1

By the end of this chapter, you will be able to:

- Understand what financial planning is and why it matters in real life—not just on paper.

- Apply the five-step financial planning process to make informed and flexible decisions.

- Set financial goals that are realistic, motivating, and aligned with your life stage.

- Recognize how your career path affects your income, lifestyle, and financial future.

- Identify how major life changes and economic crises can impact your financial stability.

- Reflect on your own financial habits, emotions, and mindset to build a stronger foundation.

- Learn the ten core principles that guide smart and sustainable money management.

1.1 Why Planning Your Finances Changes Everything

1.1.1 Money Without a Map

Let me ask you something real:

Have you ever stood in front of a café menu, credit card in hand, doing mental gymnastics just to convince yourself a $6 latte counts as self-care? Or scrolled past someone’s luxury vacation on Instagram and thought, “I work just as hard—so why am I broke by Wednesday?”

Welcome to the chaos of adulting.

Money isn’t just numbers. It’s emotion, status, identity, and survival—all tangled into one bank account. And unless you stop, take a breath, and build a plan, you’re not in control.

That’s why we’re here. Not to shame you. Not to make you a finance bro. But to give you the tools, stories, and structure you need to take your power back.

Let’s begin.

1.1.2 What Is Financial Planning, Really?

Financial planning sounds intimidating. But here’s what it really is:

-

- Thinking about what you want from life.

- Figuring out how much that life costs.

- Mapping out how to get there without panic attacks or overdraft fees.

It’s not about becoming a millionaire (though hey, go for it). It’s about designing a financial life that reflects who you are and who you’re becoming.

Financial planning gives you freedom. Not just the freedom to spend, but the freedom not to spend. The freedom to say “no” to a toxic job because you have savings. The freedom to take a sabbatical, start a business, or—like I did—walk away from a Silicon Valley director job to go study at Oxford.

In 2015, I made a bold decision. I quit my high-paying job and moved to the UK to study at Oxford’s Saïd Business School. Honestly, this wasn’t something I had originally planned. At the time, I was deeply focused on building my career in high-tech as a software engineer, climbing the corporate ladder, and securing financial success.

In 2015, I made a bold decision. I quit my high-paying job and moved to the UK to study at Oxford’s Saïd Business School. Honestly, this wasn’t something I had originally planned. At the time, I was deeply focused on building my career in high-tech as a software engineer, climbing the corporate ladder, and securing financial success.

But it was the experiences I accumulated—through work, travel, and meeting people from diverse backgrounds—that slowly opened my eyes to possibilities beyond my immediate career path. I began to see that success wasn’t just about technical titles or paychecks, but about expanding my mind and life horizons.

Of course, dreams like Oxford come with a price tag. If I hadn’t saved aggressively for years—living below my means even when I earned six figures, investing in rental properties, and resisting lifestyle inflation—I wouldn’t have had the freedom to take this leap.

Oxford transformed me. Not just my resume, but my worldview. It broadened my perspective beyond just work, teaching me to see life in a more holistic way: career, personal growth, community, and even family. It connected me with people from dozens of countries, helped me pivot into product management at Cloudflare, and ultimately shaped the mindset that allowed me to build multiple income streams, balance career and family, and live life on my own terms.

That one decision—made possible by years of planning—compounded into a cascade of opportunities that continue to shape my life today.

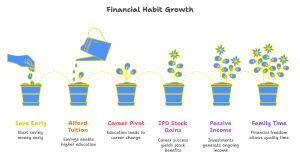

Infographic Placeholder: “The Compound Effect of One Financial Decision”

Alt Text: “Flowchart showing how one savings decision enabled a career pivot, new job, IPO participation, and long-term passive income.”

1.1.4 Case Study 2: Luxury Isn’t the Goal. Stability Is.

I have always been a car enthusiast. Since 2007, given my freedom and lack of family commitments at the time, I’ve consistently owned two-seater sports cars—switching between a Mercedes SLK and a Porsche Boxster over the years. These cars weren’t just vehicles; they were symbols of personal success and, frankly, a way to fulfill my ego in my younger years.

But when my daughter Luana was born through surrogacy in 2021, my priorities shifted dramatically. It wasn’t that I couldn’t afford the sports car anymore. The reality was that it no longer aligned with my life. I needed car seats, storage space, and practicality over speed and style.

I sold the Porsche not out of financial necessity, but out of a deeper understanding that my financial plan—and my definition of success—had evolved. Suddenly, a minivan and investments in diapers and daycare felt far more rewarding than horsepower and convertible tops.

This is the essence of financial planning: it grows and evolves as you do. What once fueled your ambition may give way to choices that prioritize family, security, and long-term goals.

1.1.5 Common Myths About Financial Planning

Let’s bust a few myths right now:

-

- Myth: You need a high income to start planning.

Truth: Planning is how you build income, not something you wait to do once you have it. - Myth: Financial planning is only for finance majors or the rich.

Truth: If you’ve ever paid rent, used a credit card, or bought groceries, congratulations—you’re already doing financial planning (just maybe without a plan). - Myth: It’s boring.

Truth: It’s only boring if you let it be. Once you tie your money goals to real life dreams (traveling, starting a business, raising kids, retiring early), it becomes personal, powerful—and even fun.

- Myth: You need a high income to start planning.

1.1.6 The Emotional Side of Planning

One thing textbooks often skip is the emotional weight of money.

Planning isn’t just about spreadsheets and bank accounts. It’s about safety, control, even identity. I’ve seen people stay in miserable jobs or relationships because they couldn’t afford to leave. I’ve seen others thrive, not because they earned more, but because they planned better.

Planning gives you power. Not over everything, but over enough.

And let’s be real: sometimes, even with the best plans, life throws curveballs. I’ve had properties lose value. I’ve had investments flop. I’ve had to pivot, adjust, and try again. But because I had a plan—and habits built over time—I didn’t collapse. I adapted.

1.1.7 Start Where You Are

If reading this makes you feel behind—don’t panic. You’re not. You’re exactly where you need to be to start.

Whether you’re living paycheck to paycheck, drowning in student loans, or just trying to figure out how taxes work, the point isn’t perfection—it’s intention.

The fact that you’re even reading this chapter already sets you apart. You’re choosing awareness. You’re choosing agency. That’s powerful.

Here’s your first takeaway:

Financial planning is a form of self-respect.

It says, “My future matters. My peace of mind matters. And I’m willing to put in the work to protect both.”

Final Thought

You don’t have to do this alone. In the following chapters, we’ll break down how to measure your financial health, set goals that feel real, manage your cash like a pro, and even start investing without losing your mind.

But it all starts here—with the decision to plan.

Not perfectly. Just on purpose.

Because your money has one job: To serve your life. Not control it.

1.2 The Five Steps to Building a Financial Life That Works

1.2.1 Okay, So You’re Ready to Get Your Money Together…

If you’ve made it this far, give yourself a moment.

You’ve already passed the hardest test in personal finance: caring enough to start. Most people don’t. They ignore it, avoid it, or assume it’s a future problem—until a credit card is declined, rent’s overdue, or a surprise medical bill throws everything into chaos.

But let’s break the stereotype: you don’t need to be rich to plan. You don’t need a financial advisor or a degree. You just need a little structure—and the courage to look honestly at where you are, where you want to go, and what it’ll take to get there.

This section walks you through the Five-Step Financial Planning Process, taken from the BUSI 45 curriculum and Keown’s Turning Money into Wealth. Don’t worry—it’s not a complicated MBA framework. It’s more like a GPS for your life.

1.2.2 Step One: Evaluate Your Financial Health

Let’s be honest. Most of us know when our financial health isn’t great. The signs are familiar:

-

- Constant stress about money

- No idea where your money actually goes

- Feeling like your income disappears before the month is over

I’ve been there.

In my early twenties, I was earning a decent salary as an engineer in Silicon Valley. But I was also spending like I had something to prove—on cars, clothes, dinners, gadgets. I didn’t budget, didn’t track expenses, and had no clue about my net worth (which, to be fair, was probably negative at the time).

It wasn’t until I sat down and made a simple spreadsheet—with income, expenses, debts, and assets—that I realized I was living paycheck to paycheck despite earning more than both my parents combined had ever made.

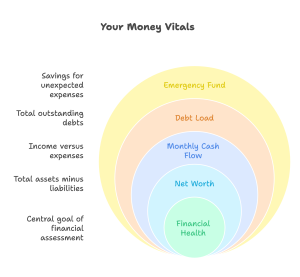

Evaluating your financial health means facing the numbers, even if they’re scary. It means calculating your:

-

- Net worth (what you own minus what you owe)

- Monthly cash flow (money in vs. money out)

- Debt load (do you owe more than you make?)

- Emergency fund (do you even have one?)

This step isn’t about shame—it’s about clarity. You can’t build anything strong on a foundation of guesswork.

1.2.3 Step Two: Set Your Financial Goals

Once you know where you are, it’s time to decide where you want to go.

Most people skip this. They jump straight to action: “Should I invest in crypto? Should I open a Roth IRA? Should I buy real estate?” Those are tactics. You need goals first.

Your goals can be:

-

- Short-term: Pay off credit cards, build a $1,000 emergency fund, save for a trip

- Mid-term: Buy a car, go back to school, build a 3–6 month cushion

- Long-term: Retire early, buy property, start a business, send your kids to college

Real-life moment:

Before I became a father, my goals were career- and travel-focused. I wanted to lead global teams, speak at conferences, and see the world. My financial goals reflected that: save for an MBA, invest in rental properties, build a safety net so I could take risks.

But when my daughter Luana was born, everything shifted. My new goals weren’t about me—they were about her. Stability, education, time. I sold assets I loved. Reallocated investments. Got life insurance. Because my “why” had changed.

That’s the magic of this step: it anchors your money to your meaning.

1.2.4 Step Three: Develop a Plan of Action

Now it’s time to make a plan.

This isn’t about fancy formulas or 20-page Excel sheets. It’s about creating actionable steps based on your goals and current reality.

Example:

-

- Goal: Pay off $5,000 in credit card debt

- Plan:

- Stop adding new charges

- Pay $300/month minimum, plus $200 extra toward highest-interest card

- Cut nonessential spending (subscriptions, dining out) by $150/month

- Use tax refund or bonus to make lump sum payments

Your plan should include:

-

- Specific amounts (not “save more” but “save $200/month”)

- Clear deadlines (“by December” not “someday”)

- Trade-offs you’re willing to make (cutting Uber, taking on freelance gigs, selling unused stuff)

Practical Tip: Use free tools like Mint, You Need a Budget (YNAB), or just Google Sheets. I built my first budget on the back of a notebook using four colors of ink. It worked.

1.2.5 Step Four: Put Your Plan into Action

Here’s the hardest part: doing the thing.

Planning is exciting. Acting is where most people quit.

I once helped a friend build a beautiful plan to save for a new apartment. We tracked her spending, adjusted her budget, even prepped automatic transfers. But she never activated it. Weeks passed, then months, and eventually the plan died in a Google Drive folder.

Execution beats perfection. Every time.

When I decided to buy my first property in the Bay Area, I didn’t feel “ready.” The market was insane, my budget was tight, and I was terrified of losing money. But I had a plan. And that plan gave me enough courage to act—even if imperfectly.

That first condo eventually became my first Airbnb, and years later, part of the portfolio that let me walk away from corporate life to raise my children.

Action is where dreams become habits.

No act is too small. Set the automatic transfer. Open the high-yield savings account. Make the call. Decline the invite. Say no to the sale. Say yes to your future.

1.2.6 Step Five: Review and Revise

You’re not carving your financial plan into stone. You’re sketching it in pencil.

Life changes. You get laid off. You fall in love. You get sick. You move. You lose a parent. You discover a passion. Or you simply… change your mind.

That’s okay.

Every few months, or at least once a year, you should check in with your plan:

-

- Are your goals still aligned with your life?

- Have your numbers changed (new job, expenses, debts)?

- Did you stick to the plan—or fall off track?

If you did fall off—welcome to the club. Perfection isn’t the goal. Persistence is.

Kevin’s moment of realignment:

During the pandemic, several of my short-term rentals lost revenue. Travel froze. Bookings dropped. I had to shift fast: adjust prices, cut discretionary expenses, and even offer long-term leases in markets I never planned to.

Did it derail my goals? No. It delayed them. But my plan had flexibility baked in. That’s what saved me.

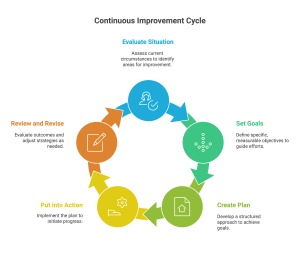

1.2.7 Putting It All Together

Let’s recap the five steps:

-

- Evaluate your financial health – know where you stand

- Set your goals – give your money direction

- Make a plan – turn those goals into steps

- Take action – do the work

- Review and revise – keep adapting

It sounds simple. And it is.

But it’s also powerful. Life-changing, even.

Final Word from Kevin

When I look back at my life—growing up in China, coming to the U.S., surviving grad school, climbing the tech ladder, becoming a dad—what made the biggest difference wasn’t luck or genius. It was consistency.

I evaluated. I adjusted. I kept planning even when I failed.

There were times I was overwhelmed, confused, even broke. But I kept returning to the same five steps. Again and again.

And somehow—one spreadsheet, one decision, one paycheck at a time—I built a life I’m proud of.

So can you.

Let this chapter be your map.

Let the next one show you how to read it.

1.3 Financial Goals: Your GPS for Adulting

1.3.1 Wait… Do I Even Have Goals?

If someone asked you right now, “What are your top three financial goals?”, could you answer confidently?

Most people can’t.

They might say things like:

“I want to make more money.”

“I guess… buy a house someday?”

“Not be broke?”

Fair enough. But those aren’t goals. Those are vibes.

Real financial goals are specific, measurable, and tied to something that matters to you.

Think of them like a GPS. You can’t get to where you’re going if you don’t know your destination. You can’t even reroute if you don’t know what direction you’re headed. And let me tell you—winging it rarely gets you anywhere worth staying.

1.3.2 Why Goals Matter More Than Money

When I started earning real money for the first time—engineer salary, Silicon Valley perks, bonus checks—I thought I was winning.

I bought designer clothes, upgraded my car, traveled often. I had stuff. But I also had stress, debt, and zero direction. I was chasing achievement without intention. And the emptiness crept in, slowly but surely.

The shift happened when I asked myself one hard question:

What do I want this money to do for me?

Not just what I wanted to buy—but how I wanted to live.

That’s when I stopped buying just to impress and started saving to build. That’s when I traded in “spontaneous fun” for freedom. That’s when I began designing a life—not just spending through one.

Your goals give your money meaning. Without them, your paycheck is just a pitstop. With them, it becomes a compass.

For years, I rented apartments in the Bay Area. I told myself it was practical—less responsibility, more flexibility, no long-term ties. But deep down, I knew that owning a home was one of my biggest financial goals. I wanted not just a place to live, but an investment in my future stability.

Buying a home in Silicon Valley is no small feat. Property prices were sky-high, and I didn’t come from wealth. But I took a disciplined approach. I started by setting a clear goal and breaking it into manageable steps.

I aggressively tracked my expenses, funneled bonuses and stock compensation into savings, and avoided lifestyle inflation even as my income increased. Every raise wasn’t an excuse to spend more—it was fuel for my down payment fund. I also invested early in rental properties, which helped build additional income streams to support my goal.

It took years of sacrifice and strategic planning, but eventually, I had enough saved for the down payment and closing costs. When the right opportunity came, I was ready.

Owning my first home wasn’t just a financial win—it was an emotional milestone. It gave me a sense of security, rooted me in my community, and opened the door to future investments like Airbnb hosting and property management.

This experience taught me a powerful lesson:

Big goals aren’t achieved overnight. They are the result of small, consistent actions compounded over time.

1.3.4 Setting SMART(ER) Goals

Let’s get practical for a second. Good financial goals follow a simple framework called SMART:

-

- Specific: What exactly do you want?

- Measurable: How will you know when you’ve achieved it?

- Achievable: Is this realistic based on your current situation?

- Relevant: Does it align with your values and stage of life?

- Time-bound: By when will you get there?

Let’s make it SMARTER by adding:

-

- Emotional: Does it genuinely matter to you?

- Reviewable: Can you track and revise it over time?

Examples:

-

- Wrong: “I want to save more.”

Right: “I will save $200 per month into a high-yield savings account to build a $2,000 emergency fund by December.”

- Wrong: “I want to save more.”

-

- Wrong: “I want to get out of debt.”

Right: “I will pay $300 monthly toward my student loan to reduce the balance from $7,000 to $3,000 in the next 12 months.”

- Wrong: “I want to get out of debt.”

Infographic Placeholder: “How to Build a SMARTER Financial Goal”

Alt Text: “Chart breaking down each element of the SMARTER goal-setting framework with examples.”

1.3.5 Case Study 4: How Airbnb Helped Us Fund Our Dreams

In 2015, when I was admitted to Oxford’s Saïd Business School, I faced a challenge: how to fund an expensive full-time international MBA while maintaining our financial responsibilities back home in Silicon Valley.

Since I wasn’t going to earn an income during my studies, my partner and I looked at our options. We decided to turn our home into an Airbnb. What began as a temporary solution ended up exceeding our expectations. The Airbnb income not only covered our mortgage payments but also generated enough extra cash flow to help with day-to-day expenses while I was abroad.

But our story didn’t end there.

After I completed my MBA, my partner pursued his own dream: a doctorate degree in Colombia, which meant two and a half years away from home. We continued to run our house as an Airbnb to sustain our finances.

To make it work even better, I chose to downsize my own lifestyle. I moved into one of the rooms at our best friend’s house—just seven minutes away from our Airbnb property. Sharing the home allowed me to keep operating the Airbnb smoothly while significantly reducing personal living costs.

This experience taught me:

Financial planning isn’t just about earning more—it’s about using what you already have, creatively and flexibly, to unlock opportunities for both you and your loved ones.

By thinking differently about our resources, we were both able to pursue life-changing educational goals without financial ruin. Our Airbnb didn’t just fund my Oxford journey—it continued to support our family’s ambitions, showing that with smart planning and a little courage, even big dreams are possible.

1.3.6 Common Goal-Setting Pitfalls

Let’s be real—setting goals isn’t the hard part. Sticking to them is.

Here are some common mistakes I’ve made (so you don’t have to):

-

- Trying to do too much at once

Focus on 2–3 solid goals, not 10 vague ones. - Setting goals that belong to someone else

Wanting to “buy a house” because everyone else is doing it is a recipe for resentment. - Forgetting the emotional side

If your goal doesn’t light a spark in you, it’s probably not going to survive the hard months. - Not tracking progress

Use apps, journals, or even visual charts. Progress = motivation.

- Trying to do too much at once

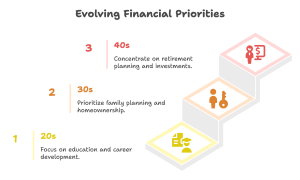

1.3.7 Aligning Goals with Life Stages

Financial goals shift as you evolve. Let me break down how mine changed over time:

-

- Early 20s (Survival & Setup):

- Goal: Build credit, create a budget, avoid overdrafts.

- Late 20s (Growth & Expansion):

- Goal: Invest in property, increase income, save for grad school.

- Early 30s (Transformation):

- Goal: Pivot career, complete MBA, build passive income.

- Late 30s (Family & Legacy):

- Goal: Provide for kids, plan for education, estate planning.

- Early 20s (Survival & Setup):

Each phase demanded different focus, habits, and tools. But they were always rooted in what I valued at that moment.

And that’s what you have to ask yourself:

“What do I care about right now? What would feel amazing to accomplish 12 months from today?”

Start there.

1.3.8 Don’t Be Afraid to Dream Big—Then Budget Small

One of the biggest lies about money is that you have to “lower your expectations.”

I disagree.

Dream as big as you want—just break it into steps.

You want to start your own business? Great. What would it cost? How long to save? What skills do you need?

Want to buy a home in five years? Cool. What down payment can you reasonably save by then?

Big dreams require big clarity. But they’re never out of reach if you move toward them on purpose.

And sometimes, dreams surprise you. I never thought I’d own property in Puerto Vallarta. Or raise children as a single gay man. Or host people from around the world in homes I redesigned with my own hands.

But each dream began with a goal. And each goal began with a decision.

1.3.9 The Financial Life Cycle – Where Are You Now?

Here’s something nobody told me when I was younger:

Your financial goals should evolve as you do.

Life has stages. And each one brings its own priorities, pressures, and possibilities. Planning is not about locking into one path—it’s about adjusting with grace.

In your 20s:

-

- Build credit

- Learn to budget

- Start saving, even if it’s just $10/month

- Live below your means (yes, really)

In your 30s:

-

- Grow your income

- Pay down debt

- Invest in your education, career, or business

- Begin long-term investing

- Protect yourself (insurance!)

In your 40s and beyond:

-

- Diversify your income

- Plan for children’s needs (if applicable)

- Focus on retirement, real estate, and legacy

- Reassess goals—what do you want the second half of life to look like?

Infographic Placeholder: “The Financial Life Cycle”

Alt Text: “Timeline showing financial goals and priorities for your 20s, 30s, 40s, and beyond.”

Planning is about movement, not perfection. The point isn’t to rush to the next stage—it’s to walk into it prepared.

Final Reflection

Goals aren’t just about money. They’re about the life you want, the person you’re becoming, and the legacy you’re building—whether that’s for your family, your community, or just yourself.

Let your goals reflect your truth.

Not what’s trending. Not what your parents expect. Not what TikTok sells you.

Because the only financial plan worth following…

is the one that leads you home—to the life you really want.

1.4 Careers and Income: Don’t Just Chase the Paycheck

1.4.1 Money Follows Meaning (Not the Other Way Around)

Let’s talk about work. Or more specifically, why we work.

Most of us start working out of necessity. Rent is due. Groceries don’t buy themselves. And honestly, that first paycheck—no matter how small—feels like a golden ticket. You’re finally earning your own money.

But somewhere along the way, a weird pressure creeps in. Suddenly, it’s not enough to have a job—you need the perfect job. The one that pays six figures, comes with a corner office, and impresses strangers on LinkedIn.

Here’s a truth I had to learn the hard way:

A high salary doesn’t always mean high satisfaction.

And more importantly: your income is only part of your wealth. The rest is made up of time, energy, freedom, values, and peace of mind.

1.4.2 Case Study 5: Leaving the Bay Area to Focus on Family and Freedom

One of the best parts of my full-time corporate job was the global travel. For several years, I traveled extensively—exploring new countries, building international teams, and enjoying company-sponsored trips that made work exciting. It extended my professional enthusiasm for a while.

But over time, even that lifestyle started to feel empty. Constant travel meant constant absence from home. The excitement faded, and I realized that what I truly wanted wasn’t another flight or hotel upgrade—it was presence.

So, I made the choice to step away from my corporate role and move away from the Bay Area. Instead of pursuing promotions, I dedicated my time to:

- Being with my children more deeply and fully

- Growing my passive income streams

- Exploring opportunities in home hospitality and related ventures

It wasn’t an impulsive move; it was a natural evolution of my priorities. I wanted to build something meaningful, and that meant designing my life around family, flexibility, and personal values—not just professional achievements.

Lesson: Work can give you freedom, but freedom means little if it takes you away from what matters most. Build a life that supports your values, not just your résumé.

1.4.3 Income Isn’t Just About the Number

When students think about income, they often ask, “What job pays the most?” It’s a valid question—but incomplete.

Here’s a better one:

“What job pays me well and fits the life I want to build?”

Because income isn’t just the dollar amount. It’s:

-

- Stability: Will the job survive an economic downturn?

- Flexibility: Can I work remotely or part-time if needed?

- Growth potential: Can I gain skills that make me more valuable over time?

- Benefits: Health insurance, paid time off, retirement plans—those add up.

- Cost of living: Earning $60K in a low-cost city can feel richer than $120K in San Francisco.

Real tip:

Use online tools like Glassdoor or the U.S. Bureau of Labor Statistics to research average salaries for your field—and compare that to cost of living in your area.

1.4.4 Case Study 6: Why Passive Income Became My Stability Anchor

My San Francisco property wasn’t my first, but it became a central part of my financial life. It was our primary home, not an investment property at first. But I discovered its potential when we needed flexibility.

As we pursued other goals, I turned to Airbnb to help cover our mortgage. It wasn’t effortless—I still had to manage guests, maintenance, and logistics. But the beauty of it was choice. I could control when to host, when to take breaks, and how to balance it with family life.

This flexibility allowed me to focus on the parts of life that truly mattered:

- Being present for my children

- Supporting my family through evolving life stages

- Pursuing my personal growth and future projects

Passive income isn’t magic, but it is empowering. It gives you breathing space to live intentionally.

Lesson: Passive income offers freedom—not from work, but from rigidity. It lets you live and work on your terms.

1.4.5 The Role of Career in Financial Planning

Your career is one of the most powerful tools in your financial toolbox. It determines:

-

- How much you can save

- How soon you can invest

- What lifestyle you can afford

- How quickly you can hit your goals

But that doesn’t mean you should chase titles just for the resume. I’ve met broke lawyers and rich plumbers. Stressed-out tech executives and joyful schoolteachers.

The difference? Alignment.

When your career matches your energy, your goals, and your values—you don’t burn out. You build.

1.4.6 How to Make Career Decisions That Support Your Financial Goals

When evaluating a job or career path, ask yourself:

-

- Does this job give me skills I can monetize later?

- Is the income enough to meet my basic financial goals?

- What’s the long-term earning potential, not just the starting salary?

- Will this job drain my energy—or feed it?

You can also think in phases. Your early 20s might be about gaining experience. Your 30s about earning and saving aggressively. Your 40s about diversifying income. Your 50s about scaling back or shifting toward purpose.

Each phase is valid—as long as it supports the life you’re designing.

Infographic Placeholder: “How Career Choices Shape Financial Trajectories”

Alt Text: “Timeline showing how career decisions impact income, savings, and lifestyle over decades.”

1.4.7 Common Myths About Careers and Money

Let’s debunk a few myths I’ve encountered:

-

- “I have to love my job.”

Nope. You have to like it enough to show up—and have a plan for what comes next. - “More degrees = more income.”

Not always. Some certifications or experience pay more than a master’s degree. - “If I make more, I’ll be rich.”

Only if you spend less than you earn. Income means nothing if your expenses grow with it. - “I’m stuck in this career.”

Never. I pivoted from engineering to product to hospitality. The only thing fixed is your mindset.

- “I have to love my job.”

Final Reflection

Work is important. It funds your dreams, supports your goals, and helps you build a life. But it’s not your life. It’s a tool—not an identity.

Design your career like you’d design a home:

with intention, flexibility, and room to grow.

And remember: the best job isn’t the one with the biggest paycheck. It’s the one that gives you the resources, energy, and time to live a life that feels like yours.

So don’t just chase the paycheck.

Chase alignment.

Chase peace.

Chase you.

1.5 Lessons from Economic Chaos – What Crisis Taught Me About Money

1.5.1 The Myth of Stability

When I was in my twenties, I believed in something I now know is a myth: financial stability is permanent.

I thought that once I earned a certain salary, got promoted enough times, and had a good savings account, I’d be “safe.” That belief lasted until the 2008 financial crisis, when markets collapsed, companies froze hiring, and people I admired—people smarter and more experienced than me—were losing everything.

I kept my job. But something shifted in me. I realized that the economy doesn’t care how good you are at your job, or how many hours you work. Crises don’t ask for permission.

And yet… you can prepare for them.

That’s what this section is about: the practical and emotional lessons I’ve learned from moments when the world flipped upside down—and how they shaped the way I think about money, security, and resilience.

1.5.2 Case Study 7: Flexibility During Crisis—Airbnb and COVID-19

When the pandemic hit, our Airbnb bookings dropped to zero for several months. It was an uncertain time, but because we still had a full-time income and had prepared financially, we didn’t panic.

Instead, we took the opportunity to enjoy our home ourselves. We reopened the space for friends and family, turning it into a gathering place filled with memorable moments.

When travel restrictions eased, we quickly adapted:

- We implemented enhanced cleaning protocols

- We ensured our space met the new safety standards

- We resumed hosting guests and let Airbnb continue to cover our property expenses

The experience reinforced the importance of flexibility. Even in uncertain times, having a plan and staying adaptable allowed us to navigate the crisis without fear.

Lesson: Flexibility is your best defense in uncertain times. With preparation and adaptability, you can turn challenges into opportunities.

1.5.3 What Every Crisis Teaches (If You’re Willing to Listen)

Here’s what I’ve learned, not just from 2008 or COVID, but from every economic upheaval I’ve witnessed:

-

- Cash is king.

Having liquid savings—an emergency fund—can mean the difference between inconvenience and disaster. Most experts recommend 3 to 6 months of living expenses. I prefer 9. - Lifestyle inflation is dangerous.

When your income goes up, it’s tempting to upgrade everything. Don’t. I’ve seen people making $200K living paycheck to paycheck. Meanwhile, someone earning $60K with low expenses can weather storms better. - Diversify your income.

Don’t rely on just one paycheck. Side hustles, rental income, freelance work, or investments can serve as financial cushions when one stream dries up. - The market always changes.

Booms don’t last. But neither do crashes. The goal isn’t to time the market—it’s to survive it.

- Cash is king.

1.5.4 Case Study 8: The Quiet Recession No One Warned Me About

Not every crisis comes from the headlines. Some creep in quietly, while life on the surface seems fine.

Right after my MBA, I accepted a great job offer—at least on paper. The pay was solid, the title looked impressive on LinkedIn, and the role checked all the boxes of what I thought I wanted in my career.

But as weeks turned into months, something felt off.

It wasn’t dramatic burnout or some huge breakdown. It was more like a slow realization: my day-to-day life didn’t feel fulfilling. Even with the steady income and professional recognition, I felt disconnected from what actually mattered to me. My energy was drained, not because of the workload, but because I couldn’t see a meaningful direction in what I was doing.

This wasn’t a “poor me” situation. I was grateful for the job and the security it brought. But deep down, I recognized that something was missing. And I think a lot of people feel this way at some point—whether you’re making minimum wage or six figures.

That’s when I started to listen to the quieter voice inside.

The one that said:

“Maybe there’s more to life than just climbing the next rung of the career ladder.”

I didn’t quit overnight. I started by reflecting on what gave me energy outside of work: real estate, design, hospitality, and eventually, raising my children. Slowly, I began to shift my focus toward these passions, building side income streams and planning for a transition that felt more authentic.

This experience taught me something no salary or promotion could:

A crisis doesn’t have to be external to be real.

Internal misalignment can quietly erode your well-being and your financial future, if you ignore it.

It’s a lesson I carry with me, and one I hope you remember too: financial success is important, but so is living in alignment with your values. Both matter.

1.5.5 Practical Tools to Crisis-Proof Your Financial Life

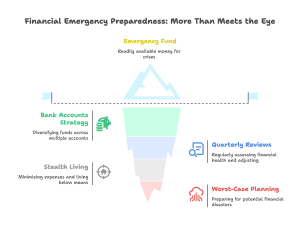

Let’s get tactical for a moment. Here are concrete things I do now, based on lessons from past chaos:

I review my financial plan quarterly.

Things change fast. A regular check-in lets me course-correct early.

I keep three bank accounts:

-

- One for essentials (bills, rent, groceries)

- One for short-term goals (travel, gifts, repairs)

- One for long-term wealth (investments, emergency fund)

I run “worst-case drills.”

Once a year, I ask: What if I lost 80% of my income tomorrow? What would I cut? What would I keep? How would I earn again?

I practice “stealth living.”

Just because I can afford something doesn’t mean I flaunt it. I’d rather be quietly stable than loudly stressed.

Infographic Placeholder: “Crisis-Proofing Your Finances: 5 Smart Habits”

Alt Text: “Checklist with five practical financial habits that prepare you for economic instability.”

1.5.6 Common Myths About Financial Crisis

Let’s clear up some false ideas:

-

- “Only poor people struggle during a crisis.”

- Nope. I’ve seen high earners go broke because their expenses were too high and their plan too thin.

- “It’s too late to prepare.”

- Never. Every small step counts. Starting today is always better than starting never.

- “If I work hard enough, I’ll be protected.”

- I wish it worked that way. But external forces—pandemics, layoffs, inflation—don’t care how many hours you put in. Planning protects you. Not hustle alone.

- “Investing during chaos is a bad idea.”

- Not necessarily. Some of the best opportunities arise when others are panicking. But only if you have a stable base first.

- “Only poor people struggle during a crisis.”

The 10 Principles That Shape Every Smart Financial Life

Reflections from experience, rewritten from Keown’s foundational model

You don’t need to memorize all these at once. But over time, they’ll shape your instincts. They’ve shaped mine.

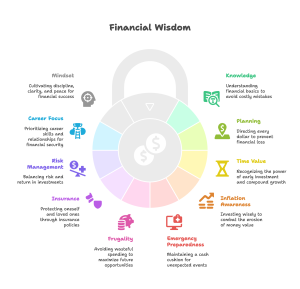

-

- The Best Protection is Knowledge

You don’t have to be a money expert. But knowing the basics will keep you from signing contracts you don’t understand or making emotional decisions with long-term consequences. - Nothing Happens Without a Plan

Money disappears when it doesn’t have a job. Every dollar needs a direction—otherwise, it vanishes. - Time is More Valuable Than Money

Start early. Compound growth is real—and powerful. Even $20/month makes a difference over decades. - Inflation Eats Lazy Money

If your cash sits in a savings account earning 0.01%, you’re losing money every day. Learn to invest wisely. - Stuff Happens. Be Ready.

Emergencies aren’t if, they’re when. Cars break. People get sick. Keep a cash cushion—and your peace of mind. - Waste Not, Want Not

Every peso, dollar, or yuan you waste is a future opportunity delayed. Spending is fine. Thoughtless spending isn’t. - Protect Yourself and Your Loved Ones

Insurance isn’t sexy, but it’s vital. Health, disability, life—protect the life you’re building. - Risk and Return Go Together

High returns come with risk. Don’t chase gains without understanding the downside. Fear and greed are expensive teachers. - Your Career is Your Greatest Asset

Not your house. Not your crypto. Your skills, adaptability, and relationships are what will fund your future. - Mindset Matters Most

Discipline beats income. Clarity beats hustle. Peace beats status.

- The Best Protection is Knowledge

Which of these hit home for you? Circle one. Write it down. Let it guide your week.

Final Reflection

Crisis has a way of stripping everything down to its essentials. What matters. What lasts. What supports—not just your lifestyle, but your well-being. I don’t fear chaos anymore. I respect it. Because every storm I’ve faced has taught me this:

Financial peace isn’t about avoiding turbulence—it’s about building a vessel strong enough to sail through it.

Prepare. Adapt. Stay humble. And never stop learning. Because the economy might not always make sense. But your response to it can.

Key Takeaways

- Financial Planning Is a Lifelong Process

It’s not something you do once—it’s a habit. Evaluate, plan, act, and adjust regularly. - The Five Steps Keep You Grounded

Assess your current state, define your goals, build a plan, implement it, and review often. - Goals Drive Direction

Without clear goals, money has no purpose. SMARTER goals connect your values to your behavior. - Your Career Is a Financial Engine

Job choices affect not just income, but freedom, stress levels, and future opportunities. - Money Without Meaning Leads to Burnout

High income alone won’t bring stability—alignment and clarity will. - Crisis Is the Ultimate Financial Stress Test

How you prepare for and respond to crisis determines whether you survive or grow from it. - The 10 Principles Are Your Compass

From building an emergency fund to understanding risk and time, these rules help you stay on course.

Exercises

Conceptual Questions

- Defining Financial Planning

In your own words, what is financial planning? Why is it about more than just budgeting or investing? - The Five-Step Planning Process

List and briefly describe the five steps of the financial planning process. Which step do you think is the most difficult for most people, and why? - Goals with Direction

Explain the SMARTER goal-setting framework. Rewrite the following vague goal into a SMARTER one:

“I want to save money for a trip someday.”

- The Role of Emotions in Money

Why is it important to recognize the emotional side of money when building a financial plan? Provide an example from your own life or from Kevin’s stories. - Financial Identity and Career Choices

How can your personal values and goals influence the kind of career you choose? Why might “chasing the highest paycheck” not always be the best move? - Crisis and Financial Resilience

How did Kevin’s financial habits help him during the COVID-19 crisis? What lessons from this situation apply to your own life? - Ten Principles Check-In

Pick two of the ten principles from the end of the chapter that resonate with you the most. Why? How could you begin applying them this month?

Scenario-Based Problems

- From Panic to Planning

After losing their job unexpectedly, Luis realizes they haven’t tracked expenses in months and have no emergency fund.

-

- Using the five-step planning process, outline how Luis could rebuild their financial health.

- What short-term goals should come first?

- Smart Goal or Not?

Here are three financial goals. Identify which ones meet the SMARTER criteria and rewrite any that don’t:

-

- “I want to retire early.”

- “I’ll save $1,000 in 5 months by reducing weekly spending.”

- “Get rich.”

- The Career Pivot

Kevin left a high-paying tech job to pursue more freedom and purpose.

-

- What risks did he take, and how did he plan for them?

- Imagine you want to pivot careers—what financial steps should you take first?

- Planning Through Chaos

Imagine you manage two rental properties, and a global event suddenly cuts your income by 70%.

-

- What would you do to stay financially afloat in the short term?

- What prior habits would make this transition easier?

-

Life Stage Priorities

Which financial priority best matches each stage of life? Choose the correct answer for each.

- Age 20s

A) Build emergency fund

B) Save for children’s education

C) Plan retirement withdrawals - Age 30s

A) Buy luxury items

B) Start retirement withdrawals

C) Save for children’s education - Age 40s+

A) Start building credit

B) Increase retirement savings

C) Open student loans

- Age 20s

Interactive Challenges

- Steps in Financial Planning – Multiple Choice

- What is the main task in the “Evaluate” step?

A) Create a strategy based on your goals

B) Make the changes and take action

C) Track your current income and expenses

D) Choose clear financial priorities - What happens during the “Set Goals” step?

A) Choose clear financial priorities

B) Implement your budget

C) Pay off all debts

D) Open a savings account - What does “Make a Plan” involve?

A) Check your credit score

B) Create a strategy based on your goals

C) Automate your bills

D) Reduce eating out - What is the focus of the “Implement” step?

A) Write your goals in a notebook

B) Track your progress

C) Make the changes and take action

D) Open a checking account - What is done in the “Review” step?

A) Celebrate and never change anything

B) Check your progress and adjust as needed

C) Pay your taxes

D) Apply for financial aid

- Personal Finance Compass: Which Principle Are You Living By?

Choose one of the ten principles at the end of the chapter.

- Write a short journal entry (4–6 sentences) on how this principle shows up—or is missing—in your current financial life.

- Career Alignment Self-Check

Make a list of:

- What you value most in a job (freedom, income, meaning, location, etc.)

- Your current or ideal career path

Then answer: Does your path support your financial goals and your lifestyle goals? What might need to change?