16

16.1 Introduction

LEARNING OBJECTIVES

- Know the available entity choices when forming a business.

- Identify the factors that determine entity selection.

- Understand common business entities and their advantages and disadvantages.

At its most fundamental level, a business exists to make a profit for its owners. Some businesses make things in factories (manufacturers), other businesses sell things that other businesses make (retailers), and still other businesses exist to help both the makers and sellers make and sell better (business consultants). Some businesses don’t make things at all, and instead profit by selling their services or by lending money.

With this diversity, it’s not surprising that there is no “one size fits all” approach to choosing a business organization. When choosing what form of entity is best, several factors are important to consider:

- How much it costs to create the entity and how hard it is to create.

- How easy it is for the business to continue if the founder dies or retires.

- How difficult it is to raise money to grow or expand the business.

- What type of managerial control they wish to keep on the business, and whether they are willing to cede control to outsiders.

- If expanding ownership to members of the public is desired.

- How to minimize the taxes paid on earnings and income.

- How to protect personal assets from claims, a feature known as limited liability.

Depending on the type of business and its goals, different business entities may be appropriate.

16.2 Sole Proprietorship

A sole proprietorship is an unincorporated business owned by one person or married couple. The legal name for a sole proprietorship is usually the owner’s name.

There are many advantages to doing business as a sole proprietor. First, it’s easy to create a sole proprietorship. In effect, no creation costs or time is required because there is nothing to create. The entrepreneur in charge of the business simply starts doing business, charging money, and providing goods or services.

Another key advantage to sole proprietorship is autonomy. The owner can decide how he or she wants to run the business. The owner can set her own hours, grow as quickly or slowly as she wants, and expand into new lines of businesses. That autonomy also comes with total ownership of the business’s finances. All the money that the owner takes in, even if it is in a separate bank account, belongs to her, and she can do with that money whatever she wants.

A sole proprietorship is a flow-through tax entity, which means the business does not pay tax on its profits and does not file a separate tax return. Instead, the owner pays personal income tax on all business profits.

These advantages must be weighed against some disadvantages. First, because a sole proprietorship can have only one owner, it is impossible to bring in others to the business. In addition, the business and the owner are identical so it is impossible to pass on the business.

Raising working capital can be a problem for sole proprietors, especially those early in their business ventures. Many entrepreneurial ventures are built on great ideas but need capital to flourish and develop. If the entrepreneur lacks individual wealth, then he or she must seek those funds from other sources. Outsiders can make a loan to the owner, or enter into a profit-sharing contract with her, but there is no way for him to own any part of the owner’s business. Traditionally, most sole proprietors seek funding from banks. Banks approach these loans just like any other personal loan to an individual, such as a car loan or mortgage. Down payment requirements may be high, and typically the banks require some form of personal collateral to guarantee the loan, even though the loan is to be used to grow the business.

Sole proprietors are personally liable for all the business’s debts and obligations. Unlimited liability puts all the personal assets of the sole proprietor at risk. Personal homes, automobiles, bank accounts and retirement accounts—all are within reach of creditors.

| Advantages of Sole Proprietorship | Disadvantages of Sole Proprietorship |

|

|

16.3 Partnerships

A partnership is an unincorporated association of two or more co-owners who operate a business for profit. Each owner is called a general partner.

General Partnerships

A general partnership is when all partners participate fully in running the business and share equally in profits and losses, even if the partners’ monetary contributions vary. No legal documents are required to file with the government to form a partnership. If two or more people do business together, sharing management of the business, profits and losses, they have a partnership.

If a partnership is formed formally, then the written agreement is called the articles of partnership. The articles can set forth anything the partners wish to include about how the partnership will be run. Normally, all general partners have an equal voice in management, but as a creation of contract, the partners can modify this if they wish.

A general partnership is taxed just like a sole proprietorship. A partnership is a flow-through tax entity, where the partnership’s income “flows through” the business to the partners, who then pay individual tax on the business income. The partnership may file an information return, reporting total income and losses for the partnership, and how those profits and losses are allocated among the general partners. However, an information return is usually not required.

General partnerships are also similar to sole proprietorships in unlimited liability. Every partner in the partnership is jointly and severally liable for the partnership’s debts and obligations. This is a very unattractive feature of general partnerships. One partner may be completely innocent of any wrongdoing and still be liable for another partner’s malpractice or bad acts.

General partnerships are dissolved as easily as they are formed. Since the central feature of a general partnership is an agreement to share profits and losses, once that agreement ends, the general partnership ends with it. In a general partnership with more than two persons, the remaining partners can reconstitute the partnership if they wish, without the old partner. A common issue that arises in this situation is how to value the withdrawing partner’s share of the business. Articles of partnership therefore typically include a buy/sell agreement, setting forth the agreement of the partners on how to account for a withdrawing partner’s share, which the remaining partners then agree to pay to the withdrawing partner.

Management Duties

Partners have a fiduciary duty to the partnership. This means that partners have a duty to act for the benefit of the partnership. In particular:

- Partners have an obligation of good faith and fair dealing with each other and the partnership.

- Partners are liable to the partnership for gross negligence or intentional misconduct. Partners are not liable for ordinary negligence.

- Partners cannot compete with the partnership.

- Partners cannot take opportunities away from the partnership unless the other partners consent.

- Partners cannot engage in conflicts of interest.

Limited Partnerships

In most states, owners can form a limited partnership. A limited partnership has both general partners and limited partners. As a limited partner, the most he or she can lose is the amount of his investment into the business, nothing more. Limited partnerships have to be formed in compliance with state law, and limited partners are generally prohibited from participating in day-to-day management of the business. This often occurs when someone invests money in the partnership but is not interested in running the business.

| Advantages of Partnerships | Disadvantages of Partnerships |

|

|

16.4 Franchises

A franchise is when a business grants to another the sole right of engaging in a certain business or in a business using a particular trademark in a certain area. Franchises are not a separate form of business organization. Rather, they are a form of contract between businesses. Most franchises involve corporations or limited liability corporations, but they may include sole proprietorships and partnerships.

The advantage of a franchise is that under a franchise agreement, an entrepreneur can open and run a business under a proven business model. The local owner, the franchisee, uses the franchisor’s trademark, intellectual property, and business model under a license agreement. The franchisee offers goods or services to the public and keeps any income earned. In exchange for the right to sell goods or services developed by the franchisor, the franchisee pays a fee to the franchisor.

Franchises are common in some industries such as fast food restaurants, hotels, and tax preparation services. Franchise agreements are very detailed and often require the franchisee to use specific vendors, ingredients, store layouts, colors, etc.

Franchises are also very popular with US businesses interested in conducting business abroad. US businesses collect franchise fees from owners in other nations who are responsible for running the business abroad. This allows US companies to have a presence in nations that may restrict business ownership by foreigners because the businesses themselves are owned and operated by locals.

16.5 Joint Venture

A joint venture is when two or more individuals or businesses combine their efforts in a particular business enterprise and agree to share the profits and losses jointly or in proportion to their contributions. Unlike a partnership, which operates as a general business for as long as the partners desire, a joint venture is for a single transaction or a limited activity. The businesses remain separate entities and they do not share financial or confidential information unless they decide to. Joint ventures automatically terminate at the conclusion of an event or project.

Joint ventures are often formed to address a common need or to reach a mutual goal. For example, Google and National Aeronautics and Space Administration (NASA) developed Google Earth as a joint venture. To do so, they shared resources and information necessary to develop Google Earth but Google did not become part of the government, nor did NASA share any confidential information or intellectual property more than necessary.

Joint ventures are also common to share the costs of major research or infrastructure projects within an industry. This occurs frequently when industries are impacted by advances in technology. For example, BMW and Toyota created a joint venture to research hydrogen fuel cells, electric vehicles, and ultra-lightweight materials needed in next generation vehicles. By sharing the cost of research and development, the companies are able to be on the forefront of technological advancements in their industry.

| Franchises | Joint Ventures |

|

|

16.6 Corporations

Unlike a sole proprietorship or general partnership, a corporation is a legal entity separate and distinct from its owners. It can be created for a limited duration, or it can have a perpetual existence. Since it is a separate legal entity, a corporation has continuity regardless of its owners. Similarly, in a publicly traded company, the identity of shareholders can change, but the corporation continues its business operations without being affected.

Corporations must be formed in compliance with the law of the state law where they are incorporated. Most corporations incorporate where their principal place of business is located, but not all do. Many companies choose to incorporate in Delaware. Delaware chancery courts have developed a reputation for fairly and quickly applying a very well-developed body of corporate law in Delaware. The courts also operate without a jury, meaning that disputes heard in Delaware courts are usually predictable and transparent, with well-written opinions explaining how the judges decided the cases.

To start a corporation, the corporate founders must file articles of incorporation with the Secretary of State where they are incorporated. Articles of incorporation typically include:

- The name of the company;

- Whether the company is for-profit or nonprofit;

- The founders’ names;

- The company’s purpose;

- How many shares the corporation will issue initially; and

- The par value of any shares issued.

Unlike sole proprietorships, corporations can be quite complicated to manage and often require attorneys and accountants to maintain corporate books in good order. In addition to the foundation requirements, corporate law requires ongoing annual maintenance of corporations. In addition to filing fees due at the time of incorporation, there are typically annual license fees, franchise fees and taxes, and fees related to maintaining minute books, corporate seals, stock certificates and registries, as well as out-of-state registration. A domestic corporation is entitled to operate in its state of incorporation but must register as a foreign corporation to do business in other states.

Corporate Legal Structure

Owners of corporations are called shareholders. Corporations can have as few as one shareholder or as many as millions of shareholders, and those shareholders can hold as few as one share or as many as millions of shares. In a closely held corporation, the number of shareholders tends to be small, while in a publicly traded corporation, the body of shareholders tends to be large.

In a publicly traded corporation, the value of a share is determined by the laws of supply and demand, with various markets or exchanges providing trading space for buyers and sellers of certain shares to be traded. Shareholders own shares in the company but have no legal right to the company’s assets. As a separate legal entity, the corporation owns any property in its name.

Shareholders of a corporation enjoy limited liability. The most they can lose is the amount of their investment. Shareholders’ personal assets are not available to the corporation’s creditors.

Shareholders can be individuals or other business entities, such as partnerships or corporations. If one corporation owns all the stock of another corporation, the owner is said to be a parent company, while the company being owned is a wholly owned subsidiary. Often large corporations form subsidiaries for specific purposes so that the parent company has limited liability or advantageous tax treatment. For example, large companies may form subsidiaries to hold real property so that premises liability is limited to that real estate subsidiary only, shielding the parent company and its assets from lawsuits. Companies that deal in a lot of intellectual property may form subsidiaries to hold their intellectual property, which is then licensed back to the parent company so that the parent company can deduct royalty payments for those licenses from its taxes. This type of sophisticated liability and tax planning makes the corporate form very attractive for larger businesses in the United States.

An exception to the rule of limited liability arises in certain cases involving closely held corporations. Many sole proprietors incorporate their businesses to gain limited liability but fail to realize when they do so that they are creating a separate legal entity that must be respected as such. If sole proprietors fail to respect the legal corporation with an arm’s length transaction, then creditors can ask a court to pierce the corporate veil. If a court agrees, then limited liability disappears and those creditors can reach the shareholder’s personal assets.

Rights of Shareholders

Not all shareholders in a corporation are necessarily equal. US corporate law allows for the creation of different types, or classes, of shareholders. Shareholders in different classes may be given preferential treatment when it comes to corporate actions such as paying dividends or voting at shareholder meetings.

Shareholder rights are generally outlined in a company’s articles of incorporation or bylaws. Some of these rights may include the right to obtain a dividend, but only if the board of directors approves one. They also include the right to attend shareholder meetings, the right to examine the company’s financial records, and the right to a portion of liquidated company assets.

Under most state laws, shareholders are also given a unique right to sue a third party on behalf of the corporation. This is called a shareholder derivative lawsuit. In essence, a shareholder alleges that the people who are ordinarily charged with acting in the corporation’s best interests (the officers and directors) are failing to do so, and therefore the shareholder must step in to protect the corporation.

One of the most important functions for shareholders is to elect the board of directors of a corporation. Only shareholders elect a director. The board is responsible for making major decisions that affect a corporation, such as declaring and paying a corporate dividend to shareholders; authorizing major decisions; appointing and removing corporate officers; determining employee compensation, especially bonus and incentive plans; and issuing new shares and corporate bonds.

One critical function for boards of directors is to appoint corporate officers. These officers often hold titles such as chief executive officer, chief operating officer, chief marketing officer, and so on. Officers are involved in everyday decision making for the company and implement the board’s decisions. As officers of the company, they have legal authority to sign contracts on behalf of the corporation, binding the corporation to legal obligations. Officers are employees of the company and work full-time for the company, but can be removed by the board.

Corporate Taxation

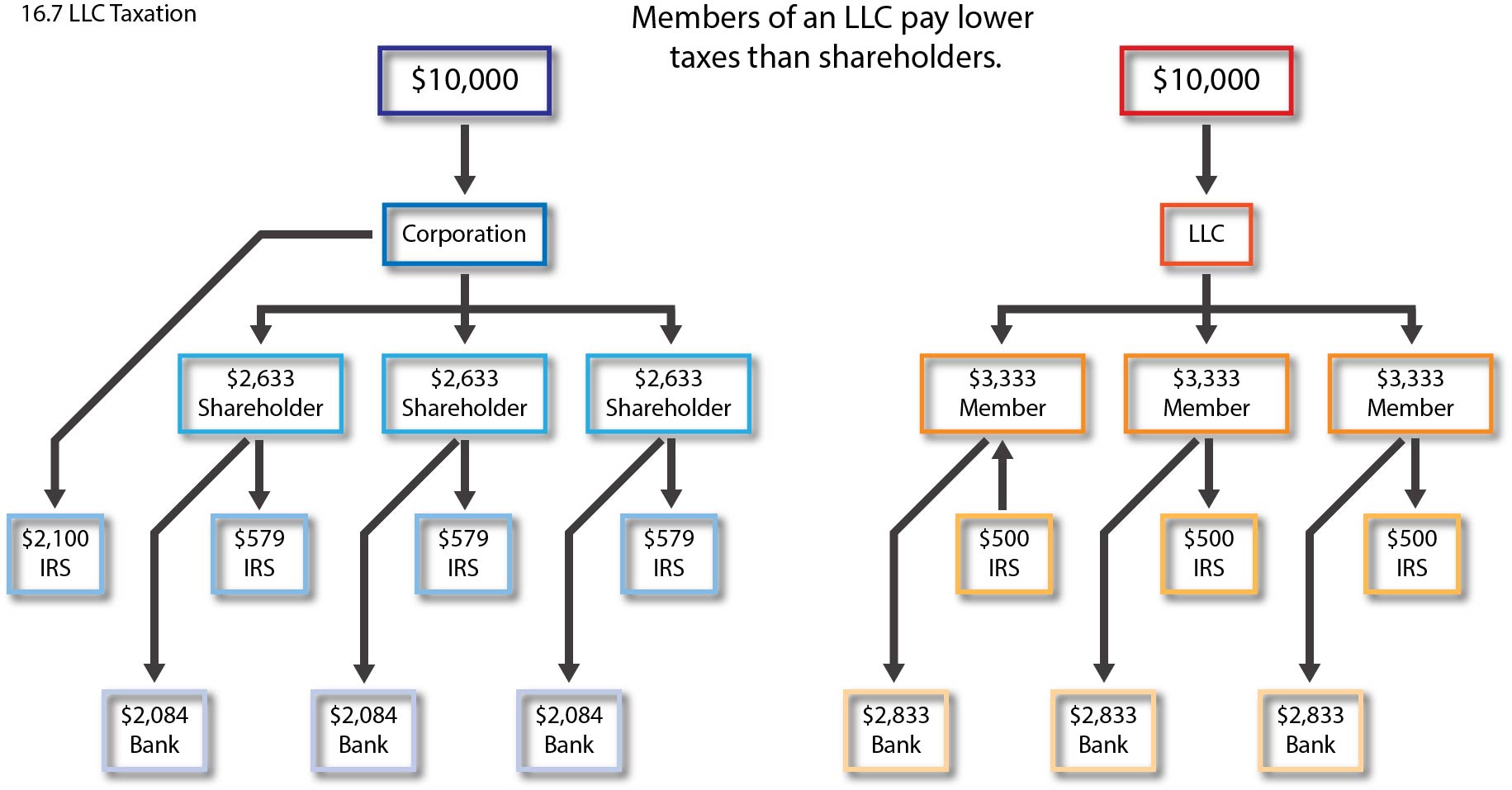

Corporations are subject to double taxation. Because corporations are separate legal entities, they must pay federal, state, and local tax on net income. Then, if the board of directors declares a dividend, shareholders are taxed on the dividend that they receive in the form of a dividend tax.

One way for closely held corporations (such as small family-run businesses) to avoid double taxation is to form an S corporation. An S corporation (the name comes from the applicable subsection of the tax law) can choose to be taxed like a partnership or sole proprietorship. In other words, taxes are only collected when a dividend is declared and not on corporate net income. An S corporation is formed and treated just like any other corporation; the only difference is in tax treatment.

S corporations provide the limited liability feature of corporations but the single-level taxation benefits of sole proprietorships. There are some important restrictions on S corporations, however. They cannot have more than one hundred shareholders, all of whom must be US citizens or resident aliens and cannot include partnerships and corporations. S corporations can have only one class of stock and there are restrictions on how shares may be transferred. Finally, all shareholders must agree that the company should be an S corporation. These restrictions ensure that “S” tax treatment is reserved only for small businesses.

| Advantages of Corporations | Disadvantages of Corporations |

|

|

16.7 Limited Liability Entities

Limited Liability Companies

A limited liability company (LLC) is a “hybrid” form of business organization that offer the limited liability feature of corporations but the tax benefits of partnerships. Owners of LLCs are called members. Just like a sole proprietorship, it is possible to create an LLC with only one member. LLC members can be individuals or other LLCs, corporations, or partnerships. LLC members can participate in day-to-day management of the business.

Members are not personally liable for the debts of the business. Like shareholders of a corporation, members of an LLC risk only their financial investment in the company.

Taxation of LLCs is very flexible. Every year the LLC can choose how it will be taxed. It may want to be taxed as a corporation, for example, and pay corporate income tax on net income. Or it may choose instead to have income “flow through” the corporate form to the member-shareholders, who then pay personal income tax just as in a partnership. Sophisticated tax planning becomes possible with LLCs because tax treatment can vary by year.

Figure 16.1 LLC Taxation

LLCs are formed by filing the articles of organization with the state agency charged with chartering business entities, typically the Secretary of State. Starting an LLC is often easier than starting a corporation. Typical LLC statutes require only the name of the LLC and the contact information for the LLC’s legal agent. Unlike corporations, there is no requirement for an LLC to issue stock certificates, maintain annual filings, elect a board of directors, hold shareholder meetings, appoint officers, or engage in any regular maintenance of the entity. Most states require LLCs to have the letters “LLC” or words “Limited Liability Company” in the official business name.

Although the articles of organization are all that is necessary to start an LLC, it is advisable for the LLC members to enter into a written LLC operating agreement. The operating agreement typically sets forth how the business will be managed and operated. It may also contain a buy/sell agreement just like a partnership agreement. The operating agreement allows members to run their LLCs any way they wish.

Since LLCs are a separate legal entity from their members, members must take care to interact with LLCs at arm’s length, because the risk of piercing the veil exists with LLCs as much as it does with corporations. Fundraising for an LLC can be as difficult as it is for a sole proprietorship, especially in the early stages of an LLC’s business operations. Most lenders require LLC members to personally guarantee any loans the LLC may take out. Finally, LLCs are not the right form for taking a company public and selling stock. Fortunately, it is not difficult to convert an LLC into a corporation, so many start-up business begin as LLCs and eventually convert into corporations prior to their initial public offering (IPO).

| Advantages of LLCs | Disadvantages of LLCs |

|

|

Limited Liability Partnerships

A related entity to the LLC is the limited liability partnership, or LLP. Be careful not to confuse limited liability partnerships with limited partnerships. LLPs are just like LLCs but are designed for professionals who do business as partners. They allow the partnership to pass through income for tax purposes, but retain limited liability for all partners. LLPs are especially popular with doctors, architects, accountants, and lawyers. Most of the major accounting firms have now converted their corporate forms into LLPs.

Professional Corporations

Professional Corporations (PCs) are mostly a legacy form of organization. In other words, before LLCs and LLPs were an option, PCs were the only option available to professionals who wanted limited liability. Some states still require doctors, lawyers, and accountants to organize as a PC.

If a member of a PC commits malpractice, the PC’s assets are at risk along with the personal assets of the member who committed malpractice. However, the personal assets of the non-involved members are not at risk. PCs do not shield individuals from their own malpractice but they offer limited liability to innocent members.

PCs are a separate taxable entity but they are not flow-through entities like partnerships. As a result, taxation of PCs is complicated and a major drawback of this form of business entity.

| Type of Business Organization | Ease of Formation | Funding | Personal Liability for Owners | Taxes | Ease of Transferring Ownership | Perpetual Existence | Dissolution |

| Sole Proprietorship | Very easy | Same as owner | Yes | Flow-through | Must sell entire business | No | When & how owner decides |

| General Partnership | Easy | Partners contribute capital | Yes | Flow-through | Hard | No | Upon death, bankruptcy, agreement, or termination of partnership |

| Limited Partnership | Easy | Partners contribute capital | General partner is personally liable; limited liability for limited partners | Flow-through | Hard | No | Upon death, bankruptcy, agreement, or termination of partnership |

| Corporations | Difficult | Sell stock to raise capital | No | Subject to double taxation | Easy | Yes | By resolution of board of directors, bankruptcy, or court order |

| S Corporations | Difficult | Sell stock to raise capital | No | Taxed only on dividends | Transfer restrictions | Yes | By resolution of board of directors, bankruptcy, or court order |

| Limited Liability Companies (LLCs) | Medium | Members make capital contributions | No | Flow-through | Depends on operating agreement | Varies by state; yes in most states | Upon death, bankruptcy, agreement, or court order |

| Limited Liability Partnerships (LLPs) | Difficult | Members make capital contributions | Non-acting partners have limited liability; state law varies regarding liability of acting partners vs. partnership | Flow-through | Depends on the partnership agreement | Depends on partnership agreement | Upon death, bankruptcy, agreement, or termination of partnership |

| Professional Corporations | Difficult | Members make capital contributions | No | Complex tax issues | Transfer restricted to members of the same profession | Yes, as long as it has shareholders | Upon death, bankruptcy, agreement, or court order |

16.8 Concluding Thoughts

Depending on a business’s type and goals, different business entities may fit the needs of owners better than others. It is important when starting a business to decide how to minimize tax and liability exposure and to maximize profits. Because there is no perfect “fit” for every business need, understanding the advantages and disadvantages of the various business entities is important.