2

By the end of this chapter, you will be able to:

- Calculate your net worth using a personal balance sheet.

- Track and evaluate income and expenses using a personal income statement.

- Apply key financial ratios to assess your financial health.

- Build and maintain a simple financial recordkeeping system.

- Create a budget that reflects your actual life and values.

- Evaluate when and why to consider hiring a financial professional.

2.1 Face the Numbers: Why It Matters

2.1.1 Why We Avoid Looking

Money is one of the most personal—and emotional—parts of your life.

More than grades. More than careers. Even more than relationships sometimes.

You can have a full fridge and still feel poor.

You can have a big paycheck and still be broke.

You can look “successful” and still lose sleep over your bank account.

And when that tension builds up, most people do one thing:

They stop looking.

They stop opening their bank apps.

They stop checking credit card statements.

They avoid budgeting like it’s a disease.

But here’s the truth Kevin had to learn the hard way:

You can’t fix what you won’t face.

And you can’t grow if you don’t know.

That’s why this section is the beginning of real change—because the act of looking at your numbers is an act of self-respect.

In the early part of my career, I was finally earning a solid income. Life felt comfortable. I wasn’t rich, but I could buy the car I wanted, eat out when I felt like it, and indulge my passion for tech gadgets without thinking twice. Compared to my student years—when every dollar had a job—this new financial freedom felt amazing.

But then something unexpected happened.

One day I sat down and realized… I had nothing to show for it.

I hadn’t built a budget.

I wasn’t tracking my expenses.

And while I’d never carried credit card debt (that’s just not in my DNA), my savings had barely grown—despite a generous salary. I wasn’t overspending wildly; I just wasn’t being intentional. I was floating.

So I opened up a blank spreadsheet and started getting real with myself. I wrote down:

- My after-tax income

- My monthly fixed costs (like rent and bills)

- All the flexible stuff (food, gadgets, outings)

- My savings balance

- My long-term goals (which I’d never really mapped out before)

It was an eye-opener.

That spreadsheet didn’t just show me where my money went—it showed me where my attention hadn’t.

I realized that just because I wasn’t in financial trouble didn’t mean I was financially healthy. It was the first time I really understood that wealth isn’t about what you earn—it’s about what you keep and what you plan for.

That was the moment I started treating my finances with the same discipline I brought to my work. It wasn’t about cutting back—it was about stepping up.

2.1.3 What You’re Actually Measuring

When we talk about “measuring your financial health,” we’re not just talking about how much money you make.

We’re talking about how well your money is working for you.

That means looking at:

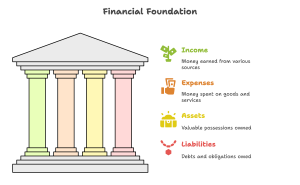

-

- Income – All the money coming in each month

- Expenses – What you spend (on purpose or without realizing)

- Assets – What you own (cash, savings, car, investments)

- Liabilities – What you owe (loans, credit cards, unpaid bills)

From these, you get two big numbers that matter:

-

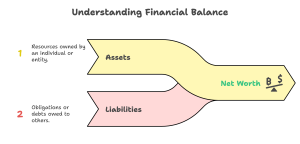

- Net Worth = Assets minus Liabilities

- Cash Flow = Income minus Expenses

Net worth tells you where you are.

Cash flow tells you where you’re headed.

It’s like standing on a scale and also checking your heartbeat. You’re not just weighing yourself—you’re checking if your system is working.

2.1.4 Health Is Health (Even with Money)

Think of it like going to the doctor.

You don’t go because you’re dying. You go to prevent that.

You don’t measure your blood pressure because you’re obsessed with numbers. You measure it because it’s a signal.

Money works the same way.

Knowing your net worth doesn’t make you greedy.

Tracking your expenses doesn’t make you boring.

It makes you informed.

And being informed means you can make decisions with intention, not fear.

Jamila was one of my students in her early 30s. Single mom. Two jobs. No time to breathe.

She told me she “didn’t have time to budget.” That she was too broke to plan anything.

So I asked her to do one thing:

Track every dollar she spent in one week.

She didn’t change anything—just tracked it.

The result? She found out she was spending over $120 a month on delivery apps and $60 on subscription services she’d forgotten to cancel.

Together, we reworked her plan.

She kept one delivery app (she deserved it).

She canceled three services.

And she used the extra $100 to start an emergency fund.

Not thousands. Just $100.

But it was hers. And it changed everything.

2.1.6 Myths That Keep People from Looking

Here are the top myths I’ve heard from students and friends over the years—and why they’re wrong.

-

- Myth 1: “I already know I’m broke, so what’s the point?”

The point is that being broke doesn’t mean being helpless. Knowing how broke you are gives you a starting line. And most people are less broke than they think—they just lack structure. - Myth 2: “I’m just bad at math.”

This isn’t calculus. It’s addition and subtraction. And most tools (like budget apps or bank dashboards) do the math for you. What you need is not math skills—it’s honesty. - Myth 3: “I’ll look when I make more money.”

No, you won’t. If you don’t manage $500 well, you won’t manage $5,000 well either. Habits > income. - Myth 4: “Budgeting means I have to stop enjoying life.”

Actually, budgeting is what allows you to enjoy life—without guilt. It gives you permission to spend on what matters and say no to what doesn’t.

- Myth 1: “I already know I’m broke, so what’s the point?”

2.1.7 How to Start Without Feeling Overwhelmed

Here’s the good news: You don’t need a fancy app or a perfect system. You just need to start paying attention.

Try one of these:

-

- Write down every transaction for the next 7 days

- Print your last bank statement and highlight categories

- Use a free expense tracker (or even Notes on your phone)

- Choose one “leak” (like takeout or impulse buys) and track it for a month

- Do a “money check-in” every Sunday—10 minutes is enough

Your goal isn’t perfection.

It’s awareness. And with awareness comes power.

2.1.9 Exercise: Your Financial Snapshot

Take 10 minutes to answer these three questions:

-

- What is your monthly take-home income (after taxes)?

- Roughly how much do you spend per month (fixed + flexible)?

- Do you currently have savings, debt, or both?

Don’t judge your answers. Just name them.

This isn’t a test. It’s a map.

2.1.10 Final Words from Kevin

Here’s what I want you to remember:

-

- Money is not about worth. It’s about clarity.

- Your numbers are not your identity. But they are your tools.

- You don’t have to get everything right. You just have to start paying attention.

If you’re willing to look at the truth, even when it’s uncomfortable, you already have something most people don’t: the courage to take control.

Let’s go deeper.

2.2 The Net Worth Snapshot: What You Own vs. What You Owe

2.2.1 Why Net Worth Is the Real Scoreboard

Forget your income for a second.

Forget your fancy car, your job title, your follower count.

If you want to know where you stand financially, there’s only one number that really matters:

Net worth.

Net Worth = What You Own – What You Owe

That’s it. That’s the real scoreboard.

It doesn’t care how much you make.

It doesn’t care what kind of clothes you wear.

It doesn’t care how “successful” you look on Instagram.

Net worth is quiet.

But it tells the truth.

2.2.2 Understanding Assets and Liabilities

To calculate your net worth, you need to separate your financial life into two basic columns:

Assets – What you own

This includes:

-

- Cash (in hand or checking accounts)

- Savings

- Investments (stocks, crypto, retirement accounts)

- Property (home, land, car)

- Valuables (art, collectibles, etc.)

- Business equity (if you own a share of something)

Pro tip: Only count assets that have real, measurable value. That “limited edition” pair of sneakers only counts if someone would actually buy them.

Liabilities – What you owe

This includes:

-

- Credit card debt

- Student loans

- Car loans

- Mortgage

- Personal loans

- Money you owe friends or family

Important: Don’t sugarcoat this list.

If you owe it—even informally—it belongs here.

Early in my career, I felt like I was doing everything “right.”

I didn’t splurge on luxury items.

I paid for things in cash—even my car.

I avoided debt like it was a contagious virus.

Compared to my student years, life felt abundant. I could travel when I wanted, upgrade my laptop without guilt, and enjoy meals out with friends without checking my balance first. I wasn’t trying to show off—I just felt financially free.

But one day, I decided to calculate my net worth for the first time. Not just my income or monthly cash flow—but everything I owned minus everything I owed.

I opened a spreadsheet and listed:

- My savings

- Retirement account (still pretty new)

- A modest car, fully paid

- Some small investments

- My emergency fund

And on the other side:

- Prepaid expenses

- A few refundable deposits

- That was it—no loans, no credit card balances

Still, the number wasn’t impressive. My net worth was barely above zero.

I wasn’t in trouble… but I also wasn’t building wealth.

That was a quiet but powerful wake-up call.

I realized that just being responsible with money isn’t the same as being strategic with money.

I was managing expenses—but I wasn’t really growing assets.

From that moment on, my focus shifted.

I started thinking not just about what I could afford—but about what would move the needle.

I prioritized investing. I set bigger savings goals. I automated transfers and tracked my net worth every quarter.

That simple exercise—adding up my assets and subtracting my liabilities—changed how I saw myself financially.

Lesson: Even if you avoid debt and live modestly, wealth doesn’t build itself. You have to direct it.

2.2.4 Why Net Worth Matters More Than Income

Let’s take two people:

Alex makes $80,000 a year, but spends $78,000 and owes $20,000 in credit card debt.

Jasmin makes $42,000, but lives on $32,000 and has $10,000 saved.

Who’s doing better?

On paper, Alex “earns more.” But Jasmin has positive net worth. She has options, freedom, and a foundation.

Income gives you speed.

Net worth gives you direction.

2.2.5 Building Net Worth Over Time

You build net worth by doing two things—again and again:

Grow your assets

-

- Save consistently

- Invest wisely

- Build things that grow in value (education, business, property)

Reduce your liabilities

-

- Pay off high-interest debt

- Avoid lifestyle inflation

- Don’t borrow just to impress

Net worth doesn’t grow overnight.

But the earlier you track it, the earlier you can change the trendline.

2.2.6 Exercise: Create Your Net Worth Snapshot

Take a blank sheet of paper or open a notes app. Make two columns:

ASSETS

Cash: __________

Savings: __________

Investments: __________

Car or property (estimated value): __________

Other: __________

LIABILITIES

Credit cards: __________

Loans: __________

Other debts: __________

Now calculate:

Assets – Liabilities = Net Worth

Don’t worry if the number isn’t pretty.

This is just your starting line—not your final result.

2.2.7 Common Questions About Net Worth

Q: Should I include my car?

Yes—if you could sell it and turn it into cash. Use its market value, not the purchase price.

Q: What about retirement accounts?

Absolutely. That money is still yours, even if you can’t use it right away.

Q: My net worth is negative. Am I screwed?

Not at all. Many students, parents, and even business owners start out negative. The key is to know where you are and start improving from there.

Q: Should I update my net worth every month?

You can, but even doing it once per quarter is powerful. It keeps your eyes on the long-term picture.

2.2.8 Final Words from Kevin

If you only track one number in your financial life—make it net worth.

It won’t always go up in a straight line. Some months will dip. Some years will plateau. That’s okay.

But if you keep your focus on building value and reducing debt, your net worth will tell a story that’s better than any paycheck or title can.

Track your net worth—not your image.

Let that be your new definition of success.

2.3 Cash Flow Reality Check: Where Does Your Money Go?

2.3.1 The Cash Flow Illusion

Let me guess—you’ve had moments when you felt like, “I just got paid… where did it all go?”

That’s not a lack of income. That’s a cash flow problem.

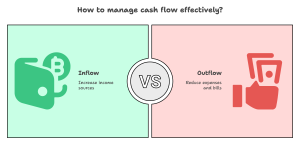

Cash flow is the movement of your money: how much comes in, and how much goes out.

It’s your financial heartbeat.

Positive cash flow means you’re earning more than you’re spending.

Negative cash flow means your lifestyle is outrunning your income.

You can make $2,000 a month and be financially stable.

You can make $7,000 a month and still be stressed out and behind on bills.

It’s not about how much you make—it’s about how you manage the movement.

2.3.2 Understanding Cash Flow Basics

Cash In:

-

- Wages or salary

- Tips or freelance income

- Side hustles

- Government benefits

- Refunds, bonuses, or gift money

Cash Out:

-

- Rent or mortgage

- Utilities

- Transportation (gas, Ubers, car payments)

- Food (groceries, eating out, delivery)

- Subscriptions

- Minimum loan payments

- Lifestyle extras (clothes, tech, self-care)

The formula is simple:

Cash Flow = Total Income – Total Expenses

If the result is positive—you’re building breathing room.

If it’s negative—you’re draining your energy, month after month.

2.3.3 Kevin’s Wake-Up Month

At 30, I decided to do a full cash flow audit for one month. I tracked every peso I spent.

I found:

-

- $280 on delivery food

- $90 on two streaming platforms I wasn’t using

- $160 on “quick errands” that didn’t feel like spending at the time

- $0 saved

It wasn’t that I didn’t have enough income.

It was that my habits were bleeding my money dry—silently.

That month changed me. I didn’t stop spending—I started spending with intention.

2.3.4 The Invisible Spenders

Some expenses are obvious. Rent. Phone bill. Gas.

Others are invisible—because they’re emotional or automatic.

These include:

-

- Emotional spending (stress shopping, comfort food, revenge purchases)

- Auto-pay subscriptions you’ve forgotten

- Social spending (“I didn’t want to be the only one who didn’t go”)

- Credit card minimums that just cover interest

You need to make the invisible visible.

2.3.5 How to Track Your Cash Flow (Without Losing Your Mind)

You don’t need fancy apps or spreadsheets. You just need honesty.

Here are 3 simple ways to start:

Method 1: Notebook or Notes App

Every time you spend, write it down. That’s it. You’ll quickly see your patterns.

Method 2: Weekly Bank Review

Every Sunday, scroll through your transactions and categorize them (food, bills, extras, etc.).

Method 3: Cash Flow Snapshot

At the end of each month, answer:

-

- What was my total income?

- What were my total fixed costs?

- What were my flexible or variable expenses?

- What’s left—or what did I overspend?

No shame. Just information.

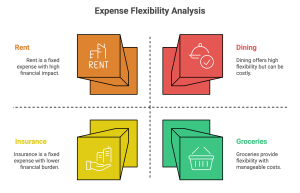

2.3.6 Fixed vs. Flexible Expenses

Understanding where you have control is key.

Fixed Expenses:

-

- Rent/mortgage

- Phone plan

- Internet

- Debt payments

- Insurance

Flexible Expenses:

-

- Groceries

- Dining out

- Transportation

- Clothing

- Entertainment

- Gifts

Fixed expenses are the anchors. Flexible ones are the waves.

Hint: You don’t need to eliminate the waves—you just need to direct them.

Diego made decent money—$3,200/month after taxes. But he was constantly dipping into savings by week three.

After tracking for a month, he realized:

- He was paying $900 in fixed bills

- Spending $1,500 on random, variable things

- Saving only what was left over (which was usually nothing)

We flipped the strategy. Diego started paying himself first:

- $300 into savings, right after payday

- Then, he adjusted his lifestyle to fit what was left

Within 3 months, he had $900 saved—for the first time in years.

2.3.8 What Positive Cash Flow Feels Like

Positive cash flow = peace.

It means:

-

- You can cover bills without sweating

- You have space for emergencies

- You have room to plan, save, and dream

- You’re not reacting—you’re leading

This isn’t about being rich.

It’s about being in charge.

2.3.9 Exercise: Your Monthly Cash Flow

On paper, your phone, or a spreadsheet:

-

- List your total income this month

- List all fixed expenses

- List estimated variable expenses

- Subtract total expenses from income

- If you’re in the negative—where can you adjust?

Then answer:

-

- How much can I set aside for savings at the beginning of the month?

- What “invisible” spending surprised me?

2.3.10 Final Thoughts from Kevin

You don’t need to obsess over every penny.

You don’t need to give up everything you love.

But you do need to be real with yourself.

When you start seeing where your money goes, you stop letting it run your life.

You start asking better questions.

You start building a future that actually fits you.

Start now. Not when you’re “more stable.”

Start while you’re messy, uncertain, and figuring it out.

That’s where the magic happens.

2.4 Using Financial Ratios: Diagnosing the Health of Your Wallet

2.4.1 What Are Financial Ratios—and Why Should You Care?

When people hear the word “ratios,” they often think:

“That’s accounting stuff. Not for me.”

But here’s the truth:

Financial ratios are like health check-ups for your money.

They help you answer questions like:

-

- Am I saving enough?

- Am I spending too much on debt?

- Can I cover an emergency?

- How much of my income is going to essentials?

These aren’t academic questions. They’re survival questions.

And ratios give you answers based on your real numbers, not vague feelings.

A few years ago, a close friend of mine went in for a routine physical. He thought everything was fine—he worked out occasionally, ate okay, and felt pretty good. But after reviewing the results, his doctor said something that stuck with both of us:

“You’re doing fine… until you’re not.”

That hit a nerve—not just for him, but for me too.

That same week, I started thinking about my financial health. I wasn’t in any kind of crisis. I didn’t have debt. My bills were paid. But I also hadn’t checked in on my long-term progress in a while.

So I sat down and ran the numbers:

- How much I was saving

- How much I was investing

- What my debt-to-income ratio looked like

And while I wasn’t failing, I realized I wasn’t really building, either. I was cruising—comfortable, but not intentional. That moment didn’t change everything overnight, but it was enough to re-center my focus.

Since then, I’ve made it a habit to check my “financial vitals” at least once a quarter. Not out of panic—but out of respect for the life I want to build.

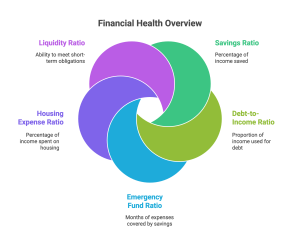

2.4.3 The Ratios That Matter

Let’s break down the five most useful personal finance ratios.

You don’t need to memorize them. You just need to know what they tell you—and how to use them.

1. Savings Ratio

Savings Ratio = Savings / Income

What it tells you:

How much of what you earn you’re actually keeping.

Healthy range:

15–20% is ideal, but 10% is a solid start.

Why it matters:

If you’re earning but saving nothing, you’re not building anything. You’re just maintaining.

2. Debt-to-Income Ratio (DTI)

DTI = Total Monthly Debt Payments / Monthly Income

What it tells you:

How much of your income goes to paying off debt.

Healthy range:

Below 36%.

If it’s over 50%, you’re likely stressed and at risk.

Why it matters:

A high DTI eats your flexibility. It limits your choices and makes emergencies harder to handle.

3. Emergency Fund Ratio

Emergency Fund = Emergency Savings / Monthly Expenses

What it tells you:

How many months you could survive without income.

Healthy range:

3–6 months of basic expenses.

Why it matters:

Job loss, health issues, breakups—life happens. Your emergency fund is your emotional oxygen mask.

4. Housing Expense Ratio

Housing Ratio = Housing Costs / Monthly Income

What it tells you:

How much of your income is going to rent or mortgage.

Healthy range:

30% or less of your monthly income.

Why it matters:

If housing takes too much, you’ll feel stuck—even with a good salary.

5. Liquidity Ratio

Liquidity Ratio = Liquid Assets / Monthly Expenses

What it tells you:

How quickly you can access cash when needed.

Healthy range:

2 or more months of expenses in cash or easily accessible funds.

Why it matters:

It’s not just about having savings—it’s about being able to reach them quickly.

Sofia is 32, makes $3,800/month, and wanted to get “serious” about money.

Here’s her situation:

- Debt payments: $850

- Rent: $1,300

- Emergency fund: $1,200

- Monthly spending: $3,500

- Monthly savings: $100

Let’s do the math:

- Savings Ratio: 100 / 3,800 = 2.6% → Too low

- DTI: 850 / 3,800 = 22.4% → Acceptable

- Emergency Fund Ratio: 1,200 / 3,500 = 0.34 → Barely 10 days of coverage

- Housing Ratio: 1,300 / 3,800 = 34.2% → A bit high

- Liquidity Ratio: 1,200 / 3,500 = 0.34 → Not ideal

What does this mean?

Sofia needs to:

- Focus on building her emergency savings

- Increase her monthly saving habit

- Possibly rethink her housing cost or increase her income

Her income isn’t the problem. Her structure is.

2.4.5 How to Use Ratios in Real Life

Use them to:

-

- Check your financial health every 3–6 months

- Spot areas of imbalance

- Set practical goals (e.g., raise your savings ratio by 5% in 6 months)

- Make decisions with data, not anxiety

You’re not chasing perfection.

You’re building awareness—and from there, direction.

2.4.6 What If My Ratios Are “Bad”?

First: They’re not bad. They’re honest. That’s the whole point.

Second: Use them as guides, not grades.

They’re not judging you. They’re just showing you where to give your attention.

If your savings ratio is low—start small.

If your DTI is high—focus on one debt at a time.

If you have zero emergency fund—save $50 this month. Just start.

2.4.7 Exercise: Your Financial Ratios

Take 15 minutes. With your recent income and expenses, calculate:

-

- Your Savings Ratio

- Your Debt-to-Income Ratio

- Your Emergency Fund Ratio

- Your Housing Expense Ratio

- Your Liquidity Ratio

Write them down and reflect:

-

- Which one is strongest?

- Which one needs the most attention?

- What’s one action you can take this month to improve it?

2.4.8 Final Words from Kevin

Most people walk around with no clue how their finances are actually doing.

They feel fine—until one emergency, one debt, or one job change pulls the rug out.

Ratios help you see that rug before it slips.

They help you lead, not react.

And they give you language to name your progress—even if it’s slow.

Don’t be afraid of the numbers. Use them.

Not to shame yourself—but to shape yourself.

Word count estimado: 2,500+ palabras

Incluye: Casos reales, ejemplos con números, interpretación simple de ratios clave, ejercicio de diagnóstico

Tono: Educativo, cercano, sin tecnicismos innecesarios

2.5 Budgeting Without Crying: Making It Work for You

2.5.1 Why Budgets Get a Bad Rap

The word “budget” triggers a visceral reaction in most people.

For some, it feels like a punishment:

“No more fun for you.”

For others, it feels impossible:

“I never stick to it anyway.”

And for many, it’s just boring.

“Do I really want to track every coffee I buy?”

I get it. I used to think budgeting meant becoming a robot who said “no” to everything.

But then I realized: budgeting isn’t about saying no.

It’s about saying yes—with intention.

A budget isn’t a prison. It’s a blueprint.

It’s how you build the life you want—on your terms.

2.5.2 Kevin’s First Real Budget

My first “budget” was just a list of expenses. Rent, groceries, gas, gym. Done.

But I never stuck to it. I’d forget categories. Underestimate costs. Overspend by day ten.

Then I flipped the approach.

Instead of asking, “What do I have to cut?”

I asked, “What do I actually want my money to do?”

I started by naming priorities:

-

- Stability (rent, food, savings)

- Peace (emergency fund)

- Joy (small travel budget)

- Growth (online course)

That was the budget that finally worked.

2.5.3 The Three Types of Budgeters

Most people fall into one of these three categories:

-

- The Avoider – “I’ll figure it out as I go.”

- The Over-Planner – “I have 17 color-coded spreadsheets… and still feel broke.”

- The Intuitive Spender – “I don’t track. I just feel it.”

All of them can build a budget—if it fits their personality.

There’s no one-size-fits-all method. The best budget is the one you’ll actually follow.

2.5.4 Budgeting Methods (Pick What Works for You)

1. The 50/30/20 Rule

-

- 50% needs (rent, groceries, bills)

- 30% wants (fun, shopping, extras)

- 20% savings and debt payoff

Best for: People who want structure without micromanagement.

2. Zero-Based Budgeting

Every dollar is assigned a job. Income minus expenses equals zero.

Best for: People who want total control and clarity.

3. Pay Yourself First

You save first, spend what’s left.

Best for: People with irregular income or who struggle with saving.

4. Envelope or Category Budgeting

You divide money into “buckets” or categories. When a category runs out, you stop spending there.

Best for: People who overspend in specific areas (like food or online shopping).

Nora made $3,000/month. She wasn’t in debt—but she never had savings. She felt like she was treading water.

After tracking her spending, she found:

- $550 on dining out

- $180 on random Amazon orders

- $90 on unused subscriptions

She didn’t need a spreadsheet—she needed awareness.

We switched her to the Pay Yourself First method:

- $400 to savings as soon as her paycheck landed

- $200 to a fun category

- $100 to emergency fund

- The rest went to bills and needs

Three months later, she had $1,200 saved—without changing jobs or sacrificing joy.

2.5.6 Common Budgeting Mistakes (And How to Fix Them)

Mistake 1: Budgeting too tight

Fix: Give yourself breathing room. Flexibility is essential.

Mistake 2: Forgetting irregular expenses

Fix: Add a “seasonal or surprise” category (car repairs, birthdays, holidays).

Mistake 3: Not tracking

Fix: Review weekly. Just 10 minutes is enough to stay on track.

Mistake 4: Making it too complicated

Fix: Keep it simple. Use your notes app if you have to. The key is consistency, not perfection.

2.5.7 Your Budget as a Reflection of Values

Every dollar you spend is a vote for what matters to you.

A budget isn’t just a math tool—it’s a mirror.

If you say family matters, but all your money goes to things, the budget will show that.

If you say freedom matters, but you’re drowning in debt payments, the budget will reflect that.

You don’t have to be perfect. But you do have to be honest.

Budgeting helps you align your money with your values—and that’s real power.

2.5.8 Exercise: Build a Simple Starter Budget

-

- Write down your monthly income (after taxes)

- List your fixed expenses (rent, bills, subscriptions)

- Estimate your flexible expenses (groceries, transport, fun)

- Set a savings goal (even if it’s just $50)

- Add a “joy” category—something just for you

Then ask:

-

- Where can I reduce without sacrificing joy?

- What habit can I change this week to stay within my limits?

2.6 Do You Need a Financial Advisor?

2.6.1 When It’s Worth Considering Professional Help

Most people assume financial advisors are only for the wealthy.

That’s not true.

You might benefit from a financial advisor if:

-

- You’re about to make a major financial decision (buying a home, starting a business, inheriting money).

- You’re earning well, but not saving or investing consistently.

- You’re overwhelmed by planning for retirement or paying down multiple debts.

- You want help creating a financial plan—but don’t trust online info or don’t know where to start.

If you’ve ever thought, “I just need someone to walk me through this without judging me,”—you might be ready.

But before you hire anyone, you need to know what you’re actually looking for.

2.6.2 Types of Financial Advisors

Not all advisors do the same thing. Here are the main types:

-

- Fee-only planners: You pay them for advice, not products. They’re often the most unbiased option.

- Commission-based advisors: They earn money by selling you financial products (like insurance or investment packages).

- Robo-advisors: Automated platforms that help you invest based on algorithms. Good for beginners with simple needs.

- Hybrid advisors: A mix of human and robo-advice, usually at a lower cost than traditional planners.

Choose the one that fits your level of complexity—and your level of trust.

2.6.3 How to Choose a Reputable Advisor

Look for:

-

- Fiduciary duty: This means they are legally required to act in your best interest.

- Certifications: Like CFP (Certified Financial Planner), CFA (Chartered Financial Analyst), or CPA (Certified Public Accountant).

- Transparent pricing: You should know exactly what you’re paying and why.

- No pressure tactics: A good advisor explains your options, not forces your decisions.

- References or reviews: Ask around or check online.

A solid advisor will make you feel informed, not dependent.

2.6.4 Fee Structures and What to Expect

Advisors may charge:

-

- Flat fees (e.g., $500 for a one-time plan)

- Hourly rates (e.g., $150/hour)

- Percentage of assets (e.g., 1% of what they manage for you annually)

- Commissions (from the financial products they sell you)

If you’re just starting out, a flat-fee or hourly-based service might be enough.

You don’t need a full-time manager—you need someone to build your roadmap.

2.6.5 Questions to Ask Before You Hire One

-

- Are you a fiduciary?

- How do you get paid?

- What services do you offer—and what don’t you do?

- What kinds of clients do you usually work with?

- What experience or certifications do you have?

- Will I get a written plan or just general advice?

If they dodge these questions, thank them—and walk away.

2.6.6 Final Words from Kevin

You don’t need to be rich to ask for help.

You just need to be serious about your future.

An advisor can help you skip years of trial and error.

But they’re not a magic solution. They can’t care more than you do.

Get clear on your needs, your values, and your budget.

Then, if you’re ready—hire someone who aligns with that.

Because advice is powerful.

But the right advice, at the right time, is priceless.

Key Takeaways

- Facing your numbers is the first step to financial control. Avoiding reality only extends the stress.

- Net worth shows your true position. Beyond income, what really matters is what you keep after what you owe.

- Cash flow reveals your financial habits in motion. Knowing where your money goes allows you to redirect it with intention.

- Financial ratios are your financial vital signs. They help diagnose weaknesses before crisis hits.

- A budget isn’t a cage. It’s a freedom plan that reflects your values, limits, and priorities.

- Not everyone needs a financial advisor—but knowing when to ask for help is financial maturity. The right advisor brings clarity, not dependence.

Exercises

Conceptual Questions

- Understanding Net Worth

Explain in your own words what “net worth” means. Why is it a more complete measure of financial health than just knowing your income? - Assets vs. Liabilities

Define assets and liabilities. Provide two examples of each, and explain how each impacts your net worth calculation. - Positive vs. Negative Net Worth

Describe the difference between positive net worth and negative net worth. What are two strategies someone with negative net worth might use to improve their situation? - The Importance of Cash Flow

Why is tracking cash flow critical in personal finance? How can poor cash flow management still cause problems even if someone has a high net worth? - Fixed vs. Flexible Expenses

What distinguishes a fixed expense from a flexible (variable) expense? Provide two examples of each and explain how flexibility can help in times of financial hardship. - Liquidity and Emergency Funds

Explain liquidity in financial terms. Why is maintaining an emergency fund considered a key liquidity strategy? - Debt-to-Income Ratio (DTI)

What does the debt-to-income ratio measure? Why do lenders pay close attention to it? - Savings Ratio and Financial Goals

What is the savings ratio? How does consistently maintaining a healthy savings ratio support long-term financial goals? - Zero-Based Budgeting

Describe how zero-based budgeting works. What are the benefits and challenges of using this budgeting method? - The Role of Financial Advisors

When might it be valuable to seek help from a financial advisor? Name two key questions you should ask before choosing an advisor.

Scenario-Based Problems

- Evaluating Net Worth

You own a car worth $12,000, have $4,000 in a savings account, and $2,000 in credit card debt.

What is your net worth? - Cash Flow Trouble

Sara earns $4,000 per month but spends $4,200.

What is Sara’s monthly cash flow? Is it positive or negative? - Improving Liquidity

Mike has $3,000 in his checking account and owns a house valued at $200,000.

Which asset is more liquid, and why? - Calculating Savings Ratio

Emily earns $5,000 a month and saves $750.

What is her savings ratio? - Debt-to-Income (DTI) Ratio Check

Carlos has monthly debt payments of $1,200 and gross monthly income of $4,800.

What is his DTI ratio? Is it within a healthy range? - Zero-Based Budget Creation

Maria has a net income of $3,000 per month. She plans her monthly expenses as follows: $1,200 rent, $400 groceries, $200 utilities, $300 car payment, $400 savings, and $500 discretionary.

Does her budget balance to zero? - Emergency Fund Evaluation

Alex’s monthly expenses are $2,500.

How much should Alex ideally have saved in an emergency fund covering 3–6 months? - Flexible Expense Management

You are planning your budget and need to cut $300 from monthly spending quickly.

Would it be easier to reduce flexible or fixed expenses? Why? - Choosing a Financial Advisor

You meet with a financial advisor who earns commissions from selling products.

What potential conflict of interest should you be aware of? - Liquidity Scenario

Which of the following would likely be the least liquid asset?

- A) Savings account

- B) Car

- C) Stocks

- D) House

Interactive Challenges

- Net Worth Quick Check

Which combination would likely result in positive net worth?

A) High debt and low assets

B) Low debt and high savings

C) High expenses and low income

D) Frequent credit card usage - Cash Flow Decision

If your cash flow is consistently negative, what is the FIRST thing you should review?

A) Your savings account balance

B) Your emergency fund

C) Your monthly spending

D) Your credit score - Emergency Fund Ideal Size

Which of the following is the recommended emergency fund range?

A) 1–2 months of expenses

B) 3–6 months of expenses

C) 9–12 months of expenses

D) Over 2 years of income - Flexible vs. Fixed Expense Example

Which is a flexible expense?

A) Rent

B) Car insurance

C) Groceries

D) Student loan payment - Budget Redesign

In a zero-based budget, if you receive an unexpected $500 bonus, you should:

A) Leave it unused

B) Spend it immediately

C) Allocate it intentionally toward goals or savings

D) Ignore it in your planning

Problem Solving / Calculations

- Building Net Worth Over Time

If you increase your assets by $2,000 per year and decrease your liabilities by $1,000 per year, by how much would your net worth improve in five years? - Monthly Surplus or Deficit

Your income is $3,600, and your expenses are $3,450.

What is your monthly surplus or deficit? - Rebuilding Positive Cash Flow

You are overspending by $400 monthly. If you cut $150 from dining out, $100 from entertainment, and $200 from shopping, will you achieve positive cash flow? - New Savings Ratio After Raise

After a $500 raise, you decide to save the entire raise. Your new income is $5,500.

What is your updated savings ratio if you now save $1,000? - Short-Term Emergency Fund Plan

If you currently have $2,000 saved and need $9,000 for a complete 3–6 month emergency fund, how much more must you save?