Learning Objectives

- Define entrepreneur and describe the three characteristics of entrepreneurial activity.

- Identify five potential advantages to starting your own business.

- Define a small business and explain the importance of small businesses to the US economy.

- Explain why small businesses tend to foster innovation more effectively than large ones.

- Describe the goods-producing and service-producing sectors of an economy.

- Explain what it takes to start a business and evaluate the advantages and disadvantages starting a business from scratch, buying an existing business, or obtaining a franchise.

- Explain why some businesses fail.

- Identify sources of small business assistance from the Small Business Administration.

Cover Story: Build a Better “Baby” and They Will Come

One balmy San Diego evening in 1993, Mary and Rick Jurmain were watching a TV program about teenage pregnancy.[1] To simulate the challenge of caring for an infant, teens on the program were assigned to tend baby-size sacks of flour. Rick, a father of two young children, remarked that trundling around a sack of flour wasn’t exactly a true-to-life experience. In particular, he argued, sacks of flour simulated only abnormally happy babies—babies who didn’t cry, especially in the middle of the night. Half-seriously, Mary suggested that her husband—a between-jobs aerospace engineer— build a better baby, and within a couple of weeks, a prototype was born. Rick’s brainchild was a bouncing 6.5-pound bundle of vinyl-covered joy with an internal computer to simulate infant crying at realistic, random intervals. He also designed a drug-affected model to simulate tremors from withdrawal, and each model monitored itself for neglect or ill treatment.

The Jurmains patented Baby Think It Over and started production in 1994 as Baby Think It Over Inc. Their first “factory” was their garage, and the “office” was the kitchen table—“a little business in a house,” as Mary put it. With a boost from articles in USA Today, Newsweek, Forbes, and People—plus a “Product of the Year” nod from Fortune—news of the Jurmains’ “infant simulator” eventually spread to the new company’s targeted education market, and by 1998, some 40,000 simulators had been babysat by more than a million teenagers in nine countries. By that time, the company had moved to Wisconsin, where it had been rechristened BTIO Educational Products Inc. to reflect an expanded product line that now includes not only dolls and equipment, like the Shaken Baby Syndrome Simulator, but also simulator-based programs like START Addiction Education and Realityworks Pregnancy Profile. BTIO was retired and replaced by the new and improved RealCare Baby and, ultimately, by RealCare Baby II–Plus, which requires the participant to determine what the “baby” needs when it cries and downloads data to record misconduct. In 2003, the name of the Jurmains’ company was changed once again, this time to Realityworks Inc.

In developing BTIO and Realityworks Inc., the Jurmains were doing what entrepreneurs do (and doing it very well). In fact, Mary was nominated three times for the Ernst & Young Entrepreneur of the Year Award and named 2001 Wisconsin Entrepreneurial Woman of the Year by the National Association of Women Business Owners. So what, exactly, is an entrepreneur and what does one do? According to one definition, an entrepreneur is an “individual who starts a new business”—and that’s true. Another definition identifies an entrepreneur as someone who “uses resources to implement innovative ideas for new, thoughtfully planned ventures.”[2] But an important component of a satisfactory definition is still missing. To appreciate fully what it is, let’s go back to the story of the Jurmains. In 1993, the Jurmains were both unemployed—Rick had been laid off by General Dynamics Corp., and Mary by the San Diego Gas and Electric Company. While they were watching the show about teenagers and flour sacks, they were living off a loan from her father and the returns from a timely investment in coffee futures. Rick recalls that the idea for a method of creating BTIO came to him while “I was awake in bed, worrying about being unemployed.” He was struggling to find a way to feed his family. He had to make the first 40 simulators himself, and at the end of the first summer, BTIO had received about 400 orders—a promising start, perhaps, but, at $250 per baby (less expenses), not exactly a windfall. “We were always about one month away from bankruptcy,” recalls Mary.

At the same time, it’s not as if the Jurmains started up BTIO simply because they had no “conventional” options for improving their financial prospects. Rick, as we’ve seen, was an aerospace engineer, and his résumé includes work on space-shuttle missions at NASA. Mary, who has not only a head for business but also a degree in industrial engineering, has worked at the Johnson Space Center. Therefore, the idea of replacing a sack of flour with a computer-controlled simulator wasn’t necessarily rocket science for the couple. But taking advantage of that idea—choosing to start a new business and to commit themselves to running it—was a risk. Risk taking is the missing component that we’re looking for in a definition of entrepreneurship, and so we’ll define an entrepreneur as someone who identifies a business opportunity and assumes the risk of creating and running a business to take advantage of it. To be successful, entrepreneurs must be comfortable accepting risk, and positive and confident that they can manage through it successfully.

The Nature of Entrepreneurship

If we look a little more closely at the definition of entrepreneurship, we can identify three characteristics of entrepreneurial activity:[3]

- Innovation. Entrepreneurship generally means offering a new product, applying a new technique or technology, opening a new market, or developing a new form of organization for the purpose of producing or enhancing a product.

- Running a business. A business, as we saw in Chapter 1 “The Foundations of Business,” combines resources to produce goods or services. Entrepreneurship means setting up a business to make a profit.

- Risk taking. The term risk means that the outcome of the entrepreneurial venture can’t be known. Entrepreneurs, therefore, are always working under a certain degree of uncertainty, and they can’t know the outcomes of many of the decisions that they have to make. Consequently, many of the steps they take are motivated mainly by their confidence in the innovation and in their understanding of the business environment in which they’re operating.

It is easy to recognize these characteristics in the entrepreneurial experience of the Jurmains. They certainly had an innovative idea. But was it a good business idea? In a practical sense, a “good” business idea has to become something more than just an idea. If, like the Jurmains, you’re interested in generating income from your idea, you’ll probably need to turn it into a product—something that you can market because it satisfies a need. If you want to develop a product, you’ll need some kind of organization to coordinate the resources necessary to make it a reality (in other words, a business). Risk enters the equation when you make the decision to start up a business and when you commit yourself to managing it.

A Few Things to Know about Going into Business for Yourself

Mark Zuckerberg founded Facebook while a student at Harvard. By age 27 he built up a personal wealth of $13.5 billion. By age 31, his net worth was $37.5 billion.

So what about you? Do you ever wonder what it would be like to start your own business? You might even turn into a “serial entrepreneur” like Marcia Kilgore.[4] After high school, she moved from Canada to New York City to attend Columbia University. But when her financial aid was delayed, Marcia abandoned her plans to attend college and took a job as a personal trainer (a natural occupation for a former bodybuilder and middleweight title holder). But things got boring in the summer when her wealthy clients left the city for the Hamptons. To keep busy, she took a skin care course at a Manhattan cosmetology institute. As a teenager, she was self-conscious about her complexion and wanted to know how to treat it herself. She learned how to give facials and work with natural remedies. She started giving facials to her fitness clients who were thrilled with the results. As demand for her services exploded, she started her first business—Bliss Spa—and picked up celebrity clients, including Madonna, Oprah Winfrey, and Jennifer Lopez. The business went international, and she sold it for more than $30 million.[5]

But the story doesn’t end here; she launched two more companies: Soap and Glory, a supplier of affordable beauty products sold at Target, and FitFlops, which sells sandals that tone and tighten your leg muscles as you walk. Oprah loves Kilgore’s sandals and plugged them on her show.[6] You can’t get a better endorsement than that. Kilgore never did finish college, but when asked if she would follow the same path again, she said, “If I had to decide what to do all over again, I would make the same choices…I found by accident what I’m good at, and I’m glad I did.”

So, a few questions to consider if you want to go into business for yourself:

- How do I find a problem to solve and know it is an opportunity worth pursuing?

- How do I come up with a business idea?

- Should I build a business from scratch, buy an existing business, or invest in a franchise?

- What steps are involved in developing a business plan?

- Where could I find help in getting my business started?

- How can I increase the likelihood that I’ll succeed?

In this chapter, we’ll provide some answers to questions like these.

Why Start Your Own Business?

What sort of characteristics distinguishes those who start businesses from those who don’t? Or, more to the point, why do some people actually follow through on the desire to start up their own businesses? The most common reasons for starting a business are the following:

- To be your own boss

- To accommodate a desired lifestyle

- To achieve financial independence

- To enjoy creative freedom

- To use your skills and knowledge

The Small Business Administration (SBA) points out, though, that these are likely to be advantages only “for the right person.” How do you know if you’re one of the “right people”? The SBA suggests that you assess your strengths and weaknesses by asking yourself a few relevant questions:[7]

- Am I a self-starter? You’ll need to develop and follow through on your ideas.

- How well do I get along with different personalities? Strong working relationships with a variety of people are crucial.

- How good am I at making decisions? Especially under pressure…..

- Do I have the physical and emotional stamina? Expect six or seven work days of about twelve hours every week.

- How well do I plan and organize? Poor planning is the culprit in most business failures.

- How will my business affect my family? Family members need to know what to expect: long hours and, at least initially, a more modest standard of living.

Before we discuss why businesses fail we should consider why a huge number of business ideas never even make it to the grand opening. One business analyst cites four reservations (or fears) that prevent people from starting businesses:[8]

- Money. Without cash, you can’t get very far. What to do: line up initial financing early or at least have done enough research to have a plan to raise money.

- Security. A lot of people don’t want to sacrifice the steady income that comes with the nine-to-five job. What to do: don’t give up your day job. Run the business part-time or connect with someone to help run your business—a “co-founder.”

- Competition. A lot of people don’t know how to distinguish their business ideas from similar ideas. What to do: figure out how to do something cheaper, faster, or better.

- Lack of ideas. Some people simply don’t know what sort of business they want to get into. What to do: find out what trends are successful. Turn a hobby into a business. Think about a franchise. Find a solution to something that annoys you—entrepreneurs call this a “pain point” —and try to turn it into a business.

If you’re interested in going into business for yourself, try to regard such drawbacks as mere obstacles to be overcome by a combination of planning, talking to potential customers, and creative thinking.

[h5p id=”19″]

Sources of Early-Stage Financing

As noted above, many businesses fail, or never get started, due to a lack of funds. But where can an entrepreneur raise money to start a business? Many first-time entrepreneurs are financed by friends and family, at least in the very early stages. Others may borrow through their personal credit cards, though quite often, high interest rates make this approach unattractive or too expensive for the new business to afford.

An entrepreneur with a great idea may win funding through a pitch competition; localities and state agencies understand that economic growth depends on successful new businesses, and so they will often conduct such competitions in the hopes of attracting them.

Crowd funding has become more common as a means of raising capital. An entrepreneur using this approach would typically utilize a crowd-funding platform like Kickstarter to attract investors. The entrepreneur might offer tokens of appreciation in exchange for funds, or perhaps might offer an ownership stake for a substantial enough investment.

Some entrepreneurs receive funding from angel investors, affluent investors who provide capital to start-ups in exchange for an ownership position in the company. Many angels are successful entrepreneurs themselves and invest not only to make money, but also to help other aspiring business owners to succeed.

Venture capital firms also invest in start-up companies, although usually at a somewhat later stage and in larger dollar amounts than would be typical of angel investors. Like angels, venture firms also take an ownership position in the company. They tend to have a higher expectation of making a return on their money than do angel investors. However, venture capitalists expect you have some paying customers to demonstrate the value your start-up brings to the marketplace.

Distinguishing Entrepreneurs from Small Business Owners

Though most entrepreneurial ventures begin as small businesses, not all small business owners are entrepreneurs. Entrepreneurs are innovators who start companies to create new or improved products. They strive to meet a need that’s not being met, and their goal is to grow the business and eventually expand into other markets.

In contrast, many people either start or buy small businesses for the sole purpose of providing an income for themselves and their families. They do not intend to be particularly innovative, nor do they plan to expand significantly. This desire to operate is what’s sometimes called a “lifestyle business.”[9] The neighborhood pizza parlor or beauty shop, the self-employed consultant who works out of the home, and even a local printing company—many of these are typically lifestyle businesses.

[h5p id=”20″]

The Importance of Small Business to the US Economy

What Is a “Small Business”?

To assess the value of small businesses to the US economy, we first need to know what constitutes a small business. Let’s start by looking at the criteria used by the Small Business Administration. According to the SBA, a small business is one that is independently owned and operated, exerts little influence in its industry, and (with a few exceptions) has fewer than 500 employees.[10]

Why Are Small Businesses Important?

There are more than 30.7 million small businesses in this country, and they generate about 47.3 percent of jobs in the US.[11] The millions of individuals who have started businesses in the United States have shaped the business world as we know it today. Some small business founders like Henry Ford and Thomas Edison have even gained places in history. Others, including Bill Gates (Microsoft), Sam Walton (Wal-Mart), Steve Jobs (Apple Computer), and Larry Page and Sergey Brin (Google), have changed the way business is done today.

Aside from contributions to our general economic well-being, founders of small businesses also contribute to growth and vitality in specific areas of economic and socioeconomic development. In particular, small businesses do the following:

- Create jobs

- Spark innovation

- Provide opportunities for many people, including women and minorities, to achieve financial success and independence

In addition, they complement the economic activity of large organizations by providing them with components, services, and distribution of their products. Let’s take a closer look at each of these contributions.

Job Creation

The majority of US workers first entered the business world working for small businesses. Although the split between those working in small companies and those working in big companies is about even, small firms hire more frequently and fire more frequently than do big companies.[12] Why is this true? At any given point in time, lots of small companies are started and some expand. These small companies need workers and so hiring takes place. But the survival and expansion rates for small firms is poor, and so, again at any given point in time, many small businesses close or contract and workers lose their jobs. Fortunately, over time more jobs are added by small firms than are taken away, which results in a net increase in the number of workers, as seen in Figure 7.2.

| Job Gains | Job Losses | Net Change |

|---|---|---|

| Openings 63.7 | Closings – 22.6 | |

| Expansions 190.0 | Contractions – 182.8 | |

| 253.7 | – 205.4 | 48.3 |

The size of the net increase in the number of workers for any given year depends on a number of factors, with the economy being at the top of the list. A strong economy encourages individuals to start small businesses and expand existing small companies, which adds to the workforce. A weak economy does just the opposite: discourages start-ups and expansions, which decreases the workforce through layoffs. Figure 7.4 reports the job gains from start-ups and expansions and job losses from business closings and contractions.

Innovation

Given the financial resources available to large businesses, you’d expect them to introduce virtually all the new products that hit the market. Yet according to the SBA, small companies develop more patents per employee than do larger companies. During a recent four-year period, large firms generated 1.7 patents per hundred employees, while small firms generated an impressive 26.5 patents per employee.[13] Over the years, the list of important innovations by small firms has included the airplane, air-conditioning, DNA “fingerprinting,” and overnight national delivery.[14]

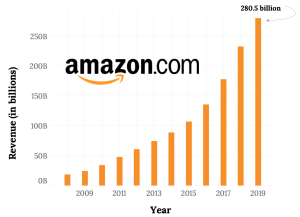

Small business owners are also particularly adept at finding new ways of doing old things. In 1994, for example, a young computer-science graduate working on Wall Street came up with the novel idea of selling books over the Internet. During the first year of operations, sales at Jeff Bezos’ new company—Amazon.com—reached half a million dollars. In less than 20 years, annual sales had topped $107 billion.[15] Not only did his innovative approach to online retailing make Bezos enormously rich, but it also established a viable model for the e-commerce industry.

Why are small businesses so innovative? For one thing, they tend to offer environments that appeal to individuals with the talent to invent new products or improve the way things are done. Fast decision making is encouraged, their research programs tend to be focused, and their compensation structures typically reward top performers.

According to one SBA study, the supportive environments of small firms are roughly 13 times more innovative per employee than the less innovation-friendly environments in which large firms traditionally operate.[16]

The success of small businesses in fostering creativity has not gone unnoticed by big businesses. In fact, many large companies have responded by downsizing to act more like small companies. Some large organizations now have separate work units whose purpose is to spark innovation. Individuals working in these units can focus their attention on creating new products that can then be developed by the company.

Opportunities for Women and Minorities

Small business is the portal through which many people enter the economic mainstream. Business ownership allows individuals, including women and minorities, to achieve financial success, as well as pride in their accomplishments. While the majority of small businesses are still owned by white males, the past two decades have seen a substantial increase in the number of businesses owned by women and minorities. Figure 7.4 gives you an idea of how many American businesses are owned by women and minorities, and indicates how much the numbers grew between 2007 and 2016.

| Business Owners | 2007 | 2012 | 2016 |

|---|---|---|---|

| Women | 28.8 | 35.8 | 20 |

| Hispanic Americans | 8.3 | 12 | 6 |

| African Americans | 7.1 | 9.4 | 2.2 |

| Asian Americans | 5.7 | 6.9 | 9.9 |

What Industries Are Small Businesses In?

If you want to start a new business, you probably should avoid certain types of businesses. You’d have a hard time, for example, setting up a new company to make automobiles or aluminum, because you’d have to make tremendous investments in property, plant, and equipment, and raise an enormous amount of capital to pay your workforce. These large, up-front investments present barriers to entry.

Fortunately, plenty of opportunities are still available. Many types of businesses require reasonable initial investments, and not surprisingly, these are the ones that usually present attractive small business opportunities.

Industries by Sector

Let’s define an industry as a group of companies that compete with one another to sell similar products. We’ll focus on the relationship between a small business and the industry in which it operates, dividing businesses into two broad types of industries, or sectors: the goods-producing sector and the service-producing sector.

- The goods-producing sector includes all businesses that produce tangible goods. Generally speaking, companies in this sector are involved in manufacturing, construction, and agriculture.

- The service-producing sector includes all businesses that provide services but don’t make tangible goods. They may be involved in retail and wholesale trade, transportation, finance, entertainment, recreation, accommodations, food service, and any number of other ventures.

About 20 percent of small businesses in the United States are concentrated in the goods-producing sector. The remaining 80 percent are in the service sector.[17] The high concentration of small businesses in the service-producing sector reflects the makeup of the overall US economy. Over the past 50 years, the service-producing sector has been growing at an impressive rate. In 1960, for example, the goods-producing sector accounted for 38 percent of GDP, the service-producing sector for 62 percent. By 2015, the balance had shifted dramatically, with the goods-producing sector accounting for only about 21 percent of GDP.[18]

Goods-Producing Sector

The largest areas of the goods-producing sector are construction and manufacturing. Construction businesses are often started by skilled workers, such as electricians, painters, plumbers, and home builders, and they generally work on local projects. Though manufacturing is primarily the domain of large businesses, there are exceptions. BTIO/Realityworks, for example, is a manufacturing enterprise (components come from Ohio and China, and assembly is done in Wisconsin).

How about making something out of trash? Daniel Blake never followed his mother’s advice at dinner when she told him to eat everything on his plate. When he served as a missionary in Puerto Rico, Aruba, Bonaire, and Curacao after his first year in college, he noticed that the families he stayed with didn’t either. But they didn’t throw their uneaten food into the trash. Instead they put it on a compost pile and used the mulch to nourish their vegetable gardens and fruit trees. While eating at an all-you-can-eat breakfast buffet back home at Brigham Young University, Blake was amazed to see volumes of uneaten food in the trash. This triggered an idea: why not turn the trash into money? Two years later, he was running his company—EcoScraps—collecting 40 tons of food scraps a day from 75 grocers and turning it into high-quality potting soil that he sells online and to nurseries. His profit has reach almost half a million dollars on sales of $1.5 million.[19]

Service-Producing Sector

Many small businesses in this sector are retailers—they buy goods from other firms and sell them to consumers, in stores, by phone, through direct mailings, or over the Internet. In fact, entrepreneurs are turning increasingly to the Internet as a venue for start-up ventures. Take Tony Roeder, for example, who had a fascination with the red Radio Flyer wagons that many of today’s adults had owned as children. In 1998, he started an online store through Yahoo! to sell red wagons from his home. In three years, he turned his online store into a million-dollar business.[20]

Other small business owners in this sector are wholesalers—they sell products to businesses that buy them for resale or for company use. A local bakery, for example, is acting as a wholesaler when it sells desserts to a restaurant, which then resells them to its customers. A small business that buys flowers from a local grower (the manufacturer) and resells them to a retail store is another example of a wholesaler.

A high proportion of small businesses in this sector provide professional, business, or personal services. Doctors and dentists are part of the service industry, as are insurance agents, accountants, and lawyers. So are businesses that provide personal services, such as dry cleaning and hairdressing.

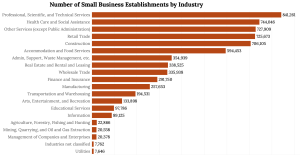

David Marcks, for example, entered the service industry about 14 years ago when he learned that his border collie enjoyed chasing geese at the golf course where he worked. While geese are lovely to look at, they can make a mess of tees, fairways, and greens. That’s where Marcks’ company, Geese Police, comes in: Marcks employs specially trained dogs to chase the geese away. He now has 27 trucks, 32 border collies, and five offices. Golf courses account for only about 5 percent of his business, as his dogs now patrol corporate parks and playgrounds as well.[21] Figure 7.5 provides a more detailed breakdown of small businesses by industry.

Advantages and Disadvantages of Business Ownership

Do you want to be a business owner someday? Before deciding, you might want to consider the following advantages and disadvantages of business ownership.[22]

Advantages of Small Business Ownership

Being a business owner can be extremely rewarding. Having the courage to take a risk and start a venture is part of the American dream. Success brings with it many advantages:

- Independence. As a business owner, you’re your own boss. You can’t get fired. More importantly, you have the freedom to make the decisions that are crucial to your own business success.

- Lifestyle. Owning a small business gives you certain lifestyle advantages. Because you’re in charge, you decide when and where you want to work. If you want to spend more time on non-work activities or with your family, you don’t have to ask for the time off. Given today’s technology, if it’s important that you be with your family all day, you can run your business from your home.

- Financial rewards. In spite of high financial risk, running your own business gives you a chance to make more money than if you were employed by someone else. You benefit from your own hard work.

- Learning opportunities. As a business owner, you’ll be involved in all aspects of your business. This situation creates numerous opportunities to gain a thorough understanding of the various business functions.

- Creative freedom and personal satisfaction. As a business owner, you’ll be able to work in a field that you really enjoy. You’ll be able to put your skills and knowledge to use, and you’ll gain personal satisfaction from implementing your ideas, working directly with customers, and watching your business succeed.

Disadvantages of Small Business Ownership

As the little boy said when he got off his first roller-coaster ride, “I like the ups but not the downs!” Here are some of the risks you run if you want to start a small business:

- Financial risk. The financial resources needed to start and grow a business can be extensive. You may need to commit most of your savings or even go into debt to get started. If things don’t go well, you may face substantial financial loss. In addition, there’s no guaranteed income. There might be times, especially in the first few years, when the business isn’t generating enough cash for you to live on.

- Stress. As a business owner, you are the business. There’s a bewildering array of things to worry about—competition, employees, bills, equipment breakdowns, etc.. As the owner, you’re also responsible for the well-being of your employees.

- Time commitment. People often start businesses so that they’ll have more time to spend with their families. Unfortunately, running a business is extremely time-consuming. In theory, you have the freedom to take time off, but in reality, you may not be able to get away. In fact, you’ll probably have less free time than you’d have working for someone else. For many entrepreneurs and small business owners, a 40-hour workweek is a myth. Vacations will be difficult to take and will often be interrupted. In recent years, the difficulty of getting away from the job has been compounded by cell phones, iPhones, Internet-connected laptops and iPads, and many small business owners have come to regret that they’re always reachable.

- Undesirable duties. When you start up, you’ll undoubtedly be responsible for either doing or overseeing just about everything that needs to be done. You can get bogged down in detail work that you don’t enjoy. As a business owner, you’ll probably have to perform some unpleasant tasks, like firing people.

In spite of these and other disadvantages, most small business owners are pleased with their decision to start a business. A survey conducted by the Wall Street Journal and Cicco and Associates indicates that small business owners and top-level corporate executives agree overwhelmingly that small business owners have a more satisfying business experience. Interestingly, the researchers had fully expected to find that small business owners were happy with their choices; they were, however, surprised at the number of corporate executives who believed that the grass was greener in the world of small business ownership.[23]

Starting a Business

Starting a business takes talent, determination, hard work, and persistence. It also requires a lot of research and planning. Before starting your business, you should appraise your strengths and weaknesses and assess your personal goals to determine whether business ownership is for you.[24]

Questions to Ask Before You Start a Business

If you’re interested in starting a business, you need to make decisions even before you bring your talent, determination, hard work, and persistence to bear on your project.

Here are the basic questions you’ll need to address:

- What, exactly, is my business idea? Is it feasible?

- What industry do I want to enter?

- What will be my competitive advantage?

- Do I want to start a new business, buy an existing one, or buy a franchise?

- What form of business organization do I want?

After making these decisions, you’ll be ready to take the most important step in the entire process of starting a business: you must describe your future business in the form of a business plan—a document that identifies the goals of your proposed business and explains how these goals will be achieved. Think of a business plan as a blueprint for a proposed company: it shows how you intend to build the company and how you intend to make sure that it’s sturdy. You must also take a second crucial step before you actually start up your business: You need to get financing—the money that you’ll need to get your business off the ground.

The Business Idea

For some people, coming up with a great business idea is a gratifying adventure. For most, however, it’s a daunting task. The key to coming up with a business idea is identifying something that customers want—or, perhaps more importantly, filling an unmet need. Your business will probably survive only if its purpose is to satisfy its customers—the ultimate users of its goods or services. In coming up with a business idea, don’t ask, “What do we want to sell?” but rather, “What does the customer want to buy?”[25]

To come up with an innovative business idea, you need to be creative. If your idea is innovative enough, it may be considered intellectual property, a right that can be protected under the law. Prior experience accounts for the bulk of new business idea and also increases your chances of success. Take Sam Walton, the late founder of Wal-Mart. He began his retailing career at JCPenney and then became a successful franchiser of a Ben Franklin five-and-dime store. In 1962, he came up with the idea of opening large stores in rural areas, with low costs and heavy discounts. He founded his first Wal-Mart store in 1962, and when he died 30 years later, his family’s net worth was $25 billion.[26]

Industry experience also gave Howard Schultz, a New York executive for a housewares company, his breakthrough idea. In 1981, Schultz noticed that a small customer in Seattle—Starbucks Coffee, Tea and Spice—ordered more coffeemaker cone filters than Macy’s and many other large customers. So he flew across the country to find out why. His meeting with the owner-operators of the original Starbucks Coffee Co. resulted in his becoming part-owner of the company. Schultz’s vision for the company far surpassed that of its other owners. While they wanted Starbucks to remain small and local, Schultz saw potential for a national business that not only sold world-class-quality coffee beans but also offered customers a European coffee-bar experience. After attempting unsuccessfully to convince his partners to try his experiment, Schultz left Starbucks and started his own chain of coffee bars, which he called Il Giornale (after an Italian newspaper). Two years later, he bought out the original owners and reclaimed the name Starbucks.[27]

Ownership Options

As we’ve already seen, you can become a small business owner in one of three ways— by starting a new business, buying an existing one, or obtaining a franchise. Let’s look more closely at the advantages and disadvantages of each option.

Starting from Scratch

The most common—and the riskiest—option is starting from scratch. This approach lets you start with a clean slate and allows you to build the business the way you want. You select the goods or services that you’re going to offer, secure your location, and hire your employees, and then it’s up to you to develop your customer base and build your reputation. This was the path taken by Andres Mason who figured out how to inject hysteria into the process of bargain hunting on the Web. The result is an overnight success story called Groupon.[28] Here is how Groupon (a blend of the words “group” and “coupon”) works: A daily email is sent to 6.5 million people in 70 cities across the United States offering a deeply discounted deal to buy something or to do something in their city. If the person receiving the email likes the deal, he or she commits to buying it. But, here’s the catch, if not enough people sign up for the deal, it is cancelled. Groupon makes money by keeping half of the revenue from the deal. The company offering the product or service gets exposure. But stay tuned: the “daily deals website isn’t just unprofitable—it’s bleeding hundreds of millions of dollars.”[29] As with all start-ups cash is always a challenge.

Buying an Existing Business

If you decide to buy an existing business, some things will be easier. You’ll already have a proven product, current customers, active suppliers, a known location, and trained employees. You’ll also find it much easier to predict the business’s future success.

There are, of course, a few bumps in this road to business ownership. First, it’s hard to determine how much you should pay for a business. You can easily determine how much things like buildings and equipment are worth, but how much should you pay for the fact that the business already has steady customers?

In addition, a business, like a used car, might have performance problems that you can’t detect without a test drive (an option, unfortunately, that you don’t get when you’re buying a business). Perhaps the current owners have disappointed customers; maybe the location isn’t as good as it used to be. You might inherit employees that you wouldn’t have hired yourself. Careful study called due diligence is necessary before going down this road.

Getting a Franchise

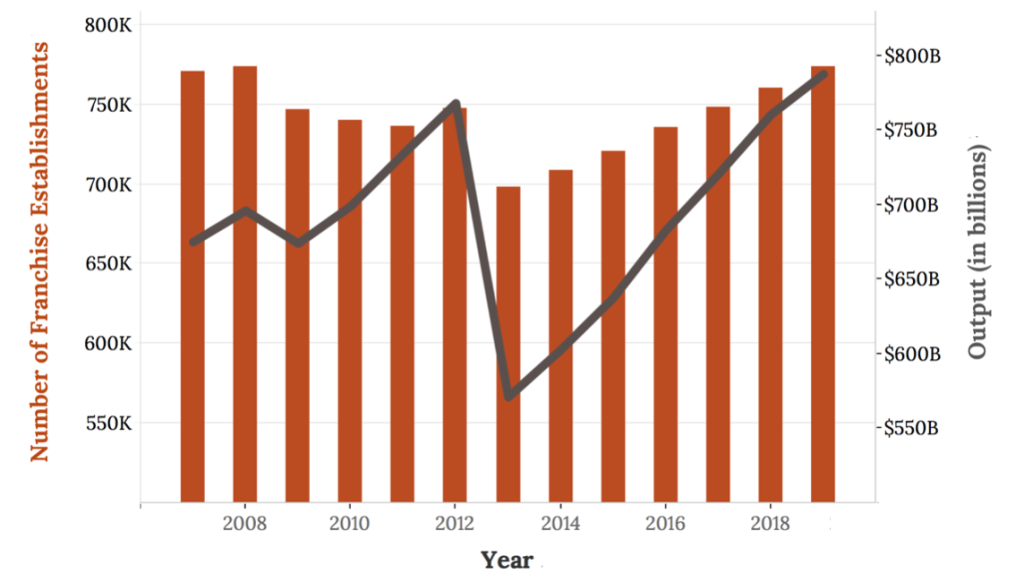

Lastly, you can buy a franchise. A franchiser (the company that sells the franchise) grants the franchisee (the buyer—you) the right to use a brand name and to sell its goods or services. Franchises market products in a variety of industries, including food, retail, hotels, travel, real estate, business services, cleaning services, and even weight-loss centers and wedding services. Figure 7.7 lists the top 10 franchises according to Entrepreneur magazine for 2015 and 2016.

| Ranking | 2015 | 2016 | 2019 | 2020 |

|---|---|---|---|---|

| 1 | Hampton by Hilton | Jimmy John’s | McDonald’s | Dunkin’ |

| 2 | Anytime Fitness | Hampton by Hilton | Dunkin’ | Taco Bell |

| 3 | Subway | Supercuts | Sonic Drive-In | McDonald’s |

| 4 | Jack in the Box | Servpro | Taco Bell | Sonic Drive-In |

| 5 | Supercuts | Subway | The UPS Store | The UPS Store |

| 6 | Jimmy John’s | McDonald’s | Culver’s | ACE Hardware |

| 7 | Servpro | 7-Eleven | Planet Fitness | Planet Fitness |

| 8 | Denny’s | Dunkin’ | Great Clips | Jersey Mike’s Subs |

| 9 | Pizza Hut | Denny’s | Jersey Mike’s Subs | Culver’s |

| 10 | 7-Eleven | Anytime Fitness | 7-Eleven Inc. | Pizza Hut LLC |

As you can see from Figure 7.8 on the next page, the popularity of franchising has been growing quickly since 2011. Although the economic downturn decreased the number of franchises between 2008-11, note that the overall value of franchise outputs steadily increased. A new franchise outlet opens once every eight minutes in the United States, where one in ten businesses is now a franchise. Franchises employ eight million people (13 percent of the workforce) and account for 17 percent of all sales in the US ($1.3 trillion).[30]

In addition to the right to use a company’s brand name and sell its products, the franchisee gets help in picking a location, starting and operating the business, and benefits from advertising done by the franchiser. Essentially, the franchisee buys into a ready-to-go business model that has proven successful elsewhere, also getting other ongoing support from the franchiser, which has a vested interest in her success.

Coming with so many advantages, franchises can be very expensive. KFC franchises, for example, require a total investment of $1.3 million to $2.5 million each. This fee includes the cost of the property, equipment, training, start-up costs, and the franchise fee—a one-time charge for the right to operate as a KFC outlet. McDonald’s is in the same price range ($1 million to $2.3 million). SUBWAY sandwich shops offer a more affordable alternative, with expected total investment ranging from $116,000 to $263,000.[31]

In addition to your initial investment, you’ll have to pay two other fees on a monthly basis—a royalty fee (typically from 3 to 12 percent of sales) for continued support from the franchiser and the right to keep using the company’s trade name, plus an advertising fee to cover your share of national and regional advertising. You’ll also be expected to buy your products from the franchiser.[32]

But there are disadvantages. The cost of obtaining and running a franchise can be high, and you have to play by the franchiser’s rules, even when you disagree with them. The franchiser maintains a great deal of control over its franchisees. For example, if you own a fast-food franchise, the franchise agreement will likely dictate the food and beverages you can sell; the methods used to store, prepare, and serve the food; and the prices you’ll charge. In addition, the agreement will dictate what the premises will look like and how they’ll be maintained. As with any business venture, you need to do your homework before investing in a franchise.

Launching a Business from the Inside

When someone mentions “entrepreneurship,” many people equate the term to “start up,” but entrepreneurial activity can also come from within established firms. However, it’s often the case that the entrepreneurial spirit is not fully unleashed until an independent entity is formed around a venture.

That’s exactly what happened in the case of Qualtrax, a company located in Blacksburg, Virginia.[33] The company was spawned from a need for customers of CCS, Inc. to become compliant with the requirements of the International Standards Organization. CCS (now known as Foxguard Solutions) employees developed a software tool to simplify ISO compliance audits, and the auditors were so impressed that they suggested marketing the tool more broadly. Over a period of nearly 20 years, the business grew to 10 dedicated employees, but Foxguard did not invest heavily in the software because the product was essentially a sideline business. Qualtrax shared sales and marketing resources with other business lines, so its growth was not necessarily a focal point for the company.

In 2011, CCS management appointed Amy Ankrum, an executive in their marketing department, to lead the Qualtrax business line with a simple mission in mind—determining whether Qualtrax could be scaled up or should be scaled down. Having the feeling that there was more to the business than had been achieved to date, Amy added Ryan Hagan as engineering manager for the software. Hagan quickly moved Qualtrax to an agile style of development, allowing for 5-6 new releases a year when annual releases had previously been the norm. This approach was much more responsive to customer needs, and in a business that depends on recurring revenue, it led to increased customer retention, which improved to over 95 percent each year. Revenue growth rates went up double digits.

In 2015, Qualtrax took its biggest leap of faith, moving out of Foxguard headquarters and becoming a separate legal entity. Ankrum located the offices near the campus of Virginia Tech, allowing the company to attract top-notch developers. The new location also allowed the company to take on its own culture—it’s more like a start-up company now than it was 23 years ago when it started! Employees enjoy flexible hours, short walks to downtown lunches, and a brightly-lit, open, and collaborative space with the company values painted right on the walls.

The move to a separate entity also allowed the company to attract new investor funding which will be used to push the company into new markets, such as the utility industry. Much of the new investor group is local and made up of former executives with significant experience in Software-as-a-Service (SaaS) and Business-to-Business (B2B) relationships. These execs will offer expertise beyond what Qualtrax had in-house, and all involved share the objective of increasing job growth in the region.

Asked what was different before and after Qualtrax began its rapid growth, Ankrum said, “It takes focus for any business to reach its full potential.” Since becoming its own company, Qualtrax has certainly enhanced that focus, and the new funding will allow them to offer ownership options to its now 26 employees. Qualtrax now dominates in quality and compliance software for a number of industries, including forensic crime labs. Thanks to the foresight of management, the company’s best days most certainly lie ahead.

Why Some Businesses Fail and Where to Get Help

Why Do Some Businesses Fail?

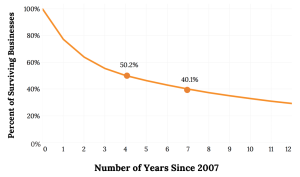

If you’ve paid attention to the occupancy of shopping malls over a few years, you’ve noticed that retailers come and go with surprising frequency. The same thing happens with restaurants—indeed, with all kinds of businesses. By definition, starting a business—small or large—is risky, and though many businesses succeed, a large proportion of them don’t. One-third of small businesses that have employees go out of business within the first two years. As shown in Figure 7.10, nearly half of small businesses have closed by the end of their fourth year, and 60-70 percent do not make it past their seventh year.[34]

As bad as these statistics on business survival are, some industries are worse than others. If you want to stay in business for a long time, you might want to avoid some of these risky industries. Even though your friends think you make the best pizza in the world, this doesn’t mean you can succeed as a pizza parlor owner. Opening a restaurant or a bar is one of the riskiest ventures (and, therefore, start-up funding is hard to get).

You might also want to avoid the transportation industry. Owning a taxi might appear lucrative until you find out what a taxi license costs. It obviously varies by city, but in New York City the price tag is upward of $400,000. No wonder taxi companies are resisting Uber and Lyft with all the energy they can muster. And setting up a shop to sell clothing can be challenging. Your view of “what’s in” may be off, and one bad season can kill your business. The same is true for stores selling communication devices: every mall has one or more cell phone stores so the competition is steep, and business can be very slow.[35]

Businesses fail for any number of reasons, but many experts agree that the vast majority of failures result from some combination of the following problems:

- Bad business idea. Like any idea, a business idea can be flawed, either in the conception or in the execution.

- Cash problems. Too many new businesses are underfunded. The owner borrows enough money to set up the business but doesn’t have enough extra cash to operate during the start-up phase, when very little money is coming in but a lot is going out.

- Managerial inexperience or incompetence. Many new business owners have no experience in running a business; many have limited management skills. Knowing how to make or market a product doesn’t necessarily mean knowing how to manage people or retain talented employees.

- Lack of customer focus. A major advantage of a small business is the ability to provide special attention to customers. But some small businesses fail to seize this advantage. Perhaps the owner doesn’t anticipate customers’ needs or keep up with changing markets or the customer-focused practices of competitors.

- Inability to handle growth. Growing sales is usually a good thing, but sometimes it can be a major problem. When a company grows, the owner’s role changes. He or she needs to delegate work to others and build a business structure that can handle the increase in volume. Some owners don’t make the transition and find themselves overwhelmed. In such cases, expansion actually damages the company.

- Failure to adapt. The external environment for a company can change dramatically. Companies that fail to keep up will not be around for long.

Help from the Small Business Administration

If you had your choice, which cupcake would you pick—vanilla Oreo, triple chocolate, or latte? In the last few years, cupcake shops are popping up in almost every city. Perhaps the bad economy has put people in the mood for small, relatively inexpensive treats.

Whatever the reason, you’re fascinated with the idea of starting a cupcake shop. You have a perfect location, have decided what equipment you need, and have tested dozens of recipes (and eaten lots of cupcakes). You are set to go with one giant exception: you don’t have enough savings to cover your start-up costs. You have made the round of most local banks, but they are all unwilling to give you a loan. So what do you do? Fortunately, there is help available. It is through your local Small Business Administration (SBA), which offers an array of programs to help current and prospective small business owners. The SBA won’t actually loan you the money, but it will increase the likelihood that you will get funding from a local bank by guaranteeing the loan.

Here’s how the SBA’s loan guarantee program works: You apply to a bank for financing. A loan officer decides if the bank will loan you the money without an SBA guarantee. If the answer is no (because of some weakness in your application), the bank then decides if it will loan you the money if the SBA guarantees the loan. If the bank decides to do this, you get the money and make payments on the loan. If you default on the loan, the government reimburses the bank for its loss, up to the amount of the SBA guarantee.

In the process of talking with someone at the SBA, you will discover other programs it offers that will help you start your business and manage your organization. For example, to apply for funding you will need a well-written business plan. Once you get the loan and move to the business start-up phase, you will have lots of questions that need to be answered. And you are sure you will need help in a number of areas as you operate your cupcake shop. Fortunately, the SBA can help with all of these management and technical-service tasks.

This assistance is available through a number of channels, including the SBA’s extensive website, online courses, and training programs. A full array of individualized services is also available. The Small Business Development Center (SBDC) assists current and prospective small business owners with business problems and provides free training and technical information on all aspects of small business management.

These services are available at approximately 1,000 locations around the country, many housed at colleges and universities.[36]

If you need individualized advice from experienced executives, you can get it through the Service Corps of Retired Executives (SCORE). Under the SCORE program, a businessperson needing advice is matched with someone on a team of retired executives who work as volunteers. Together, the SBDC and SCORE help more than a million small businesspersons every year.[37]

[h5p id=”21″]

Chapter Video

The video for this lesson features two Virginia Tech students who were attempting to get funding for their business on the hit TV show Shark Tank. The Virginia Tech students first appear at 13:25 and their segment runs about 10 minutes. You are free to fast forward to the 13:25 mark if you like.

(Copyrighted Material)

Key Takeaways

- An entrepreneur is someone who identifies a business opportunity and assumes the risk of creating and running a business to take advantage of it.

- The three characteristics of entrepreneurial activity are innovating, running a business, and risk taking.

- Key forms of early stage financing include family and friends, crowdfunding, angel investors, and venture capital. In each successive form, the amounts tend to increase. Only angel investors and venture capital firms typically take an ownership stake in the enterprise in exchange for their funds.

- A small business is independently owned and operated, exerts little influence in its industry, and has fewer than 500 employees.

- Small businesses in the United States generate about 50 percent of our GDP, create jobs, spark innovation, and provide opportunities for women and minorities.

- An industry is a group of companies that compete with one another to sell similar products. There are two broad types of industries, or sectors: the goods-producing sector and the service-producing sector.

- Once you decide to start a business, you’ll need to create a business plan—a document that identifies the goals of your proposed business and explains how it will achieve them.

- The Small Business Administration (SBA) is a government agency that provides many kinds of support for small businesses, including information and funding assistance.

Image Credits: Chapter 4

Figure 4.1: Anthony Quintano (2018). “Mark Zuckerberg F8 2018 Keynote.” CC BY 2.0. Retrieved from: https://commons.wikimedia.org/wiki/File:Mark_Zuckerberg_F8_2018_Keynote.jpg

Figure 4.3: Macrotrends. “Amazon annual revenue growth (2008-2019).” Data retrieved from: https://www.macrotrends.net/stocks/charts/AMZN/amazon/revenue; Amazon.com, Inc. (2006). “Amazon.com – Logo.” Wikimedia Commons. Public Domain. Retrieved from: https://commons.wikimedia.org/wiki/File:Amazon.com-Logo.svg

Figure 4.4 U.S. Census Bureau (2016). “Annual Survey of Entrepreneurs, Characteristics of Business Owners.” Retrieved from: https://www.census.gov/programs-surveys/ase/data/tables.html.

Figure 4.5: U.S. Census Bureau. “Number of Small Business Establishments by Industry.” Data Retrieved from: https://www.census.gov/data/tables/2017/econ/susb/2017-susb-annual.html

Figure 4.6: John Anderson (2006). “Starbucks Street Musician.” CC BY-SA 2.0. Retrieved from: https://en.wikipedia.org/wiki/Original_Starbucks#/media/File:Starbucks_street_musician.jpg

Figure 4.7: Entrepreneur. “Entrepreneur’s Top Franchises (2020).” Data Retrieved from: https://www.entrepreneur.com/franchise500/2020

Figure 4.8: Statista. “The Growth of Franchising in the U.S.” Output Data Retrieved from: https://www.statista.com/statistics/190318/economic-output-of-the-us-franchise-sector/; Franchise Data Retrieved from: https://www.statista.com/statistics/190313/estimated-number-of-us-franchise-establishments-since-2007/

Figure 4.9: Stephen Skipak (2017). “Amy Ankrum at the Qualtrax Headquarters in Blacksburg, Virginia.”

Video Credits: Chapter 4

ABC (2015, February 27). “Shark Tank Season 6 Episode 20 LATEST FULL Micro-loans funded by money raised from backpacks made of fabrics from developing countries ABC.” Daily Motion. Retrieved from: https://www.dailymotion.com/video/x2iaij4

- Vignette based on information from: Realityworks (2016). “The Realityworks Story.” Retrieved from: http://www.realityworks.com/about/realityworks-story; Alan Decker (1994). “This Doll Tells the Young to Hold Off.” New York Times. Retrieved from: http://www.nytimes.com/1994/08/03/us/this-doll-tells-the-young-to-hold-off.html ↵

- Canadian Foundation for Economic Education (2008). “Glossary of Terms.” Mentors, Ventures & Plans. Retrieved from: http://www.mvp.cfee.org/en/glossary.html#e ↵

- Adapted from Marc J. Dollinger (2003). Entrepreneurship: Strategies and Resources, 3rd ed. Upper Saddle River, NJ: Prentice Hall. pp. 5–7. ↵

- Encyclopedia of World Biography (2006). “Marcia Kilgore: Entrepreneur and spa founder.” Retrieved from: http://www.notablebiographies.com/newsmakers2/2006-Ei-La/Kilgore-Marcia.html ↵

- Jessica Bruder (2010). “The Rise Of The Serial Entrepreneur.” Forbes. Retrieved from: http://www.forbes.com/2010/08/12/serial-entrepreneur-start-up-business-forbes-woman-entrepreneurs-management.html ↵

- Ibid. ↵

- U.S. Small Business Administration (2016). “Is Entrepreneurship For You?” Retrieved from: https://www.sba.gov/starting-business/how-start-business/entrepreneurship-you ↵

- Shari Waters (2016). “Top Four Reasons People Don’t Start a Business.” The Balance Small Businesses. Retrieved from: http://retail.about.com/od/startingaretailbusiness/tp/overcome_fears.htm ↵

- Kathleen Allen (2001). Entrepreneurship for Dummies. New York: Wiley. p. 14. ↵

- U.S. Small Business Administration (2016). “Qualifying as a Small Business.” Retrieved from: https://www.sba.gov/contracting/getting-started-contractor/qualifying-small-business ↵

- SBA Office of Advocacy (2019). "2019 Small Business Profile". US Small Business Administration. Retrieved from https://cdn.advocacy.sba.gov/wp-content/uploads/2019/04/23142719/2019-Small-Business-Profiles-US.pdf ↵

- Brian Headd (2010). An Analysis of Small Business and Jobs. U.S. Small Business Administration, Office of Advocacy. Retrieved from: https://www.sba.gov/sites/default/files/files/an analysis of small business and jobs(1).pdf ↵

- Anthony Breitzman and Diana Hicks (2008). “An Analysis of Small Business Patents by Industry and Firm Size.” Faculty Scholarship for the College of Science & Mathematics. Retrieved from: https://rdw.rowan.edu/csm_facpub/12 ↵

- William J. Baumol (2005). “Small Firms: Why Market-Driven Innovation Can’t Get Along without Them.” U.S. Small Business Administration, Office of Advocacy. ↵

- Yahoo.com (2016). “Amazon.com Income Statement.” Finance.yahoo.com. Retrieved from: http://finance.yahoo.com/q/is?s=AMZN Income Statement&annual ↵

- William J. Baumol (2005). “Small Firms: Why Market-Driven Innovation Can’t Get Along without Them.” U.S. Small Business Administration, Office of Advocacy. ↵

- U.S. Census Bureau (2012). “Estimates of Business Ownership by Gender, Ethnicity, Race, and Veteran Status: 2012.” Retrieved from: http://www.census.gov/library/publications/2012/econ/2012-sbo.html#par_reference_25 ↵

- Central Intelligence Agency (2016). “World Factbook.” Retrieved from: https://www.cia.gov/library/publications/the-world-factbook/fields/2012.html ↵

- Ecoscraps (2016). “Our Story." Retrieved from: http://ecoscraps.com/pages/our-story ↵

- Isabel Isidro (2003). “How to Succeed Online with a Niche Business: Case of RedWagons.com.” PowerHomeBiz.com. Retrieved from: http://www.powerhomebiz.com/online-business/success-online-business/succeed-online-niche-business-case-redwagons-com.htm ↵

- Isabel Isidro (2001). “Geese Police: A Real-Life Home Business Success Story.” PowerHomeBiz.com. Retrieved from: http://www.powerhomebiz.com/working-from-home/success/geese-police-real-life-home-business-success-story.htm ↵

- Illinois Small Business Development Center at SIU (2016). “What are the Pros and Cons of Owning a Business?” Retrieved from: http://sbdc.siu.edu/frequently-asked-questions/index.html ↵

- Janean Chun (1997). “Type E Personality: What makes entrepreneurs tick?” Entrepreneur. Retrieved from: https://www.entrepreneur.com/article/13764 ↵

- Kathleen Allen (2001). “Getting Started in Entrepreneurship” in Entrepreneurship for Dummies. New York: Wiley. p. 46. ↵

- Scott Thurm and Joann S. Lublin (2005). “Peter Drucker’s Legacy Includes Simple Advice: It’s All about the People.” Wall Street Journal. Retrieved from: http://www.wsj.com/articles/SB113192826302796041 ↵

- Peter Krass (1997). “Sam Walton: Running a Successful Business: Ten Rules that Worked for Me” in The Book of Business Wisdom: Classic Writings by the Legends of Commerce and Industry. New York: Wiley. pp. 225-230. ↵

- Howard Schultz and Dori Jones Yang (1997). Pour Your Heart into It. New York: Hyperion. pp. 24–109. ↵

- Christopher Steiner (2010). “Meet the Fastest Growing Company Ever.” Forbes. Retrieved from: http://www.forbes.com/forbes/2010/0830/entrepreneurs-groupon-facebook-twitter-next-web-phenom.html ↵

- The Week (2011). “Groupon's 'Startling' Reversal of Fortune.” Yahoo.com. Retrieved from: https://www.yahoo.com/news/groupons-startling-reversal-fortune-172800802.html ↵

- U.S. Census Bureau (2008). “2007 Economic Census: Franchise Statistics.” Retrieved from: https://www.census.gov/econ/census/pdf/franchise_flyer.pdf ↵

- Hayley Peterson (2014). “Here's How Much It Costs To Open Different Fast Food Franchises In The US.” Business Insider. Retrieved from: http://www.businessinsider.com/cost-of-fast-food-franchise-2014-11 ↵

- Michael Seid and Kay Marie Ainsley (2002). “Franchise Fee—Made Simple.” Entrepreneur. Retrieved from: https://www.entrepreneur.com/article/51174 ↵

- Stephen Skripak (2017, February 22). Interview with Amy Ankrum. ↵

- Bureau of Labor Statistics (2016). “Survival rate of new businesses in the U.S., 2007-2015.” Retrieved from: http://www.bls.gov/bdm/entrepreneurship/bdm_chart3.htm ↵

- Maureen Farrell (2007). “Risky Business: 44% of Small Firms Reach Year 4.” Forbes. Retrieved from: http://www.msnbc.msn.com/id/16872553/ns/business-forbes_com/t/risky-business-small-firms-reach-year/#.Tl_xVY7CclA ↵

- U.S. Small Business Administration (2016). “Office of Small Business Development Centers: Entrepreneurial Development Services.” Retrieved from: https://www.sba.gov/tools/local-assistance/districtoffices ↵

- U.S. Small Business Administration (2016). “SCORE.—Counselors to America’s Small Businesses.” Retrieved from: https://www.score.org/ ↵