5 Budgeting

Student Learning Objectives:

- Describe why organizations budget and the processes they use to create budgets

- Identify the difference between estimated budgeting amounts and actual results

- Prepare the following budgets: sales budget, production budget, direct materials budget, direct labor budget, manufacturing overhead budget, cost of goods sold budget, selling and administrative budget, and budgeted income statement

Purpose of budgeting

Budgeting is a powerful tool that is widely used for planning, executing, and evaluating organizational operations. A budget is a detailed financial plan for future time periods. Budgets are typically prepared before the budgeted period begins. For this reason, budgeted amounts are estimates and not actual amounts. Most organizations use historical data and current operating plans to estimate budgeted amounts. An effective manager can make these estimates with remarkable accuracy. For example, if the lease payment is $2,000 per month it is easy to project in the upcoming budget that yearly rent expense will be $24,000. However, budgets are not static. Budgets are frequently revised during the period due to unforeseen circumstances such as a change in economic conditions, changes in sales demand, or other factors that affect the organization. Budgets are used by organizations for planning, controlling, and evaluating performance.

Planning. The budget is created prior to the time period covered by the budget. The completed budget is then used by management to help plan operations including activities like scheduling production, purchasing materials, and making capital investments.

Controlling. The budget is used to control operations during the time period covered by the budget. It sets forth expected targets and limitations. The budget projects sales and revenue targets, production targets, and spending limitations for budgeted expenditures. For example, the budgets project the amount to be spent on raw materials; direct labor; and selling, general and administrative expenses so managers should choose expenditures within the budgetary guidelines.

Performance evaluation. The budget is also used to evaluate the actual results achieved during the time period covered by the budget. Performance evaluation involves comparing the actual results to the results projected in the budget. Comparing budgeted activities to actual results is a widely used method for overall performance evaluation at all levels of the organization. For example, management can evaluate various departments or activities to see if they met expected targets or stayed within budgeted spending limitations. This feedback can be used to correct organizational inefficiencies or in some cases to justify adjusting budgeting projections and assumptions going forward.

Master budgets

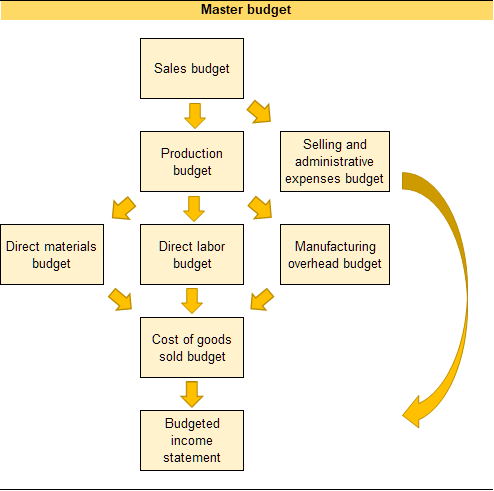

The collection of budgets for an organization are known as the master budget. An organization’s master budget consists of a set of interrelated but independent budgets that articulate the organization’s sales, production, profit, and financial position for a specified time period. A master budget is a tool used by management to effectively plan, control, and evaluate business operations.

An overview of some of the independent budgets that make up the master budget and how these individual budgets interrelate is provided in the below illustration.

The budgets are interrelated with some budgets feeding into other budgets. Therefore, budgets should be completed in a specific order. The sales budget is the first budget completed in the master budget. Estimated sales drive all other organizational decisions such as how many units to produce, how many people to employ, and what kind of facilities are necessary to support that level of sales activity.

Video Illustration 1: Preparing the sales budget

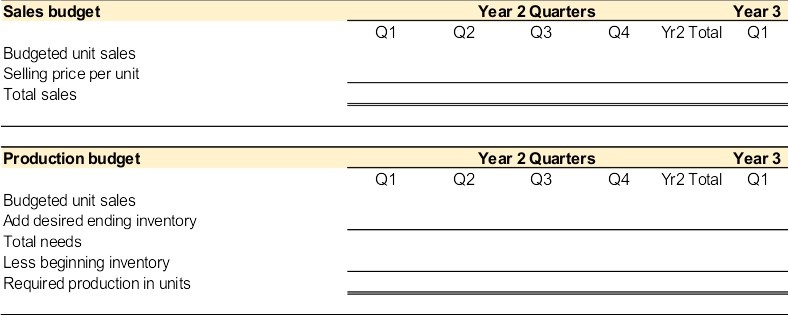

Stephanie Shuck invented a revolutionary new product called the water wiz. The water wiz can be programmed to deliver the perfect amount of water and nutrients to virtually any type of potted plant. The company experienced a profitable first year of operations. In the final quarter of the first year, Stephanie decided to compile a master budget to plan for the second year of operations.

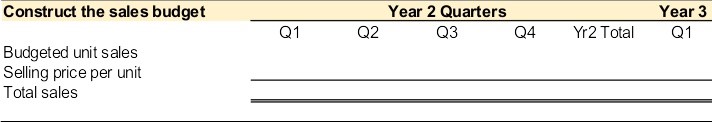

The sales budget is the first budget prepared in the master budget. All of the individual budgets within the master budget are driven by estimated sales. Estimating sales is an important part of the process as this number is used to project everything else such as sales revenue collected, production needs, and organizational expenditures. The sales budget details the estimated sales quantity, sales price per unit, and total sales revenue.

For this illustration, assume that Stephanie only sells one product, the water wiz. The water wiz sells for $20 per unit. For the upcoming year, she expects to sell 20,000 units in the first quarter, 24,000 units in the second quarter, 33,000 units in the third quarter, and 40,000 units in the fourth quarter. In the first quarter of year 3, she expects to sell 21,000 units.

Video Illustration 2: Preparing the production budget

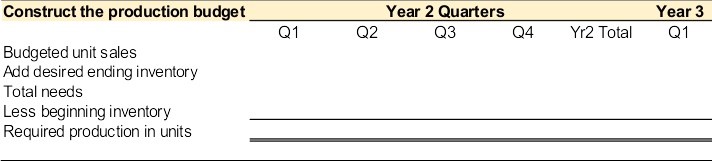

The production budget is prepared after the sales budget. The production budget estimates the number of units that need to be produced to 1) meet sales demand and 2) maintain the desired level of finished goods inventory on hand. Normally producing and storing a large quantity of excess inventory is not recommended. However, it is common practice to produce a small quantity of excess inventory or a desired level of ending finished goods inventory. The excess inventory serves as a buffer in case sales demand is more than expected, production issues occur, or the organization needs additional inventory for another reason. Maintaining a small amount of excess inventory is preferable to running out of inventory.

For this illustration, assume that Stephanie wants to maintain a desired ending finished goods inventory in the current quarter equal to 10% of the next quarter’s production. Stephanie began the first quarter of year 2 with 2,000 units in the beginning finished goods inventory account. In the first quarter of year 3, the desired ending finished goods inventory is projected to be 2,700 units.

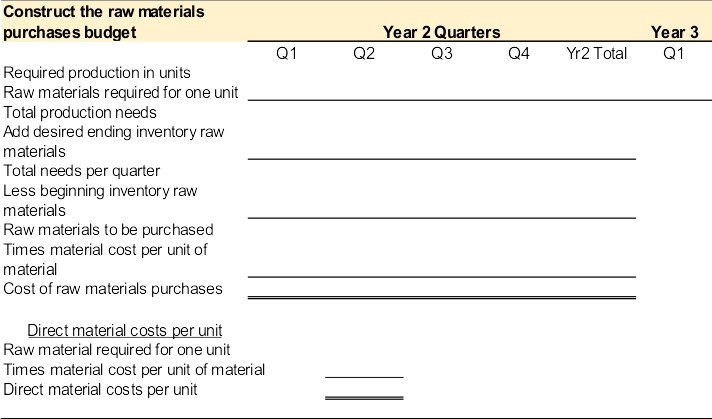

Video Illustration 3: Preparing the raw materials (direct materials) purchases budget

After the required number of units to be produced is determined, the raw materials purchases budget is prepared. The raw materials budget estimates the amount of raw materials needed to 1) produce the required number of units plus 2) the desired level of raw materials ending inventory. Purchasing a small quantity of excess raw materials, or the desired level of ending raw materials inventory acts as a buffer in case additional raw materials are needed due to unexpected production issues or sales demand.

In a manufacturing environment, it is common to use a number of raw materials in the production of a final product. A raw material budget is prepared for each direct raw material used. For example, the production of a student desk may require wood, hardware, and stain. A separate raw materials budget would be produced for each of these materials.

It is also common for the quantity of raw material used in production to be more or less than one unit. For example, assume that mold for a single water wiz unit requires 3 pounds of eco-friendly, biodegradable composite material. The quantity of material is 3 pounds per unit and not one unit of material for one unit of product.

For this illustration, assume that Stephanie wants to maintain a desired ending raw material inventory in the current quarter equal to 20% of the next quarter’s production. The only raw material used to produce a single unit is the 3 pounds of eco-friendly, biodegradable composite material. The composite material costs $1.00 per pound. Stephanie began the first quarter of year 2 with 12,240 pounds in the beginning raw material inventory account.

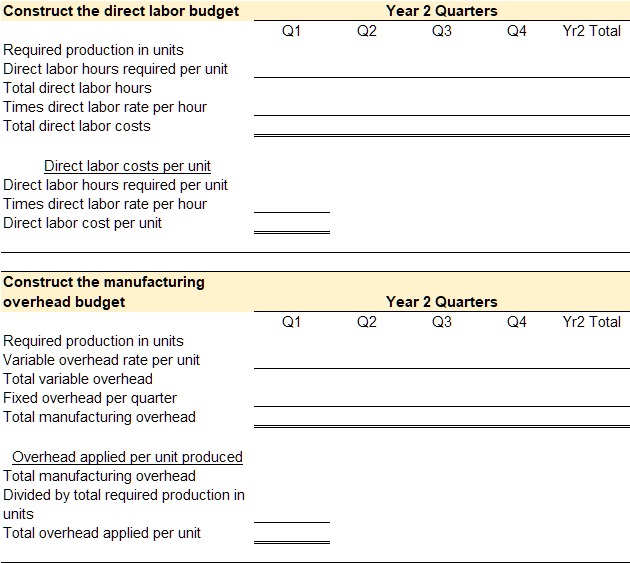

Video Illustration 4: Preparing the direct labor budget

After required production in units is determined, the direct labor budget is prepared. The direct labor budget calculates the total number of labor hours and the total cost of direct labor needed to satisfy production.

It is common for the number of direct labor hours needed to produce one unit to be more or less than one unit. For example, assume that a worker can pour and finish one unit in 15 minutes. The direct labor hours needed to produce a single unit is .25 of an hour (15 minutes / 60 minutes in an hour).

To continue the water wiz illustration, assume that each unit requires 0.25 direct labor hours to complete. The average direct labor rate is $15 per hour.

Video Illustration 5: Preparing the manufacturing overhead budget

After the required production in units is determined, the manufacturing overhead budget is prepared. The manufacturing overhead budget calculates the total manufacturing overhead that will be incurred to satisfy production.

Manufacturing overhead includes indirect materials used in production, such as glue, screws, and nails; indirect labor used in production, such as wages for the production supervisor or quality control; and all other costs incurred to manufacture a product, such as rent, insurance, taxes, and utilities incurred on the manufacturing facilities.

Manufacturing overhead is typically classified as variable or fixed. Variable manufacturing overhead costs are the same per unit but total costs depend on the quantity produced. Fixed manufacturing overhead costs are the same in total regardless of the quantity produced.

To continue the water wiz illustration, assume that each unit requires $0.10 of variable manufacturing overhead per unit produced and total fixed manufacturing overhead is $41,000 per quarter.

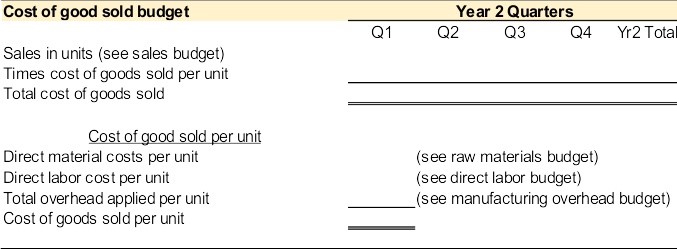

Video Illustration 6: Preparing the cost of goods sold budget

The cost of goods sold budget is prepared after the raw materials budget, direct labor budget, and manufacturing overhead budgets are prepared. The cost of goods sold budget determines the estimated cost of the inventory sold during the period.

Cost of goods sold is the total manufacturing costs, or product costs, incurred to make the products that were sold. Product costs include the costs for direct material, direct labor, and manufacturing overhead.

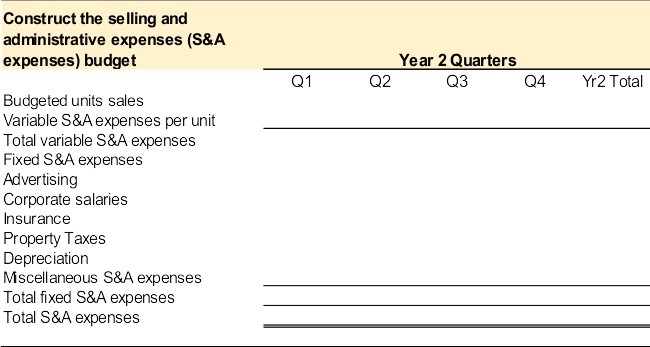

Video Illustration 7: Preparing the selling and administrative expenses (S&A expenses) budget

The selling and administrative expenses (S&A expenses) budget is prepared after the sales budget is created. Selling and administrative expenses are classified as period costs, or any cost not necessary to manufacture the product. Product costs are direct material, direct labor, and manufacturing overhead. Product costs are used to calculate the cost of goods sold. All other costs are considered period costs. Although the period costs are not necessary to produce the product, they are necessary to sustain the organization.

Selling and administrative expenses are typically classified as variable or fixed. Variable costs are the same per unit but total costs depend on the quantity sold. Fixed costs are the same in total regardless of the quantity sold.

For this illustration, assume that Stephanie projects the following selling and administrative expenses: variable S&A expenses $6.20 per unit; advertising $25,000 per quarter; corporate salaries $60,000 per quarter; insurance $12,000 per quarter; property taxes $1,000 per quarter; depreciation $21,000 per quarter; miscellaneous S&A expenses $9,000 per quarter.

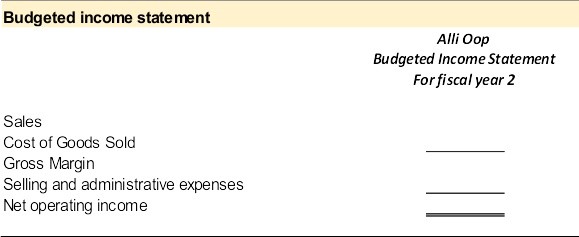

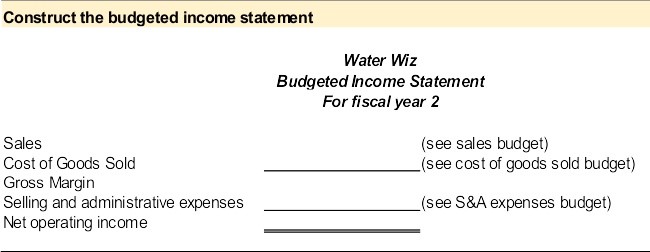

Video Illustration 8: Preparing the budgeted income statement

After all the other budgets are prepared, budgeted financial statements can be prepared. Standard financial statements include the income statement, balance sheet, and statement of cash flows. The income statement reports the profitability of the organization during a specific period of time. The balance sheet reports the financial position of the organization at a single point in time. The statement of cash flows reports the cash inflows and cash outflows of an organization during a specific period of time.

For this illustration, use the data provided by the other budgets and prepare the budgeted income statement.

Practice Video Problems

Practice Video Problem 1: Sales and production budgets

Alli Oop produces and sells pink basketballs for professional players and charity events. The company is entering its second year of operations. The company projects the following sales in units for the upcoming fiscal year: 8,000 units Q1; 9,300 units Q2; 6,000 units Q3; 5,000 units Q4; and 9,000 units in quarter 1 of year 3. The basketballs sell for $18 per unit.

Alli Oop wants to maintain a desired ending finished goods inventory in the current quarter equal to 20% of the next quarter’s production. The company began the first quarter of year 2 with 1,600 basketballs in the beginning finished goods inventory. In the first quarter of year 3, the desired ending finished goods inventory is projected to be 1,200 basketballs.

Required 1: Prepare the sales and production budgets

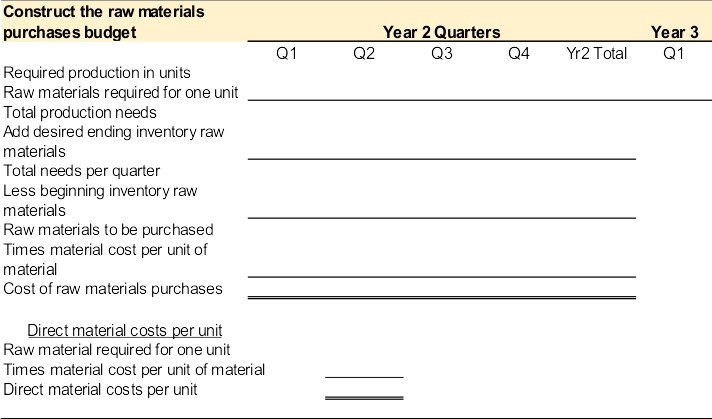

Practice Video Problem 2 Part 1: Budgets to determine product costs and cost of goods sold

Alli Oop produces and sells pink basketballs for professional players and charity events. The company is entering its second year of operations. The company’s production budget reported the following production in units for the upcoming fiscal year: 8,260 units Q1; 8,640 units Q2; 5,800 units Q3; 5,800 units Q4; and 8,400 units in quarter 1 of year 3.

Each basketball requires 2 pounds of rubber material at a cost of $1.50 per pound. Alli Oop wants to maintain a desired ending raw materials inventory in the current quarter equal to 10% of the next quarter’s production. The company began the first quarter of year 2 with 1,652 pounds of raw material in beginning inventory.

Required 1: Prepare the raw materials purchases budget

Practice Video Problem 2 Part 2: Budgets to determine product costs and cost of goods sold

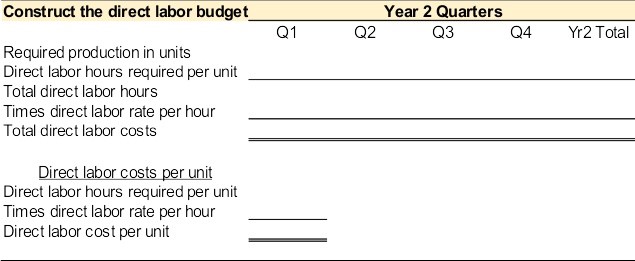

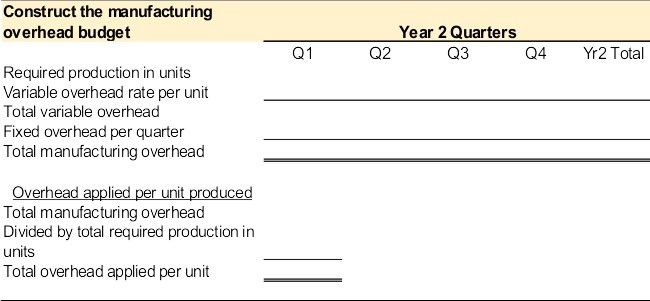

Alli Oop produces and sells pink basketballs for professional players and charity events. The company is entering its second year of operations. The company’s production budget reported the following production in units for the upcoming fiscal year: 8,260 units Q1; 8,640 units Q2; 5,800 units Q3; 5,800 units Q4; and 8,400 units in quarter 1 of year 3.

Each basketball requires .10 direct labor hours to produce. The average pay rate for direct labor is $18 per hour. Manufacturing overhead is projected to be $0.50 per unit variable and fixed overhead $45,000 per quarter.

Required 2: Prepare the direct labor budget and manufacturing overhead budget

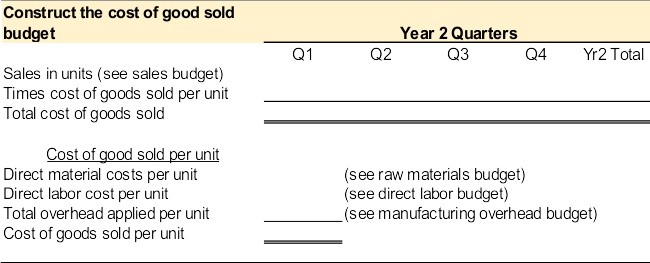

Practice Video Problem 2 Part 3: Budgets to determine product costs and cost of goods sold

Alli Oop produces and sells pink basketballs for professional players and charity events. The company is entering its second year of operations. The company projects the following sales in units for the upcoming fiscal year: 8,000 units Q1; 9,300 units Q2; 6,000 units Q3; 5,000 units Q4; and 9,000 units in quarter 1 of year 3. The basketballs sell for $18 per unit.

Required 3: Prepare the cost of goods sold budget

Practice Video Problem 3: Budgeted income statement

Alli Oop produces and sells pink basketballs for professional players and charity events. The company is entering its second year of operations. The sales budget reported 28,300 in total sales in units for year 2. Each basketball sells for $18 per unit. Total sales dollars is $509,400. The cost of goods sold budget reported the total cost of goods sold of $328,727. The selling and administrative budget reported total selling and administrative expenses as $150,900.

Required 1: Prepare the budgeted income statement for fiscal year 2