1.2. Instruments of Green Finance

Green finance instruments are pivotal in channeling capital towards sustainable development and climate goals. These instruments, ranging from green bonds to sustainability-linked loans, provide a mechanism for investors to support environmental projects while potentially securing financial returns. This section explores various green finance instruments, their development, challenges, and prospects.

Green Bonds

Green bonds are among the most prominent green finance instruments. They are designed to raise capital specifically for projects with environmental benefits, such as renewable energy, energy efficiency, sustainable waste management, and biodiversity conservation. The first green bond was issued by the European Investment Bank in 2007, marking a significant milestone in the development of green finance (Flaherty et al., 2017). Green bonds generally follow the Green Bond Principles (GBP), voluntary guidelines that recommend transparency and disclosure and promote integrity in the development of the green bond market. The success of green bonds is evident in their rapid market growth. According to the Climate Bonds Initiative, the total green bond issuance reached a new high in 2020, underscoring their increasing popularity.

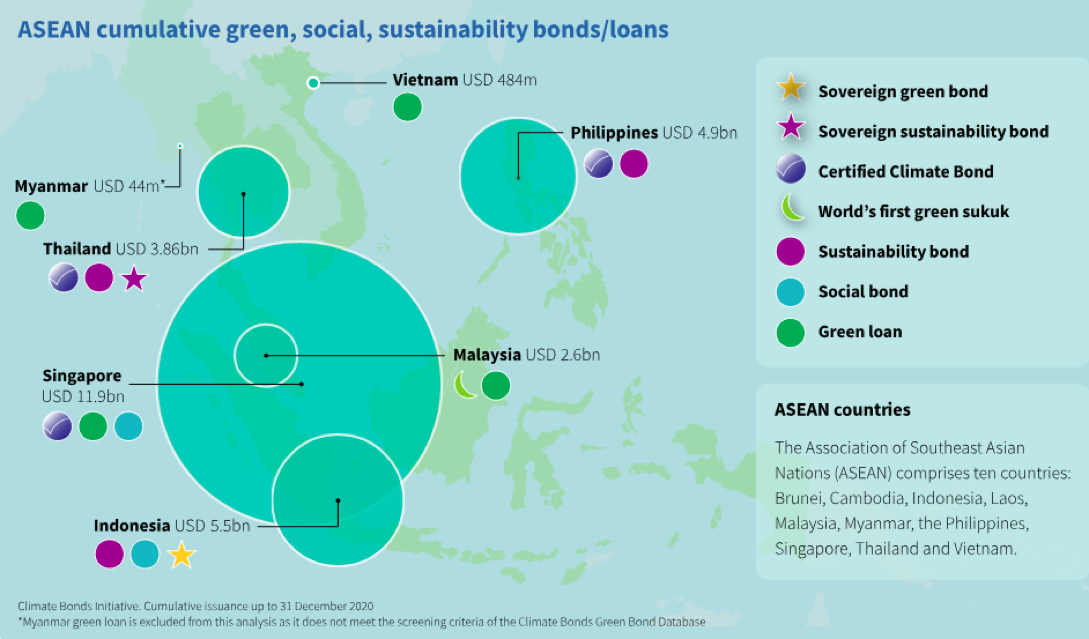

Specifically, according to Green Finance State of the Market, the overall sustainable finance market in ASEAN region performed strongly in 2020 despite COVID-19, with USD 12.1 billion issued versus USD 11.5 billion for 2019. Green, social, and sustainability bonds, which had already acquired some traction before to the pandemic, have now become an essential financial instrument for ASEAN countries. These bonds enable the raising of money to support green and sustainable recoveries, as well as to enhance systemic resilience against future shocks. The subject of green labeling remained the most prevalent, as seen by the increase in regional issuance, which rose from USD 8.8 billion in 2019 to USD 9.3 billion in 2020. Despite a slower pace compared to previous years, this is a promising indication amidst the temporary decline in the worldwide market, demonstrating increased interest from environmentally conscious investors in the area.

However, Vietnam’s green finance market is still quite limited, mainly focusing on green loans. During the period from 2015 to 2022, the outstanding balance of green credit increased (SDLink, 2023). However, the proportion of green credit in the total credit outstanding in the economy remained modest. International capital sources with lower interest rates, prioritized disbursement, and the allure of green credit have become attractive. An increasing number of banks are offering green loan packages. By the end of 2022, the outstanding balance of credit provided for 12 green projects established by the State Bank of Vietnam since 2015 reached nearly 500,000 billion VND (accounting for about 4.2% of the total credit outstanding in the economy).

Sustainability-Linked Bonds

Sustainability-linked bonds (SLBs) are a newer form of green finance instruments. Based on IEEFA’s calculations and Environmental Finance Data, SLBs issuance in Europe decreased in two consecutive years from its peak in 2021, although the level is still materially higher than in 2020 before it skyrocketed. By comparison, green bond issuance in Europe reached a record high in 2023 (IEEFA, 2024). Unlike green bonds, which are earmarked for specific projects, SLBs are general-purpose bonds tied to the issuer’s achievement of specific sustainability targets. The interest rate of the bond is often linked to the issuer’s performance against these targets, creating a direct financial incentive for sustainability performance (Uzsoki, 2020). SLBs represent an innovative approach to aligning corporate financing with broader sustainability goals. They have been hailed for their flexibility and potential to attract a broader range of issuers and investors (Zerbib, 2019).

Green Loans and Sustainability-Linked Loans

Green loans are similar to green bonds but are structured as loan agreements. They are used to finance or refinance projects with clear environmental benefits. Like green bonds, green loans adhere to principles, notably the Green Loan Principles (GLP), which were established to ensure consistency and integrity in the green loan market. Besides, sustainability-linked loans (SLLs) are a variation of green loans. These loans link the terms of the loan, typically the interest rate, to the borrower’s achievement of predetermined sustainability performance targets. This structure encourages borrowers to improve their sustainability practices.

Climate Bonds

Climate bonds are a subset of green bonds specifically focused on projects that address climate change. This includes funding for renewable energy, energy efficiency, sustainable transport, and other projects that reduce greenhouse gas emissions. The Climate Bonds Standard and Certification Scheme, managed by the Climate Bonds Initiative, provides guidelines and certification for bonds that contribute to addressing climate change.

Blue Bonds

Blue bonds are a relatively new type of bond designed to finance sustainable ocean and marine projects. The Seychelles issued the world’s first sovereign blue bond in 2018, which was used to support sustainable marine and fisheries projects. Blue bonds represent a crucial instrument for channeling investment into the sustainable use and conservation of marine resources.

Green Real Estate Investment Trusts (REITs)

Green REITs are a form of real estate investment trust that invests in properties with sustainability credentials, such as energy-efficient buildings or sustainable real estate developments. Green REITs offer investors the opportunity to invest in real estate with environmental benefits.

Green Private Equity

Green private equity involves private equity firms investing in companies that produce environmentally friendly products or services. These investments are often in the form of venture capital for startups or growth capital for more established companies focusing on green technologies or practices.