11

After reading this chapter, you should be able to:

- Plan for retirement using 401(k)s, IRAs, and other tools.

- Learn the basics of estate planning and why it’s important.

- Prepare for major life events: marriage, kids, inheritance, and more.

- Develop a long-term financial strategy for life’s uncertainties.

11.1 Retirement Planning

Most people dream about retirement—traveling the world, spending more time with family, or simply not setting an alarm clock every morning. But here’s the reality: retirement doesn’t just “happen.” It has to be planned for, and the earlier you start, the better your chances of making “future you” grateful.

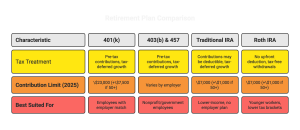

401(k)

401(k)

Contributions are made pre-tax, and growth is tax-deferred.

The contribution limit in 2025 is $23,000, with an additional $7,500 allowed for those age 50 and older.

Best suited for employees with access to an employer match.

403(b) and 457

Similar tax treatment to the 401(k), with pre-tax contributions and tax-deferred growth.

Contribution limits vary depending on the employer.

Designed for nonprofit employees and government workers.

Traditional IRA

Contributions may be deductible, with tax-deferred growth.

The 2025 contribution limit is $7,000, plus an extra $1,000 if age 50 or older.

Best suited for lower-income workers or those without an employer-sponsored plan.

Roth IRA

No upfront tax deduction, but withdrawals in retirement are tax-free.

Contribution limits are the same as the Traditional IRA.

Ideal for younger workers in lower tax brackets, who benefit most from tax-free growth.

Tip: If your job offers a 401(k) match, always contribute at least enough to receive the full match. It’s free money!

Target-Date Retirement Funds

These funds automatically shift your asset allocation over time—from aggressive to conservative as you approach retirement. They’re great for hands-off investors.

11.1.1 Kevin’s Experience: Retirement the Smart (and Boring) Way

Kevin started saving for retirement from the moment he began working full-time. Early in his career, he maximized his 401(k) contributions and later added a 457 plan when he became eligible. As his income grew, he also used a backdoor Roth IRA to increase his tax-advantaged savings. In total, he contributed over $40,000 per year for retirement alone—legally and strategically.

“For people in high tax brackets,” he explains, “retirement accounts are not just about the future. They’re one of the best tax strategies today.”

Kevin admits he didn’t always have time to research investments in detail, so he relied on broad index funds and target-date funds to keep things simple. Over time, he learned that staying consistent, automating contributions, and diversifying—rather than chasing “hot” stocks—was the smartest path forward.

11.1.2 How Much Will You Need?

A common rule of thumb is that you’ll need about 70–80% of your pre-retirement income to maintain your lifestyle. But it depends on your goals:

-

- Do you want to travel often?

- Will your house be paid off?

- Do you expect higher medical costs?

Simple Formula to Estimate Needs:

Retirement Savings Goal ≈ Annual Income × 0.75 × Number of Years in Retirement

Example:

If you make $60,000 a year and expect 25 years of retirement:

$60,000 × 0.75 × 25 = $1,125,000

That’s roughly how much you’ll need saved.

11.1.3 Retirement Savings Vehicles

You don’t need to reinvent the wheel—there are tools designed to help you.

-

- 401(k): Employer-sponsored plan; contributions are pre-tax; many employers match contributions (free money!).

- IRA (Individual Retirement Account): Similar tax advantages; available even if your job doesn’t offer a plan.

- Roth IRA: Contributions are after-tax, but withdrawals in retirement are tax-free. Perfect if you expect to be in a higher tax bracket later.

- Pensions: Becoming rare, but some jobs (teachers, government workers) still offer them.

- Social Security: Government program that provides income, but it’s not enough on its own. Think of it as a supplement, not the whole plan.

11.1.4 Investment Strategies for Retirement

Your age and timeline matter:

-

- Young (20s–30s): Can take more risk—focus on stocks and growth funds.

- Mid-career (40s–50s): Balance growth with stability—mix of stocks and bonds.

- Near retirement (60s+): Protect your money—shift toward bonds, cash, and low-risk investments.

Key Takeaway: Match your investment risk to your timeline. The closer you are to retirement, the more you should focus on preserving wealth.

Advanced Strategy Note:

Some high-income earners have access to multiple retirement plans—like a 401(k) and a 457 if they work in education or government. In addition, they may contribute to a Roth IRA using the “backdoor” method. These strategies allow total contributions of over $40,000 per year in tax-advantaged accounts.

11.1.5 Case Studies

Maria begins saving $300/month in a Roth IRA at age 25. Over 40 years, she contributes $144,000. Thanks to compound interest at a 7% return, her account grows to about $703,000 by age 65.

If she had waited until age 40 to start, the same $300/month would only grow to about $203,000 by retirement.

Lesson: By starting 15 years earlier, Maria ends up with half a million dollars more—without saving a single extra dollar.

Jake decides to delay retirement saving until age 40. He contributes the same $300/month into a Roth IRA. By age 65, he’s invested $90,000 of his own money. With 25 years of compounding at a 7% return, his account grows to about $250,000.

That’s still a solid amount, but it’s nowhere near Maria’s $703,000—even though Jake sacrificed almost the same monthly amount.

Lesson: Waiting just 15 years cost Jake nearly half a million dollars in missed growth. The later you start, the harder it is for compounding to do the heavy lifting.

11.1.6 Practical Checklist

Ask yourself:

-

- Am I contributing to a 401(k) or IRA?

- Have I increased contributions when I got raises?

- Do I understand the difference between traditional and Roth accounts?

- Do I have a target number for retirement savings?

- Am I adjusting my investments based on my age and risk tolerance?

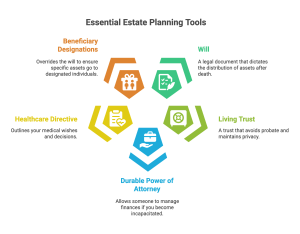

11.2 Estate Planning Basics

Estate planning is not just for the wealthy. It’s for anyone who wants to protect their loved ones and avoid unnecessary stress during already difficult times.

Core Estate Planning Tools:

-

- Will: Decides who gets what after your death.

- Living Trust: Avoids probate and keeps things private.

- Durable Power of Attorney: Lets someone handle your finances if you can’t.

- Healthcare Directive: Outlines your medical wishes.

- Beneficiary Designations: Often overlooked—these override your will.

Tip: Even if you don’t have significant assets, making your wishes legally clear is a gift to your family.

11.2.1 Kevin’s Experience: Estate Planning as a Parent

Kevin began estate planning as soon as he became a parent. In addition to naming beneficiaries on his retirement accounts, he created a living trust and a will to ensure his children would be taken care of if something unexpected happened.

“Estate planning isn’t about you—it’s about protecting the people you love,” he says. “Even if you don’t have millions, making your wishes clear avoids court delays and family conflict.”

His biggest advice: don’t wait until you feel “old” to start. Even a basic will and healthcare directive can make a big difference—especially if you have children or dependents.

11.2.2 Key Tools in Estate Planning

-

- Will: A legal document that says who gets what when you pass away.

- Trust: Lets you transfer property more smoothly, often avoiding probate. Can also provide tax benefits.

- Power of Attorney: Gives someone authority to handle your finances if you can’t.

- Health Care Directive (Living Will): States your wishes for medical care if you’re unable to decide.

Quick Tip: “I’m 22—Do I Really Need This?”

Yes. Even if you have no assets, a simple will and healthcare directive can help your loved ones avoid difficult decisions. Start small: name a beneficiary on your accounts and fill out a free healthcare directive form online. It takes 15 minutes and could make a huge difference.

11.2.3 Minimizing Taxes and Protecting Beneficiaries

For most people, estate taxes aren’t a big issue (the federal exemption is over $12 million in recent years), but state rules vary. More common issues are:

-

- Protecting minor children with guardianship plans.

- Preventing heirs from misusing assets (some trusts release money gradually).

- Making sure beneficiary designations (on retirement accounts, insurance) are up-to-date.

Quick Example:

If you forget to update your 401(k) beneficiary after a divorce, your ex might inherit your account instead of your kids or new partner.

11.2.4 Case Studies

Carlos passed away unexpectedly at 52. He lived with his partner for over a decade, but they never got legally married and Carlos never wrote a will. By law, his house and savings automatically went to his siblings—not to the partner who had shared expenses and helped maintain the home.

The result? His partner was forced to leave the house, and a long legal battle broke out among the family. Thousands of dollars were lost in court fees, and the emotional stress permanently damaged relationships.

Lesson: A simple will could have ensured Carlos’s partner was protected and avoided years of conflict. Estate planning isn’t just for the wealthy—it’s for anyone who cares about leaving order instead of chaos.

Alicia, a single mother of two, decided early on to prepare a living trust. She clearly outlined how her home, savings, and investments would pass to her children. When she passed away at 68, her estate avoided probate completely.

Instead of waiting months in court and paying expensive fees, her children had access to funds within weeks. This allowed them to cover funeral costs, manage household expenses, and grieve without added financial stress.

Lesson: A little planning ahead gave Alicia’s family peace of mind, saved them thousands in legal costs, and avoided the conflicts that often tear families apart after a death.

11.2.5 Practical Checklist

-

- Do I have a will, even a simple one?

- Have I set up guardianship plans if I have children?

- Are my beneficiaries on retirement accounts and insurance updated?

- Do I have a power of attorney and health directive?

- Have I considered whether a trust makes sense for my situation?

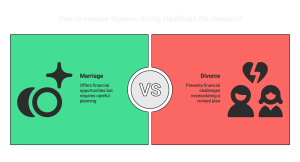

11.3 Financial Life Events

Life doesn’t move in a straight line. Big events—marriage, kids, divorce, college, or caring for parents—can shake up your finances. The good news? With planning, you can adjust and keep moving toward your goals. Think of financial life events as “plot twists” in your money story.

Marriage: Decide whether to combine or keep finances separate, and remember to update beneficiaries on accounts and insurance policies.

Having Kids: Adjust your budget for childcare and related expenses, and consider opening a 529 college savings plan or custodial account early.

Divorce: Update estate plans to reflect new circumstances and separate joint assets fairly.

Inheritance: Before spending, take time to understand possible tax implications and create a thoughtful plan for the money.

Caregiving: Plan and budget for elder care costs, and explore long-term care insurance as a way to reduce future financial stress.

Tip: Every major life event is a reason to revisit your financial plan. Don’t wait.

11.3.1 Marriage and Divorce

-

- Marriage: Joining finances can bring new opportunities (two incomes!) but also challenges (different money habits). It’s key to set joint goals, decide whether to merge or separate accounts, and update beneficiaries.

- Divorce: Often one of the most financially disruptive events. Legal fees, splitting assets, and adjusting to a single income all require a revised financial plan.

Example:

If Alex and Taylor marry and both keep student loans, they’ll need to decide if one income should go toward accelerated debt payoff while the other covers living costs.

11.3.2 Starting a Family

Children bring joy—and expenses. Think: diapers, health care, daycare, and eventually college tuition. Starting a college savings plan early (like a 529 plan) can make a huge difference.

Key Takeaway: Kids don’t come with financial instructions, but setting aside even small amounts regularly can grow into a major education fund.

11.3.3 Inheritance and Windfalls

Getting an inheritance or financial windfall sounds great, but it can also be overwhelming. Many people spend it quickly without a plan. A safer strategy is to pause, park the money in a safe account, and then create a thoughtful plan: some for savings, some for debt payoff, some for future goals.

11.3.4 Caring for Elderly Parents

As parents age, they may need financial or physical support. This can mean helping with medical bills, long-term care, or even moving them into your home. Planning ahead—such as discussing health care directives and insurance—can ease the financial burden.

11.3.5 Case Studies

Jasmine and Omar got married young and assumed love would conquer everything—including money issues. Jasmine was careful with every dollar, always saving for the future. Omar, on the other hand, loved spending on dinners out, trips, and gadgets.

At first, they ignored the differences. But over the years, unpaid credit card bills and constant arguments piled up. By the time they were in their 30s, they were carrying thousands in debt and felt more like financial enemies than partners. Eventually, the strain led to divorce.

Their biggest regret? Never setting clear financial expectations early on. A simple conversation about budgeting, goals, and shared priorities could have prevented years of stress and conflict.

Lesson: Marriage isn’t just about blending lives—it’s about blending financial values too.

When their daughter Sofia was born, Luis and Carla made a commitment: they would set aside $100/month into a 529 college savings plan. At first, it didn’t feel like much—just the cost of a family dinner or a couple of streaming subscriptions.

But they stuck with it for 18 years. Thanks to steady contributions and investment growth, the account grew to nearly $40,000 by the time Sofia graduated high school. That amount covered a large portion of her tuition and reduced the need for student loans.

Lesson: Small, consistent savings can add up to life-changing results. By starting early and using a tax-advantaged account, Luis and Carla gave Sofia a strong financial start.

Karina works full-time while raising her young son, Diego. Her salary isn’t high, but she makes every dollar count. Instead of waiting for “extra money” to appear, she set up automatic contributions to both a Roth IRA for her retirement and a 529 college savings plan for Diego.

Karina also thought about protection: she purchased a term life insurance policy so Diego would be financially secure if something happened to her. To make sure her wishes were honored, she named her sister as Diego’s legal guardian in her will.

“It’s not about how much you save,” Karina says. “It’s about building a safety net for your child. Planning ahead gives me peace of mind.”

Lesson: Even with modest income, smart planning can create stability. Karina proves that consistency, protection, and foresight matter more than a big paycheck.

11.3.6 Practical Checklist

-

- Have I updated beneficiaries after marriage, divorce, or kids?

- Do I have a plan for child-related expenses and future college costs?

- If I receive an inheritance, do I know how to manage it wisely?

- Am I prepared to help parents financially if needed?

- Have I adjusted my budget and insurance after major life changes?

11.3.7 Kevin’s Experience

Kevin shares: “When my kids were born, my financial world shifted overnight. Suddenly, retirement planning wasn’t the only priority—I had to think about college funds, insurance, and making sure they’d be okay if something happened to me. It was stressful at first, but creating a plan gave me peace of mind.”

11.4 Tools, Checklists, and Case Studies

Knowing the concepts is one thing—putting them into action is another. This section gives you practical tools, quick self-checks, and short real-life stories to help you apply retirement, estate, and life-event planning in your own life.

11.4.1 Retirement Readiness Calculator

A simple way to estimate how much you should save:

Formula:

Retirement Goal = (Annual Income × 0.75) × Years in Retirement

Then subtract what you expect from Social Security or pensions.

Example:

Evelyn earns $50,000/year and wants to retire at 67. She expects 20 years in retirement.

$50,000 × 0.75 × 20 = $750,000 needed.

If Social Security provides $20,000/year, that covers $400,000.

Her personal savings goal = $750,000 – $400,000 = $350,000.

11.4.2 Estate Planning Starter Kit

Key documents everyone should consider:

-

- A basic will.

- Health care directive.

- Power of attorney for finances.

- Updated beneficiaries on retirement accounts and insurance.

Key Takeaway: Even a “starter kit” can save your family time, money, and stress.

11.4.3 Life Events Adjustment Plan

Whenever a major event happens (marriage, baby, divorce, inheritance), run through this quick checklist:

-

- Update your budget.

- Review or increase insurance coverage.

- Adjust retirement contributions.

- Revisit estate planning documents.

- Talk with family members about new responsibilities.

11.4.4 Case Studies

Daniel always thought he would “figure out” college costs later. He focused on daily expenses and put off saving for his daughter’s education. By the time she turned 16, he realized there were only two years left before tuition bills arrived—and no savings.

In a panic, Daniel took out a Parent PLUS loan with a high interest rate. While it covered tuition, the monthly payments ate into the money he had set aside for retirement. Instead of retiring at 65, Daniel now expects to work several more years to pay off the debt.

Lesson: Planning early avoids sacrificing your own financial future for your kids’ education. Even small contributions over time can prevent last-minute debt.

When Marta passed away unexpectedly, she left behind a modest estate that included the family home. Unfortunately, she never wrote a will. Her two adult children both wanted the house, and with no clear instructions, the decision went to probate court.

What could have been a quick and simple transfer turned into years of legal battles, draining thousands of dollars in attorney fees. Worse, the siblings’ relationship suffered lasting damage.

Lesson: A simple will could have prevented years of conflict and preserved both family wealth and peace of mind.

When Ryan received an inheritance of $80,000, his first impulse was to celebrate with a big purchase. Instead, he paused. He placed the entire amount in a savings account for six months to give himself time to think clearly.

After careful planning, Ryan split the money strategically:

- $20,000 to wipe out high-interest credit card debt.

- $30,000 as part of a down payment on a home.

- $30,000 invested in an IRA for long-term retirement growth.

This balanced approach gave him immediate relief from debt, a step closer to homeownership, and a stronger financial future.

Lesson: Slow down, plan, and let a windfall work for you instead of disappearing on impulse purchases.

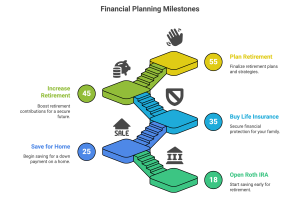

11.5 Summary & Key Takeaways

Life Milestones & Money Moves

Age 18–25: Open a Roth IRA, name beneficiaries, set up healthcare directive

Age 25–35: Save for a home, contribute to 401(k), create a basic will

Age 35–45: Buy life insurance, start college savings for kids

Age 45–55: Increase retirement contributions, review estate documents

Age 55+: Create or update trust, meet with financial planner, plan for retirement withdrawals

Retirement, estate planning, and financial life events are three areas that most people prefer to push off into the future. But ignoring them can be costly. Retirement planning ensures that one day you can stop working and still live the life you want. Estate planning makes sure your wishes are honored and protects the people you love. And life events—marriage, kids, divorce, inheritance, caring for parents—are guaranteed to happen, so preparing your finances ahead of time keeps you from being blindsided.

- Retirement accounts like 401(k)s and IRAs are powerful tools—especially when contributions are automated and started early.

- Tax-advantaged accounts help you build wealth and reduce your current tax bill if used strategically.

- Index funds and target-date funds are great for hands-off investors who want diversification and simplicity.

- Estate planning is not just for the rich—it’s for anyone who wants to protect their loved ones from uncertainty or court delays.

- Life events (marriage, children, inheritance, health issues) can change your financial plan—update your beneficiaries, insurance, and savings strategy as life evolves.

- Discipline and long-term thinking are key: build a plan that’s flexible, but stick to it even when life gets busy.

Conceptual Questions

- What is the difference between retirement planning and estate planning?

- Give one example of each.

- Explain the concept of compound growth in retirement savings.

- Why does starting early matter so much?

- What is a 401(k) and how does it differ from an IRA?

- Compare a Traditional IRA with a Roth IRA.

- Which one is better if you expect to be in a higher tax bracket in retirement?

- What role does Social Security play in retirement planning?

- What is a beneficiary designation and why is it important?

- Why is estate planning necessary even for individuals with modest wealth?

- What is the difference between a will and a trust?

- Explain the concept of portfolio rebalancing in retirement.

- Why might retirees shift more into bonds than stocks?

- Why should you review and update your estate plan after major life events (marriage, children, divorce)?

Problem-Solving Questions

- Early Retirement Saver

Maria invests $200/month in a retirement account at 8% annual return starting at age 25. By age 65, how much will she have? - Waiting to Save

If Carlos waits until age 35 to invest the same $200/month at 8% until age 65, how much will he have? How much less than Maria? - 401(k) Employer Match

Ana earns $50,000/year. Her company matches 50% up to 6% of salary in her 401(k). If she contributes the full 6%, how much goes into her 401(k) each year (including the match)? - Roth vs. Traditional

John invests $5,000 in a Roth IRA at age 30. By age 65 it grows to $40,000. How much is taxable at withdrawal? - Estate Planning Costs

Luis dies with $400,000 in assets but no will. Probate consumes 4% of the estate. How much is left for his heirs? - Trust Benefit

If Maria leaves $600,000 in a trust that avoids probate, and probate would have cost 5%, how much money did she save her heirs? - Required Minimum Distribution (RMD)

Carlos turns 73 and must withdraw 4% of his IRA balance. If his IRA has $250,000, how much must he withdraw? - Inheritance Split

Julia leaves $300,000 to her three children equally. How much does each receive? - College Savings vs. Retirement

Sara saves $250/month in a 529 college savings plan at 6% for 18 years. How much will she have when her child turns 18? - Net Estate After Taxes

If Roberto leaves $1,000,000 in assets and estate taxes take 10%, how much do his heirs receive?

Interactive Challenges

- Quick Quiz: Will or Trust?

- Directs assets through court probate.

- Avoids probate and may reduce taxes.

- Risk Spectrum in Retirement

Rank from lowest to highest risk: Treasury bonds, stock index fund, savings account, cryptocurrency. - Rebalance or Not?

A retiree’s portfolio shifts from 60% stocks/40% bonds to 75% stocks/25% bonds after a bull market. Should they rebalance? Why? - Liquidity Check

Rank by liquidity: retirement account, checking account, house. - Mistake Hunt

“I don’t need a will because my family will figure it out.”- What’s wrong with this assumption?