6

By the end of this chapter, you should be able to:

- Explain how credit cards work and the role of open credit in personal finance.

- Understand how interest (APR), minimum payments, and grace periods affect credit card debt.

- Compare different types of credit cards, including rewards, student, secured, and retail cards.

- Identify common credit card traps such as teaser rates, penalty fees, and cash advances.

- Apply smart strategies to use credit responsibly and avoid long-term debt.

- Reflect on real-world stories to recognize how emotions, habits, and mindset shape credit use.

- Evaluate your own spending behavior and take steps to build or repair your credit history.

6.1 How Credit Cards Work

6.1.1 What Is a Credit Card—and Why Does Everyone Want One?

A credit card is basically a temporary permission to spend money that isn’t yours. It’s like the bank saying, “Here’s $10,000—go have fun, but don’t forget to pay me back later (and I’ll charge you interest if you’re late).”

People often treat credit cards like an extension of their wallets. But they’re not. They’re debt in disguise—very useful if handled responsibly, but risky if ignored. And banks? They love credit cards. Why? Because they make money when you don’t pay in full. That’s the game.

6.1.2 How Do You Get Approved for a Credit Card?

Banks don’t just hand out credit cards to everyone. First, they want to know if you’re trustworthy—meaning, do you have credit history?

Your credit history is like your financial reputation. If you’ve paid loans or bills on time, you’re probably in good shape. If not, they may see you as a risk.

To decide whether to approve you, banks look at:

-

- Your monthly income

- Any debts you already have

- Your credit score

- How long you’ve had a job

If all goes well, they’ll give you a card with a credit limit—the maximum amount you can borrow. That limit is not an invitation to spend it all. In fact, using less is better for your credit score.

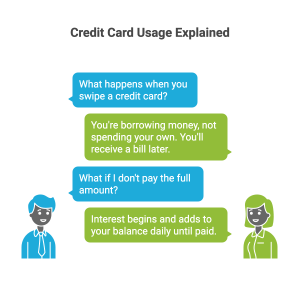

6.1.3 What Happens When You Swipe It?

When you swipe or tap your card—at a store, gas station, or online—you’re borrowing money from the bank. At the end of the month, they send you a bill (a.k.a. statement) with two choices:

-

- Pay it in full (yay! smart move)

- Or pay the minimum (yikes… welcome to the interest trap)

If you only pay the minimum, you’ll still owe the rest—and the bank will start charging interest. It’s like trying to empty a bathtub with a spoon… while someone else is still pouring water in.

6.1.4 Why Do Banks Give You Rewards?

Because they want you to keep using the card. Credit cards with cash back, airline miles, or points sound amazing—and they can be. But let’s be real: those rewards are bait.

If you carry a balance, the interest you pay often outweighs the value of the rewards. So unless you’re paying your bill in full every month, the bank wins, not you. In fact, the average household that carries a balance pays far more in interest than they ever receive in points.

Credit cards aren’t evil, though. They’re tools. Used wisely, they help you build credit, earn perks, and stay flexible. Misused, they can cause stress, debt, and financial regret.

Carla was 22 when she got her first credit card. The bank promised airline miles and access to VIP airport lounges. It felt fancy. She bought a plane ticket to Cancun, a suitcase, cute outfits, meals, tours… all on the card.

But she hadn’t planned how to pay it back. She made only the minimum payments. Six months later, she owed over $15,000. The trip was fun—but the debt stuck around for two years.

Lesson? Rewards are great—but only if you’re also paying in full and on time.

Let’s talk about Kevin—your professor (yes, the one who’s always fussing with the projector). Years ago, after a breakup, he got a credit card for “emergencies.” But his definition of emergency included sushi, a new couch, and a drone.

He paid just the minimum, thinking “I’ll get organized next month.” Before long, he was $8,000 in debt. It took him nearly three years to pay it off. Never again.

Today, Kevin uses two credit cards:

- One for flights and rewards

- One secured card to keep his credit strong. (A secured credit card is a type of credit card that requires a cash deposit upfront—usually equal to your credit limit. It’s designed to help people build or rebuild credit.)

He pays the full balance each month. No exceptions. Because he learned the hard way: a credit card isn’t a magic fix—it’s a powerful tool that demands respect.

6.1.5 How to Know If You’re Ready for a Credit Card

Before you apply, ask yourself:

-

- Do I know how much I spend each month?

- Do I have an emergency fund?

- Can I pay off what I charge in under 30 days?

- Am I spending out of need—or out of impulse?

If your answers make you pause, don’t worry. You can start with a secured credit card, or practice managing money with a debit card while you build better habits.

There’s no rush. Financial maturity takes time—and learning.

Common Credit Card Myths (Debunked)

-

- “I need a credit card to build credit.”

True—but you can start with a secured card or become an authorized user on someone else’s account. - “If I pay the minimum, I’m fine.”

Nope. That’s how debt grows quietly in the background. - “No annual fee cards are always better.”

Not necessarily. Sometimes paying a small fee gets you big rewards—but only if you pay in full every month.

- “I need a credit card to build credit.”

6.2 Understanding Interest and Minimum Payments

6.2.1 What is APR, and Why Should You Care?

APR stands for Annual Percentage Rate. It’s how credit card companies tell you how much they’ll charge if you don’t pay your full balance. If your APR is 24%, that’s not just a random number—it means your unpaid debt grows by about 2% every month.

Here’s the tricky part: APR is expressed yearly, but interest is charged monthly or even daily. That $500 you don’t pay off this month could become $510 next month, and more the month after that… unless you stop it.

APR is one of the most important numbers on your credit card. Yet most people ignore it. That’s like driving a car and never checking the gas gauge.

6.2.2 The Illusion of the “Minimum Payment”

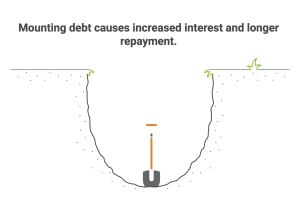

Let’s say you owe $1,000 and your minimum payment is $25. That feels manageable, right? But if you only pay $25 each month and your APR is 20%, it could take over five years to pay it off—and you’ll end up paying hundreds of dollars in interest.

Credit card companies love minimum payments. They seem helpful, but they’re designed to keep you in debt for as long as possible.

Minimum payments cover interest first, not your actual debt. So you’re mostly paying to “rent” your debt, not reduce it.

Luis got a credit card when he started community college. He used it for books, groceries, and a few nights out. Soon he had a $1,200 balance. His minimum payment? $35.

He figured: “I’ll just pay the minimum while I’m in school.”

Three years later, Luis had already paid over $800 in interest—and still owed more than $800 on the card. He realized he had bought everything twice: once with his card, and again with interest.

Once he got a better job, he switched strategies: stopped using the card, paid more than the minimum, and tracked his payments like it was a video game. Today, he’s debt-free and keeps his card just for emergencies.

6.2.3 How Interest Actually Works (Without the Math Headache)

Let’s break it down simply:

-

- Interest is charged daily, not once a year.

- If you carry a balance, interest is added to your balance every day.

- That means your next day’s interest is based on your new, slightly higher balance.

This is called compound interest—interest growing on interest. Compound interest is great when you’re investing. It’s dangerous when you’re in debt.

Even worse: if you make a purchase today and already have a balance, you start paying interest on it immediately. There’s no grace period unless you pay off the full balance first.

6.2.4 Kevin’s Fear of Interest

Kevin has always been cautious with debt.

He’s never let his credit card balances grow because the idea of paying high interest terrifies him. In fact, any time he charges more than usual—like after a big family trip—he immediately checks the balance and sets a plan to pay it off in full before the due date.

It’s not just about saving money.

For Kevin, avoiding debt is about control, peace of mind, and knowing he’s never handing over “free money” to the banks.

Moral of the story?

You don’t have to learn the hard way. Fear of debt—when grounded in good habits—can actually keep you safe.

6.2.5 What You Can Do Instead

If you’re carrying a balance:

-

- Pay more than the minimum. Even $10 extra helps.

- Stop using the card while you pay it down.

- List your debts and organize them by interest rate. Pay off the high-interest ones first.

- Call the credit card company. You can ask for a lower APR. Sometimes, they actually say yes.

And if you’re still debt-free:

-

- Pay your balance in full every month.

- Use your card for planned expenses only—never out of emotion or boredom.

- Learn what your grace period is (usually 21–25 days after your billing cycle). That’s your interest-free window.

Myth-Busting: Interest Edition

-

- “I’ll just pay the minimum and avoid late fees.”

True, but you’ll pay way more in interest. - “APR doesn’t matter if my payments are low.”

APR is everything if you’re not paying in full. - “The bank wouldn’t offer me a card if I couldn’t afford it.”

Banks want you to carry a balance. That’s how they make money.

- “I’ll just pay the minimum and avoid late fees.”

6.3 Comparing Credit Cards: Benefits vs. Traps

6.3.1 Not All Credit Cards Are Created Equal

Walk into any bank or scroll through your email, and you’ll see dozens of shiny credit card offers. Some promise cash back. Others offer travel points, low interest, or no annual fee. Sounds great—but beneath the sparkle, some of these cards hide serious traps.

Picking the right credit card is like picking a roommate. On paper, they all seem friendly. But some might leave dirty dishes everywhere—and others might wreck your credit if you’re not careful.

6.3.2 The Main Types of Credit Cards (and Who They’re For)

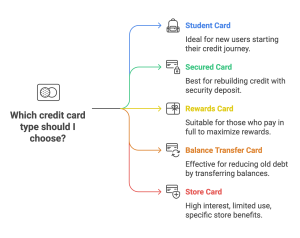

Let’s break down the most common types of credit cards and what they’re really offering:

-

- Rewards Cards

These give you cash back, points, or travel miles for every dollar you spend. They’re great—if you pay your balance in full each month. If not, the high interest rates can cancel out any perks. - Student Cards

Designed for beginners. Lower limits, fewer perks, but easier approval. They often help build credit if used wisely. - Secured Cards

You put down a deposit (usually $200–$500), which becomes your credit limit. Perfect for people with no credit or bad credit. Pay on time, and you’ll build trust with lenders. - Balance Transfer Cards

These let you move high-interest debt from another card onto them, usually with 0% APR for a few months. Useful for debt payoff—but dangerous if you keep spending. However, it usually includes a transfer fee (e.g., 3-5%). - Low Interest or 0% Intro APR Cards

Tempting for big purchases. They give you time to pay without interest—but only for a limited window. Once it closes, the interest can spike fast. - Retail Store Cards

Easy to get, with discounts and deals—but usually very high interest and limited use. Fine for regular shoppers, risky for impulse buyers.

- Rewards Cards

Case Study: Brianna and the Travel Card That Wasn’t

Brianna got a premium travel rewards card because she saw influencers posting about first-class flights and free hotel stays. The card had a $95 annual fee, but she thought, “If they can do it, I can too.”

She used it for groceries, gas, online shopping… everything. But instead of paying the balance in full, she only managed the minimum. After a year, she had over $1,500 in debt and had only earned enough points for one domestic bus ticket.

Brianna realized too late: rewards cards only reward you if you pay on time. Otherwise, the interest charges eat up all your perks—and more.

6.3.4 What to Watch Out For

Even if a card sounds perfect, read the fine print. Watch for:

-

- Annual fees (sometimes hidden in month 13)

- Introductory rates that expire and jump suddenly

- Foreign transaction fees (if you travel)

- Penalty APRs (your rate jumps if you miss a payment)

- Deferred interest (you’ll pay retroactive interest on the entire purchase amount if you don’t pay in full before the promo period ends.)

If the terms confuse you, ask someone you trust—or look for a simpler card. There’s no shame in starting basic.

6.3.5 Kevin’s Credit Card Selection System

Kevin doesn’t choose credit cards based on hype. Over the years, he’s developed his own detailed system for deciding when (and why) to apply for a card. A few of his guiding rules:

-

-

Wait for the historical high if a card has a once-in-a-lifetime bonus offer.

-

Avoid store cards and most no-annual-fee cards—unless they offer truly useful perks.

-

Match the card to your life: If you travel often, go for travel benefits. If you shop at supermarkets, prioritize grocery rewards.

-

Have a “catch-all” card: He uses a 2% flat-rate card when no category bonus applies.

-

Kevin doesn’t apply for every card he sees. He’s selective, strategic, and always asks: Will this card actually help me optimize my spending, or is it just noise?

Note to students: Don’t worry if your strategy is simpler than Kevin’s. The key is to be intentional. Start by understanding how rewards work (see next section), then decide what you want out of a card.

6.3.6 Tips for Choosing the Right Card for You

Ask yourself:

-

- Am I just starting to build credit? → Consider a secured or student card.

- Do I pay my balance in full every month? → A rewards card might work for you.

- Am I trying to get out of debt? → Look for a balance transfer card.

- Do I want the card for a specific store or travel? → Compare perks vs. fees carefully.

Always check:

-

- The APR (not just the intro rate)

- The annual fee (and if it’s worth it)

- What the rewards actually give you

- What happens if you miss a payment

Quick Comparison

-

- Student cards: Best for new users building credit. Watch out for low credit limits and very few perks.

- Secured cards: Best for people with no credit history or bad credit. Watch out because they require a deposit.

- Rewards cards: Best for those who pay their balance in full consistently. Watch out for high APR and tempting perks that can encourage overspending.

- Balance transfer cards: Best for paying off other cards. Watch out for balance transfer fees and short promotional periods.

- Low-interest intro cards: Best for making big purchases. Watch out for interest rate spikes once the introductory period ends.

- Store/Retail cards: Best for brand-loyal shoppers. Watch out for high interest rates and limited usability.

Final Thought

The best credit card is the one that fits your habits—not your fantasies. Don’t pick a card because it sounds luxurious or because a celebrity uses it. Pick one that supports your goals and your reality. It’s not about having the fanciest plastic—it’s about using it wisely.

Let me know if you want to continue to Section 6.4 or modify/add anything here.

6.4 Smart Credit Card Strategies

6.4.1 The Real Goal: Use Credit Without Falling Into Debt

Most credit card mistakes don’t come from evil intentions—they come from confusion, disorganization, or just hoping things will “work out later.” But here’s the truth: credit cards can actually help you build wealth if used right. Used wisely, credit cards help build a strong credit score—which affects loans, housing, even some jobs.

The goal isn’t to avoid credit—it’s to master it.

Using credit smartly means:

-

- Buying only what you can afford

- Paying off your balance every month

- Tracking your spending before it gets out of hand

- Knowing when to stop

Yes, you can earn points, build credit, and get perks. But only if you stay in control.

6.4.2 Strategy #1: Always Pay More Than the Minimum

Minimum payments are designed to keep you in debt. Always aim to pay your full balance. If that’s not possible, at least pay more than the minimum. Even rounding up to the nearest $50 or $100 can accelerate your payoff timeline

Tip: Set up automatic payments to avoid late fees, and manually add extra payments when you can.

6.4.3 Strategy #2: Use Alerts, Apps, and Reminders

Technology is your friend. Most credit cards let you:

-

- Set up alerts for due dates, spending limits, or large purchases

- Get notifications when your balance crosses a certain amount

- Monitor your credit score for free

You can also use budgeting apps like Mint, YNAB, or even Google Sheets to stay on top of everything.

If you’re the kind of person who loses track of time or spending—don’t rely on memory. Build systems.

6.4.4 Strategy #3: Treat It Like a Debit Card

One of the best mental tricks? Use your credit card like it’s a debit card.

Only spend what you already have in your checking account. Think of it as shifting your payment from today to next week—not next year.

If you see your card as “extra money,” you’re already setting yourself up for problems.

6.4.5 Strategy #4: Review Your Statement Every Month

Yes, every single month.

Check:

-

- Are all the charges correct?

- Are there subscriptions you forgot about?

- Are you spending more than expected in certain areas?

This habit not only protects you from fraud, it forces you to confront your real habits. It’s like looking in the financial mirror.

Kevin once found out he had been paying for a streaming service he didn’t use—for six months. That’s $90 he could’ve used elsewhere. Since then, he reviews every statement, every month, without fail.

6.4.6 Strategy #5: Know Your Grace Period

Most credit cards give you a grace period—usually 21 to 25 days after your statement closes—where you can pay off purchases without interest. Not all purchases qualify for a grace period—like cash advances or balance transfers.

If you pay the full balance during that time, you pay zero interest.

But if you carry a balance, you lose the grace period—and new charges start building interest right away.

So paying in full keeps you in the safe zone. Carrying a balance means every swipe costs more than it looks.

6.4.7 Strategy #6: Start With One Card—And Master It

You don’t need five credit cards to build good credit. In fact, one solid card, used responsibly, is enough.

Keep your balance low (ideally under 30% of your credit limit), pay on time, and use it regularly. After six months to a year, your credit score will start improving. That opens the door to better cards, loans, or even apartment rentals.

Start simple. Master one card before adding another.

6.4.8 Strategy #7: Stop Spending If You’re Feeling Out of Control

If you notice you’re:

-

- Using your card to cover basic needs

- Hiding purchases from people in your life

- Paying one card with another

- Feeling anxious every time you check your balance

It’s time to pause. Take a step back. You might not need more credit—you might need a reset.

Kevin recommends something he calls a “spending detox.” A few years ago, he put all his credit cards in a drawer and spent 60 days using only cash and debit. It helped him reconnect with his real budget, stop impulse spending, and rebuild healthy habits.

Final Thought: Credit Is a Tool—Not a Lifestyle

The best way to avoid credit card problems isn’t to fear them—it’s to understand them. You don’t have to live in constant worry about debt. But you do need to stay aware.

Set up systems. Pay attention. Ask for help when you need it. And remember: discipline doesn’t mean deprivation. It means peace of mind.

6.5 Kevin’s Credit Card Masterclass: Strategy, Strength, and Smarts

When it comes to credit cards, I’ve learned that success comes down to two things: understanding the system and staying organized. I’ve never seen credit cards as something to fear—they’ve actually been one of my greatest financial tools.

But I didn’t get here by accident.

6.5.1 Why I Got Into the Credit Game

I got my first credit card as an adult. Not because I was desperate—but because I was curious. I wanted to understand how the system worked and how to use it to my advantage.

Over the years, I’ve opened more than 50 credit cards and currently manage 20 active ones. That may sound excessive, but I’ve never carried a balance, never paid interest, and never let a late fee sneak up on me.

Why do I do it? Because credit cards give you power—if you stay in control.

6.5.2 My Credit Philosophy: Don’t Just Survive—Thrive

Here’s what I believe:

-

- Credit cards aren’t evil. Misusing them is the problem.

- You can build credit and get rewarded. The trick is discipline.

- Organization is everything. Without it, even one card can be dangerous. With it, 20 can be smooth.

6.5.3 My System: How I Stay on Top of 20+ Cards

Managing this many cards takes a system. Here’s mine:

-

- I use a spreadsheet to track each card’s:

- Bonus category

- Due date

- Annual fee

- Credits and perks

- I label cards in my wallet for easy use (groceries, travel, dining, etc.).

- I have calendar reminders for:

- Annual fees (so I can cancel or downgrade if needed)

- Monthly credits (like Uber or streaming services)

- Card renewal dates and bonus deadlines

- I use a spreadsheet to track each card’s:

Most importantly:

Every card is used with a purpose. I never swipe mindlessly.

6.5.4 Real Rewards: What I’ve Gained

Here’s what smart credit use has helped me do:

-

- Book flights using points from sign-up bonuses

- Stay in luxury hotels I wouldn’t normally pay for

- Get free meals, lounge access, trip delay protection, and more

- Save thousands through cash-back and statement credits

- Build a top-tier credit score, which helps with everything from mortgages to business financing

Even cards with annual fees are worth it when I use the perks strategically. One card gives me $240/year in credits for a $95 annual fee—that’s an easy win.

6.5.5 Kevin’s Rules for Winning the Credit Game

Here’s what I teach my students—and live by myself:

-

- Never carry a balance. You cancel out all rewards if you’re paying interest.

- Always pay on time. One late payment can undo years of progress.

- Only open cards you can manage. Start with one. Master it.

- Use the perks. Don’t let travel credits or dining rewards go to waste.

- Stay organized. Automation, reminders, and tracking tools are your best friends.

- Don’t spend to earn points. That’s like buying stuff just because it’s on sale—you still spent money you didn’t need to.

My Advice to You

Start small. Get a card that fits your current life—like a student card or a no-fee rewards card.

-

- Use it for one bill or expense (like gas or groceries).

- Pay it off completely every month.

- Track your spending.

- Build your habits.

Then—and only then—explore better cards, bigger bonuses, and smarter strategies.

You don’t need 20 cards to succeed. You just need clarity, confidence, and consistency.

6.6 Credit Card Math in Real Life

Credit cards are powerful tools—but only if you understand the math behind them. In this section, we’ll walk through the numbers that impact how much you owe, how long it takes to pay off debt, how your credit score reacts, and how to evaluate rewards. These examples and formulas connect directly to the problem-solving questions in this chapter.

6.6.1 Core Formula: Simple Interest

Formula:

Interest = Principal × Rate × Time

-

-

Principal = amount you borrow

-

Rate = annual interest rate (as a decimal, e.g., 24% = 0.24)

-

Time = number of years

-

Example:

If you owe $1,500 on a credit card with 24% APR and hold it for 1 year:

Interest = 1,500 × 0.24 × 1 = $360

So you’d pay $360 in interest if you didn’t reduce the balance at all.

6.6.2 Monthly Credit Card Interest (Real World Example)

Most credit cards use monthly compounding, so interest adds up quickly.

Formula:

Monthly Interest = Balance × (APR ÷ 12)

Example:

Balance: $3,000

APR: 24%

Monthly rate = 24% ÷ 12 = 2%

Monthly Interest = 3,000 × 0.02 = $60

So just one month of carrying that balance costs you $60 in interest.

6.6.3 Minimum Payment Trap

Let’s say your card requires a 3% minimum payment each month:

Formula:

Minimum Payment = Balance × 0.03

Example:

$3,000 balance × 0.03 = $90 minimum payment

But if you’re paying $90 and interest is $60, you’re only reducing the balance by $30/month. It would take years—and thousands in interest—to pay off the full amount.

6.6.4 Credit Utilization Ratio

Your credit score drops when your balance gets too close to your credit limit.

Formula:

Utilization = Balance ÷ Credit Limit

Example:

$2,000 balance on a $5,000 limit →

2,000 ÷ 5,000 = 0.40 = 40% utilization

That’s too high. Try to stay under 30%, ideally under 10%.

6.6.5 Debt Snowball vs. Avalanche (No Math, Just Strategy)

If you have multiple cards:

-

-

Snowball = Pay off the smallest balance first (emotional win)

-

Avalanche = Pay off the highest interest rate first (saves more money)

-

Pick the one that motivates you to stick with it.

6.6.6 Rewards Math: Is a Credit Card Worth the Fee?

Formula:

Net Reward = (Annual Spending × Reward %) – Annual Fee

Example:

$6,000 annual spending on dining and travel

Card offers 3% back

Annual fee: $95

Net Reward = 6,000 × 0.03 – 95 = $180 – 95 = $85

You made $85 in value.

But if you only spent $2,000:

2,000 × 0.03 – 95 = 60 – 95 = –$35

You’d lose money. Choose a card that fits your actual spending habits.

6.6.7 Bonus Comparison Strategy (Optional)

Many cards offer signup bonuses, like:

“$200 bonus if you spend $1,000 in 3 months.”

Formula:

Effective Bonus Rate = Bonus ÷ Required Spending

Example:

$200 ÷ $1,000 = 20% bonus return—a great deal, if it’s money you’d spend anyway.

6.6.8 Cash Advances: The Hidden Trap

A cash advance is when you withdraw money from your credit card at an ATM or bank. It feels convenient, but it’s one of the most expensive ways to borrow.

Here’s why:

-

-

Cash advance fee: Usually 3%–5% of the amount you withdraw.

-

No grace period: Interest starts immediately.

-

Higher APR: Often higher than your purchase APR (e.g., 25%–30%).

-

Formula for calculating cost of a cash advance:

-

-

Fee: Fee = Amount × Fee Rate

-

Monthly Interest: Interest = Balance × (APR ÷ 12)

-

Total Repayment: Total = Principal + Fee + Interest

-

📌 Example:

If you borrow $600 at 25% APR with a 5% fee and repay in 3 months:

-

-

Fee = $600 × 0.05 = $30

-

Interest after 3 months (compounded): about $38

-

Total Repayment = $600 + $30 + $38 = $668

-

Lesson: A $600 cash advance can cost you almost $70 extra in just 3 months. Use only in true emergencies.

6.6.9 Penalty APRs: When Mistakes Get Expensive

Credit card companies often raise your APR if you break the rules—this is called a penalty APR. It usually kicks in when:

-

-

You miss a minimum payment

-

You go over your limit

-

A payment bounces

-

Penalty APRs can be as high as 29.99%, compared to your regular 15%–20%. That means your debt grows much faster.

Formula for extra interest after a penalty APR:

-

-

Old Interest: Old = Balance × (Old APR ÷ 12)

-

New Interest: New = Balance × (New APR ÷ 12)

-

Extra Cost: Extra = New – Old

-

Example:

Balance = $2,400

Old APR = 17% → $34 interest/month

New APR = 29.99% → $60 interest/month

Extra = $26 more every month

Lesson: One late payment can cost hundreds of dollars over time. Always pay at least the minimum on time to avoid triggering penalty rates.

6.6.10 Summary: Quick Reference

Here are the main formulas to remember:

-

-

Interest = Principal × Rate × Time

-

Monthly Interest = Balance × (APR ÷ 12)

-

Minimum Payment = Balance × 0.03 (approx)

-

Utilization = Balance ÷ Credit Limit

-

Net Reward = (Spending × Reward Rate) – Annual Fee

-

Bonus Return = Bonus ÷ Required Spending

-

These formulas help you understand the costs, risks, and rewards of credit cards.

Final Word

I’ve seen credit card debt ruin lives—but I’ve also seen credit mastery change them for the better. That’s the power of knowledge.

So when you swipe your card, don’t swipe blindly.

Swipe with intention. Swipe with strategy.

And always remember: You’re in control.

Pay your balance in full and on time.

This is the most important habit to avoid interest charges and late fees. It also helps protect your credit score over time.

Credit cards are tools—not cash advances.

Used well, they can help you build credit, qualify for better loans, and improve your financial flexibility. But they’re not meant for spending money you don’t have.

Choose a card that fits your goals.

Some cards offer cash back, others give points or travel perks. Pick one based on your lifestyle, and make sure the benefits outweigh any fees.

Track your spending.

It’s easy to lose control with credit cards. Use apps or personal systems to keep an eye on purchases and avoid surprises on your statement.

Conceptual Questions

- What is a credit card, and how is it different from a debit card?

- Define APR and explain why it is important when evaluating credit cards.

- What does the “minimum payment” represent, and why is it considered a trap?

- Explain the concept of a grace period and how it affects interest charges.

- List and briefly describe three types of credit cards commonly available to consumers.

- What is the difference between a secured credit card and an unsecured one?

- Identify three common fees associated with credit card use and explain how they are triggered.

Scenario-Based Problems

Case Study A: Kevin’s Wake-Up Call

Kevin has a credit card with a balance of $3,200 and an APR of 26%. He’s been paying only the minimum each month, which is around $96.

- What are the financial consequences of only making minimum payments over time?

- What strategies could Kevin adopt to reduce or eliminate this debt faster?

- If Kevin were to stop using the card, how would it affect his credit utilization ratio?

Case Study B: Carla’s Reward Card Decision

Carla is considering applying for a travel rewards credit card that offers 1.5 miles per dollar spent. The card has a $95 annual fee and a 19.99% APR. Carla usually carries a small balance month to month.

- Should Carla apply for this card? Why or why not?

- How do the card’s rewards compare to the potential interest she might pay?

- What other card types might suit her better based on her habits?

Case Study C: Elijah and the Store Card

Elijah was offered a store credit card with 25% off his first purchase. The card has a 28% APR and no grace period.

- What risks should Elijah consider before accepting the offer?

- How could this card impact his credit score over time?

- What questions should he ask before signing up?

Problem-Solving & Financial Calculation Tasks

- Interest Cost Comparison

Jenna has a $1,500 balance on a credit card with a 20% APR. If she only makes minimum payments of 3% each month, calculate approximately how much interest she’ll pay over one year. Compare this to how much she would pay if she made fixed payments of $150 per month. - Grace Period Strategy

Tomas usually pays his full balance every month. In May, he paid only part of his balance and left $400 unpaid.- If his card has a 22% APR and compounds monthly, how much interest will he be charged in June if he makes no additional purchases?

- How does losing the grace period affect future purchases?

- Payment Planning

Design a payment plan to eliminate a $2,400 balance in 12 months on a card with 18% APR. What is the minimum monthly payment needed? What budgeting adjustments could help free up that amount? - Card Comparison Chart

Research three credit cards (real or hypothetical) and compare them based on: APR, annual fee, grace period, rewards, and additional perks.- Which card would you choose and why?

- Spending Audit

Track and categorize a hypothetical month of credit card purchases for a student. Then:- Identify areas of overspending.

- Suggest at least three changes to improve financial health and reduce credit reliance.

- Credit Behavior Self-Check

Write down 5 credit card habits you currently have or think you might develop. Then, for each:- Label it as healthy or risky.

- Propose an action to reinforce or improve the habit.