10 Chapter 10 – Cost of Capital

Learning Objectives

- Understand the drivers of a firm’s overall cost of capital.

- Measure the costs of debt, preferred stock, and common stock.

- Compute a firm’s overall weighted average cost of capital (WACC).

- Apply the WACC to evaluate investment opportunities and value projects.

- Adjust the cost of capital for varying risk levels associated with specific projects or divisions.

- Account for the direct costs of raising external capital.

10.1 A First Look at the Weighted Average Cost of Capital

10.1.1 Introduction to the Weighted Average Cost of Capital

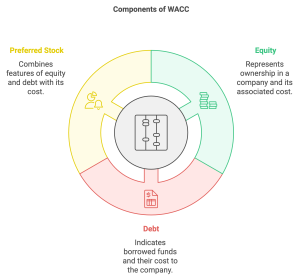

The Weighted Average Cost of Capital (WACC) represents the average return required by investors across a firm’s capital structure. It combines the costs of equity, debt, and preferred stock, weighted by their proportions in the firm’s overall financing mix.

Why WACC Matters:

-

- Serves as the discount rate for calculating the Net Present Value (NPV) of investment opportunities.

- Acts as a hurdle rate; investments must yield a return greater than WACC to add value.

10.1.2 Opportunity Cost and the Overall Cost of Capital

WACC embodies the opportunity cost of capital by representing the expected returns for all capital providers:

-

- Equity investors expect returns that reflect the risks of owning the firm’s stock.

- Debt holders require interest payments that account for lending risks.

WACC ensures the firm effectively allocates resources by balancing investor expectations across its financing structure.

10.1.3 Weighted Averages and the Overall Cost of Capital

WACC is calculated as a weighted average of the costs of equity, debt, and preferred stock:

[latex]\text{WACC} = \frac{E}{V} \cdot r_E + \frac{D}{V} \cdot r_D \cdot (1 - T) + \frac{P}{V} \cdot r_P[/latex]

Where:

-

- E, D, P: Market values of equity, debt, and preferred stock

- V = E + D + P: Total market value of the firm

- [latex]r_E[/latex], [latex]r_D[/latex], [latex]r_P[/latex]: Costs of equity, debt, and preferred stock

- T: Corporate tax rate

10.1.4 Example: Calculating WACC

Example: Calculating WACC for a Hypothetical Firm

A firm’s capital structure:

-

- Equity (E) = $500M, [latex]r_E = 10\%[/latex]

- Debt (D) = $300M, [latex]r_D = 5\%[/latex]

- Tax rate (T) = 30%

1.Calculate total value (V):

V = E + D = 500 + 300 = 800

2.Calculate weights:

[latex]\frac{E}{V} = \frac{500}{800} = 0.625, \quad \frac{D}{V} = \frac{300}{800} = 0.375[/latex]

3.Apply the WACC formula:

[latex]\text{WACC} = (0.625 \cdot 0.10) + (0.375 \cdot 0.05 \cdot (1 - 0.30))[/latex]

[latex]\text{WACC} = 0.0625 + 0.013125 = 0.075625 \, \text{or} \, 7.56\%[/latex]

Conclusion: The firm’s WACC is 7.56%, meaning projects must earn this return or more to create value.

10.2 The Firm’s Costs of Debt and Equity Capital

A firm’s cost of capital represents the return required by its investors, reflecting the risks associated with its financing choices. This section explains how to calculate the costs of debt, preferred stock, and common stock, which together form the basis for the Weighted Average Cost of Capital (WACC).

10.2.1 Cost of Debt Capital

The cost of debt ( [latex]r_D[/latex] ) is the effective interest rate a firm pays on its borrowed funds, adjusted for tax benefits. Debt is typically less expensive than equity because interest payments are tax-deductible, reducing the effective cost.

Formula for After-Tax Cost of Debt:

[latex][latex]r_D = \text{Yield on Debt} \times (1 - T)[/latex][/latex]

Where:

T = Corporate tax rate

Example: Calculating Cost of Debt

A company issues bonds with a 6% yield and faces a 30% tax rate. The after-tax cost of debt is:

[latex]r_D = 0.06 \times (1 - 0.30) = 0.06 \times 0.70 = 0.042 \, \text{or} \, 4.2\%[/latex]

Conclusion: The effective cost of debt is 4.2%, reflecting the tax shield benefit.

10.2.2 Cost of Preferred Stock Capital

Preferred stock pays fixed dividends, making its cost ( r_P ) similar to a bond’s yield. However, unlike debt, preferred dividends are not tax-deductible. The cost of preferred stock is calculated using the formula:

[latex]r_P = \frac{\text{Preferred Dividend}}{\text{Market Price of Preferred Stock}}[/latex]

Example: Calculating Cost of Preferred Stock

A company issues preferred stock that pays an annual dividend of $5 per share, and the current market price is $50 per share.

[latex]r_P = \frac{5}{50} = 0.10 \, \text{or} \, 10\%[/latex]

Conclusion: The cost of preferred stock is 10%, reflecting the return required by preferred shareholders.

10.2.3 Cost of Common Stock Capital

The cost of common stock ( [latex]r_E[/latex] ) is the return required by equity investors. This can be estimated using the Capital Asset Pricing Model (CAPM):

[latex]r_E = r_f + \beta \cdot (r_m - r_f)[/latex]

Where:

-

- [latex]r_f[/latex] = Risk-free rate

- [latex]\beta[/latex] = Beta, measuring the stock’s volatility relative to the market

- [latex]r_m[/latex] = Expected market return

Example: Using CAPM to Estimate Cost of Equity

Suppose the risk-free rate ( [latex]r_f[/latex] ) is 3%, the market return ( [latex]r_m[/latex] ) is 8%, and the stock’s beta ( [latex]\beta[/latex] ) is 1.2.

[latex]r_E = 0.03 + 1.2 \cdot (0.08 - 0.03) = 0.03 + 1.2 \cdot 0.05 = 0.03 + 0.06 = 0.09 \, \text{or} \, 9\%[/latex]

Conclusion: The cost of common equity is 9%, representing the return expected by shareholders.

Summary

Summary

Understanding the components of a firm’s cost of capital is crucial for evaluating its overall financing strategy. Debt capital benefits from tax shields, making it cheaper than equity, while preferred and common equity reflect investor expectations for fixed and variable returns, respectively.

10.3 Advanced WACC Applications

The Weighted Average Cost of Capital (WACC) serves as a key benchmark for evaluating corporate investments. Building on its foundational definition, this section explores the WACC equation in greater depth, examines its practical application, and discusses advanced considerations like net debt, the risk-free interest rate, and the market risk premium.

10.3.1 Revisiting the Concept of WACC

The WACC formula integrates all sources of capital—debt, equity, and preferred stock—weighted by their proportions in the firm’s capital structure. It reflects the average return required by investors, accounting for the tax benefits of debt.

[latex]\text{WACC} = \frac{E}{V} \cdot r_E + \frac{D}{V} \cdot r_D \cdot (1 - T) + \frac{P}{V} \cdot r_P[/latex]

Where:

E, D, P = Market values of equity, debt, and preferred stock

V = E + D + P = Total market value of the firm

r_E, r_D, r_P = Costs of equity, debt, and preferred stock

T = Corporate tax rate

Expanded Example: Revisiting the WACC Calculation

A company has:

-

- Equity ( E ) = $800 million, with r_E = 12%

- Debt ( D ) = $500 million, with r_D = 5% and T = 25%

- Preferred stock ( P ) = $200 million, with r_P = 8%

1. Calculate Total Market Value ( V ):

[latex]V = E + D + P = 800 + 500 + 200 = 1,500 \, \text{million}[/latex]

2. Determine Weights:

[latex]\frac{E}{V} = \frac{800}{1,500} = 0.533 \, (53.3\%)[/latex]

[latex]\frac{D}{V} = \frac{500}{1,500} = 0.333 \, (33.3\%)[/latex]

[latex]\frac{P}{V} = \frac{200}{1,500} = 0.133 \, (13.3\%)[/latex]

3. Apply the WACC Formula:

[latex]\text{WACC} = (0.533 \cdot 0.12) + (0.333 \cdot 0.05 \cdot (1 - 0.25)) + (0.133 \cdot 0.08)[/latex]

4. Calculate Each Component:

[latex]0.533 \cdot 0.12 = 0.06396 \, \text{(6.396% from equity)}[/latex]

[latex]0.333 \cdot 0.05 \cdot 0.75 = 0.0124875 \, \text{(1.24875% from debt)}[/latex]

[latex]0.133 \cdot 0.08 = 0.01064 \, \text{(1.064% from preferred stock)}[/latex]

5. Sum the Components:

[latex]\text{WACC} = 0.06396 + 0.0124875 + 0.01064 = 0.0870875 \, \text{or} \, 8.71\%[/latex]

Conclusion: The firm’s WACC is 8.71%.

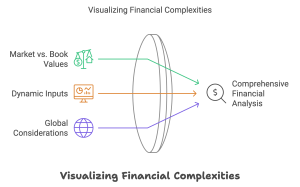

10.3.2 Weighted Average Cost of Capital in Practice

While the WACC formula is straightforward, its application requires real-world adjustments to ensure accuracy:

1. Market vs. Book Values:

WACC calculations should use the current market values of equity, debt, and preferred stock, as these better reflect investor expectations and the firm’s financial position. Using outdated book values can misrepresent the actual cost of capital.

2. Dynamic Inputs:

-

- The cost of equity can fluctuate with market volatility, influenced by changes in risk perception and macroeconomic factors.

- The cost of debt may shift based on refinancing, interest rate trends, or credit rating changes.

These factors mean that WACC is not a static figure but a dynamic metric requiring regular updates.

3. Global Adjustments:

For multinational companies, country-specific risks such as currency fluctuations, inflation, and political instability must be accounted for. This may require adjusting WACC to reflect the unique challenges of operating in different regions.

10.3.3 Methods in Practice

1. Net Debt

Net debt adjusts the total debt by subtracting cash reserves, reflecting a firm’s true leverage. This is often used when calculating WACC for firms with significant cash holdings.

[latex]\text{Net Debt} = \text{Total Debt} - \text{Cash Reserves}[/latex]

Example: A company with $1 billion in total debt and $200 million in cash has a net debt of:

[latex]1,000 - 200 = 800 \, \text{million}[/latex]

2. The Risk-Free Interest Rate

The risk-free rate ( r_f ) serves as the foundation for the cost of equity calculation in the CAPM model. U.S. Treasury bonds are commonly used as proxies due to their minimal default risk.

Example: If the 10-year Treasury yield is 3%, this becomes the baseline for the CAPM formula.

3. The Market Risk Premium

The market risk premium ( r_m - r_f ) measures the excess return investors demand for taking on equity risk. Historical averages often range between 4-6%, but this varies based on market conditions.

Example: If the expected market return ( r_m ) is 8% and the risk-free rate ( r_f ) is 3%, the market risk premium is:

[latex]r_m - r_f = 8\% - 3\% = 5\%[/latex]

10.3.4 Summary of Practical Application

An accurate WACC provides a reliable benchmark for evaluating projects and allocating capital. However, to ensure precision, firms must:

-

- Use market-based inputs to reflect current conditions.

- Adjust for unique project or regional risks.

- Regularly revisit and update WACC as external factors shift.

By incorporating these considerations, companies can align their financial strategies with shareholder expectations and make informed investment decisions.

10.4 Using the WACC to Value a Project

The Weighted Average Cost of Capital (WACC) is not just a theoretical metric; it is a practical tool for valuing projects and making informed investment decisions. This section explores the assumptions underlying WACC, demonstrates its application in evaluating a project, and summarizes its usefulness as a valuation method.

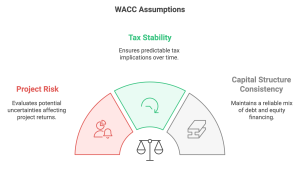

10.4.1 Key Assumptions

When using WACC to value a project, several critical assumptions must be met to ensure accurate and reliable results:

When using WACC to value a project, several critical assumptions must be met to ensure accurate and reliable results:

1. Project Risk Matches Firm Risk:

WACC assumes that the risk profile of the project is similar to the overall risk of the firm. If the project has a significantly higher or lower risk, adjustments to WACC are necessary.

2. Capital Structure Remains Stable:

The calculation presumes that the firm’s capital mix (proportions of debt, equity, and preferred stock) remains constant throughout the project’s life.

3. Tax Rate Stability:

WACC incorporates the tax benefits of debt financing, assuming that the corporate tax rate remains stable over the project duration.

4. Cash Flows After Taxes:

Since WACC accounts for after-tax costs of financing, project cash flows must also be evaluated on an after-tax basis to ensure consistency.

10.4.2 WACC Method Application: Extending the Life of a CleanTech Facility

To use WACC for project valuation, firms discount future project cash flows back to their present value using WACC as the discount rate. This allows firms to calculate the Net Present Value (NPV) of the project, which indicates whether the project is expected to create value.

Examples: CleanTech investment decision

Imagine CleanTech Manufacturing, a company specializing in renewable energy products, evaluating whether to invest $10 million to extend the life of its production facility by 5 years. The company’s WACC is 8%, and the project is expected to generate annual after-tax cash flows of $2.5 million for 5 years.

Step 1: Determine the Present Value of Future Cash Flows

The present value ( PV ) of cash flows is calculated using the WACC as the discount rate:

$$PV = \sum_{t=1}^{n} \frac{\text{Cash Flow}_t}{(1 + \text{WACC})^t}$$

For n = 5 years and annual cash flows of \$2.5 \, \text{million} :

$$PV = \frac{2.5}{(1 + 0.08)^1} + \frac{2.5}{(1 + 0.08)^2} + \frac{2.5}{(1 + 0.08)^3} + \frac{2.5}{(1 + 0.08)^4} + \frac{2.5}{(1 + 0.08)^5}$$

Breaking this down:

$$PV = \frac{2.5}{1.08} + \frac{2.5}{1.1664} + \frac{2.5}{1.2597} + \frac{2.5}{1.3605} + \frac{2.5}{1.4693}$$

Calculating each term:

$$PV = 2.3148 + 2.1445 + 1.9832 + 1.8367 + 1.7014 = 9.98 \, \text{million}$$

Step 2: Subtract Initial Investment

The Net Present Value (NPV) is the difference between the present value of cash flows and the initial investment:

[latex]NPV = PV - \text{Initial Investment} = 9.98 - 10 = -0.02 \, \text{million}[/latex]

Step 3: Decision

Since the NPV is slightly negative ( -0.02 \, \text{million} ), the project does not meet the company’s required return of 8%, suggesting CleanTech should not proceed with the investment under these assumptions.

10.4.3 Limitations of Using WACC

While WACC is an effective decision-making tool, it has limitations:

1. Risk Profile Misalignment:

Projects with different risk profiles from the overall firm may require a risk-adjusted WACC to reflect their unique challenges.

2. Dynamic Market Conditions:

Market conditions influencing WACC inputs (like interest rates or equity risk premiums) may shift during the life of the project, impacting the valuation.

3. Complex Capital Structures:

Firms with complex or changing financing arrangements may find it challenging to maintain a stable WACC.

10.4.4 Summary of WACC as a Valuation Tool

Despite its limitations, WACC remains a cornerstone of investment evaluation. It provides a clear framework for determining whether a project meets the required return threshold, aligning investment decisions with shareholder expectations.

Key Takeaway: Projects that generate returns above WACC create value, while those falling short destroy it. When used thoughtfully, WACC helps firms allocate resources effectively and pursue investments that enhance long-term profitability.

10.5 Project-Based Costs of Capital

While the Weighted Average Cost of Capital (WACC) provides a firm-wide benchmark, not all projects share the same risk profile or financing requirements as the overall firm. In such cases, project-specific costs of capital offer a more accurate approach, tailoring the evaluation to the unique characteristics of the project.

Note to Students: This section delves into some advanced concepts, like beta adjustments and divisional WACC. While it’s excellent knowledge to have, I want you to know that you will be evaluated very lightly on this material. Focus on understanding the general idea of how WACC can be adapted for different situations, and don’t stress over mastering every detail.

10.5.1 Cost of Capital for a New Acquisition

Acquisitions often involve firms operating in industries or markets with distinct risk profiles. Applying the parent company’s WACC may lead to erroneous conclusions, as the acquired firm’s business environment might differ significantly.

Steps to Determine the Cost of Capital for a New Acquisition

1. Identify Comparable Firms (Peers):

Locate firms in the same industry or market as the target, focusing on those with similar risk characteristics.

2. Estimate the Target’s Unlevered Beta (βᵤ):

Use the average beta of comparable firms and adjust for their capital structure to reflect a beta unaffected by leverage.

$$βᵤ = \frac{βₗ}{1 + \frac{D}{E} \times (1 - T)}$$

Where:

-

- βₗ = Levered beta

- D/E = Debt-to-equity ratio of comparable firms

- T = Tax rate

3. Re-Lever the Beta for the Acquisition:

Adjust the unlevered beta to account for the intended capital structure of the acquiring firm.

[latex]βₗ = βᵤ \times \left(1 + \frac{D}{E} \times (1 - T)\right)[/latex]

4. Apply CAPM to Estimate the Cost of Equity (rₑ):

Incorporate the re-levered beta into the Capital Asset Pricing Model (CAPM):

[latex]rₑ = r_f + βₗ \times (rₘ - r_f)[/latex]

Where:

-

- [latex]r_f[/latex] = Risk-free rate

- rₘ - [latex]r_f[/latex] = Market risk premium

5. Combine the Cost of Equity and Cost of Debt to Calculate WACC:

Integrate the project-specific cost of equity and debt into a new WACC formula tailored to the acquisition.

Example: Acquiring a Tech Firm

A manufacturing firm considers acquiring a technology company. The tech industry has higher risk, reflected in an average beta of 1.5, compared to the manufacturing firm’s beta of 0.9. After adjusting for capital structure, the tech firm’s re-levered beta is 1.7.

Using CAPM with a risk-free rate (r_f) of 3% and a market risk premium (rₘ - [latex]r_f[/latex]) of 5%:

[latex]rₑ = 0.03 + 1.7 \times 0.05 = 0.115 \, \text{or} \, 11.5\%[/latex]

The cost of debt is 6%, and the acquisition will be financed with 60% equity and 40% debt. The WACC for the acquisition is:

[latex]\text{WACC} = (0.6 \times 0.115) + (0.4 \times 0.06 \times (1 - 0.25)) = 0.069 + 0.018 = 0.087 \, \text{or} \, 8.7\%[/latex]

10.5.2 Divisional Costs of Capital

Large firms operating in multiple industries or sectors often face varying risk levels across divisions. Assigning a single WACC across all divisions may distort investment decisions, leading to over- or under-allocation of capital. Divisional WACCs provide a more precise measure by tailoring costs of capital to each division’s risk profile.

Steps to Determine Divisional WACC

1. Classify Divisions by Industry:

Group divisions based on their industry, geography, or market focus.

2. Assign Industry Betas:

Use the average beta for each industry as a proxy for divisional risk.

3. Estimate Divisional WACCs:

Combine each division’s cost of equity and debt, weighted by their respective proportions, using the standard WACC formula.

Example: Multidivisional Firm

A conglomerate operates in two sectors: healthcare and consumer goods.

- Healthcare has a beta of 1.3, with a debt-to-equity ratio of 0.4. Using CAPM ([latex]r_f[/latex] = 4\%, rₘ - [latex]r_f[/latex] = 6\%):

[latex]rₑ = 0.04 + 1.3 \times 0.06 = 0.118 \, \text{or} \, 11.8\%[/latex]

- Consumer goods has a beta of 0.9:

[latex]rₑ = 0.04 + 0.9 \times 0.06 = 0.094 \, \text{or} \, 9.4\%[/latex]

Calculating divisional WACCs:

1. Healthcare Division:

[latex]\text{WACC} = (0.714 \times 0.118) + (0.286 \times 0.05 \times (1 - 0.3)) = 0.0844 + 0.010 \, = 0.0944 \, \text{or} \, 9.44\%[/latex]

2. Consumer Goods Division:

[latex]\text{WACC} = (0.8 \times 0.094) + (0.2 \times 0.05 \times (1 - 0.3)) = 0.0752 + 0.007 = 0.0822 \, \text{or} \, 8.22\%[/latex]

10.5.3 Summary of Project-Based Costs of Capital

Project-based costs of capital refine investment evaluations by accounting for the unique risks and financing structures of acquisitions or divisions. By calculating specific WACCs for different projects or units, firms ensure more accurate and equitable resource allocation.

Key Takeaways

- Customizing WACC: Project-specific costs of capital provide a more accurate evaluation for projects or acquisitions with unique risk profiles, ensuring better decision-making.

- Adjusting for Risk: Acquisitions in different industries require tailored WACC calculations using industry-specific betas and capital structures.

- Divisional Analysis: Divisional WACCs account for varying risk levels across a firm’s business units, avoiding misallocation of capital.

- Using Comparable Firms: Leveraging data from similar companies or industries helps refine the beta and cost of equity for project-based calculations.

- Dynamic Inputs: Factors such as industry risk, leverage, and market conditions influence project-based WACC, making regular updates essential.

- Improved Accuracy: Tailored WACCs ensure investments align with the specific risk-return expectations of shareholders and stakeholders.

Exercises

Conceptual Questions

-

- Explain the role of WACC in investment decision-making. Why is it important to use a firm’s WACC as the discount rate when evaluating new projects?

- Why does the after-tax cost of debt differ from the pre-tax cost of debt? Provide an example.

- What is the primary benefit of using the weighted average in WACC calculations?

- Explain the significance of beta in determining the cost of equity using the CAPM.

- How do project-specific costs of capital improve decision-making in acquisitions? Provide an example.

Short Calculations

1. WACC Calculation:

A firm has the following capital structure:

-

- Equity: $400 million with a cost of equity of 10%

- Debt: $600 million with a pre-tax cost of debt of 6%

- Tax rate: 30%

Calculate the WACC.

2. Cost of Debt:

A company issues bonds with a coupon rate of 7%, and the tax rate is 25%. What is the after-tax cost of debt?

3. Cost of Equity (CAPM):

Given:

-

- Risk-free rate: 3%

- Beta: 1.2

- Market risk premium: 5%

Use the CAPM formula to calculate the cost of equity.

4. Preferred Stock Cost:

A firm’s preferred stock pays an annual dividend of $6, and the market price of the stock is $60. Calculate the cost of preferred stock.

Scenario-Based Problems

1. WACC and Investment Decision:

A firm is considering a $5 million project expected to generate $1.2 million in annual after-tax cash flows for five years. The firm’s WACC is 9%.

-

- Calculate the Net Present Value (NPV) of the project.

- Should the firm undertake the project?

2. Project-Specific Cost of Capital:

A manufacturing company is acquiring a tech firm. The target firm’s re-levered beta is 1.4, and the market risk premium is 6%. The risk-free rate is 3%. The acquisition will use 50% debt with a cost of 5% and 50% equity.

-

- Calculate the project-specific WACC for the acquisition.

3. Divisional WACC:

A conglomerate has two divisions:

-

- Division A (Healthcare): Beta = 1.1, Debt-to-Equity Ratio = 0.4, Tax Rate = 30%

- Division B (Consumer Goods): Beta = 0.9, Debt-to-Equity Ratio = 0.6, Tax Rate = 30%

Using a market risk premium of 5% and a risk-free rate of 4%, calculate the divisional WACC for both divisions.

Interactive Challenge

1. Calculate the WACC for a firm with the following details:

-

- Equity: $800 million with a cost of equity of 11%

- Debt: $500 million with a pre-tax cost of debt of 5%

- Tax rate: 25%

2. Evaluate an acquisition with a project-specific beta of 1.5, a market risk premium of 6%, and a risk-free rate of 4%. The acquisition will use 60% equity and 40% debt, with the debt cost at 5% and a tax rate of 30%. Calculate the WACC.

3. Using the CAPM, determine whether a stock with a beta of 1.3, an expected return of 12%, a risk-free rate of 3%, and a market risk premium of 5% is overvalued or undervalued.