9

By the end of this chapter, you should be able to:

- Explain the purpose of insurance and how it helps manage financial risk.

- Identify the most common types of insurance and determine which are essential based on personal circumstances.

- Understand the key components of an insurance policy, including premiums, deductibles, copays, coinsurance, out-of-pocket maximums, and exclusions.

- Evaluate and compare insurance policies using cost-benefit analysis and coverage details.

- Integrate insurance planning into your long-term financial goals, including budgeting, estate planning, and risk management.

9.1 Why Insurance Matters

9.1.1 The “What If” Factor

Let’s start with a question no one likes to ask: What if something bad happens?

What if you crash your car? What if you break your arm before a big job interview? What if your dog bites someone at the park? What if your house floods, your bike gets stolen, or you get sick while traveling?

Life is full of “what ifs.” Insurance is the adult version of carrying an umbrella—not because it’s raining now, but because it might. It doesn’t prevent bad things from happening. But it helps make sure you won’t be financially ruined if they do.

Insurance is your financial shock absorber. Without it, even a small accident could derail your budget for months or years. With it, you transfer the risk to someone else—usually a big company with deep pockets—and you pay them a fee (called a premium) to carry that risk for you.

Mark had always dreamed of owning a red convertible. One sunny afternoon, he parked downtown with the top down and ducked into a café. Out of nowhere, a summer storm rolled in. By the time he got back, the interior was soaked and the dashboard electronics were ruined—repairs totaled nearly $6,000.

Thankfully, Mark had comprehensive auto insurance, which covered the damage. Without it, he would have been on the hook for the full cost.

Key Takeaway: Comprehensive auto insurance protects against unpredictable risks like weather, theft, or vandalism. Even when you’re careful, it’s the unexpected that can cost the most.

9.1.2 Risk: The Invisible Threat to Your Budget

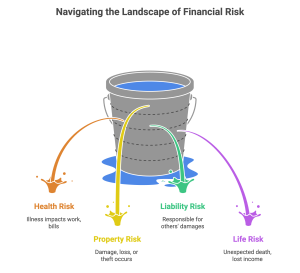

Risk is everywhere. That’s not to scare you—it’s just reality. Financial risk comes in many flavors:

-

- Health Risk – You get sick or injured and can’t work or pay bills.

- Property Risk – Your stuff gets damaged, lost, or stolen.

- Liability Risk – You’re responsible for someone else’s injury or damages.

- Life Risk – You pass away unexpectedly, and your family loses your income.

Insurance is a tool that helps manage these risks. And not all risks are equal. Some, like breaking your phone screen, are annoying. Others, like a car accident with hospital bills, can be devastating.

Jayden was biking to class on a rainy morning when he hit a slick patch and crashed. He fractured his wrist and ended up in the emergency room. Without health insurance, he had to cover over $4,000 in medical bills out of pocket. To pay for it, he used a credit card with a 24% interest rate—debt he’s still carrying years later.

With even a basic student health plan, Jayden’s cost could have been a few hundred dollars instead of thousands. One accident turned into a long-term financial setback.

Key Takeaway: Health insurance protects you from the high cost of unexpected medical events. Without it, a single accident can leave you with long-lasting debt. Even basic coverage can make a huge difference.

9.1.3 Insurance Is for Smart, Not Scared, People

There’s a myth that buying insurance means you’re paranoid or overly cautious. But in reality, it’s a smart and strategic move.

Think about it this way:

-

- You wear a seatbelt not because you expect to crash, but just in case.

- You backup your phone not because you want it to break, but because it might.

Same with insurance. You’re not buying fear—you’re buying peace of mind.

In fact, studies show that people with adequate insurance tend to feel more in control of their finances. They sleep better knowing that if something bad happens, they’re not starting from zero.

9.1.4 When Insurance Becomes a Lifeline

Let’s be honest—insurance can feel like a boring expense. You pay and pay… and most of the time, nothing happens.

But then, one day, it does.

Kevin learned this again when he became a dad. With two young kids, he shifted his priorities fast. He added life insurance to protect his children in case something ever happened to him. “I wasn’t thinking about myself anymore,” he says. “I was thinking about what they’d need if I wasn’t around.”

That’s what insurance really is: a safety net for the people you love, including your future self.

9.1.5 Insurance vs. Saving: What’s the Difference?

Some people ask: Why not just save money instead of paying for insurance?

Here’s the catch: Saving is awesome (and necessary), but insurance covers things that saving alone usually can’t. Imagine trying to save $300,000 in case of a major medical emergency or $25,000 for a stolen car.

You’d need years—and a lot of luck—to save that much. Insurance gives you access to that protection right away, for a fraction of the cost.

Think of it like this:

-

- Savings = your plan A.

- Insurance = your emergency parachute.

9.1.6 Real Talk: Is Insurance Always Worth It?

Not always. There are times when you might not need certain types of insurance. For example:

-

- If you’re young and healthy, you might choose a high-deductible health plan to save money.

- If your car isn’t worth much, maybe liability coverage is enough.

- If you’re renting a furnished apartment and don’t own much, maybe you skip renters insurance (though it’s usually very cheap).

The key is to weigh the cost of the premium versus the risk you’re protecting against.

Rule of thumb: If losing something would ruin you financially, insure it.

9.1.7 Final Takeaway

Insurance isn’t about doom and gloom. It’s about adulting like a boss. It’s about being ready, staying calm, and knowing that if life throws a curveball, you won’t have to drop everything (or go broke) to deal with it.

You don’t need to be rich to protect yourself—you just need to be smart about risk. That’s the kind of grown-up power insurance gives you.

Coming up next: the different types of insurance out there… and how to tell which ones are worth your money.

9.2 Types of Insurance: What You Need (and What You Don’t)

9.2.1 So Many Insurances, So Little Time

Insurance can feel like a buffet of anxiety: health, car, life, renters, wedding, pet… Do you need them all?

(Spoiler: no.)

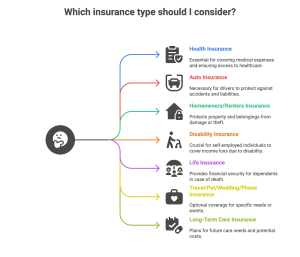

This section helps you figure out what’s essential and what you can skip—depending on your lifestyle, budget, and risk tolerance.

9.2.2 Health Insurance: The Non-Negotiable

If you can only afford one kind of insurance, make it health insurance.

Even a quick visit to the ER can cost thousands. Health insurance protects your body and your bank account.

Types:

-

- HMO – Cheaper, must use in-network doctors.

- PPO – More flexible, more expensive.

- High-Deductible Plans – Low monthly cost, high out-of-pocket costs. Often paired with an HSA.

Group Insurance Bonus: If your job or school offers group coverage, take it. Group plans are usually cheaper and easier to qualify for than private policies.

9.2.3 Auto Insurance: Required (for Drivers)

Auto Insurance: Required (and Smart)

If you drive, you’re legally required to have auto insurance—but the right coverage also protects you financially.

Key coverage types:

-

- Liability – Pays if you injure someone or damage their property.

- Collision – Covers repairs if you hit something.

- Comprehensive – Protects against theft, vandalism, and natural disasters.

- Uninsured Motorist – Helps if the other driver has no insurance.

Kevin’s Tip – Comprehensive Coverage Matters

There was a time when Kevin was driving on the highway, and out of nowhere, a small animal darted across the road. He couldn’t avoid it, and the impact caused a significant dent and damage to his front bumper.

Thanks to his comprehensive auto insurance, Kevin didn’t have to pay thousands of dollars out of pocket for the repairs. That experience taught him two things:

-

- Unexpected accidents happen—even when you’re a careful driver.

- Comprehensive coverage is worth it if you want peace of mind for events you can’t control, like animals, storms, or theft.

9.2.4 Renters & Homeowners Insurance: Your Stuff Matters

-

- Renters insurance covers your personal belongings.

- Homeowners insurance covers both your house and belongings.

Both typically cover:

-

- Fire, theft, and water damage (not floods!)

- Personal liability if someone gets hurt in your space

Group discount tip: Many renters and homeowners can bundle with auto policies or get group rates through employers.

Tasha’s apartment burned in a freak kitchen fire. Thanks to her renters insurance, she was able to replace her laptop, clothes, and books without going into debt. Her policy also covered temporary housing while her apartment was repaired.

Without that coverage, she would have faced thousands of dollars in losses plus the extra expense of paying for another place to stay. The small monthly premium she paid gave her a financial safety net when disaster struck.

Key Takeaway: Renters insurance protects you not only from the loss of personal belongings, but also from the unexpected costs of displacement. A relatively low monthly cost can prevent a financial crisis.

9.2.5 Life Insurance: When Someone Depends on You

Life Insurance: Protecting People Who Rely on You

Life insurance is for anyone whose death would financially impact others.

Types:

-

- Term Life – Affordable, simple, lasts for a set period. Ideal for most families.

- Whole Life – Lasts forever and builds cash value, but costs more.

Kevin’s Experience: Kevin didn’t think about life insurance until he became a dad. Now, he sees it as a way to safeguard his children’s future.

Rule of Thumb: If someone depends on your income, term life insurance is usually essential.

9.2.6 Disability Insurance: Protect Your Income

If you get sick or injured and can’t work, disability insurance gives you a paycheck.

-

- Short-Term – Covers up to 6 months.

- Long-Term – Covers extended loss of income.

This one is especially important if you’re self-employed or don’t have emergency savings.

Group coverage tip: Many employers include this in their benefits. Check your HR portal or ask directly.

9.2.7 Travel, Pet, Wedding, and Phone Insurance: The “Maybes”

Optional, but can be smart depending on your lifestyle:

-

- Travel – For big, expensive, non-refundable trips.

- Pet – For chronic illnesses or expensive breeds.

- Wedding – If you’re spending $20k+ on deposits.

- Phone – If you’re clumsy (we’re not judging).

9.2.8 What You Probably Don’t Need

Not all insurance is worth paying for. In many cases, you’re already covered elsewhere, or the potential benefit doesn’t justify the cost:

-

- Extended warranties on electronics → Many major credit cards automatically extend the manufacturer’s warranty for free.

- Credit card protection insurance → Often unnecessary because federal law already limits your liability for fraudulent charges.

- Trip delay or baggage insurance → Many premium credit cards already include this coverage when you book with them.

- Micro-insurance for cheap gadgets → Insuring a $50 device rarely makes financial sense; replacing it outright is usually cheaper.

Tip: Always check whether you’re already covered before buying add-on insurance. Avoid paying twice for protection you don’t need.

9.2.9 Long-Term Care Insurance: For Later in Life

Experts often emphasize planning for your future self.

Long-term care insurance helps cover things like assisted living, in-home care, or nursing facilities if you lose the ability to perform daily tasks (eating, bathing, etc.).

You probably won’t need it in your 20s or 30s—but knowing it exists helps with long-term planning.

9.2.10 Quick Checklist: What Should You Get?

Here’s a rough guide:

-

- Health

- Auto (If you drive)

- Renters or Homeowners

- Disability (Especially if self-employed)

- Life (If someone depends on your income)

- Travel, Pet, Wedding, Phone (Depends)

- Long-Term Care (For future planning)

Coming up next: how insurance policies actually work—deductibles, copays, coverage limits, and how not to get blindsided.

9.3 Understanding Insurance Costs and Coverage

9.3.1 Why Insurance Terms Sound Confusing (But Don’t Have to Be)

Let’s be real: insurance contracts can sound like they were written by a bored lawyer with a thesaurus. But once you get the hang of a few key concepts, it’s not that bad.

In this section, we’ll break down the major parts of an insurance policy—what you pay, what you get, and what to watch out for—so you can make smarter choices without needing a law degree.

9.3.2 Premiums: What You Pay Regularly

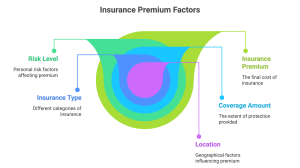

A premium is the amount you pay regularly (monthly, quarterly, or yearly) to keep your insurance active.

Think of it like a subscription:

-

- Pay = you’re covered

- Don’t pay = you’re on your own

Your premium depends on:

-

- Your risk level (age, health, driving record)

- The amount of coverage

- The type of insurance

- Your location

Higher Risk = Higher Premium

This system is based on risk pooling—a large group of people pay into a shared pool, and only some will need to use it at a time. This helps keep insurance affordable (in theory) for everyone.

9.3.3 Deductibles: What You Pay Before They Do

A deductible is the amount you pay out of pocket before your insurance kicks in.

Example:

-

- You have a $1,000 deductible.

- Your hospital bill is $3,000.

- You pay the first $1,000.

- Your insurance pays the remaining $2,000 (depending on your plan).

Lower Deductible = Higher Premium

Higher Deductible = Lower Premium

Choose based on how often you expect to use the coverage.

9.3.4 Copays and Coinsurance: The Shared Costs

After your deductible is met, you’ll still share costs with your insurer.

-

- Copay: A flat fee you pay for a service ($20 to see a doctor).

- Coinsurance: A percentage you pay (e.g., 20% of a surgery bill).

Example:

-

- Surgery costs $5,000

- You’ve met your deductible

- Coinsurance = 20%

- You pay $1,000, insurance pays $4,000

9.3.5 Out-of-Pocket Maximum: Your Safety Net

Your out-of-pocket maximum is the most you’ll pay in a year for covered medical expenses before your insurance starts paying 100%.

For example, if your plan has a $7,000 out-of-pocket max:

-

- You’ll never pay more than $7,000 in a year for covered care (this does not include your monthly premiums).

- It includes deductibles, copays, and coinsurance—everything you pay directly for care.

Tip: If you expect higher medical costs—like having a baby, managing a chronic condition, or caring for young kids—it can make sense to choose a plan with a lower out-of-pocket max, even if the monthly premiums are higher. It protects you from large, unexpected bills.

9.3.6 Coverage Limits: The Ceiling of Protection

Coverage limit = the maximum amount your insurer will pay.

Some policies have:

-

- Per incident limits (e.g., $50,000 per accident)

- Annual limits (e.g., $100,000 per year)

- Lifetime limits (now illegal on many health plans in the U.S.)

Always check your limits—especially for liability coverage or property damage.

9.3.7 Exclusions: What’s NOT Covered

Every policy has exclusions—stuff the insurer won’t cover, like:

-

- Pre-existing conditions (in some cases)

- Cosmetic procedures

- Acts of war or nuclear disasters (yep, really)

- Damage from floods (usually not included in homeowners)

Always read the exclusions section. It’s where most surprises hide.

9.3.8 Actual Cash Value vs. Replacement Cost

This concept is essential for renters and homeowners insurance.

-

- Actual Cash Value (ACV): Pays what your item is worth today (after depreciation).

- Replacement Cost: Pays what it costs to replace it with something new.

Example:

-

- Your 5-year-old laptop is stolen.

- ACV payout: $200

- Replacement Cost payout: $800

Replacement policies cost more—but you get more.

9.3.9 Summary: Know the Key Terms, Protect Your Wallet

Let’s recap the essentials:

-

- Premium = What you pay to stay insured

- Deductible = What you pay before insurance helps

- Copay/Coinsurance = What you share with the insurer

- Out-of-pocket max = What caps your yearly cost

- Coverage limit = The most they’ll ever pay

- Exclusions = What they’ll never pay

- ACV vs. Replacement Cost = Depreciated vs. new value

The more you understand, the more confident you’ll be—not just in choosing a policy, but in using it when it counts.

Up next: how to actually shop for insurance like a pro—without falling for tricks, pressure, or confusing jargon.

9.4 How to Shop for Insurance Like a Pro

9.4.1 Don’t Panic—Plan

Shopping for insurance can feel like ordering at a fancy café in another language. Everyone seems to know what they’re doing… except you.

But here’s the truth: you don’t need to be an expert. You just need a strategy.

Whether you’re buying your first renters policy or choosing a health plan at a new job, this section will teach you how to spot a good deal, avoid the traps, and ask the right questions—without sounding like a total noob.

9.4.2 Step One: Know What You Actually Need

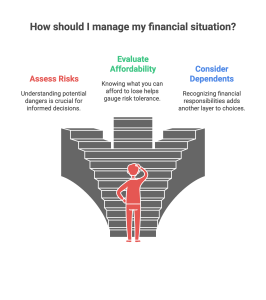

Before shopping, ask yourself:

-

- What risks do I face?

- What can I afford to lose?

- Who depends on me financially?

That’s how you figure out which types of insurance are essential and which are just nice to have.

Kevin’s Rule: “If something would destroy your finances if it happened, insure it. If it would just be annoying, maybe don’t.”

Start with the basics:

-

- Health

- Auto (If you drive)

- Renters or Homeowners

- Disability (Especially if self-employed)

- Life (If you have dependents)

- Extras based on lifestyle (Travel, Pet, Etc.)

9.4.3 Compare Before You Commit

Insurance is a product. Like phones, laptops, or sneakers, you have options.

Here’s how to compare plans effectively:

-

- Use comparison websites

Tools like Policygenius, The Zebra, or NerdWallet can help you compare quotes side by side. Some even explain policies in plain English. - Ask for quotes from multiple providers

Don’t just go with the first brand you recognize. Sometimes lesser-known companies offer better coverage or lower premiums. - Check what’s included (and what’s not)

Does that car policy include roadside assistance? Is dental included in your health plan? Read the fine print or ask directly.

- Use comparison websites

9.4.4 Don’t Be Fooled by Low Premiums

Low premiums look sexy—but they often mean high deductibles and low coverage limits.

Let’s say you pay only $10/month for health insurance. Awesome, right?

Until you break your ankle and realize:

-

- You have a $7,500 deductible

- 30% coinsurance after that

- No coverage for physical therapy

That “cheap” plan suddenly costs you $9,000.

Pro Tip: Always look at the total potential cost, not just the monthly bill.

9.4.5 Ask These Questions Before You Sign Anything

Seriously—ask these. Out loud. To a real human.

-

- What exactly does this policy cover?

- What are the exclusions?

- What’s my deductible, copay, and coinsurance?

- What is the out-of-pocket max?

- Can I choose my own providers or must I stay in-network?

- How do I file a claim—and how long does it usually take?

If the person can’t answer clearly, walk away. That’s a red flag.

9.4.6 Kevin’s Experience: The Art of Negotiation

Kevin once got a better rate on his homeowners insurance just by asking.

He called his provider and said, “Hey, I’m shopping around—can you do better?” Boom. They lowered his premium by 15% on the spot.

Don’t be shy. Insurance is a business, and you’re a customer. You have power.

Other negotiation tips:

-

- Bundle policies (home + auto = discount)

- Ask about student, alumni, or group discounts

- Request annual payment discounts (instead of monthly)

9.4.7 Red Flags to Watch For

Some insurance companies or agents are more interested in your money than your needs. Watch out for:

-

- High-pressure tactics – “This offer expires today!”

- Lack of clarity – If they can’t explain the policy in simple terms

- “Too good to be true” prices – Often means poor coverage

- Bad reviews or unresolved complaints – Google them

- No license – Always verify they’re legit in your state or country

9.4.8 Use Tech to Your Advantage

In today’s world, you don’t have to do all the comparing manually.

Here are some tools that make insurance shopping easier:

-

- Policygenius – Great for life, renters, and health comparisons

- The Zebra – Auto insurance quotes

- Healthcare.gov – Official U.S. government marketplace

- Lemonade, Root, Hippo – Tech-savvy insurers with sleek apps

- Employer HR portals – If you get insurance through work

Also helpful: Reddit, YouTube reviews, and good old Google.

9.4.9 Know When to Reevaluate

You don’t “set and forget” insurance. You need to check your policies at least once a year or whenever life changes significantly.

Re-shop your insurance if:

-

- You move to a new state

- You get married or divorced

- You buy a house or car

- You have a baby

- You switch jobs

- Your income increases or drops

Kevin’s Reminder: After his kids were born, he reassessed everything. Life insurance, property protection, even health plans—adjusting to match his new priorities.

9.4.10 Summary: You’ve Got This

Shopping for insurance isn’t glamorous—but it is powerful.

Once you understand what you need, how to compare plans, and what questions to ask, you’re no longer guessing. You’re strategizing.

And that’s what adulting is all about.

Coming up next: how insurance fits into your long-term financial plan—and why it’s not just a cost, but a crucial part of protecting your future.

9.5 Insurance and Your Long-Term Financial Plan

9.5.1 Insurance Isn’t Just for Emergencies—It’s for Life Strategy

When most people think of insurance, they picture a bad day: a car accident, a hospital visit, a lost suitcase. But smart financial planners know something deeper:

Insurance is not just about protecting against disaster—it’s about protecting your long-term goals.

If you’re working hard to build wealth, security, or freedom, one uninsured event could knock down everything like a financial Jenga tower.

This section ties it all together—how the insurance choices you make now affect not just today, but your entire future.

9.5.2 The Three Pillars of a Long-Term Plan

There are three core areas where insurance plays a long-term role:

-

- Protecting your income – Through health, disability, and life insurance

- Protecting your assets – Through home, renters, auto, and liability coverage

- Protecting your legacy – Through life insurance and estate planning

Mia was a freelance graphic designer with two kids. A car accident left her with a fractured leg—and three months of missed income. Luckily, her short-term disability insurance kicked in, helping cover rent and groceries.

That coverage allowed her to focus on healing without the stress of immediate financial collapse. She was able to maintain her household expenses, avoid debt, and keep her children’s lives stable during recovery.

Without that safety net, Mia would have faced difficult choices: dipping into retirement savings, maxing out credit cards, or falling behind on bills. Any of these would have derailed her long-term financial security. Instead, she preserved her plan, regained her health, and continued building her freelance career.

Key Takeaway: Disability insurance—whether short-term or long-term—can be the bridge that keeps a financial plan intact when health setbacks threaten income. It safeguards not only today’s bills but also tomorrow’s goals.

9.5.3 Kevin’s Real-Life Pivot: From Smart Saver to Strategic Protector

Kevin has always been a disciplined saver—he tracked spending, avoided debt, and made thoughtful financial choices. But becoming a father changed his mindset about risk.

He didn’t start spending less—he started protecting more:

-

-

Added life insurance to ensure long-term support for his kids

-

Increased property coverage on Airbnb homes

-

Bought umbrella insurance to safeguard years of savings

-

Adjusted health coverage to prioritize family care

-

Key Insight: Being financially smart isn’t just about growing wealth—it’s also about shielding it.

9.5.6 Building Insurance into Your Budget

Too often, people treat insurance as a last-minute add-on—something they pay for grudgingly, after rent, food, and Netflix.

But if you treat insurance like an essential category, right alongside savings and investments, you create a more resilient financial structure.

Budget Breakdown Example:

-

- 50% Needs (rent, food, transport)

- 20% Savings + Debt Payoff

- 10% Insurance

- 20% Wants (fun stuff)

You don’t have to hit this perfectly every month, but giving insurance a designated spot helps avoid that “oops, I forgot to pay my premium” moment.

9.5.5 Life Changes = Policy Changes

Insurance isn’t static. Your coverage should evolve with your life.

Here’s when to review and adjust:

-

- New job? Check health, disability, and life options.

- New baby? Update your life insurance beneficiaries and coverage amount.

- New home or car? Adjust property coverage.

- Marriage or divorce? Rethink dependents and liability needs.

- Big income change? Reassess all coverage amounts.

Just like your goals change, your risks change too. Good insurance planning adapts with you.

9.5.6 Estate Planning: The Insurance Angle

Estate planning sounds like something only rich people do—but it’s really just about making sure your money and responsibilities go where they should if something happens to you.

Life insurance plays a huge role here.

If you pass away unexpectedly, a well-structured policy can:

-

- Pay off debts or a mortgage

- Provide for kids or dependents

- Cover funeral costs

- Avoid burdening your loved ones financially

Even a simple term life policy can help make sure your family isn’t left scrambling. And if you own property or a business (like Kevin’s Airbnb rentals), it’s even more important to plan for succession and tax liabilities.

9.5.7 Umbrella Insurance: The “Just in Case” Layer

Once your net worth grows—maybe you own a home, have investments, or run a business—you might want umbrella insurance.

It’s a type of policy that kicks in after your other policies hit their limits. Think of it like a safety buffer.

Example:

-

- You cause a car accident.

- Your auto liability coverage covers up to $300,000.

- The person sues you for $750,000.

- Your umbrella policy pays the remaining $450,000.

This protects your home, savings, and future income from being wiped out in a single lawsuit.

9.5.8 When to “Self-Insure”

As your savings grow, you may decide to “self-insure” certain risks.

This means you choose not to buy insurance because you can afford to cover the loss yourself.

Examples:

-

- Not buying phone insurance if you have enough saved to replace it

- Dropping collision coverage on a 15-year-old car

- Opting for a high-deductible health plan paired with an HSA

Only self-insure if you actually have the funds to cover the loss. Otherwise, it’s just risky optimism.

9.5.9 Insurance as a Confidence Booster

Here’s the emotional side of insurance: it helps you sleep better.

When you know you’re protected, you make bolder, smarter moves:

-

- You take career risks, knowing you’re covered if things go sideways

- You travel more, worry less

- You invest with peace of mind

Insurance doesn’t eliminate uncertainty—but it gives you confidence that you’re not alone in facing it.

9.5.10 Final Thoughts: Insurance Is a Quiet Hero

Insurance isn’t flashy. It doesn’t sparkle like a new laptop or taste amazing like takeout sushi. But it does something powerful:

It protects your future from being erased by one unlucky day.

Whether you’re just starting out or already building wealth, insurance deserves a seat at the financial planning table. It’s the quiet hero in your money journey—there when you need it, invisible when you don’t.

- Insurance transfers financial risk from you to a company in exchange for a regular payment (the premium).

- Not all insurance is equally necessary. Health, auto, and renters/homeowners insurance are usually essential; others depend on lifestyle and income.

- Understanding policy terms (like deductibles, coverage limits, and exclusions) is crucial to making informed decisions.

- Cheapest isn’t always best. Evaluate total potential cost—not just the monthly premium—when comparing policies.

- Your insurance needs change as your life changes—review and update policies regularly.

- Umbrella and long-term care insurance may become relevant as your income and responsibilities grow.

- Good insurance planning boosts confidence, protects assets, and supports your future goals—not just emergencies.

Conceptual Questions

Q1: What is the primary purpose of insurance in personal finance?

Q2: Explain the difference between a premium and a deductible.

Q3: What is the difference between liability insurance and comprehensive insurance in an auto policy?

Q4: What are two major types of health insurance plans, and how do they differ?

Q5: Describe the concept of “actual cash value” versus “replacement cost” in property insurance.

Q6: What is the purpose of an out-of-pocket maximum in a health insurance plan?

Q7: When is life insurance necessary, and what type is generally best for young adults?

Scenario-Based Problems

Case Study 1: Kevin’s Rental Car Confusion

Kevin traveled to Panama and rented a car. The rental company offered him expensive insurance, but he declined because he thought his credit card covered it. After a minor fender bender, he discovered that his card only covered theft—not damage. Kevin had to pay nearly $2,500 in repairs.

Q1: What assumption did Kevin make that led to an unexpected cost?

Q2: How could Kevin have verified his coverage before declining the rental insurance?

Q3: What is a better practice when facing optional insurance while traveling?

Case Study 2: Aisha’s Low Premium, High Surprise

Aisha, a 24-year-old recent college grad, chose the cheapest health insurance plan available: $0 premium, but a $9,000 deductible. A sudden appendix surgery left her with a $6,500 bill—well below her deductible. She hadn’t realized how much she’d have to pay before insurance kicked in.

Q1: What kind of trade-off did Aisha make when choosing her insurance plan?

Q2: What mistake did she make in evaluating her plan?

Q3: What advice would help someone in a similar situation?

Case Study 3: Mark and the Liability Lawsuit

Mark hosted a backyard party at his new home. A guest slipped on the stairs, broke a leg, and sued Mark for $100,000 in medical and legal costs. His homeowners insurance only covered up to $50,000 in liability. Mark ended up paying the rest out of pocket.

Q1: What type of insurance coverage did Mark need more of?

Q2: How could he have prevented paying $50,000 out of pocket?

Q3: What lesson does this case show about liability risks?

Problem-Solving Questions

Case Study 1: Comparing Two Health Plans

Natalie is choosing between two health insurance plans:

-

Plan A: $350/month premium, $1,000 deductible, 20% coinsurance

-

Plan B: $150/month premium, $5,000 deductible, 30% coinsurance

She expects to have one major medical procedure this year costing $12,000. Assume the out-of-pocket max won’t be reached.

Q1: What is the total annual premium cost for each plan?

Q2: How much will Natalie pay in medical costs under each plan (excluding premiums)?

Q3: Based on total cost (premium + medical expenses), which plan is cheaper for Natalie?

Case Study 2: Understanding Replacement Cost vs. Actual Cash Value

Lena’s apartment was broken into, and her 4-year-old laptop was stolen. It originally cost $1,200. Her renters insurance offers either Actual Cash Value (ACV) coverage or Replacement Cost coverage. The laptop depreciates by $200 per year.

Q1: If Lena had ACV coverage, how much would the insurance company pay?

Q2: If Lena had Replacement Cost coverage, how much would she receive?

Q3: How much more would Lena receive with Replacement Cost coverage than with ACV?

Case Study 3: Calculating Liability Coverage Gaps

Miguel was found at fault in a car accident that caused $85,000 in total damage and injury costs. His auto insurance includes liability coverage up to $50,000. He has no umbrella policy or additional protection.

Q1: How much of the damages will Miguel’s insurance cover?

Q2: How much will Miguel have to pay out of pocket?

Q3: What type of insurance could have helped Miguel avoid paying out of pocket in this situation?