8

By the end of this chapter, students should be able to:

- Compare the financial and lifestyle implications of renting versus buying a home.

- Understand how mortgages work, including key terms such as principal, interest, and amortization.

- Evaluate affordability using industry-standard ratios (housing ratio and debt-to-income ratio).

- Distinguish between leasing and buying a car, and identify which option fits different life stages and financial goals.

- Identify hidden costs associated with home and vehicle ownership and apply strategies to reduce long-term expenses.

- Reflect on how personal values, career plans, and family needs shape major purchase decisions.

8.1 Housing Choices: Renting vs. Buying

8.1.1 Renting or Owning? It’s Deeper Than It Seems

For many people, deciding whether to rent or buy a home feels like a straightforward money question. But in reality, it’s also about lifestyle, values, and your current stage of life. It’s not just about “throwing money away” or “investing in your future,” like people often say. It’s about understanding what actually works for you—with your income, your goals, and your priorities.

Renting gives you flexibility and fewer responsibilities. Buying offers stability and the chance to build equity. One isn’t always better than the other—it just depends on timing, context, and strategy.

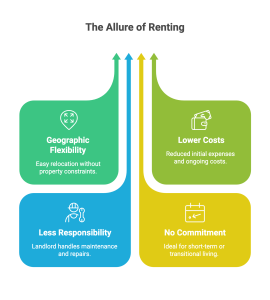

8.1.2 Why People Rent

Most people start their adult lives renting. Why? Here are a few good reasons:

-

- Geographic flexibility: You’re not tied down—you can move easily.

- Lower upfront costs: No huge down payment, no property taxes, no home insurance, and no major repairs.

- Less responsibility: If the plumbing breaks, the landlord is (hopefully) on it.

- No long-term commitment: Great if you’re switching jobs, leaving a relationship, or just starting out.

Example:

Laura just graduated and got a job in a new city. She doesn’t know the area, hasn’t saved for a down payment, and isn’t sure if the job will last. Renting a small place gives her time to adapt without financial stress.

8.1.3 Why People Buy

Buying isn’t just a financial transaction—it’s an emotional and symbolic move. It often marks a new phase in life, a sense of “finally settling down.”

Benefits of buying include:

-

- Building equity: Your mortgage payments go toward owning something, not just paying someone else.

- Long-term stability: If you’re planning to stay put for years, buying might be more cost-effective.

- Freedom to renovate: Paint, build, remodel—no permission needed.

- Protection from rent hikes: With a fixed-rate mortgage, your payments stay stable for years.

Example:

Isaac and Monse are expecting their second child. Though the mortgage will be a stretch, they want a stable place with a backyard. They use their good credit to get a low fixed rate and buy a home outside the city.

8.1.4 The True Costs: Apples to Apples

Let’s look at a side-by-side example comparing Alex (who rents) and Maya (who buys a home), assuming both plan to live in their homes for the next 5 years. Their base housing costs are similar—about $1,600 per month.

Renting – Alex’s Costs

-

- Initial cost:

Alex pays a $2,000 security deposit, which is refundable if there’s no damage. - Monthly rent:

$1,600/month for 60 months = $96,000 total rent over 5 years. - Maintenance and repairs:

Included in the rent—Alex doesn’t pay for broken plumbing, roofing, etc. - Insurance and property taxes:

Also covered by the landlord. - Flexibility:

High. Alex can move easily with a 30-day notice after any lease ends. - Total cash outlay over 5 years:

Approximately $98,000 (including small rent increases and renter’s insurance). - Equity gained:

$0. Alex walks away with no ownership or financial return.

- Initial cost:

Buying – Maya’s Costs

-

- Initial costs:

Maya pays a $20,000 down payment and $6,000 in closing costs (total: $26,000 upfront). - Monthly mortgage payment (including taxes and insurance):

About $1,600/month for 60 months = $96,000 in payments over 5 years. - Maintenance and repairs:

Estimated at $1,500/year = $7,500 total over 5 years. - Property taxes and insurance:

Already included in her $1,600 payment estimate. - Equity built (principal paid down):

Around $20,000 after 5 years. - Home appreciation (value increase):

Estimated at $15,000 over 5 years. - Flexibility:

Lower. Selling a home takes time and may involve fees or market risk. - Total cash outlay over 5 years:

About $119,500 (including upfront and maintenance costs). - Net gain (equity + appreciation):

Approximately $35,000. - Net cost after gains:

Around $84,500 (subtracting gains from outlay).

- Initial costs:

Equity is the portion of a property’s value that you actually own. It increases as you pay down your mortgage or if the home’s market value rises.

Closing Costs are upfront fees paid when buying a home, including legal, inspection, and lender fees. Typically 2%–5% of the purchase price.

Final Insight

Even though Maya paid more upfront, she gained value through equity and appreciation. Her net cost of owning was lower than Alex’s total cost of renting. Still, if she needed to move suddenly, the financial benefit could disappear due to closing costs or market downturns.

Bottom line:

-

- Renting is safer and more flexible in the short term.

- Buying pays off when you stay long enough to build equity.

8.1.5 Kevin’s Real Estate Journey – From Rent Hacks to Smart Ownership

Before becoming a finance professor, Kevin rented for six years in the early 2000s. His strategy? Move every year to take advantage of 12-month lease promotions offering a free month. In the San Jose rental market at the time, this approach helped him save significantly on rent.

In 2007, he made a big leap: buying his first home—a pre-construction condo. The developer offered a $15,000 incentive, which seemed like a great deal… but the housing market had already started to decline. Within a couple years, Kevin owed more than the home was worth. Still, he didn’t panic or walk away. He stuck with it, made his payments, and eventually the market recovered. Years later, he sold the condo for a profit.

Then came his second property purchase in 2009, right after the market crashed. It emptied his savings again, and for a few years, he lived on a tight budget. But this time, he took on a major remodel himself—learning to budget, plan, and even do some of the physical work. That experience taught him how much money you could save (or lose) depending on your choices. When he eventually sold this home, it also earned him a solid profit.

In 2013, Kevin bought a home in San Francisco—this time, as a family home with a stable job and more experience. Years later, when life took him elsewhere, he turned that home into a high-performing Airbnb rather than selling it. That single decision allowed him to keep the property, cover all the costs, and build long-term wealth.

Today, he owns two additional rental properties in Puerto Vallarta, Mexico—each generating passive income. His story shows that buying a home isn’t about timing the market perfectly—it’s about buying when you’re financially stable, thinking long-term, and being creative with your assets when life changes.

Lesson: Real estate is a journey. There will be mistakes, surprises, and moments of doubt. But if you plan carefully and adapt smartly, your home can become one of your best financial tools.

8.1.6 What Kind of Person Are You?

-

- If you value freedom, are just starting out, or don’t want long-term commitments: renting might be best for now.

- If you’re financially stable, want to build equity, and have savings: buying could be a smart next step.

The key is to make a decision based on your real life—not other people’s expectations.

Case 1: “The Strategic Nomad”

Marina works in UX design and loves switching cities every few years. She travels light and works remotely. Even though furnished rentals are more expensive, renting lets her move freely without the hassle of selling.

Case 2: “The Emotional Investment”

Jorge and his sister inherited a small amount of money. Instead of spending it, they bought a home together and listed part of it on Airbnb. Now they have both equity and an income stream to help with the mortgage.

8.1.7 Common Myths (That Aren’t Always True)

-

- “Buying is always better than renting” → Only if you’re staying at least 5 years and can afford the full costs.

- “Renting is throwing money away” → Not if it gives you freedom, flexibility, and the chance to save.

- “A home always gains value” → Not guaranteed. Housing markets can drop or stagnate.

- “You need tons of money to buy” → Some programs offer low down payments, but do your research carefully.

There’s no “one-size-fits-all” answer here. The perfect home doesn’t exist, but the right decision for your situation absolutely does. Housing isn’t just about roofs and walls—it’s about how you want to live.

8.2 Mortgages and the Home Buying Process

8.2.1 Buying a Home Isn’t Like Buying Cereal

Stepping into the world of mortgages can feel like learning a new language: fixed rates, adjustable rates, points, APRs, closing costs, pre-approvals… it’s a lot. But millions of people navigate it successfully every year, and with the right information, you can too.

This section is your roadmap to understanding the financial side of buying a home: what a mortgage is, how to get one, what it really costs, and what traps to avoid.

8.2.2 What Is a Mortgage?

A mortgage is a long-term loan used to buy real estate. It’s secured by the property itself, meaning the lender can take the home if you stop making payments.

Key components of a mortgage:

-

- Principal: The original amount you borrow from a lender, not including interest.

- Interest: The cost you pay to borrow money, usually expressed as a percentage of the loan.

- Term: How long you’ll take to pay it off.

- Interest rate: The percentage you’re charged based on the remaining balance.

8.2.3 Fixed vs. Adjustable-Rate Mortgages

Fixed-Rate Mortgage (FRM)

A loan where the interest rate stays the same throughout the life of the loan. This means your monthly payment stays consistent.

Adjustable-Rate Mortgage (ARM):

The interest rate starts lower but can change over time—usually after 5, 7, or 10 years. It can save you money short-term, but it’s riskier if rates go up later.

8.2.4 How Much Can You Actually Afford?

When deciding how much house you can afford, it’s tempting to just ask the bank. But here’s the truth: lenders may approve you for more than you should actually spend. That’s why it’s critical to run your own numbers.

Let’s introduce two key formulas used by mortgage professionals:

Formula #1: The Housing Ratio (Front-End)

This ratio calculates the percentage of your gross monthly income that will go toward housing costs only.

\[ \text{Housing Expense Ratio} = \frac{\text{Monthly PITI}}{\text{Gross Monthly Income}} \times 100 \]

\[ \text{Debt-to-Income Ratio} = \frac{\text{Total Monthly Debt}}{\text{Gross Monthly Income}} \times 100 \]

Most lenders prefer this ratio to be no more than 28%.

Example:

Let’s say your gross monthly income is $5,000.

You’re looking at a house with a total monthly cost of $1,350.

\[

\frac{1,350}{5,000} \times 100 = 27\%

\]

That’s under 28%, so you’re in a safe zone.

Formula #2: The Debt-to-Income Ratio (Back-End)

This measures how much of your income goes toward all monthly debt payments, including:

- Housing (PITI)

- Student loans

- Credit card minimums

- Car loans

- Any other required monthly debts

\[ \text{DTI Ratio} = \frac{\text{Total Monthly Debts}}{\text{Gross Monthly Income}} \times 100 \]

Most lenders prefer this to be under 36%, though some allow up to 43%.

Example:

Gross income: $5,000

Housing: $1,350

Student loan: $200

Car loan: $300

Credit card minimum: $100

Total debt: $1,950

\[

\frac{1,950}{5,000} \times 100 = 39\%

\]

That’s above the recommended 36%—you might be stretching your budget too far.

Real Talk: Lenders vs. Reality

Lenders look at these formulas—but your real life matters more:

-

- Do you travel often?

- Want to have kids soon?

- Have irregular freelance income?

Make space in your budget for life—not just a house.

Housing Affordability Ratios

When lenders evaluate your home loan application, they look at two standard affordability formulas:

Formula 1:

Front-End Ratio (Housing Ratio)

This measures what percent of your gross monthly income goes to housing expenses only (PITI: Principal, Interest, Taxes, Insurance):

\text{Front-End Ratio} = \frac{\text{Monthly PITI}}{\text{Gross Monthly Income}} \times 100

🔑 Target guideline: ≤ 28%

Formula 2:

Back-End Ratio (Debt-to-Income or DTI)

This includes all monthly debt payments, including housing, student loans, car loans, credit cards, etc.:

\text{Back-End Ratio} = \frac{\text{Total Monthly Debts}}{\text{Gross Monthly Income}} \times 100

🔑 Target guideline: ≤ 36% (some lenders allow up to 43%)

Why It Matters:

Lenders might approve you above these limits, but doing so could leave you “house poor”—stuck in a home with no budget for food, savings, or emergencies. These formulas help you protect yourself, not just satisfy the bank.

NEW PROBLEM: Can She Afford This House?

Scenario:

Natalie earns $6,000 per month (gross income). She’s considering a home with a monthly mortgage (PITI) of $1,750. She also has:

-

-

Car loan: $400/month

-

Credit card minimums: $150/month

-

Student loan: $200/month

-

Question 1: What is Natalie’s front-end ratio?

Formula:

\text{Front-End Ratio} = \frac{1,750}{6,000} \times 100 = \boxed{29.2\%}

⚠️ This exceeds the 28% guideline slightly.

Question 2: What is Natalie’s back-end ratio?

Formula:

\text{Total Debt} = 1,750 + 400 + 150 + 200 = 2,500

\text{Back-End Ratio} = \frac{2,500}{6,000} \times 100 = \boxed{41.7\%}

⚠️ Over the 36% guideline, but may still qualify depending on lender flexibility.

Question 3: How much could Natalie afford in monthly housing cost if she wanted to stay under the 28% guideline?

Formula:

0.28 \times 6,000 = \boxed{\$1,680}

So, she would need to reduce her target housing payment by at least $70/month to meet the 28% rule.

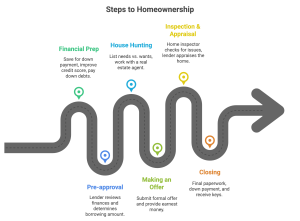

8.2.5 Step-by-Step: How to Buy a Home

Here’s a simplified version of the typical home-buying process in the U.S. or Mexico:

-

- Financial prep:

- Save for a down payment (usually 5–20% of the home price).

- Check and improve your credit score.

- Pay down existing debts.

- Pre-approval:

- A lender reviews your finances and tells you how much you can borrow.

- House hunting:

- Make a list of needs vs. wants.

- Work with a real estate agent if needed.

- Making an offer:

- Submit a formal offer on the house.

- You may need to provide earnest money (a deposit to show you’re serious).

- Inspection and appraisal:

- A home inspector checks for issues.

- The lender appraises the home to confirm its value.

- Closing:

- Final paperwork is signed.

- You pay your down payment and closing costs.

- You get the keys!

- Financial prep:

8.2.6 Hidden Costs You Shouldn’t Ignore

Buying a home comes with a lot more expenses than just the mortgage. Be prepared for:

-

- Property taxes: Often increase over time and vary by location.

- Homeowners insurance: Required by lenders.

- Closing costs: Appraisal, legal fees, title insurance, and more.

- Maintenance: You’re now responsible for the roof, plumbing, appliances—you name it.

- HOA fees: If your property is part of a homeowner association.

Ignoring these costs can wreck your budget, even if you technically “qualified” for the mortgage.

Let’s take Carla’s situation and go deeper using real mortgage math.

Scenario:

Carla is buying a $250,000 home. She puts 10% down ($25,000) and finances the rest ($225,000) with a 30-year fixed mortgage at 6% annual interest.

Step-by-Step Breakdown:

- Monthly mortgage payment (principal + interest):

Using a standard mortgage formula or calculator:

\[

P = \frac{r(1+r)^n}{(1+r)^n – 1} \times \text{Loan Amount}

\]

Where:

- \[

r = \frac{0.06}{12} = 0.005 \quad \text{(monthly interest rate)}

\] - \[

n = 360 \quad \text{(months, i.e., 30 years)}

\] - \[

\text{Loan} = \$225,000

\]

\[

P \approx 0.0059955 \times 225,000 \approx \$1,349.99 \, \text{per month}

\]

- Add other monthly costs:

Mortgage (P + I): $1,350

Property taxes: $200

Homeowners insurance: $100

HOA fees: $75

Total monthly payment: $1,725

- Annual cost (Year 1):

\[

\$1,725 \times 12 = \$20,700

\]

- Additional upfront costs:

- Down payment: $25,000

- Closing costs (estimated at 3%): $7,500

- Total upfront: $32,500

Summary: First-Year Cost Snapshot

Down payment + closing: $32,500

Year 1 monthly payments: $20,700

Total Year 1 Cost: $53,200

Key Insight:

Carla thought her budget was $1,400/month. In reality, she’s spending $1,725 monthly—plus $32,500 upfront. Without this planning, she could’ve been blindsided by cash flow issues.

8.2.9 Tips for First-Time Buyers

-

- Don’t buy under pressure.

- Improve your credit before applying.

- Shop around for mortgage rates.

- Calculate all the costs—not just your monthly payment.

- If it sounds too good to be true, it probably is.

Buying a home can be one of the most empowering decisions of your life—if you do it right. And doing it right doesn’t mean knowing everything. It just means slowing down, asking questions, and committing to making decisions that work for your future—not someone else’s expectations.

8.3 Leasing vs. Buying a Car

8.3.1 Behind the Wheel: Buy or Lease?

Deciding whether to buy a car or lease one isn’t just about dollars and cents—it’s about lifestyle, driving habits, risk tolerance, and how often you want that “new car smell.”

For some, a car is just a way to get from point A to point B. For others, it’s an identity, a reward, or even a financial trap. The key is to make a choice that supports your goals, not just your impulses.

8.3.2 What Is Leasing?

A lease is a contract where you pay to use a car for a fixed period (usually 2–4 years) without owning it. You return the car at the end unless you choose to buy it.

Residual Value is the estimated value of the car at the end of the lease. If you want to buy the car, this is the price you pay.

Leasing a car is like renting it long-term—usually for 2 to 4 years. You make monthly payments to use the car, but you don’t own it. At the end of the lease:

-

- You return the car to the dealer,

- Or buy it at a predetermined “residual value,”

- Or start a new lease with a different car.

Why people lease:

-

- Lower monthly payments compared to buying

- Little or no down payment

- Always driving a new car under warranty

- Fewer worries about long-term maintenance

But leasing also has downsides:

-

- You don’t own the car (no equity)

- Mileage limits (usually 10,000–15,000 per year)

- Fees for excess wear and tear

- Penalties if you end the lease early

8.3.3 What Does It Mean to Buy a Car?

When you buy a car (whether new or used), you either pay in full or take out a loan. After the loan is paid off, the car is yours—free and clear.

Pros of buying:

-

- No mileage limits

- You build equity—you can resell or trade in

- You can customize or modify it

- Eventually, no more monthly payments

Cons of buying:

-

- Higher monthly payments than leasing

- Larger upfront costs (down payment, taxes, registration)

- You’re responsible for all repairs once the warranty expires

- Rapid depreciation—especially with new cars

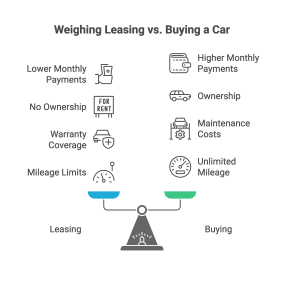

8.3.4 Side-by-Side Comparison

Leasing vs. Buying a Car

| Feature | Leasing | Buying |

| Ownership | No | Yes |

| Monthly Cost | Lower | Higher |

| Down Payment | Lower | Higher |

| Mileage Restrictions | Yes (Penalties if exceeded) | None |

| Customization | Not Allowed | Fully Allowed |

| Long-Term Cost | Higher over time | Lower if you keep the car long term |

| Value Retained | None | Can sell or trade |

| Repairs | Covered under warranty | Covered only during warranty |

8.3.5 Real-Life Scenario

Daniela is trying to choose between two options:

- Lease: New Honda Civic, $300/month for 36 months, $2,000 down

- Buy: Same Civic, $475/month for 60 months, $4,000 down

After 3 years:

- With the lease, she returns the car and starts over.

- With the purchase, she still has 2 years of payments left—but she owns a car worth about $13,000.

Which is better? It depends. If Daniela loves having a new car every few years and wants lower monthly payments, leasing is the better fit. But if she values long-term savings and ownership, buying makes more sense.

8.3.6 When Leasing Makes Sense

-

- You like driving new cars every few years

- You drive fewer miles than average

- You want lower monthly payments

- You don’t want to worry about long-term repairs

- You prioritize convenience over ownership

8.3.7 When Buying Makes Sense

-

- You plan to keep the car for many years

- You drive long distances regularly

- You want to build equity in your car

- You’re okay with higher payments now for savings later

- You want freedom to modify or resell your car

8.3.8 Car Ownership Myths

-

- “Buying is always better.” → Only if you keep the car for a long time and avoid frequent repairs.

- “Leasing is a waste of money.” → Not if you value low payments, convenience, and guaranteed warranties.

- “A car is an investment.” → Nope. Cars lose value over time. They’re a necessary expense, not an asset.

In the end, your car should support your life—not run it. Whether you lease or buy, make sure the decision fits your budget, your lifestyle, and your long-term financial goals. Drive smart.

8.4 Hidden Costs and Smart Strategies

8.4.1 The Real Price Tag: It’s Not Just the Monthly Payment

Whether you’re buying a home or a car, there’s a sneaky truth nobody tells you: the sticker price is just the beginning.

People often fall into the trap of budgeting for the obvious—mortgage or car loan payments—without considering the quiet little costs that add up fast. These hidden costs can destroy your budget if you don’t plan for them ahead of time.

This section exposes the most common financial traps in owning a home or car—and how to avoid them.

8.4.2 Homeownership’s Hidden Surprises

Buying a home feels exciting, but it comes with responsibilities that renting never required.

Hidden Costs of Owning a Home:

-

- Property taxes: These can rise yearly, depending on where you live.

- Homeowners insurance: Required by lenders and not cheap in some areas.

- Maintenance and repairs: Roof leaks, broken heaters, plumbing issues… it all adds up.

- HOA fees: If you live in a condo or private community, expect monthly dues.

- Utilities: Often higher in homes than apartments.

- Furnishing: You may need to buy everything—from curtains to lawnmowers.

Example:

Luis bought a house thinking he’d be paying $1,400/month for his mortgage. But once he factored in taxes, insurance, utilities, and an unexpected $6,000 roof repair, his “affordable” house suddenly felt like a money pit.

8.4.3 Estimating Monthly Costs Beyond the Mortgage

When most people budget for buying a home, they focus only on the mortgage. But your true monthly cost of homeownership includes several hidden or less obvious expenses. Here’s how to think about them:

-

-

Property taxes are typically 1–2% of the home’s value per year. That amount is divided into monthly payments—often escrowed with your loan.

-

Homeowners insurance usually ranges from $75 to $150 per month, depending on the region and coverage.

-

Maintenance and repairs are inevitable. A good rule of thumb is to set aside 1–3% of the home’s value each year for ongoing upkeep—things like plumbing, HVAC, roof, appliances, and general wear.

-

Utilities are often higher than in rental units—especially water, gas, and garbage, which may have been included in rent before.

-

HOA fees, if applicable, can add $100 to $500 monthly in condos or gated communities.

-

Even if these costs don’t show up in your loan estimate, they still come out of your monthly cash flow.

NEW PROBLEM: What Will Isaiah Really Pay?

Scenario:

Isaiah is buying a house priced at $320,000. His estimated monthly mortgage (principal and interest only) is $1,650. The home is not part of an HOA, but he wants to know his full monthly cost before committing.

He uses these estimates:

-

-

Property taxes: 1.2% of the home’s value per year

-

Homeowners insurance: $100 per month

-

Maintenance and repairs: 2% of the home’s value per year

-

Utilities: $300 per month

-

Step 1: Estimate property taxes

Property taxes = 1.2% of $320,000 = $3,840 per year

Monthly property tax = $3,840 ÷ 12 = $320 per month

Step 2: Estimate maintenance and repairs

Maintenance = 2% of $320,000 = $6,400 per year

Monthly maintenance = $6,400 ÷ 12 = $533 per month

Step 3: Add up Isaiah’s total monthly housing cost

-

-

Mortgage: $1,650

-

Property tax: $320

-

Homeowners insurance: $100

-

Maintenance: $533

-

Utilities: $300

-

Total monthly cost = $2,903

Final Insight:

Isaiah thought he could afford this home based on a $1,650 mortgage. But his real monthly commitment is almost $2,900—a difference of over $1,200. If he had only budgeted for the mortgage, he might have found himself struggling. That’s why understanding the full picture of ownership is critical before buying a home.

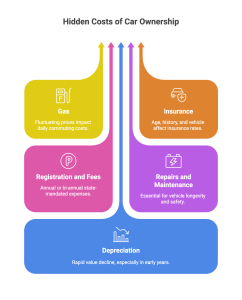

8.4.3 Hidden Costs of Car Ownership

Cars aren’t just expensive to buy—they’re expensive to keep.

Common Extra Costs:

-

- Gas: Prices fluctuate and long commutes add up.

- Insurance: Depends on your age, driving history, and vehicle type.

- Registration and fees: Annual or bi-annual in most states.

- Repairs and maintenance: Brakes, tires, oil changes, engine work—especially after the warranty expires.

- Depreciation: The value of your car drops rapidly, especially in the first few years.

Example:

Tasha bought a used luxury SUV for $22,000. She thought she got a great deal—until she realized new tires cost $1,200, insurance was nearly double her old car, and it guzzled gas. That “affordable” car turned out to be a budget-killer.

8.4.4 Smart Strategies for Homes and Cars

Don’t panic—owning things isn’t bad. But owning smartly is everything.

For Homes:

-

- Set aside 1–3% of the home’s value per year for maintenance.

If your house is worth $250,000, expect to spend $2,500–$7,500/year. - Get a home inspection before buying.

Never skip this step—it reveals what’s likely to break or cost you soon. - Buy below your max budget.

Give yourself room for repairs, lifestyle upgrades, and unexpected costs.

- Set aside 1–3% of the home’s value per year for maintenance.

For Cars:

-

- Buy used, certified pre-owned.

Let someone else take the hit on depreciation. - Research insurance and repair costs before buying.

A cheap car with expensive parts isn’t a deal. - Stick to reliable brands.

It’s boring, but long-term savings beat short-term flash.

- Buy used, certified pre-owned.

8.4.5 Kevin’s Tips from Experience: What Calculators and Car Dealers Won’t Tell You

When the Mortgage Calculator Lied

Kevin learned the hard way that online mortgage calculators can be dangerously optimistic. They often show you a rosy monthly payment but leave out all the hidden and variable costs—like property taxes, insurance, closing costs, and especially renovation surprises.

When he bought his first home, he was excited by what the calculator said he could “afford.” But once he moved in, reality hit. He had big plans to remodel—but hadn’t budgeted enough. He ended up taking out a home equity line of credit (HELOC) just to finish the renovations. That extra debt added monthly payments and created financial stress for years.

The lesson? Don’t just ask, “Can I afford the monthly payment?” Ask, “What will this home actually cost me over the next 12–24 months?” Factor in everything—from closing costs and furniture to plumbing emergencies and inspection delays.

Now, when Kevin buys a home—whether to live in or as an investment—he creates a full renovation and holding cost budget, including:

-

-

Permit fees

-

Contractor quotes with a 15% buffer for delays

-

City inspection timelines

-

Cost overruns for structural damage or hidden issues

-

Months of vacancy during remodels

-

Taxes and insurance during that time

-

That discipline is part of why his Airbnb properties are now successful and sustainable.

The Truth About Cars and Depreciation

Kevin also learned that new cars are emotional traps disguised as financial decisions. For years, he loved the smell of a new car and the excitement of being the first owner. But when he saw how fast a new vehicle’s value dropped—sometimes 30% in the first year—he realized he was losing thousands just for bragging rights.

Now, his rule is simple: never buy new. He only buys cars that are 2–3 years old, preferably off-lease models that have been well maintained but already absorbed the steepest depreciation hit. He pays cash when possible and focuses on total cost of ownership—not monthly payments.

Even newer used cars need repairs—so he always budgets at least $1,000–$1,500 per year for unexpected maintenance, from tires to alternators. That way, no surprise ever turns into a financial crisis.

Kevin’s Real-World Advice

-

-

Don’t believe the “monthly payment” trap—know your total cost of ownership.

-

Always budget for things going wrong—because they will.

-

Use calculators, but double-check them with your own critical thinking.

-

Financial peace comes from planning ahead, not just qualifying for the loan.

-

8.4.6 Planning for the Long Run

Whether it’s a car or a house, ownership isn’t a one-time cost—it’s a lifelong relationship with a budget.

Smart ownership means:

-

- Looking beyond the monthly payment

- Saving for the long-term

- Anticipating worst-case scenarios

- Being honest about your lifestyle

8.4.7 Final Thought

Everyone dreams of owning their dream home or perfect car. And that’s valid. But dreams that come with financial nightmares aren’t worth it.

The goal isn’t to avoid owning things—it’s to own things that serve you, not stress you. Think long-term, budget with realism, and give yourself the power to enjoy what you own.

8.5 Case Studies and Lifestyle Decisions

8.5.1 Financial Decisions Are Life Decisions

When it comes to big purchases like a home or a car, people love to talk numbers: interest rates, monthly payments, resale value. But behind every financial decision is something deeper—your lifestyle, your identity, and your priorities.

This section explores real-life examples—some from everyday people, some from Kevin’s personal journey—that show how your values, stage of life, and even personality traits shape the choices you make. There’s no single “right way” to own a home or car. But there is a right fit for who you are right now.

Name: Jayden

Age: 26

Location: Los Angeles

Occupation: Freelance videographer

Housing choice: Renting furnished apartments

Story:

Jayden thrives on freedom. Every few months, he switches neighborhoods. He rents short-term apartments through extended-stay platforms, even if it costs more than signing a year-long lease. Why? He values change and creativity. Buying a house would feel like a prison sentence.

Takeaway:

For some people, renting offers emotional and professional flexibility. Not everyone wants roots. And that’s okay.

Name: Araceli

Age: 43

Location: San Antonio

Occupation: Public school teacher

Housing choice: Bought a duplex with her parents

Story:

Araceli used her teacher loan program to buy a small duplex. Her elderly parents live in one unit, and she and her teenage son live in the other. It’s not her dream home, but it meets her financial and family needs. Plus, having two units gives her the option to rent one in the future.

Takeaway:

Sometimes, your housing decision is about family dynamics and practical trade-offs. Homeownership can be empowering—even if it’s not picture-perfect.

8.5.2 Kevin’s Real Estate Story

When I first started buying homes, I made the same mistake a lot of people make: I focused on the house itself—the shiny kitchen, the perfect finishes, the big backyard. What I didn’t realize then was that the location matters far more than the house.

Over time, I learned that location drives everything:

-

- School quality — the right district can add huge value and stability.

- Resale potential — buyers will always compete for good neighborhoods.

- Property appreciation — well-located homes tend to grow in value faster.

- Daily lifestyle — commute times, nearby amenities, safety, and overall happiness.

Today, my rule is simple: I’d rather buy the worst house in the best neighborhood than the best house in the worst one. You can remodel a house—you can change its walls, floors, and even its style—but you can’t move it.

In one case, I bought a smaller, older house in a highly desirable area. Years later, its value grew significantly without me lifting a finger, just because the neighborhood became even more sought after. In contrast, I’ve seen people spend big on a dream house in an unpopular area, only to struggle when it came time to sell or refinance.

Real estate is emotional, but if you treat it like an investment, location always comes first. Start there, and everything else—remodeling, upgrades, even rental income—becomes much easier to optimize later

Name: Marcus

Age: 35

Location: Chicago

Occupation: Civil engineer

Vehicle decision: Bought a certified pre-owned hybrid sedan

Story:

Marcus used to lease sporty cars every 3 years. But after a financial setback during COVID, he reassessed. He sold his luxury lease early, paid penalties, and bought a used Toyota Camry Hybrid. His monthly expenses dropped by $400, and he says the peace of mind is worth more than any horsepower.

Takeaway:

Financial maturity often comes with embracing practicality over ego. Owning a “boring” car can be a power move.

8.5.3 Kevin’s Car Shift

For years, I loved cars. I’ve owned everything from a Chrysler convertible to a Porsche Boxster, and I used to think driving something flashy and fun was worth the higher price tag. But when I became a father in 2021, my priorities shifted overnight. Suddenly, safety, practicality, and cost efficiency mattered far more than showing off on the road.

These days, I approach car buying very differently. I focus on functionality and long-term value, not emotion. Instead of chasing status symbols, I look for affordable, reliable options that offer advanced tech, good safety features, and great warranties at a fraction of the price of European luxury brands.

I used to favor certified pre-owned cars that were 2–3 years old because someone else absorbed the steepest depreciation while I still got a nearly-new vehicle. That strategy still makes sense for many people—but now, I often prefer buying brand-new vehicles from emerging brands that combine affordability with functionality.

Here’s the key lesson: don’t overspend on cars. They are depreciating assets, not investments. Be honest about what you actually need:

-

- If you have a growing family, safety, space, and reliability matter most.

- If you drive a lot, fuel efficiency and maintenance costs should lead the decision.

- If you rarely drive, you don’t need a luxury badge to get from point A to point B.

Cars can be fun, but they shouldn’t derail your financial plan. When your lifestyle changes, your approach to cars should change too.

8.5.4 What Do You Value?

Here are a few lifestyle-driven questions to help guide your next big purchase:

-

- Do you value flexibility or stability?

- Are you driven by status, comfort, or long-term savings?

- Will this purchase support your goals—or just look good on Instagram?

- Are you making this decision for yourself, or to prove something to others?

8.5.5 Final Reflection

Buying a car or home is never just about math. It’s about your life, your story, and your future.

The most successful financial decisions aren’t always the cheapest ones. They’re the ones that make sense for who you are and who you’re becoming. Own wisely—and own with intention.

- Buying a home can help you build long-term wealth, but it comes with major upfront costs and long-term commitments. It’s not always the right choice for every life stage.

- Renting offers flexibility, fewer responsibilities, and predictable monthly costs, but it doesn’t build equity or offer tax benefits.

- Mortgages are complex financial products. Understanding your loan’s interest rate, length, and amortization schedule can save you tens of thousands of dollars over time.

- Leasing a car may lower your monthly payments but offers no long-term value or ownership—perfect for those who like to drive newer vehicles and avoid maintenance headaches.

- Buying a car is more cost-effective long-term and gives you flexibility, but it typically comes with higher upfront costs and responsibility for depreciation.

Conceptual Questions

- Why might someone choose to rent a home even if they can afford to buy one?

- Describe the key advantages of buying a home.

- What are the main components of a monthly mortgage payment?

- Explain the 28/36 rule in your own words.

- What is the difference between a fixed-rate and an adjustable-rate mortgage?

- Why is homeownership sometimes considered a “forced savings plan”?

- What are some hidden costs of homeownership that buyers often overlook?

- Compare the lifestyle advantages of leasing a car versus buying one.

- Why is understanding depreciation important when buying a car?

- How do lifestyle values influence major purchases like homes or vehicles?

Problem Solving Questions

- Future Value with Monthly Compounding: Car Down Payment Savings You plan to buy a car in 3 years and want to save $200 per month into an account earning 6% annual interest, compounded monthly.

Question: How much will you have saved after 3 years?

- Present Value of a Home Down Payment You want to have $30,000 in 5 years for a home down payment. If you can earn 5% annual return, compounded annually, how much should you invest today?

- Loan Payment Calculation: Auto Loan You borrow $18,000 to buy a used car. The loan is for 5 years at 6% annual interest, with monthly payments.

Question: What is your monthly payment?

- Rule of 72 Application: Real Estate Investment You invest in a REIT (real estate investment trust) earning 8% annually.

Question: Approximately how long will it take for your investment to double using the Rule of 72?

- Comparing Two Mortgages (EAR) Mortgage A: 6% annual interest, compounded annually

Mortgage B: 5.8% annual interest, compounded monthly

Question: Which has the higher effective annual rate (EAR)?

- Annuity: Future Value of Monthly Car Savings You save $400 per month for 4 years to buy a car, earning 5% interest compounded monthly.

Question: What will be the future value of your savings?

- Annuity: Present Value of a Rental Stream You receive $15,000 in annual rent from a property for 10 years. If the discount rate is 6%, what is the present value of this rental income?

- Amortization Insight You take a $200,000 mortgage at 6% interest for 30 years. After 5 years, you check your payment history.

Question: Which portion of your monthly payments was larger during the first year: interest or principal?

- Early Mortgage Prepayment Impact You make an extra $5,000 payment toward your mortgage principal in year 2 of a 30-year loan.

Question: What is the effect on total interest paid and loan duration?

- Future Value vs. Present Value Decision

Option A: Receive $20,000 today

Option B: Receive $24,000 in 5 years

Question: If you can earn 4% interest annually elsewhere, which is better?

Interactive Challenge

- Quick Estimation: Rule of 72 for a Home Fund

You invest in a fund earning 6% annually to save for a house.

Question: Using the Rule of 72, how long will it take for your investment to double?

- Choose the Best Compounding Option: Down Payment Fund

You want to grow your $10,000 down payment fund over 10 years at 6% interest.

Options:

A) Compounded annually

B) Compounded quarterly

C) Compounded monthly

D) Compounded daily

Question: Which option gives the highest future value, and why?

- Identify the Mistake: Loan Amortization

A friend says: “My monthly mortgage payment always goes entirely to the loan balance.”

Question: What misunderstanding does your friend have?

- Real-World Comparison: Cash vs. Payment Stream

You’re offered two work relocation bonuses:

Bonus A: $5,000 upfront

Bonus B: $1,200 annually for 5 years

Question: Which has the higher present value at a 5% interest rate?

- Savings Plan Adjustment: Car Fund Strategy

You start saving $300/month at 6% for a car over 6 years. After year 2, you increase it to $400/month.

Question: How will this impact your final savings compared to staying at $300/month?

- Strategy Challenge: Paying Off a Car Loan

You have a car loan but also receive a $1,000 annual bonus.

Options:

A) Use it to pay extra on the loan

B) Put it in a savings account earning 1%

Question: Which saves more in the long term?

- Timeline Building: Leasing vs. Buying

Sketch out 3 years of costs:

Leasing: $350/month

Buying: $600/month, but you gain $5,000 equity by year 3

Question: After 3 years, which has the lower total cost, adjusted for equity?

- Mental Math: Estimating a Car Fund Doubling

You invest $2,500 at 9% annually.

Question: Approximately how many years will it take to reach $5,000?

- Lifestyle Reflection: Buy or Lease Decision

You change jobs every 2 years and move frequently.

Question: Based on your lifestyle, should you lease or buy your next car?

- Decision Point: Rent vs. Buy

You plan to stay in your city for only 2 years. You can afford to buy a small condo, but rent is cheaper short-term.

Question: Which is the smarter choice?