Rule #3: Make coffee at home, or don’t (money isn’t everything).

I am very active on Twitter. It is hands down my social media of choice. I like Twitter because of its simplicity. Tweets can be sent rapidly, and contain easy-to-understand info in 140 characters or less. Twitter is also home to many important people in the financial space, and it is very common for Twitter feeds to be organized into different niches of finance. In one of these micro niche threads, there are a plethora of financial consultants, advisors, and real estate investors, all convinced of one thing: if you make coffee at home, you will be a gazillionaire. Now, the logic behind this is that a cup of coffee costs $5, and over a year of missing that expense, you will save $1800. Should you take that money and invest it, you would undoubtedly amass yourself a small fortune. I get the easy solution it provides, and the intrigue of a simple lifestyle switch to become rich, but I wouldn’t trade my morning coffee for the world.

I enjoy coffee because it wakes me up, it tastes great on a cold day, and I often enjoy it with friends, family, coworkers – even strangers. Some of my best work is with a warm cup of jo within six inches from my right hand. The point of explaining my love of coffee (or maybe it’s an addiction), is to say that it is one of those small things I have in life that brings important moments of happiness. My mother calls them “little joys”. For some, it could be an add-on to their character in a video game. For others, a new toy for their pet, or a special drink they get with a family member. For me it’s my coffee, what is it for you?

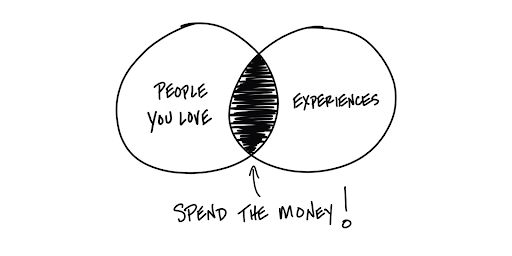

My original title for this section was going to be money isn’t everything. That’s the idea I’m trying to get at. It always drives me crazy to hear these money gurus on social media promoting strategies like this. It completely disregards the experiential nature of our human lives. It is important to experience the little joys, to spend the extra money, and go have coffee. Not only will you be miserable if you subject yourself to strict rules about what you can and cannot spend on, but you will also socially isolate yourself, as many of the most important experiences that involve money take place with other people. There’s a nice Venn diagram I saw on Twitter arguing against these money gurus. I think it is a good rule to live by, even if the person you love is yourself. It looks like this:

I also firmly believe that people should have mindsets of growth and abundance rather than scarcity when it comes to finances (spending, investing, giving). Maybe you do want to invest $5 a day, starting at a young age, to grow yourself a little fortune. I would advise taking a mindset of acquiring an extra $1800 a year to keep your much-enjoyed lifestyle, versus cutting out your coffee every day. This could be in the form of a few weeks of overtime, making custom t-shirts to sell online, or another fulfilling work-oriented opportunity. Not only will this help you achieve your goals, but it will also be immensely fulfilling and will keep you from feeling like a slave to yourself, forcing budget cuts that you really don’t want. It’s almost like going on a financial diet. If you have a plan that is too strict, you will inevitably crack and cheat. You will then feel you have let yourself down and may give up entirely. We don’t want that at all.

There’s another adage I saw on Twitter somewhere that stuck with me, and I want to touch on it. There’s a big difference between frugal and cheap, the saying goes. Frugal is something you should aim to be, cheap you should definitely not. But what’s the difference you might ask? Haley Sacks, a self-proclaimed financial “pop star” and one of my favorite Instagram contributors (more on them later), would say frugal is not eating out 4 times a week, cheap is not leaving a tip the night you do go out. We all know that one person who is overly concerned with budgeting/saving and/or not spending any money. As well-intentioned as they may be, they end up making things awkward and become disliked for it. Maybe it’s the one friend who never accepts Venmo requests or the family member who gets caught regifting things each holiday season. You don’t want to be so concerned with your situation that it could destroy your relationships.

While the focus of this book is more or less on money, our lives certainly shouldn’t be. Money is a tool for us to live better, provide for those we love, and have a little fun. Money is what will buy that first house with the partner of your dreams, money is what will get your children a good education, and money is what will allow you to take that trip with your dearest friends. In our hyper-capitalistic American economy, the focus of money is often to convey status and power, rather than paying for fruitful experiences. If that’s the reason you are reading this I understand, but I also would encourage you to explore the deeper reasons you may want status and power. Once you’ve done so, re-approach your relationship with money. Most likely, however, you just have big goals for your life and need money to accomplish them. You mustn’t lose sight of the everyday joys in sacrifice for those big goals. I assure you, they can both be done.

There is a common adage in books, movies, and other popular media that leads to this topic. When Tony Stark (Ironman) has to go back in time and steal something in Avengers: Endgame, he ends up running into none other than his own (younger) father. They chat, and upon leaving, Howard (Tony’s dad) says to Tony, “No amount of money ever bought a second of time.” Other versions of this cliché might be “money doesn’t buy happiness” or “money isn’t everything.” There is actually a substantial amount of empirical study done on this topic, and they have found one unwavering truth. Money will improve happiness up to a certain point where basic stability needs are met.[1] After this point, however, excessive money provides only marginal benefit, and often comes with great complications and related stress. These basic needs will differ for each individual or family, but generally include things like homeownership, educational expenses, medical safety, and retirement surety. Beyond this, things become dicey and hard to read. This is one of those common pearls of wisdom that I believe to be infinitely true. Our goal here is not to be infinitely wealthy, but to change our lives through prudent use of money as a tool, appropriate for our given situation. Make coffee at home, or don’t.

- Andrew T. Jebb et al., “Happiness, Income Satiation and Turning Points around the World,” Nature Human Behaviour 2, no. 1 (January 2018): 33–38, https://doi.org/10.1038/s41562-017-0277-0. ↵