Rule #4: Never ever finance a car, especially a new one.

I’ll keep this section short and sweet. Getting an auto loan on a car is, for lack of better terms, financially stupid. This is one of the worst blunders you can get yourself into. Cars don’t appreciate. When you get a new car, it is estimated to lose between 9-11% immediately after leaving the dealership.[1] On a $40,000 vehicle, that is roughly $4,000 lost in a matter of seconds. Cars are often necessary for functioning in our day-to-day lives. They take us to and from our favorite places and people and help us get to work so that we can afford all of life’s other expenses. But a car is a depreciating asset, so it will work against us – just like credit card debt. This is okay and totally expected of an automobile. Each year, the big car manufacturers make new models that are more fuel efficient, better constructed, and safer to ride in. This is a natural cycle of engineering and will continue until cars are obsolete.

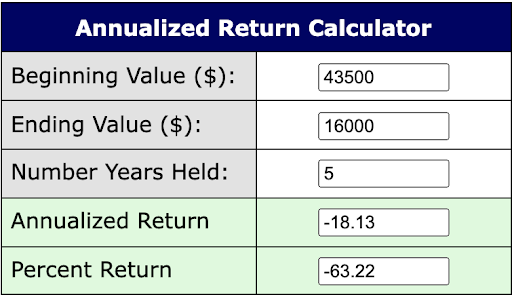

For now, though, it poses a problem – especially if you took out a loan to buy the car. In this case, not only does your asset lose value every year (up to 60% within the first five), but the loan is also charging interest. In all senses of the term, it is a money trap. Let’s put this in numbers. Say the new car you want has a sticker price of $40,000. You have good credit, so you can expect a 3.5% interest rate. Auto loans have shorter durations than home loans, most of the time being 5 years, or 60 months. This amortization, or spreading out of interest and principal payments, is more even, and less interest is accrued compared to a mortgage. So you decide to take this loan offer. After it is paid off, the car has cost you $43,500. Now let’s look at the car. With a sticker price of $40,000, your car will now have depreciated by 60%, to a total trade-in or resale value of $16,000. In the course of 5 years, you have managed to lose yourself $27,500. The percentages are given below.

At the end of the day, it’s up to you to decide whether or not you believe driving this car is worth that $27,500. After all, that’s only about $15 per day. But perhaps there is an alternative strategy I can offer you. Instead of getting a loan for a new car, save $16,000 and buy yourself a nice used car. Over the next five years, take the remainder of the money that would have gone to your loan and invest it in the form of monthly contributions equal to what your car payments would have been ($619 a month). After five years, assuming the car you bought continues to depreciate at a steady 15% a year, it will be worth $6,665. Still not great. But there’s another side to this as well. That $619 a month will have grown to a little over $44,000. Subtract the $10,000 hit you took on the older version of the car, and you have netted yourself $34,000. When compared to the example where we do get the loan, and our loss is 27,500, we see that the total difference is $61,500. Never, ever finance a car, especially a new one.

- Ramsey Solutions, “Car Depreciation: How Much Is Your Car Worth?,” Ramsey, May 10, 2022, https://www.ramseysolutions.com/saving/car-depreciation. ↵

The process and/or structure of paying off a loan in gradual calculated payments. Amortization spreads the associated cost of the principal and interest over a predetermined time frame so that the loan is paid of by an expected date.