3 Stocks

I’m sure you’ve heard of stocks and the stock market. Our presidents talk about it all the time. Sometimes it crashes, sometimes it goes up. Lots of people follow it religiously. But what exactly is a stock? And what makes it the topic of so much news and discussion?

A stock, at its simplest, is a piece of the ownership rights to a company. When stock buyers buy stock (or equity), they are really buying a small portion of that company. These portions of ownership are called shares. Each share has an attached market value and is traded in the stock market five days a week. The combined dollar value of all of a company’s shares makes up the market capitalization of that company. This is the value that the market assigns to the business. Therefore, when businesses are doing well, stocks are expected to do well. But if businesses are doing poorly, they are expected to fall. Stock investors buy into a company and are entitled to a certain share of the profits or losses of said business.

Stock has been around for hundreds of years. The first stock certificate, from the Dutch East India Company, was found to be from the year 1606. The Dutch East India Company issued stock to people to fund explorations as an alternative to issuing bonds. Since then, the stock market has become increasingly important – a growing representation of the world economy. Nowadays, virtually every major company has stock available to purchase in the market, and new companies can issue stock through an Initial Public Offering, or IPO. You can see some older stock certificates below. They can give you an idea of how pervasive stock issuance has been throughout American history. I would also encourage you to google the names of your favorite companies, navigate to their stocks, and take a look.

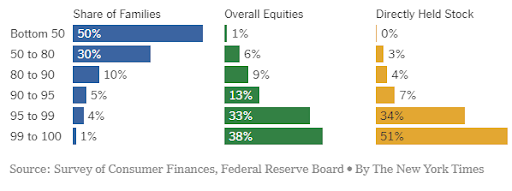

The stock market – or the stocks traded within it – have perhaps proved to be the best asset to own over a long period of time. Generally, this is considered to be a good way to beat the inflation average of 3%. Speaking broadly, the S&P 500 index (the most tracked average of the whole market) has averaged a 10% return annually since 1926. It must be noted that 10% is the average and very rarely does the market actually return 10% in a given year. More likely, some years are very good, while others return nothing, or even have negative returns. It is for this reason that stocks are also considered to be the riskiest of assets. There have been days when the stock market has fallen more than 50%. However, we also notice that the long-term return beats the inflation target – and significantly more than real estate or bonds. This paradox is a universal law of markets and buying assets: the greater the risk, the greater the possible return. The stock market is the foundation of wealth for many people in the United States. If you take a look at the chart below, you can see that the vast majority of wealth in the United States is concentrated amongst those who own stock.

![]()

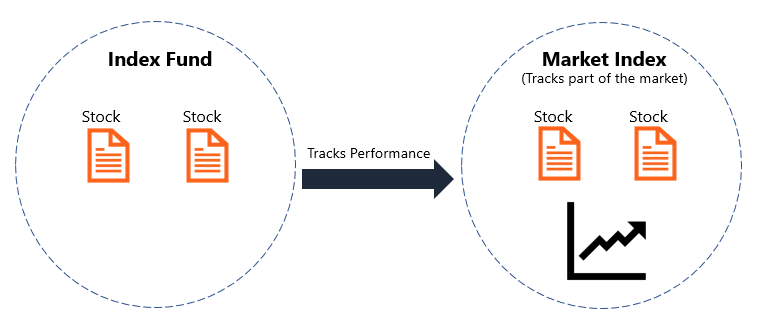

So, how does one buy stock? And which stock should you buy? Huge financial industries are built around these questions, and with so many options and strategies, it’s hard to know what to do. In the past, stocks were bought through a broker. You would call up your broker and discuss what stocks you wish to buy or sell. The broker would place these orders in your brokerage account. They would also charge a commission on the sale. Depending on the stock, it could be anywhere between 1 and 50 percent. Today, however, stock buying is much more accessible. You can get a brokerage app on your phone and digitally place your own orders. As for which stocks to purchase, most buyers are best suited with an index fund, which guarantees their fair share of the whole market’s returns. In order to understand index funds, it is firstly important to understand stock market indexes. Indexes are groups of different stocks put together in order to represent a section or entirety of the market. The three most quoted indexes are the Dow Jones Industrial Average (the Dow), The Standard and Poors 500 index (S&P 500), and the Nasdaq Composite Index (The NASDAQ). These indexes are comprised of hundreds of different stocks, and through varying methods, each attempt to create an average of the total. These are useful tools to measure the performance of stocks. An index fund is a share of an investment vehicle that mirrors the index. By buying an index fund, you purchase shares in many different companies – all in one single purchase. Think of it like a basket. Consider the image below to visually represent the index fund structure.

An index fund is tax efficient, comes at a low cost, and has good liquidity. On top of this, buying an index fund is also quite easy, available to purchase online in minutes. Stock is one of the best assets to own – you can enter the market and achieve its returns easily. Index funds allow you to achieve the returns from theoretically thousands of different companies, all at once. We spoke in the previous section about bond funds, which are traded in the same markets as stocks. A bond fund is similar to an index fund in many regards. It represents the ownership share of an assortment of different bonds grouped together. These bonds will have an average yield, which will be distributed to the holders of the fund on a regular basis. One difference between direct bonds and bond funds, however, is that bond funds are infinite – they do not have set terms or maturity dates like regular bonds. When a bond in the basket matures, it is simply redeemed, and the funds are used for the purchase of a new bond. Therefore, the bond fund will always trade at a relatively stable level over time. Just like stocks and index funds, bond funds can be purchased easily. If you are interested in purchasing stocks, you must dedicate time and effort to researching the business and industry in which it operates. Here is a list of questions you should start with:

- Is the business growing?

- Do I understand how the company makes money?

- Do I use the company’s product(s)? What is my experience with them?

- What is expected of the industry this company operates in? Is it growing?

- Does the company have major competition? If so, how are they staying ahead?

- Am I confident enough in this business to buy stock?

While these are just a few examples, they provide a good starting point for any research you might want to do. Picking stocks in individual companies is a very difficult thing to do. It is rare to beat the average return of 10% per year.[1] Rather, stock pickers usually fall short of this return over the long run.[2] There are many reasons for this – the most notable being that stock pickers tend to chase the hottest new stocks, have biases towards certain industries and companies, and buy and sell too often, which subjects them to lots of taxes. While it may seem enticing to pick your own stocks, most people are better off buying the index funds with the majority of their money (and perhaps purchasing a select few stocks on the side).

- James Royal and Arielle O’Shea, “What Is the Average Stock Market Return?,” NerdWallet, August 11, 2021, https://www.nerdwallet.com/article/investing/average-stock-market-return. ↵

- Bob Pisani, “Stock Picking Has a Terrible Track Record, and It’s Getting Worse,” Trader Talk (CNBC, September 18, 2020), https://www.cnbc.com/2020/09/18/stock-picking-has-a-terrible-track-record-and-its-getting-worse.html. ↵

Initial Public Offering or IPO, is the first time a companies shares are available on the public markets for purchase.

The largest and most actively followed gauge of the U.S. stock market, the Standard & Poor's 500 index tracks the 500 largest publicly traded American companies.

A special type of fund meant to track the results of a specified index, an S&P 500 index fund will on average, after expenses and fees, return the same as the S&P 500. There are many index funds tracking many different indices.

The process by which bondholders are paid back in full, bond redemption is the act of going back to whoever issued they bonds when they are due, and receiving your initial principal or face value investment back.