Learning Objectives

At the end of this section, students should be able to meet the following objectives:

- Explain the meaning of the FOB point in connection with an inventory purchase and its impact on the recording of the transaction.

- Identify the time at which cost of goods sold is computed in a perpetual inventory system as well as the recording made at the time of sale.

- Understand the necessity of taking a physical inventory count.

Question: Rider Inc. (the sporting goods company) buys a bicycle for resell purposes and records the transaction using either a perpetual or periodic system. When should an inventory purchase be recorded? Assume, for example, that Builder Company (the manufacturer of this bicycle) is located in Wisconsin, whereas the retail store operated by Rider is in Kentucky. Delivery takes several days at a minimum. The precise moment for recording the transaction is probably not critical except near the end of the year when the timing of journal entries can impact the balances to be included on the financial statements.

To illustrate, assume this bicycle is ordered by Rider Inc. on December 27 of Year One. It is shipped by Builder Company from Wisconsin on December 29 of Year One and arrives at the retail store on January 4 of Year Two. When Rider produces its financial statements for Year One, should the inventory cost and related payable be included even though the bicycle was not physically received until Year Two?

Answer: Documents prepared in connection with shipments made from a seller to a buyer are normally marked with an “FOB” point. FOB stands for “Free On Board” (a traditional maritime term that has gained a wider use over the years) and indicates when legal title to property is transferred. That is the moment that the bicycle is assumed to be conveyed from one party to the other. It signifies the appropriate date for recording.

In this illustration, if Builder Company specifies that the sale of this bicycle is made “FOB shipping point” and Rider Inc. agrees to this condition, the transaction occurs on December 29, Year One, when the bicycle leaves the seller. Consequently, both the asset and the liability appear on the December 31, Year One, balance sheet prepared by the buyer while Builder records sale revenue in Year One. However, if the contract states that the transaction is made “FOB destination,” the seller maintains legal ownership until the bicycle arrives at the store on January 4, Year Two. Neither party records the transaction until that time. Near the end of a reporting period, account balances can clearly be altered by the FOB designation.

The FOB point is often important for two other reasons.

- The company that holds legal title to merchandise during the trip from seller to buyer normally incurs all transportation costs. If no other arrangements are negotiated, “FOB shipping point” means that Rider Inc. as the buyer pays shipping. “FOB destination” assigns this same cost to Builder, as the seller.

- Any losses or damages that occur in route affect the party holding legal title (again, unless other arrangements are specified in a contract). If shipment from Wisconsin to Kentucky was noted as FOB shipping point and the bicycle breaks as the result of an accident in Illinois, it is the buyer’s inventory that was hurt. It is the seller’s problem, though, if the shipment is marked as FOB destination. The legal owner bears the cost of damages that occur during the physical conveyance of property.

Check Yourself

The ABC Company sells inventory to the RST Company on December 28, 2020 and it is shipped the same day. The agreement between the two includes that the inventory is sold FOB shipping point. The inventory arrives at the RST warehouse on January 2, 2021. Who owns the inventory on December 31, 2020?

A. RST]

B. ABC

C. Both companies

D. Neither company

The answer is A. When items are sold FOB shipping point then ownership transfers from ABC to RST at the point it is shipped on December 28 and thus would be owned by the buyer (RST) as it is in transit on December 31 (balance sheet date)

Question: When a sale is made so that inventory is surrendered, the seller reports an expense that has previously been identified as “cost of goods sold” or “cost of sales.” For example, Best Buy reported “cost of goods sold,” for the year ended February 1, 2020, as $33.59 billion. When should cost of goods sold be determined?

To illustrate, assume that Rider Inc. begins the current year holding three Model XY-7 bicycles costing $260 each—$780 in total. During the period, another five units of this same model are acquired, again for $260 apiece or $1,300 in total1. Eventually, a customer buys seven of these bicycles for her family and friends paying cash of $440 each or $3,080 in total. No further sales are made of this model. At the end of the period, a single bicycle remains (3 + 5 – 7). One is still in stock while seven have been sold. What is the proper method of recording the company’s cost of goods sold?

Answer: Perpetual inventory system. The acquisition and subsequent sale of inventory when a perpetual system is in use was demonstrated earlier. The accounting records maintain current balances so that officials are cognizant of (a) the amount of merchandise being held and (b) the cost of goods sold for the year to date. These figures are readily available in general ledger T-accounts. In addition, separate subsidiary ledger balances are usually established for the individual items in stock, showing the quantity on hand and its cost. When each sale is made, the applicable cost is reclassified from the inventory account on the balance sheet to cost of goods sold on the income statement. Simultaneously, the corresponding balance in the subsidiary ledger is lowered.

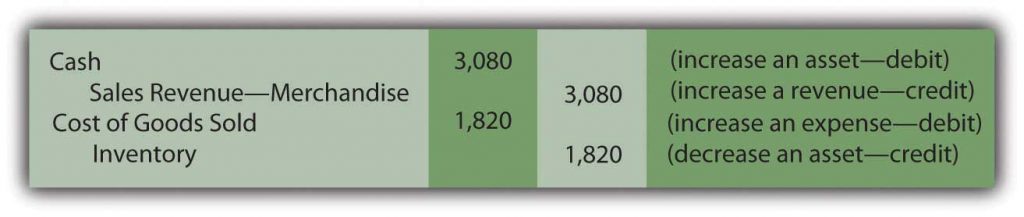

In this example, bicycles had been acquired by Rider Inc. and seven of them, costing $260 each (a total of $1,820), are sold to a customer for $440 apiece or $3,080. When a perpetual system is in use, two journal entries are prepared at the time of this transaction: one for the sale and a second to shift the cost of the inventory from asset to expense.

Figure 3.4 Journal Entries for Sale of Seven Model XY-7 Bicycles—Perpetual Inventory System

| ASSETS | = LIABILITIES | + STOCKHOLDERS EQUITY | ||||||

| CURRENT ASSETS | + RETAINED EARNINGS | |||||||

| Cash | Inventory | Sales | Cost of Goods Sold | |||||

| 780 (beginning from last period) | ||||||||

| 1,300 (purchases) | ||||||||

| 3,080 | 1,820 | 3,080 | 1,820 | |||||

| Ending (780 + 1300 – 1820) = 260 | ||||||||

To focus on the inventory the beginning/ending balances were not shown for other accounts and neither is the credit for the entry for purchases (could be either accounts payable or cash)

Removing $1,820 leaves an inventory balance of $260 ($780 + $1,300 – $1,820) representing the cost of the one remaining unit. The $1,260 difference between revenue and cost of goods sold for this sale ($3,080 minus $1,820) is the markup (also known as “gross profit” or “gross margin”).

Check yourself

RST purchases 50 soccer balls for $10 each for a total of $500. They pay $20 for shipping to get them to their store. They had no soccer balls on hand at the end of last accounting period. When they sell 25 soccer balls for $20 each to a customer on credit, they will debit cost of goods sold for what amount?

A. $45

B. $250

C. $260

D. $270

The answer is C. The cost of each soccer ball is $10 plus $.40 for shipping ($20/50 balls) = $10.40. Sales of 25 soccer balls for $20 each will result in a debit to Accounts Receivable $500 and credit to Sales for $500. Also, the debit to COGS will be recorded for 25 x $10.40 = 260 along with a credit to inventory for $260.

Question: In a perpetual inventory system, cost of goods sold is determined at the time of each sale. Figures retained in a subsidiary ledger provide the cost of the specific item being surrendered so that an immediate reclassification from asset to expense can be made.

With a periodic system, cost of goods sold is not calculated until financial statements are prepared. The beginning inventory balance (the ending amount from the previous year) is combined with the total acquisition costs incurred this period. How is the cost of goods sold determined and can that method be used to check the result of the perpetual inventory system.

The Inventory Formula can be stated as:

Beginning Inventory

+ Net Purchases (adjusted for all of the freight and assembly and discounts) Cost

– Ending Inventory

= Cost of Goods Sold

This is the formula that is used to calculate the adjusting entry at the end of the year in a periodic system and with items that are small in amount or quantity such that perpetual inventory is not deemed necessary. It is also the formula to use when checking the results of the perpetual system and look for errors in inventory accounting. Finding the ending inventory either by using computer records or by taking a physical count is important to getting the correct amount in cost of goods sold. Any errors or in either the ending or beginning inventory will affect cost of goods sold and therefore net income.

Key Takeaways

The legal conveyance of inventory from seller to buyer establishes the timing for recording and is based on the FOB point specified. This designation also identifies the party responsible for transportation costs and items damaged while in transit. In contrast, the recording of cost of goods sold depends on the inventory system used. For a perpetual system, the reclassification of an item from inventory to expense occurs at the time of each sale. The expense is found by adding the beginning inventory to the purchase costs for the period and then subtracting ending inventory. A year-end adjusting entry then updates the various general ledger accounts.

1In this illustration, each bicycle in the company’s inventory has the same cost: $260. At this introductory stage, utilizing a single cost for all items eliminates a significant theoretical problem concerning the flow of costs, one that will be discussed in detail in a subsequent chapter.

2The Purchases figure here could have also been shown by displaying the various cost components, such as the invoice price, purchases discount, transportation-in, and assembly. That breakdown is important for internal decision making and control but probably of less interest to external parties.