Main Body

Elements of Fraud

What qualities make an ethical person? This question is not easily answered. Some would say that ethics is demonstrated through their actions. Others would say that it is their character. If someone makes an error in judgment and does something outside of their own ethical framework, does that make them an unethical person? What factors influence our personal ethics? Do these same factors also influence our ethical decision-making on a professional level? How do these factors add to the risk of fraud and why does fraud occur? There are certain elements to a fraud, but even if all of the “textbook” elements of fraud are present, it does not ensure that a fraud will occur. The most important factor in all frauds is the human element. Our perceptions of ourselves and of others shape our ethical frame of reference. To help prevent fraud, we need to start by looking at how others perceive us versus how we perceive ourselves.

What is perception?

Dictionary.com defines perception as “the act or faculty of apprehending by means of the senses or of the mind; cognition; understanding.” This, of course, is just one interpretation. It is also defined as “a single unified awareness derived from sensory processes while a stimulus is present.” Is the definition any clearer now? A simpler definition for perception should be: how we view others and our environment, based on our background and experience. Everyone has a different frame of reference. If you see the weather as partly sunny, some might say it is partly cloudy. If you were to tell someone that twenty five divided by five is five, would you expect the other person to agree? Of course you would. What if the other person believed that twenty five divided by five is fourteen? Would you disagree right away and laugh or would you ask them to explain why? In other words, how willing would you be to try and put yourself in their shoes or their frame of reference?

The basic premise of perception is the foundation for what ethics are. How do you see yourself and how does everyone else see you?

Background Influences Personal Ethics

Ethics are used in many of the decisions we make – both personally and professionally. It could be something as simple as a “little white lie” when a person comments on how good an outfit looks on another person, when they actually think it is hideous. Or perhaps a person who is given too much change by cashier will keep the overpayment, rather than return it. One ethical breech (the lie) is to spare someone’s feelings and the other (the theft of money) is for purely selfish reasons. Think about if you have ever been in either of those situations. If so, did you act ethically? If not, how did your actions make you feel? If you had no problem pocketing the money, are you a bad person for it? Little ethical breaches may seem to not really hurt anyone. But the friend whom you said looked great will now wear the hideous outfit more often because of the false compliment you gave. When others point out that the outfit is less than flattering, your friend will see you as a liar and may no longer trust your opinion. The extra ten dollars that you pocketed from the unwitting cashier may not mean a lot to a multi-billion dollar company like Wal-Mart, but if everyone pocketed the extra money, the company would start to feel the effect in their profits. This result is higher prices and possibly the loss of a job for some Wal-Mart employees.

Your ethics and moral values are the result of your background, including:

- Culture – this includes your ancestors, heritage, and traditions. Some cultures widely accept bribery as a cost of doing business. Does that make this practice ethical? At one time, it was acceptable to burn a human being alive if it appeared that they were practicing witchcraft. Is this still an acceptable cultural norm today?

- Environment – where did you grow up and where have you lived? Did you grow up in a poorer neighborhood where theft and robbery was a means to survive? What about certain places where gangs set the social norms? The act of killing another rival gang member was necessary to protect others from being killed. Does this type of behavior reflect the ethical values of that neighborhood?

- Experience – What kinds of experiences did you have as a child, teenager, and adult? Were you abused as a child and then grew up to abuse others? Would this be an acceptable excuse if you were on their jury? Did you hang out with peers growing up that used illegal drugs and participated in underage drinking, so you did also? How did experiences from your past shape what behaviors you do today? Would others find your behaviors to be ethical?

- Religion – What are your religious beliefs and how do you practice them? How many ethical breaches have occurred in the name of religion? Witch burning as mentioned earlier is based on religious beliefs. The Crusades of the 11th and 12th centuries were wars blessed by the Catholic religion. Thousands of people were killed in the name of religion. What about the religious arguments of today. Is it ethical to discriminate against someone because their religious beliefs do not match yours? This practice occurs on a daily basis.

- Upbringing – What were your parents’ ethical beliefs? Have you ever been in a situation when your parents told the waitress at a restaurant that you were 10 years old, when you were actually 11, in order for you to get the less expensive children’s meal? What about lying about a child’s age to the cashier at a movie theater so they would only be charged the child’s price for the ticket?

It is a combination of the historical factors and the current circumstance that shapes our decision making process.

Perceptions Influence Personal Ethics

Everyone’s viewpoints and personal ethics are different. Consider the following situations:

- sending a quick text to your friend while you are working

- making small talk with a co-worker during your shift for a few minutes

- coming in “a little late” or leaving “a little early” once or twice a week

- taking home small office supplies once in a while because you are too busy to run to the store

Most people would say that taking home the office supplies is not ethical since it is stealing, but the other situations are commonplace in many companies so it is ethical. That opinion is a bit short-sighted as you need to account for the time that the employer paid you that did not result in productivity for the company. What defines “quick” or “a few” or “a little”? It is five minutes, 20 minutes or an hour? If your definition is 5 minutes, then how long to your think it will take some people to expand on that definition? If 5 minutes is the norm for time spent doing other things at work, what is the harm in taking “a little” more time? Now the definition approached 10 minutes and soon 20 minutes, etc. It is not hard for those “little” minutes to turn into hours once added together.

While it is obvious that taking office supplies home is theft, what people do not think about is time theft. Think about how much money are you being paid for your job? How much money will your employer pay in benefits for you? It is less expensive for the employer to let you have non-working “moments” or keep purchasing office supplies that get stolen? Either way, the employer loses. How many times have you participated in or seen the situations above at your workplace? At the time, did you think that this practice was ethical? Some employers may look the other way for a quick text or a quick chat with another employee, but does their acceptance change the ethical analysis? Are those situations any different than having a co-worker clock in for you because you are going to be “a little” late?

Situations Influence Ethics

Sometimes our ethical views change with a situation. Have you had a time when you have changed your ethical position? Think about your position on these ethical topics:

- Death Penalty

- Abortion

- Assisted Suicide

If you are for the death penalty, would your opinion change if your family member was about to face the electric chair? Would a person who was pro-life find their beliefs challenged if a close family member was faced with a difficult decision? Might a person who opposes physician-assisted suicide feel less confident if a loved one was facing a lingering, painful death?

In those situations, did their frame of mind change or did their ethical framework change? Do you think your current position would change if you were in that situation? If a family member was? If you think you would change your mind, does that mean your ethical position was wrong before? Each person has a right to their ethical beliefs. We may even change our beliefs as the situation changes.

Professional Ethics

Every profession has an ethical code of conduct. Most members of the profession strive to follow that ethical code. But in every profession there will be a few that violate the professional ethical code.

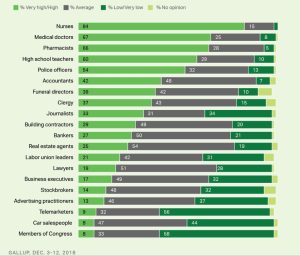

How does the public perceive the ethics of various professions and in turn the ethics of the individual people in that profession? Gallup studied this question in December of 2018 and came out with a ranking of the most (and least) trusted professions. [1]

On the top of the list were nurses and on the bottom were Members of Congress. Is there an unconscious bias here in how we perceive each profession? Police officers rank far below medical doctors, but they are both in the profession of helping the public. Is the perception of the people polled in this study based on experience, thoughts and opinions of other people, or the reporting of the media? We will study more about unconscious bias in a future chapter.

The good done by the accounting profession is not as evident so it is easier to perceive the accounting profession as a whole as less ethical. So when someone in the profession breaks the public trust, the whole profession is painted with that same unethical brush. What would be the point of having an accounting profession without trust? Accounting produces information to help internal and external users to make decisions. If the information is not trustworthy, what value does the accounting profession have? To remain a valuable part of society, accountants must exhibit high integrity and earn the public trust.

Since 2000, accountants have fallen when it comes to the public’s perception of ethics and is slowly making their way back to the top of the Gallop Poll.[2]

This loss of public trust in the accounting profession is a reason for concern. Article II of the AICPA Code of Professional Conduct states:

“Members should accept the obligation to act in a way that will serve the public interest, honor the public trust, and demonstrate commitment to professionalism.”[3]

This statement is from the accounting profession’s own code of conduct. Why is it then that the public perceives the profession as less than ethical? With accounting scandals such as Enron, Arthur Andersen, MCI/WorldCom, Rite Aid, Bernie Madoff, etc., it is hard for the accounting profession as a whole to recover their tarnished public image. These scandals held very high public visibility in the press. There was a public outcry so loud that Congress passed the Sarbanes Oxley Act of 2002. This act made top management responsible for the contents of their company’s financial statements. We will study more about Sarbanes-Oxley and accounting scandals in future chapters.

Definition of Fraud

Most accountants abide by a strict code of ethics, but there are disappointing exceptions. Over the past few years, there have been several high-profile examples of ethical lapses from individuals and corporations. Enron, Arthur Anderson, WorldCom, Bernie Madoff, and Martha Stewart are only a few of the names receiving press in the past. For each of those, there are many more with less egregious ethical lapses. This leads to the question why do they do it? Why would someone (or a group of people) risk losing everything while hurting others in the process? To answer this question, let’s look at the elements of fraud. Fraud requires

- Intentional misrepresentation – the person representing the fact needs to know that the fact is false.

- Made by one person to another – the fact needs to be told to another person.

- For the purpose of inducing the other person to act – the fact needs to cause someone else to rely or act upon it.

- The other person relies with resulting injury or damage – the reliance on the fact needs to cause some kind of harm or damage to the other person.

If one of those points is not present, fraud may not have necessarily occurred. For example, if a represented fact hurts another, but the party that stated the fact did not know that the fact was false, it is considered simple negligence and not fraud. If the fact was false, but no one relied upon or was hurt because of it, it is not fraud.

The legal definition of fraud seems straightforward, but the human element of the factors that lead to fraud is very complex.

Consumer Fraud

Consumer fraud is the act of deception for financial gain against a consumer. This fraud takes on various forms and can be quite profitable to the perpetrator. Some common types of consumer fraud are:

- Credit/Debit Card fraud – the fraudulent use of another person’s credit or debit card.

- Identity Theft– the fraudulent use of a consumer’s identification for the perpetrator’s financial gain. Thieves will obtain some aspect of personal information. Once the thief has the consumer’s personal information, it is easy to open up credit in the consumer’s name. Once credit is damaged by the non-payment on these accounts, it is time consuming and frustrating to fix.

- Lottery Scams – a random chance at winning a prize that requires the consumer to make an advance payment to win. This is different from a sweepstakes which does not require a payment or purchase in order to have a chance at winning the prize. These become scams when the consumer is notified in advance that they have won, but to collect, they need to send in their money, and no prize will ever be awarded.

- Internet Auction Frauds – these auction frauds typically happen on websites like E-bay where the seller never ships the item or claims that the item is something that it is not. These frauds usually require money to be wired to the seller instead of going through usual payment channels. It is also typical for these fraudulent sellers to reside outside of the United States.

- Confidence – Nigerian Advance Fees Fraud (AFF)– this fraud is sometimes referred to as “419” which is the section in the Nigerian law that regarding fraud. Confidence frauds are usually in the form of a letter sent by e-mail. These can come from any foreign country, but they are often originated in Nigeria. The letter explains that a diplomat, widow of a diplomat, wealthy business person, etc. has their money tied up in a foreign bank and needs your help with the “transfer fee” or the “taxes” to help transfer the money out. They promise to share in the millions of dollars in the account as a thank you for your help. Once you wire the “fee” to them, you will never see the money promised to you.

-

- Other forms of this fraud include catfishing. This is someone who impersonates someone else in order to get money. This is common on dating websites. The perpetrator is usually in a foreign country and using the identity of a citizen. The criminal will get close to the victim and then start asking for money. The victim will send money until they figure out it is a con. Usually this is after hundreds of thousands of dollars are paid out. Aside from dating sites, catfishing can be done in any form – someone impersonating a grandchild who needs money to get out of a situation they are in or even someone impersonating your boss to scam the employee out of cash or gift cards!

- Cyber Crimes – Related to the internet auction frauds and confidence frauds above are a variety of crimes committed through the use of the internet. The following are examples of how cyber criminals can defraud the consumer.

-

- Phishing emails – These crimes trick the consumer into clicking on links and collecting personal passwords. Some of the most popular are emails that spoof a company’s IT department claiming that a password has expired or your email will no longer receive messages unless you click on the link and give your password. The password is collected and the criminal can sell or use your information for identity theft or they may gain access to the company’s internal system to steal data.

- Hacking into companies/personal bank accounts – whether it is through a phishing email or another method of gaining access, a cybercriminal may also steal passwords plus personal and credit card information directly from a company’s own servers. There have been several instances of data breaches involving large companies with the most recent including Marriott Hotels, Twitter, Anthem, and even Equifax! This is frightening given that they are one of the three major credit reporting agencies and the holders of everyone’s credit data!

- Social media – In addition to phishing scams leading to fake social media sites, social media can lead consumers to a number of different fraudulent websites meant to collect money or personal information. Sometimes referred to as “click bait” people can be lured in by taking polls to find out things like “what is your inner spiritual animal” which leads to giving the site information like your cell phone number. Then you find an unauthorized charge on your bill.

- Ransomware – This is software that is fraudulently downloaded to your computer through a fraudulent website or phishing email that shuts down your computer and the consumer needs to pay money (ransom) to regain access.

According to data compiled from the Internet Crime Complaint Center (IC3), consumer fraud is on the rise. The IC3 began operation on May 8, 2000, as the Internet Fraud Complaint Center and was established as a partnership between the National White Collar Crime Center (NW3C) and the Federal Bureau of Investigations (FBI).

Investor Fraud

Investor fraud is a practice that induces people to purchase or sell an investment because of fraudulent or misleading information. This includes insider trading [4], “Ponzi” schemes [5], pyramid schemes [6], and “front running” by brokers who invest in a stock and then induce other people to invest in the same stock causing the stock price to rise. In recent years there have been a series of high-profile Ponzi schemes, where the fraudster takes the original investments and then uses cash from recent investors to pay prior investors. This requires the scammer to draw in ever-increasing investments from new investors. Initially people pay to get “in.” In a pyramid scheme, profits or commissions are directly related to how many new people join the scheme. If no new investors or sellers join, no money comes in and all of the newcomers lose their profits and their initial investment. Both Ponzi schemes and pyramid schemes ultimately fail and the latest participants incur the biggest losses.

Case Study: Bernie Madoff’s Ponzi Scheme

The term “Ponzi Scheme” was named for Charles Ponzi who used the technique in 1920, but the most famous Ponzi scheme was run by Bernie Madoff. He promised investors abnormally high returns on their investments if they allowed him to manage their money. Instead of investing the consumer’s money, he used it to pay the returns of previous investors.

In order to continue this scheme, he needed a constant flow of new investors. Madoff was able to keep his Ponzi scheme alive for about twenty years. The stock market crash of 2009 caused many of Madoff’s investors to pull out their investments. Madoff could not pay all of the investors’ money by selling their investments because there were no investments to sell. This led to the downfall of Madoff and his Ponzi scheme. The Madoff scheme lasted an unusually long time. Most Ponzi schemes unravel in only a few years.

Corporate Fraud

Corporate fraud is any activity done by an individual or company that is done illegally to create a financial or competitive advantage. There have been many examples in recent years of corporate fraud. Companies like Enron, Sunbeam, Rite Aid, MCI, and Waste Management have all perpetrated a form of corporate fraud by falsifying financial reports in order to drive up stock prices. We will study a few of those cases in future chapters.

Occupational Fraud

The Association of Certified Fraud Examiners (ACFE) publishes their “Report to the Nations” outlining how fraud is perpetrated, detected and investigated. This report gives fraud statistics by organization, type of fraud, and fraud losses. The statistics below are from the 2018 report.

Occupational fraud is generally broken into three categories:

- Asset misappropriation (common examples)

- Fraudulent disbursements (including payroll schemes, check tampering, and expense reimbursement schemes)

- Theft of inventory (including misuse and larceny)

- Theft of cash (cash on hand or cash receipts)

- Corruption

- Conflicts of interest

- Bribery and illegal gratuities

- Economic Extortion

- Financial Statement Fraud

- Net income overstatements (including fictitious revenues and improper asset valuations)

- Net income understatements (including understated revenues or overstated liabilities and expenses)

Below are the categories and the percent of cases with median losses:

- Asset Misappropriation – 89% of cases with a $114,000 median loss per case

- Corruption – 38% of cases with a $250,000 median loss per case

- Financial Statement fraud – 10% of cases with an $800,000 median loss per case

According to the report, Asset Misappropriation had the most cases, but the lowest median loss per case. Financial statement fraud however had the least number of cases, but the largest median loss per case.[7]

Losses also relate to the duration of the fraud. According to the ACFE, frauds lasting six months or less had the lowest median loss while frauds lasting more than 60 months had the highest loss which makes sense given the perpetrator(s) has more time to collect money. But the good news is statistically speaking these frauds are being caught earlier since 27% of cases are discovered within 6 months. Frauds lasting the longest are only 8% of the cases. This could be due to the complexity of keeping a fraud going.

Also according to the report, payroll frauds lasted the longest at 30 months on average. This is why it is important to have proper internal controls over payroll including having a human resources department hire employees while payroll pays them. This prevents the problem of “ghost” employees.

For additional findings, check out the ACFE’s report. The results of this study only cover occupational fraud. This does not include statistics for other types of frauds discussed in previous paragraphs.

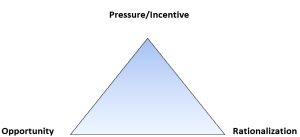

The Fraud Triangle

Criminologist Donald R. Cressey developed the fraud triangle in the 1950s to explain the factors common to all frauds. In his research, Cressey interviewed about 200 convicted embezzlers who had no previous criminal records. From his interviews, Cressey developed the following theory:

“Trusted Persons become trust violators when they conceive of themselves as having a financial problem which is non-shareable, are aware this problem can be secretly resolved by violation of the position of financial trust, and are able to apply to their own conduct in that situation verbalizations which enable them to adjust their conceptions of themselves as trusted persons with their conceptions of themselves as users entrusted funds or property.”[8]

Cressey went on to develop the fraud triangle, as shown below:

Pressure

Pressure is a form of stress. This is usually through some outside circumstance like financial troubles, chemical addictions, family problems, or other troubles. Cressey’s research indicated these were “non-sharable” problems. Think about pressure that you may have felt in your life. Did you ever feel pressure to do something you felt was illegal or unethical because your peers were doing it, or because your boss required it? How about pressure that you put upon yourself to pass a class? Did that pressure ever cause you to want to cheat on an exam or plagiarize a paper? Did time pressures affect your decision? Have you ever been asked to help someone else cheat (“can you give me the answer to this homework problem”)? What about financial pressure? Have you ever been in a situation where you really needed money and thought about stealing or lying to get it? In cases of fraud, the most likely source of pressure is financial. It could be financial pressure for your benefit or financial pressure from your employer to make the company look better to outsiders. Another example could be your boss asking you to work “a few more minutes” off of the clock. You may feel pressure to comply. Pressure leads to motivation or incentive to commit fraud.

Opportunity

Opportunity is the accessibility (or ability) to commit the fraud. In the case of a financial fraud where money is stolen, consider a bookkeeper in a business with no internal controls. The bookkeeper is allowed to approve checks for payment, write the checks, and reconcile the bank statement. There is no one that could spot the embezzlement if the bookkeeper decided to write a check to a fake vendor and then cash the check. In this case, the bookkeeper has an opportunity to commit the fraud.

Rationalization

Rationalization is justification as to why committing this fraud is necessary or acceptable. For most people, they would say that stealing from their employer is wrong. Sometimes an employee believes that since they are underpaid, they are entitled to the money that they are stealing from the company. This rationalization makes them comfortable with going against their core values or moral compass. There is often an attitude of entitlement. “Since I have not received a raise in five years and my co-workers have, I am entitled to this extra money. The company owes me.” For those with low moral standards, rationalization is easy to achieve. For others, it is more difficult. Ask yourself, “What would make me commit fraud against my employer, a friend, or even a family member?” Most would answer with “I would never do that.” If you ask many who committed fraud, they would tell you the same thing. Those who commit fraud do not wake up one day and decide that they are going to do it. It is a process. Rationalization is the element that causes most fraudsters to abandon their moral compass. Instead of asking yourself, “What is my price to be unethical?” perhaps you should ask yourself, “What factors/circumstances need to be in place for me to commit an unethical act?” If you are ever put in a situation when those factors are present, you may discover that “your price” is not as high as you once thought.

Fraud often will not occur with only one of the factors above present. Cressey found that all three factors were always present. When all three factors are present it does not necessarily mean that fraud is occurring, but there is an increased risk that it could occur. Most people would still follow their ethical values and not commit fraud. Employers need to be aware of these risks and develop ways to minimize them.

How employers can address the three fraud factors

Opportunity is one of the easiest factors for employers to control. By putting good internal controls in place, employees will find it too difficult to commit the fraud. For example, the bookkeeper that had the opportunity to embezzle money from the company because no one was overseeing their work would not have the opportunity to steal if the company had one person authorized the checks for payment, a second person writing the checks, and a third person reconciling the bank statement. These internal controls (or segregation of duties) would minimize the risk, but not prevent it altogether. This is why employers need to continuously evaluate their internal controls and make adjustments when needed.

Pressure, sometimes called incentive, is one of the most difficult to minimize for companies since much of the pressure that people feel are out of managements’ control. They can put policies in place to minimize workplace pressure like fair/competitive wages, overtime policies, vacations, realistic budgets and timelines for completed projects, etc. Many employers now check applicants’ credit reports prior to hiring and will not hire a person who appears to have financial pressure.

When an employer minimizes the risk of pressure, they will also minimize some of the rationalizations that go with it. When employees are paid a competitive wage, employees may not feel as much financial pressure and may feel more valued, thus reducing rationalization. Vacations would help relieve employee stress. Realistic budgets and timelines also reduce pressure.

An important technique that reduces employee fraud risk is the company’s “Tone at the Top.” This phrase refers to the management’s attitude towards the rules and policies at the company and how employees perceive the ethics of their managers. If management does not exhibit ethical behavior and prioritizes ethics as an organizational value, employees will be more prone to commit fraud or steal from the company themselves. It is also not enough for management to say that ethical behavior is a priority, but they also need to reflect that priority in their own behavior. Think about how you would feel if you were docked for a half hour of pay for coming back late from lunch, but managers frequently take two hour lunches without any loss of pay. After a while, you may feel a bit angry that you are treated differently. This adds to your rationalization that the company “owes you.”

Case Study: Walt Pavlo and MCI/WorldCom

The situation that brought about Walt Pavlo’s downfall as well as MCI/WorldCom, could have been easily prevented. Companies need to be aware of three common factors for fraud:Walt Pavlo is an example of how a company’s tone at the top can lead to employee theft and fraud. He embezzled $1.5 million from his employer, MCI/WorldCom. Pavlo was convicted of wire fraud in addition to money laundering and obstruction of justice. He was a highly educated person earning an engineering degree and an MBA. He also had a wife and two kids.

What made Pavlo give up his career and family to spend two years in a federal prison? It was the tone at the top of MCI/WorldCom. Walt’s bosses put pressure on him to achieve revenue growth for the company. Revenue projections were put in place and management pressured employees, like Pavlo, to meet or exceed expectations through unethical techniques. Not only did management pressure employees to achieve this growth, but management themselves manipulated the company’s financial statements. Pavlo started to follow management’s lead. Since Pavlo was a Senior Manager in Billings and Collections for MCI/WorldCom, he had the opportunity to make adjustments to Accounts Receivable to minimize bad debts. He was directed by management to make false entries in order to inflate the company’s profit. In the process, he saw an opportunity for himself to profit.

Since management was manipulating the accounting records, Walt did not see it as an ethical breach to do so himself. He set up a dummy investor who called MCI/WorldCom’s customers and offered to settle their debt to the company for a fee. Once an agreement was reached, Pavlo would simply “clear” that customer’s debt on the books. He was able to rationalize this act because he had been trained by management to be unethical and he felt underpaid. Walt Pavlo manipulated the records of MCI/WorldCom for management, and for himself. The company saw a boost to their assets and profits while Walt saw a boost to his bank account.

Were there red flags in the MCI/Worldcom case?

- Pressure to meet or exceed goals – having goals for employees to reach is good, but when management adds the pressure of losing compensation or the employee’s job if they do not perform, the increased pressure creates a serious fraud risk.

- Creating incentives/bonuses for performance – If management gives employees a large monetary incentive to perform, it is more likely to incentivize employees to commit fraud in order to meet management’s performance expectations.

- Trying to meet analyst’s expectations – this was at the core of MCI/WorldCom’s problems. Top management was so preoccupied with meeting analyst’s expectations that they manipulated the company’s books. This led to a trickledown effect with lower management and staff employees following suit.

Obedience vs. Moral Courage

The fraud that Walt Pavlo perpetrated started with his compliance to top management. Pavlo did what was asked of him by his boss. While doing what you are told may not lead to the extensive fraud that Pavlo perpetrated, it still may be unethical. If your employer told you to shortchange all of your customers by one penny or you would be fired, would you? A penny is not much and most of your customers would not miss it. Does this make it right? Did you ever do something wrong as a child and when you were caught you used the “but he/she made me do it” defense? Did that always work? That is because if an act is wrong or unethical, it does not make it right to do it because you were asked to by a higher authority. Carrying out the request even though you know it is wrong would be considered obedience, but not doing the request because it is wrong would be considered moral courage.

Case Study: Stanley Milgram and the Milgram Experiment

Stanley Milgram conducted an experiment in 1963 to prove the theory that people will do what they are told if the task is given to them by someone of authority. Milgram wondered why the people of Nazi Germany would violate the value of humanity when told to do so by a person in authority.

In his experiment, Milgram directed subjects to ask questions of the respondent and told the subject to administer a series of progressively stronger shocks to the respondent if that person answered a question incorrectly. The person receiving the shocks was an actor in another room. On cue, the actor would answer the question incorrectly, moan at smaller shocks, and yell louder with each “stronger” shock. The actor was not hooked up to any machine and was not really receiving any shocks. The person administering the shocks did not know that.

Over two thirds of the subjects administering the shocks valued obedience over moral courage knowing that the shocks they were giving could be lethal.

More information on the Milgram Experiment.

Questions for Research and Discussion

1. What factors do you feel define the moral values you have today?

2. Have you ever committed “time theft” at your work?

- Have you ever witnessed others stealing time?

- What are your thoughts about the ethical implications of stealing time vs. stealing office supplies or other assets?

- Is “time theft” wrong or morally acceptable by society?

3. Have you ever experienced a time when your ethical framework changed?

- What was the situation?

- How did you feel about the issue before?

- How do you feel now?

- Why?

4. Do you feel that the Gallup poll on professional ethics was accurate?

- How would you have ranked the professions listed in the poll?

- Why?

5. Have you ever been the victim of a consumer fraud?

-

- If so, which fraud?

- Were you able to recover your losses?

- Were you the only person affected?

- If you have never been a victim, were you ever presented with a potential consumer fraud?

- Which one?

- How did you avoid becoming a victim?

6. Do some research on Bernie Madoff.

- What was his punishment for the Ponzi scheme?

- How much money did investors lose?

- How was Madoff’s family affected?

7. Was there ever a time in your life that you felt all three sides of the fraud triangle at once?

- What was the situation?

- Did you commit an unethical act as a result?

- Why or why not?

8. Watch the video “Tone at the Top” about Walt Pavlo.

- Do you think that Pavlo’s punishment was fair?

- Give reasons for your answer.

- Do you think management was partly to blame for Pavlo choosing obedience over moral courage and later rationalizing his fraud?

- Could that happen to you?

9. Watch the video “Tone at the Top” about Walt Pavlo.

- What could have MCI/WorldCom’s management have done to prevent Pavlo’s fraud from occurring?

10. Watch the video on Milgram’s experiment.

- How would you have reacted if you were the subject who had to administer electric shocks?

- Do you think that you would have displayed obedience or moral courage?

- Why?

- https://news.gallup.com/poll/245597/nurses-again-outpace-professions-honesty-ethics.aspx ↵

- https://news.gallup.com/poll/1654/honesty-ethics-professions.aspx ↵

- https://www.aicpa.org/interestareas/personalfinancialplanning/resources/practicecenter/professionalresponsibilities.html ↵

- https://www.lexico.com/en/definition/insider_trading ↵

- https://www.lexico.com/en/definition/ponzi_scheme ↵

- https://www.lexico.com/en/definition/pyramid_scheme ↵

- https://www.acfe.com/report-to-the-nations/2018/ ↵

- Donald R. Cressey, Other People's Money (Montclair: Patterson Smith, 1973) p. 30. ↵

the illegal practice of trading on the stock exchange to one's own advantage through having access to confidential information.

a form of fraud in which belief in the success of a nonexistent enterprise is fostered by the payment of quick returns to the first investors from money invested by later investors.

a form of investment (illegal in the US and elsewhere) in which each paying participant recruits two further participants, with returns being given to early participants using money contributed by later ones.