Research Methodology

13 Choosing a Sensory Panel

A panel is a group of research participants, consisting of panel members (panellists). You can imagine that a different type of panel is used for research on how consumers will perceive a new flavour of crisps, compared to assessing the subtle change of structure in a cake where sugar is partly replaced by a sweetener. Consumer panels should be representative of typical consumers of the specific product, while other panels, such as analytical and expert panels, require training before they can do their job.

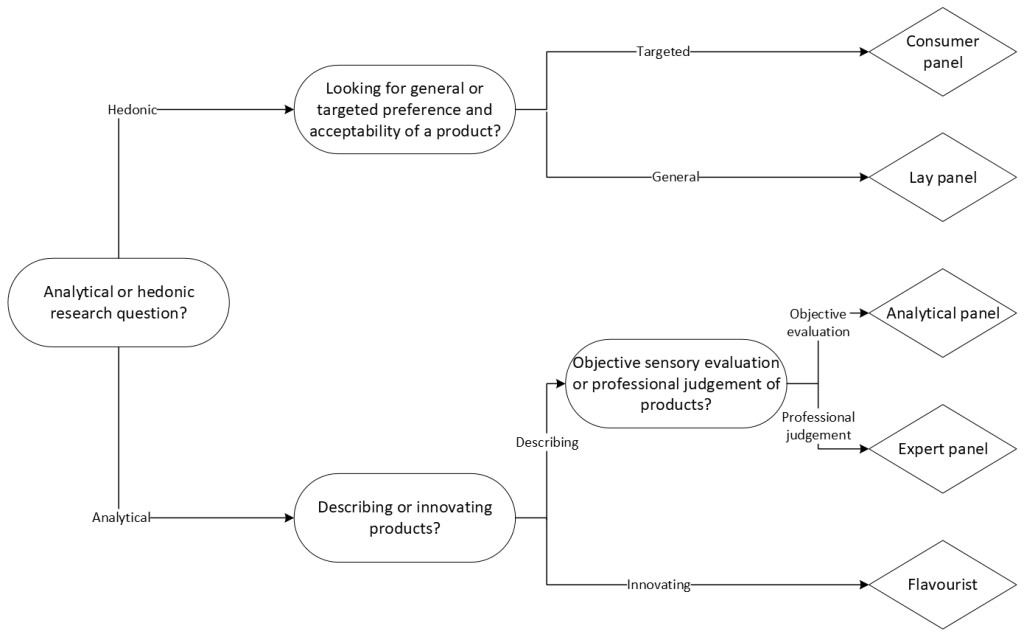

The type of panel is mainly selected based on the type of research question that you want to answer. It depends on the type of response, that is, whether it isan analytical or a hedonic response (see chapter 2. A Crucial Difference: Analytical Versus Hedonic Evaluation). An example of a hedonic research question can be: ‘How well is a reduced sugar content in juice by a brand accepted?’ or ‘How much is a new flavour of breakfast yogurt liked by people regularly consuming yogurt for breakfast?’. For these types of questions, usually, consumer panels, or lay panels are used. It is important that the panel member is a frequent consumer of the product that is tested.

When there is an analytical question to be answered, for example: ‘What attributes can be used best to describe the flavour of cheese biscuits’ or ‘What is the difference in sweetness intensity in different food items?’, analytical panels or expert panels can be used. These panels first need to be trained to be able to conduct such a task. See Figure 13 for how to apply your research question to find a suitable sensory panel. In Video 6, more explanation on the use of distinct types of panels is given.

“WUR, SSEB -Panel choice”, license: Creative Commons Attribution

Video 6. Explanatory video on the different type of panels that exist.

Five types of panels

- Consumer panels:

Untrained panels consist of many regular consumers of the product that is being tested. They solely answer affective questions, a type of hedonic question asking about consumer liking or preference. Consumer panels can, for example, be used when launching a new product, changing an existing product or when comparing different product formulations. Consumer panels help ensure that the product meets the expectations and preferences of the target market. - Lay panels:

Panels that fall between consumer panels and analytical panels. These panels are not trained, but they have some knowledge of scale use and attribute interpretation. They mainly answer hedonic questions. A lay panel can for example be used during product development to ensure the product meets consumer expectations, or when there is a need to know how the average consumer perceives a product. - Analytical panels:

Trained panels consisting of around ten to twenty panellists. They are trained on attributes and scales and only answer analytical questions. Analytical panels are mainly used to answer descriptivequestions. Analytical panels can, for example, be used when there is a need for precise and detailed information about product attributes or during development and reformulation of products. Analytical panels help ensure products meet specific sensory standards. - Expert panels

Trained panels consisting of around three to ten panellists. They are trained on attributes and scales and only answer analytical questions. Expert panels are mainly used to answer discriminatory questions. They can be used, for example, to test food quality or machine malfunction in batches, by detection of off-flavour or odour in one specific food product. - Flavourists

Usually only one person in a food manufacturing company. They work to optimise the taste of a product. Flavourists help to develop new flavours or enhance existing flavours, by, for example, combining different ingredients or chemicals.

differences between paNEls

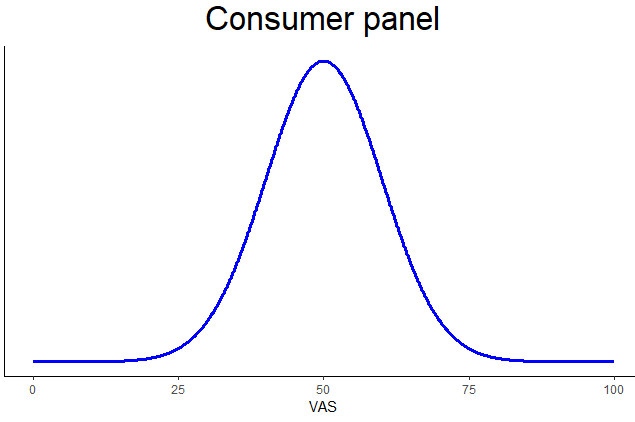

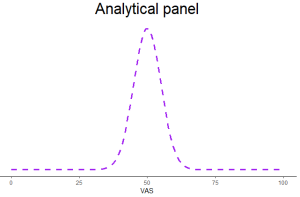

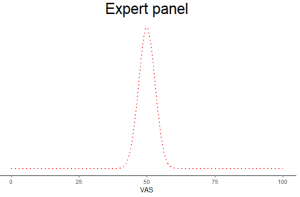

Imagine that three different panels – consumer panel, analytical panel and an expert panel – have to evaluate the same product with the following question: “How smooth is this pudding?” The ratings for three different panels are visualised in Figure 14.

With panel training, you can standardise attribute interpretation and scale use so that the distribution in the answer distribution can be narrowed. People in the consumer panel may interpret smooth as either creamy, flat, without lumps, or something similar, while people in the analytical and expert panel will interpret smooth as: ‘having a texture free from roughness, bumps, ridges, or irregularities.’ Training on a specific product can even narrow the distribution more which makes the panel an expert panel for a specific food category.

The more similar panellists judge a specific food on a specific attribute, the narrower the distribution, the more sensitive it is to assess small differences between products.

Figure 16. Differences between consumer, analytical, and expert panels in terms of variation around the mean rating of an attribute.

Example 4 – Consumer Research in Companies

Companies apply sensory research during the product development process using team tastings. These team tastings can include every employee in smaller companies, also product developers. During the idea generation, experimenting and product selection, team tastings can add value to the product development phase, while requiring less time and resources than consumer panels, or trained panels. Using team tastings, sensory tests during the product development phase can go ahead more efficiently, flexible and adjustable. Often, team tastings occur in an unstructured way, and decisions are made based on just a few opinions, as the main reason to perform team tastings is to make fast, minimal risk decisions.

After team tastings contributed to product development, selection and sensory optimisation, consumer tests can be executed to find out how the new product is perceived by consumers.

Recently, Inholland set up a practical guide for sensory testing for small and medium size enterprises. You can find this practical guide via this link.

Media Attributions

- 20250601_flowchart_panelchoice (1)

- consumer panel

- analytical panel

- expert panel

A group of research participants used to describe properties or modalities of a food product, or differences between food products.

Analytical testing refers to the objective measurement of the intensity of a sensation

hedonic testing refers to the subjective evaluation of a sensation, for example, liking or palatability.

Analysis that is used to describe the difference between products.

Analysis that is used to describe whether there is a difference between products or not.