4 Segmented Income Reporting

Student Learning Objectives:

- Explain the purposes and advantages of segment income reporting

- Identify and account for traceable fixed costs and common fixed costs

- Prepare a segmented income statement that reports profit data for individual segments

- Analyze segment profitability in relation to the whole organization

- Compute breakeven for the whole organization as well as individual segments within the organization

Purpose of segmented income reporting

In addition to companywide income reporting, managers or owners also need to measure the profitability of individual segments within their organization. A segment is a part or activity within an organization about which managers would like cost, revenue, or profit data. Organizational segments can include divisions, individual stores, geographic regions, customers, or product lines. For example, Graeters Ice Cream will look at the profitability of the company as a whole as well as the profitability of each individual retail location. The individual stores are considered segments within the organization.

The contribution margin format can be used to prepare segmented income statements. The contribution margin income statement classifies costs on the basis of cost behavior. Cost behavior is how a cost reacts to changes in production or sales quantity. Cost behavior is classified as variable, fixed or mixed. The contribution margin income statement format is used to allocate costs to the identified segments and then to prepare segmented income statements reporting the profitability of each segment. Managers can use this data to make informed decisions about the individual segments in relation to the whole organization.

Video Illustration 1: Overview of organizational segments

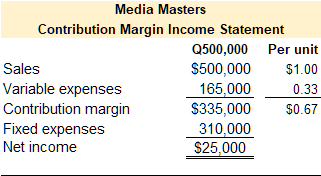

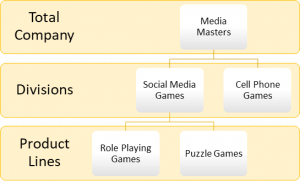

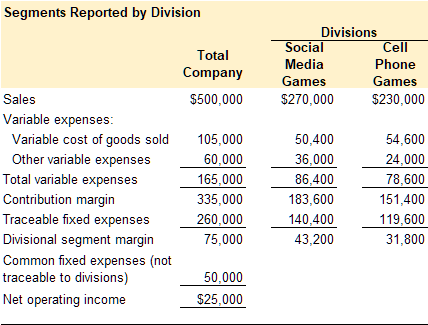

Media Masters is a rapidly growing social media game development company. The company’s programmers develop online games for social media applications and cell phones. To manage growth and make informed decisions, the company’s management has asked for a contribution margin income statement as well as segmented income statements.

A contribution margin income statement for the total company and an example of the company’s segments are presented below.

Segmented income reporting

Segmented income reporting traces sales, variable costs, and fixed costs to the segments responsible for generating the sales revenue or costs. Since sales and variable costs are typically driven by units sold these costs can be easily traced to a particular segment. For example, it is easy to determine if a sale was a social media game or a cell phone game.

Fixed costs are more difficult to allocate to segments since some fixed costs are generated by a particular segment and some fixed costs are common to all the segments. Therefore, fixed costs are divided into two categories.

Traceable fixed costs are costs that can be traced directly to a segment. For example, assume that the social media games segment employs a product developer that works solely on social media games. Her salary is a fixed cost that is traceable to that division. Another way to look at traceable fixed costs is these costs could be eliminated if the segment were eliminated.

Common fixed costs are costs that are common to, or shared by, all the segments. For example, the President of Media Masters manages both divisions. Her salary would be considered a common fixed cost since it is not traceable to a particular segment. In segment income reporting, common fixed costs are not used to calculate the segment margin since these costs are not traceable to the segment and would not be eliminated if the segment were eliminated. Instead, common fixed costs are deducted from the segment margin to arrive at net operating income.

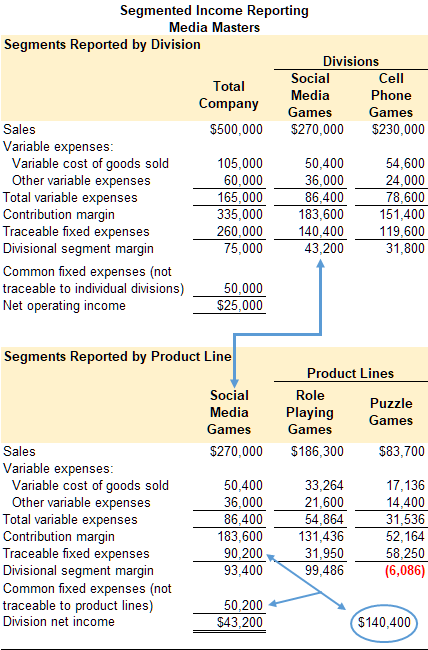

Media Masters’ segmented income statements for the total company, divisions, and product lines are presented in the following illustration.

Breakeven calculations for segmented income reporting

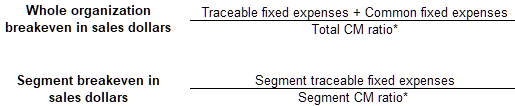

Breakeven can be computed for the whole organization or for individual segments within the organization. Breakeven is the point at which net operating income equals zero. Or, an organization or segment breaks even when its sales revenue covers total costs–both variable and fixed. The formulas to compute breakeven in sales dollars for the whole organization as well as breakeven in sales dollars for segments within the organization are provided below.

*Contribution margin ratio or CM ratio (contribution margin in dollars/sales revenue in dollars)

Video Illustration 2: Computing breakeven

Media Masters’ segmented income statement for the total company and its two divisions is presented below. Compute breakeven for the whole organization and breakeven for the social media games division.

Breakeven in sales dollars for the whole organization

Breakeven in sales dollars for social media games segment

Practice Video Problem 1 Part 1: Segmented income statements

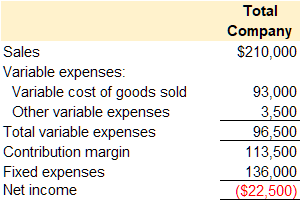

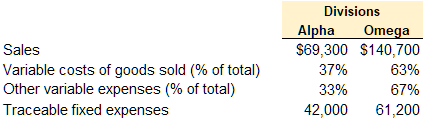

Whole Universe, a wholesale distributor of electronic products, has been experiencing losses for the last two fiscal quarters. The most recent quarterly contribution margin income statement is presented below.

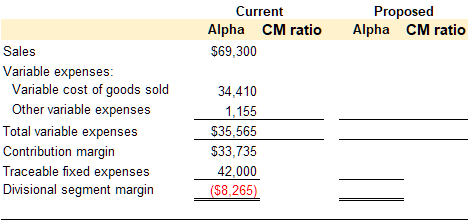

In an effort to isolate the problem, the CFO asked for segmented income reporting by division. The company has two divisions, Alpha and Omega. Additional divisional data is provided below.

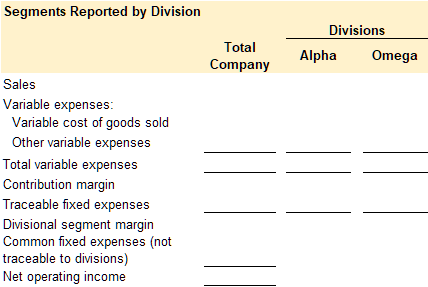

Required 1: Prepare a contribution format income statement segmented by divisions.

Practice Video Problem 1 Part 2: Segment cost volume profit analysis

Required 2: As a result of a marketing study, the CFO believes that sales in the Alpha division could be increased to $97,000 if monthly advertising traceable to the Alpha division were increased by $6,000. Would you recommend the proposed increase to advertising? Show computations to support your answer.

Practice Video Problem 2: Companywide and segment breakeven

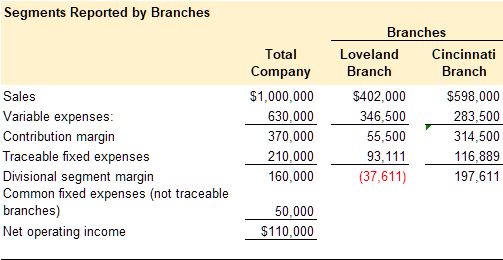

Ba Boutique sells high-end, custom-made clothes. The company has two branch locations in Ohio, one in Cincinnati and one in Loveland. Ba Boutique’s segmented income statement for the total company and branch locations is provided below.

Required 1: Compute breakeven in sales dollars for the whole organization.

Required 2: Compute breakeven in sales dollars for the Loveland Branch

Required 3: Compute breakeven in sales dollars for the Cincinnati Branch