Financial Aid

In the Financial Aid Section, we will share definitions and resources of various types of Financial Aid.

In the Financial Aid Section, we will share definitions and resources of various types of Financial Aid.

The Financial Aid application process happens outside of Common App. Students will typically use FAFSA and possibly CSS Profile to apply for financial aid.

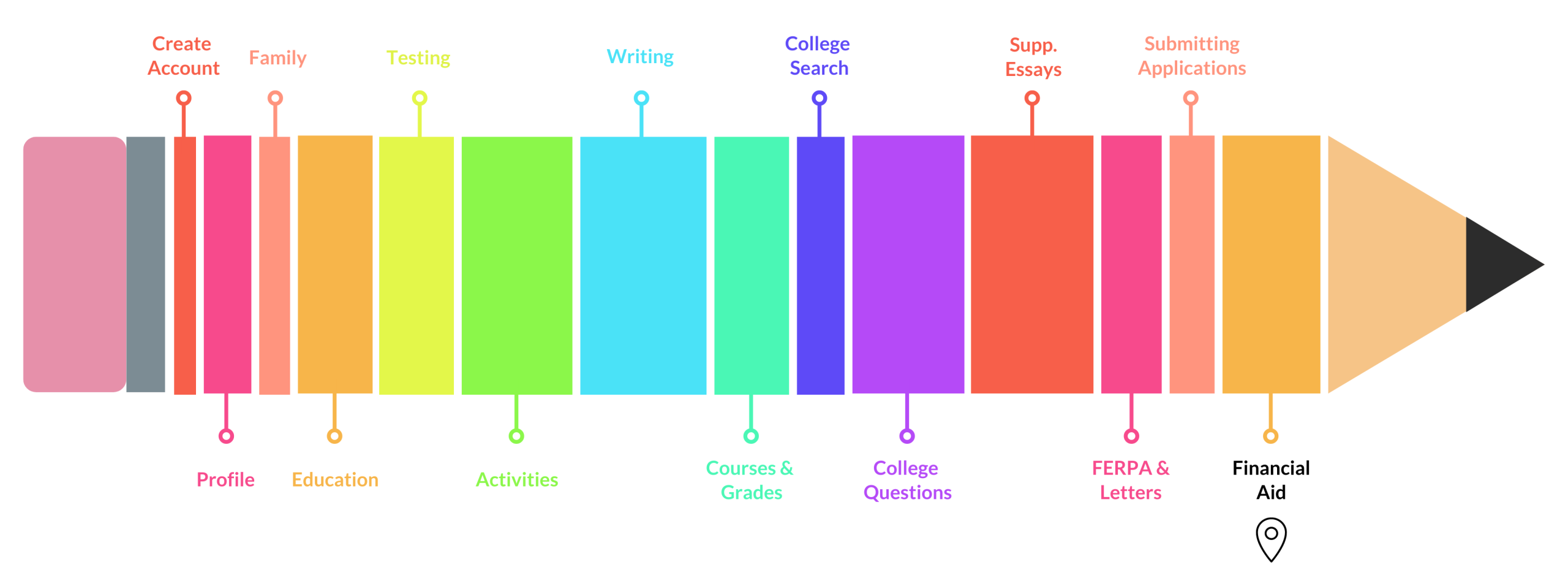

Introduction

In the Financial Aid section, we explain how to determine which colleges will be the best financial fit for your family’s budget.

The AXS Companion’s financial aid section explains:

- How financial aid works

- Why your family should ignore the sticker price when determining affordability.

- Where to apply for need-based financial aid

- How to use loans to help pay for college, and how to determine if loans are excessive

- What is merit aid and how to find colleges that offer merit aid

- How to create a list of colleges that are a good financial fit for you

Vocabulary

- Total Cost of Attendance (COA):. The total COA includes tuition, fees, room and board, books, transportation, and personal expenses.This is often referred to as the “sticker price” of a college.

- Net Price: The total cost of attendance minus all grants and scholarships. Grants and scholarships are free money that does not have to be paid back.

- Student Aid Index (SAI): The Student Aid Index (SAI) is a calculation used by college financial aid administrators to determine a student’s need-based financial aid. This is determined from the information the student provided on their FAFSA form.

- Expected Family Contribution (EFC): Expected Family Contribution (EFC) was a calculation used in past versions of FAFSA to determine financial need. EFC has been replaced with SAI, Student Aid Index.

- Need-based aid: Need-based aid includes scholarships and grants, work study, and subsidized loans that students may receive to help pay for college. Need-based aid is awarded based on a family’s financial need.

- FAFSA: The Free Application for Federal Student Aid (FAFSA) is an application that must be completed annually by students to receive need-based financial aid. Almost every college uses FAFSA information to calculate the student’s eligibility for need-based aid.

- CSS Profile: An additional application for financial aid is required by approximately 175 colleges and universities for students seeking assistance. These institutions require both the FAFSA and the CSS Profile to determine how much financial aid a student qualifies to receive. There is a fee for the CSS Profile.

- Grants: A grant is a form of financial aid that doesn’t have to be repaid.

- Loans: A student loan is money that you borrow to help pay for college. You must repay the loan as well as the accrued interest.

- Merit aid: Merit aid is non-need-based financial aid that is awarded based on achievements related to things like academics, athletics, music, or civic participation. Merit aid awards are not based on a family’s ability to pay.

- Work Study: Work study is a type of financial aid that provides part-time jobs for students with financial need, allowing them to earn money to help pay education expenses.

Videos

In this video, we provide an overview of Common App’s Financial Aid Resources.

In this video, we discuss why families should understand that the “sticker price” of a college (the full cost)is not what many students/families actually pay for college. It is typically less. What a student/family actually pays is determined by what the federal government and the college calculate, based on parent and student income and assets, as well as demographic factors. This video is approximately 10 minutes.

In this video, we discuss the parts of a financial aid award and why you should apply for need-based financial aid. This video is approximately 12 minutes.

In this video, we discuss who should apply for financial aid and how to apply. We will discuss the Free Application for Federal Student Aid (FAFSA), where to find what applications are required by each college, information needed to complete each application, and when to apply. This video is approximately 12 minutes.

In this video, we discuss using loans to help pay for college. Student loans are often part of financial aid awards. We also discuss how to distinguish between reasonable and excessive debt. This video should take approximately 12 minutes.

In this video, we help students and families understand merit aid. This video should take approximately 12 minutes.

In this video, we discuss how to create an application list of affordable colleges. There are three components of a smart college list: financial fit, social fit, and academic fit. We show students various resources they can use to identify colleges that will be affordable for them and their family. This video should take approximately 25 minutes.

Tips & Reminders

- Approximately 85% of students in the US do not pay the full cost(“sticker price”) for college. There is a possibility that you could receive financial assistance for college.

- Most students will have to complete the Free Application for Federal Student Aid (FAFSA) in order to be considered for financial aid. Approximately 175 colleges and universities also require the CSS Profile, a second application for financial aid.

- Applying for financial aid with FAFSA is free.

- Applying for financial aid with the CSS Profile requires a fee.

- Students with little or no demonstrated financial need should look for colleges that are generous with merit aid. Students with moderate to high financial need should look for colleges that are generous with need-based aid.

- To determine if you have high, moderate, or low financial need, you must calculate your Student Aid Index (SAI). You can also calculate your expected costs at a particular college by using a Net Price Calculator (NPC) for that college. You can find links to these resources below.

Resources

FAFSA (Free Application for Federal Student Aid)

For help with your financial aid application:

- FAFSA Help for resources, including articles, videos, and infographics

- Aidan, the financial aid virtual assistant, can be accessed by selecting the owl icon in the bottom right-hand corner of a page on the FAFSA site. You can use this tool to find answers to most questions

- FSA Information Center at 800-4-FED-AID (800-433-3243). The TDD number for hearing-impaired individuals is 800-730-8913

- CSS Profile – an additional financial aid application used by some colleges and universities

Find colleges that:

- Meet 90% of financial need or more

- Are generous with merit aid or have lower sticker prices

Big J Educational Consulting’s Domestic Financial Aid Chart

Collegedata.com

A student loan is money that you borrow to help pay for college. You must repay the loan as well as the interest that accrues.

Need-based aid includes scholarships and grants, work-study, and subsidized loans that students may receive to help pay for college. Need-based aid is awarded based on a family’s financial need.

Many colleges require applicants to submit one or two letters of recommendation from teachers as part of their application. The purpose of the letter is to provide a college or university the opportunity to learn more about you, the type of student you are, and how you contribute in the classroom, school, or community. Many colleges also request a letter of recommendation from your high school counselor. The counselor’s recommendation is used to understand your school and its curriculum and how you as a student fit into the school community. Many colleges also accept recommendations from “other” recommenders, which can include an employer, a coach, or another person who knows you well and can speak to your accomplishments or character. Each college where you will apply states how many letters of recommendation they require. Be sure to go through these requirements and identify the people who will provide the letters of recommendation. Some high schools use Common App to manage their recommendation process while other high schools use different platforms such as SCOIR, Parchment, or Naviance. Talk to your high school counselor to learn how your school handles the recommendation process and be sure to follow that process.

The Student Aid Index (SAI) is an eligibility index number that a college’s financial aid office uses to determine how much federal student aid students would receive if they attend the school. This number results from the information the student provided on their FAFSA form.

The total cost of attendance minus all grants and scholarships. Grants and scholarships are free money that does not have to be paid back.