4 Chapter 4 – Interest Rate

Learning Objectives

- Identify the roles of financial managers and competitive markets in decision-making.

- Understand the Valuation Principle and how it can be used to identify decisions that increase the value of the firm.

- Assess the effect of interest rates on today’s value of future cash flows.

- Calculate the value of distant cash flows in the present and of current cash flows in the future.

4.1 Interest Rate Quotes and Adjustments

4.1.1 Introduction to Interest Rates

Definition and Importance

Interest rates represent the cost of borrowing money or the return on invested capital. This cost or return is often expressed as a percentage of the principal amount on an annual basis. Interest rates are central to financial decision-making, influencing everything from personal loans and savings accounts to corporate investments and government bonds. By understanding interest rates, borrowers and investors can make informed choices about loans, investments, and savings.

Fundamental Concepts:

-

- Principal: The original amount of money borrowed or invested.

- Compounding: The process by which interest is calculated on both the initial principal and the accumulated interest from previous periods.

- Time Value of Money (TVM): The foundational idea that a dollar today is worth more than a dollar in the future due to its earning potential.

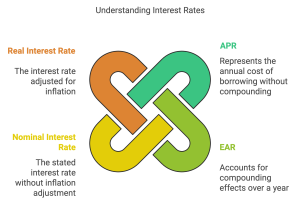

4.1.2 Key Types of Interest Rates

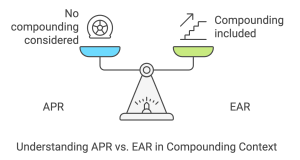

Annual Percentage Rate (APR):

-

- Definition: APR is the nominal or stated interest rate expressed on an annual basis, commonly used for loans and credit products. APR does not account for the effects of compounding within the year.

- Application: APR is useful for comparing credit products that compound interest at the same frequency, such as monthly or quarterly.

- Example: Suppose you take a loan with a 12% APR compounded monthly. This means each month, interest is calculated at 1% (12% ÷ 12 months).

- Limitations: Since APR does not factor in the effects of compounding, it can understate the true cost of a loan if compounding occurs more than once per year.

Effective Annual Rate (EAR):

-

- Definition: EAR, also called the annual equivalent rate, incorporates the effects of compounding within the year, giving a more accurate representation of the true annual interest rate.

- Formula:

[latex]\text{EAR} = \left(1 + \frac{\text{APR}}{n}\right)^n - 1[/latex]

where n is the number of compounding periods per year.

-

- Example Calculation: For a 12% APR loan compounded monthly, the EAR calculation would be:

[latex]\text{EAR} = \left(1 + \frac{0.12}{12}\right)^{12} - 1 \approx 0.1268 \text{ or 12.68%}[/latex]

-

- Practical Meaning: The EAR of 12.68% represents the actual annual cost of the loan when compounding is considered. This value is higher than the APR due to monthly compounding.

4.1.3 Adjusting Discount Rates for Different Time Periods

Importance of Adjusting Rates:

Financial scenarios often require calculations over different time periods, making it necessary to adjust interest rates for accurate present or future value calculations. Converting rates helps maintain consistency across different compounding frequencies.

Adjusting to Different Compounding Periods:

-

- Monthly Rate: Divide the APR by 12 for monthly compounding.

- Quarterly Rate: Divide the APR by 4 for quarterly compounding.

- Example Calculation: For a 12% APR compounded monthly, the monthly rate would be:

[latex]\text{Monthly Rate} = \frac{12\%}{12} = 1\%[/latex]

Converting APR to Match Different Time Periods:

-

- Converting Annual Rate to Semi-Annual: Suppose we have a 6% APR with semi-annual compounding. To calculate the effective rate for a 6-month period:

[latex]\text{Semi-Annual Rate} = \left(1 + \frac{0.06}{2}\right)^2 - 1[/latex]

-

- Practical Tip: Adjusting rates ensures that cash flows are accurately compared, regardless of compounding frequency.

Case Study: Comparing Loan Offers with Different Compounding Frequencies

Scenario: Consider two loan options offered by different banks for financing a $10,000 car loan. Each loan has a different compounding frequency, and the goal is to determine which loan is more cost-effective in terms of actual interest paid.

Loan Options:

-

- Loan A: 12% APR compounded monthly.

- Loan B: 11.5% APR compounded quarterly.

Objective: Use the EAR to compare these options and identify the more affordable loan.

Solution:

-

- Step 1: Calculate the EAR for Loan A (compounded monthly)

[latex]\text{EAR}_{A} = \left(1 + \frac{0.12}{12}\right)^{12} - 1 \approx 12.68\%[/latex]

-

- Step 2: Calculate the EAR for Loan B (compounded quarterly)

[latex]\text{EAR}_{B} = \left(1 + \frac{0.115}{4}\right)^4 - 1 \approx 11.93\%[/latex]

-

- Step 3: Compare the EARs:

Loan A has an effective annual rate of 12.68%, while Loan B has an EAR of 11.93%. Therefore, Loan B is the more affordable option.

Conclusion: Even though Loan B has a slightly lower APR, the compounding frequency plays a crucial role. By calculating the EAR, we see that Loan B offers the better rate, leading to lower overall costs over the life of the loan.

Extended Case Study: Choosing an Investment Based on Compounding Impact

Scenario: Imagine you have $5,000 to invest and are comparing two bank accounts:

-

- Investment Account 1: Offers a 6% APR, compounded monthly.

- Investment Account 2: Offers a 5.85% APR, compounded daily.

Objective: Determine which account will yield a higher balance after one year.

Solution:

-

- Step 1: Calculate EAR for Investment Account 1 (compounded monthly)

[latex]\text{EAR}_{1} = \left(1 + \frac{0.06}{12}\right)^{12} - 1 \approx 6.17\%[/latex]

-

- Step 2: Calculate EAR for Investment Account 2 (compounded daily)

[latex]\text{EAR}_{2} = \left(1 + \frac{0.0585}{365}\right)^{365} - 1 \approx 6.02\%[/latex]

-

- Step 3: Compare Investment Growth:

•Using the EARs, we can calculate the future value of each investment after one year.

-

- Investment 1 Future Value:

[latex]\text{FV}_{1} = 5000 \times (1 + 0.0617) \approx 5308.50[/latex]

-

- Investment 2 Future Value:

[latex]\text{FV}_{2} = 5000 \times (1 + 0.0602) \approx 5301.00[/latex]

Conclusion:

Investment Account 1 yields a higher balance of $5,308.50, compared to $5,301.00 in Account 2. Despite the slightly lower APR, the monthly compounding frequency makes Investment Account 1 more profitable.

4.1.4 Practical Applications and Key Takeaways

Using APR and EAR:

-

- APR is useful for straightforward comparisons when compounding frequencies are the same but does not account for the effects of compounding.

- EAR provides a more accurate representation of the true annual cost or yield and is essential when compounding frequencies differ.

Compounding Frequency Matters:

-

- The frequency of compounding significantly impacts the actual return on investments or the cost of loans over time.

- Higher compounding frequencies result in a higher EAR for the same APR, emphasizing the importance of understanding how compounding affects financial outcomes.

Final Reminder on Calculations:

-

- Always adjust APR for the correct compounding period when calculating future or present values to ensure consistency in financial analysis.

- Use EAR to accurately compare loans or investments with different compounding intervals, as it accounts for the true cost or return over time.

4.2 Application - Discount Rates and Loans

4.2.1 Introduction to Loan Calculations

Loans are a critical component of personal and business finance, and understanding their structure helps borrowers make better financial decisions. Loan payments often involve both the repayment of principal (the amount borrowed) and interest (the cost of borrowing). The process of gradually repaying a loan over time through fixed payments is known as amortization.

Key Concepts:

-

- Principal: The original amount borrowed.

- Interest: The cost of borrowing, calculated as a percentage of the outstanding balance.

- Amortization: The process of systematically reducing a loan balance over time through fixed payments.

4.2.2 Computing Loan Payments

Fixed-payment loans, such as mortgages or car loans, divide each payment into two parts: interest and principal repayment. As the loan progresses, the portion allocated to interest decreases, and the portion allocated to the principal increases.

Loan Payment Formula (for Fixed-Rate Loans):

The formula to calculate the monthly loan payment for a fixed-rate loan is:

$$\text{PMT} = \frac{P \times r}{1 - (1 + r)^{-n}}$$

Where:

-

- PMT = Monthly payment

- P = Principal (initial loan amount)

- r = Monthly interest rate (annual rate divided by 12)

- n = Total number of payments (loan term in years multiplied by 12)

Example 1: Calculating Monthly Payments for a Car Loan

Scenario: Sarah is taking out a $20,000 car loan with a 5% annual interest rate, to be repaid over 5 years with monthly payments.

Step 1: Identify the variables:

-

- Principal (P) = $20,000

- Annual interest rate = 5%, so monthly rate (r) = 5% / 12 = 0.004167

- Loan term (n) = 5 years × 12 months = 60 months

Step 2: Plug the values into the formula:

$$\text{PMT} = \frac{20000 \times 0.004167}{1 - (1 + 0.004167)^{-60}}$$

Step 3: Calculate the result:

-

- Numerator: [latex]20000 \times 0.004167 = 83.34[/latex]

- Denominator: [latex]1 - (1 + 0.004167)^{-60} = 1 - (1.004167)^{-60} = 1 - 0.7796 = 0.2204[/latex]

- PMT Calculation: [latex]83.34 / 0.2204 \approx 378.76[/latex]

Result: Sarah’s monthly car payment would be approximately $378.76.

Example 2: Mortgage Payment Calculation

Scenario: John is buying a home with a $300,000 mortgage at a 3.5% annual interest rate for a term of 30 years.

Step 1: Identify the variables:

-

- Principal (P) = $300,000

- Monthly interest rate [latex](r) = 3.5% / 12 = 0.002917[/latex]

- Loan term (n) = 30 years × 12 months = 360 months

Step 2: Plug the values into the formula:

$$\text{PMT} = \frac{300000 \times 0.002917}{1 - (1 + 0.002917)^{-360}}$$

Step 3: Calculate the result:

-

- Numerator: [latex]300000 \times 0.002917 = 875.10[/latex]

- Denominator: [latex]1 - (1 + 0.002917)^{-360} = 1 - (1.002917)^{-360} = 1 - 0.3893 = 0.6107[/latex]

- PMT Calculation: [latex]875.10 / 0.6107 \approx 1433.39[/latex]

Result: John’s monthly mortgage payment would be approximately $1,433.39.

4.2.3 Computing the Outstanding Loan Balance

The outstanding loan balance is the amount still owed at any point during the loan term. As monthly payments are made, the principal balance decreases, and each payment reduces the outstanding balance by a larger amount over time.

To calculate the outstanding balance after a certain number of payments, we can use a variation of the loan payment formula, focusing on the remaining payments.

Outstanding Balance Formula:

$$\text{Balance} = P \times \left( \frac{(1 + r)^n - (1 + r)^p}{(1 + r)^n - 1} \right)$$

Where:

-

- Balance = Outstanding loan balance after p payments

- P = Principal (initial loan amount)

- r = Monthly interest rate

- n = Total number of payments

- p = Number of payments made so far

Example: Calculating Outstanding Balance for a Mortgage

Scenario: John from the previous example wants to know the remaining balance on his mortgage after making 120 payments (10 years into his 30-year loan).

Step 1: Identify the variables:

-

- Principal (P) = $300,000

- Monthly interest rate (r) = 0.002917

- Total number of payments (n) = 360

- Payments made so far (p) = 120

Step 2: Plug the values into the formula:

$$\text{Balance} = 300000 \times \left( \frac{(1 + 0.002917)^{360} - (1 + 0.002917)^{120}}{(1 + 0.002917)^{360} - 1} \right)$$

Step 3: Calculate the result:

-

- Calculate [latex](1 + 0.002917)^{360} \approx 2.8533[/latex]

- Calculate [latex](1 + 0.002917)^{120} \approx 1.4233[/latex]

- Numerator: 2.8533 - 1.4233 = 1.4300

- Denominator: 2.8533 - 1 = 1.8533

- Balance Calculation: [latex]300000 \times (1.4300 / 1.8533) \approx 231,438[/latex]

Result: After 10 years, John’s remaining mortgage balance is approximately $231,438.

Extended Case Study: Comparing Loan Options and Analyzing Balance Progress

Maria is considering buying a new car and needs to finance part of the purchase. She has two loan options available from different lenders:

-

- Loan Option 1: 3-year loan with an APR of 4.5%, compounded monthly.

- Loan Option 2: 5-year loan with an APR of 5%, compounded monthly.

Loan Amount: $25,000 (for both options).

Maria wants to know:

-

- The monthly payment for each loan.

- The total cost of each loan over its full term.

- How the outstanding balance progresses over time, especially in the first few years.

Step 1: Calculating Monthly Payments for Each Loan

Using the annuity payment formula:

$$\text{PMT} = \frac{P \cdot r}{1 - (1 + r)^{-n}}$$

where:

-

- P = $25,000

- r = monthly interest rate (APR divided by 12)

- n = total number of payments.

For Loan Option 1 (3 years, 4.5% APR):

-

- Monthly Interest Rate: $$r = \frac{0.045}{12} = 0.00375$$

- Total Payments: $$n = 3 \times 12 = 36$$

- Payment calculation:

$$\text{PMT} = \frac{25000 \times 0.00375}{1 - (1 + 0.00375)^{-36}} \approx 743.64$$

Monthly Payment: $743.64

-

- Total Cost of Loan Option 1: [latex]743.64 \times 36 = 26,371.04[/latex]

For Loan Option 2 (5 years, 5% APR):

-

- Monthly Interest Rate: $$r = \frac{0.05}{12} = 0.004167$$

- Total Payments: $$n = 5 \times 12 = 60$$

- Payment calculation:

$$\text{PMT} = \frac{25000 \times 0.004167}{1 - (1 + 0.004167)^{-60}} \approx 471.78$$

Monthly Payment: $471.78

-

- Total Cost of Loan Option 2: 471.78 \times 60 = 28,306.80

Step 2: Comparing Loan Options

Summary of Loan Costs:

-

- Loan Option 1 (3 years at 4.5% APR): Total cost = $26,371.04

- Loan Option 2 (5 years at 5% APR): Total cost = $28,306.80

Although Loan Option 1 has a higher monthly payment, it costs Maria less overall than Loan Option 2 due to the shorter term and lower interest rate.

Step 3: Analyzing Balance Progression

Next, let’s examine how the outstanding balance changes over time for each loan. This will help Maria understand how quickly she’ll be paying down the principal and how much interest she’ll pay in the earlier years of the loan.

Loan Amortization for Loan Option 1 (3-Year Term)

For a 3-year term, we’ll look at the outstanding balance at the end of each year.

Amortization Table Snapshot for Loan Option 1:

Payment 1

-

- Total Payment: $743.64

- Interest Paid: $93.75

- Principal Paid: $649.89

- Outstanding Balance: $24,350.11

Payment 12

-

- Total Payment: $743.64

- Interest Paid: $58.22

- Principal Paid: $685.42

- Outstanding Balance: $16,415.13

Payment 24

-

- Total Payment: $743.64

- Interest Paid: $36.54

- Principal Paid: $707.10

- Outstanding Balance: $8,173.20

Payment 36

-

- Total Payment: $743.64

- Interest Paid: $2.80

- Principal Paid: $740.84

- Outstanding Balance: $0.00

Loan Amortization for Loan Option 2 (5-Year Term)

Now let’s examine the 5-year term, focusing on how the balance changes in this longer loan period.

Amortization Table Snapshot for Loan Option 2:

Payment 1

-

- Total Payment: $471.78

- Interest Paid: $104.17

- Principal Paid: $367.61

- Outstanding Balance: $24,632.39

Payment 12

-

- Total Payment: $471.78

- Interest Paid: $86.77

- Principal Paid: $385.01

- Outstanding Balance: $20,466.36

Payment 24

-

- Total Payment: $471.78

- Interest Paid: $67.68

- Principal Paid: $404.10

- Outstanding Balance: $15,737.78

Payment 36

-

- Total Payment: $471.78

- Interest Paid: $46.49

- Principal Paid: $425.29

- Outstanding Balance: $10,345.82

Payment 48

-

- Total Payment: $471.78

- Interest Paid: $22.85

- Principal Paid: $448.93

- Outstanding Balance: $4,380.94

Payment 60

-

- Total Payment: $471.78

- Interest Paid: $1.96

- Principal Paid: $469.82

- Outstanding Balance: $0.00

Analysis and Insights

1. Interest Costs Over Time:

-

- In both options, a higher portion of each monthly payment goes toward interest at the beginning of the loan term. As the principal balance decreases, the interest portion of each payment reduces, and more goes toward paying down the principal.

- In Loan Option 2, with a longer term, the initial payments contribute less to the principal than in Loan Option 1, resulting in a slower payoff of the outstanding balance.

2. Impact of Loan Term on Balance Progression:

-

- With Loan Option 1, the balance decreases more rapidly because the payments are higher, covering more of the principal earlier.

- In Loan Option 2, the smaller monthly payments extend the time needed to reduce the outstanding balance, leading to a higher total cost over the loan’s duration.

3. Key Considerations:

-

- Financial Flexibility: Loan Option 2 offers lower monthly payments, which may be easier for Maria’s monthly budget.

- Cost Efficiency: Loan Option 1 is more cost-effective in the long run, saving her nearly $2,000 in interest payments.

Conclusion: Choosing the Best Loan Option

From the analysis, Maria can see the trade-off between monthly payment size and overall cost:

-

- If she can afford the higher monthly payment, Loan Option 1 provides a faster payoff and lower total cost.

- If her budget requires lower monthly payments, Loan Option 2 is more manageable but ultimately more expensive.

4.3: The Determinants of Interest Rates

Interest rates are influenced by various economic factors, including inflation, monetary policy, market conditions, and risk perceptions. Understanding these determinants is crucial for borrowers, investors, and businesses to make informed decisions about loans, savings, and investments.

4.3.1 Inflation and Real Versus Nominal Rates

Inflation Overview:

-

- Inflation measures the general increase in prices over time, eroding the purchasing power of money.

- Lenders require compensation for inflation, which is reflected in higher nominal interest rates.

Nominal vs. Real Interest Rates:

-

- Nominal Interest Rate: The stated rate, including inflation expectations.

- Real Interest Rate: The rate adjusted for inflation, reflecting true purchasing power.

- Formula:

[latex]\text{Real Interest Rate} = \frac{1 + \text{Nominal Rate}}{1 + \text{Inflation Rate}} - 1[/latex]

Approximation for modest inflation:

[latex]\text{Real Rate} \approx \text{Nominal Rate} - \text{Inflation Rate}[/latex]

Example: Calculating Real Rates in the Context of Inflation

Imagine you have invested in a savings account with a nominal interest rate of 6% in an economy with an inflation rate of 2%. To determine the true value of your return, calculate the real interest rate:

Using the approximation:

[latex]\text{Real Interest Rate} = 6\% - 2\% = 4\%[/latex]

Thus, your purchasing power increases by approximately 4% after adjusting for inflation.

Real-World Context:

-

- High Inflation Periods:

During the 1970s in the United States, inflation was exceptionally high. While nominal interest rates also rose significantly, the real interest rates were often negative. This means the value of savings eroded over time, even though the nominal returns appeared high.

-

- Low Inflation Periods:

Following the 2008 financial crisis, inflation remained low in many developed economies. Central banks reduced nominal interest rates to near zero to encourage borrowing and spending. As a result, real interest rates stayed low but positive, promoting economic recovery while preserving some purchasing power for savers.

This interplay between nominal rates, inflation, and real rates underscores the importance of considering inflation when evaluating investment returns or borrowing costs.

4.3.2 Investment and Interest Rate Policy

Concept Overview:

Interest rates are a powerful tool in influencing economic activity. For businesses and individuals, they dictate borrowing costs and potential returns on investments. Central banks, such as the U.S. Federal Reserve, adjust interest rates as part of their monetary policy to regulate inflation, promote economic growth, or cool down overheated markets.

Role of Central Banks:

-

- Central banks like the Federal Reserve adjust interest rates through monetary policy to influence economic activity.

- Lower rates stimulate borrowing and spending; higher rates control inflation by slowing economic growth.

Example: The Federal Reserve’s Response to Economic Downturns

After the 2008 financial crisis, the Federal Reserve reduced interest rates to near zero to encourage borrowing and investment, aiding economic recovery.

Real-World Impact:

-

- Low-Rate Environment: A mortgage at 3% makes home-buying more accessible, stimulating the housing market.

- High-Rate Environment: A 7% mortgage rate increases monthly costs, reducing affordability and slowing housing demand.

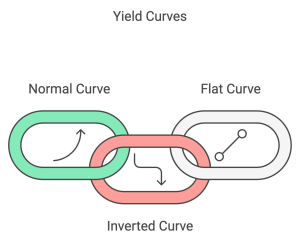

4.3.3 The Yield Curve and Discount Rates

Concept Overview:

-

- The yield curve plots interest rates for bonds of varying maturities.

- A “normal” yield curve slopes upward, with long-term rates higher than short-term rates.

Types of Yield Curves:

-

- Normal Yield Curve: Long-term rates are higher than short-term rates, signaling economic growth expectations.

- Inverted Yield Curve: Short-term rates are higher than long-term rates, often a signal of an upcoming recession.

- Flat Yield Curve: Short- and long-term rates are similar, often indicating uncertainty in economic conditions.

Real-World Example: Interpreting an Inverted Yield Curve

An inverted yield curve has historically been a reliable predictor of recession. For example, in 2006, the U.S. yield curve inverted, and by late 2007, the economy entered the Great Recession. Financial institutions and investors watch yield curves closely as signals for economic forecasting.

Case Study: Mortgage Rates and Economic Policy

Scenario: Lisa is considering buying a home for $300,000. She observes how changing interest rates affect her decision:

Low-Rate Environment (3%):

[latex]•Monthly Payment: \approx \$1,265[/latex]

-

- More affordable, encouraging Lisa to buy now.

High-Rate Environment (7%):

[latex]•Monthly Payment: \approx \$1,995[/latex]

-

- Higher cost discourages immediate purchase, delaying her plans.

Conclusion:

Interest rate policies directly influence consumer behavior and broader economic activity, impacting decisions on spending, saving, and investment.

4.3.5 Key Takeaways

-

- Inflation and Real Rates: Inflation affects the real return on investments. Nominal rates include inflation expectations, but real rates reflect true purchasing power.

- Interest Rate Policy and Investment: Central banks use interest rate adjustments to influence economic activity, with low rates spurring investment and high rates cooling spending.

- Yield Curve: The shape of the yield curve reflects economic expectations. An inverted yield curve, for example, can signal recession concerns.

4.4 The Opportunity Cost of Capital

4.4.1 Concept Overview:

The opportunity cost of capital refers to the return investors forgo when choosing one investment over another with a similar risk profile. This concept is central to financial decision-making because it helps businesses and individuals assess whether an investment or project offers a return that justifies the resources committed.

Interest rates play a significant role in shaping opportunity costs. They influence borrowing costs and set a benchmark for potential returns on investments. Central banks, such as the U.S. Federal Reserve, adjust interest rates as part of their monetary policy to regulate inflation, promote economic growth, or cool overheated markets. Understanding these dynamics is key to evaluating investment decisions.

While this section provides an introduction to the opportunity cost of capital, a more in-depth exploration of its applications—including capital budgeting, Net Present Value (NPV), and Internal Rate of Return (IRR)—will be covered in later Chapters.

4.4.2 Key Relationships

-

- Defining Opportunity Cost in Finance

Explain the concept of opportunity cost with respect to investment decisions.

Discuss how opportunity cost impacts the decision-making process, especially for businesses considering capital investments.

-

- Opportunity Cost of Capital as a Benchmark Rate

Introduce the idea of using opportunity cost as a benchmark, often referred to as the “hurdle rate” in corporate finance.

Explain that the opportunity cost of capital is used to assess the minimum acceptable return for an investment project.

-

- Examples of Opportunity Cost in Investment Decisions

Provide concrete examples, such as deciding between two investment projects or evaluating whether to reinvest in the business versus paying dividends to shareholders.

Discuss how opportunity cost applies to both individual investors (e.g., choosing between investing in a stock or a high-yield bond) and corporate investors.

-

- Link Between Opportunity Cost and Capital Budgeting

Explain how companies use opportunity cost when performing capital budgeting to determine if a project should be pursued.

Connect this concept to topics like Net Present Value (NPV) and Internal Rate of Return (IRR), which are tools for comparing potential returns of different projects to the opportunity cost of capital.

Example: Choosing Between Two Investment Projects

Imagine a manufacturing company, BrightMakers Inc., considering two major projects:

-

- Project A: Expanding its existing production line to increase output. Expected return is 8%.

- Project B: Investing in a new product line with higher risk but a potential return of 12%.

If BrightMakers Inc. determines that its opportunity cost of capital (based on similar investments in the industry) is 10%, it faces a dilemma. While Project A offers some growth, it does not meet the 10% threshold. Project B, however, exceeds this benchmark. The company would likely favor Project B, as its expected return compensates for the opportunity cost of capital and aligns with its financial goals.

In this example, the 10% opportunity cost of capital reflects BrightMakers’ best alternative for investing resources. If they go with Project A, they forgo the potential returns of similar investments that could yield 10% or more.

Case Study: Corporate Opportunity Cost and Capital Allocation

Consider XYZ Enterprises, a large corporation with extra cash flow for the fiscal year. The board faces several options:

-

- Repurchase Shares: Buying back shares to increase shareholder value.

- Pay Dividends: Distributing extra profits to shareholders.

- Invest in New Ventures: Exploring new business areas that promise higher future returns.

The board evaluates these choices using opportunity cost as a benchmark. By comparing expected returns from reinvestment to potential shareholder returns, they aim to maximize long-term value.

4.4.3 Recap

The opportunity cost of capital serves as a critical benchmark in financial decision-making, guiding both corporate and individual investors toward options that maximize potential returns. While this section introduces key principles, future chapters will dive deeper into its role in capital budgeting and investment analysis.

Key Takeaways

- APR and EAR differ in how they account for compounding; EAR provides a more accurate reflection of true costs or returns.

- Compounding frequency significantly impacts the effective interest rate and total costs or returns.

- Loan payments reduce both interest and principal over time, with balances declining faster in later periods.

- Real interest rates account for inflation, offering insight into true purchasing power.

- Central bank policies shape interest rates, affecting borrowing and investment decisions.

- Opportunity cost of capital serves as a benchmark for evaluating investment decisions, guiding capital allocation.

Exercises

Conceptual Questions

- Compounding Frequency and Interest Rates

Why does the frequency of compounding significantly impact the effective annual rate (EAR)? How does it influence the true cost of borrowing or return on investment?

- Difference Between APR and EAR

Explain the difference between the APR and EAR. Why is EAR considered a better measure for comparing loans or investments with different compounding frequencies?

- Real vs. Nominal Interest Rates

How does inflation influence the difference between nominal and real interest rates? Why is it essential to distinguish between them in financial planning?

- Yield Curve Interpretation

What does an inverted yield curve suggest about the economy? Why is it considered a predictor of recessions?

Short Calculations

-

- Effective Annual Rate (EAR)

A credit card advertises an APR of 18% with monthly compounding. What is the EAR?

-

- Comparing APR and EAR

A car loan has an APR of 9.6% with quarterly compounding. Calculate the EAR.

-

- Real Interest Rate Calculation

If the nominal interest rate is 7% and the inflation rate is 3%, what is the real interest rate? Use the precise formula.

-

- Loan Payment Calculation

You take out a $15,000 loan with a 5% annual interest rate, compounded monthly, to be repaid over 4 years. What is the monthly payment?

Scenario-Based Problems

- Comparing Investment Options

You have $20,000 to invest. Two banks offer the following:

- Bank A: 5% APR with quarterly compounding.

- Bank B: 4.8% APR with monthly compounding.

Which option gives the higher effective annual rate (EAR), and how much will your investment grow after 3 years in each?

- Loan Comparison

You’re financing a $30,000 car purchase. Two lenders offer these terms:

- Lender A: 6% APR, compounded monthly, for 5 years.

- Lender B: 5.8% APR, compounded quarterly, for 5 years.

Determine the monthly payments and the total interest paid under each option. Which loan is more cost-effective?

- Real vs. Nominal Returns

You invest $10,000 in a government bond that yields a nominal annual return of 8%. Inflation averages 3% over the next year. What is the real return on your investment?

Case Study: Understanding the Yield Curve

Scenario:

ABC Corporation is deciding whether to issue 5-year or 10-year bonds to finance a new project. The current yield curve is upward-sloping, with 5-year bonds offering a yield of 4% and 10-year bonds offering 5%.

Tasks:

- Explain what the upward-sloping yield curve suggests about market expectations for the economy.

- Calculate the cost of borrowing $1,000,000 for each option if the company chooses to pay interest annually.

- Discuss how inflation expectations could influence ABC Corporation’s choice between 5-year and 10-year bonds.

Interactive Challenge

Question:

You are saving for a $50,000 down payment on a house in 6 years. You have two investment options:

- Invest $40,000 today in an account earning 6% annual interest.

- Contribute $600 monthly to an account earning 5% annual interest, compounded monthly.

- Calculate the future value of each option.

- Which option helps you meet your goal, and which is more cost-effective?