8 Time Horizon

The best investors are the ones who give themselves the most time. This is why I have written this book primarily for younger folks just beginning to look into asset ownership. It is estimated that the average saver begins planning and saving for retirement by age 31, even though they have had the legal ability to own assets since their 18th birthday, sometime earlier.[1] I believe the main reason many people are so woefully financially underprepared for retirement is the simple fact that they did not begin early enough.

There is also a quantitative advantage to beginning early. We touched on the idea of compound interest earlier but will revisit it now. Compound interest means that when you invest, the money you make off of your investments also makes money. And that money makes money. And so on and so forth. It’s almost like a snowball. Take the example of $100 and a 10% annual return. At the end of year one, you will have $110. During the next year, that $110 will earn 10%, resulting in an $11 dollar gain on the year, bringing the total to $121 at the end of year two. The famed physicist Albert Einstein once said:

“Compound interest is the most powerful force in the universe. He who understands it, earns it; he who doesn’t, pays it.”

Benjamin Franklin aptly described it as such:

“Money makes money. And the money that money makes, makes money.”

Once you understand compound interest, you will also, in turn, understand why it is so important to hold onto your investments for long periods of time. It is human nature to want to time things just right, to be able to buy an asset when its price is lowered and sell once it has gone up. In finance, we have a term for this. It is known as timing the market, and it is nearly impossible to do. Think about the stock market, for example. There are thousands of companies that have their stock purchased or sold by billions of accounts in trillions of total dollars. Each and every buyer and seller act as independently as they wish, and prices are defined and set by supply and demand. The economy affecting these businesses can also be unpredictable, and political tensions further complicate the markets.

So what makes one person think they can outsmart not only the other investors in the market but also the chaos and unpredictable nature of the world economy? Some will disagree with my statement, and believe markets can indeed be timed. I believe it may be possible, but only under very specific situations. I also believe most Americans work full time, have hobbies and families to raise, and therefore don’t have the time necessary to succeed in this endeavor. Certain folks, like Warren Buffett, Peter Lynch, Joel Greenblatt, Michael Burry, and Jim Simons, have been able to do this in isolated market events, but never consistently over time. However, it is unlikely you will have the time, resources, or skills for timing the market. Likely, you would just generate more losses and taxes for yourself overall. It is, for this reason, we should all abide by the age-old saying: “time in the market beats timing the market.”

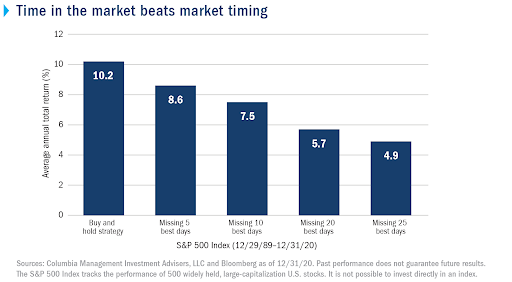

If an investor sits out days in the market by trying to time it, it is statistically proven to impact their returns. We can see that the buy and hold strategy always provides superior annual returns. If an investor were to miss just the 5 best days in an over 30-year period, their yearly return would drop over 1.5%. This effect takes greater hold the more days are missed. But what if you could somehow know the lowest point the market will reach that year? Would you fare any better if you were clairvoyantly able to buy the market at these low points? The evidence on this is also quite clear, and further supports the hypothesis we have been building.

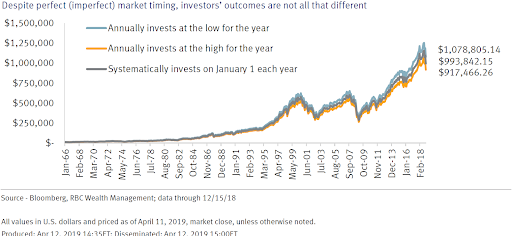

Taking stock market prices since 1966, we have three lines utilizing different investing strategies. One line invests at the highest price of the year, the other on January 1st and the last at the lowest price for the year. Although it is hard to see, the line representing the lowest point timed buying is a bit above those of the other strategies. The chart also shows us that the low point buying investor ended with an asset amount of $1,078,805, while the investor who buys periodically ended with $993,842 – a total difference of $84,963. While an extra $84,963 would be nice, the truth of the matter is that you would have to be incredibly lucky to find the exact bottom price every year. As we stated earlier, during the short term, asset prices often move unpredictably and without reason. I’m not telling you it’s impossible, but I am telling you it’s extremely improbable. Also, given the fact that you have a life, it may be hard to find the time to do the research and tracking necessary to purchase the exact bottom points. Consider that a warning – if you try to do this, you might drive yourself crazy.

- Katie Brockman, “This Is the Age When Most People Start Saving for Retirement,” The Motley Fool, September 2, 2019, https://www.fool.com/retirement/2019/09/02/this-is-the-age-most-people-start-saving-for-retir.aspx#:~:text=A%20separate%20survey%20from%20Nationwide. ↵

Something you probably can't do, timing the market is an incredibly daunting task. Investors who try to do this often lag the major market indexes in performance and subject themselves to lots of trading.

The best type of investment strategy, buy and hold is simply that, buying an asset or investment and holding it for as long as possible, often for life.