31 Developing a Budget

Once the work plan has been created, the next step is to develop a budget for at least the first year of the project, strategy, or organization. It is important to develop a detailed and realistic budget to provide a clear overview of the financial resources needed for your project, such as hiring of staff, leasing an office, purchasing equipment, printing materials, etc.

As Pakroo (2021) points out, creating a budget can be very intimidating, but it is very important to understand exactly which resources are needed to carry out the planned program or service. [1] Like the work plan, a budget is created in a spreadsheet format with a particular style of formatting. Thankfully, there are tools available to help with this important step, such as Microsoft Excel, Google Sheets, and QuickBooks.

The budget must be realistic, driven by organizational values, and developed based on an accurate cost of implementation. This is especially important as you consider the salaries, wages, and benefits of staff. The development of a budget is an opportunity to communicate and commit to fair and equitable compensation, but you have to do this with a plan for maintaining the revenue needed for the compensation so that you are considering retention and recruitment of desired staff.

If the organization is a non-profit, then the budget must also be approved by the Board of Directors and it will be used to communicate and justify financial need to organizations which you may be seeking funding from, like a philanthropic foundation. Keep in mind that budgets are often a very scrutinized part of the grant proposal and reviewers will look to ensure that the budget seems fair and feasible, and that it reflects the resources included in the work plan.

A budget consists of two primary components:

- Estimation of expenses

- Estimation of income

Expenses

There are typical categories of expenses that should be considered. According to Pakroo (2021), these should include:

- Regular expenses: These are expenses that would be needed during the year and likely ongoing.

- Salaries and benefits

- Rent

- Utilities

- Postage and phone

- Office supplies

- Insurance

- Transportation and travel

- Food

- Printing and marketing

- Training

- Accounting/bookkeeping

- Fundraising expenses

- Capital expenses: These are expenses that would likely be made within a start-up period and considered a long-term expense. The cost of the asset (initial cost, depreciation, maintenance, etc.) would be spread out over multiple years.

- Vehicles

- Computers

- Large office equipment[2]

Each expense category needs to be clearly explained and directly related to the project work plan. This will be useful to the organizational and programming staff and administrators but also to any potential funder who may be reviewing the budget. For example, the salary amount and any employee benefits (health insurance, workman’s comp, family leave, etc.) need to be clear as well as the additional amount for benefits.

Revenue

Like the list of expenses, the budget should also include a thoughtful, diverse, and realistic list of revenue sources. You need to identify sources and amounts of income that are at least equal to or slightly greater than the amount of expenses to demonstrate the financial viability of the organization or program. The sources may be ‘pending’ or waiting for approval but you at least need to name them in your budget. For example, if you identify the expenses to be $230,000 for a year, then you need to identify at least $230,000 in revenue.

It is important to be creative and realistic as you consider income sources. You also need to consider the sustainability of the program. If your program or organization is initially grant-funded, you should attempt to diversify additional sources of funding for the future.

Finally, think about the revenue part of your budget as an opportunity to develop relationships and buy-in. A fundraiser may not raise a lot of money and may have a cost to organize but it may raise awareness and can be a helpful way to communicate about your work to the community.

Potential sources of revenue for your organization or project are:

- Grants

- Grants are received from foundations, private donors, or units of government.

- Grants are typically applied for by submitting a grant application.

- They are for a specific timeframe, likely to fund a program or set of activities, and aligned with the values of the mission or priorities of the funding agency.

- Often grants are accepted on a periodic basis or in response to a Request for Proposals.

- Be sure to research the foundation you are interested in applying to so you can determine the likely grant award amount, timing, and funding priorities.

- You may search for foundations through Cadid online (formally known as the Foundation Directory).

- You may also want to examine comparable programs to the one you are designing the budget for and see where their funding comes from. Often this can be found on their website or in their annual reports.

- Contracts

- Contracts are written agreements with an organization or unit of government to provide a certain set of services within a specific timeframe.

- Contracts are typically applied for by submitting a contract proposal.

- Fundraising and Cash Donations

- Common fundraising strategies include events (walk/run, auctions, dinners/lunches, showcases of program outcomes, etc.).

- Donations of cash or stock are often solicited online or via mail from persons you have reason to think value your work enough to make a financial investment.

- Remember, if your organization is a 501©(3) there are likely tax implications for persons who donate to you. You should consult a legal expert to ensure that you provide accurate documentation to the entity or person making the donation.

- The cost of organizing and hosting the fundraiser needs to be clearly included in the expenses and referenced as ‘funding expenses.’

- Fundraising resources include:

- The Network for Good (www.networkforgood.com)

- The National Council for Nonprofits (www.councilofnonprofits.org)

- Memberships

- A membership is a formal relationship between your organization/program and a third party. Typically, there are benefits to this relationship and there is a cost to becoming a member, which provides a source of revenue.

- Possible benefits to membership could include items of value that reflect your organization and mission (clothing, bags, etc.), invitations to events or trainings, participation in strategic planning, etc.

- The cost of membership should be enough to generate valuable revenue but not too high that it dissuades people from joining.

- In-kind Donations

- In-kind contributions are non-cash donations of items that have value to your organization or program but for which there was not a cash transaction.

- In-kind donations are often requested for specific needs that you may have, such as for a computer, office supplies, or a skill like website development.

- These items need to be included as a source of revenue and be given a monetary value.

The sources of income need to be thoughtfully researched and realistic. For example, if you plan to hold a fundraiser you need to think through how many people are likely to attend, how much they are likely to contribute, and what it will cost to plan and host the fundraiser.

Budget Format

There is a preferred format for communicating information in your budget. They include:

- Using a table or spreadsheet

- Using a common title or label to identify the expense item

- Abbreviating the budget detail, using common symbols as appropriate

- Lining up (justifying) all total dollar amounts on the right side of the column

- Using the same timeframe for all expenses, which is commonly one year

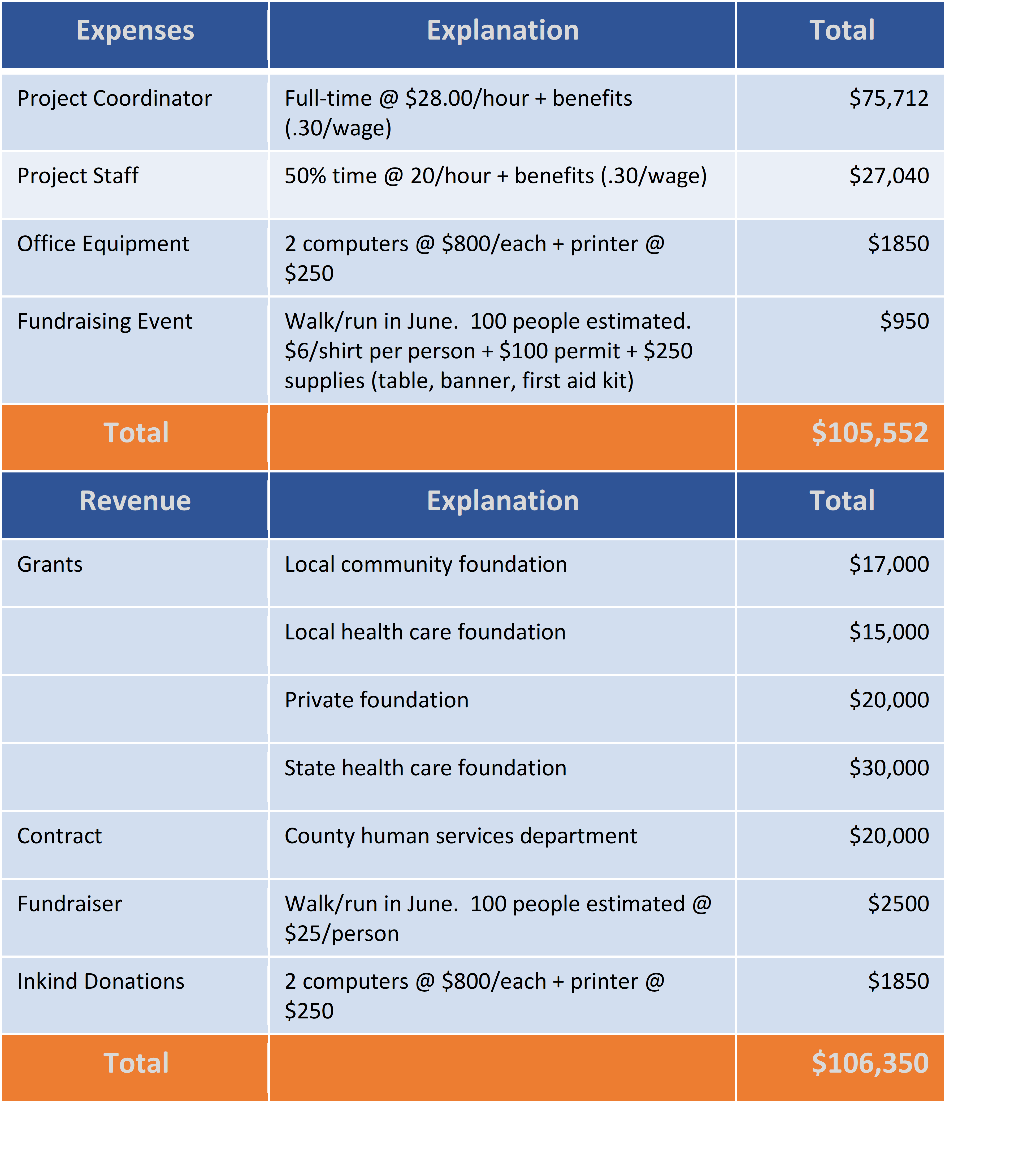

Here is a sample budget using just a few common expenses and revenue categories, incorporating preferred format expectations. Pay attention to the expense/revenue titles, abbreviations, and how the dollar amounts are lined up to the right of the column (right-justified).

Budget Explanation

Some budget items will require more of a detailed explanation than you can adequately express in the spreadsheet or table. So, you are encouraged to create a document that is considered ‘attached’ to the budget spreadsheet which provides a narrative explanation for the specific items or categories that you think need more explanation.

For example, provide the rationale for a wage level or you could explain how you arrived at the lease amount for office space since that level of detail would not fit in a budget spreadsheet.

Additional Considerations

It is important that we pause at this stage of planning to consider some nuances and implications of budgeting, particularly on budgeting for wages and when seeking donations from local businesses. They include:

- Method of calculating wages and employee (fringe) benefits:

- If you have full-time employees, you should calculate their salary or wage based on 2080 hours per year (number of hours per 40-hour work week), unless the organization had adopted or intends to adopt the 32-hour work week model.[3]

- You should consult with your human resources department or professionals to identify the cost of the employee benefits (health insurance, workers’ compensation, family leave, etc.). A typical benefit cost is 30% which needs to be clearly identified in the budget and incorporated into the expenses.

- Public perception of wages for human services professionals:

- There is a public perception that people working in human services or community change should be motivated by helping others and not by money. This is not reasonable and not sustainable.

- The gender and racial pay gap in the field of social work and other helping professions is well documented and has implications on the health, well-being, and wealth of the employees[4].

- It is unfair and unethical to expect people to work in the field of human services—or any profession—to be compensated at a level that does not allow them to thrive.

- It is optimal for an organization or program to plan salary and compensation based on what is best for employee recruitment and retention and not just based on historical compensation levels in the community.

- Seeking donations from local businesses:

- There is a common mindset that businesses in our community should be partners in our change work and therefore should always donate to our ‘cause.’

- Community businesses do care about your cause, are likely very motivated to partner in your work, and are likely to contribute in some way to support you.

- Local small businesses tend to make at least twice as many contributions to local organizations than large businesses, so they are very likely to contribute to your cause—at some point. [5]

- Keep in mind, however, that a business also needs to make money, pay its employees, and plan for sustainability. Often this means having a limit on the extent of their contributions.

- So, do not be surprised or offended if a business says no to your request. That may not mean that you shouldn’t ask them the next year, especially if you have reason to think that their business or their employees value your work and your mission.

- Pakroo, P.H. (2021). Starting and building a nonprofit: A practical guide. (9th ed.). Berkley: Nolo. ↵

- Pakroo, P.H. (2021). Starting and building a nonprofit: A practical guide. (9th ed.). Berkley: Nolo. ↵

- 4 Day Week Global. https://www.4dayweek.com/ ↵

- Chen, Z., Zhang, Y., Luo, H., Zhang, D., Rajbhandari-Thapa, J., Wang, Y., Wang, R., & Bagwell-Adams, G. (2021). Narrowing but persisting gender pay gap among employees of the US Department of Health and Human Services during 2010-2018. Human Resources for Health, 19(1), 1–8. https://doi-org.link.uwsuper.edu:9433/10.1186/s12960-021-00608-w ↵

- SCORE. https://www.score.org/resource/infographic-small-business-charitable-giving-big-impact-local-communities ↵