1 Managerial Accounting and Cost Concepts

Student Learning Objectives:

- Distinguish financial accounting from managerial accounting

- Distinguish between product and period costs

- Distinguish between fixed, mixed, and variable costs, and relate them to cost drivers

- Compile a traditional income statement

- Calculate the contribution margin and contribution margin ratio

- Compile contribution margin income statement

- Contrast the contribution margin income statement and the traditional income statement

Managerial accounting versus financial accounting

In general, financial accounting is concerned with classifying, recording, and reporting financial transactions in a formal accounting system. Financial accounting is relatively uniform and prescribed by various regulatory bodies, such as the Securities and Exchange Commission, the Financial Accounting Standards Board, and the Public Company Accounting Oversight Board. Accountants, higher management, creditors, investors, and other external users are the primary users of financial accounting reports.

Managerial accounting is concerned with classifying, analyzing, and reporting data for internal decision making. Internal users at all levels of the organization use managerial accounting reports. Managerial accounting tools are used by management to plan, control, and evaluate business operations and to make internal business decisions.

Cost classification: Product versus period

Cost classification is the process of separating costs into different categories. The costs incurred by an organization can be classified in many different ways. An important cost classification in accounting is distinguishing product costs from period costs. In financial accounting, product costs are treated differently than period costs. As a general rule, product costs are capitalized as a part of the inventory asset account; whereas, period costs are expensed as incurred.

Product costs are all costs associated with purchasing or producing inventory for resale.

Period costs are all other costs not associated with purchasing or producing inventory for resale but are necessary for sustaining the organization, selling the inventory, and servicing customers.

Merchandising business: Product and period cost classifications

A merchandising business is a business entity that purchases finished inventory products from the business that manufactures the inventory with the intent to resale it and make a profit. A merchandiser makes a profit by marking up the inventory and selling it at a higher price to its customers. Retail stores such as Walmart and Target are examples of merchandising operations.

For a merchandiser, the costs of purchasing and holding the inventory are product costs. All other costs associated with sustaining the organization and selling the product are classified as period costs. Period costs include all non-inventory costs such as rent, utilities, wages, customer service, and advertising. Period costs are important to sustaining the organization, selling the inventory, and servicing customers but they are not included in the cost of the inventory.

To illustrate, assume that Kelly owns a small business selling seat cushions at sporting events. She buys the cushions from a wholesale company for $1 each and resales them to customers at the stadium for $5 each. Last year, she sold 10,500 seat cushions. She also paid $15,000 for rent on her booth and $9,600 for miscellaneous expenses. In this example, total product costs are calculated as $1 per cushion times 10,500 sold equals $10,500. Or, her product costs equal the costs of the inventory or product. Period costs are $15,000 rent plus $9,600 miscellaneous expenses for a total of $24,600. Period costs are the other non-inventory costs Kelly incurred to run her business.

Manufacturing business: Product and period cost classifications

A manufacturing business is a business entity that uses raw materials, parts, or other components to make a finished good. The finished good is then considered inventory in a manufacturing organization. A manufacturer makes a profit by selling the inventory for more than it costs them to produce the inventory for resell.

For a manufacturer, the costs associated with making the inventory are product costs. The three categories of costs included in product costs when manufacturing inventory are:

Direct materials—raw materials costs that can be easily and economically traced to the production of the product

Direct labor—manufacturing labor costs that can be easily and economically traced to the production of the product

Manufacturing overhead—all other indirect costs associated with manufacturing the product that are not direct material or direct labor. All indirect—not direct material or direct labor—costs incurred in the manufacturing process are included in manufacturing overhead. Examples of manufacturing overhead costs include indirect materials, e.g. glue, nails, sandpaper; indirect labor, e.g. the production supervisor’s salary or quality control; and all other production costs incurred to run the production facility, e.g. rent, utilities, and taxes on the production facility.

All other costs associated with sustaining the organization and selling the product are classified as period costs. Period costs include all non-inventory costs such as the costs to provide administrative and selling services including rent, utilities, wages, customer service, and advertising. Period costs are important to sustaining the organization, selling the inventory, and servicing customers but they are not included in the cost of producing inventory.

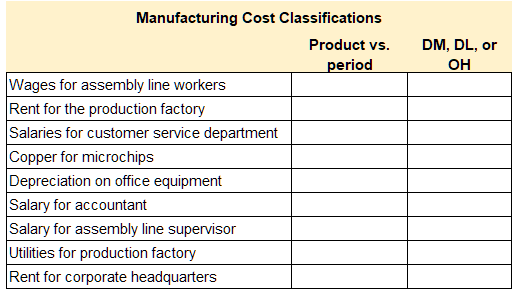

Video Illustration 1: Identifying product and period cost classifications for a manufacturer

Cincy Chips produces microchips for small electronic devices. Classify the following costs as product or period. If the cost is a product cost, classify the cost as direct material, direct labor, or manufacturing overhead.

Cost behavior: Variable, fixed, and mixed

Another important classification in managerial accounting is cost behavior. Cost behavior is how a cost reacts to changes in production, usage, or sales quantity. Cost behavior is classified as variable, fixed, or mixed.

Variable—the same cost per unit but the total cost depends on the quantity produced, used, or sold

Fixed—the same cost in total regardless of the quantity produced, used, or sold but the per-unit cost changes depending on the quantity produced, used, or sold

Mixed—a cost that has both a variable and a fixed component

An effective manager must consider cost behavior in order to predict future costs.

To illustrate cost behavior assume that Big Drink Company sells drinks in souvenir cups at an entertainment venue. Big Drink purchases the souvenir cups from a manufacturer for $1 each. Then they sell the cups for $10 filled with the customer’s choice of beverage.

The cost of the souvenir cups is a variable cost. The cost per cup is always $1 per unit but the total cost incurred depends on how many drinks are sold. For example, if they sell 100 drinks, the total costs are $1 times 100 equals $100. If they sell 500 drinks, the total costs are $1 times 500 equals $500.

The cost of renting the booth at the entertainment venue is a fixed cost. Assume Big Drink pays $3,500 per month to rent a booth at the entertainment venue. The total cost for rent is always the same regardless of how many drinks they sell. However, the per-unit cost allocated to drinks sold changes depending on the quantity sold. For example, if Big Drink sells 100 drinks the rent amount allocated per-unit is $3,500 divided by 100 equals $35 per drink. If they sell 500 drinks, the rent amount allocated per-unit is $3,500 divided by 500 equals $7 per drink.

The cost charged for utilities is usually a mixed cost. For example, Big Drink likely pays a minimum charge regardless of how much electricity is used. This minimum charge is fixed because it does not change depending on actual usage. Then they pay a charge per kilowatt-hour used. This part of the electric bill is variable since it depends on usage. The total electric bill has both a fixed and variable component so it is considered a mixed cost.

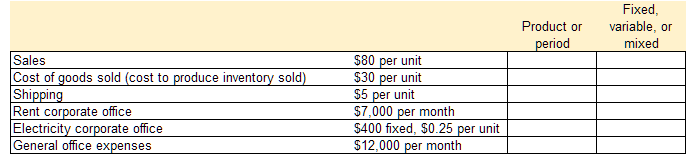

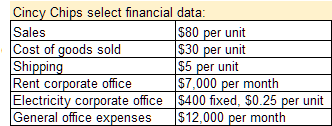

Video Illustration 2: Cost classifications and cost behavior

Cincy Chips produces microchips for small electronic devices. They produced and sold 600 microchips in the current month. Select financial data for Cincy Chips is provided below. Determine the cost classifications and cost behavior for the below costs.

Relevant range of production

The relevant range of production is the range between a minimum and a maximum production activity where certain revenue and expense levels can be expected to occur. Revenue and expense amounts will likely increase or decrease when production activity falls outside of the relevant range. In a manufacturing environment, product and period costs can be estimated with a reasonable degree of accuracy within the relevant range. Cost estimates are less likely to be accurate when production falls outside of the relevant range.

For example, at Cincy Chips the manufacturing line can produce up to 1,000 units per day. Production in excess of 1,000 units per day would require the company to purchase a new manufacturing line which would significantly change the current cost estimates. Therefore, maximum production in the relevant range is set at 1,000 units.

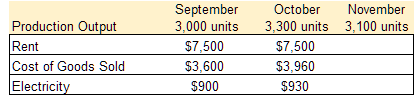

Video Illustration 3: Using cost behavior to predict future costs

Stephanie, the production manager, is collecting data for the November budget. Cost data are generated by the manager for each department. The production manager is responsible for estimating the costs for rent expense, cost of goods sold, and electricity. Data for September and October are provided below. Predict the costs for November.

Traditional income statement versus contribution margin income statement

An income statement also referred to as a profit and loss statement, reports an organization’s revenue and expenses for a specified period of time. The formula to compute net income is revenues less expenses. If an organization has more revenue, the resulting number is positive and represents net income or profit. If an organization has more expenses, the resulting number is negative and represents a net loss. On a traditional income statement, costs are classified as product or period. On a contribution margin income statement, costs are classified as variable or fixed. Regardless of how the costs are classified, reported net income or profit is always the same on both income statements.

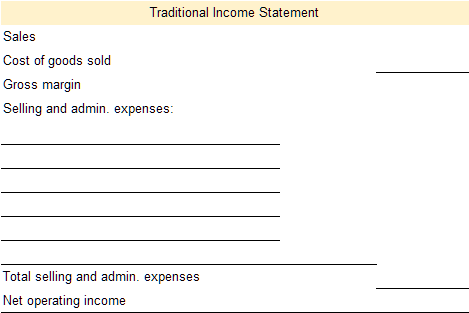

Traditional income statement

A traditional income statement is primarily used for financial reporting purposes. A traditional income statement, reports an organization’s revenue and expenses for a specified period of time. On a traditional income statement, the organization’s expenses are presented based on product and period cost classifications.

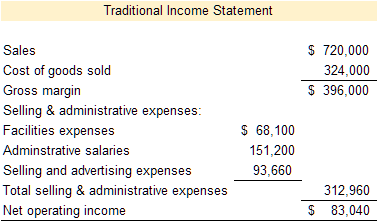

Video Illustration 4: Traditional income statement explained

An example of a traditional income statement is presented below.

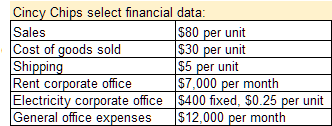

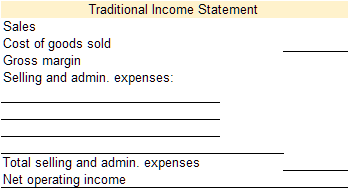

Video Illustration 5: Preparing a traditional income statement

Cincy Chips produces microchips for small electronic devices. They produced and sold 600 microchips in the current month. Select financial data for Cincy Chips is provided below. Prepare a traditional income statement.

Contribution margin income statement

A contribution margin income statement is primarily used by internal users, usually management, for planning operations, controlling operations, and making decisions. Like a traditional income statement, the contribution margin income statement reports an organization’s revenue and expenses for a specified period of time. The contribution margin income statement classifies expenses on the basis of cost behavior—variable versus fixed.

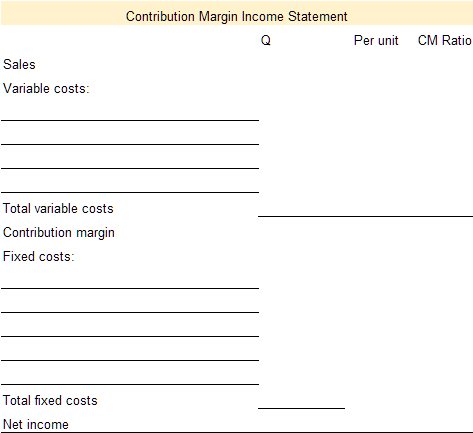

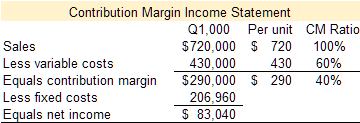

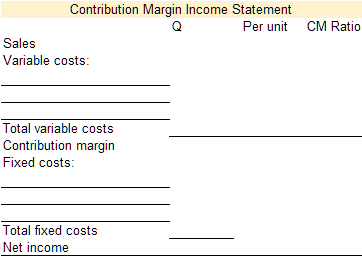

Video Illustration 6: Contribution margin income statement explained

Below is an example of a contribution margin income statement.

Video Illustration 7: Preparing a contribution margin income statement

Cincy Chips produces microchips for small electronic devices. They produced and sold 600 microchips in the current month. Select financial data for Cincy Chips is provided below. Prepare a contribution margin income statement.

Practice Video Problems

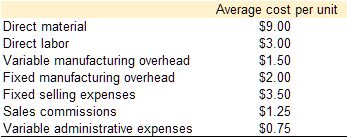

Practice video problem 1: Product, period, fixed, and variable costs

Crazy Candy’s Carpets makes whimsical and eccentric rugs. The relevant range of production is 10,000 to 14,000 units per month. When she produces and sells 12,000 units the average costs per unit are as follows:

Required 1: What is the total amount of product costs incurred to make 14,000 units?

Required 2: What is the total amount of period costs incurred to sell 14,000 units?

Required 3: What is the total amount of costs incurred to make and sell 11,000 units?

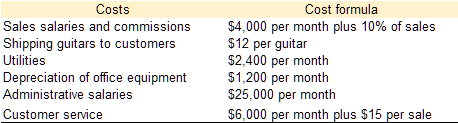

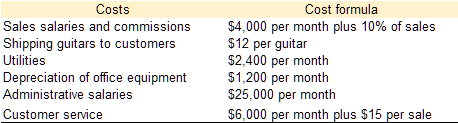

Practice video problem 2: Traditional income statement

Magick Musicals sells custom guitars that they purchase from a local artist. Magick purchases the guitars from the artist for $960 each, marks them up, and resells them for $2,200 each. Magick’s general and administrative costs are presented below.

In May, Magick purchased and sold 150 guitars.

Required: Prepare a traditional format income statement for May

Practice video problem 3: Contribution margin income statement

Magick Musicals sells custom guitars that they purchase from a local artist. Magick purchases the guitars from the artist for $960 each, marks them up, and resells them for $2,200 each. Magick’s general and administrative costs are presented below.

In May, Magick purchased and sold 150 guitars.

Required: Prepare a contribution margin income statement for May. Show revenue and variable costs on both a total and a per-unit basis.