7 Production: Domestic Interests and Institutions

Learning Objectives

Students will be able to:

- Understand the history of FDI politicization

- Explain the political power of MNCs

- Examine the regulation and liberalization of FDI

- Compare the financial mechanisms used to regulate and liberalize FDI

FDI Politicization: The History

The politics of foreign direct investment (FDI) and the battle between domestic institutions and multinational corporations (MNCs) is a storied history that, at its core, challenges the very nature of the governing bodies and the enterprises they seek to regulate. American economist Raymond Vernon highlights these innate differences by asserting that “the regime of [states] is built on the principle that the people in any national jurisdiction have a right to try and maximize their well being…within that jurisdiction” while the MNC “…is bent on maximizing the well being of its stakeholders from global operation, without accepting any responsibility for the consequences of its actions in individual national jurisdictions”. It is this intrinsic conflict that motivates the ever shifting winds of FDI regulatory policy.

The history of FDI politicization has gone through many iterations of increased restrictions, open liberalization, and relative stagnation since its inception. Various scholars note the relative novelty of the concept foreign investment regulation as a result of the industrial revolution. Prior to that, capital flows generally went from that of rich Western European countries to the cash-poor periphery, most of which were under colonial control. Countries very rarely restricted foreign direct investment as much of it came in the form of large-scale infrastructure projects. But as the world entered the twentieth century, the approach towards FDI policy began to change.

By the early 1900s, private firms began to direct investments towards research and development and other projects based on intellectual property. These investments lead the way to develop firm-specific assets, or assets that are exclusive to a firm for private use. Additionally, firms saw an increase in market demand for consumer products, not just domestically, but internationally. Together, this led to an increase in FDI for the production of goods and services, allowing firms to expand the scale of economies that their intellectual properties created. The increase in FDI pathed the way for the global economy, but with it came the first instances of politicization that would linger for years to come.

FDI first faced politicization during the interwar period, or the period of time between the end of WWI and the beginning of WWII. Cases arose from the perceived threat to national security posed by foreign ownership of production assets. One example of this was the seizure of all foreign-based assets by the U.S. government during WWI, the likes of which included chemical and pharmaceutical patents owned by U.S. subsidiaries of German companies. Simultaneously, the removal of foreign-based firms helped advance the interests of local producers who could finally compete with the larger, more productive MNCs.3

The era of FDI regulation brought about changes to the organization of political and labor efforts that solidified the position of the U.S. in terms of deflecting foreign investment. Political coalitions created by state-led development strategies dissolved resistance of locally operating firms under foreign control while local firms profited off of high tariffs rates. Additionally, workers gained higher wages in protected industries where labor was organized effectively. Through this, politicians and bureaucratic agents who helped shape FDI policy reaped the benefits from their regulatory decisions.2

Towards the end of the twentieth century, countries markedly adopted an increasingly open stance towards FDI. During the 1970s, up to 35 percent of industries within a given country were protected from foreign-ownership of local firms; thirty years later, that number had dropped to 10 percent. Additionally, MNCs faced more favorable attitudes from host countries. For example, beginning in 1975, there were over eighty acts of expropriation directed at MNCs, levied across thirty countries internationally. Expropriations are actions taken by host countries that seek to redistribute income generated by the MNC to domestic groups, through the use of tax increases and sometimes seizure of property. Nearly a decade later, not only were these acts becoming increasingly scarce, but many governments revised national investment laws to specifically guarantee property rights for foreign-owned MNCs.3

Regulation of FDI

One of the difficult aspects of studying FDI is the complexity of enforcement and regulation mechanisms that govern FDI policy around the globe. Due to the expansive nature of multinational participation and various regulatory issues at play (i.e. business licensing, finance, labor, etc.), there is no single regulatory agency that strictly handles FDI policy. For this reason, this can make the regulatory environment to which FDI policy exists confusing, complex, and at times, contradictory. One concern for scholars on the subject is the differences in location of regulatory authority over FDI within the government. By and large, investment policy first originates from the national legal code, which is expressed through the government’s legislative body. In turn, investment and company laws provide the legal basis on which the regulatory authority of the government exists. Despite this, these laws often set aside huge amounts of autonomy relating to policy implementation for regulatory agencies in the executive branch. At times, these laws can create investment boards, which are regulatory bodies designed to review and approve foreign investment schemes and additionally, provide guidance on entry and operational procedures for MNCs. Alternatively, the legal code may vest regulatory authority in preexisting agencies with the relevant jurisdiction, much like Japan’s Ministry of Trade and Industry, which coordinates FDI regulation with other macroeconomic policy points.2 In the United States, the interagency committee that is responsible for reviewing and approving foreign investment in U.S. companies is called the Committee on Foreign Investment in the United States (CFIUS). While CFIUS is not considered an investment board or an independent agency as previously mentioned, CFIUS was established by an executive order in 1975, and its jurisdiction and authority have been expanded over the years by subsequent legislation and executive orders, most recently in 2018 when Congress and the Trump administration passed the Foreign Investment Risk Review Modernization Act which sought to adjust to the “shifting” national security landscape and the nature of investments that follow. Its primary mandate is to review and evaluate proposed foreign investments in U.S. businesses to determine whether they could result in a threat to U.S. national security. The committee is composed of representatives from various U.S. government agencies, including the Departments of Defense, Treasury, Justice, Commerce, State, Homeland Security, and Energy, as well as other federal agencies and departments as appropriate, and it operates under the auspices of the Department of the Treasury. CFIUS has the power to block or modify proposed foreign investments in U.S. companies, as well as to impose conditions on those investments in order to mitigate any potential national security risks. Its decisions are confidential, and it does not generally disclose the details of its reviews or investigations.

The Political Power of MNCs

While some scholars have chosen to study the various government institutions around the world and the mechanisms they use to administer and govern FDI regulation, others have chosen to analyze the multinational corporations themselves as political actors that play a significant role in shaping the global economy. For example, just looking at the United States, MNCs represent less than 1% of American firms but comprise more than 24% of private sector GDP and 26% of private sector compensation. Similarly, the OECD (2018) estimates that MNCs constitute half of global exports, account for almost a third of world GDP (28%), and nearly a fourth of global employment. The transnational activities such as outsourcing and offshoring by MNCs have driven the transformation of international trade, investment, and technology transfers in the globalized economy. Additionally, their decisions have massive implications for a variety of policy issues including taxation, investment protection and immigration across a wide range of political and economic institutions. It is for this reason that scholars have chosen to assess how and why MNCs function as political actors.

As researchers have found, there exist unique economic and political characteristics compared to other (domestic) firms that MNCs utilize to shape policy preferences. The first distinct characteristic that separates MNCs from other firms is their size and capacity for production. In general, MNCs tend to be larger and more productive than domestic firms. Additionally, they tend to be the largest exporters, the most integrated in global value chains (GVCs), employ the most high-skilled laborers, and are the largest spenders on research and development. This variation in size and scale of firms leads to a “pecking order” by which only the most productive firms invest in numerous foreign locations while the least productive firms invest in only the most productive locations. Another distinct characteristic of MNCs that allows them to shape policy preferences is their influence in foreign policy. Because of their size and scope, MNCs hold great influence over areas such as trade, foreign investment, exchange rates, and immigration. With regards to trade, it has long been understood that firms will have different preferences based on their ties to the international economy. Furthermore, domestic firms that face competition with imports will advocate for greater protections, whereas big exporters and MNCs will opt for freer trade. Finally, the last distinctive quality is that MNCs are the main advocates of preferential trade agreements and bilateral investment treaties. Additionally, MNCs have been the primary leaders on the inclusion of provisions protecting investment and intellectual property rights and liberalizing services in preferential trade agreements, as means to gain an edge over MNCs from other countries, which are excluded from the trade agreements.

All in all, these policy preferences and distinct characteristics lead to MNCs exerting their political influence in three primary ways: direct lobbying, indirect influence as a component of the state, unintended influence as an agenda-setter. First, MNCs may directly enlist in political activities such as lobbying and contributing to campaigns to affect the policy making process or to pressure political leaders to address their demands. In doing so, they can also partner with industry associations and political action committees to advance similar interests. Firms can leverage their bargaining power by offering both “inducements” or promises of brand-new investment and “deprivations” or threats of withdrawal of investment. Second, many have argued that MNCs hold an inadvertent role in foreign policy as a component of the state. In this point of view, governments have utilized MNCs to further their national interest by bolstering the effects of sanctions through the production networks of MNCs, fostering capital transfers through firms to enhance monetary policy, or permitting MNC’s foreign affiliates to assist in the gathering of intelligence.12 Finally, MNCs can hold extensive agenda-setting power from their simple presence abroad. The view of governments towards MNCs is that of a “privileged position” that assists political leaders in defining problems, devising policies, and prioritizing objectives. Taken together, multinational corporations exert significant influence over domestic institutions through a variety of methods that ultimately work in favor of advancing their interests on a global economic level.

FDI Liberalizing Factors

FDI has various direct and indirect advantages for the host country, including contributing to capital formation, economic growth and development, increasing the transfer of managerial skills, organizational capabilities, know-how, market access, and technology. Additionally, it can enlarge domestic firms’ competitiveness and productivity. As mentioned earlier, to benefit from the advantages FDI brings to a country, governments, domestic institutions, and interest groups engage in creating policies that liberalize FDI. There are multiple factors behind FDI liberalization, such as democratization, increased effect on economic growth, shift towards neoliberal reform, increased cost of closure, trade openness, and reaction to other economic policies.

In autocratic countries, policymakers serve the interests of domestic firms by implementing strict regulations on MNCs.3 Democratization is the change in the ways organizations, institutions, and countries practices to democratic principles and it can partake in reforming FDI policies. Democratization is one of the primary causes of FDI liberalization globally.3 Democratization contributes to the deregulation of FDI by propelling policymakers to favor policies that align with the interests of labor.3 Reforms in domestic institutions may cause the empowerment of laborers over capital.2 Increased political participation of labor groups leads to the monitoring of politicians to keep them accountable to voters.3 As a result, voters’ need for higher wages, jobs, and economic growth causes economic restrictions to be more demanding, causing the relaxation of protectionist policies towards FDI.2 Moreover, domestic political institutions may be motivated to engage in policy liberalization because of pressures from outside forces. Policymakers’ interests could be amended due to other competitors’ or countries’ activity. Countries heavily dependent on foreign direct investment may compete with each other and become responsive to each other’s FDI policies by relaxing their restrictions and offering legal and tax incentives.2 Another explanation for greater openness to FDI is policymakers’ “rational” decision in understanding “an opportunity cost of closure”.16 The opportunity cost of closure includes the level of development, country size, market size, human resource capabilities, and trade openness.16 These opportunities of costs help determine whether a country is losing advantage and efficiency when liberalizing FDI. When the benefits outweigh the costs for FDI, policymakers are more likely to attract FDI. Furthermore, a country’s openness towards other policies, such as trade, reflects its openness towards FDI because it can display policymakers’ preferences on the positive correlation of economic openness, development, and growth to a connected global economy.16

Financial Mechanisms

Similar to how domestic interests and institutions affect policies and regulations, they also regulate FDI openness and closure using financial mechanisms. Domestic political institutions have access to financial privileges that allows them to make decisions for credit distribution through personal and political networks instead of market discipline.2 Financial privileges grant these institutions financial benefits at a lower cost. When there is banking reform that limits locals’ privileged access, elites will seek alternative sources of finance. MNCs provide greater access to international investment banking. The lack of access to financial privileges drives domestic businesses to back policies and lobby to support FDI liberalization.2 Lack of access to financial sources for domestic companies because of circumstances at the local and global scale can influence FDI liberalization.2 Costly financing constraints force local firms to support liberal FDI policies in order to benefit from MNCs’ capital. Financial constraints faced by domestic firms can encourage FDI openness in order to gain increased access to MNCs’ investment financing and increase economic growth by benefiting domestic economies.2

On the other hand, governments can use financial instruments to attract FDI by implementing incentive policies such as fiscal and financial incentives. Financial incentives can appeal to MNCs to engage in operations by helping reduce the cost of establishment and operation. Financial incentives can be indirect or direct subsidies, including loans, subsidies, grants, expatriation costs, and others.17 The government supplies direct subsidies to assist the MNC by renting operation areas, funding job training, and covering other operations costs for greenfield projects.17 Additionaly, the government can provide funding to build infrastructure, including power, road, healthcare, and education facilities.17 Comparatively, fiscal incentives involve preferential tax treatment through deductions, exemptions, grants, or other strategies. It comprises tax allowances, tax holidays, lower tax rates, credits, allowances, and decreased import tariffs. Unlike financial incentives, fiscal incentives are more beneficial to FDI in the latter phases of investment because they help decrease future costs of operation for the MNC.17

Financial mechanisms can also be used to restrict FDI. One of the most common methods of engaging in FDI is mergers and acquisitions (M&A), when two companies join together to form one company or when one company takes over another. The government’s response towards M&As is usually driven by competition or the “nationality” of the MNC involved in the M&A. Economic nationalism is the partiality for domestics instead of foreigners in economic interests. The level of economic nationalism within a country determines the extent domestic institutions will go to support or oppose FDI. Governments advocate for firms not to be owned by foreign corporations and instead remain domestically owned.19 Nationalist governments are able to achieve economic nationalism by intervening in economic activities, promoting, and implementing different policies that would be in favor of domestic corporations.

Some common methods used to implement nationalism in M&A are moral persuasion, public interests, prudential rules for financial companies, golden shares in privatized companies, providing financing to domestic bidders, playing for time, and creating national champions.19 Moral persuasion can be used by a government by blocking the merger initially and using implicit threats toward the MNC.19 Governments can impose restrictions to safeguard public interests.19 Governments often fund local bidders to acquire companies through government-owned banks, public pension funds, or investing directly in the company.19 Additionally, the domestic government can create national champions, which are large companies with vital positions in a country’s economy and promote the interests of a political group to prevent M&A. This encompasses developing a new big firm by aiding the merger of local firms and making it difficult for it to be acquired by foreign companies.19 If the company’s size is too big, it becomes demanding for MNCs to acquire, discouraging FDI. Governments can also buy time to obtain or finance a domestic bidder by implementing prudential rules or creating requirements for regulator approvals from different commissions.19 A “white knight” or a favorable acquirer in order to obstruct MNCs from acquiring the firm can be used.19 The “white knight” may receive financing from financial institutions that the government backs. Another strategy for implementing nationalism to block FDI is using golden shares, which are shares that grant veto power to shareholders over changes in the company’s operation, rules, and regulations. Having golden shares in a company allows governments to make the decision for the company not to be acquired.19 Similar to these techniques, domestic institutions can implement many other policies to discourage MNCs from engaging in FDI.

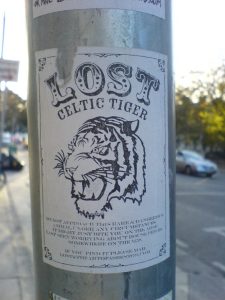

Case Study: Ireland and the Celtic Tiger

The relationship between domestic institutions, multinational corporations, and foreign direct investment is complex and interconnected. One intriguing historical example of this multifaceted relationship is Ireland during it Celtic Tiger period. From the 1990s to the early 2000s, Ireland witnessed unparalleled economic growth, largely thanks to foreign direct investment (FDI), which saw multinational corporations establish operations in Ireland and create jobs for local workers. This phenomenon of success did not appear suddenly. Rather, it was a series of policy changes that arose over a period of multiple decades. Therefore, understanding the causes of Ireland’s economic success during the Celtic Tiger period can provide useful insights into the relationship between domestic institutions, MNCs, and FDI, and influence discussions on how to promote economic growth and development in other countries.

Beginning in the 1920s, Ireland held a staunchly protectionist stance that aimed to protect local industries and promote a self-sufficient economy. However, this policy was counterproductive and led to high unemployment rates and emigration.20 Like other protectionist countries, the Irish government gradually began to realize the opportunities that came with allowing foreign direct investment in the 1960s, and as a result, began taking down their trade barriers to draw in foreign investors. These actions led to an inflow of FDI into the country, which prompted Ireland’s explosive economic growth beginning in the 1990s.20 In 1994, one of the most rapid years of growth, Irish gross domestic product (GDP) growth rates increased to 5.8%.20 Despite the benefits of FDI, managing tensions between domestic institutions and multinational corporations remained a persistent challenge. Critics argued that the Irish government prioritized the interests of foreign corporations over those of local businesses and workers.For example, some multinational corporations allegedly were not paying their fair share of taxes or underpaying their workers.21 Other critics were worried about the effect of FDI on Ireland’s society and culture. The influx of foreign corporations caused the inflation of property prices and rent, making it difficult for locals to afford housing, widening the social gap.20 Nonetheless, Ireland’s strategic location in the European Union, its well-educated workforce, and English-speaking population made it an enticing place for multinational corporations looking to enter the European market.22 The government continued to develop policies that were favorable to FDI, such as low corporate tax rates, which strengthened the country’s appeal to multinationals.

As previously mentioned, the benefits of FDI during the Celtic Tiger period brought along challenges. Ireland’s dependence on MNCs for economic growth led to concerns about the impact of foreign investment on local businesses and workers.22 The government addressed these concerns by implementing policies promoting local entrepreneurship and investment alongside FDI. These initiatives were designed to balance promoting foreign investment with support for domestic businesses and industries. For instance, it established Enterprise Ireland, a state agency tasked with promoting the development of Irish-owned businesses. This agency gave support and funding to Irish businesses to help them compete with the more resource-rich multinationals. In addition to promoting local entrepreneurship, the Irish government invested in education and training programs to help local workers acquire the skills to compete in the global economy.24 This investment into human capital ensured that Irish employees benefitted from jobs created by the foreign firms operating in Ireland. While there were many, one example of this program was Skillnets, which funded training programs for the workers of small and medium-sized corporations.

Despite these efforts to balance the competing interests of foreign investment and domestic businesses and industries, some expressed concerns about the longevity and fairness of the tax incentives afforded to multinational corporations.28 Low corporate tax rats did enable foreign investment and economic growth, but concerned parties believed this could lead to a “race to the bottom,” with countries competing to provide corporations the most favorable tax environment.29 The 2008 global financial crisis had a significant impact on Ireland’s economy, leading to a period of instability and slowed growth. Some critics suggested that the country’s reliance on FDI had left it vulnerable to economic shocks, as foreign corporations chose to relocate or downsize operations in response to the shaky economic conditions.30 As a result, the Irish government introduced a range of measures aimed at promoting local businesses and industries, including a 500-million-euro innovation fund for high-growth startups.31

One of the critical lessons learned from Ireland’s experience is the need to develop a comprehensive strategy for promoting FDI while supporting local businesses and industries.22 In particular, governments must ensure they are not sacrificing long-term economic growth for short-term gains by offering excessive tax incentives to foreign corporations.28 Moreover, they must ensure that MNCs are doing their part to support local communities and create high-quality jobs.28 Additionally, governments must invest in education and training programs to help local workers acquire the skills to compete in the global economy.32

Ireland’s experience during the Celtic Tiger period illustrates the complexities of FDI and the tensions that can arise between domestic institutions and MNCs.22 While the government’s decision to liberalize the economy to foreign investment played a crucial role in stimulating economic growth, it also created challenges that policymakers must navigate carefully.25

Conclusion

Domestic institutions exert a significant amount of political influence when it comes to the regulation of foreign direct investment. Since the twentieth century, foreign direct investment has been used to expand industry while the world engages in repeated cycles of increasing and decreasing levels of trade liberalization. The measures taken by each country to regulate foreign direct investment changes based on regime type and domestic politics, but in cases such as the United States, where organized interests play a powerful role in legislative and oversight processes, multinational corporations occupy an influential role in dictating FDI policy for the nation. Various factors contribute to domestic Institutions and interest groups creating policies that liberalize FDI including democratization, increased effect on economic growth, shift towards neoliberal reform, and increased cost of closure, trade openness, and reaction to other economic policies. Financial mechanisms are also used to regulate FDI closure and openness. Fiscal and financial incentives are used by governments to attract FDI. Moreover, financial constraints faced by domestic firms can influence FDI liberalization. On the other hand, governments can use moral persuasion, public interests, prudential rules for financial companies, golden shares in privatized companies, providing financing to domestic bidders, playing for time, and creating national champions to restrict FDI. The case study discusses the complex relationship between domestic institutions, multinational corporations (MNCs), and foreign direct investment (FDI) using the example of Ireland’s Celtic Tiger period. The policy changes made by the Irish government over multiple decades to attract FDI led to explosive economic growth, but also raised concerns about the impact of foreign investment on local businesses and workers. The government addressed these concerns by implementing policies to promote local entrepreneurship and investment alongside FDI. One of the critical lessons learned is the need to develop a comprehensive strategy for promoting FDI while supporting local businesses and industries, investing in education and training programs, and ensuring MNCs are creating high-quality jobs and supporting local communities.

Works Cited

“Activities of U.S. Multinational Enterprises: 2016.” New Releases. U.S. Bureau of Economic Analysis (August 24, 2018). https://www.bea.gov/news/2018/activities-us-multinational-enterprises-2016.

Autor, David, David Dorn, Lawrence F. Katz, Christina Patterson, and John Van Reenen. “The Fall of the Labor Share and the Rise of Superstar Firms.” NBER Working Papers Series. National Bureau of Economic Research (May 2017). https://www.nber.org/system/files/working_papers/w23396/w23396.pdf.

Baccini, Leonardo. “The Economics and Politics of Preferential Trade Agreements.” Annual Review of Political Science. Annual Reviews (November 28, 2018). https://www.annualreviews.org/doi/abs/10.1146/annurev-polisci-050317-070708.

Barry, Frank, Linda Barry, and Aisling Menton. “Tariff-jumping foreign direct investment in protectionist era Ireland.” Economic History Review 69 (2016): 1285-1308. https://doi.org/10.1111/ehr.12329.

Barry, Frank, and John Bradley. “Economic imperialism and the tyranny of experts: Ireland in the crucible of the international financial crisis.” Journal of Contemporary European Research 9, no. 4 (2013): 560-579.

Barry, Frank, and John Bradley. FDI and the labour market: Lessons from Ireland’s inward investment experience. Oxford University Press (2013).

Barry, Frank, and John Bradley. “The Irish model of corporate development, 1945-2005.” Business History 55, no. 5 (2013): 754-771.

Bernard, Andrew B., J. Bradford Jensen, and Peter K. Schott. “Importers, Exporters and Multinationals: A Portrait of Firms in the U.S. That Trade Goods.” Producer Dynamics: New Evidence From Micro Data. National Bureau of Economic Research (January 16, 2009). https://www.nber.org/books-and-chapters/producer-dynamics-new-evidence-micro-data/importers-exporters-and-multinationals-portrait-firms-us-trade-goods.

“The Committee on Foreign Investment in the United States (CFIUS).” Policy Issues. U.S. Department of the Treasury (April 5, 2023). https://home.treasury.gov/policy-issues/international/the-committee-on-foreign-investment-in-the-united-states-cfius.

Cimino-Isaacs, Cathleen D. “The Committee on Foreign Investment in the United States (CFIUS) – Congress.” CRS Reports. Congressional Research Service, February 26, 2020. https://crsreports.congress.gov/product/pdf/RL/RL33388/91.

Coulter, Colin, and Steve Coleman. The End of Irish History?: Reflections on the Celtic Tiger. Manchester University Press (2003).

Cuervo-Cazurra, Alvaro, Bernardo Silva-Rêgo, and Ariane Figueira. “Financial and Fiscal Incentives and Inward Foreign Direct Investment: When Quality Institutions Substitute Incentives.” Journal of International Business Policy 5, no. 4 (2022): 417–443.

Danzman, Sarah Baurle. Merging Interests: When Domestic Firms Shape FDI Policy. Cambridge: Cambridge University Press (2019).

Dinc, I. Serdar, and Isil Erel. “Economic Nationalism in Mergers and Acquisitions.” The Journal of Finance 68, no. 6 (2013): 2471–2514. http://www.jstor.org/stable/42002573.

Department of Jobs, Enterprise and Innovations. “Ireland’s National Development Plan 2018-2027.” (2018).

Enterprise Ireland. “About Us.” (2021). Retrieved from https://www.enterprise-ireland.com/en/about-us/.

Erel, Isil, Yeejin Jang, and Michael Weisbach. “The Corporate Finance of Multinational Firms,” (February 2020). https://doi.org/10.3386/w26762.

Gilpin, Robert. U.S. Power and the Multinational Corporation: The Political Economy of Foreign Direct Investment. London: MacMillan Press (1975).

Forfas. “FDI in Ireland: Performance and policy.” (2010).

Henderson, David. “The Celtic Tiger and its lessons for globalization.” Journal of International Affairs 61, no. 2 (2008): 59-76.

Hunt, Jennifer, and Andrea L. Wheeler. “Foreign direct investment in Ireland: policy implications for emerging economies.” Journal of International Business and Economy 18, no. 1 (2017): 31-44.

Kim, In Song, and Helen V. Milner. “Multinational Corporations and Their Influence Though Lobbying on Foreign Policy.” Brookings Institute. Princeton University (January 2019). https://www.brookings.edu/wp-content/uploads/2019/12/Kim_Milner_Brookings19-final.pdf.

Kim, In Song, and Iain Osgood. “Firms in Trade and Trade Politics.” Annual Review of Political Science. Annual Reviews (February 1, 2019). https://www.annualreviews.org/doi/abs/10.1146/annurev-polisci-050317-063728.

Kobrin, Stephen J. “The Determinants of Liberalization of FDI Policy in Developing Countries: a Cross-Sectional Analysis, 1992-2001.” Transnational corporations 14, no. 1 (2005): 67–.

Lavelle, John and Kenny, O. “Irish entrepreneurship policy: Progress made and lessons learned.” International Journal of Entrepreneurship and Innovation Management, 20 (2016): 223-244.

Lindblom, C. E. Politics and Markets: The World’s Political Economic Systems. New York: Baisic Book, Inc. (1977).

Martin, Lisa L., and Soo Yeon Kim. “Deep Integration and Regional Trade Agreements.” Essay. In The Oxford Handbook of the Political Economy of International Trade. Oxford: Oxford University Press (2015).

“Multinational Enterprises in the Global Economy.” OECD (May 2018). https://search.oecd.org/industry/ind/MNEs-in-the-global-economy-policy-note.pdf.

Nye, Joseph S. “Multinational Corporations in World Politics.” JSTOR. Foreign Affairs (October 1974). https://www.jstor.org/stable/20039497.

Skillnets. “About Us.” (2021). Retrieved from https://www.skillnets.ie/about-us/what-we-do

O’Rourke, Kevin H., and Alan M. Walsh. “The Irish economy since 1987: from crisis to boom to bust.” Journal of Economic Perspectives 24, no. 3 (2010): 67-85.

Pandya, Sonal S. “Democratization and Cross-National FDI Liberalization.” In Trading Spaces (2013):88–108

Pandya, Sonal S. Trading Spaces: Foreign Direct Investment Regulation, 1970-2000. Cambridge: Cambridge University Press (2013).

Vernon, Raymond. In the Hurricane’s Eye: The Troubled Prospects of Multinational Enterprises. Harvard University Press, 2000.

Yeaple, Stephen Ross. “Firm Heterogeneity and the Structure of U.S. Multinational Activity.” Science Direct. Journal of International Economics (March 18, 2009).