9 Differential Decision Making

Student Learning Objectives:

- Classify costs and benefits as relevant or irrelevant for decision making

- Prepare an analysis for adding or dropping segments/product lines decisions

- Prepare an analysis for make or buy decisions

- Prepare an analysis for special order decisions

- Prepare an analysis for sell or process further decisions

Differential decision making

Decision making is a fundamental managerial skill required to effectively run an organization. In organizations, decisions need to be made about what products or services to sell, what prices to charge, and how to maximize profits. In most cases, managers are choosing between at least two competing alternatives. The goal of effective managerial decision making is to select the alternative that yields the most benefit to the organization by comparing the costs and benefits of the alternatives.

When a manager is comparing the costs and benefits of competing alternatives it is not necessary, or even possible in many cases, for them to consider all of the financial data for the entire organization. Generally, effective decisions are based on relevant costs or benefits. Relevant costs or benefits are defined as costs or benefits that differ between the alternatives. The process of analyzing only relevant costs and benefits is known as differential decision making.

Using relevant costs to make specific managerial accounting decisions is the focus of this chapter. Identifying relevant costs and benefits for differential decision making is covered in the next section. Differential decision making tools for four common managerial decisions are covered in the remaining sections. Specifically, tools that aid with the following decisions are illustrated: adding or dropping a segment; making or buying (outsourcing); accepting or rejecting a special order; and selling or further processing a joint product.

Identifying relevant costs and benefits

Relevant costs or benefits are defined as costs or benefits that differ between alternatives. If a cost or benefit does not differ between alternatives, it is not considered relevant to the decision. If a cost or benefit differs between alternatives, it is considered relevant to the decision. The underlying theory is that costs or benefits that do not differ would not change regardless of which decision is made. Since they are the same regardless, it is not necessary to consider them when making a decision. Relevant costs are also considered avoidable costs.

To illustrate relevant costs, assume that Kendra is trying to decide if she wants to make dinner at home or go out to dinner. It is not necessary for Kendra to compile all of her personal financial information, e.g. income, rent, and other expense data, to make this decision. Her income and her monthly rent payment are both the same regardless if she makes the meal or goes out to eat. Since these costs are the same for both alternatives, they are not relevant. Only the costs and benefits that are different between the alternatives are relevant. Examples of costs that differ between the two alternatives are the cost of the food required to make the meal at home, the cost of the restaurant meal, and the cost of gas or parking necessary to go out to eat. If she decides to make the meal, she must purchase groceries. If she decides to go out to eat, she does not need to purchase the groceries to make the meal. This cost differs between the alternatives so it is relevant to this decision. In other words, the cost to purchase groceries can be avoided if she decides to go out to dinner. Therefore, it is an avoidable cost. Avoidable costs are always relevant.

Sunk costs are not relevant to a decision. Sunk costs are costs that have already been incurred and therefore cannot be avoided. In the above example, the cost of the car that Kendra would drive to the restaurant is considered a sunk cost.

Analyzing allocated fixed costs

Fixed costs are commonly included in differential decision making involving segments within an organization such as individual products, product lines, geographic locations, or departments. Fixed costs are more difficult to analyze since some fixed costs are generated by a particular segment and some fixed costs are common multiple segments. Therefore, fixed costs are divided into two categories.

Avoidable fixed costs are fixed costs that can be traced directly to a segment and would be avoided if the segment were eliminated. Since these fixed costs can be avoided they are relevant to the decision.

Allocated fixed costs (unavoidable) are fixed costs that are common to, or shared by, more than one segment. Allocated fixed costs are not relevant to a segment decision if they would not be eliminated if the segment were eliminated.

For example, assume that a small drug store has two departments—prescription medications and over-the-counter medications. Both departments are housed in the same building. The cost of rent for the building would be considered an allocated fixed cost since it would not be eliminated if one of the departments were eliminated. It rent is unavoidable, or not different regardless of what segments are housed within the building, it is not considered relevant to a decision about one of the segments.

Adding or dropping a segment

Differential decision making can be applied to a decision about adding or dropping a segment within an organization. Examples of business segments include product lines, geographic locations, or departments. Organizations must evaluate the products and services that they offer and determine the product mix or segment structure that best meets the organization’s objectives. Differential decision analysis using relevant costs can be used to quantify the effects of adding or dropping a segment. Of course, both quantitative and qualitative factors must be considered for any decision.

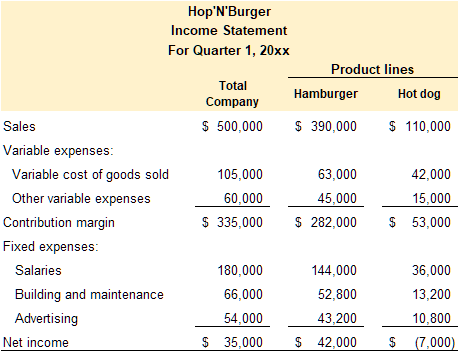

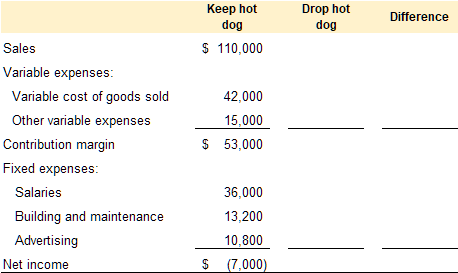

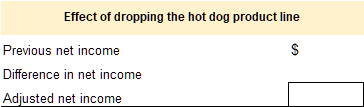

Video Illustration 1: Adding or dropping a segment

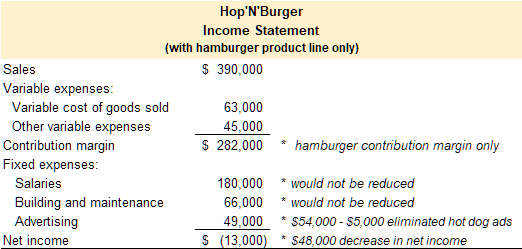

Hop’N’Burger is a local drive-thru restaurant that offers hamburgers and hot dogs. They have two product lines, hamburgers and hot dogs. According to the segmented income statement provided below, the hot dog product line lost $(7,000) in the previous quarter. The manager is considering dropping the hot dog product line to focus on hamburgers. The manager collected the additional information presented below to aid in making this decision.

Additional information:

1.) The revenue and all of the variable expenses are traceable to the product lines. They would be eliminated if the product line was dropped.

2.) Salary expense is for the store manager and the hourly employees. None of the employees would be terminated if the hot dog product line was dropped.

3.) Building and maintenance represent the expenses related to the restaurant property including rent, insurance, and deprecation. None of these costs would be eliminated if the hot dog product line was dropped.

4.) The majority of advertising expense is general and represents both product lines. However, $5,000 of the advertising budget is spent to advertise the hot dog product line. This advertising would be eliminated if the hot dog product line was dropped.

Prepare a differential analysis to determine if the hot dog product line should be dropped.

Check figures:

Make or buy (outsourcing) decision

An organization has the option to perform most business activities internally or to purchase the product or service from an external supplier. Evaluating this decision is traditionally known as a make or buy decision. Although this differential decision making tool is referred to as a make or buy decision, it is also used to analyze performing any activity internally versus outsourcing the activity to an outside supplier. For example, this tool can be used to compare the costs of making a physical product versus buying the product from an outside supplier. It can also be used to compare the costs of performing other activities internally, such as payroll and customer service, versus outsourcing those services to an external company.

Video Illustration 2: Make or buy (outsourcing) decision

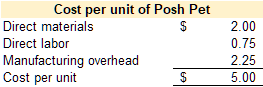

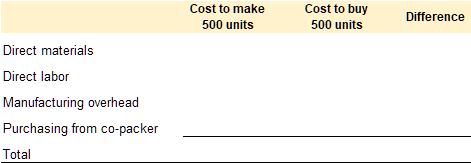

Jada developed an all-natural, human-grade dog food called Posh Pet. She is currently making the dog food in a small rented space. She was approached by a local co-packer. The co-packer offered to make Posh Pet for $3.30 per unit. She currently sells 500 units per month. She collected the following information to aid in making this decision. Should she sign a contract to purchase Posh Pet from the co-packer?

Additional information:

1.) Direct materials would be provided by the co-packer

2.) Jada has one employee that makes the dog food. If she outsources to a co-packer this employee would be terminated.

3.) All of the manufacturing overhead would be eliminated except the rent on the facility. Jada signed a two year lease on the space. If she outsources to a co-packer the space currently used to make the product would be converted to office space. She doesn’t need the additional space and cannot use it for any other purpose. Of the monthly lease amount, $1,000 per month is allocated to producing the product. The lease represents $2.00 ($1,000/500 units) of the current overhead charge.

Special order decision

A special order is a one-time order that is not connected to an organization’s normal business. Special orders do not affect normally projected sales. Requests for charity or non-profit events are examples of special orders. Differential decision making can be used to analyze the effects of accepting a special order.

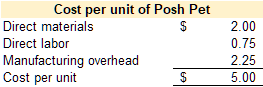

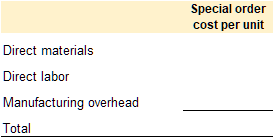

Video Illustration 3: Special order decision

Jada developed an all-natural, human-grade dog food called Posh Pet. She is currently making the dog food in a small rented space. Due to local wildfires, a local shelter asked if she could provide her dog food at cost to help with the influx of displaced animals. She currently sells 500 units per month and this request would not affect her normal sales. She wants to help the shelter and just cover the incremental costs associated with the special order. She collected the following information to aid in making this decision. What is the per unit amount she needs to charge to cover her costs?

Additional information:

1.) All of the additional units would require direct material and direct labor.

2.) Of the manufacturing overhead, $2.00 per unit is a fixed charge for rent on the facility. She has the space to make the order so the special order would have no effect on the rent. The remaining $0.25 of manufacturing overhead is variable and would be incurred on each unit in the special order.

Sell or process further decisions

During the manufacturing process, some raw materials need to be separated or refined in order to process a final product. In some cases, secondary materials or by-products are created when the original raw material is separate or refined. A single raw material input that can be separated into one or more materials is known as a joint product. The point at which the original raw material input is separated into more than one input is known as the spilt-off point. For example, crude oil is a joint product and a number of oil products are extracted during the refinement process including gasoline, jet fuel, lubricants, petroleum jelly, and other chemicals. Differential decision making can be used to analyze the effects of selling the products at the split-off point versus processing the split-off products further before selling them.

When considering a sell or process further decision, costs are classified as joint costs or additional processing costs. Joint costs are the costs incurred to process the raw material input to the spilt-off point. Secondary materials or by-products are created at the split-off point. Any cost incurred to process the secondary materials are additional processing costs.

When making the decision to process secondary products further, joint costs are not relevant. Joint costs are considered sunk costs. Regardless if you discard, sell the secondary product as is, or process the secondary product further, joint costs have already been incurred and are therefore unavoidable. Additional processing costs are relevant to the decision to process further because they are different between the alternatives. If you discard or sell as is, additional processing costs are not incurred. However, if the secondary product is processed further, additional processing costs are incurred.

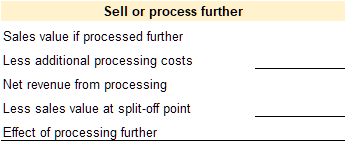

Video Illustration 4: Sell or process further decision

CheezeChef is a local cheese manufacturer that specializes in small-batch, artisanal cheeses. During the cheese making process whole milk is separated into curds and whey. Curds are the solids that are used to make the most cheeses. Whey is the liquid left after the solids are removed. Whey is rich in nutrients. The milk costs $2.40 per gallon. It costs CheezeChef $0.90 to separate the curds and whey.

CheezeChef is considering processing the whey into ricotta cheese or selling it to a local company that extracts protein from the whey. The local company offered to pay $2.60 per gallon of whey. Or, CheezeChef can process one gallon of whey to make one pound of ricotta cheese. It would cost $1.80 to process the whey into ricotta. They could sell the ricotta for $4 per pound. Should CheezeChef sell the whey at the split-off point or process it further into ricotta cheese?

Joint costs (not relevant)

Practice Video Problems

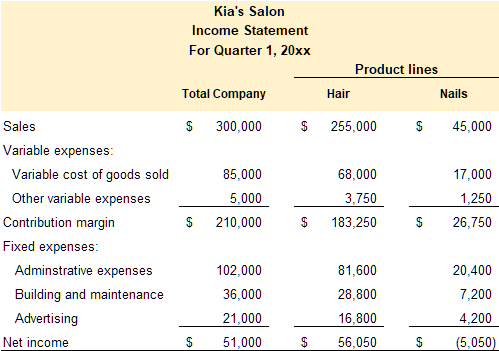

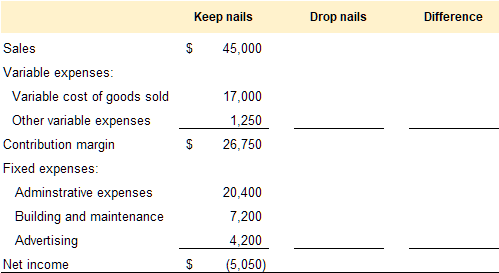

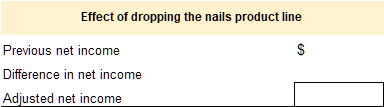

Practice Video Problem 1: Adding or dropping a segment

Kia’s Salon offers two services, hair styling and nails. According to the segmented income statement presented below, the nails product line lost $(5,050) in the previous quarter. The manager is considering dropping the nails product line to focus on hair styling. The manager collected the additional information presented below to aid in making this decision.

Additional information:

1.) The revenue and all of the variable expenses are traceable to the product lines. They would be eliminated if the product line was dropped.

2.) Administrative expenses include salaries and general administrative expenses. Of the $20,400 allocated to the nails product line, $18,000 represents the salary for the nail technician and scheduler. Her position would be eliminated if the nails product line is dropped. The remaining expenses are general expenses and would not be eliminated.

3.) Building and maintenance represent the expenses related to the salon property including rent, insurance, and deprecation. None of these costs would be eliminated if the nails product line was dropped.

4.) The entire $4,200 of the advertising budget is spent to advertise the nails product line. This advertising would be eliminated if the nails product line was dropped.

Required: Prepare a differential decision making analysis to determine if the nails product line should be dropped.

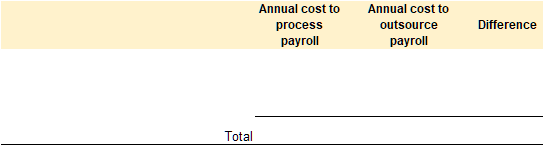

Practice Video Problem 2: Make or buy (outsourcing) decision

Ali’s Grooming currently processes the company’s payroll in house. She received a quote from a local CPA firm to process her payroll for $75 per week. Currently, Ali’s bookkeeper enters the data into a payroll module within the company’s accounting software. It costs an extra $2,500 per year to purchase the payroll module with the accounting software package. The accounting software creates the paychecks as well as the related entries for payroll taxes and benefits. The bookkeeper spends about 4 hours per week processing payroll and handling payroll related tasks. The bookkeeper makes $20 per hour. The bookkeeper would still work her normal 40 hours per week even if the payroll function was outsourced. The bookkeeper currently does not have enough work to require overtime hours.

Required: Prepare a differential decision making analysis to determine if the payroll function should be outsourced.

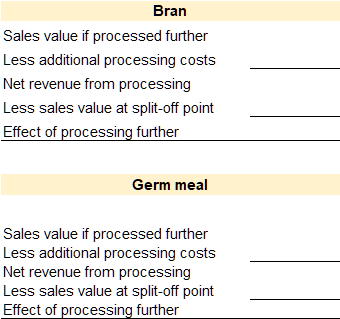

Practice Video Problem 3: Sell or process further decision

Healthy Farms operates a small family farm that specializes in growing organic, non-GMO produce. Their largest product in terms of revenue is wheat flour. It costs approximately $2.70 to grow one bushel of wheat. The wheat is milled on the farm to create flour. It costs $0.90 per bushel to mill the wheat and produce wheat flour.

Two by-products of the milling process are bran and germ meal. Each year they generate approximately 4,000 pounds of bran and 8,000 pounds of germ meal. Healthy Farms can sell the bran and germ meal as is to a local farmer for livestock feed and get $2 per pound. Or, Healthy farms can process the bran into a fiber supplement that sells for $3.00 per pound for an additional $4,200 in processing and packaging costs. And they can process the germ meal into a health food supplement that sells for $2.75 per pound for an additional $4,700 in processing and packaging costs.

Required: Prepare a differential decision making analysis to determine if the bran and germ meal should be sold as is or processed further.