4

By the end of this chapter, students will be able to:

- Understand the purpose and structure of the U.S. federal income tax system, including progressive tax brackets.

- Distinguish between gross income, adjusted gross income (AGI), and taxable income.

- Differentiate between standard and itemized deductions, and evaluate when to use each.

- Identify common tax credits (refundable and non-refundable) and explain their impact on tax liability.

- Interpret the differences between marginal and effective tax rates, and apply this understanding using examples.

- Recognize the importance of tracking various forms of income, including capital gains, dividends, and self-employment earnings.

- Explain the impact of inflation on tax planning, including the concept of bracket creep.

- Compare filing statuses and understand how they influence deductions, rates, and eligibility.

- Analyze the role and limitations of tax software in filing accurately.

- Identify and avoid common tax filing mistakes related to reporting income, claiming credits, and missing deadlines.

4.1 Introduction to the U.S. Tax System

4.1.1 The Purpose of Taxes

Taxes are not just a government burden—they are the financial foundation of public life.

They fund schools, roads, emergency services, national defense, and many other services that shape everyday life.

From a personal finance perspective, understanding taxes is essential.

Your take-home pay, savings capacity, investment choices, and even career decisions can be directly influenced by how much tax you owe—and how well you plan for it.

4.1.2 Who Pays Taxes (and Why)?

In the U.S., all individuals with income above a certain threshold are required to file a federal tax return—and possibly a state return too.

You may also encounter:

-

- FICA taxes: Support Social Security and Medicare

- State and local taxes: Vary depending on where you live

- Sales and excise taxes: Embedded in the price of what you buy

- Property taxes: Based on owned assets like land or buildings

While the system may seem complex, at its core, taxation is about sharing the cost of running a society.

4.1.3 Progressive Taxation: What It Means

The U.S. income tax system is progressive, meaning:

-

- People with higher incomes pay a higher percentage in taxes.

- Tax brackets are structured so that only the income within each bracket is taxed at that rate—not your entire income.

For example, earning $50,000 doesn’t mean all of it is taxed at the same rate. The first portion is taxed at a lower rate, the next portion higher, and so on.

This is a common myth – people think earning more pushes me into a higher tax and I lose money, that’s false.

4.1.4 Taxes as a Part of Financial Life

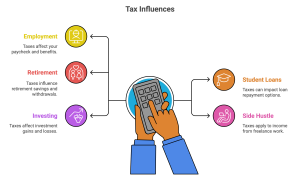

Taxes are not an isolated topic—they intersect with nearly every financial decision:

-

- Working a second job

- Selling investments

- Paying student loans

- Starting a business

- Saving for retirement

By learning how taxes work, you can avoid costly surprises, take advantage of legal strategies, and improve your long-term financial outcomes.

4.1.5 Final Thought: Learn the Rules, Change the Game

Most people see taxes as something to fear or avoid.

But the truth is this: once you understand the system, you gain power.

Tax literacy allows you to:

-

- Keep more of what you earn

- Avoid penalties

- Plan better for the future

Taxes are not just a civic obligation.

They are a personal finance strategy—if you know how to play the game well.

Before Kevin started teaching personal finance, taxes felt like a black box—full of mystery and anxiety. He did what most people did: relied on basic tax software, answered questions without fully understanding them, and hoped for the best.

But everything changed when he started running his own Airbnb business. Suddenly, taxes weren’t just about filing once a year—they became part of his strategy. He learned that expenses like cleaning supplies, repairs, depreciation, and even part of his internet bill could be deducted if tracked properly.

That knowledge flipped a switch. Instead of dreading taxes, Kevin saw them as a puzzle he could solve. Every decision—whether to furnish a space, upgrade appliances, or renovate—had tax consequences. And once he understood the rules, he started playing the game with confidence, not fear.

Lesson: Tax literacy isn’t just for accountants. Once you understand the system, taxes become a tool to protect income and grow wealth.

4.2 Types of Taxes and How They Affect You

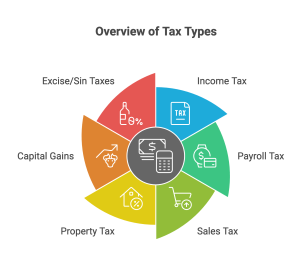

4.2.1 The Main Categories of Taxes

Understanding the different types of taxes is essential for making informed financial decisions.

Here are the most common tax categories you will encounter:

-

- Income Taxes:

Based on money earned through wages, self-employment, investments, and retirement benefits. - Payroll Taxes:

These fund Social Security and Medicare (FICA), and are typically split between employee and employer. - Sales Taxes:

Applied at the point of purchase, this is a consumption-based tax that varies by state and locality. - Property Taxes:

Levied on real estate and sometimes vehicles. Rates are based on assessed value and used to fund schools, roads, and municipal services. - Excise Taxes:

Often called “sin taxes,” these apply to specific goods like gasoline, alcohol, and tobacco. - Capital Gains Taxes:

Applied to profits from selling investments or property.

- Income Taxes:

Each of these taxes affects people differently depending on where they live, what they earn, and how they spend or invest.

4.2.2 Federal vs. State and Local Taxes

Not all taxes are created—or collected—equally.

In the U.S., tax responsibilities are shared across federal, state, and local governments.

-

- Federal Taxes: Uniform across the country; fund national priorities (defense, Social Security, infrastructure).

- State Taxes: Vary significantly. Some states have high income taxes (like California), others have none (like Texas).

- Local Taxes: May include additional sales taxes, utility taxes, or municipal fees.

Where you live matters. Some states rely more heavily on sales taxes, while others emphasize income or property taxes.

Andrea lives in New York, earning $65,000 a year.

She pays a state income tax of nearly 6.5%, along with local city tax in New York City.

Her friend Marcus earns the same amount in Florida—but Florida has no state income tax.

However, Marcus pays higher property taxes and faces higher sales taxes on goods and services.

When comparing notes, they realize:

- Andrea keeps less of her paycheck, but gets access to subsidized public transit, robust city programs, and tax credits for renters.

- Marcus keeps more take-home pay, but spends more on essentials, private insurance, and transportation.

Lesson:

Tax responsibility goes beyond rates. It’s about the trade-offs between cost and services depending on where you live.

4.2.3 How Taxes Shape Your Behavior

Taxes influence everyday decisions—even when you don’t notice:

-

- You might choose to rent instead of buy if property taxes are high.

- You might delay selling stocks to avoid capital gains.

- You might buy in bulk to reduce sales tax impact over time.

- You might invest in tax-advantaged accounts to reduce your taxable income.

Understanding the tax consequences of your habits helps you make smarter, long-term decisions.

4.2.4 Final Thought: Location is a Tax Strategy

Your zip code can shape your financial life just as much as your job title.

Where you live determines which taxes hit you hardest—and which benefits you can access.

Being tax-smart isn’t just about deductions.

It’s also about understanding the hidden costs of your environment—and how to work with them instead of against them.

4.3 Income Tax Fundamentals

4.3.1 What Is Taxable Income?

Not all the money you receive is taxable—but much of it is.

Taxable income includes:

-

- Wages, salaries, and tips

- Freelance and gig work

- Business income

- Interest and dividends

- Retirement account withdrawals

- Rental income

- Unemployment compensation

Excluded income may include:

-

- Life insurance payouts

- Child support

- Qualified scholarships

- Certain disability payments

Knowing what’s included helps you anticipate your tax burden and prepare accordingly.

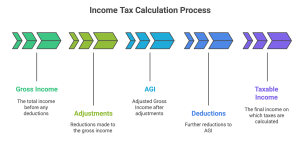

4.3.2 From Gross to Taxable Income: Understanding AGI

Your gross income is your total income from all sources.

From this, you subtract “above-the-line” deductions like:

-

- Traditional IRA contributions

- Student loan interest

- HSA contributions

- Self-employment tax adjustment

This gives you your Adjusted Gross Income (AGI), a crucial number that determines your eligibility for many tax benefits.

From your AGI, you subtract either the standard deduction or itemized deductions, resulting in your taxable income.

4.3.3 Tax Brackets: Marginal vs. Average Tax Rate

The U.S. tax system is progressive, meaning income is taxed in layers (brackets).

-

- Your marginal tax rate is the rate at which your last dollar is taxed

- Your average (or effective) tax rate is the total tax paid divided by your total income

Example:

Sofia earns $50,000. Her marginal tax rate is 22%, but her effective tax rate is around 12% because portions of her income are taxed at 10% and 12%.

Takeaway: Earning more won’t “punish” you by taxing all your income at a higher rate.

4.3.4 Capital Gains and Dividend Income

Not all income is treated the same. Two types that receive special tax treatment are:

-

- Capital gains: Profits from selling assets like stocks, property, or crypto.

- Short-term gains (held < 1 year) are taxed at ordinary income rates

- Long-term gains (held > 1 year) are taxed at reduced rates (0%, 15%, or 20%)

- Qualified dividends: Paid by U.S. corporations and taxed at capital gains rates

Why it matters:

This treatment rewards long-term investment and may offer better after-tax returns than regular wages.

Emily earns $45,000 from her job. Leo earns $45,000 freelancing and from selling stocks.

Emily’s taxes are withheld from her paycheck. Leo must:

- Pay self-employment tax (15.3%)

- Report a $3,000 capital gain from selling an ETF he held for over a year

Leo qualifies for the long-term capital gains rate of 15% on his investment profit—significantly less than his marginal income tax rate.

Lesson:

Your income type—not just amount—can greatly affect your tax bill.

4.3.5 Bracket Creep: The Silent Tax Increase

Bracket creep happens when your income rises due to inflation or cost-of-living adjustments, but tax brackets don’t rise accordingly.

Result: You get pushed into a higher bracket without gaining real purchasing power.

Thankfully, most U.S. tax brackets are now indexed to inflation, but other thresholds (like credits or phaseouts) are not.

Tip: Monitor your AGI every year to avoid creeping into phases where deductions or credits disappear.

4.3.6 Withholding and Estimated Payments

-

- W-2 workers: Taxes are automatically withheld

- 1099/freelancers: Must make quarterly estimated payments or risk IRS penalties

- If you’re self-employed, set aside ~25-30% of your income for quarterly tax payments to avoid surprises.

Use Form 1040-ES or online calculators to estimate your payments.

Planning ahead avoids unexpected tax bills—and builds trust with your future self.

4.3.7 Final Thought: Your Income Deserves Attention

Your income isn’t just what you earn—it’s what you keep and how you use it.

Understanding how income is classified, taxed, and planned for gives you the edge to optimize your earnings, not just collect them.

The tax code rewards clarity and planning. So pay attention—and pay less.

Case Study 4: Kevin’s Tax Strategy with Mixed Income

Kevin earns income from multiple sources: a W-2 teaching job in California, Airbnb income from his Mexico properties, and occasional consulting gigs. At first, this mix made tax season overwhelming. Was he supposed to report foreign income? Could he deduct flights to inspect properties? What about depreciation?

Over time, Kevin built a system: he separated personal and business expenses, documented travel for work purposes, and even used currency exchange reports to accurately track earnings from Airbnb. He learned that while foreign rental income is still taxable in the U.S., strategic deductions—like home office use, repair costs, and advertising—could dramatically reduce his tax liability.

By keeping good records and understanding self-employment rules, Kevin minimized his taxes and avoided surprises—even with a complex income mix.

4.4 Tax Deductions, Credits, and Brackets

4.4.1 How Deductions and Credits Work

-

- A deduction reduces your taxable income.

- A credit reduces your actual tax bill—dollar for dollar.

Example:

If your taxable income is $40,000 and you claim a $2,000 deduction, you might reduce your tax by ~$240 (if in 12% bracket).

But a $2,000 credit would reduce your tax by exactly $2,000.

Credits are usually more powerful, especially refundable ones.

4.4.2 Standard Deduction vs. Itemized Deductions

In 2024, standard deduction amounts are:

-

- $13,850 (single)

- $27,700 (married filing jointly)

You itemize when specific deductions exceed those amounts.

4.4.3 Itemized Deductions: What You Can Include

Itemized deductions may include:

-

- Mortgage interest

- State and local taxes (SALT) (capped at $10,000)

- Medical expenses (exceeding 7.5% of AGI)

- Charitable contributions

- Casualty and theft losses (in federally declared disaster areas)

Pro tip: Keep receipts and documentation all year if you think you might itemize.

Raquel is single. She paid:

- $8,000 in mortgage interest

- $2,000 in charitable donations

- $1,500 in unreimbursed medical expenses (note: only the amount above 7.5% of her AGI is deductible).

Total: $11,500 in itemized deductions.

Since the standard deduction is $13,850, she chooses that instead.

Lesson: Itemizing only makes sense if your deductions exceed the standard amount. Always compare before filing.

4.4.4 Tax Credits: Refundable vs. Non-Refundable

Refundable credits:

-

- Can result in a refund even if you owe no tax

- Examples: Earned Income Tax Credit (EITC), American Opportunity Credit (partially refundable)

Non-refundable credits:

-

- Only reduce your tax to zero

- Examples: Child and Dependent Care Credit, Lifetime Learning Credit

You may qualify for credits based on:

-

- Income

- Dependents

- Education expenses

- Retirement contributions

- Health insurance premiums

James pays $3,500 in tuition and qualifies for the American Opportunity Credit.

- Total eligible credit: $2,500

- His tax owed: $600

- Result: $600 tax is eliminated, plus $1,400 refunded (as part of the refundable portion)

Lesson: Even if your income is low, you might get money back just for attending school—if you file smart.

4.4.5 Understanding Tax Brackets

U.S. tax brackets are marginal, meaning each slice of income is taxed at different rates.

2024 Federal Income Tax Rates for Single Filers

For the 2024 tax year, the U.S. federal income tax system follows a progressive structure. This means that different portions of a taxpayer’s income are taxed at different rates. Here is a breakdown of the tax brackets for single filers:

- Income up to $11,000 is taxed at 10%.

- Income from $11,001 to $44,725 is taxed at 12%.

- Income from $44,726 to $95,375 is taxed at 22%.

- Income from $95,376 to $182,100 is taxed at 24%.

- Income from $182,101 to $231,250 is taxed at 32%.

- Income from $231,251 to $578,125 is taxed at 35%.

- Income over $578,125 is taxed at 37%.

Each rate applies only to the income within that specific range, not to the taxpayer’s total income. This progressive structure ensures that higher income levels are taxed at higher rates, but only on the portion that exceeds each threshold.

If you earn $50,000, only the $5,275 above $44,726 is taxed at 22%.

4.4.6 Example: Marginal vs. Effective Rate

Sophia earns $50,000.

-

- First $11,000 taxed at 10% = $1,100

- Next ~$33,725 at 12% = ~$4,047

- which is the same ~$5,275 portion from the previous section at 22% = ~$1,161

Total tax owed: ~$6,308

Effective tax rate: ~12.6%

Marginal rate is 22%, but most income was taxed at lower rates.

4.4.7 Bracket Creep and Inflation

If your wages increase due to inflation but credits, deductions, or thresholds don’t adjust, you can owe more tax without actually earning more real income.

This is called bracket creep.

Most brackets are now indexed for inflation, but some thresholds (like the Child Tax Credit phaseout) are not.

4.4.8 Final Thought: Your Tax Tools Are Waiting

You don’t need to be rich to use the tax code to your advantage—you just need to be informed.

Credits, deductions, and income planning are like tools in a toolbox.

The more confidently you use them, the more financially resilient and empowered you become.

Don’t leave money on the table—claim it with knowledge.

4.5 Planning Strategies to Minimize Taxes

4.5.1 Why Tax Planning Matters

Paying taxes is unavoidable—but overpaying isn’t.

Smart tax planning helps you:

-

- Reduce your taxable income

- Delay taxes to a future (often lower) year

- Shift income to lower-tax individuals or vehicles

- Convert taxable income into tax-free growth

Tax planning is not about loopholes—it’s about legal, strategic decisions made before tax season hits.

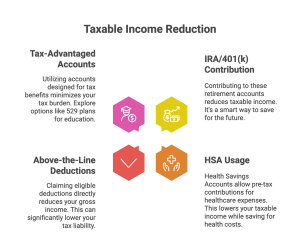

4.5.2 Common Strategies to Reduce Taxable Income

Here are some widely used techniques:

-

- Contribute to a Traditional IRA or 401(k):

Lowers your current taxable income while growing investments tax-deferred. - Use an HSA (Health Savings Account):

Triple tax advantage: contributions are tax-deductible, growth is tax-free, and withdrawals for medical use are tax-free. - Claim above-the-line deductions:

Includes student loan interest, educator expenses, self-employment tax adjustments. - Invest in tax-advantaged accounts:

Roth IRAs, 529 plans, and employer-sponsored retirement plans all offer tax benefits.

- Contribute to a Traditional IRA or 401(k):

Tasha earns $60,000 per year and contributes $6,500 to a Traditional IRA.

This reduces her taxable income to $53,500.

Her total tax savings for the year is around $1,300—just for moving money into her future.

Over time, this strategy not only reduces her yearly tax bill but builds long-term retirement security.

Lesson: Saving for the future isn’t just responsible—it’s also tax-efficient.

4.5.3 Family and Income-Shifting Strategies

Families can take advantage of income-shifting techniques:

-

- Hiring your children: If you own a business, employing your child (at fair market value) shifts income from your higher bracket to theirs—possibly tax-free.

- Filing jointly vs. separately: Married couples often reduce total tax by filing jointly, but in some cases (e.g., high medical bills), filing separately may help.

- Gift exclusions: You can give up to $18,000 per year (2024) to any person without triggering gift tax.

Rosa and Eric Brown both work full-time and earn a combined $120,000.

They’ve traditionally filed jointly but are considering separate filing this year because Rosa had over $10,000 in medical bills.

After calculating both options, they find:

- Filing separately allows Rosa to exceed the 7.5% AGI threshold for medical deductions.

- They save $900 in total taxes compared to filing jointly.

Lesson: The best filing status isn’t always obvious—strategic comparisons can save money.

4.5.4 Final Thought: Plan Early, Save Often

Last-minute tax filing is like cramming for an exam—you might survive, but you probably won’t excel.

Tax planning is a year-round discipline that rewards those who think ahead.

You don’t need to memorize tax codes.

You just need to know which tools exist—and when to use them.

The earlier you plan, the more you keep.

4.6 Understanding Tax Forms and Filing Options

4.6.1 Common Forms Every Taxpayer Should Know

These are the most common tax forms individuals encounter:

-

- Form W-2 – Reports wages and withholding from your employer

- Form 1099-NEC – Reports freelance, contract, or gig work income

- Form 1099-INT – Reports interest earned from savings and bank accounts

- Form 1099-DIV – Reports dividends, both ordinary and qualified

- Form 1099-B – Reports capital gains or losses from selling investments

- Form 1040 – The main individual tax return used to summarize income, deductions, credits, and refund or tax owed

Note: Capital gains and dividends have their own specific lines and may require additional schedules (like Schedule D for investments).

4.6.2 Filing Status: More Than a Checkbox

Your filing status affects:

-

- Tax bracket thresholds

- Standard deduction amount

- Eligibility for many credits

Options include:

-

- Single

- Married Filing Jointly

- Married Filing Separately

- Head of Household

- Qualifying Widow(er)

Pro tip: Filing jointly is usually best, but not always. Compare both if you’re married.

4.6.3 Choosing How to File: DIY, Software, or Pro

Common Tax Filing Methods: Who They’re Best For and Their Limitations

When it comes to filing your taxes, choosing the right method can save you time, stress, and even money. Below is an overview of the most common filing options, who they are best suited for, and their potential drawbacks:

-

-

DIY (paper filing or e-file):

This method works best for individuals with simple tax situations, such as having no dependents and income solely from a W-2 job. However, it comes with a high risk of making errors and offers very limited guidance throughout the process. -

Tax software:

Ideal for those with moderate tax complexity—for example, freelancers, or individuals claiming one or two deductions. While convenient and user-friendly, it doesn’t substitute a solid understanding of tax concepts, and users might miss out on potential benefits without realizing it. -

Hiring a tax professional:

Recommended for individuals with complex tax returns, such as those involving investments, rental properties, or business income. This option offers greater accuracy and strategic planning, though it typically comes at a higher cost.

-

Each method has its strengths and trade-offs. The best choice depends on the complexity of your financial life and your comfort level with tax terminology and decision-making.

Miguel is 27, works full-time, and also invests. This year, he sold shares in a mutual fund and received:

Form 1099-DIV (showing $650 in qualified dividends)

Form 1099-B (showing $2,200 long-term capital gains)

He uses basic tax software but accidentally enters the wrong purchase date for his investment—treating long-term gains as short-term.

Result? His return estimated $450 more tax owed than necessary.

He consults a tax pro, who:

Corrects the entry

Applies the lower capital gains rate (15%)

Saves him money and files an amended return

Lesson: When dealing with investments, precision matters. A small detail can mean hundreds of dollars.

4.6.4 When and Where to File

-

- Deadline: April 15 each year (or the next business day)

- Extensions: You can request an extension to file, but not to pay

- Where: File online (recommended), by mail, or with a professional

You can file through:

-

- IRS Free File (if income is below threshold)

- IRS e-File with commercial software

- Paid services or licensed tax professionals

4.6.5 Final Thought: The Form is Just the Beginning

Filing taxes isn’t just about the forms—it’s about what’s behind the numbers.

Every 1099, every deduction, every filing status choice tells a story about your financial life.

Understanding what those forms mean gives you more than a refund—it gives you clarity and control.

When in doubt, don’t just click “next.” Pause. Learn. Decide.

Because the form may be standard—but your finances aren’t.

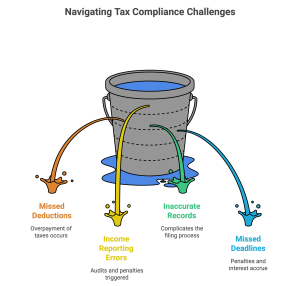

4.7 Common Tax Mistakes and How to Avoid Them

4.7.1 Mistake #1: Ignoring Freelance or Side Income

If you drive for Uber, tutor online, or sell crafts on Etsy, you’re required to report that income—even if it seems “small.”

These earnings often generate a 1099-NEC, which is reported to the IRS. If you don’t include it on your tax return, you could face:

-

- IRS notices

- Underpayment penalties

- Interest on unpaid taxes

Solution: Track all income—even the irregular, informal, or “cash-like” streams.

4.7.2 Mistake #2: Overlooking Deductions and Credits

Every year, taxpayers miss out on thousands in tax breaks they legally qualify for.

Commonly overlooked:

-

- Student loan interest

- Education credits (AOTC, LLC)

- Saver’s credit

- HSA contributions

- Child and Dependent Care Credit

Solution: Use guided software or work with a professional to review all options before filing.

4.7.3 Mistake #3: Filing Late or Not Filing at All

Even if you can’t pay the full amount owed, file your return on time.

Failing to do so can result in:

-

- Late filing penalty (up to 5% per month)

- Late payment penalty (0.5% per month)

- Accrued interest on the full tax owed

Solution: File early and set up a payment plan if needed. Ignoring it only makes it worse.

4.7.4 Mistake #4: Misunderstanding Investment Tax Rules

Capital gains and dividends have different rules—and software isn’t always foolproof.

Examples of common errors:

-

- Mislabeling short-term gains as long-term

- Forgetting to include reinvested dividends

- Missing out on the 0% capital gains bracket (for lower earners)

Solution: Keep track of your cost basis, holding periods, and review Form 1099-B and 1099-DIV carefully.

4.7.5 Mistake #5: Relying Too Heavily on Software

Tax software is convenient, but it only works with the data you enter.

-

- Misread a question? Wrong outcome.

- Miss a form? Missing tax owed or refund.

- Claim the wrong credit? Flagged for review.

Solution: Learn the basics—even if you use software. Software is a tool, not a substitute for understanding.

Leo drives rideshare on weekends and earns about $8,500 from it. He gets a 1099-NEC from the platform, but thinks it’s “not important” and files without reporting it.

Three months later, the IRS sends him a notice.

- He owes back taxes on the full amount

- Plus penalties and interest for underreporting

- His refund is withheld, and he enters a payment plan

Lesson: Any income the IRS knows about—you need to report.

4.7.6 Final Thought: The Most Expensive Mistake Is Silence

Most tax mistakes don’t come from bad intentions—they come from confusion, procrastination, or neglect.

The price of silence is high: audits, penalties, and lost refunds.

Get organized. Learn a little. Ask questions.

Because when it comes to taxes, what you don’t know can cost you.

And what you do know?

It puts money back in your pocket—and peace in your head.

- The U.S. tax system is marginal and progressive—only the income within each bracket is taxed at that bracket’s rate.

- Adjusted Gross Income (AGI) is the foundation for calculating your taxable income and determines eligibility for many deductions and credits.

- Standard deductions simplify filing for most taxpayers, but itemizing can be beneficial when deductible expenses exceed the standard.

- Tax credits reduce your tax bill dollar-for-dollar and are more powerful than deductions; refundable credits can generate refunds even if no tax is owed.

- Capital gains and qualified dividends are taxed differently depending on how long the asset was held and the type of income received.

- Filing status has a significant impact on your tax outcome and should reflect your household and support responsibilities.

- Freelancers and gig workers must track income carefully and may owe self-employment tax even with modest earnings.

- Mistakes such as underreporting income, claiming ineligible credits, or missing filing deadlines can lead to penalties and lost refunds.

- Tax software is a helpful tool but doesn’t replace the need for financial awareness and accuracy.

- Staying informed about tax rules—especially during life transitions—can help reduce liabilities and optimize returns.

Conceptual Questions

- What is the difference between a tax deduction and a tax credit?

Provide an example of each and explain which one offers greater tax savings. - Explain the concept of marginal tax rates.

How does it differ from your effective (average) tax rate? - What types of income are subject to capital gains taxes, and how do short-term and long-term rates differ?

- Define Adjusted Gross Income (AGI).

Why is this number important when calculating your tax liability? - What is “Bracket Creep,” and how can it silently increase your tax burden over time?

- Compare the standard deduction with itemized deductions.

Under what circumstances would it make sense to itemize? - What are refundable and non-refundable tax credits?

Give an example of each and explain how they affect your final tax bill. - Why is it important to track all freelance or side income?

What form(s) typically report this income to the IRS? - Describe how tax software might fail to catch filing mistakes.

Why is it important to understand your tax situation, even if you use software? - What role does your filing status play in determining your tax bracket and deduction eligibility?

Problem Solving Questions

- Calculating Taxable Income

Jamal earns $55,000 annually and has $2,000 in student loan interest and a $6,500 IRA contribution.

What is his Adjusted Gross Income? - Tax Owed with Standard Deduction

Maria is a single filer with a taxable income of $45,000.

Using the 2024 tax brackets, estimate her federal income tax owed (use bracket method). - Standard vs. Itemized Deduction

Sophie has the following deductions: $9,000 mortgage interest, $2,500 in donations, and $1,000 in state taxes.

Should she itemize or take the standard deduction ($13,850)? - Capital Gains Tax

Andres bought stock for $5,000 and sold it two years later for $8,500.

What is his capital gain, and at what rate will it likely be taxed? - Refundable Credit Application

Lilly owes $700 in taxes but qualifies for a refundable education credit of $1,200.

What will her final tax refund be? - Self-Employment Tax Estimate

Kevin earns $20,000 from freelance work.

Estimate how much he owes in self-employment tax (assume 15.3%). - Filing Status Impact

Compare the standard deduction and income brackets for a single filer vs. Head of Household.

How does filing as Head of Household benefit a single parent? - Withholding Gap

Jordan earns $40,000/year. His employer withholds $3,200 in federal tax.

His total tax owed is $3,800. Will he owe the IRS or get a refund? - Tax Savings from a Credit vs. Deduction

Which is more valuable: a $1,000 tax credit or a $1,000 deduction in the 22% tax bracket? Show your reasoning. - Estimated Quarterly Payments

Esteban is self-employed and expects to earn $60,000 this year.

How much should he pay quarterly in estimated taxes if he wants to avoid penalties? (Use 15% estimate.)

Interactive Challenges

- Quick Quiz: Credit or Deduction?

Match the following with “Credit” or “Deduction”:- Student loan interest

- Child Tax Benefit

- Retirement account contribution

- American Opportunity Credit

- Tax Bracket Breakdown

Estimate the marginal tax rate and average tax rate for someone earning $70,000. - Itemize or Not?

If your itemized deductions total $12,000 and the standard deduction is $13,850, what’s the better choice? Why? - Capital Gain Classification

You bought stock and sold it 8 months later. What kind of gain is it, and how is it taxed? - Mistake Hunt

“I didn’t report my side income because it was less than $600.”

What’s wrong with this assumption? - File or Extend?

You can’t pay your tax bill on time. Should you still file your return? Why? - Case Study Snapshot

Raquel is single. She earns $48,000, contributes $5,000 to a traditional IRA, and pays $2,000 in student loan interest.

What is her AGI? - Refund Impact

You qualify for a $2,000 credit and owe $1,500 in tax. What refund, if any, should you expect?