1 Real Estate

Real Estate is the oldest and most basic type of asset. The earliest recordings of real estate markets are from just after the Stone or Paleolithic age when hunter-gathering became more systematic and communal.[1] Tribes would stake claims to farming land and defend it from neighboring tribes. Tribe elders would be responsible for doling out the returns from this land to the members of the community. As society became more advanced and trade accelerated, tribes appointed kings and other dignitaries in order to establish leadership. As these superiors divided the land, they would give their close associates the deeds and titles, to do with it whatever they pleased. They built homes and farms – and later, castles and kingdoms. Thus real estate as we now know it was born.

Real Estate comes in three forms: residential, commercial, and land. Residential real estate refers to a dwelling where residents currently reside. This includes houses, condos, townhomes, apartments, co-ops, mobile homes, and boathouses. Commercial real estate is real estate used for business. This can include offices, storefronts, garages, fulfillment centers, warehouses, and so on. Land refers to everything else – farmland, land above oil reserves, land with natural resources, and land to be developed for residential or commercial use at a later time. For the average American, residential real estate is the most important to be familiar with. Commercial real estate and the purchasing of raw land are rather niche markets that most folks won’t have to deal with in their lives. For this book, we will only focus on Residential Real estate – which, according to the majority of financial professionals, is the best asset you can own.

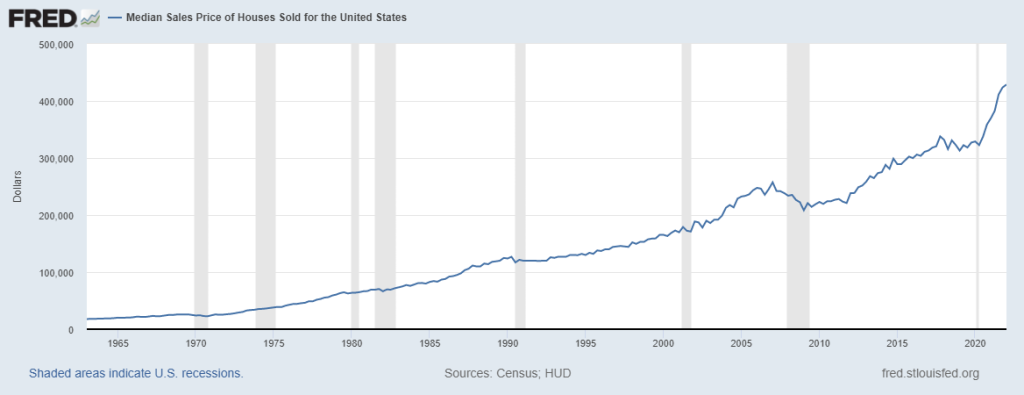

When discussing Residential Real estate, we have to make the important distinction between owning and renting. Assets are only valuable to someone if they are owned under their name legally. Renting does not fit that bill. Rather, by renting, you are making someone else money. They own the property and are charging you to stay there. In almost every case, they are renting to you at a price that makes them a profit. You pay more than they would, over the same period of time, to own the same property. Of course, it’s difficult to own a house when you are young; you don’t make enough money yet and may have other expenses, like tuition and the cost of living on your own. For folks in this position, renting might make a lot of sense – and that is perfectly fine. However, renting as a way of life, beyond your younger, early adult years, is not the best idea. Remember: owning assets is the big goal here. It is what will protect us from inflation and set us up for future financial success. A house is the best asset you can own – more specifically, the single-family residence or SFR. There are advantages to owning this type of residence, and all of those reasons are why house prices have gone up each year by about 4% on average.[2] Here is a chart from the Federal Government that shows the average price of a new single-family home in the United States since 1965.

In 1965 the average sale price was $20,200. Now, ask a homeowner how much they paid. The increase will be striking. 4% a year is pretty good and beats our benchmark 3% inflation rate. If all we did was buy a house and live there, never doing any other investing, our real return, or real wealth growth, would be 1% annually. There are also other benefits to owning a home. It’s a place to raise kids (if that’s your plan), it’s a place to have your family come and visit, and it’s a place to start a business. It’s even a place to work if your job allows. Most importantly, it is yours. You live there and can build a life there. Homes are not only incredibly important for your finances and wealth, they are also incredibly important for your health and psychological well-being.

So how does one purchase a house? Where do you start? Most of the time, none of this information is taught in schools. I firmly believe that is somewhat intentional. Home buying is kept opaque so that only the already wealthy and affluent partake – another big barrier to disrupting systemic wealth inequality. If no one knows how to make it happen, no one will do it – and the vicious cycle of renting will continue. The purchasing of a house is conducted in a different manner than normal purchases (you don’t buy houses like you buy things on Amazon, so to speak). For the most part, houses are not purchased fully or in cash, rather they are financed and paid over time, using a financial instrument known as a mortgage. A mortgage is essentially a loan from the bank that allows you to pay a portion of the cost of the home upfront (known as the down payment) and the rest of the cost over a set period of years (known as the term). You pay this given amount, along with an additional fee, to the bank that has extended the money to you (known as the mortgage rate). The majority of the time, mortgage rates are fixed. This means that the extra percentage you pay is set in stone over the term of the mortgage. This rate has averaged out to be roughly 5% for a 30-year fixed mortgage since the start of the 21st century. This means each year your payment will include 5% of the amount you borrowed. You might be wondering if this deal is worth it. But trust me, it is. There’s something uniquely awesome about the fixed mortgage structure. Because of inflation, that fixed amount becomes less and less real wealth every year. If you own assets that beat inflation over the term of the loan, your mortgage payment becomes increasingly smaller, while simultaneously, your home’s value is expectedly growing. Let’s create a scenario for ourselves to help understand this better.

![]()

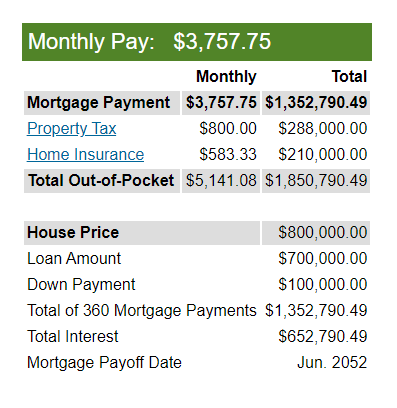

You found the home of your dreams – a beautiful 3-bedroom 2-bathroom rambler a little outside of Seattle. The house is selling for $800,000, and you have $100,000 to put towards a down payment. The bank is offering you a 5% fixed rate 30-year mortgage. The interest on that loan is going to compound, meaning it will grow exponentially over the years, as each year it gets 5% bigger, which scares you a bit – you’re not sure you want to take on the extra cost. Luckily, though, you have a great realtor and mortgage broker who are going to help you through the whole process. You need to borrow $700,000 to finance the rest of the house. This number is derived by calculating the selling price minus the down payment. The bank is offering a 30-year (360 months) fixed rate mortgage at 5% interest. Before the loan, they also must give you the total cost, including the interest, that they will charge for borrowing their money. Many lenders are also kind enough to make your home insurance and tax payments for you as well, which get wrapped up in the monthly mortgage bill. For our illustration, we have included those amounts as well.

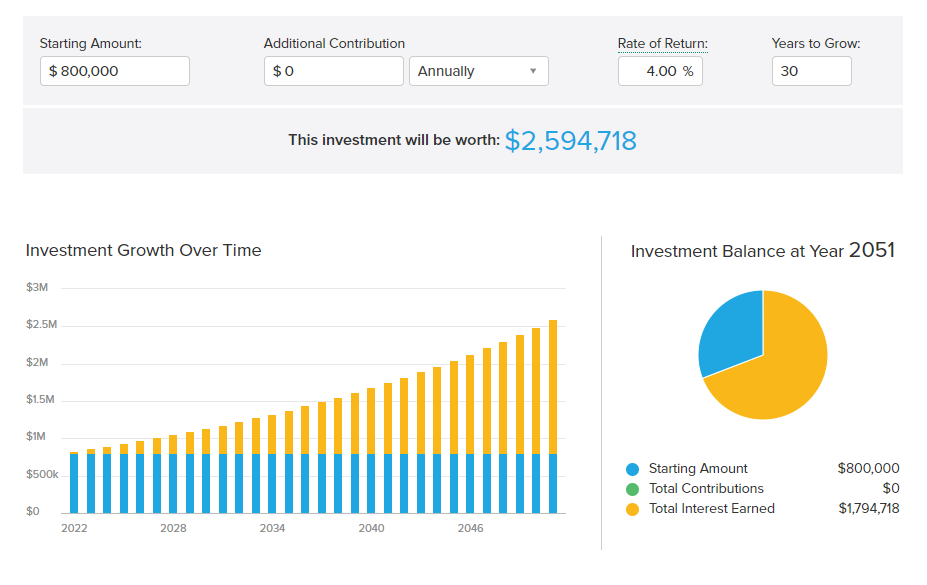

Taking a look at this chart, we can see that you will pay $652,790.49 in interest on your loan. That means that the total cost of the house will come out to almost 2 million dollars when we account for taxes and insurance. That’s a lot of money. But what about the house, the asset you are purchasing? That will go up too. If you bought your house for $800,000, 30 years later, at a 4% return, it would be worth roughly 2.6 million dollars.

After 30 years, you are left with a paid-off asset with a value of $2,594,718 and a total cost of $1,850,790. If we were to immediately sell the house and take the cash, we would have realized a return of roughly 40% on our cost basis. While it is not important here to inflation adjust (since we have both a debt and an asset, the bad inflation that eats at our asset will also eat at our fixed debt payments) the annual (yearly) return of our 40% would be about 1.13%. Technically that doesn’t beat our inflation target of 3%, but technically we also shouldn’t think about it that way. Also speaking “technically” anyone who rents has a -100% return on every single one of their rent payments. I digress.

Once the mortgage from the bank is fully paid off, the homeowner has many options of what to do with this asset. The mortgage has provided the homebuyer with the easiest and simplest access to leverage that they will get in their lives. Leverage is a financial term used to describe the act of borrowing money from a bank or other financial institution in order to purchase an asset that you hope will appreciate over time. You put up a fraction of the cost of the asset and are then able to buy it in full, as long as you commit to making periodic payments on the balance you owe. Leverage is used in many common transactions, like using a credit card, buying a car, or entering into insurance contracts. While there may be a stigma around having debt, it is very important to recognize that the debt will only hurt you if you are earning less from the assets you choose to purchase. In the case of a home, you will not be hurt by this debt unless the interest rate is larger than the amount the asset appreciates.

An example of bad debt would be the use of leverage to purchase a depreciating asset. Depreciating assets lose their value over time. Common examples are cars and large appliances. For example, let’s say that you pay 3% interest to borrow the money for a car, while on average, a car will lose 15-18% per year.[3] This leaves you with a real cost of -18% to -21%, depending on the attributes of your car. Talk about a scam!

The lesson here is that leverage can be a tool, so long as it is used correctly, in the form of mortgage debt. But on the other hand, it can also be detrimental to financial health if used to pay for things that do not go up in value. As stated earlier, the goal of all of our work here is to understand appreciating assets: why they appreciate, which ones to own, and how to own them. A house is the simplest of these assets, but as we move forward we will continue to explore more. Hang tight.

- Andrew Beattie, “No Longer Nomads: The History of Real Estate,” Investopedia, 2019, https://www.investopedia.com/articles/07/history-real-estate.asp. ↵

- Sarah Szczypinski, “What Is Average Home Appreciation?,” www.ownerly.com, December 13, 2019, https://www.ownerly.com/real-estate/average-home-appreciation/. ↵

- Nicole Arata, “Managing the Hidden Costs of Car Depreciation,” NerdWallet, July 17, 2017, https://www.nerdwallet.com/article/insurance/car-depreciation. ↵

A term used to describe a loan that is for the purchase and maintenance of land and real estate, the mortgage is quite possibly the most important consumer financial tool.

A financial tool whereby someone borrows money to make an investment they could otherwise not afford, leverage is most commonly seen on households balance sheets in the form of a mortgage but could also look like companies buying other companies or borrowing money to put on a certain expensive stock trade.