café’s growth?

- Risk and Reward: Stock vs. Bond Investment

John has $10,000 to invest and is deciding between a corporate bond offering a 5% annual return and a stock with higher potential returns but greater risk.

- What factors should John consider in making his decision?

- How might risk aversion influence his choice?

- CSR in Practice

A clothing brand decides to launch a recycling program for used garments and pledges to donate 1% of profits to environmental causes.

- How might this initiative improve the company’s reputation?

- What financial benefits or challenges could arise from prioritizing social responsibility?

- Financial Manager’s Investment Decision

A technology company is considering two projects:

- Project A requires $1 million and is expected to generate $1.5 million in three years.

- Project B requires $1.2 million and is expected to generate $2 million in five years.

- As a financial manager, how would you evaluate these options? What factors would influence your recommendation?

- Global Expansion

A U.S.-based beverage company plans to expand to Europe but is concerned about currency fluctuations and regulatory differences.

- What steps can the company take to mitigate these risks?

- How might diversification into international markets benefit the company?

Interactive Challenge

- Business Structure Match-Up

Match each business structure with its correct description:

- Sole Proprietorship

- Partnership

- Corporation

- LLC

Options:

- Offers pass-through taxation and limited liability.

- Simplest form of business ownership with unlimited liability.

- Involves shared decision-making and shared liability.

- A separate legal entity with limited liability and double taxation.

Case Study: Tesla’s Gigafactory

Tesla invested billions in its Gigafactory to scale battery production.

- What investment, financing, and cash flow decisions were critical to this project?

- How did these decisions align with Tesla’s goal of maximizing shareholder value?

- Stock or Bond?

Create a pros-and-cons chart for investing in stocks versus bonds. Include factors like risk, return, and time horizon.

- Which option might be better for a risk-averse individual saving for retirement?

- How might a younger investor’s choice differ?