8 Decentralized Performance Evaluation

Student Learning Objectives:

- Describe the advantages and disadvantages of a decentralized organizational structure

- Compute the profit margin ratio and show how changes in sales and income affect profit margin

- Compute the asset turnover ratio and show how changes in sales and average operating assets affect asset turnover

- Compute return on investment (ROI) and show how changes in sales, expenses, and assets affect ROI

- Describe social return on investment (SROI)

- Compute residual income and understand its strengths and weaknesses

Decentralized organizational structure

Organizational structure is the way that authority, responsibility, and lines of communication are arranged within an organization. In business, the organizational structure is normally considered more centralized or more decentralized. In a centralized organization, authority and responsibility are concentrated at higher levels of management and the rest of the organization is responsible for following orders. A small, family-owned business likely has a more centralized structure.

In a decentralized organization, lower-levels of management have the authority to make decisions as well as the responsibility for those decisions. Examples of decentralized organizations are fast-food or retail store chains such as Chipotle or Walmart. In most chain stores, store managers have the authority and responsibility for daily operations of their store or location.

Except in very small organizations, some authority and responsibly must be delegated to lower-level employees. Very few organizations are considered entirely centralized or decentralized. Instead, most organizations fall somewhere on the centralized spectrum. For example, decision-making authority is more centralized in the military but some decisions are delegated to lower-ranking members. And chain stores are more decentralized but some decisions are made at the corporate level and pushed down to the store managers.

Performance evaluation in decentralized organizations is the focus of this chapter. Additionally, the major advantages and disadvantages of decentralization are discussed.

Advantages of decentralization

- Higher management can focus on larger organizational issues if routine business decisions are delegated to lower-level management.

- Lower-level employees are more involved in day-to-day operations and usually have more information about routine business than higher-level employees.

- Organizations can respond to issues more quickly when authority is delegated.

- Lower-level employees feel more empowered, which can lead to increased job satisfaction.

Disadvantages of decentralization

- Lower-level employees may make decisions without fully understanding the impact on the larger organization.

- The motivation of an employee may conflict with the objectives of the overall organization. For example, an employee might be concern with getting resources for a particular department or for personal promotion. When authority is delegated to more employees the potential for personal conflict increases.

Responsibility centers and performance evaluation

Responsibility centers are individual segments within an organization where authority and responsibility have been delegated. There are four main types of responsibility centers—revenue centers, cost centers, profit centers, and investment centers.

Revenue centers

Managers of revenue centers usually have authority and responsibility over revenue or sales but very little authority over costs, profits, or investments in assets. The sales staff in a telemarketing organization is an example of a revenue center. Actual revenue or sales are used to evaluate performance in a revenue center and costs and investments in assets are typically ignored. Normally, performance evaluation involves comparing actual results with revenue projections. Flexible budgeting is commonly used for performance evaluation in revenue centers.

Cost centers

Managers of cost centers usually have authority and responsibility for the costs associated with a particular segment within the organization. Managers of cost centers typically don’t have responsibility for revenues, profits, or investments in assets. An example of a cost center, would be the administrative departments within an organization such as marketing, accounting, or human resources. While these departments don’t usually generate sales they are responsible for the costs associated with daily departmental operations. Actual costs are used to evaluate performance in a cost center and revenue and investments in assets are typically ignored. Normally, performance evaluation involves comparing actual results with cost projections. Flexible budgeting and standard cost variance analysis are two examples of tools used for performance evaluation in cost centers.

Profit centers

Managers of profit centers usually have authority and responsibility for the profits associated with a particular segment within the organization. Mangers of profit centers do not have responsibly for investments in assets. Profit is sales or revenue less the costs associated with generating that revenue also known as expenses. Therefore, managers of profit centers have responsibility for both sales and costs. Normally, performance evaluation involves comparing actual profit to projected profit. Flexible budgeting is typically used for performance evaluation in profit centers.

Investment centers

Managers of investment centers usually have authority and responsibility for the revenue, costs, and investments in assets associated with a particular segment within the organization. The entire organization is considered an investment center. The organization may also have smaller investment centers embedded within the overall structure, such as product lines or geographic locations. Performance evaluation for revenue centers, cost centers, and profit centers was discussed in the previous chapters on flexible budgeting and standard cost variance analysis. The remainder of this chapter focuses on performance evaluation for investment centers.

Performance evaluation for investment centers

Investment centers are responsible for generating revenue, controlling costs, and earning a profit on operating assets. Performance evaluation for investment centers analyzes these three areas. In this section, four performance evaluation tools for investment centers are discussed: profit margin ratio, asset turnover ratio, return on investment ratio, and residual income.

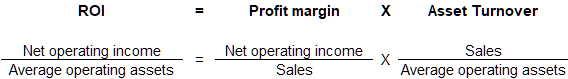

Profit margin ratio

The profit margin ratio is a measure of profitability. It calculates net operating income as a percentage of sales. Net operating income is typically used for this ratio, which is net income before interest expense and taxes also commonly known as earnings before interest and taxes, EBIT. This ratio measures a manger’s ability to generate sales, control costs, and make profits. The profit margin ratio is:

![]()

While the profit margin ratio is sufficient to evaluate profitability, it does not evaluate a manager’s ability to generate a profit on operating assets.

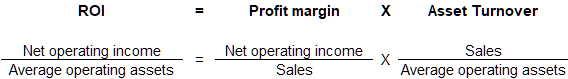

Asset turnover ratio

The asset turnover ratio is a measure of efficiency. It calculates sales as a percentage of average operating assets. Average operating assets is used for this ratio, which includes an average of the assets used by the business but not assets held for future investment. This ratio measures how efficiently an organization can use its assets to generate sales. The asset turnover ratio is:

![]()

While the asset turnover ratio is sufficient to evaluate how efficiently an organization can use its assets to generate sales, it does not consider a manager’s ability to control costs and generate profit.

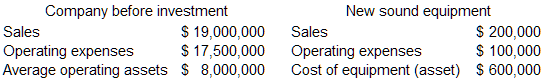

Return on Investment (ROI) ratio

The return on investment or ROI ratio is a measure of both profitability and efficiency. It calculates net operating income as a percentage of average operating assets. This ratio measures how efficiently an organization can use its assets to generate profit or net income. The ROI ratio is:

![]()

ROI, profit margin, and asset turnover are related. ROI can also be expressed as profit margin x asset turnover as shown below:

Because of its simplicity and versatility, ROI is a widely used performance measure for entire organizations, investment centers within organizations, and specific projects or investments.

Video Illustration 1: Return on investment (ROI), profit margin, and asset turnover ratios

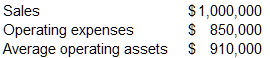

Ashanti is the founder of a successful multi-state retail chain that specializes in office and home décor. She reported the following results for last month.

Compute her profit margin, asset turnover, and return on investment (ROI) ratios.

Advantages and disadvantages of return on investment (ROI)

Return on Investment (ROI) has significant advantages so it is widely used in business and the financial sector for performance evaluation. ROI measures an organization’s profitability on its assets, which encourages the optimum use of assets throughout the organization. And ROI is a good measure for comparative analysis. ROI can be used to compare the efficiency and profitable between organizations, of individual units within an organization, or of specific projects or investments.

ROI also has disadvantages. A significant limitation is that ROI tends to focus on current profitability so long term goals are often ignored. This focus on short-term profits can create an incentive for some employees to make decisions that have short term gains but are negative in the long term. For example, managers may cut funds for employee training or product development because these costs are incurred immediately whereas the benefit may not be realized until a future period. Another limitation is that organizations with a high ROI may reject profitable investments with long-term benefits if accepting the investment would lower the current ROI.

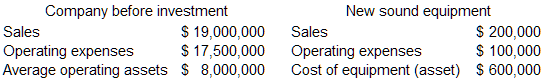

Video Illustration 2: Computing return on investment (ROI) for an organization and a project within the organization and illustrating a disadvantage of ROI

NewAge Sound is a successful audio company. The company requires a minimum new investment ROI of 15%. Financial data for the company’s most recent fiscal year is provided below. The company is considering investing in a new piece of sound equipment that can be used to securely transmit data within a small space. The equipment can be rented by event organizers to verify ticket data at events. Projected financial data for the new equipment is also provided below.

Calculate the return on investment (ROI) for the company before the investment, the potential investment in the new equipment, and the company if the investment in the equipment is made.

ROI–company before investment

ROI–investment in new sound equipment

ROI–company with sound equipment

Social return on investment (SROI)

Social return on investment (SROI) is a relatively new tool used by organizations to quantify social responsibility and environmental benefits. One of the major disadvantages of traditional return on investment (ROI) is that it focuses almost exclusively on financial measures and short-term profitability. Social and environmental benefits are ignored by traditional ROI measures. If traditional ROI is the only performance measure, projects that create social value are not considered because ROI only considers profit. SROI is a measure that quantifies social benefits and can be used to measure how effectively a company uses its assets to create value for the community.

Assigning monetary amounts to social benefits or determining the social impact value is an inherently problematic process. However, several methodologies have been developed to quantify the social impact value for this measure. Once the social impact value is assigned, the below ratio can be used to compute SROI.

![]()

Residual income

Residual income is another way to evaluate investment center performance. Residual income is the amount of income earned above a certain required minimum return. The minimum required return is set by the organization and considers inputs such as the cost of capital and desired profitability. The formula for residual income is:

![]()

Residual income produces the dollar amount of net income above or below the required minimum return. This is both an advantage and disadvantage of this performance measure. A positive return indicates that a project produces more than the minimum required return so it should be considered. Unlike return on investment (ROI) that might eliminate a profitable project that has a lower return than the current ROI. The disadvantage of residual income is that the formula produces a dollar amount so it is difficult to determine the actual return percentage above or below the minimum required return.

Video Illustration 3: Computing residual income for an organization and a project within the organization

NewAge Sound is a successful audio company. The company requires a minimum ROI of 15% on new investments. Financial data for the company’s most recent fiscal year is provided below. The company is considering investing in a new piece of sound equipment that can be used to securely transmit data within a small space. The equipment can be rented by event organizers to verify ticket data at events. Projected financial data for the new equipment is also provided below.

Calculate the residual income for the company before the investment, the residual income for the investment, and the residual income after the investment

Residual income–company before investment

Residual income–investment in new sound equipment

Residual income–company with sound equipment

Practice Video Problems

Practice Video Problem 1: Profit margin, asset turnover, and ROI

Krisha Patel owns a local accounting and tax firm. She reported the following results for the most recent fiscal year.

Required 1: Compute profit margin, asset turnover, and return on investment (ROI)

Profit margin

Asset turnover

Return on investment (ROI)

Practice Video Problem 2: Computing return on investment (ROI) and residual income for an organization and a project within the organization

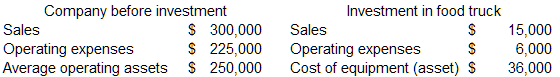

Lilo Alana is the owner of the Hawaiian Grill a new restaurant located in a suburb just south of the city. She is considering expanding her operations by purchasing a food truck so she can serve the downtown lunch crowd. Financial data for her most recent year of operations as well as data for the new food truck is provided below. Lilo requires a 15% minimum return on investments.

Required 1: Calculate the return on investment (ROI) and residual income for the company before the investment and the ROI and residual income for the proposed food truck investment.

ROI and residual income company

ROI and residual income food truck investment