Questions

- Define “cost” as it relates to determining the value of inventory.

- What is a cash discount?

- Explain what the term “3/10 n/30” means.

- How do cash discounts impact the reported value of inventory?

- What is a perpetual inventory system?

- What is a periodic inventory system?

- Explain the concept of “free on board.”

- When does ownership transfer if documents specify “FOB shipping point”?

- When does ownership transfer if documents specify “FOB destination”?

- What two journal entries are made when inventory is sold under a perpetual system?

- Give the formula for computing cost of goods sold under a periodic system.

- Explain the concept of “lower-of-cost-or-market.”

- Why would a company that uses a perpetual inventory system still perform a physical inventory count?

- Why is it unrealistic to assume that inventory costs will remain constant over time?

- What is a cost flow assumption?

- Briefly explain the specific identification approach.

- Briefly explain the first-in, first-out cost flow assumption.

- Briefly explain the last-in, first-out cost flow assumption.

- Briefly explain the averaging cost flow assumption.

- Which cost flow assumption will give a higher net income in a period of rising prices?

- Why don’t all companies use specific identification?

- What are advantages of using LIFO?

- Why must a company keep one set of books for financial reporting purposes and another for tax compliance purposes?

True or False

- ____ If the market value of a company’s inventory increases, the company should record a gain.

- ____ A company should include costs of transporting an item to its store when determining the cost of the item.

- ____ A company that uses a perpetual inventory system should still perform a physical inventory count.

- ____ In a perpetual system, but not a periodic system, cost of goods sold is determined and recorded at the time of sale.

- ____ If inventory is shipped FOB shipping point, the buyer takes title as soon as the inventory leaves the seller’s warehouse.

- ____ Companies infrequently take advantage of purchase discounts because they amount to so little savings.

- ____ Companies only follow the “lower-of-cost-or-market” guideline if they use a periodic inventory system.

- ____ Using the LIFO cost assumption will always result in a lower net income than using the FIFO cost assumption.

- ____ LIFO tends to provide a better match of costs and expenses than FIFO and averaging.

- ____ Companies can use LIFO for tax purposes and FIFO for financial reporting.

- ____ It is impossible for decision makers to compare a company who uses LIFO with one who uses FIFO.

- ____ A jewelry store or boat dealership would normally be able to use the specific identification method.

- ____ The underlying concept of FIFO is that the earliest inventory purchased would be sold first.

Multiple Choice

-

On February 13, North Carolina Furniture purchases three sofas from a manufacturer for $300 each. The terms of the sale are 2/10 n/45. North Carolina Furniture pays the invoice on February 21. How much would they pay?

- $300

- $900

- $882

- $810

-

Crayson Inc. started the year with $490,000 in beginning inventory. During the year, Crayson purchased an additional $1,060,000 in inventory. At the end of the year, Crayson employees performed a physical count and determined that ending inventory amounted to $450,000. What was Crayson’s cost of goods sold for the year?

- $1,100,000

- $1,020,000

- $120,000

- $1,060,000

-

Raceway Corporation manufactures miniature cars and racetracks for collectors and enthusiasts. Raceway placed an order for supplies from Delta Inc. on December 1. The sales staff at Delta informed Raceway that the supplies would not be available to ship out until December 22 and Raceway accepted this arrangement. The supplies actually shipped, FOB shipping point, on December 26 and arrived at Raceway’s receiving dock on January 2. On which date should Raceway include the supplies in its inventory?

- December 1

- December 22

- December 26

- January 2

-

Which of the following concerning the “lower-of-cost-or-market” rule is not true?

- If the estimated value of an inventory item falls below its historical cost, the value of the item should be written down.

- If the market value of an item exceeds its historical cost, it should be written up and a gain should be recorded.

- It is possible for an item’s net realizable value to fall below its historical cost.

- Lower-of-cost-or-market is an example of the conservatism principle.

-

Romulus Company sells maps. At the end of the year, Romulus’s inventory account indicated that it had 2,900 maps of Italy on hand that had originally cost $30 each. An inventory count showed that only 2,875 were actually in ending inventory. What journal entry should Romulus make?

-

Debit cost of goods sold 750 credit loss on inventory shortage 750

-

Debit cost of goods sold 30 and credit inventory 30

-

Debit inventory 750 and credit cost of goods sold 750

-

Debit cost of goods sold 750 and credit inventory 750

-

-

Real South Products has $400,000 worth of inventory on hand on January 1. Between January and March 13, Real South purchased an additional $190,000 in inventory and sales of $530,000 had been made. On March 13, Real South’s warehouse flooded and all but $15,000 worth of inventory was ruined. Real South has an average gross profit percentage of 25 percent. What would be the approximate value of the inventory destroyed in the flood?

- $240,000

- $275,000

- $207,500

- $177,500

-

Which of the following provides the best matching of revenues and expenses?

- Specific Identification

- FIFO

- LIFO

- Averaging

-

Milby Corporation purchased three hats to sell during the year. The first, purchased in February, cost $5. The second, purchased in April, cost $6. The third, purchased in July, cost $8. If Milby sells two hats during the year and uses the FIFO method, what would cost of goods sold be for the year?

- $13

- $19

- $14

- $11

-

Which is not a reason a company would choose to use LIFO for financial reporting?

- The company wishes to use LIFO for tax purposes.

- The company wants net income to be as high as possible to may more taxes.

- The company would like to match the most current costs with revenues.

- LIFO does provide for a postponement of income taxes.

-

Traylor Corporation began the year with three items in beginning inventory, each costing $4. During the year Traylor purchased five more items at a cost of $5 each and two more items at a cost of $6.50 each. Traylor sold eight items for $9 each. If Traylor uses LIFO, what would be Traylor’s gross profit for the year?

- $42

- $30

- $35

- $72

Problems

-

ConnecTech bought 400 computers in December 20X2 for $300 each. It paid $260 to have them delivered to its store. In January 20X3, ConnecTech sold 220 of the computers for $550 each. ConnecTech uses a perpetual inventory system.

- Prepare the journal entry(ies) to record ConnecTech’s purchase of the computers.

- Determine the balance in ConnecTech’s ending inventory on December 31, 20X2.

- Prepare the journal entry(ies) to record the sale of the computers.

- Determine the balance in ConnecTech’s ending inventory on January 31, 20X3.

-

Montez Muffins and More is a bakery located in New York. Montez purchases a great deal of flour in bulk from a wholesaler. The wholesaler offers purchase discounts for fast payment. Montez purchased 600 pounds of flour for $100 on May 1, under terms 2/10 n/30. Determine the amount Montez should pay under the following scenarios:

- Montez pays the full balance on May 25.

- Montez pays the full balance on May 10.

- Montez pays half the balance on May 10 and half on May 25.

-

Racers ATVs sells many makes and models of all terrain vehicles. Racers uses a periodic inventory system. On January 1, Racers had a beginning inventory of AXVs costing $28,600. On January 14, Racers received a shipment of Model AXVs with a purchase price of $14,700 and transportation costs of $400. On May 19, Racers received a second shipment of AXVs with a purchase price of $16,900 and transportation costs of $450. On November 1, Racers received its before-Christmas shipment of AXVs with a purchase price of $27,800 and transportation costs of $750.

- Make the necessary journal entries for January 14, May 19, and November 1 to show the purchase of the inventory.

- Assume that a physical inventory count on December 31 showed an ending inventory of AXVs of $25,800. Determine cost of goods sold for the AXV model for the year.

- If sales of AXVs were $96,700, what profit did Racers make on this model?

-

Magic Carpets Inc. sells a full line of area rugs, from top quality to bargain basement. Economic conditions have hit the textile industry, and Magic Carpets accountant is concerned that its rug inventory may not worth the amount Magic paid for it. Information about three lines of rugs is found below:

Cost Sales Price Cost to Sell Number in inventory High Flyers $230 $250 $40 80 Midflight 150 220 25 125 Under the Radar 100 110 20 165 - Determine market value for each type of rug.

- Determine lower-of-cost-or-market for each type of rug.

- Determine if Magic Carpets has suffered a loss of value on its inventory, and if so, what the amount of loss is.

-

Costello Corporation uses a perpetual inventory system. At the end of the year, the inventory balance reported by its system is $45,270. Costello performs an inventory count and determines that the actual ending inventory is $39,780.

- Discuss why a company that uses a perpetual inventory system would perform a physical inventory count.

- Why might the ending balance in inventory differ between the perpetual inventory system and physical inventory count?

- Assume that Costello believes the difference is due to errors made by its accounting staff and this is a normal risk in tracking inventory. Record the journal entry Costello should make in this case.

-

Fabulous Fay’s is a boutique clothing store in San Diego. Fay’s uses a perpetual inventory system. In March, Fay’s purchased a type of swimwear designed to be slimming to the wearer. It purchased twenty suits of varying sizes for $40 each and priced them at $120 each. They sold out almost immediately, so Fay purchased forty more suits in April for $40 each and sold thirty-eight of them for $130 each. Again in July, Fay made one more purchase of twenty suits at $40 each and sold fifteen of them for $130 each. Fay decided not to put the rest of her inventory on sale at the end of the summer, but to hold onto it until cruise season started the following winter. She believed she could sell the rest then without having to mark them down.

- Make the journal entries for the purchases Fay made.

- Make the journal entries for the sales Fay made.

- Determine the balance in ending inventory on December 31.

- Fay performed a physical count on December 31 and determined that three of the swimsuits had been severely damaged due to a leaky pipe. Make the journal entry to show the loss of this inventory.

-

Paula’s Parkas sells NorthPlace jackets. At the beginning of the year, Paula’s had twenty jackets in stock, each costing $35 and selling for $60. The following table details the purchases and sales made during January:

Date Number of Items Cost per Item January 2 Purchased 12 $36.00 January 8 Purchased 10 36.50 January 10 Sold 15 January 17 Sold 14 January 22 Purchased 8 37.00 January 28 Sold 10 Assume that Paula’s Parkas uses the perpetual FIFO method.

- Determine Paula’s Parkas cost of goods sold and ending inventory for January.

- Determine Parka’s gross profit for January.

-

Assume the same facts as in problem 7 above, but that Paula’s Parkas uses the perpetual LIFO method.

- Determine Paula’s Parkas cost of goods sold and ending inventory for January.

- Determine Parka’s gross profit for January.

-

Assume the same facts as in problem 7 above, but that Paula’s Parkas uses the moving average method.

- Determine Paula’s Parkas cost of goods sold and ending inventory for January.

- Determine Parka’s gross profit for January.

Comprehensive Problem

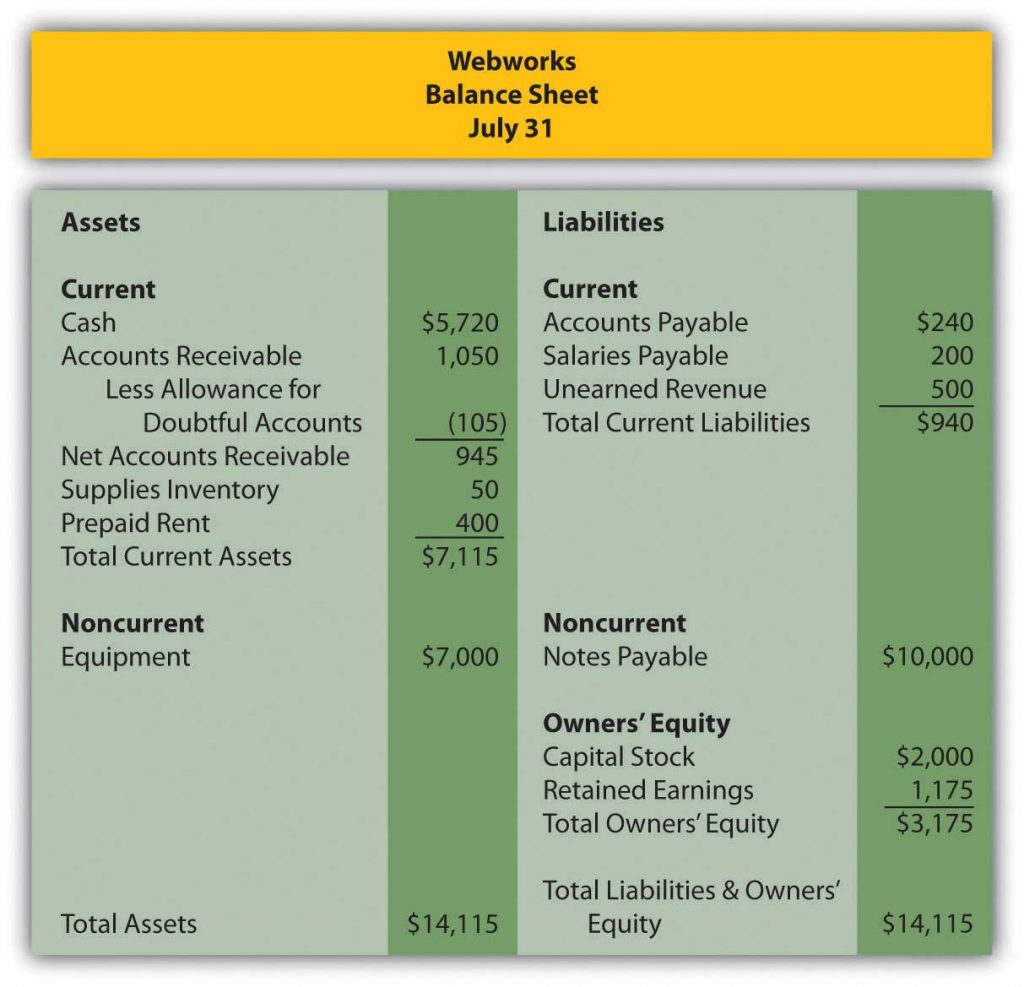

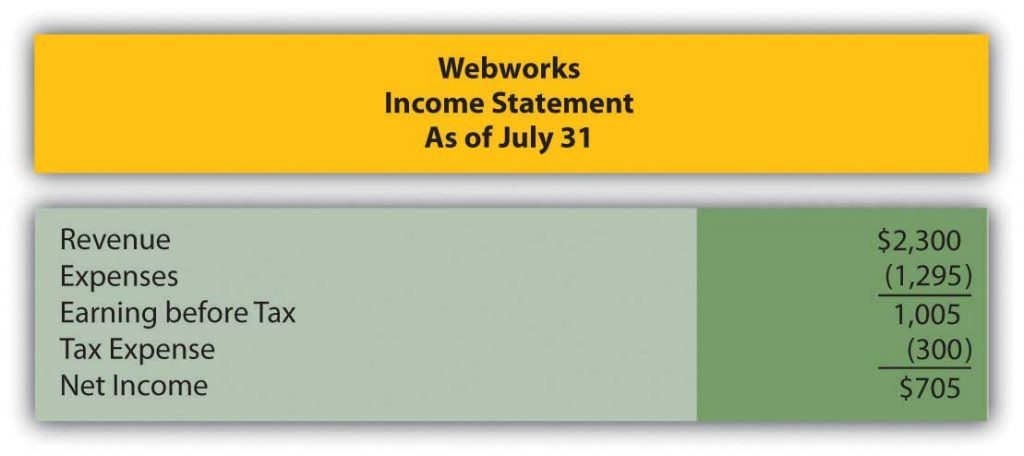

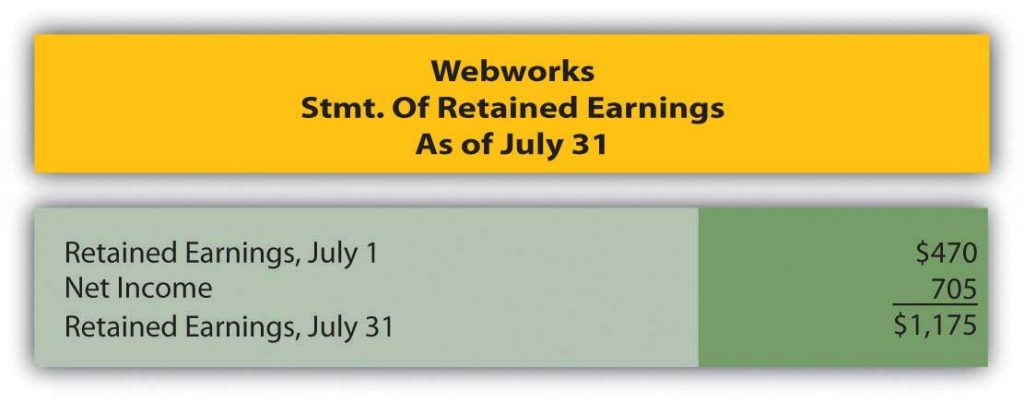

In Chapter 2 “In a Set of Financial Statements, What Information Is Conveyed about Receivables?”, you prepared Webworks statements for July. They are included here as a starting point for August.

Here are Webworks financial statements as of July 31.

The following events occur during August:

a. Webworks decides to begin selling a limited selection of inventory items related to its business. During August, Webworks purchases specialty keyboards for $4,900 on account and flash drives for $3,200 on account with the hopes of selling them to its Web site customers or others who might be interested. Due to the limited amount of inventory, Webworks will use a periodic system. Record these purchases.

b. Webworks purchases supplies worth $100 on account.

c. Webworks starts and completes six more Web sites and bills clients for $2,700.

d. Recall that in July, Webworks received $500 in advance to design two Web sites. Webworks completes these sites during August.

e. Webworks collects $2,400 in accounts receivable.

f. Webworks pays Nancy $600 for her work during the first three weeks of August.

g. In June, Webworks designed a site for Pauline Smith and billed her. Unfortunately, before she could finish paying the bill, Ms. Smith’s business folded. It is unlikely Webworks will collect anything. Record the entry to write off the $100 remaining receivable from Ms. Smith.

h. Webworks sells keyboards for $4,500 and flash drives for $3,000 cash.

i. Webworks pays off its salaries payable from July.

j. Webworks pays off $6,000 of its accounts payable.

k. Webworks receives $100 in advance to work on a Web site for a local dentist. Work will not begin on the Web site until September.

l. Webworks pays Leon salary of $2,000.

m. Webworks pays taxes of $475 in cash.

Required:

A. Prepare journal entries for the above events.

B. Post the journal entries to T-accounts.

C. Prepare an unadjusted trial balance for Webworks for August.

D. Prepare adjusting entries for the following and post them to your T-accounts.

n. Webworks owes Nancy $250 for her work during the last week of August.

o. Leon’s parents let him know that Webworks owes $250 toward the electricity bill. Webworks will pay them in September.

p. Webworks determines that it has $60 worth of supplies remaining at the end of August.

q. Prepaid rent should be adjusted for August’s portion.

r. Webworks is continuing to accrue bad debts at 10 percent of accounts receivable.

s. Webworks performs a count of ending inventory and determines that $1,900 in keyboards and $1,100 in flash drives remain. Record cost of goods sold.

E. Prepare an adjusted trial balance.

F. Prepare financial statements for August.

Above, you prepared Webworks statements for August.

The following events occur during September:

a. Webworks purchases supplies worth $120 on account.

b. At the beginning of September, Webworks had 19 keyboards costing $100 each and 110 flash drives costing $10 each. Webworks has decided to use perpetual FIFO to cost its inventory.

c. On account, Webworks purchases thirty keyboards for $105 each and fifty flash drives for $11 each.

d. Webworks starts and completes five more Web sites and bills clients for $3,000.

e. Webworks pays Nancy $500 for her work during the first three weeks of September.

f. Webworks sells 40 keyboards for $6,000 and 120 flash drives for $2,400 cash.

g. Webworks collects $2,500 in accounts receivable.

h. Webworks pays off its salaries payable from August.

i. Webworks pays off $5,500 of its accounts payable.

j. Webworks pays off $5,000 of its outstanding note payable.

k. Webworks pays Leon salary of $2,000.

l. Webworks pays taxes of $795 in cash.

Required:

A. Prepare journal entries for the above events.

B. Post the journal entries to T-accounts.

C. Prepare an unadjusted trial balance for Webworks for September.

D. Prepare adjusting entries for the following and post them to your T-accounts.

m. Webworks owes Nancy $300 for her work during the last week of September.

n. Leon’s parents let him know that Webworks owes $275 toward the electricity bill. Webworks will pay them in October.

o. Webworks determines that it has $70 worth of supplies remaining at the end of September.

p. Prepaid rent should be adjusted for September’s portion.

q. Webworks is continuing to accrue bad debts so that the allowance for doubtful accounts is 10 percent of accounts receivable.

E. Prepare an adjusted trial balance.

F. Prepare financial statements for September.