15

15.1 Introduction

LEARNING OBJECTIVES

- Know the basic principles of an agency relationship.

- Identify the different duties principals and agents owe each other.

- Understand the consequences of legal liability for principals regarding an agent’s actions.

Fundamentally, the principles of agency hold individuals and businesses liable for the acts of others. For example, if an employee uses a racial slur against a customer, the business is liable for that employee’s discriminatory act. Likewise, if an agent signs a contract in the name of a business, that business may be bound by the terms of the contract.

Agents cannot give themselves power without the express or implied authority of the principal. Once an agency relationship is formed, agents and principals owe each other certain duties. This ensures fair dealings between them and gives third parties some assurance regarding their rights.

15.2 The Agency Relationship

An agency relationship is created when one person or entity agrees to perform a task for, and under the direction of, another individual or entity. An agent is the person who is authorized to act for or in place of another. A principal is the person who authorizes another to act on his, her, or its behalf as an agent.

Agency is a fiduciary relationship created by express contract or implied actions, in which the agent has the authority to act on behalf of the principal and legally bind the principal to third parties.

A fiduciary relationship is a relationship in which one person is under a duty to act for the benefit of the other on matters within the scope of the relationship. Fiduciary relationships require trust, good faith, and acting in the best interest of the other. In fiduciary relationships, the law requires the fiduciary to act with the highest duty of care. This means that the fiduciary must put the interests of the other party before their own. Examples of fiduciary relationships include doctor-patient, attorney-client, accountant-client, trustee-beneficiary, and guardian-child. An agent is also a fiduciary of a principal.

Types of Principals

There are three types of principals, which are described from the perspective of a third party: disclosed, partially disclosed, and undisclosed.

A disclosed principal is a principal whose identity is revealed by the agent to a third party. These are the most common types of principals. For example, employees work for a disclosed principal when they are on the employer’s premise, wear a name badge or uniform identifying the employer, or answer the phone by identifying the employer’s name.

A partially disclosed principal is a principal whose existence, but not actual identity, is revealed by the agent to a third party. In other words, a third party knows that the agent represents a principal but does not know the identity of the principal. For example, a realtor in Aspen may represent celebrities and wealthy individuals who want to purchase property but do not want the paparazzi to publicize the information.

An undisclosed principal is a principal whose identity is kept secret by the agent. Often third parties do not realize that an agency relationship exists and believe that the agent is working on his or her own behalf. Undisclosed principals occur when the identity of the principal can lead to increased purchase prices, unwanted publicity, and security concerns.

Types of Agents

An agent is someone who is authorized to act on behalf of a principal. Because there is a variety of authority that a principal can grant an agent, there are many different types of agents. In general, agents are described as either general or special. General agents have the authority to transact all the principal’s business of a particular kind or in a particular place. General agents often include partners, managers, factors and brokers. Special agents, in contrast, only have the authority to conduct a particular transaction or to perform a specific act. Special agents often include realtors, athlete’s agents, and employment recruiters.

Some of the most common business agents include:

| Agent | Description |

| Broker | Receives a commission to make contracts with third parties on behalf of a principal |

| Business agent | Has general power involving the exercise of judgment and discretion, such as a manager or officer |

| Factor | Receives and sells goods or property for a commission |

| Forwarding agent | Receives and ships goods for a principal |

| Independent contractor | Exercises independent judgment on the means used to accomplish the result demanded by principal |

| Local agent | Acts as a representative to transact business within a specified area |

| Ordinary agent | Acts under the direction and control of the principal, such as an employee |

| Process agent | Authorized to accept legal service of process on behalf of the principal |

| Registered agent | Authorized to accept legal service of process for a corporation in a particular jurisdiction |

Types of Authority

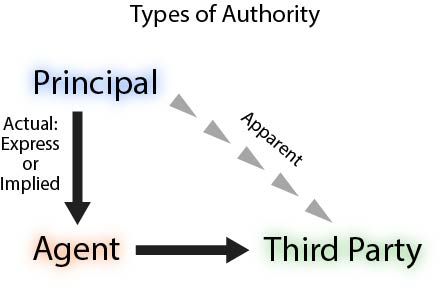

Authority is the right or permission to act legally on another’s behalf. In general, authority can be either actual or apparent. Actual authority, sometimes called real authority, occurs when a principal intentionally confers authority on an agent. Actual authority can be either express or implied. Express authority is authority given by an express agreement, either orally or in writing. Implied authority is authority granted to the agent as a result of the principal’s conduct.

Figure 15.1 Types of Authority

Apparent authority is authority that a third party reasonably believes an agent has, based on the third party’s dealings with the principal. If a principal’s words or actions lead others to believe that he or she gave authority to someone else, then the principal is held accountable even if no authority was actually given to the agent. For example, if a principal fails to give notice that an agent is no longer working for the principal, the agent may still bind the principal through apparent authority when dealing with third parties.

To constitute apparent authority, three elements must be met:

- The principal’s words or actions lead others to believe the agent has authority;

- A third party reasonably relies on the principal’s words or actions; and

- The third party is injured.

Sometimes an agent acts without authority. If a disclosed principal likes what an agent does, even if done without authority at the time, the principal can still benefit from the agent’s actions. Ratification occurs when a disclosed principal adopts or confirms a contract entered into on his or her behalf by an agent who did not have authority to act. Unlike apparent authority, the third party does not have to be injured. Rather, ratification allows principals to enter into contracts for their benefit. Ratification is an “all or nothing” doctrine that prevents principals from ratifying only part of the contract or renegotiating its terms.

15.3 Duties of Agents and Principals

Because they are in a fiduciary relationship, agents and principals owe each other specific duties. While the duties are similar in nature, there are differences based on their roles.

Duties of Agents

Figure 15.2 Duties of Agents

Agents are fiduciaries of principals and so they are required to act with the highest duty of care. In particular, agents owe principals the following duties:

| Duty | Description |

| Account | Agent must keep proper records to account for all principal’s money and property given to agent |

| Care | Agent must act reasonably, in good faith, and avoid negligence at all times |

| Inform | Agent must inform principal of all material facts that affect principal’s interests |

| Loyalty | Agent cannot engage in any dealings that compete or interfere with the principal’s business or interests |

| Obedience | Agent must obey all principal’s instructions within scope of agency unless they are illegal or unethical |

| Protect confidential information | Agent cannot use or disclose principal’s confidential information |

If an agent breaches a duty owed to the principal, the principal has three available remedies:

- The principal may recover damages the breach has caused;

- The principal may receive any profit the agent received as a result of a breach of the duty of loyalty; and

- The principal may rescind a transaction when the duty of loyalty is violated.

Duties of Principals

Principals also owe duties to agents as part of the fiduciary relationship. These duties are:

| Duty | Description |

| Compensation | Principal must pay agent for work performed |

| Honesty | Principals cannot deceive agents about the nature and scope of the work they are to perform |

| Indemnification | Principal must hold agent harmless and free from legal liability for actions properly taken on principal’s behalf |

| Loyalty | Principal cannot engage in any dealings that prevent agent from performing agency tasks |

| Reimbursement | Principal must reimburse agent for money reasonably expended on behalf of principal |

Figure 15.3 Duties of Principals

If a principal breaches a duty owed to the agent, the agent has two available remedies:

- The agent may recover damages the breach has caused; and

- The agent may terminate the agency relationship.

15.4 Liability to Third Parties

An agency relationship affects liability to third parties. The scope of liability depends on the type of principal involved, the type of authority involved, and the nature of the dispute.

Contractual Liability

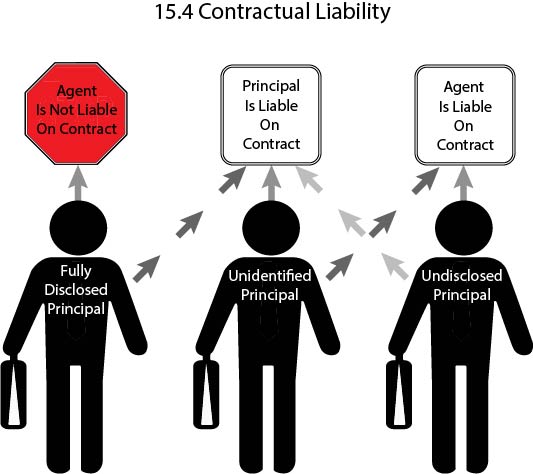

A principal is always liable on a contract if the the agent had authority. However, the agent’s liability on a contract depends on how much the third party knows about the principal. Disclosure, when allowed by the principal, is the agent’s best protection against legal liability.

Figure 15.4 When Agents are Liable on Contracts

An agent is not liable for any contracts he or she makes with authority on behalf of a fully disclosed principal. Therefore, if a third party knows the existence and identity of the principal, then all legal liability lies with the principal. The only exception to this is when an agent exceeds his or her authority. In that case, the agent has not acted with authority and becomes personally responsible to the third party. If the agent did not have authority, but the principal later ratifies the contract, then the principal will be liable for the contract.

If a principal is partially disclosed, then the third party may recover from either the principal or agent. In this situation, the principal and agent are jointly and severally liable, and the third party may sue either or both of them to recover the full amount of damages owed. However, the third party cannot seek “double damages” and recover more than the total amount owed for the contractual breach.

In the event of an undisclosed principal, a third party may recover from either the agent or the principal. The fact that a principal’s existence or identity is hidden from third parties does not change the nature of the agent-principal relationship. Therefore, undisclosed principals may become liable for contracts entered into by agents acting with actual authority. An undisclosed principal has no liability to an agent or third party when the agent exceeds the actual authority granted by the principal. In addition, the type of contract must be the type that can be assigned to the undisclosed principal. If the contract is for personal services, then liability cannot be assigned to the principal in case of a breach.

Tort Liability

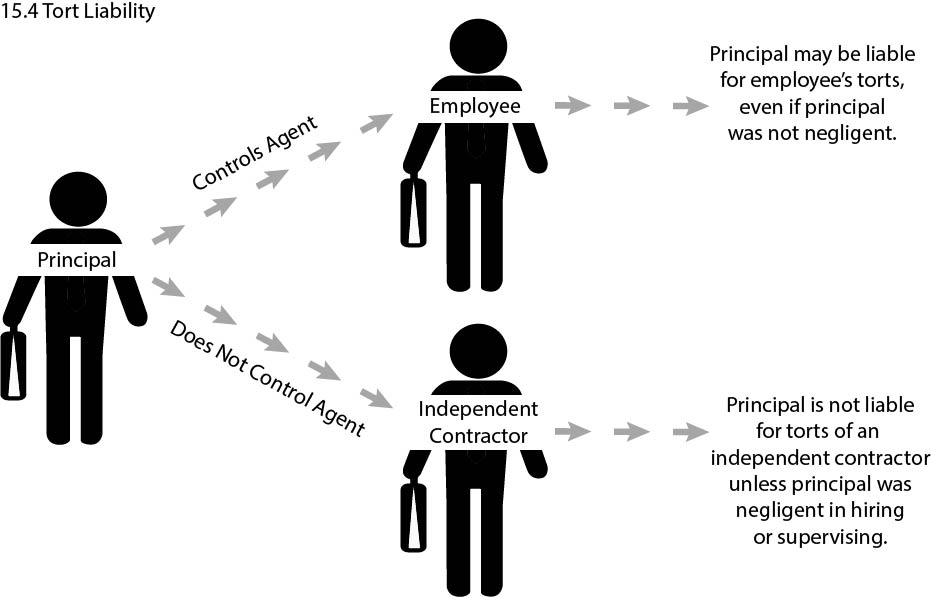

Agents, employees, and independent contractors are personally liable for their own torts. This concept is rooted in the notion that every individual who commits a tort is personally liable to the party who is damaged by the tortious act. The law holds wrongdoers personally accountable.

However, the reverse is not true. Agents, employees, and independent contractors are not liable for the torts of the principal or employer. If a principal or employer is engaged in tortious behavior, its liability cannot be passed down to its agents and employees.

Figure 15.5 When Principals Have Tort Liability for Employees and Independent Contractors

An employer is liable for the torts of an employee if the employee is acting within the scope of employment. This doctrine is called respondeat superior and imposes vicarious liability on employers as a matter of public policy. Even if the employer does not direct its employees to act negligently or intentionally, the employer is responsible because employers are usually in a better position to pay for damages than employees. There is also a strong public policy consideration to not allow employers to turn a blind eye to an employee’s bad behavior. By making an employer responsible for an employee’s actions, it incentivizes the employer to address situations promptly that could lead to potential liability.

Conversely, a principal is not usually liable for the torts of an independent contractor. Independent contractors have the power to control the details of the work they perform and generally are only responsible to a principal for the results of their work. Therefore, independent contractors are not directed and controlled by a principal as employees are by their employers. As a result, the doctrine of respondeat superior does not apply to independent contractors.

Two exceptions exist that may impose liability on a principal for the work of an independent contractor. The first exception is where the work is inherently dangerous. Public policy prevents principals from insulating themselves from the risks of liability by selecting an independent contractor rather than an employee to perform the dangerous work. The second exception is where the work is illegal. Public policy also prevents principals from hiring independent contractors to perform a task that is illegal.

15.5 Termination of Agency Relationship

Agents and principals may end their agency relationship in various ways. The most common way is through mutual agreement. As a matter of contract, principals and agents may decide to end their relationship. For example, an employee may decide to quit his or her job, or the agency agreement may only be for a set period of time or for a specific transaction.

In addition, there are some events that will terminate an agency relationship as a matter of law. Death of a principal or agent automatically terminates the agency agreement, even if the other party is unaware of the death. Once the time of death is established, any transactions afterward are deemed void.

Similar to death, mental incapacity of a principal or agent terminates an agency relationship. It is often hard to determine the precise time someone loses mental capacity. Therefore, courts often hold that an agent’s contract with a third party is binding on the principal unless the third party was aware of the principal’s incapacity.

Bankruptcy terminates an agency relationship when the bankruptcy affects the subject matter of the agency agreement. For example, if a principal declares bankruptcy and the real property that an agent is authorized to sell is part of the bankruptcy estate, then the bankruptcy will automatically terminate the agency relationship.

Finally, the destruction or illegality of the subject matter will terminate the agency relationship. For example, if Congress passes a law making it illegal for private parties to sell specific types of weapons, the agency relationship between a gun dealer and its factor for selling those weapons will automatically end.

15.6 Concluding Thoughts

Agency relationships are flexible and varied depending on the needs and interest of the principals and agents. Because the agency relationship is fiduciary in nature, agents and principals owe each other certain duties. Third parties may hold principals legally liable for the actions of their agents. Therefore, it is important for businesses to select their agents carefully to minimize their risk of liability.