Main Body

ENRON: The Pinnacle of Financial Statement Fraud

Enron History: Leading to the Massive Fraud

Enron was founded in 1985 by Ken Lay as a natural gas pipeline company. Lay was the son of a Baptist minister and came from humble roots. He obtained a PhD in Economics and his thoughts about energy deregulation were thought to be “before its time.” Lay pushed for deregulation in Washington and was an advocate for businesses to break free from government rules and regulations.

minister and came from humble roots. He obtained a PhD in Economics and his thoughts about energy deregulation were thought to be “before its time.” Lay pushed for deregulation in Washington and was an advocate for businesses to break free from government rules and regulations.

Ken Lay’s focus in Enron was its stock price and he was always looking for the next big idea to make himself profits. Lay felt that Jeff Skilling was the person that could take Enron to the next level. In June of 1990, Jeff Skilling became Enron’s new CEO. Skilling felt that the key to Enron’s future success was in how the company “delivered” energy. In addition to delivering through pipelines, he felt that the future was in trading energy commodities. His idea was to make Enron a “stock market” for natural gas. In December 1996, Skilling is appointed as Chief Operating Officer (COO) of Enron.

Enron went global in 1993 in an agreement with the government of the state of Maharashtra, India. A massive power plant was to be built in Maharashtra by Enron which lead to the formation of the Dabhol Power Company, a joint venture of Enron, General Electric and Bechtel Corporation which provides energy, transportation, and government services.

In May 1999, Tim Belden, the head of Enron’s West Coast trading desk takes advantage of the 1996 deregulation bill signed by then Governor Pete Wilson. Enron moved into the electricity business by merging with Portland General Electric (PGE). In this merger, all PGE stock was converted to Enron stock and employees were encouraged to invest all of their retirement funds in Enron. Many of the employees did just that.

In 1999 Enron’s CFO, Andy Fastow, created many Special Purpose Entities (SPE) to move liabilities off of Enron’s balance sheet. SPEs are legal and many companies use them to shield themselves from risk, but Fastow was also in charge of some of these entities while acting as Enron’s CFO. The SPEs that he was not in charge of were run by other Enron employees. There were several SPEs with names like Chewco and JEDI (named for Star Wars characters). The largest of the SPEs were LJM, LJM1, and LJM2.

In 2000 Enron expands into the bandwidth trading market allowing the company to control how the internet was transmitted. Enron started selling unused bandwidth to other companies making bandwidth a commodity. The company also announced a partnership with Blockbuster to deliver video on demand. This was before companies like Netflix, Hulu, and Amazon started offering streaming video! Enron’s stock soared 32% in two days upon the announcement. Enron assured their investors and the public that the technology for the on demand video was working fine, but in fact the company was struggling with it. Enron booked $53 million on the deal using mark to market accounting (see below), yet the deal fell apart without ever making a penny.

By 2001, Enron was the subject of many investigative reports on their accounting methods and the reasons behind their successful profits. Jeff Skilling resigned from Enron in August 2001 for “personal reasons” but it is rumored that he was trying to get out of Enron before it collapsed. The day after Skilling resigned, Sharon Watkins sent a letter to Ken Lay outlining her concerns for the company and its questionable accounting practices. In October, the SEC launched an investigation into Enron and the company declared bankruptcy in December 2001. This was the largest corporate bankruptcy of our time next to MCI WorldCom. The seventh largest corporation in the United States that took sixteen years to build took only 24 days to fall.

Enron’s Slide into Bankruptcy

The Valhalla Scandal

Enron’s first ethical lapse came in April of 1987. Two Enron oil traders in the Valhalla, NY office named Louis Borget and Tom Mastroeni were making trades for Enron on oil commodities beyond what they were authorized. In addition, they destroyed trading reports, skimmed over 3 million dollars for themselves, kept two sets of books, and manipulated the accounting records to give the appearance that the Valhalla office was earning a steady profit.

When this came to the attention of the board, no action was taken against these traders because Lay felt that they made too much money for the company to fire them. The traders kept their jobs and Lay increased their trading limits. It is only when Borget and Mastroeni gambled away Enron’s reserves in a bad trade did Lay take any action. The traders were fired as Lay professes shock over their unethical actions. It is an Enron executive, Mike Muckleroy, who managed to bluff the market and realized a loss for Enron of 140 million instead of the one billion dollars they should have lost. This action saved the company from bankruptcy. Borget was convicted of fraud and was sentenced to one year in prison. Mastroeni had his sentence suspended.

Mark to Market Accounting

Mark to market accounting is a practice that is accepted under GAAP. The process values certain assets and liabilities at their fair value (or market value) instead of cost. This method of accounting is generally used with securities. The company can record the present value of future cash streams. This is similar to the concept of goodwill (the amount paid to acquire a company over the fair market value of its assets), except that goodwill is purchased and the future value of the cash streams can be estimated through past performance with relative accuracy. In the case of securities, the volatility of the market makes estimating cash flows more difficult.

Part of Skilling’s idea to trade energy as a commodity involved how to account for this “intangible” source of revenues. He proposed using a variation of “mark to market” accounting. Skilling’s idea allowed Enron to book future potential revenues on the day that the transaction occurred no matter how much or how little cash came in to the company (this goes against the revenue recognition principle where you book revenues when they are earned). This allowed Enron to book revenues at whatever the company wanted them to be by recording the present value of predicted future revenues. This subjective way to account for revenues left profits open to manipulation and overstatement. Skilling joked that he practices “hypothetical future value accounting.” Despite the inherent risks of this type of accounting, Enron’s auditor, Arthur Anderson, bought off on this accounting method. In January of 1992, the Security and Exchange Commission (SEC) gave its approval.

Dabhol Power Plant

The Dabhol Power Plant in Maharashtra, India was to be Enron’s big splash into the energy business overseas. Loans in the amount of $635 million were taken out to fund the project. An agreement was signed in February 1993 to build the plant. This was a joint venture between Enron, General Electric and Bechtel with Enron as the majority owner and GE and Bechtel holding 10% of the shares. When the project was completed, the power generated by the plant was twice the cost of energy generated from other power plants in India due to an agreement that was negotiated secretly, because “policy makers and company officials said it would be faster that way.” The deal promised Enron “a guaranteed rate of return in dollars, which meant that the price of power to India would most likely rise because the government was depreciating the rupee against the dollar.”[1]

Because of the mark to market practice that Enron had adopted, the company was able to book huge profits and pay out large bonuses to its executives for a project that ended up losing one billion dollars. The profits that were needed to pay those bonuses never materialized. To outside investors, Enron appeared to have increasing profits while in fact the company was rapidly losing money. Enron shut down the power plant in a dispute over what Maharashtra owed the company. Enron sold its shares in the company to GE and Bechtel after Enron’s bankruptcy.

Sale or Loan of Assets?

To improve net profit and cash flows at year end, Enron “sells” a Nigerian energy barge to Merrill-Lynch. Enron and Merrill Lynch came to an agreement to “move” the title of three energy barges located off of the Nigerian coast to Merrill Lynch in 1999. Evidence in court surfaced that Enron promised that the assets would be bought back in six months by the company or another investor. Enron recorded a gain on this “sale” of $12 million. But if Enron had an agreement with Merrill Lynch to repurchase the assets, they could not call it a true sale.

Enron should have accounted for this transaction as a loan since Merrill Lynch never had full ownership of the assets and Enron would eventually give back the money. Treating this transaction as a sale allowed Enron to book a gain (increasing their net income) instead of a liability (which they should have recorded since this was more like a collateral loan). This is referred to as an “off balance sheet transaction” since the amounts that should have been included as a liability on the balance sheet were moved “off of the balance sheet” and onto the income statement while keeping cash on the balance sheet. This raises Enron’s net income (keeping the stock price up), improves cash flows, and holds the assets steady on the balance sheet (the asset of the barges is exchanged for cash). In 2004, four former executives for Merrill Lynch were found guilty of fraud and conspiracy. Merrill Lynch paid over $90 million in fines for the unethical behavior of those executives.

Enron’s Special Purpose Entities

CFO Andy Fastow, with Board permission, creates and manages partnerships designed to hide Enron’s debt and make profits on asset sales. This “structured finance” was Fastow’s way to prop up Enron’s stock by making it look like Enron did not incur any losses. Fastow created Special Purpose Entities (SPE) and moved debt to the SPEs in order to get the debt off of Enron’s balance sheet. To comply with generally accetpted accounting principles (GAAP) and legal requirements, the SPEs needed to be independent of Enron so that all transactions would be at arm’s length (the company would not be seen as doing business with themselves). To achieve this independence, the SPEs were required to have an independent investor who:

- Contributed at least 3% of the entity’s assets.

- Acted as the controlling shareholder in the entity and made all of the entity’s business decisions.

Enron needed the SPEs to be independent before its 1997 year end. Howver, Enron’s JEDI and Chewco SPEs did not get the independent investors that they needed. This meant that Enron could not report any profits made from sales to JEDI or Chewco in that fiscal year. Transactions that are not at arm’s length do not have any independent valuation of the asset’s selling price (market value) and Enron could set that value at whatever amount it wanted. This is in direct violation of GAAP.

Fastow proposed to be Chewco’s outside investor. The lawyers at Enron wanted public disclosure of this so Michael Kopper, a low ranking employee at Enron, stepped in to be the “investor.” This information was kept from the board. Kopper never had any financial risk in this investment since Enron was guaranteeing the investment. Since Enron was on the hook for Chewco, it can be argued that this SPE did not meet the criteria for Enron to exclude its dealings from their financial statements. Since this was not a true arm’s length transaction, Enron was able to “sell” assets to Chewco at inflated prices.

Kopper was able to profit significantly from Chewco while doing little work by taking excessive management fees, borrowing $15 million in unsecured loans that were never recovered and receiving indemnification (relief) from tax liability on his profits. Enron, in turn, was able to book the revenues from Chewco on its books in advance of transactions taking place, which was very handy at year end.

Fastow did eventually form an SPE that he controlled. To do this, Enron’s board of directors granted Fastow an exemption from Enron’s Code of Conduct to become the managing partner for this entity. This means that there was no 3% investor as required for the entity to remain independent from Enron. The SPE, called LJM, was created to “buy” Enron’s assets while still giving Enron control. This is similar to the purpose of the Chewco and JEDI SPEs. Fastow was able to convince banks to invest in these companies despite the full disclosure of Fastow running it. Fastow was put into a position of deciding which entity’s interests to look after with each transaction, Enron or LJM, since LJM was created to do business with only Enron. Ninety six individual bankers invested with LJM knowing that Enron’s practices in this case were deceptive. Chase, GE Capital, JP Morgan, Merrill Lynch, and Morgan Stanley put up as much as $25 million each. Some banks even participated in the deception (See “Sale or Loan of Assets” above).

The SPE LJM1 was supported with Enron’s stock and was created to hedge against losses from one of Enron’s investments (Rhythms NetCommunications). As Enron’s stock price fell, LJM1 proved to be unfeasible and was wound up in March 2000. The arrangements to wind up the SPE were not valued properly and $70 million cash was transferred from Enron before the SPE was shut down. Despite the failure of this SPE, others were created using the same (or a slightly modified) structure. In the end, over one hundred SPEs were created for Enron.

Exploiting California Deregulation

In 1996, then Governor of California, Pete Wilson, signed legislation to deregulate (or remove government restrictions) electricity in California. Enron was always looking for a new way to make money and the deregulation of California provided a perfect opportunity to exploit the market. Tim Belden, a west coast trader for Enron, looked through the new regulation for loopholes and found quite a few. In what is known as the “Silverpeak Incident,” energy was diverted out of California which drove up electricity prices for the state because of the increased demand. This led to rolling blackouts in California at a time when the state was producing enough energy to handle the demand. There should have been plenty of power for California except that power was being diverted out of the state. Enron would then sell that electricity back to California at an inflated rate.

Other schemes such as one called the “Death Star” was implemented to further increase the cost of energy to California. Power plants were taken off line for “maintenance” at peak usage periods driving the demand and cost even higher. In the height of the energy crisis, Enron was investigated and no wrongdoing was found. Jeff Skilling joked about the whole situation as he compared the state of California to the Titanic asking, “What is the difference between California and the Titanic? At least when the Titanic went down, the lights were on.”

When normal energy prices were $35-$40 per mega-watt hour, Enron was charging California over $1,400 per mega-watt hour. Requests by California to implement a price cap were denied by the National Energy Development Task Force which was headed by then Vice President Dick Chaney. Chaney insisted that the deregulation of energy must continue for California. With then President George W. Bush in office, this decision called into question who benefited from deregulation. Ken Lay met with Bush on the subject of price caps in California and Enron was the largest contributor to George W. Bush’s campaign. Lay’s relationship with Bush began when Bush was the governor of Texas. The year-long crisis cost California $30 billion (with some estimates at $40-$50 billion) in higher energy costs and the additional expense of a recall election for then Governor Gray Davis.

Company Culture

One of the best indicators in a company for fraud risk is the “tone at the top.” To review, tone at the top refers to the management’s attitude towards the rules and policies at the company and how employees perceive the ethics of their managers. Enron’s management focused on the stock price of the company at all times and put considerable pressure on employees to do everything possible to keep the stock price high. This was so important at Enron, the stock prices were displayed in the elevators!

While Ken Lay talked about the importance of high morals and integrity to employees and outsiders, his actions sent a different message. When the Valhalla scandal broke, Lay would not fire the traders involved, but instead sent a letter to Borget and Mastroeni, encouraging them to “please keep making us millions.” Ken Lay, being Enron’s highest ranked officer, knew about all of the ethical lapses the company was making.

Lay knew about the accounting going on behind the scenes at Enron as evidenced by a whistle blower named Sherron Watkins, a former Arthur Andersen employee hired by Lay. Watkins was seen as an intelligent, sharp auditor who was straight forward and honest. She felt that going to Fastow with the improper accounting information would not be productive as he was the one that gave his blessing to the transactions. She also felt that going to Skilling would not produce any changes either since she felt Skilling was not being honest with Lay. She decided to send a letter to Lay in August 2001. She was particularly concerned with two SPEs that Fastow created named Raptors and Condors. The following is an excerpt from the seven page letter Watkins sent to Lay:

“Has Enron become a risky place to work? For those of us who didn’t get rich over the last few years, can we afford to stay?

Skilling’s abrupt departure will raise suspicions of accounting improprieties and valuation issues. Enron has been very aggressive in its accounting–most notably the Raptor transactions and the Condor vehicle. We do have valuation issues with our international assets and possibly some of our EES MTM positions*.

The spotlight will be on us, the market just can’t accept that Skilling is leaving his dream job. I think that the valuation issues can be fixed and reported with other good will write-downs to occur in 2002. How do we fix the Raptor and Condor deals? They unwind in 2002 and 2003, we will have to pony up Enron stock and that won’t go unnoticed.

To the layman on the street, it will look like we recognized funds flow of $800 million from merchant asset sales in 1999 by selling to a vehicle (Condor) that we capitalized with a promise of Enron stock in later years. Is that really funds flow or is it cash from equity issuance?

We have recognized over $550 million of fair value gains on stocks via our swaps with Raptor. Much of that stock has declined significantly–Avici by 98 percent from $178 million, to $5 million; the New Power Company by 80 percent from $40 a share, to $6 a share.

The value in the swaps won’t be there for Raptor, so once again Enron will issue stock to offset these losses. Raptor is an LJM entity. It sure looks to the layman on the street that we are hiding losses in a related company and will compensate that company with Enron stock in the future.

I am incredibly nervous that we will implode in a wave of accounting scandals. My eight years of Enron work history will be worth nothing on my resume, the business world will consider the past successes as nothing but an elaborate accounting hoax. Skilling is resigning now for “personal reasons” but I would think he wasn’t having fun, looked down the road and knew this stuff was unfixable and would rather abandon ship now than resign in shame in two years.

Is there a way our accounting guru’s can unwind these deals now? I have thought and thought about a way to do this, but I keep bumping into one big problem–we booked the Condor and Raptor deals in 1999 and 2000, we enjoyed wonderfully high stock price, many executives sold stock, we then try and reverse or fix the deals in 2001, and it’s a bit like robbing the bank in one year and trying to pay it back two years later. Nice try, but investors were hurt, they bought at $70 and $80 a share looking for $120 a share and now they’re at $38 or worse. We are under too much scrutiny and there are probably one or two disgruntled “redeployed” employees who know enough about the “funny” accounting to get us in trouble.

What do we do? I know this question cannot be addressed in the all-employee meeting, but can you give some assurances that you and Causey will sit down and take a good hard objective look at what is going to happen to Condor and Raptor in 2002 and 2003?”[1]

Watkins’s letter goes on to list the accounting irregularities and offer the names of employees that could back up the allegations. She also included a list of ways to correct the issues. Lay chose to take no action as the employees involved were helping Enron’s bottom line. A half a dozen people approached Lay and other top executives with reports of odd accounting practices. For Watkins’s bravery in speaking out, she was demoted to a lower level job and not allowed on key projects.

Employees at Enron claim that a lot of pressure was put on them before the company’s quarterly reports came out. The company would state that they will not be able to reach their targeted numbers. Yet when the financial statements are released, the company is always on target with their projections and even produced better than expected earnings, which is a red flag that fraud was going on.

Top executives at Enron frequently pushed the company’s stock price up so they could cash in their options at a significant profit. This was known as the “pump and dump” at Enron. Many employees had a vested interest in seeing Enron’s stock price go up. Even if an employee did not have stock options, much (if not all) of their retirement was invested in Enron stock. Enron’s executives always promoted what a safe investment the company was and investors should see the company’s profits increase by 10-15% per year.

The people that Lay hired also shared his philosophy that propping up the stock price of the company was the key to their success. One of those hires, Jeff Skilling, believed that money was the sole source of motivation for everyone. He implemented the Performance Review Committee (PRC). This committee required that employees be graded on a one to five scale. Those employees that scored a five were fired. About 10% of the employees were required to be ranked at “5”. This was called “rank and yank” by employees. This system made Enron employees extremely competitive.

The atmosphere at Enron was described as a “macho culture.” Key executives (under Skilling’s direction) would take retreats to participate in extreme sports. Broken bones on these retreats were considered badges of courage. If you were not willing to be one of “the good old boys” you did not last long at Enron. Enron’s culture was full of business and personal risk taking. But to outsiders, Enron (and Skilling especially) were presented and perceived as conservative on risk.

Their culture was one of “you are with us or you are against us.” Since Enron’s stock price was so important to the company, if you were an analyst that did not have a buy recommendation for the stock, you were considered to be an enemy of the company. Almost all of the analysts had Enron as a buy based on the financial statements that Arthur Anderson (the company’s auditors) certified, the information that Skilling gave, and the evidence of the stock price continuing to climb. One analyst with Merrill Lynch however did not feel the same as the other analysts. John Olson downgraded Enron’s stock to a neutral rating in 1998. Fastow took retaliatory action against Olson and Merrill Lynch decided that Enron’s business was more important than the work Olson had done for them and he was fired. Merrill Lynch was then rewarded by Enron with two investment banking jobs worth $2 million.

Jeff Skilling was questioned in April 2001 about why Enron was the only financial institution that could not produce a balance sheet or cash flow statement with their earnings. Skilling lost his composure and called the investor “***hole”. Bethany McClean, a reporter for Fortune magazine, also questioned Skilling about how the company makes their money. Skilling accused McClean of being unethical for not doing her research ahead of time. Enron sent executives to the magazine to talk to McClean about the article. In that interview, Fastow tells McClean, “I don’t care what you say about the company. Just don’t make me look bad.” The event was discussed at the House Subcommittee Hearings that looked into Enron after its collapse. The following is an excerpt from those hearings:

“WAXMAN — In March 2001, Bethany McLean, a reporter with Fortune magazine, first raised questions about Enron’s financial condition. She wrote in Fortune magazine that the company’s financial reports were missing crucial information. She asked a simple question in the article that no one could seem to answer: How exactly does Enron make its money?

Mr. Skilling, in response to this criticism, you reportedly called Ms. McLean unethical for not doing her research. Three Enron executives flew to New York to try to convince Fortune’s editors that Ms. McLean was wrong. Kenneth Lay also called Fortune’s managing editor to complain. Mr. Skilling, it’s clear now that Ms. McLean was right, and that you were wrong. She was asking all the right questions about how Enron made its money. If that’s the case, it appears as if you were trying to bully someone who was asking very basic questions about Enron. How could it be that she would know basic questions about Enron and raise them, and you didn’t seem to know about them? You got very upset, sir, didn’t you?

SKILLING — I very specifically remember the telephone conversation that I had with the Fortune reporter. As a matter of fact, she had been working on a story, it was my understanding, for about a week. And they had — she had called up and said she wanted 15 minutes of time to discuss some issues, remaining issues related to this report. I said fine. And it was between two meetings — 9:30, between 9:30 and 9:45 some Tuesday — it might have been a Monday morning, I forget the specific date, but there was 15 minutes carved out of my calendar to spend some time with the Fortune reporter.

She called up and started asking some very, very specific questions about accounting treatment on things. I am not an accountant, and I could not answer them. And I said to her, ”Look, we can have our people come up — I will have our chief accounting officer, I will have our chief financial officer — I will have whoever you want come up to explain these specific transactions. I have got six minutes left before I have to be in a meeting, and I can’t get into the details, and I am not an accountant.” And she said: ”Well, that’s fine. We’re going to do the article anyway.”

And I said, ”If you do that, I personally think that’s unethical, because we are making available whatever resources you need to get full and fulsome answers to the questions that you have.” And the next day . . . our chief financial officer and our chief accounting officer flew to New York at Enron’s expense to sit down not with the editors, but to sit down with the reporter on that story and help her understand the questions that she was asking.

WAXMAN — And was her article critical?

SKILLING — Yes, it was.”[2]

The Effects of the Collapse for Enron

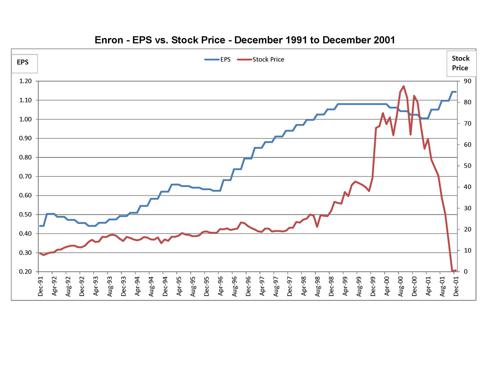

In the end, a company that had the potential to change the energy business crumbled. There were many casualties of this fraud including investors, creditors, employees, and the perpetrators themselves. Enron’s stock price rose exponentially between 1998 and 2000, but fell just as fast as it had risen. The following chart shows Enron’s stock price in relation to its earnings per share (EPS). A timeline of major events is outlined with the chart to show how the stock price was affected.[3]

Note on the graph that Earnings per Share (EPS) remained fairly constant as the stock price continued to fall. This is an indicator of the fraudulent inflated reports of earnings vs. how investors felt about Enron. Part of the falling stock prices could also be blamed on the dumping of Enron stock by executives.

Enron Timeline[4]

| January 30, 1992 | SEC approves mark-to-market accounting for Enron. |

| February 1993 | Enron and the government of the state of Maharashtra, India sign a formal agreement to build a massive power plant leading to the formation of the Dabhol Power Company, a joint venture of Enron, General Electric and Bechtel. The cost for construction will soar to 2.8 billion dollars. |

| December 10, 1996 | Enron announces that Jeff Skilling is taking over as COO. |

| May 24, 1999 | Tim Belden, head of Enron’s West Coast Trading Desk in Portland Oregon, conducts his first experiment to exploit the new rules of California’s deregulated energy market. Known as the Silverpeak Incident. |

| June 28, 1999 | Enron’s Board of Directors exempts CFO Andy Fastow from the company’s code of ethics so that he can run a private equity fund—LJM1—that will raise money for and do deals with Enron. |

| January 19-20, 2000 | Annual Analysts Meeting. First day: Skilling proclaims, “EES (Enron Energy Services) is just rockin’ and rollin.’” Second Day: Enron rolls out its broadband plan. By end of day, stock rises 26 percent to a new high of 67.25 dollars. |

| May 5, 2000 | Enron trader, in an email to colleagues, announces “Death Star,” a new strategy to game the California market. |

| May 12, 2000 | Timothy Belden (chief trader for Enron’s West Coast power desk) sends email to Enron headquarters in Houston confirming his strategy is working. “So far so good… pricing keeps going up.” Belden has made a massive bet that California energy prices will increase. His e-mail confirms that prices are rising. |

| July 2000 | Enron announces that its Broadband unit (EBS) has joined forces with Blockbuster to supply video-on-demand. |

| August 23, 2000 | Stock hits all-time high of 90 dollars. Market valuation of 70 billion dollars. FERC (the Federal Energy Regulatory Commission) orders an investigation into strategies designed to drive electricity prices up in California. |

| November 1, 2000 | FERC (Federal Energy Regulatory Commission) investigation exonerates Enron from any wrongdoing in California. |

| December 13, 2000 | Enron announces that President and COO Jeffrey Skilling will take over as chief executive in February. Kenneth Lay will remain as chairman. |

| Late 2000 | Enron uses “aggressive” accounting to declare 53 million dollars in earnings for broadband on a collapsing deal that hadn’t earned a penny in profit. |

| January 17, 2001 | Rolling blackouts in Northern California. |

| February 14, 2001 | Writer Bethany McLean interviews Skilling for Fortune magazine. |

| February 19, 2001 | Fortune article by Bethany McLean published: “Is Enron Overpriced?” |

| April 17, 2001 | Quarterly Conference Call. In the call, now legendary on Wall Street, an analyst questioned Skilling on the company’s progress. Skilling dismissed him as an “***hole.” |

| June 2001 | FERC finally institutes price caps across the western states. The California energy crisis ends. |

| August 3, 2001 | Skilling makes a bullish speech on EES. That afternoon, he lays off 300 employees. |

| August 14, 2001 | Skilling’s resignation announcement. In evening, analyst and investor conference call. Skilling: “The company is in great shape…” Lay: “Company is in the strongest shape that it’s ever been in.” Lay is named CEO. |

| September 2001 | Skilling sells 15.5 million dollars of stock, bringing the total of his sold shares, since May 2000, to over 70 million dollars. |

| September 26, 2001 | Employee meeting. Lay tells employees Enron stock is an “incredible bargain,” and that, “third quarter is looking great.” |

| October 17, 2001 | Wall Street Journal article, written by John Emshwiller and Rebecca Smith, appears. The article reveals, for the first time, the details of Fastow’s partnerships and shows the precarious nature of Enron’s business. |

| October 22, 2001 | Enron acknowledges Securities and Exchange Commission inquiry into a possible conflict of interest related to the company’s dealings with the partnerships. |

| October 23, 2001 | Lay professes support for Fastow, saying he has the “highest regard” for his character during conference call with analysts and employee meeting. In a massive shredding operation, Arthur Andersen destroys one ton of Enron documents. Enron fires Fastow the next day. |

| October 31, 2001 | Enron announces the SEC inquiry has been upgraded to a formal investigation. |

| November 8, 2001 | Enron files documents with SEC revising its financial statements for past five years to account for 586 million dollars in losses. |

| November 19, 2001 | Enron restates its third quarter earnings and discloses it is trying to restructure a 690-million-dollar obligation that could come due November 27. |

| November 28, 2001 | Enron shares plunge below one dollar. |

| December 2, 2001 | Enron files for Chapter 11 bankruptcy protection. |

The Effects of the Collapse for Parties Involved

Effect on Investors

Enron’s stock price fell from $90 per share to $0 in a just a few months. Investors were misled not only by Enron, but by stock analysts. About 90% of stock analysts rated Enron stock as a “buy” even as late as November 2001 when the company was restating earnings. Many investors relied on the analysts opinions. As a result, investors lost $40 billion. They were only able to recover $7.2 billion from the banks involved with the SPE partnerships and $74.5 million was recovered from Enron’s auditors Arthur Anderson. A class action lawsuit was settled in 2010 opening the door to individual lawsuits from investors against the banks involved. One of those suits, Silvercreek Management, Inc. v. Citigroup, Inc, is still in the courts. Emails written over 17 years ago are being used as evidence in the lawsuit bringing the effects of Enron into modern day.

Effect on Creditors

When Enron went bankrupt, creditors lost $21 billion. They were able to recover only $5 billion from the Enron bankruptcy and settlements with the banks involved in the SPE partnerships.

Effect on Employees

Not only did employees lose their jobs, health insurance and other benefits, $1.2 billion was lost in their 401(k) because they were heavily invested in Enron stock (at the continued suggestion of the company). This resulted in anguish and financial hardship for 20,000 employees. One employee had $348,000 in his 401(k) and after the bankruptcy settlement received only $1,200. Employees did not see the bankruptcy coming and were not able to cash out of their stock. Key executives, however, were still able to cash out their stock netting millions of dollars and some were paid bonuses totaling $55 million while the average severance pay for employees was $4,500. Retirees also saw their retirement savings disappear.

Effect on Perpetrators

Ken Lay: Enron Chairman of the Board

Lay made $300 million in compensation and stock options over a period of four years. In September through October of 2001, Lay cashed in $26 million in Enron stock while telling employees and investors that the company was doing fine. At the time of Enron’s bankruptcy, Lay’s net worth fell from $40 million to nothing. He was convicted of 10 felony counts including conspiracy to commit fraud. Lay never took responsibility for Enron’s demise and continued to blame Andy Fastow for the company’s problems. Lay died of a heart attack before sentencing which voided the conviction.

Jeff Skilling: Enron CEO, COO

Skilling made $200 million from Enron before he left the company in August 2001. Shortly after he left, he cashed out $15.5 million in Enron stock bringing his total gain from stock sales to $66.9 million. In 2006, Skilling was convicted of 19 felony counts which carried a sentence of 24 years in prison and was fined $45 million. Skilling appealed the ruling citing a mistake in the law. In 2010 the U.S. Supreme court tossed out one of the legal theories used in his defense and sent the conviction back to appeals court to determine if Skilling should have a new trial. On June 21, 2013, a federal judge approved a sentencing agreement that reduced Skilling’s prison sentence from 24 years to 14 years. In exchange, Skilling relinquished his right to all appeals and $40 million of his assets were released to Enron victims. Skilling served 11 years in prison which is the longest sentence of anyone involved in the Enron fraud and was released in August 2018 to a halfway house for six months.

Andy Fastow: Enron CFO

Fastow made $30.5 million on Enron stock alone and a reported $45 million for the LJM partnerships he created. When investigators questioned Ken Lay about Fastow’s SPE partnerships, Lay said that Fastow acted in the most ethical manner. The day after making that statement, Lay fired Fastow and set him up to take the fall for Enron. Fastow cooperated with prosecutors to help convict other top executives at Enron and received 10 years in prison in a plea deal for conspiracy to commit wire and securities fraud in 2004. Fastow forfeited nearly $30 million in assets. His sentence was reduced to 6 years in 2006 and he was released in December 2011. His wife, Lea, was convicted of tax fraud for not reporting all of Fastow’s Enron earnings and spent a year in jail.

The Role of the Auditors – Arthur Andersen

Arthur Andersen served as Enron’s auditors for sixteen years. They served Enron as their outside  auditor, performed internal audit functions, and provided consulting services. Overall, Andersen earned $25 million for their audit work of Andersen and $27 million in non-audit fees in 2000 alone. Andersen approved Jeff Skilling’s “mark-to-market” accounting concept and helped structure the SPE partnerships. They were paid $5.7 million for their partnership advice. By doing these things, Andersen violated audit standards of training, due professional care, and independence. Audit firms generally have a quality control partner that reviews audits to ensure that those standards are being met. Arthur Andersen’s managing partner on the Enron audit was allowed to disregard the quality control partner. Andersen did show some understanding of Enron’s wrongdoing in February 2001 when the partners met to discuss dropping Enron as a client. In that meeting Andersen partners called Enron’s mark to market accounting “intelligent gambling.” Andersen ultimately decided to keep Enron.

auditor, performed internal audit functions, and provided consulting services. Overall, Andersen earned $25 million for their audit work of Andersen and $27 million in non-audit fees in 2000 alone. Andersen approved Jeff Skilling’s “mark-to-market” accounting concept and helped structure the SPE partnerships. They were paid $5.7 million for their partnership advice. By doing these things, Andersen violated audit standards of training, due professional care, and independence. Audit firms generally have a quality control partner that reviews audits to ensure that those standards are being met. Arthur Andersen’s managing partner on the Enron audit was allowed to disregard the quality control partner. Andersen did show some understanding of Enron’s wrongdoing in February 2001 when the partners met to discuss dropping Enron as a client. In that meeting Andersen partners called Enron’s mark to market accounting “intelligent gambling.” Andersen ultimately decided to keep Enron.

When the SEC launched their investigation into Enron, Andersen deleted 30,000 e-mails and shredded one ton of documents to cover up the fact that millions of dollars in Enron profits were really losses. This direction came from Andersen’s legal counsel shortly before they received a subpoena from the SEC.

Effect on Arthur Andersen

In 2002 Arthur Andersen was convicted of obstruction of justice (a felony). This means that Andersen could no longer practice public accounting before the SEC and they lost their CPA license. This ultimately closed Arthur Andersen and put thousands of employees out of work. This brought the “Big 5” accounting firms (Deloitte, Ernst & Young, KPMG, PricewaterhouseCoopers, and Andersen) to be the “Big 4.”

In 2005, the U. S. Supreme Court overturned the conviction based on faulty jury instructions. The overturning of their conviction still did not help the employees of Andersen as the firm no longer existed. Andersen still had to pay $74.5 million to Enron investors and $16 million to Enron creditors in addition to other lawsuits. Andersen was able to spin off its consulting services and that part of the firm is still doing business today under the name Accenture.

David Duncan: Arthur Andersen Audit Partner

David Duncan was the audit partner on the Enron audit. He failed to exercise due professional care (applied care and skill that any reasonably competent auditor would exercise). He also failed to ensure proper presentation and disclosure (many significant disclosures were missing from Enron’s audit reports). He signed an unqualified opinion (gave the financial statements a “clean” opinion), but should not have. Enron was Duncan’s only audit client and he made over $1 million per year from them (Andersen made $1 million per week). In fact, Enron was such a big client for Duncan and Andersen that an entire floor was devoted to Andersen so they could have audit staff located at Enron year round impeding the concept of independence.

After the investigation into Enron broke, Duncan was fired by Andersen. Duncan testified against Andersen and received a plea deal for one felony count of obstruction of justice. Prosecutors dropped the fraud charge. Duncan was sentenced to one year in prison and he was permanently barred from doing SEC work. In 2005, Duncan’s conviction was voided (like Andersen’s).

Effect on the public and other companies

When the Enron scandal and subsequent bankruptcy broke, investors lost faith in the markets. Because of Arthur Andersen’s involvement with Enron and other accounting frauds going on at the time like MCI WorldCom, the public perception of CPAs dropped dramatically. The demise of Arthur Andersen caused regulators to be wary of losing another “Big 4” CPA firm. Public perceptions of the employees who worked for Enron and Arthur Andersen changed too. People who say that they used to work for Andersen or Enron are sometimes painted with the same brush as those who were responsible for the fraud by the public. There were many good employees that worked for Andersen and Enron that still fight the stigma that had been placed on them because a handful of people in their firms acted badly.

Lessons Learned?

With the high noteriety of Enron and the frauds committed, you would think that companies would learn a valuable lesson of what not to do, but this is not the case.

In 2013, JP Morgan paid $410 million to settle allegations of manipulating the California and mid-western power markets from September 2010 to November 2012. This is nearly 10 years after Enron did the same thing and went down for it.

In Jan 2018, BP (the world’s largest natural gas company in North America) paid out $102 million to California for overcharging the state for natural gas. They provided false and misleading information to cover up violations in state and government contracts for providing natual gas at a set or capped amount.

Sarbanes-Oxley Act of 2002

To help prevent future frauds in the accounting profession, Congress enacted the Sarbanes-Oxley Act

(SOX) named for its sponsors U.S. Senator Paul Sarbanes and U.S. Representative Michael G. Oxley. This act did many things to improve the integrity of the accounting profession including:

- Issuance and evaluation of a company’s internal controls. This is similar to the audit and opinion of the financial statements. A separate report on the internal controls can be issued or auditors may choose to do an integrated report including the financial statement and internal control reports in one document.

- Auditors have restrictions on what services they can perform for their audit clients. The auditing firm can no longer perform consulting services at the same time for a company. In the case of Enron, Arthur Andersen was doing both. This presents a conflict of interest as the auditor is giving advice to the company and then auditing the results of their own advice.

- The lead audit partner (in Enron’s case, this was David Duncan) cannot serve more than seven years on an audit without a two year break. This will require another partner to run the audit to ensure that the original partner has not helped to cover up any fraud (as in Enron’s case).

- A new government board was created to oversee the work of auditors. It is called the Public Company Accounting Oversight Board or PCAOB.

- New stronger penalties were put into place for those who violated the laws. Sentences can include up to 25 years in prison with steep fines.

- Management must now include in the annual report acknowledgement that they know and understand what is in the financial statements. This includes the amounts and the effectiveness of the company’s internal controls. This is in Section 404 of SOX and prevents the CEO from saying that they did not know what was going on with the accounting of the company (like Ken Lay did). The management report serves as a written disclaimer of responsibility.

The Sarbanes-Oxley Act increased the number of auditors needed to perform an audit and added significant increases to audit fees. The job market for entry level auditors dramatically increased after the act was passed and stayed strong for many years afterward.

Conclusion

Companies that do not have a strong “Tone at the Top” for ethical behavior are at a higher risk for fraud. It is important in your job and personal life to lead by example and make decisions with a strong moral compass. Companies need to have a sound code of ethics that is adhered to and not overlooked when it is better for the company’s bottom line.

It is also important to not have employees’ compensation tied to the company’s stock price (stock options). A strong internal audit function is key to catching frauds quickly. Internal auditors can still be independent of the company, even though the company pays them. The external auditor should always remain independent of the company. This was not the case at Enron. Internal auditors can help to prevent abuses of accounting practices such as mark-to-market accounting. Companies that have all of the right elements in place and functioning well are at a much reduced risk of fraud.

While we cannot control everyone’s individual ethics, we can prevent the opportunities for fraud to occur. Ken Lay and Jeff Skilling were known as the smartest guys in the room. They were the captains of a ship too powerful to go down. If more employees would have practiced Enron’s slogan to “Ask Why?” the opportunity for fraud would not have been there and those employees may still have their jobs.

Questions for Research and Discussion

1. Enron’s top executives were not the only people with a role in Enron’s demise. Name five other people/organizations that played a role and explain what part they played.

2. If Arthur Andersen felt that Enron’s accounting practices were suspect (mark to market, etc), why do you think they would decide to keep Enron as a client?

3. Name three people related to the Enron scandal that may have succumbed to authority and “shocked to the death” if they participated in the Milgram experiment and three people that may not.

- Why did you choose the people you did?

4. Do you think that there is any irony in Enron’s slogan “Ask Why?”

- Justify your answer.

5. Give an example of rationalization (fraud triangle) in the case of Enron.

- Justify your answer with examples from the case.

6. Give an example of opportunity (fraud triangle) in the case of Enron.

- Justify your answer with examples from the case.

7. Give an example of pressure/incentive (fraud triangle) in the case of Enron.

- Justify your answer with examples from the case.

8. Do you think that Arthur Andersen would still be in business today if Sarbanes-Oxley had been in place throughout Andersen’s relationship with Enron?

- Why or why not?

9. Research what has happened to Sherron Watkins since the collapse of Enron and include any websites where you did your research.

- Do you think that her decision to write the memo to Ken Lay to be a good decision in retrospect?

- What risks did she face in her decision to write the memo to Ken Lay?

10. Evaluate how Sarbanes-Oxley helps to reduce the factors in the fraud triangle for Arthur Andersen.

- Give examples for two of those factors.

11. Cite three examples (using three different Enron executives) that show the “Tone at the Top” for Enron was unethical. Why did you choose your examples?

12. Give five examples of people/organizations that could have helped prevent this fraud from occurring if they would have listened to their ethics. Why did you choose your examples?

13. Research what Andy Fastow is doing today and include any websites where you did your research.

- What is his current job and do you think that he regrets his actions with Enron?

- https://caraellison.files.wordpress.com/2010/06/sherronwatkinslettertolay.pdf ↵

- http://www.nytimes.com/2002/02/09/business/enron-s-many-strands-excerpts-house-subcommittee-hearings-enron-collapse.html?pagewanted=all&src=pm ↵

- http://seekingalpha.com/article/473771-dst-systems-why-enterprise-value-based-valuation-metrics-are-superior-to-p-e-ratio ↵

- http://www.pbs.org/independentlens/enron/timeline2001.html ↵

Enron Energy System

Mark to Market

the state of being famous or well known for some bad quality or deed

fail to resist pressure, temptation, or some other negative force