4.1. Green Finance Education Needs and Demand of Students

4.1.1. General Awareness and Understanding of Green Finance

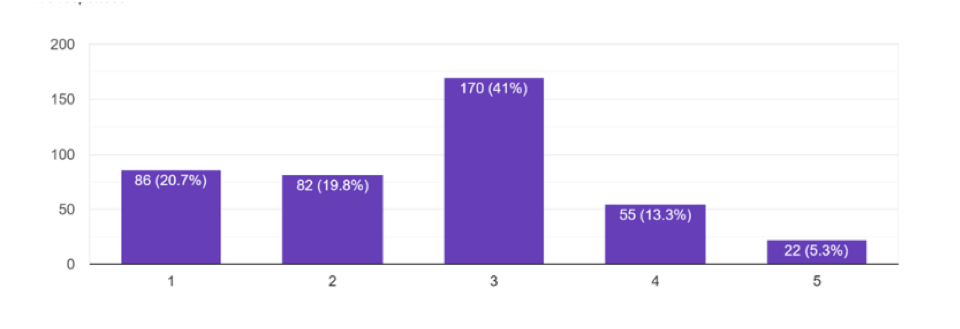

The varied levels of awareness about green finance among university students in Vietnam are indicative of the nascent stage of green finance education in the country. A significant 20.7% of students have never heard of green finance, suggesting a considerable gap in basic financial education. This gap is crucial because awareness is the first step towards understanding and adoption. On the other hand, 5.3% of students who have a clear understanding represent a small but potentially influential group that could spearhead green finance initiatives and influence their peers. The middle ground, where 41% of students have a neutral understanding, is particularly interesting (Figure 2). This group represents a significant potential for educational programs to make a meaningful impact. Their basic awareness is a foundation that can be built upon through targeted educational interventions. However, this also suggests that current exposure to green finance, perhaps through general media or peripheral mentions in coursework, is insufficient for a comprehensive understanding.

The survey results regarding specific green finance instruments paint a picture of selective familiarity among students. For instance, green private equity is somewhat better understood, which might be due to its more frequent inclusion in mainstream financial discussions or its more direct link to visible projects and companies. However, other instruments like green bonds (20.98% votes), green loans (13.54% votes), and carbon credits (17.55% votes) are less known. This variation in familiarity is a significant concern as it points to a lack of comprehensive exposure to the range of instruments available within green finance. This gap in knowledge can limit students’ ability to engage with the green finance sector effectively post-graduation. It also suggests that current academic programs may be inadequately equipped to provide students with a holistic understanding of green finance, thereby limiting their future career opportunities in this burgeoning field.

The primary sources through which students gain knowledge about green finance are indicative of the current state of green finance education. University courses (93 votes) are a primary source, but a substantial reliance on online resources (79 votes) and self-study (74 votes) suggests that the formal education system may not be fully meeting students’ learning needs in this area. This reliance on self-study and online resources indicates a proactive interest among students but also highlights a gap in the formal curriculum. The limited impact of extracurricular activities, such as clubs and seminars, in providing knowledge about green finance is also notable. These activities can be instrumental in offering practical insights and real-world applications of green finance principles, which are often hard to convey through traditional classroom teaching. The underutilization of these avenues suggests a potential area for development within universities to enhance students’ practical understanding of green finance.

4.1.2. Perceptions and Misconceptions of Green Finance

The understanding among students of green finance’s role in reducing environmental impacts (242 votes) and promoting sustainable development (306 votes) is a positive sign. However, this understanding appears to be more at a surface level. The depth to which students comprehend how green finance directly contributes to these broader goals is unclear. This superficial understanding might lead to misconceptions about the practicality and effectiveness of green finance solutions. For instance, understanding the role of green finance in sustainable development requires a grasp of how investments can be directed towards environmentally sustainable projects, how these projects contribute to broader sustainable development goals, and the long-term benefits of such investments. Without this depth of understanding, students might not fully appreciate the significance of green finance in driving sustainable development.

The survey results provide insight into how students perceive the benefits of green finance. While they correctly identify its role in creating green jobs (154 votes) and improving community health (159 votes), the lower emphasis on increasing financial profits (142 votes) indicates a potential misconception about the financial viability of green finance. This misconception could be detrimental, as it might lead students to perceive green finance as a less attractive or viable career path compared to traditional finance. This perception could stem from a lack of exposure to successful green finance models or case studies that demonstrate the profitability and long-term financial benefits of sustainable investment practices. Addressing this misconception is crucial, as it can influence students’ career choices and their willingness to engage with green finance in the future.

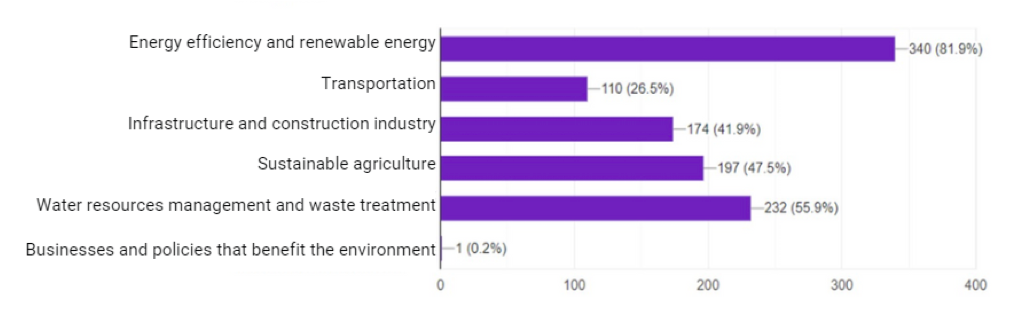

4.1.3. Educational Implications for Green Finance in Vietnam

The moderate level of awareness and understanding of green finance among university students highlights a clear need for an enhanced and more focused educational curriculum. While 60% of students have been taught about sustainable development, the fact that only 34% have received formal education on green finance points to a significant gap in the curriculum. This gap is concerning because green finance is a critical component of sustainable development, and understanding its mechanisms and applications is essential for future finance professionals. An enhanced curriculum should aim to cover not only the basics of green finance but also delve into its various instruments, their applications, and their impact on the environment and economy. Such a curriculum would equip students with the knowledge and skills necessary to contribute effectively to the green finance sector upon graduation.

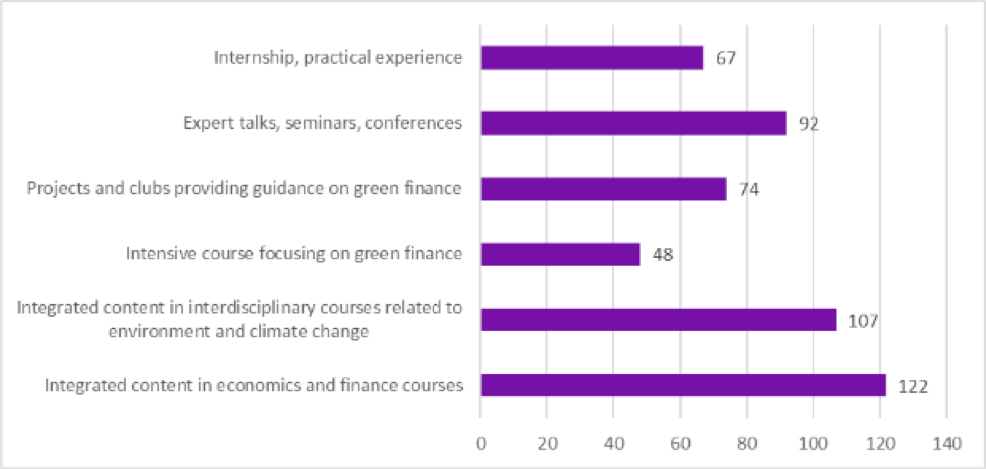

Educational institutions play a crucial role in shaping students’ understanding and perceptions of green finance. The integration of practical experiences in the curriculum, such as internships (67 votes) and project-based learning (74 votes), can provide students with valuable hands-on experience. These experiences are critical for students to understand the real-world applications and implications of green finance. Expert talks and seminars (92 votes) are also vital in bridging the gap between theoretical knowledge and practical applications. Inviting professionals and experts in the field of green finance to speak with students can provide them with insights into the latest trends, challenges, and opportunities in the sector. This exposure is crucial for students to stay abreast of developments in the field and to understand the practical aspects of green finance that are often not covered in traditional textbooks.

Universities can play a significant role in enhancing students’ practical understanding of green finance by encouraging more engagement through extracurricular activities. Currently, the impact of clubs and seminars in imparting practical insights into green finance seems limited. By enhancing these opportunities, universities can offer students a more dynamic and engaging way to understand green finance. Clubs focused on green finance and sustainability can provide a platform for students to discuss and explore green finance concepts and their applications. Seminars and workshops led by experts in the field can give students an opportunity to learn about real-world challenges and solutions in green finance. These activities can supplement formal education and provide a more holistic learning experience for students.

In conclusion, while there is a basic level of awareness about green finance among university students in Vietnam, there is a clear need for a deeper, more practical understanding and exposure. Addressing this need through comprehensive educational programs, practical experiences, and enhanced student engagement can prepare students to be effective participants in the green finance sector. The survey results serve as a call to action for educational institutions to reevaluate and enhance their curricula and extracurricular offerings to meet the evolving needs of the green finance sector and prepare students for future challenges and opportunities in this field.

4.1.4. Educational Aspects of Green Finance

The survey data highlights a significant disparity in students’ exposure to sustainable development (60%) versus specific green finance education (34%). This gap in educational content points to a larger issue in academic curricula where green finance is not adequately highlighted as a distinct and crucial area within the broader sustainability framework. This lack of focused education in green finance could lead to a superficial understanding of the subject. Students might grasp basic sustainability principles but may not understand how these principles translate into financial strategies and instruments in the context of green finance. This understanding is crucial, as green finance is a key driver in achieving sustainable development goals.

The reliance of students on self-study and online resources indicates a gap in practical, real-world learning within the current academic programs. While theoretical knowledge forms the foundation, understanding the practical application of green finance is essential for students to fully grasp the complexities of the field. Experiential learning opportunities, such as internships in green finance firms or participation in sustainable finance projects, can provide critical hands-on experience. These experiences not only reinforce classroom learning but also expose students to the practical challenges and decision-making processes inherent in green finance. Furthermore, collaborations with industry professionals through guest lectures and workshops can offer students valuable insights into current practices and emerging trends in green finance.

The survey reflects a broad interest in green finance topics among students, ranging from trends in development (206 votes) to risk management (210 votes) and understanding government policies (176 votes). However, there is a notable gap between the content students are interested in and what is currently being taught. This mismatch suggests a need for a more comprehensive curriculum that covers a wide spectrum of green finance topics. In-depth courses on green finance instruments like green bonds (141 votes) and green loans (91 votes) are crucial, as they are fundamental tools in the transition to a sustainable economy. Furthermore, integrating topics such as the impact of green finance on community health and its role in achieving financial profitability could address common misconceptions and provide a more rounded view of the field.

4.1.5. Career Orientation and Job Market for Green Finance

The growing interest in green jobs is evident, yet students’ understanding of these roles is limited. The survey shows that while students are aware of green jobs, they lack a deep understanding of the specific roles, skills required, and opportunities within this emerging sector. This limited understanding could hinder students from fully exploring and realizing their potential in the green finance job market. The motivations driving students towards green finance careers are multifaceted. Personal values (205 votes), career development potential (290 votes), and financial incentives (188 votes) all play a role in shaping their interest. However, the educational alignment with the market demands of green finance is lacking, which could impact students’ preparedness and success in this field.

The responsibility of universities in preparing students for green finance careers extends beyond classroom education. It involves providing comprehensive career guidance, mentorship, and real-world exposure to green finance projects. Career services in universities should offer detailed information about the green finance sector, including emerging job opportunities, required skill sets, and potential career paths. Organizing specialized career fairs, networking events, and mentorship programs focused on green finance can facilitate valuable interactions between students and industry professionals. These initiatives can provide platforms for students to gain insights into the job market, understand the practical applications of their education, and explore various career opportunities in green finance.

The survey indicates that a majority of students perceive knowledge in green finance as a competitive advantage in the job market (62.7%). However, a significant proportion are uncertain about this advantage (33.7%), highlighting a need for better communication about the value and relevance of green finance skills. Collaboration between universities and industry is key to developing a curriculum that aligns with market needs. Courses should not only impart technical knowledge in green finance but also emphasize the development of soft skills such as critical thinking, ethical decision-making, and adaptability – all crucial for success in this dynamic field.

In conclusion, enhancing green finance education and career readiness among university students in Vietnam requires a comprehensive and multifaceted approach. This approach should encompass expanding the curriculum to cover a wider range of green finance topics, integrating practical learning opportunities, providing targeted career guidance, and fostering collaboration between academia and industry. By addressing these areas, universities can effectively prepare students for successful careers in the green finance sector, contributing to the broader goals of sustainable economic development and environmental stewardship. This preparation is essential for both individual career growth and the advancement of sustainable finance practices.