Rule #5: The brokerage is safer than the bank.

Now, I’m not sure what your opinion on bank accounts so far may be; if you’re like me, you might refuse to use your bank account for anything besides transacting altogether. Maybe after reading along, you are also beginning to question why you are stashing so much in a savings account, seeing very little in return. These are important thoughts to have regarding your saving practices.

I’d like to offer you another one to ponder on. I have experience working in banking, and I have experience working with clients who have had whole bank accounts emptied in a matter of minutes. How many of you can share a similar story? Perhaps a friend or family member who had thousands of dollars zapped or disintegrate out of their accounts?

I would hazard a guess that most of you know someone who has experienced this misfortune. It’s no fun. In examining this more I’d like to break down the way money moves – sometimes unwontedly – through the banking system, as well as why it’s often quite archaic and unsafe, putting you at risk of losing your funds and spending hours trying to get them back.

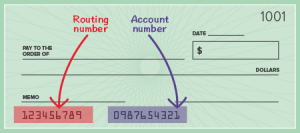

At its simplest, a bank account is a set of two number codes that correspond to a spot inside the bank’s much larger overall accounting ledger. This specific spot is your account and your funds, and can only be accessed through the combined routing and account numbers. The routing number tells us which big financial institution the account belongs to. The account number tells us which specific spot inside this bank’s ledger your money falls.

The practice of using routing and account numbers actually dates back over 100 years. In 1910, the routing numbers were created to let clearing houses and payment processors know exactly where money was going to and from, reducing confusion in processing transactions.[1] Modernly they indicate that the bank is a member of the Federal Reserve System, and might be referred to as ABA or Fed routing numbers. With these two numbers, you can access your bank account – and so can anybody else.

This is the number one problem with the safety of bank accounts. The two number system theoretically allows anyone with knowledge of these digits to initiate transactions in and out of your account. What’s even worse is that banks give out hundreds of little paper slips that have these two numbers printed on them, front and center. These pieces of paper are often left around, signed and given to strangers, photographed, or sent in the mail to other countries. You might be wondering why the bank would be so dumb to give out access to their accounts like this. You also might be wondering exactly what little pieces of paper I’m talking about. Colloquially, these pieces of paper are known as checks. Since they are just pieces of paper, checks aren’t hard to recreate, forge, or downright copy. Below is an illustration of where the routing and account numbers fall on a check.

Banks aren’t totally oblivious. Much work has been done to increase the security of checks and offer other means of transfer or payment that aren’t so susceptible. These other methods are all, unfortunately, underpinned by the same two number systems. Many banks will tout their “digital first” approaches. Digital offerings include ACH transfers, including external deposits and withdrawals. In an external deposit, money is transferred from your associated routing and account numbers to another account at another institution. An external withdrawal is at the other end of this transaction, when someone at another institution requests funds moved to their account by way of giving their bank your routing and account number. While this might appear at surface level more secure than using checks, what ends up happening is that fraudsters, too, become “digital first.” With the power of advanced software, and the anonymity of being behind a screen, they are often able to scam banks more efficiently. During my career in banking I saw this unfold multiple times.

In one of these instances the client had somehow compromised their routing and account numbers, after which unknown transactions began popping up in her account. Many of us have used the micro-deposit method of verifying our bank accounts with another institution to which we need to send or receive money. The client’s account had dozens of these micro deposits, all made from different counterparties and all within a period of an hour. It appeared that the fraudsters had gained access to the routing and account numbers and plugged them into an aggregation software. The software put the two numbers into tons of the micro-deposit authorizers and proceeded to guess what the deposits were. It did this repeatedly until it hit, after which it initiated transfer, clearing the entire account. I remember being aghast, and in all honesty, a little impressed with the hackers. People will stop at nothing to get their hands on money, and the unfortunate reality is that technology only makes this easier.

Banks are well aware of these issues, and thus offer clients insurance on their deposits. All large banks have FDIC insurance, which insures up to $250,000 per account holder, per account type. This insurance, however, only applies in the event of a bank’s failure – it has nothing to do with fraud or scams. For those specific issues, banks often have their own supplemental insurance and departments of investigators to handle disputes. It is worth checking with your bank and reading your account’s deposit disclosures to see how it will be handled. In all situations, getting back your money will be a monumental, time consuming and stressful process. Even in the instance where you are completely defrauded, you may find the bank’s first interest is not taking a loss on your stolen deposit. In many cases, the bank will initiate a whole investigation to make sure you didn’t make a mistake and give out your two numbers, which would make them less liable. However, there is little consideration given to the fact a two number system might itself be the problem.

The good news here is that you will eventually get your stolen money back, operative word being eventually. The bank will need to investigate, dispute, and contact their own insurance providers. In sum total, it will cost the bank money to go through all these processes – so they will opt to take their time to make sure all their liability is taken care of. They will also want to make sure this doesn’t happen again, which will involve changing your magic two numbers. For people who have been using the same account for years, this can prove the biggest hassle. All new debit cards will be needed, direct deposits or social security will have to be changed, and any recurring authorized deposits or withdrawals will cease. Many folks will end up having to give out their new routing and account numbers to a sleuth of new counter-parties, increasing the risk of interception and thus possibly starting the cycle once again.

By telling you all this my goal is not to bash the banking system, or to scare you out of all your accounts. It’s to make you aware of the exact risks present in the two number system, so at the very least, you are educated on how your money moves between different places. I also wish to offer an alternative to the bank account as the principal safe spot for your hard earned cash. This is also a place where your cash can start working for you just as hard as you are working for it. This place is the brokerage.

![]()

We spoke earlier about the different accounts available to purchase assets with, as well as their corresponding annual contribution limits. In a sense, these are all brokerage accounts: accounts used for the purchase of publicly traded assets. The brokerage account has a few distinct advantages over the bank, which I will break down. But first, I have a question. Have you ever heard of someone’s 401K or Roth IRA account being compromised and cleared out? I have not – and these are some reasons why:

Allocation Flexibility

Inside a brokerage account you can purchase most types of publicly traded assets. Furthermore, you are holding assets, not cash. These assets can’t be cleared or pulled away from your account. Since they represent ownership or interest in income or capital producing assets, they must be sold in the open market during trading hours before they can be moved anywhere. It is for this reason that either you, a broker, or a financial advisor must confirm the sale of these assets by taking action in the account; either by pressing a button, making a call, or authorizing a sale. Without one of those actions no access can be granted to the securities. Furthermore, in the brokerage you may structure your investments so that they align with your goals and risk tolerances. Maybe the interest rate on your savings is not getting it done, and, for example, you are comfortable with a little bit of risk in the principal value of your account for the chance of doubling the interest of your savings. Maybe you also would like to keep some cash available for emergencies as well, which you can do in the brokerage. Using what are called deposit sweeps, brokerages will “sweep” your cash to bank accounts held in their name in order to earn interest on the cash. Oftentimes these swept balances are put in accounts that yield comparable amounts to consumer savings. In many cases they earn even more, since the brokerage is able to leverage the massive pool of cash balances they control to get banks to offer them good rates. These deposits, when swept, are held by the banks, and are thus FDIC insured the same way your savings would be. When you need the cash you are able to withdraw immediately. The brokerage gives you the cash due, then later contacts the bank for the funds back, since they fronted you for it.

Multiple Counter-Parties

As we mentioned in the previous section, there are many more counter-parties involved in the operation of the brokerage account. These multiple players reduce the risk of fraud and scams, since money has to pass through three or more intermediaries before it is accessible. For example, a financial advisor may be the first intermediary protection, taking the first action to request a buy or sell in the account. After the order is submitted by the financial advisor, it makes its way to the brokerage itself. The brokerage is responsible for executing the order, i.e. finding a willing counter-party in the open market with which to execute the trade. They do that through a regulated exchange, most commonly a stock exchange. The exchange makes sure prices are accurately quoted, and assures the trading brokers each get their fair side of the deal. After this trading partner is found and the trade amount is in line with the market amounts on the exchange, the brokers introduce a clearing firm, who processes the safe legal ownership of the said securities between the two parties. After the clearing firm processes, the trade settles, giving time for all four parties to confirm that everything is in line. This whole process is much more complex than two numbers: it represents a decentralized web of participants, each of which makes sure no fraudulent activity passes through their checkpoints.

SIPC Insurance

Since brokerages hold consumers’ money, they must always act in good faith to stay solvent, in order to be able to fill their client’s requests. In the past, brokerages have gone belly up, which led to the creation of the Securities Investor Protection Corporation. The SIPC is a federally mandated non-profit that provides insurance to brokerage clients in the event of a brokerage failure. Every registered broker-dealer is required to have this insurance, the same way a bank has FDIC insurance. The coverage on SIPC insured accounts is even better than that of FDIC; in addition to $250,000 worth of cash balance insurance, it also covers an aggregate total of $500,000 for the entire account. For an account holding $250,000 worth of cash and $250,000 of securities, the entire amount would be insured. It is important to mention that this insurance does not apply to losses induced by market price movements. If your $250,000 worth of securities fall in value to $225,000 due to a stock market crash, SIPC has no jurisdiction. If your broker goes out of business, however, your whole account will be reimbursed to the market value of the securities the day the brokerage went down at the expense of the SIPC.

Payments and Transactions

Your last reservation might be that the brokerage sounds great, but sometimes you need to write checks, wire money, or transact out of your savings. Many brokerages actually allow these privileges. Depending on your broker, checks can be written off an account from which your cash has been swept, and brokerages frequently partner with banks to offer their clients wiring and ACH transfers. The key distinction here is that these traditionally two number banking transfers won’t be coming out of your brokerage account, rather out of a side bank account the broker owns and operates for you. So in this case, the risk all falls upon the brokerage – not on you. The broker will only debit or credit your brokerage accounts after the transactions have been posted and cleared in their company owned holding accounts. In the event of fraud or a scam, the layer of protection between the broker’s bank account and your brokerage account means your brokerage funds won’t ever be touched. Recently, many brokers have begun offering accounts with checking and transaction privileges. While each brokerage is different, some even give clients debit cards attached to their swept cash balances. This is nice but might be overkill, as a checking account is something everyone should have and use, even if it’s their only use of banking services at large.

Hopefully by now we can see that the brokerage can be a much safer spot for your cash and savings than a traditional account. We also have learned about the intricacies of trading public securities, from trades themselves to exchange, clearing, and settlement. I will return to my initial two questions. How many stories have you heard of bank accounts getting accessed and emptied out? How many times have you heard of this happening to a brokerage or securities account? The brokerage is safer than the bank.

- American Bankers Association, “ABA Routing Number,” www.aba.com (American Bankers Association), accessed August 30, 2022, https://www.aba.com/about-us/routing-number#:~:text=You%20can%20find%20the%20ABA. ↵

A running list of transactions, a ledger is meant to serve as a history for future analysis.

The central banking system of the United States, the Federal Reserve System regulates and supervises large systemically important financial institutions.

Used for the transfer of money, an ACH or Automated Clearing House is the primary system banks use for electronic funds transfers.

Insurance meant to stabilize deposits in the financial system, FDIC Insurance is issued by the Federal Deposit Insurance Corporation.

A platform or company who performs trading, a brokerage assists clients in the purchase and sale of assets.

Assets that are publicly traded, securities represent investment interest in a common enterprise, ran by others, with the expectation of profit.

Overseen by a government or other industry body, a regulated exchange controls who may enter and participate in the market, along with ensuring its safety and honesty.

Tasked with the final step in securities transactions, a clearing firm works with the regulated exchanges to process the settlement and completion of trades.

A non-profit, government adjacent organization, the SIPC provides the securities industry what the FDIC provides to banking.