2 Job Order Costing

Student Learning Objectives:

- Describe a job-order costing system

- Describe the flow of inventory costs in a job-order costing system

- Calculate the predetermined manufacturing overhead rate

- Apply manufacturing overhead to jobs using an organizational predetermined manufacturing overhead rate

- Apply manufacturing overhead to jobs using multiple predetermined manufacturing overhead rates

- Compute the total cost of a job, cost per unit, and selling price in a job-order costing system

Job-order costing

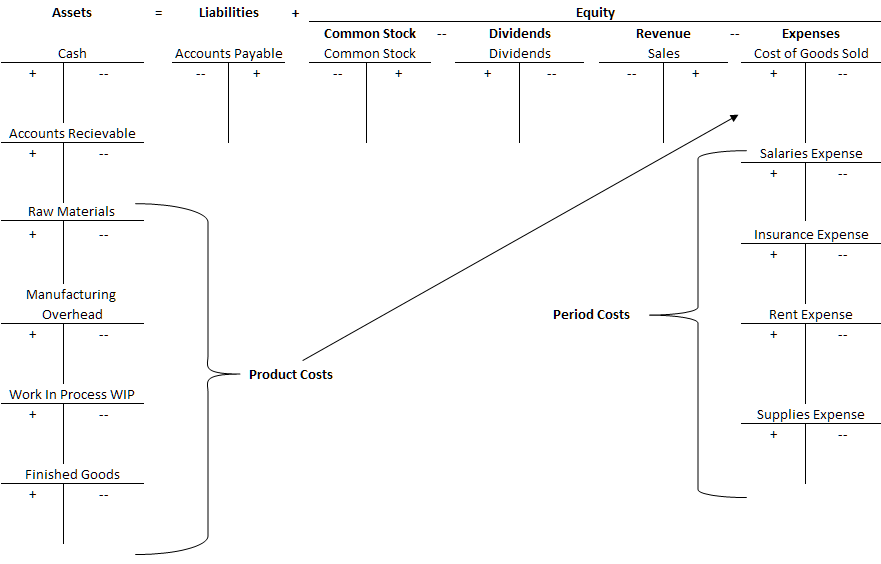

Job-order costing is an accounting system used to assign costs to the products or services that an organization produces. Product costs, or inventory costs, include the costs for direct material, direct labor, and manufacturing overhead. In a job-order costing system, product costs are assigned directly to the products or jobs as they are produced or completed. A job-order costing system is typically used by organizations that produce unique or custom products or services.

Job-order costing flow of inventory costs

Raw materials (direct and indirect)

All raw materials—direct and indirect—purchased to manufacture the product are debited to the Raw Materials inventory account. The credit for raw materials costs is typically recorded in the Cash account or a related liability account. Direct materials are raw materials that can be easily and economically traced to the production of the product. Indirect materials are raw materials that cannot be easily and economically traced to the production of the product, e.g. glue, nails, sandpaper, towels, etc.

When materials are requisitioned for manufacturing, all materials are credited out of the Raw Materials inventory account. Direct materials are debited into the Work In Process inventory account and indirect materials are debited to the Manufacturing Overhead account.

Labor

Direct labor is debited to the Work In Process inventory account and indirect labor is debited to the Manufacturing Overhead account. Typically, a liability account such as Salaries Payable is credited. Direct labor costs are manufacturing labor costs that can be easily and economically traced to the production of the product. Indirect labor costs are manufacturing labor costs that cannot be easily and economically traced to the production of the product, e.g. the production supervisor’s salary or quality control.

Non-manufacturing labor costs, such as office or administrative wages, are period costs. Non-manufacturing labor costs are debited to an expense account for wages or salaries. A liability account such as Salaries Payable is credited.

Manufacturing Overhead

Actual manufacturing overhead costs are debited to the Manufacturing Overhead account. The credit for these costs is typically recorded in the Cash account or a related liability account. Manufacturing overhead costs include all indirect costs associated with manufacturing the product that are not direct material or direct labor, such as indirect materials, indirect labor, and all other production costs incurred to run the production facility, e.g. rent, utilities, janitorial services, and taxes on the production facility.

Manufacturing overhead costs are applied to the jobs in process using a predetermined manufacturing overhead rate. The predetermined manufacturing overhead rate is discussed in detail in subsequent sections of this chapter. When manufacturing overhead is applied to the jobs in process, it is credited from the Manufacturing Overhead account and debited to the Work In Process account.

Work In Process (WIP)

Work in Process (WIP) is the inventory account where product costs including direct material, direct labor, and manufacturing overhead are accumulated while the jobs are in the manufacturing process.

Finished Goods Account

When a job is finished, the total costs for the job are moved from the Work In Process inventory account (credit) to the Finished Goods inventory account (debit). The Finished Goods inventory account is where finished inventory is reported at the cost to produce—direct material, direct labor, and manufacturing overhead—until it is sold.

Cost of Goods Sold

When the inventory is sold, the total costs for the job are moved from the Finished Goods inventory account (credit) and to the Cost of Goods Sold expense account (debit). Cost of Goods Sold is the expense account used to report the costs associated with purchasing or manufacturing the inventory sold.

Sales revenue is also recorded when the job is sold. Gross profit for the job is calculated as the sales revenue collected from the customer less the cost of goods sold, which represents total production costs, e.g. direct material, direct labor, and manufacturing overhead.

Video Illustration 1: Demonstrating cost flow in a job-order costing system

Manufacturing overhead

All manufacturing, or product costs, that are not direct material or direct labor, are recorded in the Manufacturing Overhead account. Direct material and direct labor are applied directly to the jobs and do not flow through the Manufacturing Overhead account. Manufacturing overhead includes indirect materials, such as glue, screws, and nails; indirect labor, such as wages for the production supervisor or production maintenance personnel; and all other costs incurred to manufacture a product, such as rent, insurance, taxes, and utilities paid for the manufacturing facilities.

Manufacturing overhead is applied to jobs using a predetermined manufacturing overhead rate. Unlike direct material or direct labor, it not easy to apply manufacturing overhead costs directly to jobs. Manufacturing overhead costs are not incurred uniformly and many of these costs are not directly traceable to the jobs in process. For example, an organization might pay property taxes on the production plant twice a year. These property taxes are considered indirect manufacturing costs and should be applied to all jobs produced and not just the jobs in process at the time the taxes are paid.

Think of manufacturing overhead as a pool or bucket of all indirect product costs. At the beginning of the period, the total amount of manufacturing overhead costs is estimated based on historical data and current year production estimates. Throughout the year, the total amount of estimated manufacturing overhead is uniformly applied to the jobs in process using some type of allocation base or cost driver. An allocation base or cost driver is a production activity that drives costs such as direct labor hours or machine hours. At the end of the year, the estimated applied overhead costs and actual overhead costs incurred are reconciled and any difference is adjusted.

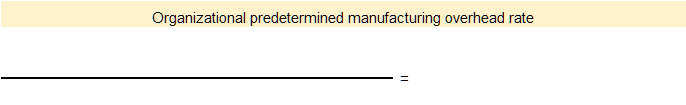

A single organizational predetermined manufacturing overhead rate is computed by dividing the total estimated manufacturing overhead amount by the total estimated allocation base or cost driver. Total estimated overhead includes total fixed overhead and total variable overhead. Allocation bases or costs drivers vary across organizations. Common allocation bases are direct labor hours, direct material dollars, or machine hours.

The formula for computing the organizational predetermined manufacturing overhead rate is presented below.

![]()

Video Illustration 2: Computing an organizational predetermined manufacturing overhead rate

Cincy Chips produces microchips for small electronic devices. On January 1, Cincy Chips estimates that they will produce 50,500 microchips and run 2,080 machine hours in the upcoming year. The company uses a single organizational manufacturing overhead rate. Manufacturing overhead is allocated to jobs based on machine hours. The cost formula to estimate manufacturing overhead at the beginning of the year is $128,960 fixed plus $33 per machine hour. Compute the organizational predetermined manufacturing overhead rate.

Applying manufacturing overhead to jobs

The predetermined manufacturing overhead rate is computed before the period starts, usually at the beginning of a year or quarter. Manufacturing overhead is then applied to the jobs as the work is completed throughout the year. In a normal costing system, the predetermined overhead rate is applied to the jobs based on the job’s actual use of the allocation base or cost driver used to calculate the predetermined rate.

Video Illustration 3: Applying manufacturing overhead to jobs

Cincy Chips produces microchips for small electronic devices. The predetermined manufacturing overhead rate is $95 per machine hour (total estimated overhead $197,600 / 2,080 total estimated machine hours). Job 36A was for 75 microchips and used 3.5 machine hours. Compute the manufacturing overhead applied to Job 36A.

![]()

Job cost sheets

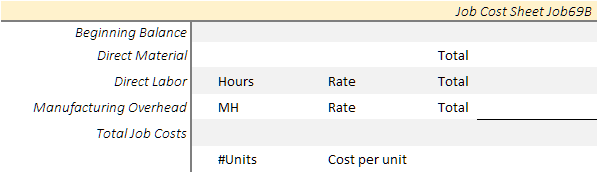

All manufacturing costs incurred to complete a job are recorded on job cost sheets. Job cost sheets can be kept on physical paper or digitally. A standard job cost sheet records all direct material, direct labor, and manufacturing overhead costs applied to a job. Typically, a job cost sheet also records the total costs, the number of units, the cost per unit, as well as the selling price for each job.

Video Illustration 4: Completing a job cost sheet

Cincy Chips produces microchips for small electronic devices. The predetermined manufacturing overhead rate is $95 per machine hour. Job 69B was for 500 microchips and used 22 machine hours. Production used $13,500 of direct material and worked 21 direct labor hours at a rate of $20 per hour. Complete the below job cost sheet for Job 69B.

Multiple predetermined manufacturing overhead rates

In some cases, organizations choose not to use a single organizational predetermined manufacturing overhead rate to apply overhead to the products or services produced. In the preceding sections, an organizational predetermined manufacturing overhead rate was calculated. Many organizations have multiple departments or processes that consume different amounts of manufacturing overhead resources at different rates. In these organizations, a single manufacturing overhead rate, while more simplistic, may not accurately apply overhead to the final product. An organization with multiple departments or processes may choose to apply manufacturing overhead using multiple predetermined manufacturing overhead rates. When multiple predetermined manufacturing overhead rates are used, manufacturing overhead costs are allocated to specific departments or processes and then applied to jobs using an allocation base that drives the overhead costs for that department or process.

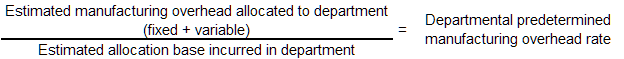

Before multiple predetermined manufacturing overhead rates can be computed, manufacturing overhead costs must be assigned to departments or processes. Then the departmental or process manufacturing overhead rate is computed by dividing the total estimated manufacturing overhead assigned to the department or process by the total estimated allocation base or cost driver incurred within that department or process.

It is important to note, that only manufacturing overhead costs that are allocated to the department or process as well as the allocation base or cost driver incurred within the same department or process are used to compute a departmental predetermined manufacturing overhead rate.

The formula for computing the departmental predetermined manufacturing overhead rates is presented below.

Video Illustration 5: Computing multiple predetermined manufacturing overhead rates

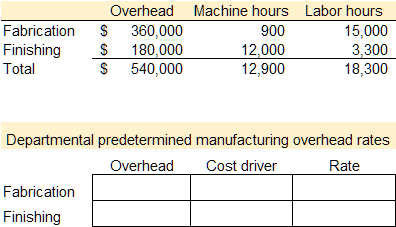

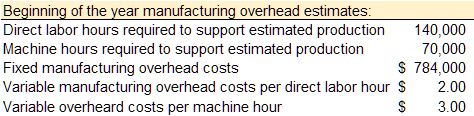

SunCo, Inc. manufactures widgets. The manufacturing process has two departments—fabrication and finishing. In the fabrication department, laborers pour composite materials into custom carved molds. Fabrication is a labor intensive process. After molding, the widgets are sent to the finishing department. In finishing, the widgets are put on an automated production line where they are heated and coated. Finishing is a machine intensive process.

SunCo, Inc. assigns manufacturing overhead to the products produced using departmental predetermined manufacturing overhead rates. Manufacturing overhead is applied based on labor hours in the fabrication department and machine hours in the finishing department. Relevant data are provided below. Compute the departmental predetermined manufacturing overhead rates for the fabrication and finishing departments.

Practice Video Problems

Practice video problem 1: Compute organizational predetermined manufacturing overhead rate, total job costs, and selling price

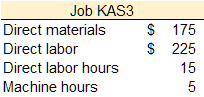

Kelly Shuck Productions uses a job-order costing system. At the beginning of the year, the company made the following estimates:

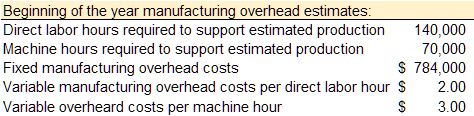

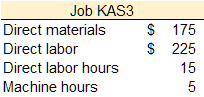

During the year, Job KAS3 was started and completed. The following information is available with respect to this job:

Required 1: Compute the organizational predetermined manufacturing overhead rate (single rate for the entire organization) with direct labor hours as the allocation base.

Required 2: Assume that Kelly uses the organizational predetermined manufacturing overhead rate calculated in requirement 1. Compute the total manufacturing cost of Job KAS3.

Required 3: If Kelly uses a markup percentage of 200% of its total manufacturing cost, what is the selling price for Job KAS3 (based on the total costs of computed in requirement 2)?

Practice video problem 2: Compute organizational predetermined manufacturing overhead rate, total job costs, and selling price

Kelly Shuck Productions uses a job-order costing system. At the beginning of the year, the company made the following estimates:

During the year, Job KAS3 was started and completed. The following information is available with respect to this job:

Required 1: Compute the organizational predetermined manufacturing overhead rate (single rate for the entire organization) with machine hours as the allocation base.

Required 2: Assume that Kelly uses the organizational predetermined manufacturing overhead rate calculated in requirement 1. Compute the total manufacturing cost of Job KAS3.

Required 3: If Kelly uses a markup percentage of 200% of its total manufacturing cost, what is the selling price for Job KAS3 (based on the total costs of computed in requirement 2)?

Practice video problem 3: Compute departmental predetermined manufacturing overhead rates, total job costs, and cost per unit

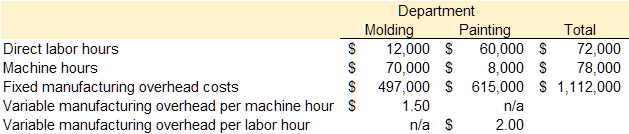

Rookwood Pottery makes a variety of pottery products that it sells to retailers. The company uses a job-order costing system. Relevant data are provided below.

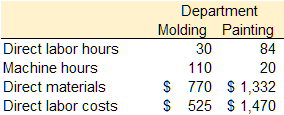

The following information was recorded for Job B53, which was started and completed during the year.

Required 1: Assume that Rookwood uses departmental predetermined manufacturing overhead rates to apply manufacturing overhead costs to jobs. The predetermined manufacturing overhead rate in the Molding Department is based on machine-hours, and the rate in the Painting Department is based on direct labor-hours. Compute the predetermined manufacturing overhead rates used in the Molding Department and the Painting Department.

Required 2: Assume that Rookwood uses the departmental predetermined manufacturing overhead rates calculated in requirement 1. Compute the total costs of Job B53.

Required 3: If Job B53 contained 50 units, compute the cost per unit (based on the total costs of Job B53 computed in requirement 2).