2 Bonds

There’s an old saying in investing, “gentlemen prefer bonds.” Bonds are simple, easy to understand, and are a safe way to protect your hard-earned money. There is no doubt you’ve heard the term bond before. But what does it actually mean?

A bond, at its most basic, is an agreement between two parties to exchange money over a period of time, at a certain rate. The bond gets its name from the bond between the two parties of the agreement. There are many forms of bonds, used for a wide variety of purposes, but they all have certain things in common. For our example, we will focus on the simpler types, as these are the most commonly encountered by the everyday American. At the onset of the agreement, person A (this could be a single person, a business, or even a government) receives a fixed amount of money. They receive this money from person B, who has essentially loaned it to them. The length of this loan can be anywhere from overnight to 30+ years. This is known as the term of the bond. The term specifies a set date upon which person A must give person B back their $1,000.

Why would person B just give them that money? That will take us into the defining differences between a bond and a traditional loan. Over the term of the bond, the bond issuer (the entity borrowing money, in this case, person A) has to pay a coupon to the bondholder (the entity who has lent the money, in this case, person B) to make their loan worthwhile. The coupon is generally paid semi-annually and is always quoted as a percentage of the face value of the bond (the fixed, typically $1,000 amount). So for example, a 30-year $1,000 Face Value bond with a yield (the percentage of the face value that makes up the coupon) of 4% would pay the bondholder $40 annually or $20 semi-annually. Remember, this is in addition to the full $1,000 that must be paid back at the end of the term (or at maturity). That is the basic explanation of the bond vehicle’s structure.

So who uses bonds? And what are they used for? As a matter of fact, the biggest issuer of bonds in the entire world is the United States Federal Government. Since the creation of the federal reserve in 1913, they have been issuing bonds in order to build infrastructure, like railroads or highways, to provide benefits for American citizens. These bonds are called treasuries. Treasuries are backed by the full faith of the United States Government, which has never once failed to pay off their debts. It is for this reason that treasuries are considered the safest asset in the world, second only to cash. Treasuries are sold in a full slate of increments from 90 days to 30 years. This brings us to another point. In almost every circumstance the longer the term (the period of time you are loaning money), the higher your coupon or yield will be. You are given higher payments for a 30-year loan than you are for 90 days, as you will have to wait longer to get your money back.

Other issuers (or users) of bonds are state and city governments. The federal government is mostly occupied with national security, voting on laws in congress, and running the federal reserve and other large subgroups. However, there is a low chance they will be directly involved in the building of a small park near your house. This is where the state and local governments step in. As the federal government issues treasuries, state and local governments issue municipalities (or munis, for short). These have the same bond structure as treasuries, and can be used for a variety of things, including toll bridge and landmark construction, the funding of state pensions, and providing capital for other projects the city or state may take part in.

Perhaps the second biggest group to issue bonds, behind the US Federal Government, are companies. All different kinds of corporations from around the world use bonds as a straightforward way to raise money for their expanding businesses. Auto companies like Tesla and Ford issue bonds to build new plants and factories. Software companies like Microsoft and Salesforce issue bonds to develop new platforms and programs. Netflix issues bonds to produce their shows. Bonds are businesses’ number one choice for raising new money, and they can be on terms longer than 50 years. This type of bond is called a corporate bond. Corporate bonds are unique, in that unlike treasuries, they may have significant risk. What if Apple doesn’t sell enough iPhones this year and they can’t pay the coupon payment to their bondholders?

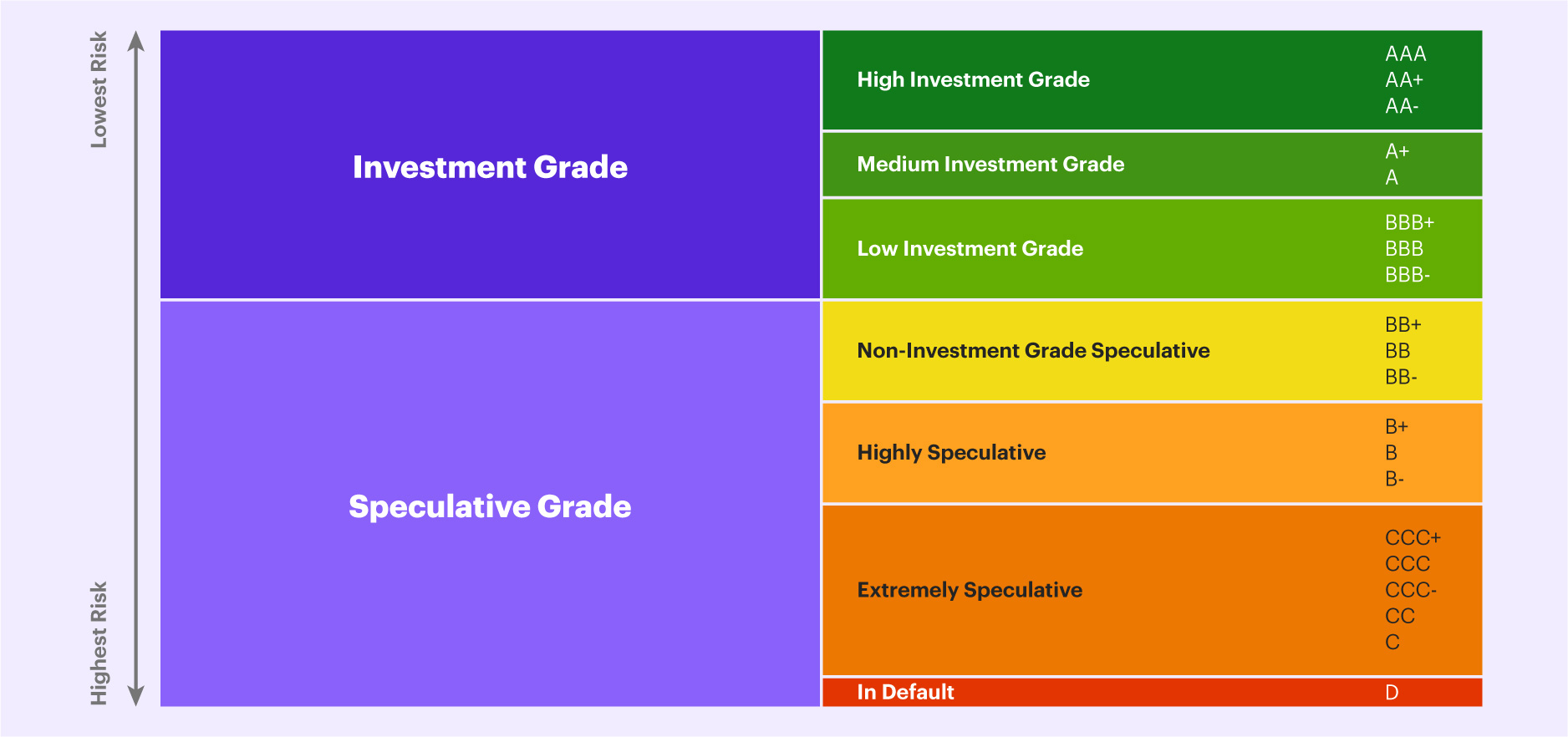

When a bond is issued, it is given a rating by a rating agency. The three major rating agencies are S&P, Moody’s, and Fitch. Based on the quality of the business borrowing the money (and issuing the bonds), the bonds are given a rating to describe their risk. As noted earlier, the more risky a bond is, the higher its coupon payment (or yield) should be. Corporate bonds will always have higher coupons than treasuries of the same terms. Risky businesses thus have to pay bondholders higher semi-annual payments in order to compensate the holder if something were to happen to the company. While the intricacies of bond ratings aren’t important for most folks to know, it is important to understand the difference between a good and bad rating. Take a look at the chart below, and then google some of your favorite companies to see what their ratings are. You may be surprised.

Bonds, like the other items we have been discussing here, are an asset – and we want to own assets in order to beat our inflation benchmark of 3%. Bonds, like other assets, trade in the open market. And just like other liquid assets, their values fluctuate. Once a bond has been issued, it enters the market. This is normally done at the offered face value of $1,000, but over time, economic and company conditions may change, thus causing the face amount to change. Say, for example, you own some bonds from your local city government, but this past year has been tough for tourism and the city doesn’t expect to bring in as much in taxes as years prior. Sensing this deterioration in the city’s ability to repay the bonds, people may rush to sell their bonds in the free market, thus dropping the price. When an issuer can no longer pay the coupons on their bonds, the bonds are considered to be in default. Defaulted bonds are often worth nothing.

Bonds can also do the opposite, rising in price. Taking our example of a city, perhaps a new high-growth industrial company has moved into the area, and the city plans to levy heavy taxes on this industry. Bond buyers might rush to buy the city’s bonds, feeling assured that the new tax revenue will make the bonds safer. This could cause the price of the bonds to rise. Bonds that have a market price above their face values are said to be premium bonds, or trading at a premium. Bonds marked at less than the face value are said to be discount bonds or trading at a discount. Another phenomenon occurs when bond prices rise and fall. That is considered the yield change. We must recognize that the coupon, however, does not rise and fall. The yield is simply a percentage of the price of the bond that the coupon is for. When a bond falls in price, the yield rises, and when a bond’s price rises, its yield falls. These are all important aspects of the bond market which we should understand.

The bond market is the world’s largest market besides Real Estate. It is essentially a market of borrowers and lenders all over the world exchanging prices during business hours. In the bond market, you will find treasuries, municipalities, and corporate bonds of all different lengths and qualities. Millions of these bonds change hands every day, some being traded so much that they are quoted to four decimal places. Bonds can be bought in a few forms, and are available to every United States citizen. Treasuries can be bought directly from the government on the treasury direct website. In the past, the government has given paper certificates to bondholders, but they are now making the transition to a fully digital system. Some corporations sell their bonds directly to people in offerings. You can find more information about any company’s bonds on the investor relations portion of their website. Finally, bonds can be bought most efficiently in bond funds, which are traded in the stock market and represent fractional ownership of many bonds at once.

Deciding which bonds to purchase is a rather straightforward process. A bond buyer looking to earn a certain rate of return, let’s say 4%, to beat our inflation percentage of 3%, would look for bonds or bond funds with yields of 4% and above. It is important to remember that higher yields may sometimes be a sign of risk in the bonds, as their face values may have gone down in the open market. The buyer will also have to think about the term of the bond. For example, if you are planning to get a master’s degree in 5 years, you would be looking for bonds with maturities in that time frame. We must also remember that the price or face value of the bonds we own may be affected by market movements, to some degree. However, in terms of price fluctuation, bonds are relatively stable and do not exhibit the swings sometimes seen in real estate and often seen in stocks, our next topic.

The annual interest rate payment on a bond expressed as a percentage of its face value, the coupon is the amount a bondholder can expect to receive each year they hold the bond.

Bonds issued by the United States Treasury, treasuries are considered the safest form of investment as they are backed by the full faith and credit of the United States Government. Treasuries come in 3 types based on maturity: bills (1-52 weeks), notes (2-10 years), and bonds (20 or 30 years).

Bonds issued by state and local governments, municipalities or "muni's" for short often come with higher yields and better tax benefits then regular federal government issues.

Bonds issued by big companies, corporate bonds are the preferred method for large enterprises to raise money, as selling stock can often be expensive and time consuming.

The instance in which a bond issuer can no longer make coupon payments to its creditors. When bonds go are marked as in default, it is often a very bad sign for the company or entity issuing them.

Bonds that trade above face value, premium bonds have been bought aggressively in the market and may come with lower yields.

Bonds that trade below face value, discount bonds have been sold aggressively in the market and may come with higher yields.