Questions

- At what value is property, plant, and equipment (PP&E) typically reported on the balance sheet?

- What is accumulated depreciation?

- What type of account is accumulated depreciation?

- Define “book value.”

- Why is property and equipment not reported at its fair value?

- Why is land not depreciated?

- Why would land be classified as an investment rather than PP&E?

- How does a company determine the historical cost of a property and equipment?

- Define “useful life.”

- Define “residual value.”

- Which method of depreciation allocates an equal amount to each period the asset is used?

- How does a company determine the gain or loss on the sale of PP&E?

- What is the half-year convention?

- What is accelerated depreciation and how is its use justified?

- How does the units-of-production method differ from straight-line?

- Define “intangible asset.”

- Give three examples of intangible assets.

- At what value are intangible assets typically reported?

- How does an intangible asset differ from property and equipment?

- What is amortization?

- How does a company typically determine the useful life of an intangible?

- Under what circumstances could the cost to defend an intangible asset in court be capitalized to the asset account?

- Why are intangibles, like trademarks, not recorded at their market value, which can greatly exceed historical cost?

- When should a parent (acquiring) company record the intangibles of a subsidiary on its balance sheet?

- What is “goodwill”?

- Is goodwill amortized like other intangibles?

- What should companies do with goodwill each reporting period?

True or False

-

- ____Almost all property, plant, and equipment (PP&E) is depreciated, which means that its cost is spread over its useful life.

- ____ PP&E is a long-term asset.

- ____ If an expenditure increases the useful life of an asset, it should be capitalized, not expensed.

- ____ The only acceptable method of depreciation is straight-line.

- ____ Accumulated depreciation is a contra-asset account.

- ____ The purchase price of an asset is capitalized, but costs like transportation and set up of the asset should be expensed as incurred.

- ____ Both assets used to generate revenue from operations and assets held as investment property are reported as PP&E on the balance sheet.

- ____Typically, intangible assets are shown at their fair value

- ____ A patent is an example of an intangible asset.

- ____ Amortization of intangibles is usually done over the asset’s legal life.

- ____Once a company records goodwill, it will be on the company’s books forever because it is not amortized

- ____ If an intangible asset is successfully defended from a legal challenge, legal costs may be capitalized to the asset account.

- ____When one company acquires another, the acquiring company should continue to report any intangible assets of the purchased company at the same cost used by the purchased company.

- ____An intangible asset is a right that helps the owner generate revenues.

- ____Research and development costs that help develop successful programs can be capitalized

- ____ Intangibles purchased from another company are reported at the amount paid for them less any amortization.

Multiple Choice

-

Which of the following would not be subject to amortization?

- Goodwill

- Patent

- Copyright

- Trademark

-

Mitchell Inc. developed a product, spending $4,900,000 in research to do so. Mitchell applied for and received a patent for the product in January, spending $34,800 in legal and filing fees. The patent is valid for seventeen years. What would be the book value of the patent at the end of Year 1?

- $4,644,518

- $34,800

- $32,753

- $4,611,765

-

Kremlin Company pays $2,900,000 for the common stock of Reticular Corporation. Reticular has assets on the balance sheet with a book value of $1,500,000 and a fair value of $2,500,000. What is goodwill in this purchase?

- $1,400,000

- $1,000,000

- $400,000

- $0

-

Which of the following concerning the research and development costs is true?

- According to U.S. GAAP, research and development costs must be expensed as incurred.

- Current U.S. GAAP reporting for research and development costs violates the matching principle.

- International Financial Reporting Standards allow some development costs to be capitalized.

- U.S. GAAP reporting for research and development costs is superior to international reporting.

-

Krypton Corporation offers Earth Company $800,000 for a patent held by Earth Company. The patent is currently on Earth Company’s books in the amount of $14,000, the legal costs of registering the patent in the first place. Krypton had appraisers examine the patent before making an offer to purchase it, and the experts determined that it could be worth anywhere from $459,000 to $1,090,000. If the purchase falls through, at what amount should Earth Company now report the patent?

- $80,000

- $14,000

- $459,000

- $1,090,000

-

On January 1, the Rhode Island Redbirds organization purchased new workout equipment for its athletes. The equipment had a cost of $15,600, transportation costs of $450, and set up costs of $290. The Redbirds spent $350 training their trainers and athletes on its proper use. The useful life of the equipment is five years and has no residual value. How much depreciation expense should the Redbirds take in the first year, if straight-line is being used?

- $3,120

- $3,268

- $3,338

- $3,210

-

See the information in number 16 above. Assume the Redbirds decide to use the double-declining balance depreciation method instead. What would Year 1 depreciation expense be?

- $6,420

- $6,676

- $6,240

- $6,536

-

At the beginning of the year, the Kelvin Company owned equipment that appeared on its balance sheet as such:

Equipment $7,000,000 Accumulated Depreciation ($2,000,000) The equipment was purchased two years ago and assigned a useful life of six years and a salvage value of $1,000,000. During the first month of the year, Kelvin made modifications to the equipment that increased its remaining useful life from four years to five years. Its salvage value remained unchanged. The cost of these modifications was $50,000. What would be the balance in the accumulated depreciation account of this equipment on 12/31 of that year?

- $2,760,000

- $3,000,000

- $810,000

- $2,000,000

-

Maxwell Corporation wishes to sell a building it has owned for five years. It was purchased for $430,000. Maxwell performed additional modifications to the building, which totaled $45,000. On the proposed date of sale, the accumulated depreciation on the building totaled $75,000. The proposed sales price of the building is $380,000. Maxwell is trying to determine the income statement effect of this transaction. What would be Maxwell’s gain or loss on this sale?

- $20,000 loss

- $25,000 gain

- $50,000 loss

- $95,000 loss

Problems

-

At the beginning of the year, Jaguar Corporation purchased a license from Angel Corporation that gives Jaguar the right to use a process Angel created. The purchase price of the license was $1,500,000, including legal fees. Jaguar will be able to use the process for five years under the license agreement.

- Record Jaguar’s purchase of the license.

- Record amortization of the license at the end of year one.

- What is the book value of the license reported on Jaguar’s balance sheet at the end of Year One?

-

Yolanda Company created a product for which it was able to obtain a patent. Yolanda sold the patent to Christiana Inc. for $20,780,000 at the beginning of 20X4. Christiana paid an additional $200,000 in legal fees to properly record the patent. At the beginning of 20X4, Christiana determined that the patent had a remaining life of seven years.

- Record Christiana’s purchase of the patent.

- Record amortization of the patent at the end of 20X4 and 20X5.

- What is the book value of the patent reported on Christiana’s balance sheet at the end of 20X5?

- During 20X6, Christiana is sued by Bushnell Corporation, who claims that it has a patent on a product similar to the one held by Christiana and that Bushnell’s patent was registered first. After a lengthy court battle, in December of 20X7, Christiana discovers that it has successfully defended its patent. The defense of the patent cost Christiana $1,700,000 in legal fees. Record any necessary journal entries dealing with the court battle.

- Christiana reaffirms that the patent has a remaining life of three years on December 31, 20X7. Record amortization expense on this date.

- What is the book value of the patent reported on Christiana’s balance sheet at the end of 20X7?

-

Star Corporation purchases Trek Inc. for $71,660,000. Star Corporation is gaining the following assets and liabilities:

Value on Trek’s Books Current Market Value Inventory $456,000 $456,000 Land $1,050,000 $50,000,000 Trademarks $64,000 $20,004,000 Patent $15,000 $1,850,000 Accounts Payable $650,000 $650,000 Prepare the journal entry for Star to record the purchase of Trek.

-

Assume the same facts as in problem 3 above, but assume that Star pays $100,000,000 for Trek.

- When a purchasing company pays more than the fair market value of the assets of a company being acquired, what is this excess payment called?

- Why might Star be willing to pay more than $71,660,000 for Trek?

- Record the purchase of Trek by Star given this new purchase amount of $100,000,000.

-

Springfield Corporation purchases a new machine on March 3, 20X4 for $35,600 in cash. It pays an additional $3,400 to transport and set up the machine. Springfield’s accountant determines that the equipment has no residual value and that the useful life is five years. It is expected to generate 2,400,000 units during its life. Assume Springfield employs the half-year convention.

- Record the purchase of the machine.

- Assume that Springfield uses the straight-line method of depreciation. Record depreciation expense for the first two years of the machine’s life.

- Assume that Springfield uses the double-declining balance method of depreciation. Record depreciation expense for the first two years of the machine’s life.

- Assume that Springfield uses the units-of-production method of depreciation. During Year 1, the machine produces 600,000 units. During Year 2, the machine produces 578,000 units. Record depreciation expense for the first two years of the machine’s life.

-

On April 1, 20X1, Chang and Chang Inc. invested in a new machine to manufacture soccer balls. The machine is expected to manufacture 1,400,000 balls over its life of three years and then it will be scrapped. The machine cost $50,000 including normal and necessary costs of setting it up. Chang will use units-of-production to depreciate the machine.

- Record depreciation for 20X1 and 20X2 assuming that 450,000 balls were manufactured and sold in 20X1 and 600,000 were manufactured and sold in 20X2.

- On January 1, 20X3, Chang decides to get out of the soccer ball business, and sells the machine for $15,000. Record this journal entry.

-

Gameplay Company operates in mall locations and sells videogame equipment and games. The company purchased furniture and fixtures to use in one of its stores for $440,000 in January of 20X5. The furniture and fixtures were being depreciated using the straight-line method over ten years with a residual value of $10,000. In December 20X9, Gameplay decided to close the location and entered into an sales agreement with Allero Corporation. Allero agreed to give Gameplay cash of $250,000 in exchange for the furniture and fixtures from this store. The furniture and fixtures have an estimated fair value of $250,000 on the date of exchange.

- Make the depreciation entry for the furniture and fixtures that would be necessary in December 20X9, assuming that no entries have been made during the year.

- Determine the book value of the furniture and fixtures on the date of exchange.

- Record the journal entry Gameplay would make for this exchange.

- Where would Gameplay report the gain or loss you determined in part c. above?

Comprehensive Problem

This problem will carry through several chapters, building in difficulty. It allows students to continuously practice skills and knowledge learned in previous chapters.

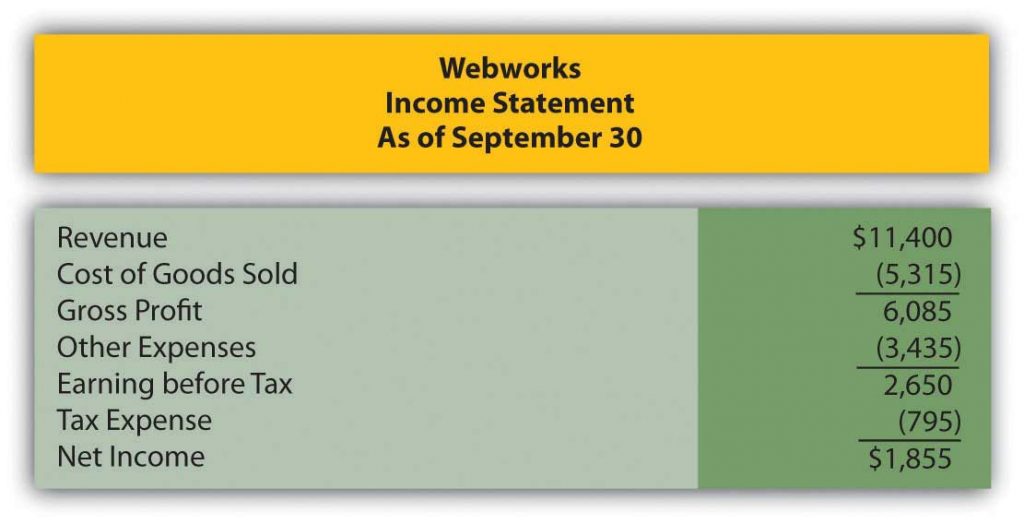

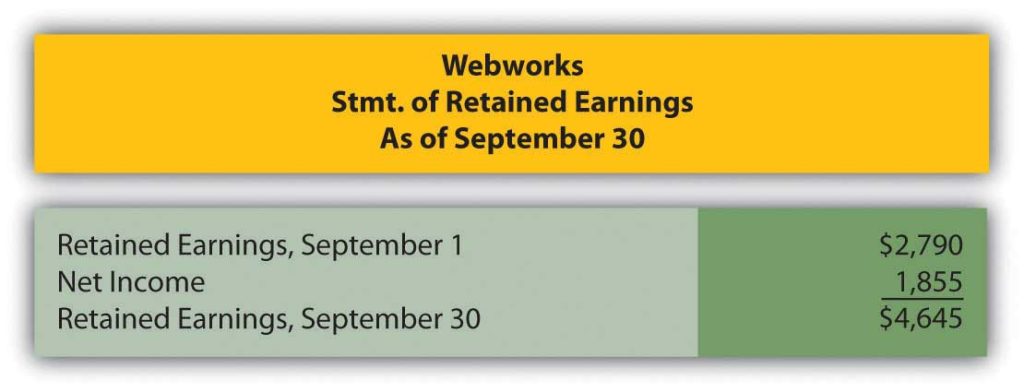

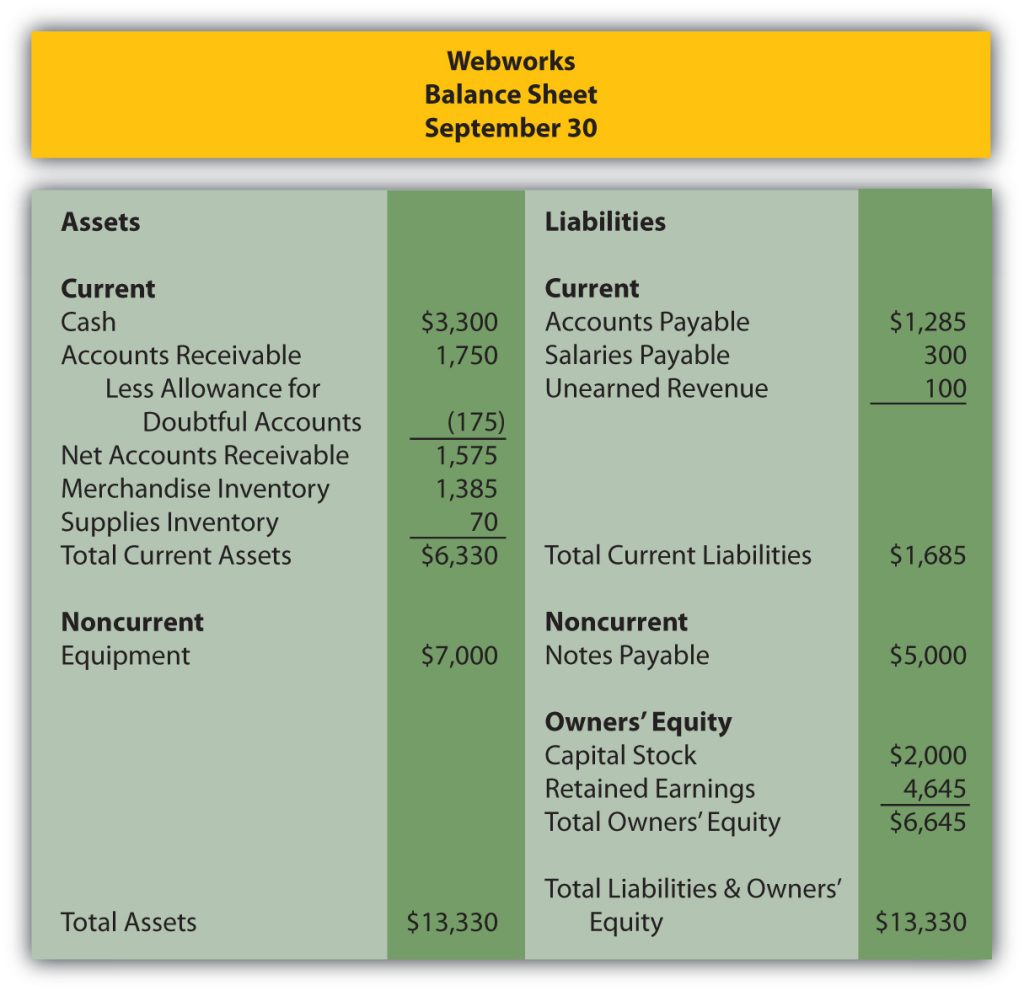

In Chapter 3 “Why Does a Company Need a Cost Flow Assumption in Reporting Inventory?”, you prepared Webworks statements for September. They are included here as a starting point for October.

Here are Webworks financial statements as of September 30.

The following events occur during October:

a. Webworks purchases supplies worth $100 on account.

b. Webworks paid $600 in rent for October, November, and December.

c. At the beginning of October, Webworks had nine keyboards costing $105 each and forty flash drives costing $11 each. Webworks uses periodic FIFO to cost its inventory.

d. On account, Webworks purchases fifty keyboards for $110 each and 100 flash drives for $12 each.

e. Webworks starts and completes seven more Web sites and bills clients for $3,900.

f. Webworks pays Nancy $700 for her work during the first three weeks of October.

g. Webworks sells 50 keyboards for $7,500 and 100 flash drives for $2,200 cash.

h. The Web site paid for in August and started in September was completed. The client had originally paid $100 in advance.

i. Webworks paid off the remainder of its note payable.

j. Webworks collects $4,000 in accounts receivable.

k. Webworks pays off its salaries payable from October.

l. Webworks pays off $6,000 of its accounts payable.

m. One Web site client is dissatisfied with the work done and refuses to pay his bill. Rather than incur the expense of taking the client to court, Webworks writes off the account in the amount of $200.

n. Webworks pays Leon a salary of $2,000.

o. Webworks purchased office furniture on account for $1,000, including transportation and setup.

p. Webworks pays taxes of $868 in cash.

Required:

A. Prepare journal entries for the above events.

B. Post the journal entries to T-accounts.

C. Prepare an unadjusted trial balance for Webworks for October.

D. Prepare adjusting entries for the following and post them to your T-accounts.

q. Webworks owes Nancy $100 for her work during the last week of October.

r. Leon’s parents let him know that Webworks owes $300 toward the electricity bill. Webworks will pay them in November.

s. Webworks determines that it has $50 worth of supplies remaining at the end of October.

t. Prepaid rent should be adjusted for October’s portion.

u. Webworks is continuing to accrue bad debts at 10 percent of accounts receivable.

v. A CPA tells Leon that Webworks should be depreciating its equipment and furniture. The CPA recommends that Webworks use the straight-line method with a four-year life for the equipment and a five-year life for the furniture. Normally, when an error is made, such as not depreciating equipment, the company must go back and restate prior financial statements correctly. Since Webworks is only generating these monthly statements for internal information, the CPA recommends that Leon just “catch up” the prior month’s depreciation on the equipment this month. So when Webworks records October’s equipment depreciation, it will also record the deprecation that should have been taken in July, August and September. The depreciation on the furniture should just be for one month. Round to the nearest whole number.

E. Prepare an adjusted trial balance.

F. Prepare financial statements for October.

The following events occur during November:

a. Webworks starts and completes eight more Web sites and bills clients for $4,600.

b. Webworks purchases supplies worth $80 on account.

c. At the beginning of November, Webworks had nine keyboards costing $110 each and forty flash drives costing $12 each. Webworks uses periodic FIFO to cost its inventory.

d. On account, Webworks purchases sixty keyboards for $111 each and ninety flash drives for $13 each.

e. Webworks pays Nancy $800 for her work during the first three weeks of October.

f. Webworks sells 60 keyboards for $9,000 and 120 flash drives for $2,400 cash.

g. A local realtor pays $400 in advance for a Web site. It will not be completed until December.

h. Leon read about a new program that could enhance the Web sites Webworks is developing for clients. He decides to purchase a license to be able to use the program for one year by paying $2,400 cash. This is called a “license agreement” and is an intangible asset.

i. Webworks collects $4,200 in accounts receivable.

j. Webworks pays off its salaries payable from November.

k. Webworks pays off $9,000 of its accounts payable.

l. Webworks pays Leon a salary of $2,000.

m. Webworks wrote off an uncollectible account in the amount of $100.

n. Webworks pays taxes of $1,135 in cash.

Required:

A. Prepare journal entries for the above events.

B. Post the journal entries to T-accounts.

C. Prepare an unadjusted trial balance for Webworks for November.

D. Prepare adjusting entries for the following and post them to your T-accounts.

o. Webworks owes Nancy $150 for her work during the last week of November.

p. Leon’s parents let him know that Webworks owes $290 toward the electricity bill. Webworks will pay them in December.

q. Webworks determines that it has $20 worth of supplies remaining at the end of November.

r. Prepaid rent should be adjusted for November’s portion.

s. Webworks is continuing to accrue bad debts at 10 percent of accounts receivable.

t. Webworks continues to depreciate its equipment over four years and its furniture over five years, using the straight-line method.

u. The license agreement should be amortized over its one-year life.

v. Record cost of goods sold.

E. Prepare an adjusted trial balance.

F. Prepare financial statements for November.