5 Risk

It is generally known that the younger the investor, the higher their tolerance for risk. Risk is an interesting topic, as it is not easily quantified, and different individuals may have different perceptions of risk. So how do we measure it? Let’s use an example. Say you just bought some stock in a company you love and paid an even $100 for one share. You plan to have this stock for years, maybe even passing it down to your kids. You are worried, however, that the stock is risky, and you may want to know how much exact risk is in the $100 share. Financial professionals and academics alike use a main standard measurement. This is called volatility, and relates to the price swings of an investment. Since your stock trades in the open market, its price is always changing. Buyers and sellers of the stock meet in the market to exchange the stock for cash. If there are more buyers than sellers, the price rises. If sellers outnumber buyers, prices fall. Liquid markets are fascinating, as prices are determined by the people in the market, not by any government or corporation. Back to our $100 stock, let’s say things go poorly and more sellers enter the market than buyers. In order to allow the sellers to sell, the price must fall to match the demand for sales. Let’s say a year after buying the stock its market price has fallen to $75, due to the large selloff. What are we to make of this? In the time we have owned the stock, it has declined by 25%. Now, let’s say that the opposite occurs. the buyers outnumber the sellers and over the course of a year, it goes up to $125, thus increasing by 25%.

Let’s run through those examples again, but with 10% instead of 25%; the stock moves from a value of $100 to $90 or $110. Let’s call the 25% mover stock A and the 10% mover stock B. Which stock do you think is riskier? Why do you say that?

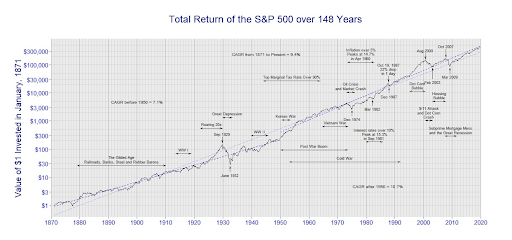

Using our measure of volatility, stock A is more volatile and in turn, riskier. Its price swings in greater proportion to the initial investment. Notice, however, that Stock B also provides less gain than stock A, which brings us to the fundamental tradeoff between risk (as measured by price swings of an asset in the open market) and reward (as measured by the amount it will increase past its initial investment amount). Just like in life, there is no such thing as free lunch in investing. In order to make more money, you must take more risks. That is just the way it is. So what does this have to do with age? Well, over time, asset prices go up, especially here in the United States. Stocks are the example we will use, but the same can be applied to real estate and commodities. Fixed income is a different story, which we will get to. Below you will see the 148-year chart for the S&P 500, which is the most commonly used measure for the entire U.S. stock market.

Despite the price swings, the stock market always goes up. Younger investors have the best advantage they could possibly ask for: the advantage of time. Given the long-term upward trend in stock prices, young investors have more time to be a part of these increases. This is why younger asset buyers are advised to take more risks. If their $100 stock investment falls to $75, they have ample time to let it get back up to $100, or $125 and beyond. Therefore, young people looking to buy assets for the first time should first look at stocks. The common stock of United States companies offers the highest measured volatility and risk, but also the highest possible return. The general rule of thumb is to subtract your age from 100. This is the portion of your portfolio that should be allocated to the stock. For example, a 25-year-old would construct his portfolio so that around 75% of it was common stock assets. A 55-year-old would only target 45% stock.

It is advisable, however, not to start with this precise percentage. This moves us to our next pillar of risk learning: risk tolerance. I want you to take a moment to think about how you approach risk and uncertainty in your life. Do you rush into it headfirst and fearlessly? Do you avoid it in lieu of more safe solutions? Do you take calculated risky endeavors, only when you are well researched beforehand? These may seem like silly questions, but money, and your wealth and livelihood, often end up being a great source of stress, even for the most dedicated risk takers. The role of money in our everyday lives is profound – and many of us struggle with it. It is for that reason that the young man who dives headfirst off any diving board panics when his investments fall a mere 5%, but the busy, well-paid banker feels fine when her assets lose 50%. While risk should always be prefaced with age calculations, we must also take into account our psychological risk tolerance. As they say, how well do you want to sleep at night?

Generally, it is advisable that you start conservative, in order to get a sense of the feelings associated with seeing your assets change in value. Once you begin to develop a stomach for it, so to speak, you may begin to construct your portfolio that swings in amounts that are comfortable to you. Perhaps start with half of what the age rule suggests for stocks. Just like a diet, investing won’t work unless you can maintain consistency. Don’t push yourself too hard or you will inevitably lose a whole lot of money.

The measured price oscillations of an investment, volatility is how much, on average, the asset fluctuates in price. Can also be interpreted as standard deviation.

A word used by portfolio and asset managers to describe how much volatility someone is willing to stand in their investments. Risk tolerance, just like risk overall does not adhere to a specific measurement or definition per se, rather, there are many ways of quantifying it.